Cheap Ferrari California Car Insurance in 2026 (Earn Savings With These 10 Companies!)

Progressive, State Farm, and Nationwide offer the best rates for cheap Ferrari California car insurance, starting at $149 per month. These insurers provide excellent affordability and comprehensive coverage, making them the top picks for Ferrari California owners seeking quality insurance at competitive prices.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Travis Thompson

Updated January 2025

Company Facts

Min. Coverage for Ferrari California

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Ferrari California

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Ferrari California

A.M. Best

Complaint Level

Pros & Cons

Our Top 10 Company Picks: Cheap Ferrari California Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $149 A+ Competitive Rates Progressive

#2 $153 B Discount Options State Farm

#3 $157 A+ Customer Service Nationwide

#4 $162 A++ Comprehensive Coverage Geico

#5 $168 A++ Digital Experience Chubb

#6 $173 A++ Balanced Coverage Travelers

#7 $179 A Personalized Options Liberty Mutual

#8 $183 A Service Excellence Farmers

#9 $187 A+ Extensive Discounts Allstate

#10 $193 A++ Military Families USAA

Shield your car from financial setbacks. Enter your ZIP code above to shop for cheap commercial insurance rates from top providers near you.

Whether you’re looking to protect your investment with robust insurance coverage or seeking ways to optimize your policy for cost-effectiveness, exploring these options can help you find the right balance of affordability and protection for your Ferrari California.

