Cheap Jaguar X-Type Car Insurance in 2026 (Top 10 Companies for Savings)

Erie, USAA, and Progressive are the top picks for cheap Jaguar X-Type car insurance, offering competitive rates and comprehensive coverage. With rates starting as low as $73 per month, these companies provide the best options for Jaguar X-Type owners looking for affordable and reliable car insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated July 2024

Company Facts

Min. Coverage for Jaguar X-Type

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Jaguar X-Type

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Jaguar X-Type

A.M. Best Rating

Complaint Level

Pros & Cons

Erie, USAA, and Progressive are the top picks for cheap Jaguar X-Type car insurance, offering the most competitive rates and free insurance quotes starting at just $73 per month.

This article evaluates these providers based on affordability, comprehensive coverage options, and customer satisfaction. Discover why Erie stands out as the best choice for its unbeatable rates and extensive benefits.

Our Top 10 Company Picks: Cheap Jaguar X-Type Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

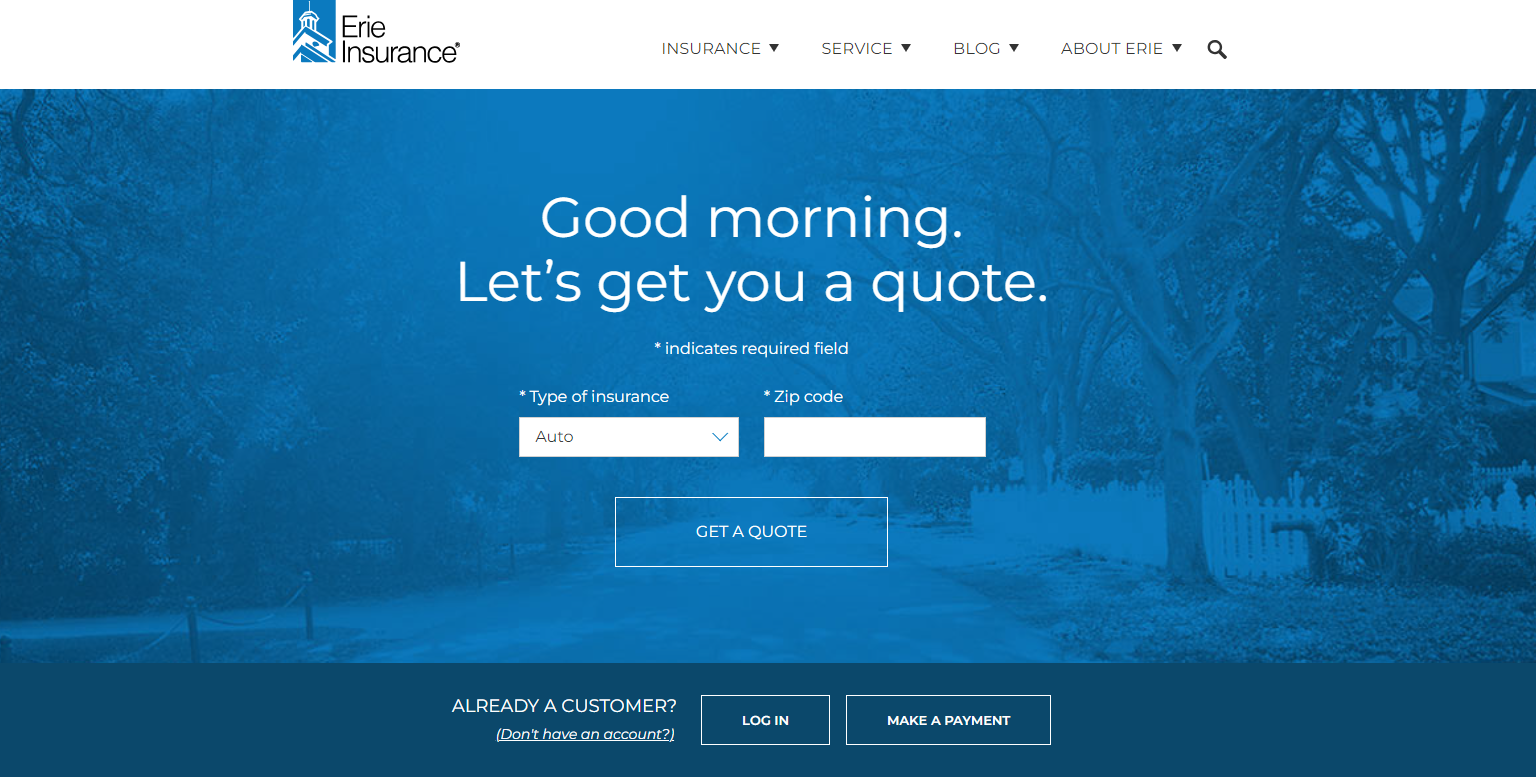

#1 $73 A+ Competitive Rates Erie

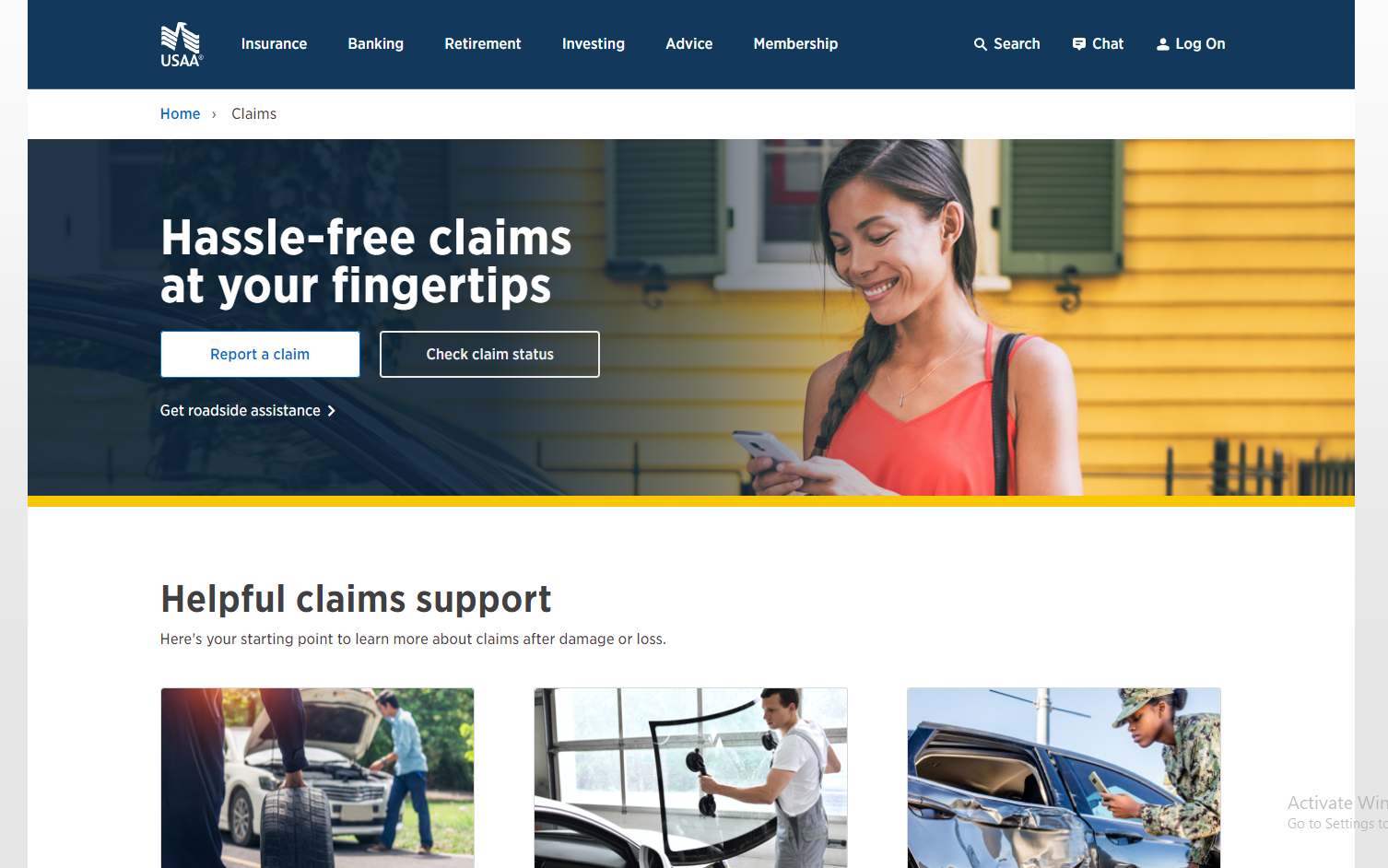

#2 $79 A++ Military Benefits USAA

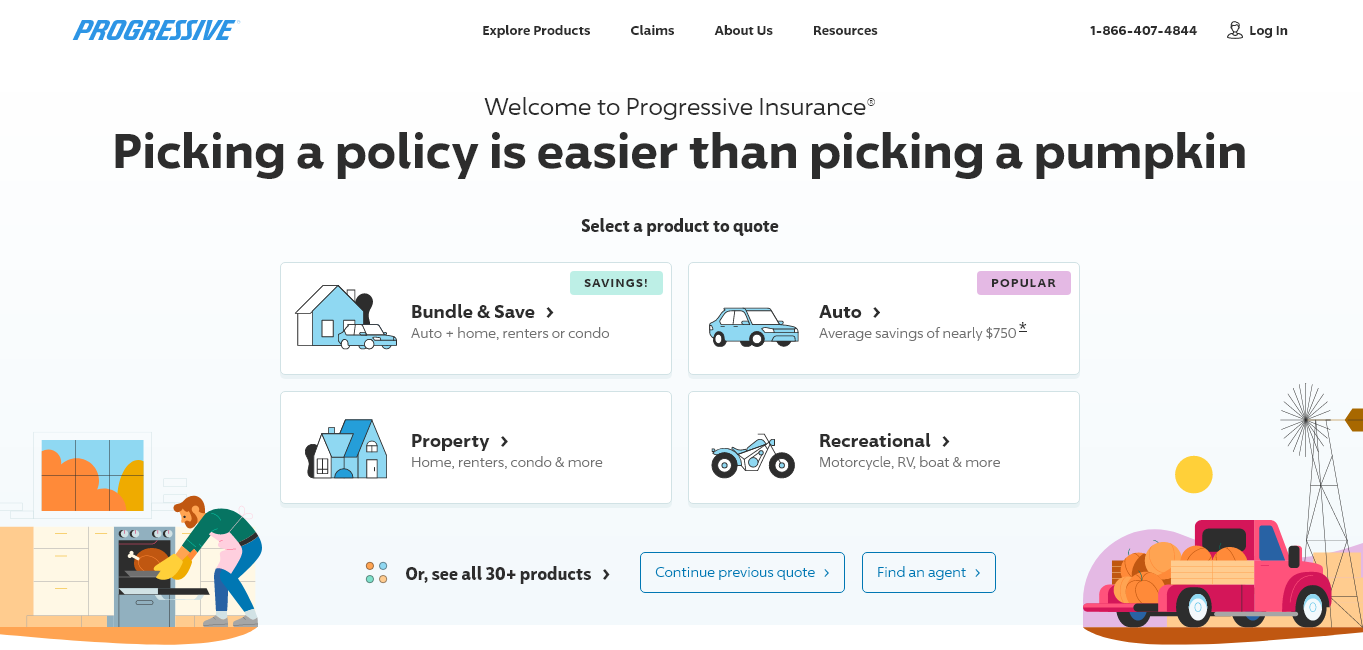

#3 $86 A+ Snapshot Discounts Progressive

#4 $91 B Agent Network State Farm

#5 $94 A+ Various Discounts Allstate

#6 $99 A Custom Coverage Farmers

#7 $105 A New Car Liberty Mutual

#8 $109 A+ Vanishing Deductible Nationwide

#9 $114 A+ Customizable Policies American Family

#10 $119 A++ Multi-Policy Discounts Travelers

Explore your options and find the perfect coverage for your Jaguar X-Type today. Avoid overpaying for your car insurance by entering your ZIP code above in our free comparison tool to find which company has the lowest rates.

#1 – Erie: Top Overall Pick

Pros

- Comprehensive Coverage: Provides extensive coverage options, including roadside assistance and rental car reimbursement, ensuring your Jaguar X-Type is well protected in various scenarios, as highlighted in the Erie Insurance Review & Ratings.

- Accident Forgiveness: Offers accident forgiveness, which means your first accident won’t result in a premium increase, providing peace of mind for Jaguar X-Type drivers.

- Customizable Policies: Allows policyholders to customize their coverage to fit their specific needs, which can be particularly beneficial for Jaguar X-Type owners with unique requirements.

