Cheap Hyundai Santa Fe Sport Car Insurance in 2026 (Best 10 Companies for Savings!)

Erie, State Farm, and Progressive offer cheap Hyundai Santa Fe Sport car insurance, with rates starting at just $48 per month. These providers lead the market by combining affordable rates and comprehensive coverage options specifically tailored for Hyundai Santa Fe Sport models, ensuring top-notch protection and value.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Jimmy McMillan

Updated November 2024

Company Facts

Min. Coverage for Hyundai Santa Fe Sport

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Hyundai Santa Fe Sport

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Hyundai Santa Fe Sport

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for cheap Hyundai Santa Fe Sport car insurance are Erie, State Farm, and Progressive, known for their affordable rates and comprehensive coverage.

These companies stand out by offering tailored policies that cater specifically to Hyundai Santa Fe owners, ensuring optimal protection and peace of mind. Navigating the various factors that influence insurance costs, such as location, driving history, and vehicle features, these providers consistently deliver value and reliability.

Our Top 10 Company Picks: Cheap Hyundai Santa Fe Sport Car Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $48 | A+ | Personalized Policies | Erie |

| #2 | $52 | B | Agency Network | State Farm | |

| #3 | $57 | A+ | Competitive Rates | Progressive | |

| #4 | $61 | A | Loyalty Rewards | American Family | |

| #5 | $65 | A+ | Multi-Policy Savings | Nationwide |

| #6 | $68 | A++ | Bundling Policies | Travelers | |

| #7 | $72 | A+ | Full Coverage | Allstate | |

| #8 | $76 | A | Online Tools | Safeco | |

| #9 | $79 | A | Various Discounts | Farmers | |

| #10 | $84 | A | 24/7 Support | Liberty Mutual |

Understanding these elements is essential for Hyundai Santa Fe Sport owners looking to secure the best possible insurance coverage.

Searching for more affordable premiums? Insert your ZIP code above to get started on finding the right provider for you and your budget.

#1 – Erie: Top Overall Pick

Pros

- Tailored Coverage: Erie offers policies that can be customized to fit individual needs.

- Competitive Pricing: With starting rates at $48, Erie provides affordable options. Unlock details in our article titled “Erie Insurance Review & Ratings.”

- High Customer Satisfaction: Erie is well-known for excellent customer service and support.

Cons

- Limited Availability: Erie’s insurance products are not available in all states.

- Fewer Online Resources: Compared to larger insurers, Erie has less robust online tools.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Agency Network

Pros

- Bundling Policies: Significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: Offers substantial savings for low-mileage drivers.

- Wide Coverage: Provides a variety of coverage options to meet diverse needs. Discover more about offerings in our article titled State Farm car insurance review & ratings.

Cons

- Limited Multi-Policy Discount: Discounts for multiple policies are not as competitive.

- Premium Costs: Premiums can be higher for certain levels of coverage despite discounts.

#3 – Progressive: Best for Competitive Rates

Pros

- Affordable Rates: Known for competitive pricing, starting at $57 monthly. Read up on the “Progressive Insurance Review & Ratings” for more information.

- Dynamic Pricing Models: Uses technology to offer rates based on real-time driving behavior.

- Extensive Discounts: Offers a range of discounts, including for safe drivers and online policies.

Cons

- Customer Service Variability: Customer service quality can vary significantly.

- Policy Upselling: Some customers report frequent upselling of additional features.

#4 – American Family: Best for Loyalty Rewards

Pros

- Loyalty Discounts: Rewards long-term customers with significant discounts. Check out insurance savings in our complete article titled American Family insurance review & ratings.

- Wide Range of Products: Offers a variety of insurance products beyond car insurance.

- Customizable Options: Provides many options to tailor policies to specific needs.

Cons

- Higher Base Rates: Starting rates are higher than some competitors.

- Limited Geographic Coverage: Not available in all states, limiting its reach.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Multi-Policy Savings

Pros

- Multi-Policy Discounts: Offers substantial savings for customers who bundle policies.

- Financial Stability: High financial ratings indicate reliability and the ability to pay claims.

- Flexible Options: Provides flexibility in coverage levels and policy adjustments. More information is available about this provider in our article titled Nationwide insurance review & ratings.

Cons

- Customer Service Issues: Some reports of less responsive customer service.

- Policy Costs: Initial policy quotes can be higher than some direct competitors.

#6 – Travelers: Best for Bundling Policies

Pros

- Strong Bundling Offers: Excellent discounts for combining multiple policies. Delve into our evaluation of our article titled Travelers insurance review & ratings.