- Progressive offers Ferrari California insurance from $149/month

- Factors such as driver age, location, and vehicle value impact coverage needs

- Tailored insurance options are available to meet luxury vehicle requirements

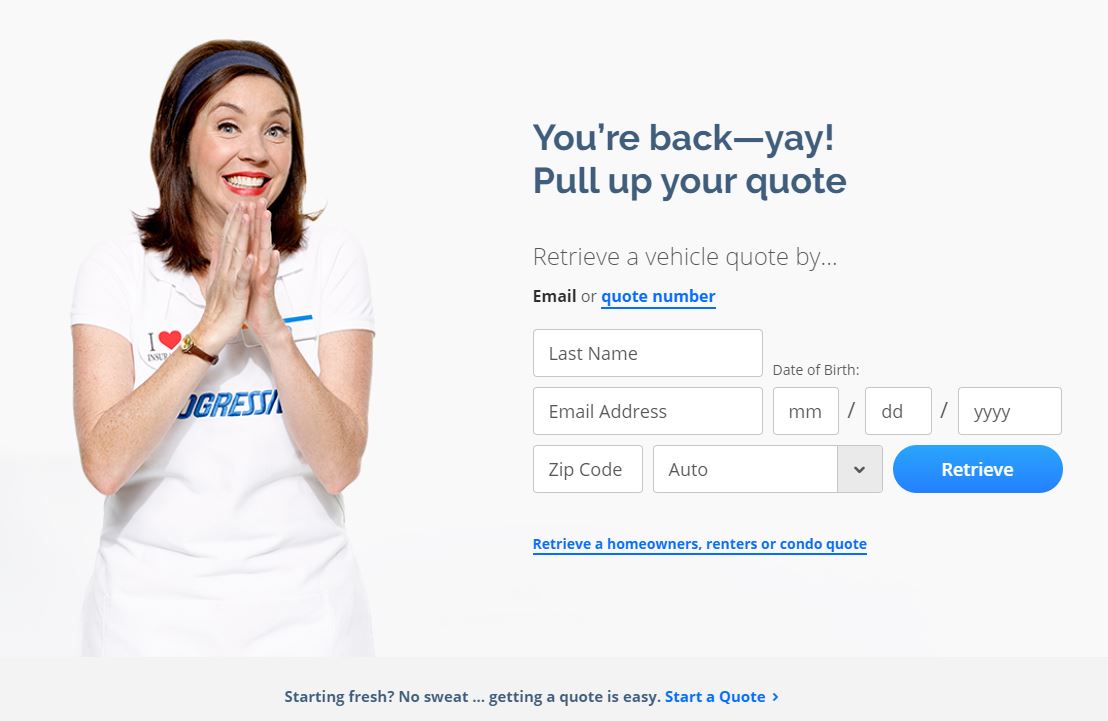

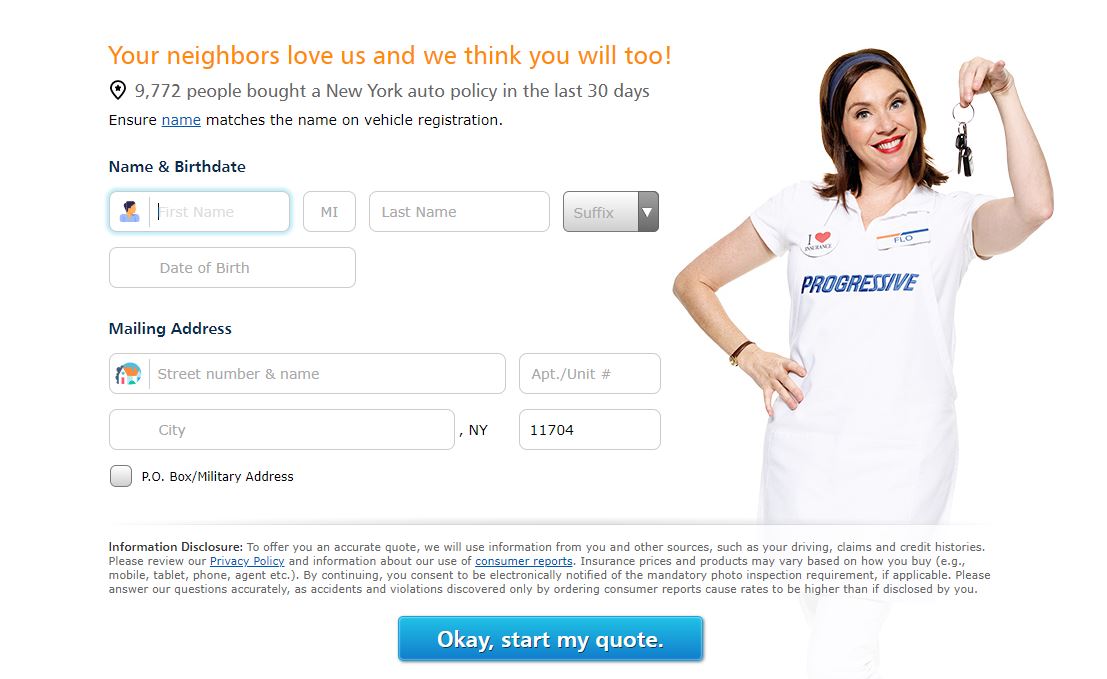

#1 – Progressive: Top Overall Pick

Pros

- Competitive Rates: Progressive insurance review & ratings parade the company’s competitive pricing in the insurance market, making it an attractive option for cost-conscious consumers.

- Variety of Coverage Options: Progressive provides a wide range of coverage options, from basic liability to comprehensive and specialized coverages like rideshare insurance, catering to diverse customer needs.

- Strong Financial Strength: Progressive has a solid financial foundation, ensuring stability and reliability for policyholders.

Cons

- Customer Service Reviews: While Progressive generally offers efficient service, some customers have reported mixed experiences with their customer service, including delays and varied responsiveness.

- Limited Discounts: Compared to some competitors, Progressive may offer fewer discount options, potentially limiting opportunities for additional savings.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Discount Options

Pros

- Discount Options: State Farm offers various discounts that can help lower premiums, including multi-policy, safe driver, and vehicle safety feature discounts, making it appealing for budget-conscious customers.

- Personalized Service: State Farm insurance review & ratings showcase the company’s vast network of local agents known for providing personalized service and expert guidance, ensuring customers receive tailored insurance solutions.

- Range of Insurance Products: In addition to auto insurance, State Farm offers a comprehensive suite of insurance products such as home, life, and health insurance, allowing customers to bundle policies for convenience and savings.

Cons

- Higher Rates: Rates at State Farm may be slightly higher compared to some other insurers on the list, depending on the individual’s profile and location.