Cons

- Limited Availability: Erie’s services are not available in all states, which can be a significant drawback if you live outside their coverage area.

- Fewer Discounts: Compared to larger insurers, Erie may offer fewer discount options, potentially limiting savings opportunities for Jaguar X-Type owners.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Exclusive Benefits

Pros

- Exclusive Benefits: Provides special discounts and benefits for military members and their families, making it an excellent choice for Jaguar X-Type owners with a military background, as highlighted in the USAA insurance review & ratings.

- Affordable Rates: Offers competitive pricing for Jaguar X-Type insurance, often resulting in significant savings for members.

- Comprehensive Coverage Options: Provides a wide range of coverage options, including rental reimbursement and vehicle replacement assistance, tailored to meet the needs of Jaguar X-Type owners.

Cons

- Eligibility Restrictions: Only available to military personnel, veterans, and their families, limiting access for non-military Jaguar X-Type owners.

- Limited Physical Locations: USAA primarily operates online and via phone, which can be less convenient for those who prefer in-person interactions.

#3 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program: Progressive’s Snapshot program offers potential discounts based on safe driving habits, which can lead to additional savings for Jaguar X-Type owners.

- Comprehensive Coverage: Provides a wide range of coverage options, including custom parts coverage, which is particularly beneficial for owners of Jaguar X-Type vehicles with aftermarket modifications.

- Multiple Discounts: Offers various discounts, such as for bundling policies, being a good driver, and more, helping reduce the overall cost of insuring a Jaguar X-Type.

Cons

- Mixed Customer Service Reviews: Progressive has received inconsistent customer service reviews, with some customers reporting dissatisfaction with their experiences.

- Higher Rates for High-Risk Drivers: Progressive’s premiums can be higher for drivers with poor driving records, which may affect some Jaguar X-Type owners, according to Progressive insurance review & ratings.

#4 – State Farm: Best for Steer Clear Program

Pros

- Steer Clear Program: Provides discounts for young drivers with clean records, encouraging safe driving habits and reducing insurance costs for Jaguar X-Type owners with young drivers in the household.

- Comprehensive Coverage Options: Provides a wide range of coverage options, including rental and travel expenses coverage, ensuring comprehensive protection for Jaguar X-Type vehicles.

- Good Driver Discounts: Offers discounts for good drivers, rewarding safe driving habits with lower premiums, as highlighted in the State Farm insurance review & ratings.

Cons

- Rates Vary Widely: Rates can vary significantly depending on location and individual factors, which may affect the affordability of insurance for some Jaguar X-Type owners.

- Limited Online Tools: Offers fewer digital tools and online resources compared to some competitors, which may be less convenient for tech-savvy Jaguar X-Type owners.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for Drivewise Program

Pros

- Drivewise Program: Offers discounts for safe driving habits, potentially leading to significant savings for Jaguar X-Type owners, according to Allstate insurance review & ratings.

- Multiple Coverage Options: Provides various coverage options, including new car replacement coverage, ensuring comprehensive protection for your Jaguar X-Type.

- Extensive Discount Programs: Offers numerous discounts, such as for bundling policies, installing anti-theft devices, and maintaining a clean driving record, helping to reduce insurance costs for Jaguar X-Type owners.

Cons

- Higher Average Rates: Premiums tend to be higher than those of some competitors, which can impact affordability for Jaguar X-Type owners.

- Mixed Customer Service Reviews: Allstate has received varied reviews regarding customer service, with some customers reporting inconsistent service quality.

#6 – Farmers: Best for Comprehensive Coverage Options

Pros

- Comprehensive Coverage Options: Offers extensive coverage options, including spare parts and glass replacement, ensuring thorough protection for Jaguar X-Type vehicles.

- Accident Forgiveness: Prevents premium increases after the first accident, providing peace of mind for Jaguar X-Type owners.

- Good Claims Process: Known for its efficient and reliable claims handling, ensuring a smooth experience for Jaguar X-Type owners when filing a claim.

Cons

- Higher Premiums: Tends to have higher rates compared to other insurers, which can impact the affordability of insurance for Jaguar X-Type owners, as noted in the Farmers insurance review & ratings.

- Limited Online Tools: Offers fewer digital tools and resources compared to some competitors, which may be less convenient for tech-savvy Jaguar X-Type owners.

