Cheap INFINITI Q40 Car Insurance in 2026 (Save With These 10 Providers!)

Progressive, State Farm, and Nationwide are top providers of cheap INFINITI Q40 car insurance, starting at just $41 per month. Known for their competitive rates, comprehensive coverage, and excellent customer service, these insurers offer affordable and reliable protection for INFINITI Q40 drivers.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Eric Stauffer

Updated January 2025

Company Facts

Min. Coverage for INFINITI Q40

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for INFINITI Q40

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for INFINITI Q40

A.M. Best

Complaint Level

Pros & Cons

The top picks for cheap INFINITI Q40 car insurance are Progressive, State Farm, and Nationwide, with rates starting as low as $41 per month.

These companies excel due to their competitive pricing, comprehensive coverage options, and outstanding customer service.

Our Top 10 Company Picks: Cheap INFINITI Q40 Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $41 A++ Multi-Policy Progressive

![]()

#2 $43 B Safe Driver State Farm

#3 $46 A+ Accident-Free Nationwide

![]()

#4 $49 A+ Loyalty Discount Allstate

#5 $52 A New Car Liberty Mutual

#6 $57 A++ Military Personnel USAA

#7 $61 A++ Multi-Vehicle Farmers

#8 $68 A Hybrid/Electric Vehicle Travelers

#9 $74 A Homeowner Discount AAA

#10 $79 A Low Mileage Mercury

Shield your car from financial setbacks. Enter your ZIP code above to shop for cheap commercial insurance rates from top providers near you.

For drivers seeking affordable and reliable protection, Progressive stands out as the best choice. This article explores how these top insurers provide excellent value and tips to save on your INFINITI Q40 insurance premiums.

- Discover cheap INFINITI Q40 car insurance with Progressive, starting at $41/month

- Compare quotes for the best coverage options tailored to your INFINITI Q40

- Learn tips to lower premiums while ensuring adequate vehicle protection

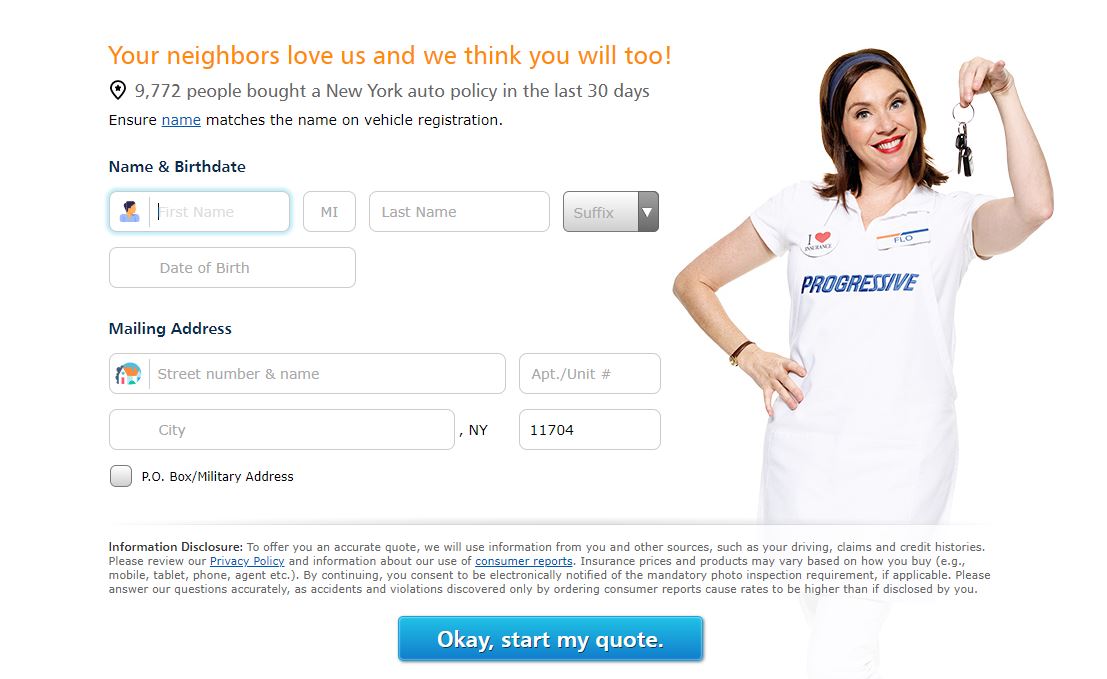

#1 – Progressive: Top Overall Pick

Pros

- Multi-Policy Discount: Progressive insurance review & ratings display the company’s substantial savings when bundling car insurance with other policies like home or renters insurance.

