Cheap Ford F150 Lightning Car Insurance in 2026 (Top 10 Low-Cost Companies)

Erie, USAA, and State Farm offer cheap Ford F150 Lightning car insurance, with rates beginning at just $56 per month. These providers lead the market by combining affordability, comprehensive coverage, and exceptional customer service, making them the top choices for your F150 Lightning insurance needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated January 2025

Company Facts

Min. Coverage for Ford F150 Lightning

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Ford F150 Lightning

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Ford F150 Lightning

A.M. Best

Complaint Level

Pros & Cons

The best providers for cheap Ford F150 Lightning car insurance are Erie, USAA, and State Farm, known for their competitive pricing and comprehensive coverage.

These companies cater specifically to the needs of electric truck owners, offering policies that combine affordability with thorough protection. They distinguish themselves in the insurance market with exceptional customer service and efficient claims handling, ensuring that Ford F150 Lightning owners receive the best possible value and support.

Our Top 10 Company Picks: Cheap Ford F150 Lightning Car Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $56 | A+ | Filing Claims | Erie |

| #2 | $64 | A++ | Military Members | USAA | |

| #3 | $70 | B | Financial Strength | State Farm | |

| #4 | $74 | A | Diminishing Deductible | Safeco | |

| #5 | $81 | A++ | Add-on Coverages | Auto-Owners | |

| #6 | $88 | A+ | Accident Forgiveness | Nationwide |

| #7 | $91 | A+ | Customer Service | Allstate | |

| #8 | $96 | A | Safe-Driving Discounts | Farmers | |

| #9 | $102 | A+ | Coverage Options | Progressive | |

| #10 | $113 | A | High-Risk Coverage | The General |

When selecting an insurer, it’s crucial to consider factors like their reputation for customer satisfaction, the breadth of their coverage offerings, and their overall reliability.

Enter your ZIP code above to compare rates from the top providers near you.