- Limited Digital Experience: While State Farm has made strides in enhancing its online presence, some customers may find its digital tools and mobile app less advanced compared to newer competitors.

#3 – Nationwide: Best for Customer Service

Pros

- Excellent Customer Service: Nationwide is highly regarded for its customer service, with responsive agents and efficient claims handling, contributing to high customer satisfaction.

- Wide Range of Coverage Options: Nationwide offers competitive pricing for various types of coverage beyond auto insurance, including home, renters, and life insurance, ensuring comprehensive protection options.

- Accessibility: Nationwide insurance review & ratings present the company’s coverage across many states, ensuring availability and accessibility to a wide customer base.

Cons

- Limited Availability: Nationwide’s coverage may not be as widely available in some regions compared to larger insurers with more extensive networks, potentially limiting choices for customers in certain areas.

- Digital Tools: Some customers may find Nationwide’s online tools and digital experience less intuitive and user-friendly compared to leading competitors in the digital space.

#4 – Geico: Best for Comprehensive Coverage

Pros

- Comprehensive Coverage: Geico car insurance discounts showcase the company’s comprehensive coverage options that can be tailored to meet individual needs, including additional services like roadside assistance and rental car reimbursement.

- User-Friendly Experience: Geico excels in providing a seamless digital experience with an intuitive website and mobile app, making policy management, claims filing, and customer support easily accessible and efficient.

- Strong Financial Stability: Geico maintains a robust financial standing, providing policyholders with confidence in the company’s ability to meet its financial obligations.

Cons

- Customer Service Reviews: While Geico generally provides efficient customer service, some customers have reported mixed experiences with impersonal interactions or challenges in reaching support during peak times.

- Price Changes: Like many insurers, Geico has been known to adjust premiums over time, which can be a consideration for customers seeking long-term rate stability.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Chubb: Best for Digital Experience

Pros

- Digital Experience: Chubb offers a streamlined digital platform for policy management, claims submission, and customer support, enhancing convenience and efficiency for its clients.

- High Financial Strength: Chubb insurance review & ratings highlight the company’s financial stability, providing reassurance to policyholders of its ability to handle claims and maintain operations effectively.

- Tailored Coverage: Chubb specializes in providing personalized insurance solutions for high-net-worth individuals and businesses, offering high limits and comprehensive protection tailored to unique needs.

Cons

- Higher Premiums: Chubb’s premiums may be higher compared to other insurers due to the comprehensive nature of their coverage and focus on serving affluent clientele.

- Limited Availability: Chubb’s coverage may be more selective and not as widely available compared to larger insurers with broader market reach, potentially limiting options for some customers.

#6 – Travelers: Best for Balance Coverage

Pros

- Balanced Coverage Options: Travelers offers a diverse range of insurance products beyond auto, including home, business, and specialty insurance, providing comprehensive coverage solutions for individuals and businesses alike.

- Excellent Financial Strength: Travelers is highly rated for financial stability, offering policyholders confidence in the company’s ability to withstand economic challenges and meet its obligations.

- Claims Handling: Travelers insurance review & ratings flaunt the company’s for efficient and fair claims processing, Travelers ensures quick resolution and support during critical moments for its customers.

Cons

- Higher Premiums: Travelers may have higher premiums compared to some competitors, particularly for certain demographics or coverage types.

- Customer Service Variability: While Travelers generally provides efficient customer service, some customers have reported mixed experiences with aspects of claims handling or policy inquiries.

#7 – Liberty Mutual: Best for Personalized Options

Pros

- Customizable Options: Liberty Mutual review & ratings exhibit the company’s wide array of customizable coverage options, allowing policyholders to tailor their insurance plans to fit their unique needs and preferences.

- Nationwide Availability: With coverage available across the United States, Liberty Mutual ensures accessibility and widespread reach for potential customers.

- Range of Insurance Products: In addition to auto insurance, Liberty Mutual provides home, renters, and life insurance, offering comprehensive coverage solutions for various aspects of customers’ lives.

Cons

- Higher Premiums: Depending on the coverage and location, premiums at Liberty Mutual may be higher compared to some competitors, potentially impacting budget-conscious consumers.

