Cheap Jaguar S-Type Car Insurance in 2026 (Best 10 Companies for Savings)

Erie, USAA, and Progressive are the top picks for cheap Jaguar S-Type car insurance, offering the best and cheapest rates. With Erie providing rates as low as $78/mo, these companies stand out for their affordability and comprehensive coverage options, ensuring luxury vehicle owners get both value and protection.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Updated January 2025

Company Facts

Min. Coverage for Jaguar S-Type

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Jaguar S-Type

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Jaguar S-Type

A.M. Best Rating

Complaint Level

Pros & Cons

Erie, USAA, and Progressive are the providers of cheap Jaguar S-Type car insurance, offering competitive rates and comprehensive coverage options. See if you’re getting the best deal on car insurance by entering your ZIP code above.

With rates as low as $78, these companies excel in affordability while ensuring robust protection. The article explores various factors affecting insurance costs, including driver age, location, and vehicle modifications.

Our Top 10 Company Picks: Cheap Jaguar S-Type Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

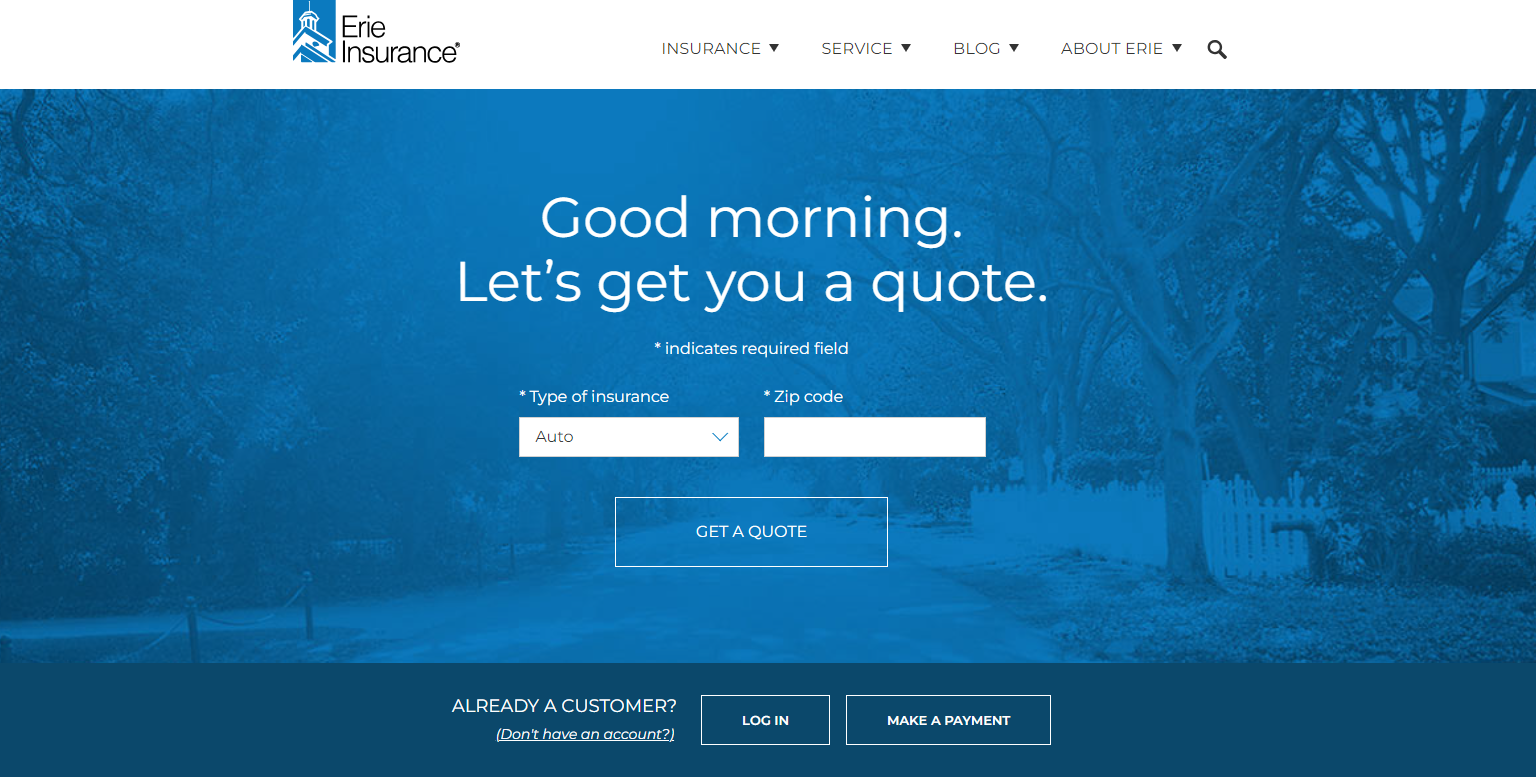