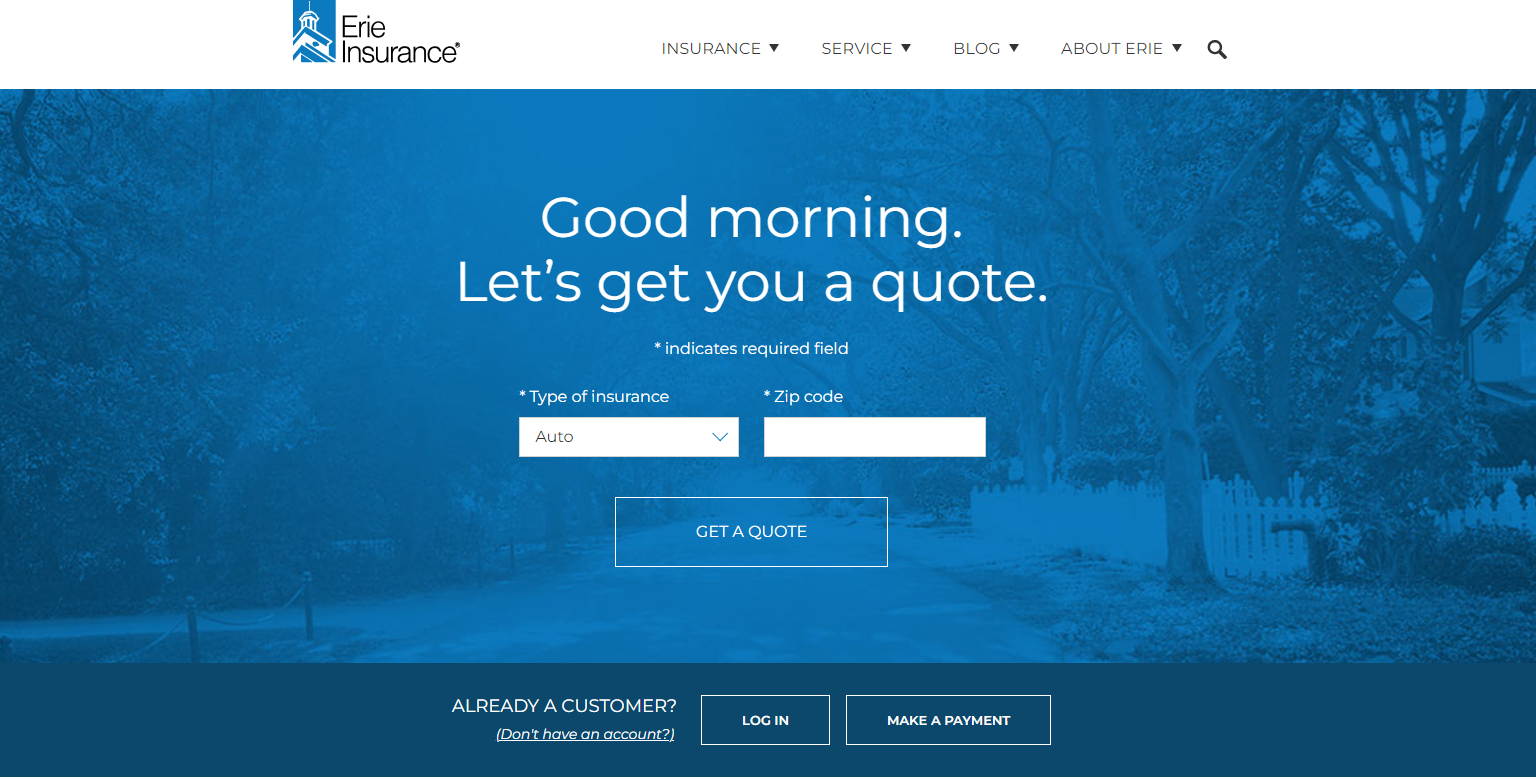

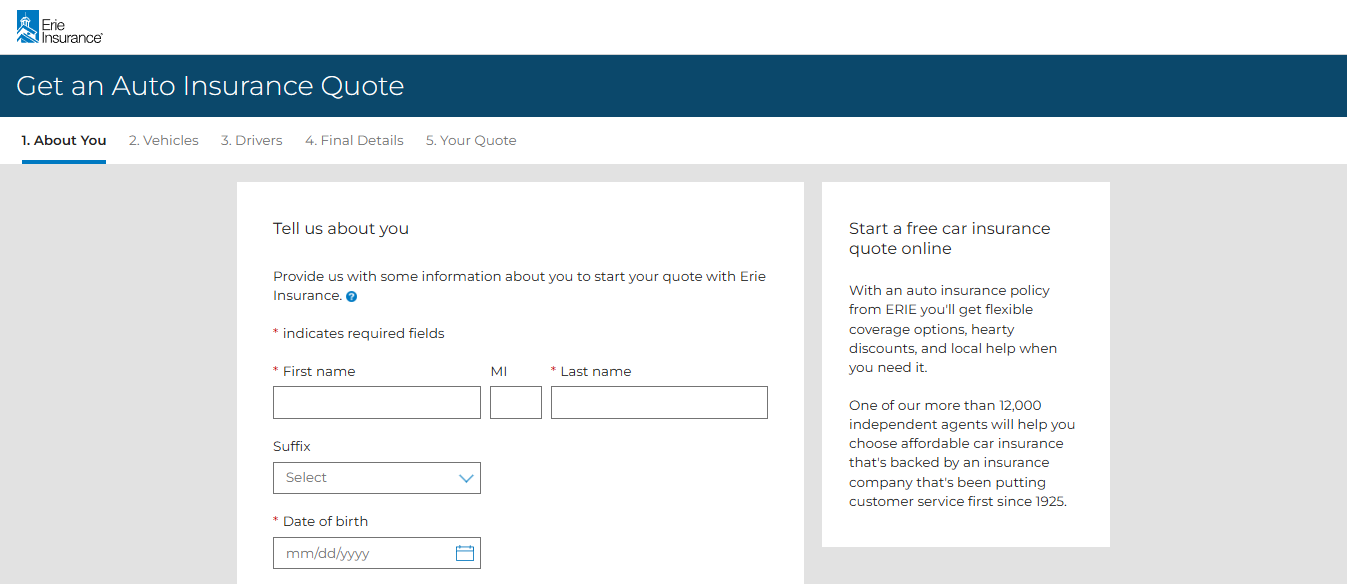

#1 – Erie: Top Overall Pick

Pros

- Fast Claims Process: Erie is renowned for its efficient and quick handling of claims, making it ideal for those who prioritize speed and reliability. Learn more in our article titled Erie insurance review & ratings.

- Competitive Rates: With monthly rates starting at $56, Erie offers some of the most affordable premiums for high-quality coverage.

- High Customer Satisfaction: Erie consistently receives high marks for customer service, emphasizing a personalized approach.

Cons

- Regional Availability: Erie’s services are not available nationwide, limiting accessibility for some potential customers.

- Less Flexibility: Fewer options for customizing policies compared to larger national insurers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Members

Pros

- Tailored to Military: USAA offers specific benefits and discounts for service members and their families. See more details on our article titled USAA insurance review & ratings.

- Superior Customer Support: Known for exceptional customer service, especially in handling claims and inquiries.

- Robust Financial Health: USAA boasts an A++ rating from A.M. Best, indicating superior financial stability.

Cons

- Exclusive Membership: Only available to military members, veterans, and their families, which restricts access for the general public.

- Limited Physical Locations: While they offer excellent online services, physical branches are relatively few.

#3 – State Farm: Best for Financial Strength

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: Provides a substantial discount for low-mileage usage.

- Wide Coverage: Offers various coverage options tailored for different business needs. More information is available about this provider in our article titled State Farm car insurance review & ratings.

Cons

- Limited Multi-Policy Discount: The multi-policy discount is not as high compared to some competitors.

- Premium Costs: Despite discounts, premiums might still be relatively higher for certain coverage levels.

#4 – Safeco: Best for Diminishing Deductible