- Name Your Price Tool: This feature allows customers to tailor coverage options to their budget, ensuring flexibility and affordability.

- Strong Financial Rating: With an A++ rating from A.M. Best, Progressive demonstrates excellent financial stability and reliability.

Cons

- Customer Service Concerns: Despite its popularity, some customers have reported issues with claims processing and customer support responsiveness.

- Higher Rates for Young Drivers: Like many insurers, Progressive tends to charge higher premiums for younger drivers due to higher perceived risk.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Safe Driver Discount

Pros

- Safe Driver Discount: State Farm rewards policyholders with a clean driving record, offering discounts for safe driving habits.

- Local Agents: State Farm insurance review & ratings exhibit the company’s vast network of local agents, State Farm provides personalized service and support.

- Wide Range of Coverage Options: Beyond auto insurance, State Farm offers a comprehensive array of insurance products to meet various needs.

Cons

- Mixed Customer Satisfaction: While many customers appreciate the personal service, State Farm has received mixed reviews regarding overall customer satisfaction.

- Limited Online Tools: The online tools for managing policies and claims might not be as advanced as those of some competitors.

#3 – Nationwide: Best for Accident-Free Discount

Pros

- Accident-Free Discount: Nationwide offers discounts for policyholders with a history of safe driving and accident-free records.

- Member Resources: Nationwide insurance review & ratings present the company’s robust resources and tools online, making it easy for members to manage their policies.

- High Financial Strength: With an A+ rating from A.M. Best, Nationwide demonstrates strong financial stability and reliability.

Cons

- Higher Premiums for High-Risk Drivers: Policy rates may be higher for drivers with less favorable driving records or higher-risk profiles.

- Limited Discounts: Nationwide may offer fewer discount opportunities compared to some competitors, potentially impacting overall affordability for certain policyholders.

#4 – Allstate: Best for Loyalty Discount

Pros

- Loyalty Discount: Allstate insurance review & ratings highlight the company’s long-term customers with loyalty discounts, providing savings over time.

- Wide Range of Optional Coverages: Offers extensive optional coverages like accident forgiveness and new car replacement.

- High Financial Strength: Allstate holds an A+ rating from A.M. Best, indicating strong financial stability.

Cons

- Higher Premiums for New Customers: New customers may face higher initial premiums compared to other insurers.

- Mixed Customer Service Reviews: Customer feedback varies, with some reporting excellent service and others experiencing challenges.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for New Car

Pros

- New Car Replacement: Liberty Mutual offers new car replacement coverage, ensuring policyholders can replace totaled vehicles with new ones of the same make and model year.

- Multiple Policy Discounts: Liberty Mutual review & ratings feature the company’s discounts for bundling auto insurance with home or renters insurance.

- Strong Financial Rating: Liberty Mutual holds an A rating from A.M. Best, indicating strong financial stability.

Cons

- Higher Rates for High-Risk Drivers: Premiums may be higher for drivers with less favorable driving records or higher-risk profiles.

- Complex Claims Process: Some customers have reported challenges and delays in the claims process.

#6 – USAA: Best for Military Personnel

Pros

- Military Personnel Discount: USAA offers exclusive discounts and benefits for military members and their families.

- High Customer Satisfaction: Known for outstanding customer service and high satisfaction ratings.

- Top-tier Financial Strength: USAA insurance review & ratings demonstrate holds an A++ rating from A.M. Best, demonstrating superior financial stability.

Cons

- Membership Limitations: Only available to military personnel, veterans, and their families.

- Limited Branch Locations: Physical branch locations are limited, which may affect accessibility for some members.

#7 – Farmers: Best for Multi-Vehicle

Pros

- Multi-Vehicle Discount: Farmers insurance review & ratings flaunt the company’s discounts for insuring multiple vehicles on the same policy.

- Customizable Coverage: Provides a wide range of coverage options and customizable policies.

- High Financial Strength: Farmers Insurance has an A++ rating from A.M. Best, indicating strong financial stability.

Cons

- Higher Rates in Certain Regions: Premiums may vary significantly depending on the geographical region.