#7 – Liberty Mutual: Best for Lifetime Repair Guarantee

Pros

- Lifetime Repair Guarantee: Offers a lifetime repair guarantee on repairs made through approved shops, ensuring quality service for your Jaguar X-Type.

- New Car Replacement: Provides new car replacement coverage, which is particularly beneficial for Jaguar X-Type owners in the event of a total loss, as noted in the Liberty Mutual Review & Ratings.

- Wide Range of Discounts: Offers numerous discounts, including for safe drivers, bundling policies, and having vehicle safety features, helping reduce insurance costs for Jaguar X-Type owners.

Cons

- Higher Rates for Some Drivers: Premiums can be higher for certain demographics, which may affect affordability for some Jaguar X-Type owners.

- Mixed Customer Reviews: Received varied reviews regarding customer service, with some customers reporting inconsistent experiences.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best for SmartRide Program

Pros

- SmartRide Program: Offers discounts based on driving habits, potentially leading to significant savings for Jaguar X-Type owners, as highlighted in the Nationwide insurance review & ratings.

- Vanishing Deductible: Reduces your deductible over time with safe driving, providing long-term savings for Jaguar X-Type owners.

- Comprehensive Coverage Options: Offers a wide range of coverage options, including total loss deductible waiver, ensuring thorough protection for Jaguar X-Type vehicles.

Cons

- Above-Average Rates: Nationwide’s premiums can be higher than those of some competitors, which may impact affordability for Jaguar X-Type owners.

- Limited Availability of Discounts: Nationwide offers fewer discount options compared to some competitors, potentially limiting savings opportunities for Jaguar X-Type owners.

#9 – American Family: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Provides extensive coverage options, including gap insurance and OEM parts, ensuring thorough protection for Jaguar X-Type vehicles.

- MyAmFam App: MyAmFam app allows for easy policy management, claims filing, and tracking, enhancing convenience for Jaguar X-Type owners.

- Multiple Discounts: Offers various discounts, such as for safe driving, bundling policies, and more, helping reduce the overall cost of insuring a Jaguar X-Type.

Cons

- Limited Availability: Services are not available in all states, which can be a significant drawback if you live outside their coverage area, as noted in the American Family insurance review & ratings.

- Higher Premiums for Young Drivers: Rates can be higher for younger demographics, which may affect affordability for young Jaguar X-Type owners.

#10 – Travelers: Best for IntelliDrive Program

Pros

- IntelliDrive Program: Offers discounts for safe driving monitored via a mobile app, potentially leading to significant savings for Jaguar X-Type owners, as mentioned in the Travelers insurance review & ratings.

- Comprehensive Coverage Options: Provides a wide range of coverage options, including new car replacement and accident forgiveness, ensuring thorough protection for Jaguar X-Type vehicles.

- Multiple Discount Opportunities: Offers various discounts, such as for bundling policies, being a good driver, and more, helping reduce the overall cost of insuring a Jaguar X-Type.

Cons

- Mixed Customer Service Reviews: Received varied reviews regarding customer service, with some customers reporting inconsistent service quality.

- Higher Premiums for High-Risk Drivers: Premiums can be higher for drivers with poor driving records, which may affect affordability for some Jaguar X-Type owners.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors Affecting Jaguar X-Type Insurance Costs

Several factors influence the cost of insuring your Jaguar X-Type. One of the most significant factors is the value of the car itself. Because Jaguar X-Types are luxury vehicles, they generally have a higher market value, which can increase insurance costs.

Additionally, the age of the vehicle can impact insurance rates. Older Jaguar X-Types may have a lower market value, resulting in slightly lower insurance premiums. Other factors that impact the cost of insurance include your location, driving record, age, and gender. It’s essential to consider these factors when estimating the cost of insuring your Jaguar X-Type.

Dani Best Licensed Insurance Producer

Another factor that can impact the cost of Jaguar X-Type car insurance is the level of coverage you choose. Different insurance policies offer varying levels of coverage, such as liability-only or comprehensive coverage. Discover our comprehensive guide to “How much is car insurance?” for additional insights.

The more comprehensive the coverage, the higher the insurance premium is likely to be. It’s important to carefully evaluate your insurance needs and budget to determine the appropriate level of coverage for your Jaguar X-Type. Furthermore, the frequency and type of use of your Jaguar X-Type can also affect insurance costs.