Pros

- Diminishing Deductible: Safeco rewards safe drivers by reducing the deductible over time without a claim.

- Broad Coverage Options: Offers a wide range of coverages, including unique options like pet insurance during travel.

- Bonus Track: Provides incentives for good driving habits through their RightTrack program. Check out insurance savings in our complete article titled Safeco insurance review & ratings.

Cons

- Customer Service Variability: Some customers report inconsistent experiences with customer service.

- Rate Fluctuations: Premiums may increase significantly upon policy renewal, which can be unpredictable.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Auto-Owners: Best for Add-on Coverages

Pros

- Extensive Add-On Options: Auto-Owners offers a variety of additional coverages that can be tailored to specific needs.

- Superior Claims Service: Known for an efficient claims process and responsive service. Discover more about offerings in our article titled Auto-Owners insurance review & ratings.

- Strong Financial Stability: Holds an A++ rating, reflecting high levels of financial health.

Cons

- Higher Cost: Generally more expensive than some competitors, particularly for basic coverage levels.

- Less Online Presence: Relies more on agent-based interactions, which might not appeal to all customers.

#6 – Nationwide: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Nationwide does not increase your premiums after your first at-fault accident.

- Flexible Policies: Offers a variety of customizable options to fit different insurance needs.

- Loyalty Discounts: Provides significant discounts for long-term customers. Access comprehensive insights into our article titled Nationwide insurance review & ratings.

Cons

- Variable Customer Satisfaction: Reports on customer satisfaction can vary widely based on region and agent.

- Premium Increases: Some customers may experience rate increases even without filing a claim.

#7 – Allstate: Best for Customer Service

Pros

- Superior Customer Interaction: Allstate is renowned for its customer service, providing support and detailed guidance through claims.