- Complex Pricing Structure: Some customers find the pricing structure and discounts confusing to navigate.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Hybrid/Electric Vehicle

Pros

- Hybrid/Electric Vehicle Discount: Offers discounts specifically tailored for owners of hybrid or electric vehicles.

- Wide Range of Coverage Options: Travelers insurance review & ratings parade the company’s extensive options for coverage customization.

- Excellent Financial Stability: Holds an A rating from A.M. Best, ensuring strong financial backing.

Cons

- Limited Availability of Local Agents: Relies heavily on online and phone-based customer service, which may not suit all customers.

- Average Customer Satisfaction: Reviews on customer service and claims handling are mixed, impacting overall satisfaction.

#9 – AAA: Best for Homeowner Discount

Pros

- Homeowner Discount: Offers discounts for policyholders who also have home or renters insurance through AAA.

- Roadside Assistance Benefits: AAA members receive additional roadside assistance benefits.

- Strong Financial Rating: AAA insurance review & ratings spotlight the company’s A rating from A.M. Best, indicating solid financial stability.

Cons

- Membership Requirements: Only available to AAA club members, which may require additional membership fees.

- Higher Premiums for Non-Members: Non-members may face higher insurance premiums compared to AAA club members.

#10 – Mercury Insurance: Best for Low Mileage

Pros

- Low Mileage Discount: Mercury insurance review & ratings promote the company’s discounts for policyholders who drive fewer miles annually.

- Customizable Policies: Provides options for tailoring policies to fit specific coverage needs.

- Solid Financial Standing: Mercury Insurance maintains an A rating from A.M. Best, indicating strong financial health.

Cons

- Limited Availability: Coverage may not be available in all states, limiting accessibility for potential customers.

- Customer Service Reviews: Mixed reviews regarding customer service experiences, with some reporting delays in claims processing.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors Affecting INFINITI Q40 Car Insurance Costs

When assessing the cost of insuring your INFINITI Q40, several key factors come into play. Insurance providers analyze these factors to determine the level of risk associated with insuring your specific vehicle. Understanding these influences can help you make informed decisions when selecting insurance coverage.

- Vehicle Value: The value of your INFINITI Q40 plays a significant role in determining insurance costs. Generally, the more expensive the car, the higher the insurance premium will be.

- Driving History: Insurance providers consider your driving history when determining your car insurance rate. If you have a history of accidents or traffic violations, you may be considered a higher risk and your premium may be higher.

- Location: The place where you live also affects your insurance cost. If you reside in an area with high rates of car theft or accidents, your INFINITI Q40 insurance premium may be higher. To gain further insights, consult our comprehensive guide titled “How does the insurance company determine my premium?“

When shopping for insurance for your INFINITI Q40, it’s essential to consider these factors carefully. Your vehicle’s value, your driving record, and your location all play pivotal roles in determining the cost of coverage.

INFINITI Q40 Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $74 $120

Allstate $49 $105

Farmers $61 $110

Liberty Mutual $52 $115

Mercury $79 $130

Nationwide $46 $100

Progressive $41 $95

State Farm $43 $98

Travelers $68 $125

USAA $57 $112

By understanding these influences, you can take proactive steps to potentially lower your insurance premiums while ensuring adequate protection for your vehicle.

Key Factors in INFINITI Q40 Insurance Premiums

Understanding insurance premiums for your INFINITI Q40 involves several critical factors. First, your deductible is key—it’s the amount you pay out of pocket before your coverage kicks in, with higher deductibles typically leading to lower premiums.

Insurance coverage limits dictate the maximum payout for claims, balancing higher protection with increased costs. Optional coverages like collision and comprehensive insurance provide additional security but raise premiums. Discounts for safe driving, policy bundling, and safety features can significantly reduce costs.

Lastly, your choice of insurance provider affects rates, with each offering unique pricing structures and discounts. Comparing quotes ensures you secure the best coverage at the most competitive rate for your specific needs. For additional details, explore our comprehensive resource titled “Types of Car Insurance Coverage.”

Essential Tips for Affordable INFINITI Q40 Insurance

Navigating the world of insurance for your INFINITI Q40 can be daunting, but with the right strategies, affordable coverage is within reach. Here are some essential tips to help you find the best insurance rates while protecting your beloved vehicle.

- Shop Around: Don’t settle for the first quote. Compare insurance rates from different providers to find the best deal for your INFINITI Q40.

