Cheap Isuzu i-350 Car Insurance in 2026 (Secure Low Rates With These 10 Companies)

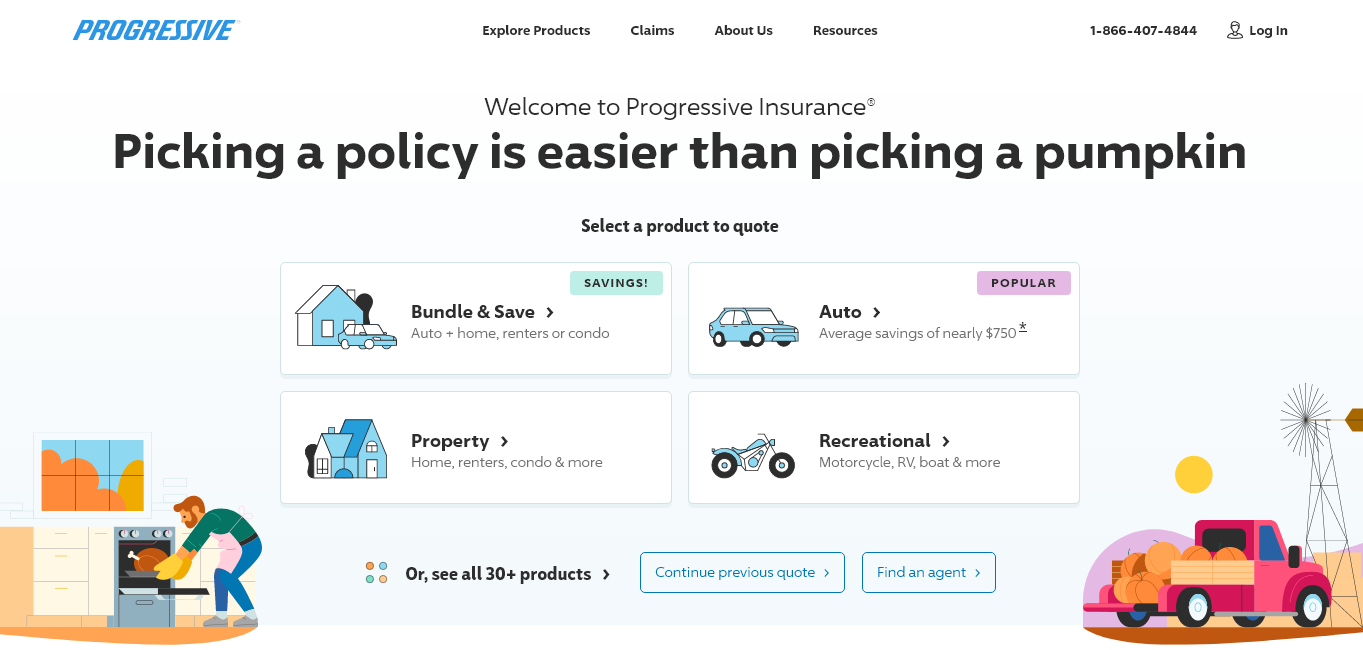

Our top choices for cheap Isuzu i-350 car insurance are Progressive, State Farm, and Travelers. Progressive tops the list with rates starting from $37 monthly. Insurance companies categorize vehicles into groups based on factors like repair costs, theft risk, and performance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Ty Stewart

Updated January 2025

13,285 reviews

13,285 reviewsCompany Facts

Min. Coverage for Isuzu i-350

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage for Isuzu i-350

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 1,734 reviews

1,734 reviewsCompany Facts

Min. Coverage for Isuzu i-350

A.M. Best Rating

Complaint Level

Pros & Cons

1,734 reviews

1,734 reviewsProgressive, State Farm and Travelers are our top picks for cheap Isuzu i-350 car insurance with progressive offering the cheapest rates.

We will also provide expert tips on how to get affordable insurance coverage for your Isuzu i-350 and highlight common mistakes to avoid.

Comparing quotes is the easiest way to find affordable car insurance.