#1 $78 A+ Competitive Rates Erie

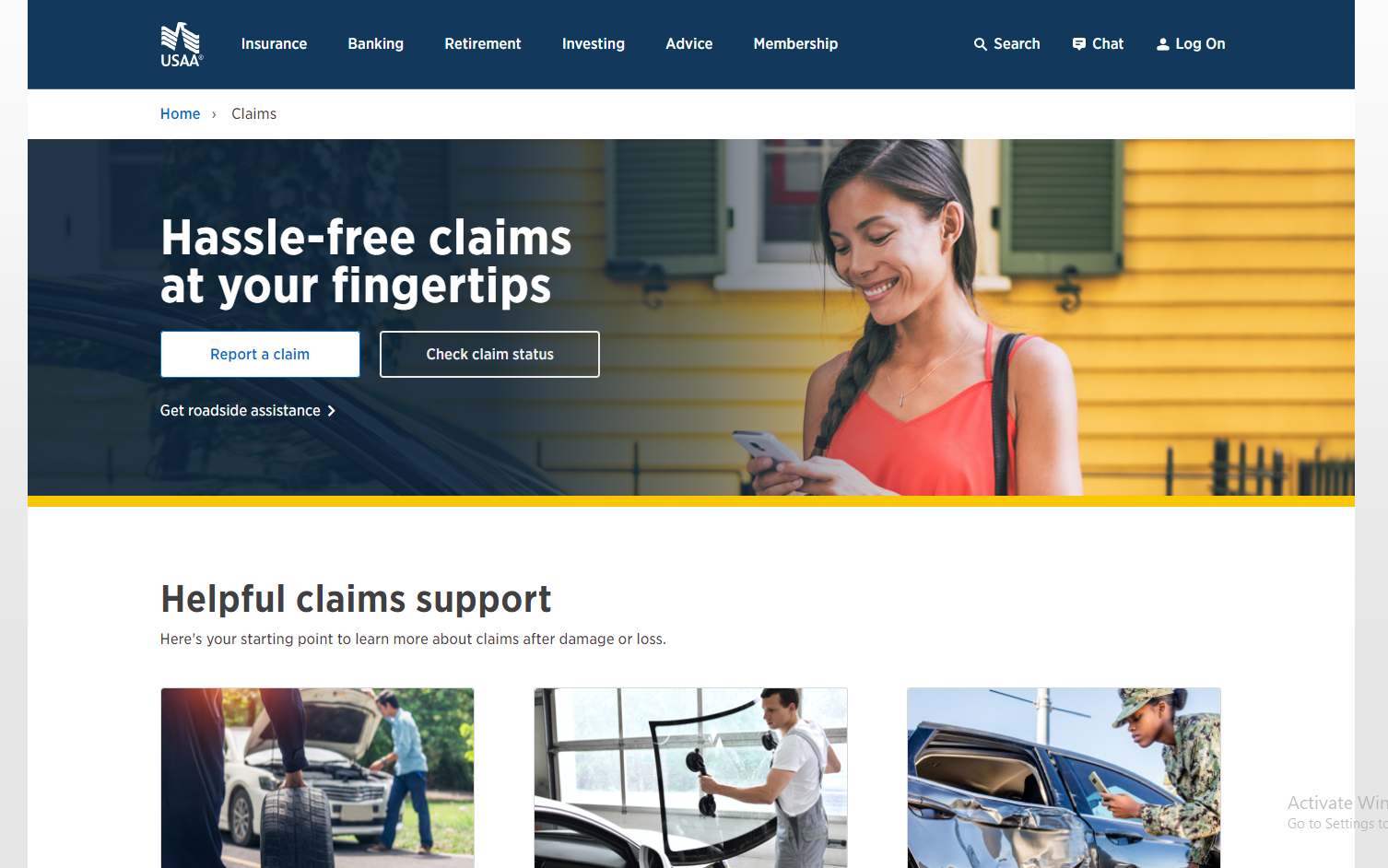

#2 $82 A++ Military Benefits USAA

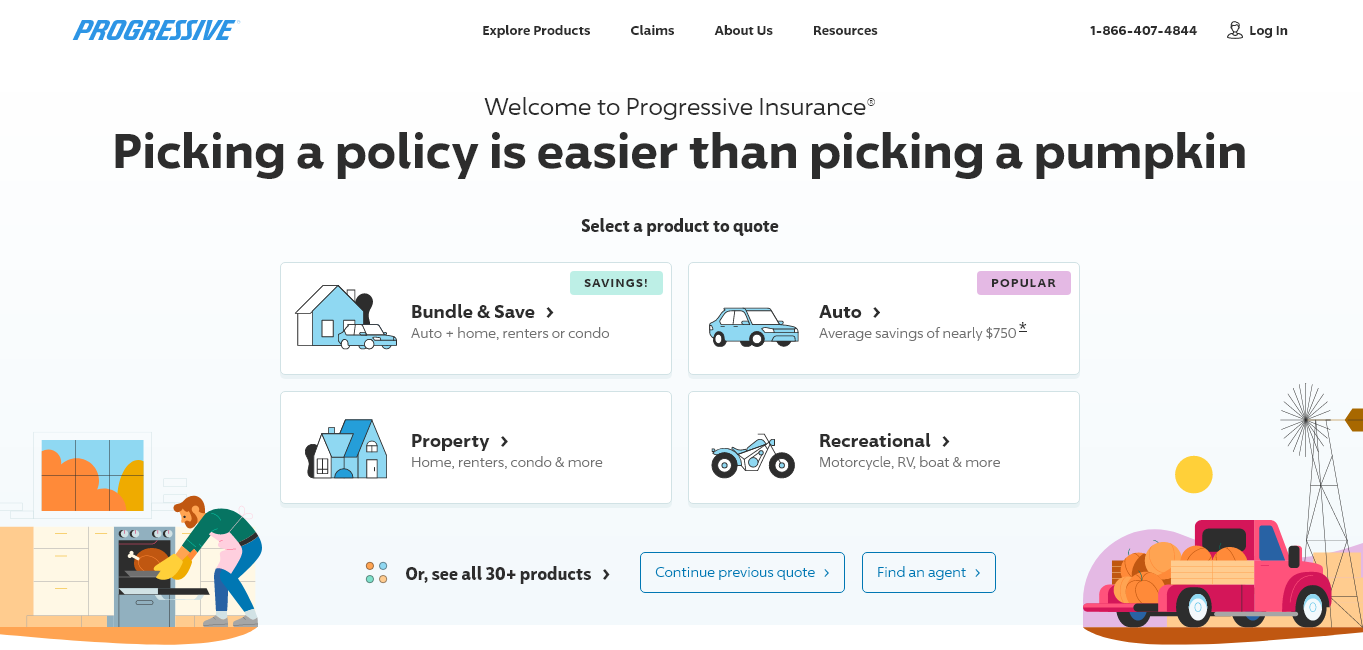

#3 $88 A+ Snapshot Discounts Progressive

#4 $93 B Agent Network State Farm

#5 $101 A+ Various Discounts Allstate

#6 $107 A Custom Coverage Farmers

#7 $112 A New Car Liberty Mutual

#8 $117 A+ Vanishing Deductible Nationwide

#9 $123 A+ Customizable Policies American Family

#10 $129 A++ Multi-Policy Discounts Travelers

It also provides tips for finding the most affordable car insurance and highlights the importance of comparing quotes from different providers to secure the best deal.