If you primarily use your car for personal use and have a low annual mileage, you may be eligible for lower insurance rates. On the other hand, if you use your Jaguar X-Type for business purposes or have a high annual mileage, your insurance premiums may be higher due to the increased risk of accidents or damage.

Understanding Jaguar X-Type Insurance Rates

When it comes to insuring a Jaguar X-Type, it’s essential to understand how insurance rates are calculated. Auto insurance companies determine rates based on factors such as the driver’s age, driving history, credit score, and location. For further details, check out our in-depth “Insurance Quotes Online” article.

Jaguar X-Type Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $94 $172

American Family $114 $193

Erie $73 $138

Farmers $99 $177

Liberty Mutual $105 $182

Nationwide $109 $188

Progressive $86 $161

State Farm $91 $167

Travelers $119 $197

USAA $79 $149

Additionally, insurance companies consider the Jaguar X-Type’s safety features, maintenance costs, and the likelihood of theft. Understanding how insurance rates are calculated can help you make informed decisions when choosing coverage for your Jaguar X-Type.

Another important factor that insurance companies consider when calculating rates for Jaguar X-Type vehicles is the model year. Newer models may have higher insurance rates due to their higher value and cost of repairs. On the other hand, older models may have lower rates as they are typically less expensive to replace or repair.

Comparing Insurance Quotes For The Jaguar X-Type

When searching for car insurance for your Jaguar X-Type, it’s crucial to compare quotes from different insurance providers. Prices can vary significantly between insurers, so taking the time to compare rates can help you find the best deal. Learn more by visiting our detailed “Compare Car Insurance Quotes” section.

Request quotes from multiple providers, taking into account the coverage options and deductibles offered. By comparing insurance quotes, you can ensure that you’re getting the most competitive rates for your Jaguar X-Type.

Additionally, it’s important to consider factors other than just price when comparing insurance quotes for your Jaguar X-Type. Look for insurers that have a good reputation for customer service and claims handling. Reading reviews and checking ratings can give you insight into the experiences of other policyholders.

It’s also worth considering any additional benefits or discounts that insurers may offer, such as roadside assistance or multi-policy discounts. By taking these factors into account, you can make a more informed decision and choose an insurance provider that not only offers competitive rates but also provides excellent service and coverage for your Jaguar X-Type.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Finding Low-Cost Insurance for Jaguar X-Type

While the cost of insuring a Jaguar X-Type may be higher than average, there are steps you can take to find more affordable premiums. One tip is to maintain a good driving record. Insurance companies often reward drivers with clean records by offering lower rates.

Additionally, consider bundling your Jaguar X-Type insurance with other policies, such as homeowner’s insurance, from the same provider. This can often result in discounted rates. Shopping around for the best rates and discounts is crucial for finding affordable car insurance for your Jaguar X-Type.

Another way to potentially lower your car insurance premiums for your Jaguar X-Type is to increase your deductible. Dive deeper into “Lesser Known Car Insurance Discounts for” with our complete resource.

By opting for a higher deductible, you may be able to reduce your monthly premium payments. However, it’s important to carefully consider your financial situation and ability to pay the deductible in the event of an accident.

The Average Cost of Insuring a Jaguar X-type

On average, insuring a Jaguar X-Type can cost anywhere from $125 to $250 per month. However, keep in mind that these figures are estimates, and the actual cost may vary depending on your individual circumstances. Read our extensive guide on “Free Insurance Comparison” for more knowledge.

Factors such as your location, driving record, and coverage choices will influence the final premium amount. It’s always best to request personalized quotes from insurance providers to get an accurate idea of the cost of insuring your Jaguar X-Type.

Additionally, it’s important to note that the cost of insuring a Jaguar X-Type may also be affected by the age of the vehicle. Older models may have lower insurance premiums compared to newer ones, as they may have a lower market value and be less expensive to repair or replace.

On the other hand, newer models with advanced safety features may qualify for discounts or lower rates due to their enhanced safety ratings. When considering insurance for your Jaguar X-Type, it’s worth discussing these factors with your insurance provider to determine the most suitable coverage options for your specific needs.

Exploring The Coverage Options Available For Jaguar X-Type Insurance

When it comes to insuring your Jaguar X-Type, there are various coverage options available to protect your investment. Some common coverage options for Jaguar X-Type insurance include liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage.