Our Top 10 Company Picks: Cheap Isuzu i-350 Car Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $37 | A+ | Qualifying Coverage | Progressive | |

| #2 | $41 | B | Customer Service | State Farm | |

| #3 | $45 | A++ | Bundling Policies | Travelers | |

| #4 | $47 | A+ | Usage-Based Coverage | Nationwide |

| #5 | $49 | A | Costco Members | American Family | |

| #6 | $51 | A | Add-on Coverages | Liberty Mutual |

| #7 | $53 | A | Discount Variety | Farmers | |

| #8 | $55 | A+ | UBI Savings | Allstate | |

| #9 | $58 | A | Online Tools | Safeco | |

| #10 | $60 | A+ | Dividend Payments | Amica |

Simply enter your ZIP code above into our free comparison tool to see rates in your area.

#1 – Progressive: Top Pick Overall

Pros

- Wide Selection of Coverage Options: Progressive offers a range of insurance products, allowing you to tailor your Isuzu i-350 car insurance to meet your specific needs without breaking the bank.

- Non-owner Coverage: Progressive provides SR-22 filings and non-owner car insurance, which can be beneficial if you drive multiple vehicles, including the Isuzu i-350.

- Usage-based Insurance Discount: With Progressive’s Snapshot program, safe driving habits in your Isuzu i-350 could lead to significant premium savings Our complete Progressive insurance review goes over this in more detail.

Cons

- Average Customer Service Ratings: While Progressive’s customer service is reliable, it doesn’t stand out, which could be a drawback if you need frequent support for your Isuzu i-350.

- Snapshot Program Risks: Though the Snapshot program can lower rates, it may also lead to higher premiums if your driving habits with the Isuzu i-350 don’t meet the program’s criteria.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best Customer Service

Pros

- Good Customer Service: State Farm ranks highly in customer loyalty and satisfaction, making it a reliable choice for Isuzu i-350 owners who value top-notch service.

- Numerous Discounts: State Farm offers various discounts, including programs for safe driving and young drivers, which can help reduce the cost of insuring your Isuzu i-350.

- Generous Coverage: They provide generous coverage for rental cars and travel expenses, adding extra value to your Isuzu i-350 insurance policy. Learn more here: State Farm Insurance Review

Cons

- Rate Above Average: Despite their discounts, State Farm’s base rates for adult drivers are above average, which may impact affordability for Isuzu i-350 insurance.

- No Gap Insurance: State Farm doesn’t offer gap insurance, which could be a drawback if you owe more on your Isuzu i-350 than its current value.

#3 – Travelers: Best for Bundling Policies

Pros

- Bundling Discounts: Travelers allows you to bundle your Isuzu i-350 auto insurance with other policies like homeowners insurance, providing significant savings.

- Local Agents Available: Travelers offers easy access to local agents, ensuring personalized service and support for your Isuzu i-350 insurance needs.

- Accident Forgiveness: They provide accident forgiveness coverage, protecting your rates if you have a one-time accident with your Isuzu i-350. Read more in our detailed Travelers insurance review.

Cons

- Higher Premiums: Sample premiums for adult drivers can be higher than some competitors, affecting the overall affordability of Isuzu i-350 insurance.

- Mixed Customer Ratings: Customer satisfaction ratings vary, with some reviews indicating lower satisfaction levels, which might be a concern for Isuzu i-350 owners seeking consistent service.

#4 – Nationwide: Best for Usage-Based Coverage

Pros

- Usage-Based Coverage: Nationwide’s SmartRide program offers substantial discounts for safe, low-mileage drivers, which can make insuring your Isuzu i-350 more affordable. Learn more about SmartRide in our Nationwide insurance review.

- Multiple Product Options: With a variety of insurance products available, Nationwide makes it easy to bundle your Isuzu i-350 insurance with other policies, potentially saving you more.

- Extra Perks for Loyal Customers: Nationwide provides perks like minor accident forgiveness and pet injury coverage, adding extra value to your Isuzu i-350 insurance policy.

Cons

- Limited Discounts: While Nationwide offers some great features, they don’t score as high in discount options compared to other insurers, which could impact the overall cost of your Isuzu i-350 insurance.

- Higher Costs for DUI: If you have a DUI on your record, you might face steeper premiums with Nationwide, making it less budget-friendly for Isuzu i-350 drivers in this situation.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – American Family: Best for Costco Members

Pros

- Costco Member Benefits: If you’re a Costco member, American Family offers special deals that can help reduce the cost of your Isuzu i-350 car insurance.