- Extensive Coverage Options: Wide array of choices for different insurance needs.

- Reputation for Stability: Highly rated for financial stability and claim satisfaction.

Cons

- Higher Premiums: Can be more expensive for individual policyholders.

- Complex Policy Management: Customers may find managing their policies challenging.

#7 – Allstate: Best for Full Coverage

Pros

- Comprehensive Options: Offers a range of policies that provide full coverage.

- Rewards Safe Driving: Provides discounts for safe drivers through various programs.

- Robust Mobile App: Features an extensive mobile app for policy management. See more details on our article titled Allstate insurance review & ratings.

Cons

- Higher Costs: Generally more expensive than some of its competitors.

- Variable Agent Quality: Experience can vary depending on the individual agent.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Safeco: Best for Online Tools

Pros

- Advanced Online Tools: Provides innovative tools for managing policies online.

- Flexible Payment Options: Offers various payment plans to accommodate different budgets.

- Broad Coverage: Covers a wide range of incidents and scenarios. Access comprehensive insights into our article titled Safeco insurance review & ratings.

Cons

- Customer Support Issues: Some users report less satisfactory customer service.

- Rate Fluctuations: Premiums can vary more than some customers expect.

#9 – Farmers: Best for Various Discounts

Pros

- Diverse Discounts: Offers a wide range of discounts, enhancing affordability.

- Customizable Policies: Allows for detailed customization of coverage. Discover insights in our article titled Farmers insurance review & ratings.

- Strong Agent Network: Well-supported by a comprehensive network of agents.

Cons

- Higher Starting Rates: Generally starts at higher rates compared to competitors.

- Complex Claims Process: Some customers find the claims process cumbersome.

#10 – Liberty Mutual: Best for 24/7 Support

Pros

- Around-the-Clock Support: Offers 24/7 customer service and claims support.

- Customizable Coverage: Provides highly customizable policy options. If you want to learn more about the company, head to our article titled Liberty Mutual review & ratings.

- Good for High-Risk Drivers: Often willing to insure drivers who may be considered high-risk.

Cons

- Higher Premiums: Tends to have higher premiums than some other insurers.

- Inconsistent Customer Experiences: Customer satisfaction can vary widely.

Hyundai Santa Fe Sport Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $72 | $154 |

| American Family | $61 | $138 |

| Erie | $48 | $116 |

| Farmers | $79 | $168 |

| Liberty Mutual | $84 | $175 |

| Nationwide | $65 | $144 |

| Progressive | $57 | $130 |

| Safeco | $76 | $160 |

| State Farm | $52 | $123 |

| Travelers | $68 | $149 |

For those seeking the most economical option, Erie offers the lowest monthly premium at $48 for minimum coverage, closely followed by State Farm at $52. On the higher end, Liberty Mutual car insurance review & ratings charges $84 for the same level of coverage. Full coverage premiums paint a similar picture, with Erie again proving the most affordable at $116 per month, while Liberty Mutual presents the highest rate at $175.

This range in prices illustrates the importance of comparing insurance costs not just between different providers but also between coverage levels, as choosing full coverage over minimum can nearly double the monthly insurance expense, as seen with Farmers, where the price jumps from $79 to $168.

Factors That Influence Hyundai Santa Fe Sport Car Insurance Rates

Several factors influence the cost of Hyundai Santa Fe Sport car insurance, including the driver’s age, driving record, credit history, location, and the vehicle’s model, mileage, and safety features. Young or high-risk drivers and those living in high-crime or severe weather areas may see higher premiums.

Keep these considerations in mind when estimating your insurance costs. Driver’s gender, occupation, and annual mileage can influence Hyundai Santa Fe Sport car insurance rates. Certain genders and professions may incur higher premiums due to increased accident or claim likelihood. See more details on our guide titled “Defensive Driving Courses Can Lower Your Car Insurance Rates.”

Additionally, long commutes can raise premiums due to greater accident risk. Accurately reporting these factors is crucial when seeking car insurance quotes for a Hyundai Santa Fe Sport.

Understanding the Importance of Car Insurance for Hyundai Santa Fe Sport

Car insurance is legally required in many states and offers financial protection against accidents, theft, or damage to your Hyundai Santa Fe Sport. Without it, you could face high repair and medical costs. It ensures financial security in unexpected events, helping you recover quickly and with less financial strain.