- Complex Claims Process: Some customers have found Liberty Mutual’s claims process to be intricate and time-consuming, requiring thorough documentation and communication for resolution.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Service Excellence

Pros

- Service Excellence: Farmers insurance review & ratings display the company’s exceptional customer service, supported by a network of knowledgeable agents who provide personalized guidance and support throughout the insurance process.

- Diverse Coverage Options: In addition to auto insurance, Farmers offers a broad range of insurance products including home, life, and business insurance, allowing for comprehensive coverage solutions tailored to individual needs.

- Strong Financial Standing: Farmers maintains a strong financial rating, providing policyholders with confidence in the company’s stability and ability to fulfill its obligations.

Cons

- Price Competitiveness: Farmers’ premiums may be higher compared to some competitors, which could be a consideration for price-sensitive consumers seeking more affordable options.

- Limited Discounts: While Farmers offers various discounts, some policyholders may find that the range of available discounts is not as extensive as with other insurers, potentially limiting savings opportunities.

#9 – Allstate: Best for Extensive Discounts

Pros

- Extensive Discounts: Allstate provides numerous discount opportunities, helping policyholders save on premiums through safe driver discounts, bundling discounts, and more.

- User-Friendly Technology: Allstate insurance review & ratings highlight the company’s innovative mobile app and online tools, making it easy for customers to manage their policies, file claims, and access support services quickly and conveniently.

- Strong Financial Stability: With a top-tier financial rating, Allstate offers stability and reliability, ensuring that policyholders are protected financially.

Cons

- Higher Rates: Allstate’s premiums may be on the higher side for certain demographics or coverage types, which could be a consideration for cost-conscious consumers comparing insurance options.

- Customer Service: While generally positive, customer service experiences at Allstate can vary, with occasional reports of delays or challenges in claims processing or policy inquiries.

#10 – USAA: Best for Military Families

Pros

- Exclusive Focus on Military Families: USAA specializes in serving military members, veterans, and their families, offering tailored insurance products designed to meet the unique needs and challenges faced by military personnel.

- Top-Rated Customer Service: USAA insurance review & ratings demonstrate the company’s customer service providing personalized support, efficient claims handling, and dedicated assistance to its members.

- Competitive Rates: USAA offers competitive pricing on various insurance products, helping military families save on premiums and overall insurance costs.

Cons

- Membership Eligibility: USAA membership is limited to military personnel, veterans, and their immediate family members, which restricts its availability to the general public.

- Limited Coverage Options: While comprehensive for its target demographic, USAA’s coverage options may be more focused and tailored compared to larger insurers offering a wider array of products.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors Influencing Ferrari California Insurance Rates

Insuring a Ferrari California involves several key factors. Insurance providers consider your age, driving history, location, the car’s value and age, and any modifications. Your credit score, chosen coverage level, and deductibles also impact your rates.

Younger drivers, especially those under 25, often face higher premiums due to higher accident risk. Additionally, your location plays a role; areas with higher accident or theft rates may lead to increased insurance costs. Understanding these factors can help you find ways to lower your premiums. To gain further insights, consult our comprehensive guide titled “Car Accidents: What to do in Worst Case Scenarios.”

Key Points on the Cost of Insuring Your Ferrari California

Insuring a Ferrari California involves understanding various factors that impact both the cost and coverage of your policy. This guide outlines essential points to consider for protecting your high-performance vehicle.

- Legal and Financial Protection: Car insurance is crucial for your Ferrari California, not only as a legal requirement but also to protect against the high costs of repairs and replacement parts. Comprehensive coverage ensures you are not burdened with exorbitant expenses.

- Liability Coverage: Insurance provides liability protection, covering the costs of injuries or property damage your Ferrari California may cause to others, safeguarding your financial interests.

- Cost Considerations: Insuring a Ferrari California is typically more expensive due to its high performance and luxury status. Premiums vary based on factors like driving history, location, age, and coverage level. Shopping around and comparing quotes is essential to find the best coverage at a competitive price.