- Maintain a Clean Driving Record: Responsible driving habits, free of accidents and traffic violations, can help you secure lower insurance premiums.

- Consider Higher Deductibles: Opting for a higher deductible can lower your monthly insurance costs, though be prepared to pay more out of pocket in case of an accident. To learn more, explore our comprehensive resource on commercial auto insurance titled “What is embedded deductible?“

By applying these tips, you can optimize your search for affordable insurance for your INFINITI Q40. Remember, comparing quotes from different insurers ensures you get the best rate. Maintaining a clean driving record not only keeps premiums down but also enhances your safety on the road.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

INFINITI Q40 Insurance Factors and Location Costs

Insurance companies utilize a variety of factors to determine the rate of car insurance for the INFINITI Q40. These factors include the vehicle’s value, your driving history, age, gender, location, credit score, and the specific coverage options you select.

By evaluating these elements, insurers gauge the risk involved in insuring your INFINITI Q40 and calculate the corresponding insurance premium. The average cost of insuring an INFINITI Q40 can fluctuate based on your location, influenced by factors such as local cost of living, crime rates, and accident statistics.

For a more precise estimation, it’s advisable to request quotes from insurance providers tailored to your specific location. To enhance your understanding, explore our comprehensive resource on business insurance titled “How To Get Free Insurance Quotes Online.”

Finding Affordable Insurance for Your INFINITI Q40

When exploring insurance options for your INFINITI Q40, it’s crucial to compare different providers. Each insurer offers varying coverage options, discounts, and service quality.

Take the time to research and compare companies to find one that meets your needs and budget. One effective strategy to save on INFINITI Q40 car insurance is comparing quotes from multiple providers.

By collecting and reviewing quotes, including coverage options, deductibles, discounts, and premiums, you can make an informed choice and secure affordable insurance without compromising coverage. To delve deeper, refer to our in-depth report titled “Lesser Known Car Insurance Discounts.”

Choosing the Right Insurance for Your INFINITI Q40

When insuring your INFINITI Q40, navigating the array of insurance providers can significantly impact both coverage and costs. It’s essential to explore your options thoroughly to find the best fit for your needs.

- Explore Various Insurance Providers: Research different insurers to find the best coverage and rates tailored for your INFINITI Q40.

- Compare Insurance Quotes: Obtain quotes from multiple providers to identify cost-saving opportunities and suitable coverage options.

- Save Money Effectively: Use comparison shopping to secure affordable premiums without compromising on essential coverage for your INFINITI Q40. For a thorough understanding, refer to our detailed analysis titled “What is premium subsidies?“

By comparing insurance quotes and examining various providers, you can ensure that you’re getting the most competitive rates and suitable coverage for your INFINITI Q40. Take the time to research and leverage different insurers’ offerings to secure peace of mind on the road.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Expert Tips for Choosing INFINITI Q40 Car Insurance

To find the best car insurance coverage for your INFINITI Q40, follow these expert tips. Start by assessing your coverage needs based on factors like your financial situation and driving habits.

Next, research insurance providers known for their reliability and positive customer service. Read and understand the policy details thoroughly, including coverage, deductibles, and limitations. To expand your knowledge, refer to our comprehensive handbook titled “Full Coverage Car Insurance: A Complete Guide.”

Ty Stewart Licensed Insurance Agent

Seek recommendations from trusted sources to inform your decision. Remember, prioritize quality over price to ensure reliable service and financial protection for your INFINITI Q40, especially considering its value.

Choosing the Right Deductible for Your Infiniti Q40 Insurance

Here are the three factors to consider when choosing the right car insurance deductible for your INFINITI Q40:

- Your Financial Situation: Assess your ability to pay the deductible in case of an accident or damage. To gain profound insights, consult our extensive guide titled “How to Document Damage for Car Insurance Claims.”

- Insurance Premiums: Evaluate how adjusting your deductible affects your insurance premium and find a balance between upfront costs and ongoing expenses.

- Vehicle Value: Consider the value of your INFINITI Q40 to determine whether a lower or higher deductible would provide adequate coverage.

Choosing the right car insurance deductible for your INFINITI Q40 involves balancing financial considerations with coverage needs.