Car insurance for your Hyundai Santa Fe Sport covers incidents like vandalism, natural disasters, or theft, offering broad protection against various risks. It’s crucial to review your policy thoroughly to understand the specific coverage it provides. With the right insurance, you can drive confidently, prepared for any unexpected situations. Check out insurance savings in our complete guide titled “Is car theft covered by car insurance?”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

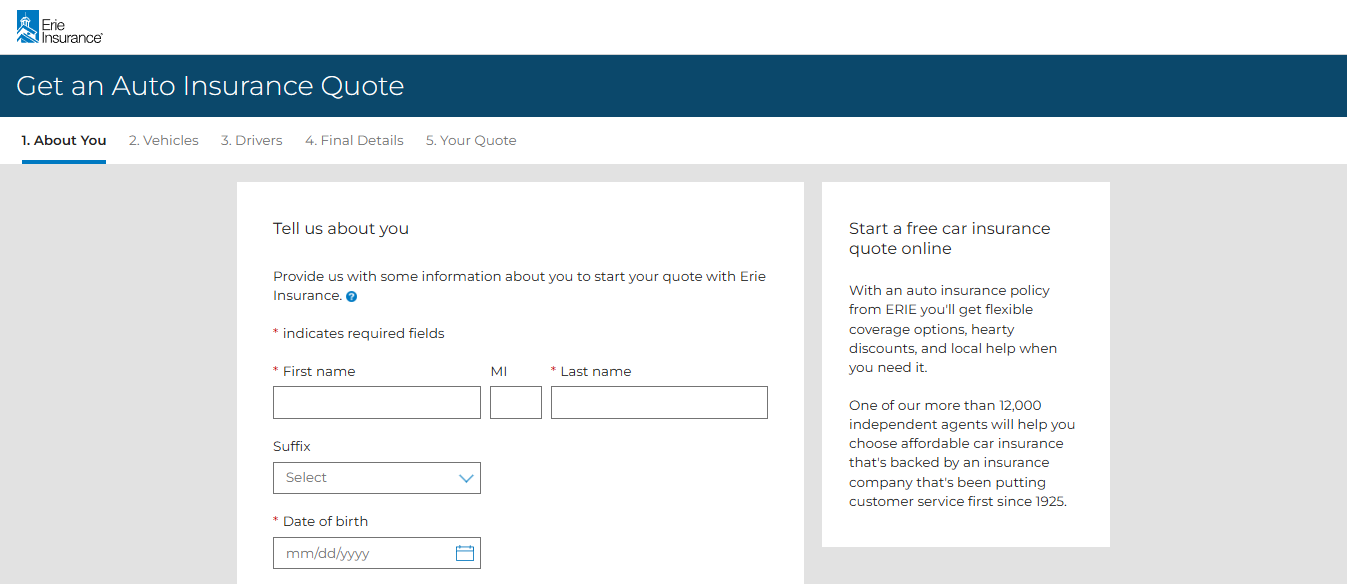

Comparing Car Insurance Quotes for Hyundai Santa Fe Sport

When it comes to insuring your Hyundai Santa Fe Sport, it’s essential to shop around and compare car insurance quotes from multiple providers.

Different insurance companies have varying methods of calculating premiums, so it’s crucial to gather quotes from different sources to find the best coverage at the most affordable price. Take the time to compare coverage options, deductibles, and limits to ensure you select the policy that meets your specific needs and budget.

Kristine Lee Licensed Insurance Agent

When comparing car insurance quotes for your Hyundai Santa Fe Sport, consider the customer service quality of each insurer by researching their reputation and reading customer reviews. Also, explore potential discounts for anti-theft devices, safe driving records, or bundling policies, as these can significantly lower your insurance costs.

Tips to Lower Your Hyundai Santa Fe Sport Car Insurance Premiums

To reduce your Hyundai Santa Fe Sport car insurance premiums, consider maintaining a clean driving record to access discounts, bundling your car insurance with other policies like homeowner’s insurance for a multi-policy discount, installing safety features such as anti-theft devices and anti-lock brakes, and increasing your deductibles to decrease monthly costs.

These strategies can help you secure comprehensive coverage at a more affordable rate. Discover more about offerings in our guide titled “What is the difference between a deductible and a premium in car insurance?”

The Average Cost of Hyundai Santa Fe Sport Car Insurance

While the actual cost of car insurance for a Hyundai Santa Fe Sport will vary depending on the factors mentioned above, it’s worth exploring the average costs to get a general idea. On average, insuring a Hyundai Santa Fe Sport costs around $100 to $125 per month.