By understanding the factors that influence the cost of insuring your Ferrari California, you can make informed decisions to ensure comprehensive coverage while managing expenses. For additional details, explore our comprehensive resource titled “What is comprehensive coverage?”

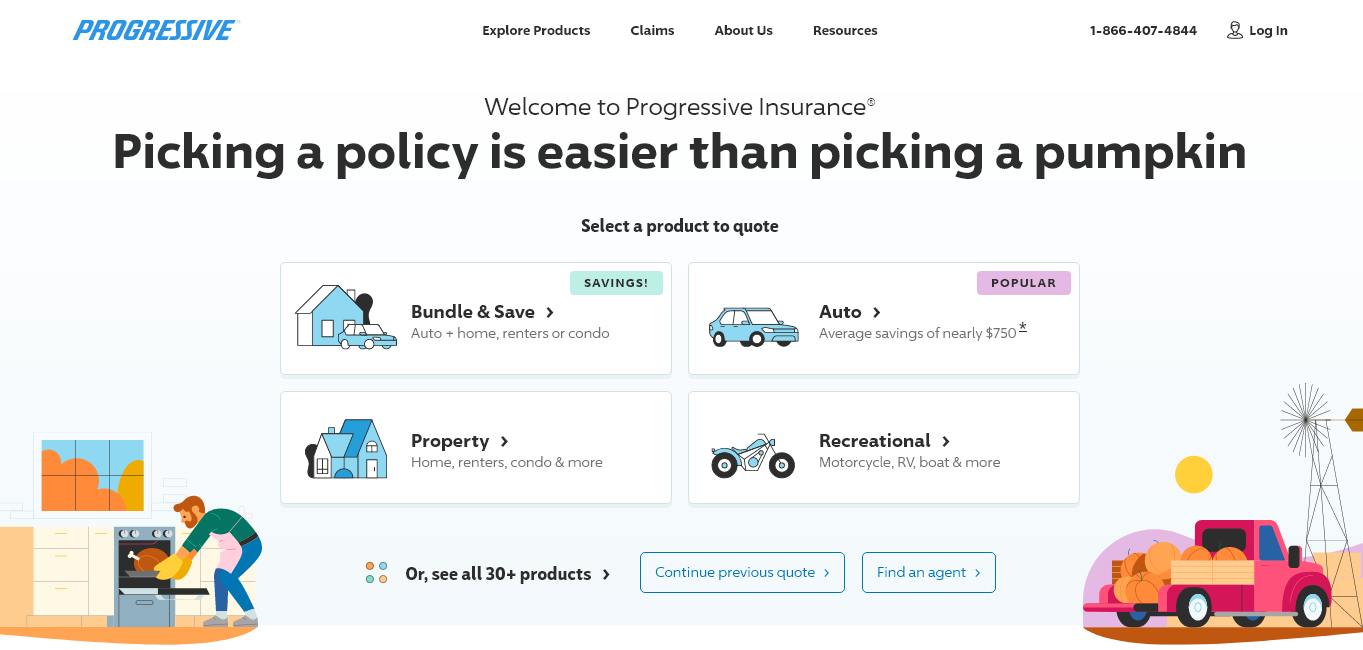

Ferrari California Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $187 $558

Chubb $168 $503

Farmers $183 $545

Geico $162 $489

Liberty Mutual $179 $531

Nationwide $157 $476

Progressive $149 $448

State Farm $153 $462

Travelers $173 $517

USAA $193 $572

Factors and Tips for Ferrari California Insurance

Several factors contribute to higher insurance premiums for the Ferrari California, including the high value and costly repairs typical of luxury vehicles. The increased risk associated with high-performance cars, such as a higher likelihood of accidents or theft, also drives up premiums. Insurance rates are further influenced by the insured’s age, driving history, and location, impacting the perceived risk for insurance providers.

To find affordable car insurance for your Ferrari California, maintain a clean driving record to qualify for lower rates. Consider raising deductibles and bundling insurance policies like home or boat insurance to potentially reduce costs. To delve deeper, refer to our in-depth report titled “Home and Car Insurance Discounts.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Guide to Ferrari California Insurance Factors

When insuring your Ferrari California, understanding the factors that affect insurance costs is crucial. From comparing insurance providers to considering the vehicle’s value and your location, each element plays a significant role in determining premiums.