#1 – Erie: Top Overall Pick

Pros

- Competitive Rates: Offers lower premiums for luxury cars like the Jaguar S-Type, making it an attractive option for owners of high-value vehicles, as highlighted in the Erie Insurance Review & Ratings.

- Comprehensive Coverage Options: Provides extensive coverage plans, including comprehensive and collision, which are essential for protecting a luxury vehicle.

- Rate Lock Program: Erie’s Rate Lock program prevents your rates from increasing, even after filing a claim, providing financial predictability.

Cons

- Limited Availability: Only available in certain states, which can be a drawback for potential customers outside those areas.

- Fewer Online Tools: Limited online tools and resources compared to larger national insurers, which might be a disadvantage for tech-savvy users.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Discounts for Military

Pros

- Discounts for Military: Offers special discounts for active duty, veterans, and their families, including savings for safe driving and vehicle storage, as highlighted in the USAA insurance review & ratings.

- Low Rates: Offers competitive pricing for military members and their families, including luxury cars like the Jaguar S-Type, often resulting in significant savings.

- Comprehensive Coverage: Provides a broad range of coverage options tailored for high-value vehicles, including comprehensive, collision, and more.

Cons

- Eligibility Restrictions: Only available to military members, veterans, and their families, limiting its accessibility to the general public.

- Limited Local Offices: USAA has fewer physical locations compared to some other insurers, which may be inconvenient for those preferring in-person interactions.

#3 – Progressive: Best for Competitive Pricing

Pros

- Competitive Pricing: Lower rates for luxury vehicles like the Jaguar S-Type, making it an affordable option for high-end car owners.

- Snapshot Program: Progressive’s usage-based insurance program, Snapshot, can lead to significant discounts for safe driving habits, benefiting careful drivers.

- Comprehensive Online Tools: Offers excellent online resources and a robust mobile app for managing policies, making it easy for users to handle their insurance needs.

Cons

- Mixed Customer Service Reviews: Customer service ratings can vary by location, which might lead to inconsistent experiences for policyholders, according to Progressive insurance review & ratings.

- Higher Rates for High-Risk Drivers: Progressive’s rates can be higher for drivers with a less-than-perfect driving record, making it less competitive for some.

#4 – State Farm: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Offers a variety of coverage options suitable for luxury vehicles, including comprehensive, collision, and liability, as highlighted in the State Farm insurance review & ratings.

- Good Driver Discounts: Offers significant savings for drivers with clean records, making insurance more affordable for safe drivers.

- Reliable Claims Service: State Farm has a reputation for handling claims efficiently and fairly, ensuring policyholders receive timely assistance.

Cons

- Higher Premiums: State Farm can be more expensive than some competitors, especially for luxury cars like the Jaguar S-Type.

- Limited Online Quote Options: Online tools are less comprehensive compared to other insurers, which may inconvenience users who prefer digital interactions.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for Comprehensive Coverage Options

Pros

- Comprehensive Coverage Options: Offers extensive coverage plans, including extras like accident forgiveness and new car replacement, which are beneficial for luxury vehicle owners, according to Allstate insurance review & ratings.

- Good Driver Discounts: Offers substantial discounts for maintaining a clean driving record, which can lower insurance costs significantly.

- Advanced Technology: Provides robust online tools and a comprehensive mobile app for managing policies, making it easy for users to handle their insurance needs.

Cons

- Higher Rates: Allstate typically has higher premiums for luxury cars compared to other insurers, which can be a disadvantage for some policyholders.

- Mixed Customer Service Reviews: Customer satisfaction can vary by region, leading to inconsistent experiences for policyholders.

#6 – Farmers: Best for Customizable Policies

Pros

- Customizable Policies: Offers highly customizable insurance plans suitable for luxury vehicles, allowing policyholders to tailor coverage to their needs.

- Accident Forgiveness: Provides accident forgiveness to protect your rates after your first at-fault accident, which can be beneficial for maintaining affordable premiums.

- New Car Replacement: Offers new car replacement coverage, ensuring your Jaguar S-Type can be replaced with a new model if it’s totaled.