- Affordable Policy Choices: American Family provides a range of budget-friendly options, making it easier to find cheap Isuzu i-350 car insurance that suits your financial situation. Find out more about American Family in our American Family insurance review.

- Wide Range of Discounts: From safe driver to loyalty discounts, American Family offers numerous ways to lower your Isuzu i-350 insurance premiums.

Cons

- Poor Customer Reviews: Some customers have reported negative experiences with American Family, which is reflected in feedback on sites like BBB and Trustpilot—something to consider when insuring your Isuzu i-350.

- Limited Digital Experience: The mobile app and online tools offered by American Family may not be as extensive as those from other insurers, potentially impacting the convenience of managing your Isuzu i-350 insurance.

#6 – Liberty Mutual: Best for Add-on Coverages

Pros

- Variety of Add-on Coverage: Liberty Mutual provides numerous additional coverage options, allowing you to customize your Isuzu i-350 insurance policy to fit your specific needs. You can learn more about Liberty Mutual’s insurance options in our complete guide: Liberty Mutual Auto Insurance Review

- Good Financial Ratings: With strong ratings from AM Best and BBB, Liberty Mutual is financially stable and reliable, ensuring your Isuzu i-350 is protected by a trusted insurer.

- Discounts for Young Drivers: Liberty Mutual offers several discounts designed to help younger, often more expensive-to-insure drivers, lower their Isuzu i-350 insurance premiums.

Cons

- Average Customer Satisfaction: Liberty Mutual’s customer satisfaction ratings, especially for claims handling, are average, which might be a consideration for Isuzu i-350 owners who prioritize customer service.

- Potentially High Premiums: Some drivers may find Liberty Mutual’s base rates higher compared to other insurers, affecting the affordability of Isuzu i-350 insurance.

#7 – Farmers: Best for Discount Variety

Pros

- Many Discount Opportunities: Farmers offers a wide range of discounts, providing several ways to save on Isuzu i-350 insurance. Check out our Farmers insurance review to learn more.

- Comprehensive Coverage Options: Farmers provides a broad selection of coverage options and add-ons, giving you flexibility in tailoring your Isuzu i-350 insurance. Take a look at our Farmers insurance review to learn more.

- Well-Reviewed Mobile App: The Farmers app is praised for its functionality and ease of use, making it convenient to manage your Isuzu i-350 insurance on the go.

Cons

- High State-Specific Premiums: Premiums with Farmers can vary significantly by state, leading to higher rates for Isuzu i-350 insurance in certain regions.

- Mixed Customer Reviews: While many customers are satisfied, some have reported issues with slow roadside assistance and other service concerns, which could be a drawback for Isuzu i-350 owners.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Allstate: Best for UBI Savings

Pros

- Usage-Based Insurance Savings: Allstate’s Drivewise program offers significant discounts based on your driving habits, potentially lowering your Isuzu i-350 insurance costs.

- Easy-to-Use Device: The Allstate UBI device is easy to install, helping Isuzu i-350 drivers track and improve their driving habits effortlessly.

- Rewards Program: Allstate’s reward program allows you to earn points and redeem rewards for safe driving, adding an extra incentive for responsible Isuzu i-350 drivers. Read more: Allstate Insurance Review.

Cons

- Cost for High-Mileage Drivers: If you’re a high-mileage driver, Allstate’s UBI program may be more expensive, as charges increase with mileage, impacting the overall cost of Isuzu i-350 insurance.

- Device Issues: Allstate charges for miles even if the UBI device malfunctions, which could lead to unexpected costs for Isuzu i-350 owners.

#9 – Safeco: Best for Online Tools

Pros

- Strong Online Presence: Safeco’s advanced digital tools can simplify managing your Isuzu i-350 insurance and potentially help you find ways to save money.

- Accident Forgiveness: Safeco offers accident forgiveness, which can be beneficial if you have an accident, helping to keep your Isuzu i-350 insurance costs lower.