- Comparing Insurance Providers: When insuring your Ferrari California, compare multiple insurance providers to find the best coverage at a competitive price. Review criteria, rates, coverage options, deductibles, and customer feedback to make an informed choice.

- Value and Age Impact: The value and age of your Ferrari California significantly influence insurance costs. Higher vehicle values and newer models typically result in higher premiums due to increased replacement costs. Insurance providers consider these factors when setting premiums and coverage options.

- Location’s Influence: Your location affects Ferrari California insurance rates, with higher-risk areas for accidents, theft, and vandalism often resulting in higher premiums. Consider the impact of location—urban versus rural—when obtaining insurance quotes to ensure cost-effective coverage.

Choosing the right insurance for your Ferrari California involves comparing providers to find optimal coverage at competitive rates.

Factors such as the vehicle’s value, age, and your location impact insurance costs significantly. By evaluating these factors carefully, you can secure comprehensive coverage that meets your needs effectively. For a thorough understanding, refer to our detailed analysis titled “What age do you get cheap car insurance?”

Navigating Ferrari California Insurance

Your driving history is crucial for determining insurance rates. A clean record lowers premiums, while accidents or violations increase costs. Safe driving habits ensure safety and reduce expenses.

Review coverage options and deductibles when selecting insurance. Comprehensive coverage protects against accidents, theft, and vandalism, while liability covers damages caused by your vehicle. Consider specialized options like agreed value coverage for luxury vehicles. To expand your knowledge, refer to our comprehensive handbook titled “How to Document Damage for Car Insurance Claims.”

Ty Stewart Licensed Insurance Agent

Avoid common pitfalls. Underestimating coverage to save money can lead to unexpected expenses. Disclose all modifications to ensure proper protection.

Ferrari California Insurance: Specialized Coverage Benefits

Understanding specialized coverage options is crucial for insuring luxury sports cars like the Ferrari California, ensuring comprehensive protection tailored to specific needs.

- Specialized Coverage Options: Tailored for luxury sports cars like the Ferrari California, options such as agreed value coverage guarantee full compensation without depreciation for total losses, and customization coverage protects enhancements.

- Benefits of Bundling Policies: Bundling Ferrari California insurance with home or boat policies often results in discounts, streamlining management with one provider for greater convenience in renewals, claims, and overall insurance needs. To gain in-depth knowledge, consult our comprehensive resource titled “What is claim?“

- Catering to Unique Needs: Understanding and exploring these specialized coverage options allows Ferrari California owners to customize their insurance policies to effectively meet their unique needs and protect their valuable investments.

Exploring specialized coverage options like agreed value coverage and bundling policies ensures thorough protection for your Ferrari California while potentially saving costs and simplifying insurance management.

Tailoring your strategy with these options provides peace of mind, knowing your luxury vehicle is fully covered under optimal insurance arrangements.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Managing Insurance Costs for Your Modified Ferrari California

Modifications and customizations to your Ferrari California can increase insurance premiums due to higher perceived risk. It’s crucial to inform your insurer about these changes to avoid coverage gaps or claim denials.

To reduce insurance costs without compromising coverage, maintain a clean driving record and consider adjusting deductibles. Compare quotes from multiple insurers and explore available discounts. Balancing affordability with adequate coverage is essential for effective insurance.

Regular maintenance and security measures significantly impact insurance rates for your Ferrari California. Proper upkeep reduces accident risks, potentially leading to lower premiums.

Managing Insurance for Your Ferrari California

When insuring a Ferrari California, understanding available discounts and preparing for potential claims are essential steps to ensure comprehensive coverage and cost efficiency.

- Explore specific discounts and incentives tailored for insuring luxury vehicles like the Ferrari California, such as loyalty discounts, safe driver rewards, and multi-vehicle ownership benefits. To delve deeper, refer to our in-depth report titled “Safe Driver Car Insurance Discounts.”

- Prepare comprehensive documentation including vehicle photographs, customization receipts, and maintenance records in case of an accident or damage to your Ferrari California.