However, it’s crucial to remember that this is just an estimate, and your individual circumstances may result in higher or lower premiums. By discussing your specific needs with insurance providers and obtaining quotes tailored to your situation, you can get a more accurate picture of the potential cost. Discover insights in our article titled “How does the insurance company determine my premium?”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Different Types of Coverage for Hyundai Santa Fe Sport

When selecting car insurance for your Hyundai Santa Fe Sport, you will have various coverage options to consider. The most common types of car insurance coverage include liability coverage, which is mandatory in most states and covers damages to other vehicles and property in case of an accident where you are at fault.

Additionally, collision coverage covers damages to your Hyundai Santa Fe Sport caused by a collision with another vehicle or object. Comprehensive coverage, on the other hand, protects against non-collision events such as theft, vandalism, or natural disasters. Understanding the different types of coverage available can help you make informed decisions when choosing the right insurance policy for your Hyundai Santa Fe Sport.

Common Mistakes to Avoid When Insuring a Hyundai Santa Fe Sport

When insuring your Hyundai Santa Fe Sport, avoid common mistakes to secure the best coverage. Not comparing quotes can lead to overpaying, while misunderstanding your policy’s terms might cause surprises during claims. Opting for only the minimum coverage could expose you financially in a major accident.

Also, not informing your insurer about changes to your vehicle or driving habits can create coverage gaps or claim denials. Being vigilant about these points helps ensure optimal coverage and pricing. Unlock details in our guide titled “How to File a Car Insurance Claim.”

How Your Driving Record Affects Hyundai Santa Fe Sport Car Insurance Rates

Your driving record significantly affects your Hyundai Santa Fe Sport car insurance rates. Insurers evaluate your history of accidents, traffic violations, and claims to determine premiums.

A clean record usually results in lower rates, while a history of incidents can increase your premiums due to higher risk. Maintaining a clean driving record is crucial for securing the most affordable rates. Access comprehensive insights into our guide titled “Car Driving Safety Guide for Teens and Parents.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors That Make the Hyundai Santa Fe Sport a Safe and Affordable Option to Insure

The Hyundai Santa Fe Sport is a safe and cost-effective vehicle to insure due to its advanced safety features like electronic stability control, anti-lock brakes, multiple airbags, and a rearview camera. These features not only protect occupants during accidents but also help prevent them. Unlock details in our guide titled “Best Safety Features Car Insurance Discounts.”

Ty Stewart Licensed Insurance Agent

The vehicle’s reliability and durability further contribute to lower insurance costs, as it’s less prone to frequent repairs, making it an attractive option for insurance companies.

The Impact of Vehicle Age and Condition on Hyundai Santa Fe Sport Car Insurance Costs

The age and condition of your Hyundai Santa Fe Sport significantly impact insurance costs. Older, high-mileage vehicles often have lower premiums due to reduced value and theft risk, but may lack modern safety features, potentially raising rates.

In contrast, new models might incur higher premiums due to their greater value and theft risk. Insurance providers take into account these factors when setting rates. Delve into our evaluation of guide titled “Mileage-Based Car Insurance: A Complete Guide.”

Tips for Finding the Best Car Insurance Provider for Your Hyundai Santa Fe Sport

When searching for the best car insurance provider for your Hyundai Santa Fe Sport, consider the following tips. Firstly, research the financial stability and reputation of the insurance companies you are considering. A financially stable provider is more likely to meet its obligations in case of a claim.

Additionally, seek recommendations from family, friends, or online reviews to gauge the customer satisfaction and claims experience of different insurers. Comparing quotes from multiple providers and reviewing their coverage options, discounts, and customer service are also crucial steps in finding the right insurance provider for your Hyundai Santa Fe Sport.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding Deductibles and Coverage Limits for Hyundai Santa Fe Sport Car Insurance

When choosing Hyundai Santa Fe Sport car insurance, understanding deductibles and coverage limits is crucial. Deductibles are what you pay out of pocket before insurance applies; opting for a higher deductible can lower your premiums, but ensure it’s affordable in case of an accident.

Coverage limits define the maximum your insurer will pay for claims. Select these figures based on your financial situation and risk tolerance to find the best policy fit. Learn more in our guide titled “Full Coverage Car Insurance: A Complete Guide.”