- Innovative Tools: Offers tools like Drivewise to help customers manage their policies and driving habits.

- Wide Network: Large network of agents providing personalized service. Delve into our evaluation of Allstate insurance review & ratings.

Cons

- Higher Premiums: Generally higher rates compared to competitors, especially for new customers.

- Complex Claims Process: Some customers find the claims process to be lengthy and complex.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Safe-Driving Discounts

Pros

- Safe Driver Rewards: Farmers offers substantial discounts for drivers with a clean driving record.

- Customizable Coverage: Provides extensive options to tailor coverage to individual needs.

- Effective Online Tools: Offers efficient online management tools for policy handling. Unlock details in our article titled Farmers car insurance review & ratings.

Cons

- Higher Rates for High-Risk: Rates can be significantly higher for those with previous claims or poor driving records.

- Agent Dependence: Relies heavily on agent interactions, which may vary in quality.

#9 – Progressive: Best for Coverage Options

Pros

- Extensive Coverage Choices: Progressive offers a wide array of coverage options, from standard to highly specialized.

- Snapshot Program: Offers potential savings through their usage-based Snapshot program.

- Online Efficiency: Known for a user-friendly online interface and quick quote process. Read up on the “Progressive Insurance Review & Ratings” for more information.

Cons

- Customer Service Complaints: Some customers report dissatisfaction with the claims service.

- Pricing Inconsistency: Rates can vary greatly depending on multiple factors, sometimes unpredictably so.

#10 – The General: Best for High-Risk Coverage

Pros

- Specializes in High-Risk: The General provides coverage for drivers who may have a hard time finding insurance elsewhere.

- Flexible Payment Options: Offers various payment plans to accommodate different budget needs. Discover insights in our article titled The General car insurance review & ratings.

- Quick Coverage: Fast and easy process to start coverage, especially useful for those requiring immediate insurance.

Cons

- Higher Premiums: Typically, premiums are higher due to the nature of insuring high-risk drivers.

- Customer Service Quality: Customer service ratings are lower compared to other insurers, with some reports of dissatisfaction.

Ford F150 Lightning Car Insurance Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $91 | $178 |

| Auto-Owners | $81 | $163 |

| Erie | $56 | $130 |

| Farmers | $96 | $186 |

| Nationwide | $88 | $170 |

| Progressive | $102 | $192 |

| Safeco | $74 | $158 |

| State Farm | $70 | $145 |

| The General | $113 | $210 |

| USAA | $64 | $138 |

For owners of the Ford F150 Lightning considering minimum coverage, rates start as low as $56 with Erie and can go up to $113 with The General, highlighting a significant variance based on the insurer. See more details on our article titled “Full Coverage Car Insurance: A Complete Guide.”

On the other hand, full coverage premiums also show considerable differences; Erie offers the most affordable option at $130 per month, whereas The General’s rate climbs to $210.

This range in pricing reflects the different levels of protection and benefits that each company offers, making it essential for truck owners to carefully assess their coverage needs against their budget. Notably, companies like State Farm and USAA provide middle-ground options at $145 and $138 for full coverage, respectively, balancing cost with comprehensive benefits.

Factors That Determine Ford F150 Lightning Car Insurance Rates

Several factors influence car insurance rates for the Ford F150 Lightning, including the vehicle’s cost, powertrain, repair costs, safety features, theft rates, and accident statistics. As an electric vehicle (EV), the F150 Lightning’s specialized components and required expertise also impact premiums.

Additionally, insurers evaluate the driver’s age, driving history, location, and credit score to assess risk. Drivers who are younger, have poor driving records, or live in high-risk areas may face higher premiums. Learn more in our article titled “Cheapest Car Insurance for 23-Year-Old

Insurance companies may raise premiums for the Ford F150 Lightning if it has a higher accident rate compared to other vehicles, reflecting the increased risk. Insurance companies consider the Ford F150 Lightning’s usage when setting premiums. Higher rates may apply if it’s used commercially or driven long distances regularly, due to greater accident risk and mileage.