Cons

- Higher Rates: Farmers’ premiums can be higher for luxury cars like the Jaguar S-Type, making it less competitive in some cases, as noted in the Farmers insurance review & ratings.

- Mixed Reviews on Claims Handling: Customer experiences with claims handling can vary, leading to potential dissatisfaction.

#7 – Liberty Mutual: Best for Comprehensive Coverage Options

Pros

- Comprehensive Coverage Options: Offers a broad range of coverages, including roadside assistance, new car replacement, and accident forgiveness, which are valuable for luxury vehicle owners.

- Discounts: Liberty Mutual provides multiple discounts, including those for safe driving and vehicle safety features, which can lower premiums, as noted in the Liberty Mutual Review & Ratings.

- Flexible Payment Plans: Liberty Mutual offers flexible payment options to fit various budgets, making it easier for policyholders to manage their insurance costs.

Cons

- Higher Premiums: Liberty Mutual tends to have higher rates for luxury vehicles, which can be a disadvantage for some policyholders.

- Mixed Customer Service: Customer service ratings can be inconsistent, leading to varied experiences for policyholders.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best for SmartRide Program

Pros

- SmartRide Program: Nationwide’s SmartRide program rewards safe driving with discounts, benefiting careful drivers, as highlighted in the Nationwide insurance review & ratings.

- Comprehensive Coverage: Nationwide offers a wide array of coverage options, including accident forgiveness and vanishing deductible, which are beneficial for luxury vehicle owners.

- On Your Side Review: Nationwide provides personalized insurance reviews to ensure adequate coverage, helping policyholders make informed decisions.

Cons

- Higher Rates: Nationwide generally has higher premiums for luxury vehicles like the Jaguar S-Type, making it less competitive in some cases.

- Limited Local Presence: Nationwide has fewer local offices compared to other major insurers, which may be inconvenient for those preferring in-person interactions.

#9 – American Family: Best for Customizable Policies

Pros

- Customizable Policies: American Family offers highly customizable coverage options for luxury vehicles, allowing policyholders to tailor their insurance plans to meet their needs.

- Comprehensive Coverage: American Family offers extensive coverage options, including accident forgiveness and rental reimbursement, which are beneficial for luxury car owners.

- MyAmFam App: American Family offers a user-friendly mobile app for managing policies and filing claims, enhancing convenience for policyholders.

Cons

- Availability: American Family’s insurance is limited to certain states, which can be a drawback for potential customers outside those areas, as noted in the American Family insurance review & ratings.

- Higher Rates: Premiums for luxury cars can be higher compared to some competitors, which may be a disadvantage for policyholders.

#10 – Travelers: Best for Multiple Discounts

Pros

- Multiple Discounts: Travelers provides numerous discounts, including those for safe driving, multi-policy bundling, and vehicle safety features, which can lower premiums.

- Comprehensive Coverage Options: Travelers offers a wide range of coverages suitable for high-value vehicles, including comprehensive, collision, and liability.

- IntelliDrive Program: Travelers’ IntelliDrive program rewards safe driving with discounts, benefiting careful drivers, as mentioned in the Travelers insurance review & ratings.

Cons

- Higher Rates: Travelers can be more expensive for luxury cars like the Jaguar S-Type, making it less competitive in some cases.

- Mixed Customer Service Reviews: Customer service experiences can vary by region, leading to potential dissatisfaction.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors That Impact Jaguar S-Type Car Insurance Rates

When determining the cost of car insurance for a Jaguar S-Type, insurance providers take into consideration several factors. These factors include age, driving history, location, credit score, modifications to the vehicle, and safety features.

Jaguar S-Type Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $101 $176

American Family $123 $198

Erie $78 $145

Farmers $107 $182

Liberty Mutual $112 $187

Nationwide $117 $192

Progressive $88 $163

State Farm $93 $169

Travelers $129 $204

USAA $82 $158

Another factor that can impact Jaguar S-Type car insurance rates is the frequency of car usage. Insurance providers may consider how often the vehicle is driven and for what purposes. If the car is used for daily commuting or long-distance travel, it may be considered a higher risk and result in higher insurance premiums.