It’s essential to understand the details of each coverage option and select the ones that best meet your needs. By exploring the available coverage options, you can ensure that you have the right protection in place for your Jaguar X-Type. Expand your understanding with our thorough “Liability Insurance: A Complete Guide” overview.

Liability coverage is a fundamental component of Jaguar X-Type insurance. It provides financial protection in case you are at fault in an accident and cause bodily injury or property damage to others. This coverage helps cover the medical expenses, legal fees, and property repair costs of the affected party.

Collision coverage is another important coverage option for Jaguar X-Type insurance. It helps pay for the repair or replacement of your vehicle if it is damaged in a collision with another vehicle or object, regardless of who is at fault. This coverage is particularly valuable for protecting your investment in a luxury car like the Jaguar X-Type.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors for Picking Jaguar X-Type Insurance

Choosing the right insurance provider is crucial when insuring your Jaguar X-Type. Consider factors such as the company’s reputation, customer service, and financial strength. It’s also worthwhile to read reviews and ask for recommendations from other Jaguar X-Type owners.

Additionally, inquire about any specialized coverage options tailored specifically for luxury vehicles. By carefully considering these factors, you can ensure that you choose an insurance provider that will provide reliable coverage and excellent service for your Jaguar X-Type. For more information, explore our informative “Full Coverage Car Insurance: A Complete Guide” page.

Another important factor to consider when choosing an insurance provider for your Jaguar X-Type is the cost of coverage. Luxury vehicles like the Jaguar X-Type often come with higher insurance premiums due to their higher value and repair costs. It’s essential to compare quotes from different insurance companies to find the best balance between coverage and affordability.

Additionally, some insurance providers may offer discounts or special rates for luxury vehicle owners, so be sure to inquire about any available cost-saving options. By carefully evaluating the cost of coverage, you can ensure that you find an insurance provider that offers competitive rates for your Jaguar X-Type.

Tips to Reduce Jaguar X-Type Insurance Premiums

If you’re looking to lower your Jaguar X-Type car insurance premiums, there are steps you can take. First, consider increasing your deductible. A higher deductible means you’ll pay more out of pocket in the event of a claim, but it can also lower your premium. Continue reading our full “How does the insurance company determine my premium?” guide for extra tips.

Additionally, ask your insurance provider about available discounts. You may be eligible for discounts based on factors such as your driving record, safety features in your Jaguar X-Type, or even belonging to certain professional organizations. Taking these steps can help reduce your insurance costs for your Jaguar X-Type.

Misconceptions About Jaguar X-Type Insurance

There are several common misconceptions about insuring a Jaguar X-Type vehicle. One misconception is that luxury cars always have higher insurance rates. While it’s true that luxury vehicles can have higher premiums, factors such as your driving record and location play a significant role in determining rates.

Another misconception is that sticking with the same insurance provider is always the best option. While loyalty may be rewarded by some insurers, it’s essential to compare rates regularly and switch providers if necessary to get the best coverage and rates for your Jaguar X-Type. Get more insights by reading our expert “Car Insurance Startups Change How You Buy Car Insurance” advice.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How Your Driving Record Impacts Jaguar X-Type Insurance

Your driving record has a significant impact on the cost of insuring your Jaguar X-Type. Insurance companies consider factors such as previous accidents, traffic citations, and claims history when calculating premiums. Learn more by visiting our detailed “How much insurance coverage do I need?” section.

If you have a clean driving record, you may be eligible for lower insurance rates. On the other hand, a history of accidents or traffic violations can increase your premiums. It’s crucial to maintain a safe driving record to help keep your insurance costs for your Jaguar X-Type as low as possible.

The Value of Comprehensive Coverage for Jaguar X-Type

Comprehensive coverage is highly recommended for Jaguar X-Type car insurance. This coverage helps protect your vehicle from non-collision damage, such as theft, vandalism, and natural disasters. Given the higher market value of a Jaguar X-Type, having comprehensive coverage ensures that you’re adequately protected in various scenarios.

While comprehensive coverage may add to your insurance cost, it provides valuable peace of mind knowing that you’re covered for a wide range of potential risks. Dive deeper into “Collision vs. Comprehensive Car Insurance” with our complete resource.

Tips for Insuring a Luxury Car: Jaguar X-Type

Insuring a luxury vehicle like the Jaguar X-Type can be a unique experience. Luxury car insurance often requires specialized coverage options and higher premiums compared to mainstream vehicles. It’s essential to understand the intricacies of luxury car insurance to ensure that you’re adequately protected.