- Immediately report any incidents to your insurance provider, providing essential details such as police reports, and maintain open communication throughout the claims process for a fair and efficient resolution.

By exploring tailored discounts, maintaining thorough documentation, and promptly reporting incidents, Ferrari California owners can navigate insurance processes effectively, safeguarding their investment and ensuring peace of mind on the road.

Frequently Asked Questions

Can you get insurance on a Ferrari in California, and how much is insurance on a Ferrari?

Yes, you can insure a Ferrari in California. Insurance costs for a Ferrari can vary widely depending on factors like the model, driver’s age, location, and coverage options. Premiums are generally higher due to the vehicle’s high value and performance.

What is the best auto insurance for California drivers, and is California car insurance expensive?

The best auto insurance for California drivers depends on individual needs. Companies like AAA, State Farm, and Geico offer competitive rates and comprehensive coverage options. California car insurance can be relatively expensive compared to other states due to factors like high population density and traffic congestion.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

Why is California car insurance high, and what is California minimum car insurance?

California car insurance is typically higher due to factors like high population density, traffic congestion, and insurance regulations. The minimum car insurance required in California includes liability coverage of at least $15,000 for injury or death to one person, $30,000 for injury or death to more than one person, and $5,000 for property damage per accident (15/30/5).

For a comprehensive overview, explore our detailed resource titled “Personal Injury Protection (PIP) Insurance.”

How much is AAA insurance in California, and can you get insurance on a Ferrari through AAA?

AAA offers various insurance products including auto insurance in California. Insurance rates with AAA can vary based on coverage options and individual circumstances. Yes, you can also insure a Ferrari through AAA, though premiums may be higher due to the vehicle’s value and performance.

What insurance group is a Ferrari in, and is a Ferrari expensive to insure?

Ferraris are typically classified in higher insurance groups due to their luxury status, high performance, and expensive repairs. Insurance costs for a Ferrari are generally higher compared to standard vehicles due to these factors.

What is the cheapest car insurance in California, and do I need a California license to get California car insurance?

The cheapest car insurance in California varies based on factors like driving history and location. While a California driver’s license is typically required to register and drive a vehicle in the state, some insurers may offer policies to drivers with out-of-state licenses under certain conditions.

To enhance your understanding, explore our comprehensive resource on business insurance titled “Cheapest Car Insurance Companies.”

Is California car insurance expensive, and what happens if you drive without insurance in California?

California car insurance can be relatively expensive due to various factors including high population density and traffic congestion. Driving without insurance in California can lead to penalties such as fines, license suspension, and vehicle impoundment.

Can I have a bond instead of car insurance in California, and what is the new law on car insurance in California?

In California, drivers can provide a cash deposit or a surety bond with the Department of Motor Vehicles (DMV) as an alternative to purchasing car insurance. The new law on car insurance in California may involve updates to minimum coverage requirements or other regulatory changes.

What is the cheapest full coverage car insurance in California, and why is it so hard to get car insurance in California?

The cheapest full coverage car insurance in California depends on factors like the vehicle’s value, driver’s age, and coverage limits. It can be challenging to get car insurance in California due to factors like high population density, traffic congestion, and stringent insurance regulations.

For detailed information, refer to our comprehensive report titled “Full Coverage Car Insurance: A Complete Guide.”

What is the best car insurance, and how much is insurance on a Ferrari in California?

The best car insurance depends on individual preferences and needs, with companies like AAA, Geico, and Progressive often highly regarded for their coverage options and customer service. Insurance costs for a Ferrari in California can vary significantly based on factors like the model, driver’s age, and coverage choices.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.

To secure the best insurance, consider factors like driving history, location, vehicle age, and value. By comparing providers, exploring coverage options, and maintaining safe driving habits, you can ensure your Ferrari California is well-protected while navigating insurance matters confidently.

To secure the best insurance, consider factors like driving history, location, vehicle age, and value. By comparing providers, exploring coverage options, and maintaining safe driving habits, you can ensure your Ferrari California is well-protected while navigating insurance matters confidently.