On the other hand, if the car is primarily used for leisure or occasional driving, it may be seen as a lower risk and result in lower insurance rates. Discover our comprehensive guide to “How much is car insurance?” for additional insights.

Understanding the Insurance Coverage Options for Jaguar S-Type

Before purchasing car insurance for your Jaguar S-Type, it is important to understand the different types of coverage options available. Comprehensive coverage provides protection against theft, vandalism, and damage caused by natural disasters. Liability-only coverage, on the other hand, only covers damages to other people and their property if you are at fault in an accident.

Chris Abrams Licensed Insurance Agent

Another important coverage option to consider for your Jaguar S-Type is collision coverage. Collision coverage helps pay for repairs or replacement of your vehicle if it is damaged in a collision with another vehicle or object, regardless of who is at fault.

This coverage can be especially beneficial if you frequently drive in areas with heavy traffic or if you live in an area prone to accidents.For further details, check out our in-depth “Collision Car Insurance: A Complete Guide” article.

Comparing Different Insurance Providers for Jaguar S-Type

When shopping for car insurance for your Jaguar S-Type, it is important to compare rates from different insurance providers. Each insurance company has its own pricing structure and factors that they consider when determining rates. By comparing quotes from multiple providers, you can ensure that you are getting the best price and coverage for your Jaguar S-Type.

One important factor to consider when comparing insurance providers for your Jaguar S-Type is the level of coverage they offer. Some insurance companies may offer basic coverage that meets the minimum legal requirements, while others may offer more comprehensive coverage options. It is important to carefully review the coverage details and determine which options best suit your needs and budget.

In addition to coverage options, it is also important to consider the reputation and customer service of the insurance providers you are comparing. Reading reviews and checking ratings from other Jaguar S-Type owners can give you insight into the experiences others have had with different insurance companies.

Good customer service can make a big difference when it comes to filing claims or dealing with any issues that may arise. Learn more by visiting our detailed “Compare Car Insurance Quotes” section.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips for Finding Affordable Car Insurance for a Jaguar S-Type

If you are looking for affordable car insurance for your Jaguar S-Type, there are several tips you can follow. First, consider bundling your car insurance with other policies, such as homeowner’s or renter’s insurance, to take advantage of multi-policy discounts. Additionally, maintaining a good driving record and credit score can help lower your insurance premiums.

Another tip for finding affordable car insurance for a Jaguar S-Type is to shop around and compare quotes from different insurance companies. Each company may have different rates and discounts available, so it’s important to do your research and find the best option for your specific needs. Dive deeper into “Insurance Quotes Online” with our complete resource.

Furthermore, you can also consider increasing your deductible to lower your insurance premiums. A higher deductible means you will have to pay more out of pocket in the event of a claim, but it can result in lower monthly premiums. However, it’s important to make sure you can afford the higher deductible before making this decision.

The Average Cost of Car Insurance for a Jaguar S-Type

The Average Cost Of Car Insurance For A Jaguar S-Type can vary depending on several factors, including the driver’s age, driving history, location, and coverage options. On average, the monthly cost of car insurance for a Jaguar S-Type is around $125 to $170.

One of the factors that can affect the cost of car insurance for a Jaguar S-Type is the driver’s age. Younger drivers, especially those under the age of 25, may face higher insurance premiums due to their lack of driving experience and higher risk of accidents.

Another factor that can impact the cost of car insurance for a Jaguar S-Type is the driver’s driving history. Drivers with a clean driving record and no history of accidents or traffic violations are generally considered lower risk and may be eligible for lower insurance rates. Read our extensive guide on “How To Get Free Insurance Quotes Online” for more knowledge.

Driver Age and Jaguar S-Type Insurance Costs

The age of the driver is a significant factor that can impact the cost of car insurance for a Jaguar S-Type. Younger drivers, especially those under the age of 25, typically have higher insurance rates due to their lack of driving experience. Conversely, older drivers with a clean driving record may be eligible for lower insurance premiums.

Additionally, insurance companies may also consider the age of the driver when determining the level of risk associated with insuring a Jaguar S-Type. Statistically, younger drivers are more likely to engage in risky driving behaviors, such as speeding or distracted driving, which can increase the likelihood of accidents and insurance claims.