- Customizable Policies: Safeco provides various options to tailor your Isuzu i-350 insurance, allowing you to customize your coverage to find the most cost-effective solution. See what coverage you can customize in our detailed guide: Safeco Insurance Review

Cons

- Customer Satisfaction: Safeco’s customer satisfaction ratings, particularly regarding claims, are below average, which could be a drawback for Isuzu i-350 owners seeking reliable service.

- Above Average Complaints: Safeco has a higher-than-average NAIC complaint index score, suggesting potential issues that might affect your overall experience with insuring your Isuzu i-350.

#10 – Amica: Best for Dividend Payments

Pros:

- Dividend Payments: As a mutual company, Amica may return a portion of your premium as a dividend, which can help reduce the overall cost of insuring your Isuzu i-350.

- Competitive Pricing: Amica’s pricing is generally in line with national averages, making it a reasonably priced option for Isuzu i-350 insurance.

- Bundling Discounts: By bundling your Isuzu i-350 auto policy with home insurance or other coverages, you can take advantage of additional savings. See other discounts you may qualify for in our Amica car insurance discounts.

Cons

- Limited Offerings: Amica does not offer ridesharing coverage, and some policies like dividends might not be available in every state, which could limit options for Isuzu i-350 owners.

- Mixed Customer Reviews: Reviews suggest mixed experiences with their digital insurance services and customer satisfaction, which might affect the overall value of your Isuzu i-350 insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Isuzu I-350 Car Insurance Rates: A Comprehensive Guide

When it comes to getting an accurate estimate of your Isuzu i-350 car insurance rates, it’s essential to obtain quotes from multiple insurance companies. Each insurer may have its own formula and considerations when calculating premiums. Get more information in our article “How does the insurance company determine my premium?”

Comparing quotes will give you a better idea of the potential costs and help you find the most affordable coverage.

Isuzu i-350 Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $55 | $107 |

| American Family | $49 | $97 |

| Amica | $60 | $112 |

| Farmers | $53 | $102 |

| Liberty Mutual | $51 | $100 |

| Nationwide | $47 | $91 |

| Progressive | $37 | $82 |

| Safeco | $58 | $110 |

| State Farm | $41 | $88 |

| Travelers | $45 | $94 |

Factors that can affect your Isuzu i-350 car insurance rates include your driving record, age, location, and the level of coverage you choose. Insurance companies typically consider these factors to assess the risk associated with insuring your vehicle. For example, if you have a clean driving record and live in a low-crime area, you may be eligible for lower premiums.

In addition to these factors, the type of coverage you select can also impact your insurance rates. Basic liability coverage is typically the minimum requirement, but you may want to consider additional coverage options such as collision and comprehensive coverage for added protection. Keep in mind that the more coverage you choose, the higher your premiums may be.

Factors That Determine the Cost of Isuzu I-350 Car Insurance

When it comes to calculating car insurance premiums for your Isuzu i-350, several factors come into play. These factors can vary from one insurance provider to another, but here are the most common ones:

- Vehicle Value: The value of your Isuzu i-350 plays a significant role in determining your insurance costs. Higher-value vehicles generally have higher premiums.

- Location: Insurance premiums can vary depending on where you live. Areas with higher crime rates or frequent accidents may have higher premiums.

- Driver’s Record: Your driving record and history of accidents or claims can significantly impact your insurance costs. A clean driving record generally leads to lower premiums.

- Coverage Amount: The level of coverage you choose for your Isuzu i-350 can affect your premium. Opting for higher liability limits or additional coverage will typically lead to higher premiums.

- Age and Driving Experience: Teen drivers often face higher insurance premiums compared to older, more experienced drivers. Learn more about how age affects premiums for different types of bad drivers in our article.

The deductible you choose can also impact your premium, with higher deductibles leading to lower premiums but more out-of-pocket costs during a claim.

Teen driving can be a wild ride. But if you cover them with Progressive, you could at least get a discount. And maybe some sleep. pic.twitter.com/yXv7l8LOOd

— Progressive (@progressive) June 26, 2024

Additionally, credit scores, driving habits, annual mileage, vehicle use, and traffic violations are factors that insurance providers may consider when calculating your premium.

Understanding the Insurance Group of Isuzu I-350

Insurance companies use an insurance group system to categorize different vehicles based on various factors such as cost of repairs, likelihood of theft, and performance. The group your Isuzu i-350 falls into can impact your insurance costs. Generally, vehicles in higher insurance groups tend to have higher premiums due to increased risk.