Research the specific coverage options available for your Jaguar X-Type, and consider working with an insurance provider that specializes in luxury car insurance. By navigating the world of luxury car insurance, you can find the right coverage for your Jaguar X-Type. Read our extensive guide on “Best Car Insurance for 21-Year-Old Drivers” for more knowledge.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Maximize Savings on Jaguar X-Type Insurance

If you’re looking to maximize savings on your Jaguar X-Type car insurance policy, consider the following tips. Firstly, maintain a good credit score, as many insurance companies use credit-based insurance scores when determining rates. Expand your understanding with our thorough “Car Insurance Discounts by Age” overview.

Additionally, take advantage of available discounts, such as bundling your Jaguar X-Type insurance with other policies or installing anti-theft devices. Finally, regularly review your coverage needs and adjust your policy accordingly. By implementing these tips, you can potentially save on your Jaguar X-Type car insurance premiums.

Jaguar X-Type Coverage Options Explained

When selecting coverage options for your Jaguar X-Type, it’s important to understand the various types available. Liability coverage helps protect you financially if you’re at fault in an accident. Collision coverage pays for damage to your vehicle in the event of a collision, regardless of fault. For more information, explore our informative “Collision Car Insurance: A Complete Guide” page.

Comprehensive coverage provides protection against non-collision events, while uninsured/underinsured motorist coverage covers damages caused by drivers without insurance or insufficient coverage. By comprehensively understanding the different types of coverage options, you can choose the right insurance for your Jaguar X-Type.

Jeff Root Licensed Insurance Agent

In conclusion, the cost of Jaguar X-Type car insurance depends on various factors, including the value of the vehicle, your location, driving record, and coverage choices. However, by understanding these factors, comparing quotes, and implementing money-saving tips, it’s possible to find affordable insurance for your Jaguar X-Type while ensuring adequate coverage.

Take the time to research and evaluate different insurance providers to ensure you find the best option for your needs. Remember, the cost of insurance is a worthwhile investment to protect your cherished Jaguar X-Type. Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

Frequently Asked Questions

What is the cheapest Jaguar to insure?

The cheapest Jaguar to insure varies by model, but the Jaguar X-Type generally offers affordable rates.

For further details, check out our in-depth “Cheapest Car Insurance for 23-Year-Old Drivers” article.

How can I find the best Jaguar insurance rates?

To find the best Jaguar insurance rates, compare quotes from multiple providers and look for discounts.

What are some cheap car insurance brands for Jaguar X-Type?

Cheap car insurance brands for Jaguar X-Type include Erie, USAA, and Progressive, known for their competitive rates.

What is the least expensive car insurance available?

The least expensive car insurance is often offered by companies like Erie and USAA for cars like the Jaguar X-Type.

Learn more by visiting our detailed “Best Car Insurance for College Students” section.

What is the best type of car insurance for the Jaguar X-Type?

The best type of car insurance for the Jaguar X-Type is comprehensive coverage, which protects against various risks.

See if you’re getting the best deal on car insurance by entering your ZIP code below.

Which cars have the lowest insurance rates for used cars?

Lowest insurance rates for used cars are often available for models like the Jaguar X-Type, especially with good driving records.

What are the most expensive car colors to insure?

The most expensive car colors to insure are typically bright colors like red or yellow, which can attract higher premiums.

What are the cheapest car insurance groups for the Jaguar X-Type?

The cheapest car insurance groups for the Jaguar X-Type are generally lower groups due to its safety features and low repair costs.

Read our extensive guide on “Cheapest Car Insurance Companies” for more knowledge.

What are the best car insurance options for a Jaguar X-Type?

The best car insurance options for a Jaguar X-Type include policies from Erie and USAA for their low rates and comprehensive coverage.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

How do I get the best Jaguar X-Type car insurance?

To get the best Jaguar X-Type car insurance, compare quotes, check for discounts, and review coverage options from top providers.

What are the benefits of Jaguar insurance policies?

What are the typical Jaguar car insurance rates for a Jaguar X-Type?

What factors influence Jaguar X-Type insurance costs?

What is the best Jaguar X-Type insurance comparison tool?

What are some available Jaguar X-Type car insurance discounts?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.