As a result, insurance premiums for younger drivers may be higher to account for this increased risk. On the other hand, older drivers are often seen as more experienced and responsible behind the wheel, leading to lower insurance rates. Expand your understanding with our thorough “What age do you get cheap car insurance?” overview.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Driving History and Jaguar S-Type Insurance Rates

Insurance providers also consider a driver’s past driving history when determining rates for insuring a Jaguar S-Type. Drivers with a history of accidents, tickets, or other violations may face higher insurance premiums than those with a clean driving record. For more information, explore our informative “Car Insurance Startups Change How You Buy Car Insurance” page.

Additionally, insurance providers may also take into account the length of a driver’s driving history. New drivers, especially those with limited experience, may be seen as higher risk and therefore may be charged higher insurance rates for a Jaguar S-Type. On the other hand, drivers with a long and established driving history, free from any accidents or violations, may be eligible for lower insurance premiums.

Exploring Discounts and Savings Options for Jaguar S-Type Insurance

Many insurance providers offer discounts and savings options that can help lower the cost of car insurance for a Jaguar S-Type. These discounts may include safe driver discounts, multi-policy discounts, or discounts for installing certain safety features in the vehicle.

One common discount offered by insurance providers for Jaguar S-Type insurance is the safe driver discount. This discount is typically given to drivers who have a clean driving record and have not been involved in any accidents or received any traffic violations. Insurance companies view safe drivers as less of a risk, and therefore offer them lower insurance premiums.

Another way to save on Jaguar S-Type insurance is by taking advantage of multi-policy discounts. Many insurance providers offer discounts to customers who have multiple insurance policies with them, such as home insurance or renters insurance. By bundling your car insurance with other policies, you can often receive a discounted rate on your Jaguar S-Type insurance.

Comprehensive vs. Liability Insurance for Jaguar S-Type

When deciding between comprehensive and liability-only insurance for your Jaguar S-Type, it is important to consider your individual needs and budget. Comprehensive coverage offers more extensive protection but comes at a higher cost, while liability-only coverage provides basic coverage at a lower price. Continue reading our full “Liability Insurance: A Complete Guide” guide for extra tips.

Additionally, comprehensive insurance typically covers a wider range of risks, including theft, vandalism, and damage caused by natural disasters. This can be especially beneficial if you live in an area prone to these types of incidents. On the other hand, liability-only insurance only covers damages you may cause to others in an accident, and does not provide any coverage for your own vehicle.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Choosing the Right Deductible for Your Jaguar S-Type

When choosing a deductible for your Jaguar S-Type car insurance, it is important to consider your financial situation and risk tolerance. A higher deductible can lower your monthly premiums but may result in higher out-of-pocket expenses in the event of a claim, while a lower deductible will result in higher premiums but lower out-of-pocket costs.

Another factor to consider when choosing the right deductible for your Jaguar S-Type is the value of your car. If your car is older or has a lower market value, opting for a higher deductible may be a more cost-effective choice.

On the other hand, if your car is newer or has a higher market value, a lower deductible may provide you with more peace of mind in case of an accident or theft. Get more insights by reading our expert “How does the insurance company determine my premium?” advice.

How Location Affects the Cost of Insuring a Jaguar S-Type

The location where you live can have a significant impact on the cost of insuring your Jaguar S-Type. Areas with higher rates of accidents, theft, or vandalism may result in higher insurance premiums. Conversely, living in a low-risk area can lead to lower insurance rates.

One factor that insurance companies consider when determining the cost of insuring a Jaguar S-Type based on location is the proximity to high-crime areas. If you live in a neighborhood with a high crime rate, such as a city center or an area known for car theft, your insurance premiums may be higher. This is because the risk of your car being stolen or damaged is higher in these areas.

Another aspect that affects the cost of insuring a Jaguar S-Type based on location is the availability of repair shops and parts. If you live in a remote or rural area where there are limited repair shops or a scarcity of Jaguar-specific parts, it may be more expensive to insure your vehicle.

This is because the insurance company may have to cover the cost of shipping parts or sending a specialized mechanic to your location, which can drive up the overall cost of insurance. Explore our detailed analysis on “Free Insurance Comparison” for additional information.