How Modifications and Upgrades Can Affect Hyundai Santa Fe Sport Car Insurance Prices

When modifying or upgrading your Hyundai Santa Fe Sport, consider how it might affect your insurance rates, as enhancements can increase risk and premiums. Always notify your insurer about any changes to ensure proper coverage and avoid issues with claims or compensation after an accident. See more details on our article titled “How to Document Damage for Car Insurance Claims.”

Exploring Discounts and Savings Opportunities for Hyundai Santa Fe Sport Car Insurance

Insurance providers offer many discounts for Hyundai Santa Fe Sport car insurance that can significantly reduce premiums. These include multi-policy, safe driver, and good student discounts, as well as savings for bundling policies and adding safety features. Discuss these options with your provider to maximize your savings. Discover more about offerings in our article titled “Multiple owner vehicle who is required to carry insurance.”

Melanie Musson Published Insurance Expert

In conclusion, the cost of Hyundai Santa Fe Sport car insurance is influenced by factors like driving record, vehicle model, location, and coverage choices. By understanding these factors, comparing quotes, and employing strategies to reduce premiums, you can choose the best policy for your needs and budget. Adequate insurance ensures financial protection and peace of mind while driving your Hyundai Santa Fe Sport.

Enter your ZIP code below to compare rates from the top providers near you.

Frequently Asked Questions

What factors affect the cost of Hyundai Santa Fe Sport car insurance?

The cost of Hyundai Santa Fe Sport car insurance can be influenced by factors such as the driver’s age, location, driving history, credit score, coverage limits, deductible amount, and the insurance company’s rating.

For additional details, explore our comprehensive resource titled “What age do you get cheap car insurance?”

Is Hyundai Santa Fe Sport car insurance more expensive than other car models?

The cost of Hyundai Santa Fe Sport car insurance can vary depending on several factors, but it is generally comparable to insurance costs for similar car models in its class.

Are there any discounts available for Hyundai Santa Fe Sport car insurance?

Yes, insurance companies often offer discounts for Hyundai Santa Fe Sport car insurance. These discounts can include safe driver discounts, multi-policy discounts, anti-theft device discounts, and more. It’s recommended to check with your insurance provider to see what discounts you may be eligible for.

Is it more expensive to insure a new Hyundai Santa Fe Sport compared to an older model?

Generally, insuring a new Hyundai Santa Fe Sport may be slightly more expensive than insuring an older model due to factors such as higher replacement costs and potential higher repair costs. However, insurance rates can vary based on multiple factors, so it’s advisable to obtain quotes from different insurance companies to compare the costs.

What are some tips for getting affordable Hyundai Santa Fe Sport car insurance?

To secure affordable Hyundai Santa Fe Sport car insurance, consider maintaining a clean driving record, opting for a higher deductible if financially feasible, bundling your car insurance with other policies, inquiring about available discounts, and comparing quotes from multiple insurance providers.

To find out more, explore our guide titled “Hyundai Car Insurance Discount.”

Is a Hyundai Santa Fe expensive to insure?

Hyundai Santa Fe auto insurance overview: The average car insurance cost for a 40-year-old driver is approximately $166 a month.

What is the cheapest Hyundai to insure?

The Tucson SE, a compact SUV, is the most affordable Hyundai to insure, with an average full-coverage policy costing about $143 monthly. Conversely, the Venue SE ranks as the priciest Hyundai for insurance, averaging around $194 per month.

Are sport vehicles more expensive to insure?

Sports cars, particularly high-end models, generally have a much higher intrinsic value than standard sedans, leading to correspondingly higher insurance premiums on a monthly basis.

Who is known for cheapest car insurance?

The most affordable car insurance companies include Geico, best for discounts; Nationwide, top choice for full coverage; Auto-Owners, preferred for minimum coverage; Amica, leading in customer satisfaction; and USAA, ideal for military members and veterans.

To learn more, explore our comprehensive resource on “Best Car Insurance for College Students.”

Why are Hyundai’s uninsurable?

Insurance companies are increasingly reluctant to cover certain models from these two makes because they are perceived as too easy to steal. This concern became prominent in July 2022 when a trend on TikTok showed people stealing Kias using just a flathead screwdriver and a USB cable.

What is considered a sports car?

What is the cheapest muscle car to insure?

Is Geico the most expensive car insurance?

Why does Hyundai have a bad reputation?

What are the disadvantages of Hyundai cars?

Are Hyundais worth it?

Which car is more expensive Santa Fe or Tucson?

Do Hyundai Santa Fe hold value?

Are Hyundai’s reliable after 100k miles?

How long do Hyundai Santa Fe transmissions last?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.