Understanding the Insurance Coverage Options for Ford F150 Lightning

When insuring a Ford F150 Lightning, knowing your coverage options is key. State laws vary, but liability coverage is essential for damages and injuries you cause in an accident.

Also consider comprehensive and collision coverage for your vehicle’s protection against accidents, theft, and disasters. Personal injury protection (PIP) and uninsured/underinsured motorist coverage offer additional safety. Evaluate your needs and budget to choose the right coverage for your F150 Lightning.

Consider adding roadside assistance to your Ford F150 Lightning insurance for help with breakdowns, flat tires, and other emergencies, including towing and jump-start services. Having roadside assistance coverage can give you peace of mind knowing that help is just a phone call away, especially during long trips or in unfamiliar areas. Confirm the availability and details of roadside assistance with your insurance provider.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Car Insurance Quotes for Ford F150 Lightning

Comparing car insurance quotes is an essential step in finding the best coverage at the most competitive rates for your Ford F150 Lightning. Insurance companies vary in pricing and coverage, so getting quotes from multiple insurers is crucial for informed decisions. When requesting quotes, accurately detail your vehicle, driving history, and coverage needs. Consider deductibles, coverage limits, and additional insurer benefits.

When comparing car insurance quotes for your Ford F150 Lightning, consider available discounts for safe driving, multiple policies, or vehicle safety features. Reading reviews and seeking recommendations from other owners can also help you find the best coverage and value for your insurance needs.

Tips to Lower Your Ford F150 Lightning Car Insurance Premiums

Insurance rates for the Ford F150 Lightning can vary, but you can reduce your premiums through several strategies. Maintaining a clean driving record is key, as it shows responsible driving. Consider choosing higher deductibles, bundling policies, or adding anti-theft devices and safety features to your vehicle.

Additionally, taking defensive driving courses, monitoring your annual mileage, and regularly reviewing your coverage can also lead to discounts. Check out insurance savings in our complete guide titled “Mileage-Based Car Insurance: A Complete Guide.”

The Impact of Ford F150 Lightning’s Features on Insurance Costs

The Ford F150 Lightning features numerous performance and safety enhancements that can affect insurance costs. Advanced safety features like lane departure warning and automatic braking may lower premiums, while high-performance engines could increase them.

Discussing these feature impacts with your insurer is crucial for understanding their effect on insurance rates. Discover more about offerings in our article titled “How does the insurance company determine my premium?”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How the Ford F150 Lightning’s Safety Ratings Affect Insurance Rates

Safety ratings significantly influence car insurance rates. The Ford F150 Lightning, with its advanced safety technologies and robust design, receives high marks from organizations like the National Highway Traffic Safety Administration (NHTSA) and the Insurance Institute for Highway Safety (IIHS).

These high safety ratings indicate a lower risk of injuries and damages, potentially reducing insurance premiums. Access comprehensive insights into our article titled “How to Document Damage for Car Insurance Claims.”

Exploring Discounts and Savings Opportunities for Ford F150 Lightning Car Insurance

Insurance companies provide various discounts and savings opportunities to encourage safe driving and customer loyalty when insuring a Ford F150 Lightning. Available discounts may include reductions for safe driving records, bundling policies, paying premiums in full, or membership in professional organizations.

Jeff Root Licensed Life Insurance Agent

Some insurers also offer usage-based programs using telematics or mobile apps to track driving habits, which can lead to lower premiums for safe drivers. Delve into our evaluation of article titled “Best Safe Driver Car Insurance Discounts.”

Common Mistakes to Avoid When Insuring a Ford F150 Lightning

When insuring a Ford F150 Lightning, it’s crucial to avoid common pitfalls that may increase costs or compromise coverage. Common mistakes include underinsuring with minimal coverage limits, risking vulnerability in accidents, neglecting periodic policy reviews as needs change, and missing out on discounts or better rates by not shopping around.