Maintaining Good Credit for Jaguar S-Type Insurance

Insurance companies often consider the driver’s credit score when calculating car insurance rates. Maintaining a good credit score can help lower insurance premiums for your Jaguar S-Type, as it is seen as an indicator of responsible financial behavior.

Additionally, a good credit score can also provide you with access to better insurance coverage options for your Jaguar S-Type. Insurance companies may offer more comprehensive policies or additional benefits to drivers with higher credit scores, as they are perceived to be less of a financial risk.

By maintaining a good credit score, you can not only save money on insurance premiums but also ensure that you have the best possible coverage for your luxury vehicle. Dive deeper into “How much insurance coverage do I need?” with our complete resource.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jaguar S-Type Modifications and Insurance Premiums

If you have made modifications to your Jaguar S-Type, such as adding performance enhancements or aftermarket parts, it is important to disclose these changes to your insurance provider. Depending on the modifications, your insurance premiums may be adjusted accordingly. For further details, check out our in-depth “How can I pay my Geico insurance premium?” article.

Modifications to your vehicle can impact your insurance premiums in several ways. Firstly, certain modifications, such as adding performance enhancements or aftermarket parts, may increase the value of your car. This means that in the event of a total loss, your insurance company may have to pay out a higher amount to replace or repair your vehicle, resulting in higher premiums.

Safety Features and Jaguar S-Type Insurance Costs

The presence of safety features in your Jaguar S-Type can have a positive impact on your car insurance costs. Insurance providers often offer discounts for vehicles equipped with safety features such as anti-lock brakes, airbags, and anti-theft devices. Learn more by visiting our detailed “Car Insurance Discounts by Age” section.

Tim Bain Licensed Insurance Agent

In conclusion, the cost of car insurance for a Jaguar S-Type can vary based on several factors, including age, driving history, location, credit score, modifications, and safety features. Find cheap car insurance quotes by entering your ZIP code below.

It is important to compare quotes from different insurance providers, consider different coverage options, and take advantage of available discounts to find the most affordable and suitable car insurance for your Jaguar S-Type.

Frequently Asked Questions

What is the average cost to insure a Jaguar S-Type?

The cost to insure a Jaguar S-Type varies based on factors like location and driving history.

What are the cheapest car insurance types for luxury vehicles?

You can explore various cheapest car insurance types to find affordable coverage for luxury vehicles like the Jaguar S-Type.

Which brands offer the cheapest car insurance for a Jaguar S-Type?

Discover the cheapest car insurance brands for the Jaguar S-Type to get the best rates and coverage.

Read our extensive guide on “Cheapest Car Insurance Companies” for more knowledge.

What is the cheapest car insurance group for a Jaguar S-Type?

Find out which cheapest car insurance group applies to the Jaguar S-Type to save on premiums.

Find cheap car insurance quotes by entering your ZIP code below.

Is there a specific car color that is the most expensive to insure?

Learn about the most expensive car color to insure and how it affects your insurance rates.

What is the best type of car insurance for a Jaguar S-Type?

The best type of car insurance for a Jaguar S-Type includes options like comprehensive and collision coverage.

Expand your understanding with our thorough “Collision vs. Comprehensive Car Insurance” overview.

Which used cars have the lowest insurance rates?

Check out the used cars with lowest insurance rates to compare with the Jaguar S-Type.

What are the cheapest car insurance categories for the Jaguar S-Type?

Explore the cheapest car insurance categories available for the Jaguar S-Type to find the most affordable options.

Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

What are the most expensive forms of car insurance?

Learn about the most expensive car insurance forms and compare them with more affordable options.

Continue reading our full “What is included in comprehensive car insurance?” guide for extra tips.

What is the lowest form of car insurance available?

Find out what the lowest form of car insurance is for basic coverage needs.

Which vehicle types have the cheapest insurance rates?

What are the best car insurance categories for luxury vehicles?

What are the most expensive car insurance groups?

What is the best car insurance for a Jaguar S-Type?

Where can I find classic car insurance for a Jaguar S-Type?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.