When determining the insurance group of a vehicle, insurance companies also consider the safety features and technology installed in the car. Vehicles with advanced safety features such as lane departure warning, adaptive cruise control, and automatic emergency braking are often placed in lower insurance groups, as they are considered to be safer and less likely to be involved in accidents.

Learn more: Best Safety Features Car Insurance Discounts

In addition to the insurance group, other factors that can affect your insurance costs for an Isuzu i-350 include your driving history, age, and location. If you have a clean driving record and live in an area with low crime rates, you may be eligible for lower insurance premiums.

On the other hand, if you have a history of accidents or live in an area with high rates of vehicle theft, your insurance costs may be higher.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips for Getting Affordable Isuzu I-350 Car Insurance

While insurance premiums can vary, there are several strategies you can use to potentially lower your Isuzu i-350 car insurance costs:

- Shop Around: As mentioned earlier, comparing quotes from multiple insurance providers can help you find the best rates for your Isuzu i-350.

- Bundle Policies: Consider bundling your Isuzu i-350 insurance with other insurance policies, such as homeowners or renters insurance, to potentially receive a discount.

- Maintain a Good Driving Record: Avoid accidents and traffic violations to keep your driving record clean, which can result in lower premiums.

- Increase Deductibles: If you’re comfortable with a higher out-of-pocket expense in the event of a claim, you may choose a higher deductible to lower your premiums.

- Take Advantage of Discounts: Many insurance providers offer discounts for features such as anti-theft devices, safety features, or completing defensive driving courses. Inquire about available discounts when obtaining quotes.

Implementing these tips and maintaining a good credit score can lead to lower insurance premiums for your Isuzu I-350. If you have low mileage or drive safely, consider usage-based insurance for potential cost savings.

Comparing Insurance Quotes for Isuzu I-350: What To Look For

When comparing insurance quotes for your Isuzu i-350, it’s not just about the price. While affordability is important, also consider the coverage limits, deductibles, and any additional benefits or services offered by the insurance company. Opting for a reputable insurer with excellent customer service and strong financial stability is crucial for peace of mind.

Additionally, it’s worth considering the insurance company’s claims process and reputation for handling claims efficiently. Look for reviews or ratings from other Isuzu i-350 owners to get an idea of their experiences with different insurers.

Read more: How long does it typically take for Progressive to process an car insurance claim?

It’s also a good idea to inquire about any discounts or special programs that may be available for Isuzu i-350 owners, such as safe driver discounts or loyalty rewards. Taking the time to thoroughly compare insurance quotes and evaluate all these factors will help you make an informed decision and ensure that you have the right coverage for your Isuzu i-350.

The Importance of Comprehensive Coverage for Isuzu I-350

Considering the value of your Isuzu i-350, it’s highly recommended to consider comprehensive coverage. Comprehensive coverage protects you from damages not caused by a collision, such as theft, vandalism, or natural disasters. Although it may contribute to the overall cost, it provides valuable protection for your investment.

Additionally, comprehensive coverage can also provide coverage for other non-collision related incidents, such as fire damage or damage caused by falling objects. This type of coverage ensures that you are protected from a wide range of potential risks and can help give you peace of mind knowing that your Isuzu i-350 is fully protected.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How To Lower Your Isuzu I-350 Car Insurance Premiums

Aside from the tips mentioned earlier, here are some additional ways to potentially lower your Isuzu i-350 car insurance premiums:

Pay Annually

Paying your insurance premium annually rather than monthly can often lead to savings. Many insurance companies offer discounts for annual payments because it reduces administrative costs and ensures consistent revenue.

By opting for an annual payment, you may also avoid monthly processing fees that can add up over time, contributing to overall cost savings on your Isuzu i-350 car insurance.

Low Mileage Discount

If you drive fewer miles than average, you might qualify for a low mileage car insurance discount. Insurance providers consider low mileage drivers to be at lower risk of accidents, which can translate into lower premiums for your Isuzu i-350. To determine eligibility, discuss your driving habits and mileage with your insurance agent or provider.