By recognizing and avoiding these errors, you can make informed choices and secure optimal insurance for your Ford F150 Lightning. Unlock details in our article titled “Lesser Known Car Insurance Discounts.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

What to Expect When Insuring a New Ford F150 Lightning Model

Insuring a new Ford F150 Lightning involves unique considerations. New models often face higher insurance rates due to greater replacement costs and limited claim data. Yet, the Lightning’s advanced safety features and solid build quality might help secure competitive rates.

Discussing options with providers and getting quotes is recommended to grasp the specific costs for this new model. Discover insights in our “How To Get Free Insurance Quotes Online.”

Specialized Insurance Policies for Electric Vehicles Like the Ford F150 Lightning

Electric vehicles like the Ford F150 Lightning need specialized insurance policies that address their unique risks, such as battery damage and the need for home charging equipment coverage. It’s important to consult with insurers experienced in EV policies to secure comprehensive coverage tailored to your F150 Lightning’s specific requirements. Learn more in our article titled “What is included in comprehensive car insurance?”

Understanding Deductibles and Coverage Limits for Ford F150 Lightning Car Insurance

Deductibles and coverage limits are important factors to consider when choosing car insurance for your Ford F150 Lightning. A deductible is the amount you are responsible for paying out of pocket before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, while lower deductibles provide more immediate coverage but may increase insurance costs.

Coverage limits refer to the maximum amount your insurance provider will pay for covered claims. It is essential to carefully evaluate your financial situation and risk tolerance to select deductibles and coverage limits that strike the right balance for your Ford F150 Lightning insurance policy. See more details on our article titled “How to File a Car Insurance Claim.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Importance of Comprehensive and Collision Coverage for Your Ford F150 Lightning

Comprehensive and collision coverage are crucial considerations for insurance policies covering the Ford F150 Lightning. Comprehensive coverage protects against damages to your vehicle from non-collision events, such as theft, vandalism, fire, or natural disasters. Check out insurance savings in our complete guide titled “Collision vs. Comprehensive Car Insurance.”

Collision coverage, on the other hand, covers damage to your vehicle resulting from collisions with other vehicles or objects. Given the value and unique features of the Ford F150 Lightning, having comprehensive and collision coverage provides an added layer of protection, ensuring that you are covered in a wide range of scenarios.

How Location Can Affect Your Ford F150 Lightning Car Insurance Rates

The location where you reside can have a significant impact on your car insurance rates for the Ford F150 Lightning. Insurance companies consider factors such as the crime rate in your area, the frequency of accidents, and the cost of vehicle repair services when determining rates. Urban areas with higher population densities and increased traffic tend to have higher insurance rates due to a higher likelihood of accidents and theft.

Laura Walker Former Licensed Agent

Furthermore, geographic areas prone to severe weather conditions or natural disasters may also experience higher insurance costs. It’s important to consider your location when seeking insurance coverage for your Ford F150 Lightning. Discover more about offerings in our “What states require car insurance?”

Differences in Premiums: Ford F150 Lightning vs. Other Similar Trucks

When comparing insurance premiums for the Ford F150 Lightning with similar trucks, several variables affect the rates. These include vehicle value, performance, safety ratings, and repair costs. The unique components of electric trucks like the Ford F150 Lightning also influence costs. It’s wise to get quotes for various trucks, considering your needs, driving habits, and budget to make a well-informed insurance decision.

In conclusion, the cost of car insurance for the Ford F150 Lightning is influenced by the vehicle’s features, safety ratings, the driver’s profile, and location. Delve into our evaluation of our guide titled “Best Safety Features Car Insurance Discounts.”

Understanding coverage options and comparing insurer quotes is crucial for finding competitive rates. Awareness of deductibles, coverage limits, and available discounts can also reduce premiums. Armed with this knowledge, you can make informed decisions that protect your investment and meet your specific needs.