Case Studies: Infiniti Q40 Car Insurance

Unlocking affordable insurance for your Infiniti Q40 is within reach. Explore proven strategies with our expert guidance and real-world case studies:

- Case Study #1 – Bundling Benefits: Jessica saved 12% by bundling her Infiniti Q40 insurance with her home coverage, showcasing the savings potential of consolidating policies with one insurer. For a comprehensive overview, explore our detailed resource titled “Best Home Insurance for Renovations.”

- Case Study #2 – Academic Excellence Discount: The Wilsons enjoyed a 15% reduction in premiums for their Infiniti Q40 due to their daughter’s exceptional academic achievements, highlighting available discounts beyond driving records.

- Case Study #3 – Safe Driving Rewards: Brian earned a 20% discount by participating in a telematics program, illustrating how safe driving practices can significantly reduce insurance costs for the Infiniti Q40.

By exploring these case studies, you can see firsthand how different strategies can lead to affordable insurance rates for your Infiniti Q40.

Zach Fagiano Licensed Insurance Broker

Whether through bundling policies, leveraging academic achievements, or embracing safe driving initiatives, these examples demonstrate practical approaches to optimizing your insurance coverage while saving money.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Bottom Line: Car Insurance for Infiniti Q40

Navigating the complexities of insuring your Infiniti Q40 requires thoughtful consideration of factors like deductible choices, coverage needs, and potential discounts.

By leveraging these insights and case studies, you’re equipped to make informed decisions that balance cost-efficiency with comprehensive protection for your vehicle, ensuring peace of mind on the road ahead. To enhance your understanding, explore our comprehensive resource on business insurance titled “Roadside Assistance Coverage: A Complete Guide.”

Affordable car insurance rates are just a click away. Enter your ZIP code into our free quote tool below to find the best policy for you.

Frequently Asked Questions

Is INFINITI a luxury car and is it better than Nissan?

Yes, INFINITI is considered a luxury car brand owned by Nissan. It offers higher-end features and performance compared to standard Nissan models.

Why is INFINITI so expensive and are its car parts expensive?

INFINITI vehicles are priced higher due to their luxury branding, advanced technology, and higher quality materials. Yes, INFINITI car parts can be more expensive compared to non-luxury brands.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

Is INFINITI high maintenance and does it need premium gas?

INFINITI vehicles generally require regular maintenance to upkeep their performance standards, which can include higher costs for parts and labor. Yes, many INFINITI models recommend or require premium gasoline for optimal performance and may have higher liability costs due to their luxury status.

For detailed information, refer to our comprehensive report titled “Liability Insurance.”

Do Infiniti’s need premium gas and are they considered a luxury car?

Yes, many INFINITI models recommend or require premium gasoline for optimal performance. INFINITI is widely considered a luxury car brand due to its premium features, performance, and pricing.

Is INFINITI good or bad and how long does an INFINITI engine last?

INFINITI is known for producing reliable vehicles with strong performance and luxury features, making it a good choice for many drivers. With proper maintenance, an INFINITI engine can last well over 100,000 miles or more.

Is INFINITI made in Japan and does it offer comprehensive coverage?

Yes, INFINITI vehicles are primarily manufactured in Japan. Comprehensive coverage options are available for INFINITI models to protect against a wide range of potential damages.

To gain in-depth knowledge, consult our comprehensive resource titled “What is comprehensive coverage?”

Is INFINITI better than Nissan and is Acura more reliable than INFINITI?

INFINITI, being a luxury brand under Nissan, generally offers higher-end features and performance compared to standard Nissan models. Acura and INFINITI are both respected luxury brands, with reliability often depending on specific models and individual experiences.

Why is INFINITI better than Nissan and is it made by Nissan?

INFINITI is a luxury division of Nissan, offering more advanced features, higher-quality materials, and superior performance compared to standard Nissan vehicles.

Is INFINITI a Honda or Nissan and which are the cheapest companies for INFINITI insurance?

INFINITI is a luxury brand owned by Nissan, not Honda. When looking for affordable insurance options for INFINITI vehicles, consider comparing quotes from companies known for offering competitive rates on luxury car insurance, such as Progressive and Geico.

For a comprehensive analysis, refer to our detailed guide titled “Cheapest Car Insurance Companies.”

Is INFINITI considered a luxury car and what is the maintenance on an INFINITI?

Yes, INFINITI is widely recognized as a luxury car brand due to its premium features, performance capabilities, and higher price point. Maintenance costs for INFINITI vehicles can vary but generally reflect the higher standards associated with luxury vehicles.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.