Maintain Good Credit

Maintaining a good credit score can positively impact your insurance premiums. Insurers often use credit scores as a factor in determining risk and setting rates.

A higher credit score demonstrates financial responsibility, which insurers interpret as a lower likelihood of filing claims. By keeping your credit in good standing, you can potentially reduce your Isuzu i-350 car insurance costs.

Bundle Policies

Bundle your Isuzu i-350 car insurance with other policies such as home or renters insurance to potentially receive a multi-policy discount. Insurance companies often reward customers who consolidate their insurance needs with them, offering savings and simplifying management with a single insurer for multiple policies. Read more about payment bundling in our article.

Install Safety Features

Enhancing your Isuzu i-350 with safety features like anti-theft devices or a tracking system not only enhances security but can also lower your insurance premiums. These safety features reduce the risk of theft or damage, making your vehicle safer and less costly to insure.

Before installing any safety equipment, confirm with your insurer which features qualify for safety features car insurance discounts to maximize savings on your insurance coverage.

Exploring Different Types of Coverage Options for Isuzu I-350

When choosing insurance coverage for your Isuzu i-350, it’s crucial to understand the different options available. Here are some common coverage types:

- Liability Coverage: This coverage is typically required by law and helps cover damages to another person’s property or injuries they sustained in an accident you caused.

- Collision Coverage: This coverage pays for damages to your Isuzu i-350 resulting from a collision, regardless of who is at fault.

- Comprehensive Coverage: As mentioned earlier, this coverage protects your Isuzu i-350 from damages caused by incidents other than collisions, such as theft, vandalism, or natural disasters.

- Personal Injury Protection (PIP) Coverage: PIP coverage is designed to cover medical expenses, lost wages, and other related costs for you and your passengers in the event of an accident, regardless of who is at fault.

Understanding these coverage options ensures you can select the right insurance plan tailored to protect your Isuzu i-350 in various situations.

Common Mistakes To Avoid When Insuring Your Isuzu I-350

When insuring your Isuzu i-350, it’s essential to avoid these three common mistakes:

Purchasing Only the Minimum Required Coverage

Opting for only the minimum required coverage may fulfill legal obligations, but it might not offer sufficient protection in case of accidents or other incidents. Consider the potential costs of repairs or medical bills that exceed minimum coverage limits when selecting your Isuzu I-350 insurance policy. Read more: What states require car insurance?

Failing to Read and Understand Policy Terms

It’s crucial to thoroughly read and understand your insurance policy. Knowing what is covered, excluded, and the extent of coverage limits can prevent surprises and ensure you’re adequately protected. Take the time to clarify any uncertainties with your insurer before finalizing your insurance policy.

If you’re wondering what car insurance covers, ask your insurance agent or provider for detailed explanations of specific coverage scenarios.

Not Comparing Insurance Quotes

Skipping the step of comparing insurance quotes from different providers is a common mistake. Each insurer offers different coverage options and rates. By comparing car insurance quotes, you can identify competitive pricing and potentially uncover better coverage options tailored to your Isuzu I-350, ensuring you get the most value from your insurance investment.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Expert Advice on Finding the Best Isuzu I-350 Car Insurance Deals

When it comes to finding the best Isuzu i-350 car insurance deals, it’s advisable to consult with insurance professionals or independent agents.

They have the expertise and resources to guide you through the process and help you find the most suitable coverage at a competitive price. Read more: Does your insurance agent have your best interests in mind?

Factors That Can Help You Save Money on Isuzu I-350 Car Insurance

Vehicle safety features can play a significant role in reducing your insurance premiums. Isuzu I-350 models equipped with advanced safety features such as anti-lock brakes, traction control, or airbags may qualify for insurance discounts. These features reduce the risk of accidents and injuries, making your vehicle safer and less expensive to insure.

Membership discounts are another avenue to explore for potential savings.

Brad Larson Licensed Insurance Agent

Many insurance companies offer discounts to members of certain groups, which can help lower your overall insurance costs.

See the table below for a summary of different types of discounts from our top insurance companies:

Taking advantage of these discounts and other hidden car insurance discounts from various insurance companies can significantly reduce your insurance costs for the Isuzu I-350.