Searching for more affordable premiums? Insert your ZIP code below to get started on finding the right provider for you and your budget.

Frequently Asked Questions

What factors affect the cost of insurance for a Ford F150 Lightning?

The cost of insurance for a Ford F150 Lightning can be influenced by factors such as the driver’s age, driving history, location, coverage options, deductible amount, and the specific insurance provider’s rates.

For additional details, explore our comprehensive resource titled “Best Car Insurance for 21-Year-Old Drivers.”

Is the insurance cost for a Ford F150 Lightning higher compared to other Ford truck models?

The insurance cost for a Ford F150 Lightning may be higher compared to other Ford truck models due to factors like the Lightning’s higher performance capabilities, potential repair costs, and overall value. However, specific insurance rates can vary depending on various factors and the insurance provider’s assessment.

Are there any discounts available to lower the insurance cost for a Ford F150 Lightning?

Yes, various insurance providers may offer discounts that can help lower the insurance cost for a Ford F150 Lightning. These discounts can include safe driver discounts, multi-vehicle discounts, bundling discounts, loyalty discounts, and more. It’s recommended to inquire with different insurance companies to explore available discounts.

Does the cost of insurance for a Ford F150 Lightning differ based on the trim level?

The cost of insurance for a Ford F150 Lightning may vary based on the trim level. Higher trim levels with additional features and higher values may result in slightly higher insurance premiums. However, the specific impact can vary depending on the insurance provider’s evaluation and the driver’s individual circumstances.

Can I get an estimate of the insurance cost for a Ford F150 Lightning without contacting insurance providers directly?

Yes, you can estimate the insurance cost for a Ford F150 Lightning using online comparison tools. By inputting details about the vehicle and your driving history, you can quickly receive estimates from various insurers without direct contact.

To find out more, explore our guide titled “Best Car Insurance by Vehicle.”

How much are people paying for f150 Lightning?

The starting monthly rate for the 2023 Ford F-150 Lightning’s base-level Pro trim, including destination fees and common options, is approximately $4,332, based on the Manufacturer’s Suggested Retail Price of $51,990.

Is there a rebate for f150 Lightning?

The discounted monthly rates for the F-150 Lightning are as follows: The Pro model, with an MSRP of $49,995 and a $7,500 credit, costs about $3,541. The XLT model, starting at $54,995 with the same credit, is around $3,958. The 320-mile range XLT, initially $69,995, after a total of $15,000 in incentives, is roughly $4,583 per month.

Why are Fords so expensive to insure?

This isn’t to imply that the renowned American car manufacturer doesn’t also make higher-priced vehicles; it certainly does. Generally, though, these vehicles are reasonably priced and come equipped with premium features. Mediocre safety ratings and relatively high theft rates can make some models a bit more expensive to insure on a monthly basis.

Does 4WD increase insurance?

Similar to AWD vehicles, 4WD vehicles might incur higher monthly insurance costs because they are sturdier than standard cars. Check with your auto insurance provider to determine if and how much off-roading is included in your policy and to discover which cars are the least expensive to insure monthly.

To learn more, explore our comprehensive resource on “Best Car Insurance for College Students.”

Do F-150 Lightning hold value?

This detailed procedure guarantees that the vehicles chosen for the awards epitomize the top performers in value retention over a five-year ownership period. The Ford F-150 Lightning exemplifies this, with an expected five-year resale value of 43% of its MSRP, highlighting the electric truck category’s increasing robustness in maintaining value.

Why are Ford lightnings so cheap?

Is Ford losing money on F-150 Lightning?

Do you get free charging with Ford Lightning?

How long does it take to charge a Ford Lightning?

Is Ford F-150 Lightning deposit refundable?

Are older cars cheaper to insure?

Which is safer AWD or 4WD?

Does lifting your car increase insurance?

Is it better to drive more or less for insurance?

How many miles will a Ford F-150 Lightning last?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.