Factors That Can Help You Save Money on Isuzu I-350 Car Insurance

A clean driving record is typically rewarded with lower insurance premiums. On the other hand, a history of accidents, traffic violations such as DUIs, or claims can significantly increase your insurance costs.

Read more: How long does a DUI stay on your record?

Safe driving habits and maintaining a clean record are key to keeping your Isuzu i-350 insurance premiums as low as possible.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding Deductibles and Their Impact on Isuzu I-350 Car Insurance Costs

Deductibles are an essential aspect of car insurance. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Generally, choosing a higher deductible can lead to lower premiums, while a lower deductible will result in higher premiums.

Consider your budget and risk tolerance when deciding on a deductible amount for your Isuzu i-350 car insurance. Learn the difference between a deductible and a premium in car insurance in our guide.

Comparing Different Insurance Companies for Isuzu I-350 Coverage

When it comes to insuring your Isuzu i-350, it’s crucial to compare multiple insurance companies. This allows you to evaluate their offerings, pricing, customer reviews, and overall reputation. By conducting thorough research, you can make an informed decision and find the best car insurance in your state for your Isuzu i-350.

With all these factors in mind, you now have a better understanding of how much Isuzu i-350 car insurance may cost. Remember, every insurance provider is different, so it’s essential to obtain personalized quotes tailored to your specific circumstances.

By taking the time to compare quotes and making informed choices, you’ll be well on your way to finding the most affordable and reliable Isuzu i-350 car insurance coverage for your needs.

Don’t let expensive insurance rates hold you back. Enter your ZIP code below and shop for low-cost Isuzu i-350 insurance policies.

Frequently Asked Questions

At what age is car insurance cheapest?

Car insurance is cheapest for drivers between 35 and 55 because they develop more reliable driving habits with time. Read more: What age do you get cheap car insurance?

What factors affect the cost of Isuzu i-350 car insurance?

The cost of Isuzu i-350 car insurance can be influenced by several factors, including the driver’s age, location, driving history, coverage options, deductible amount, and the insurance company’s rates.

Are Isuzu i-350 cars expensive to insure?

The insurance cost for Isuzu i-350 cars can vary depending on the factors mentioned earlier. However, generally speaking, Isuzu i-350 cars tend to have affordable insurance rates compared to other vehicles in the same class.

Can I get discounts on Isuzu i-350 car insurance?

Yes, many insurance companies offer discounts that can help reduce the cost of Isuzu i-350 car insurance. Some common discounts include safe driver discounts, multi-policy discounts, anti-theft device discounts, and good student car insurance discounts.

What is the average cost of Isuzu i-350 car insurance?

The average cost of Isuzu i-350 car insurance can vary depending on various factors. However, as of the article’s publication date, the average annual cost for Isuzu i-350 car insurance was around $1,200 to $1,500.

How can I find the best insurance rates for an Isuzu i-350?

To find the best insurance rates for an Isuzu i-350, it is recommended to shop around and compare quotes from multiple insurance companies. Additionally, maintaining a clean driving record, opting for higher deductibles, and bundling insurance policies can help lower the insurance premiums.

What is the cheapest full-coverage car insurance for 2024?

According to Money Geek’s analysis, Travelers offers the cheapest full coverage car insurance, at $907 per year or $76 per month for 2024.

Which insurance company is the cheapest for full coverage?

Progressive offers some of the cheapest full-coverage insurance policies. The national average monthly cost for full-coverage car insurance is $82.

Who typically has the cheapest insurance?

Progressive, State Farm, Travelers, and Nationwide offer the cheapest car insurance nationwide, but the price largely depends on your driver’s profile.

What car has the cheapest insurance rates?

Smaller SUVs and minivans generally have the most cost-effective insurance. Compact or crossover SUVs like the Subaru Crosstrek, Mazda CX-30, and Jeep Wrangler are among the most affordable to insure.

What type of car insurance is the cheapest?

How do I get around high insurance rates?

Are older cars cheaper to insure?

Is $500 a lot for car insurance?

Will insurance rates go down in 2024?

What type of car has the highest insurance rate?

Which gender pays more for car insurance?

At what age is car insurance most expensive?

What’s the best car insurance coverage to have?

Why is full car insurance so expensive?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.