Cheap Dodge Viper Car Insurance in 2026 (Save Big With These 10 Companies!)

Nationwide, USAA, and State Farm stand out as the top choices for cheap Dodge Viper car insurance, with monthly rates starting at just $95. Known for their excellent coverage options and top-notch customer service, these insurers provide reliable protection for your Dodge Viper at an affordable price.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Dan Walker graduated with a BS in Administrative Management in 2005 and has been working in his family’s insurance agency, FCI Agency, for 15 years (BBB A+). He is licensed as an agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. He reviews content, ensuring tha...

Daniel Walker

Updated October 2024

Company Facts

Min. Coverage for Dodge Viper

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Dodge Viper

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Dodge Viper

A.M. Best

Complaint Level

Pros & Cons

Nationwide, USAA and State Farm are the top picks for cheap Dodge Viper car insurance, providing monthly rates starting at just $95.

Our Top 10 Company Picks: Cheap Dodge Viper Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $95 A+ Vanishing Deductible Nationwide

![]()

#2 $100 A++ Military Benefits USAA

![]()

#3 $110 B Accident Forgiveness State Farm

![]()

#4 $115 A++ Online Convenience Geico

#5 $120 A+ Snapshot Program Progressive

#6 $125 A Free Discount Farmers

#7 $130 A+ Safe Driving Allstate

#8 $135 A Car Replacement Liberty Mutual

#9 $140 A Loyalty Discount American Family

#10 $150 A++ Hybrid Discount Travelers

Shield your business from financial setbacks. Enter your ZIP code above to shop for cheap commercial insurance rates from top providers near you.

Progressive stands out for its exceptional customer service and customizable policies, ensuring that you get the best coverage at the best price while driving your Dodge Viper confidently on the road.

- Nationwide offers $95/month for cheap Dodge Viper car insurance

- Tailored coverage for Dodge Viper owners

- Affordable rates and reliable service

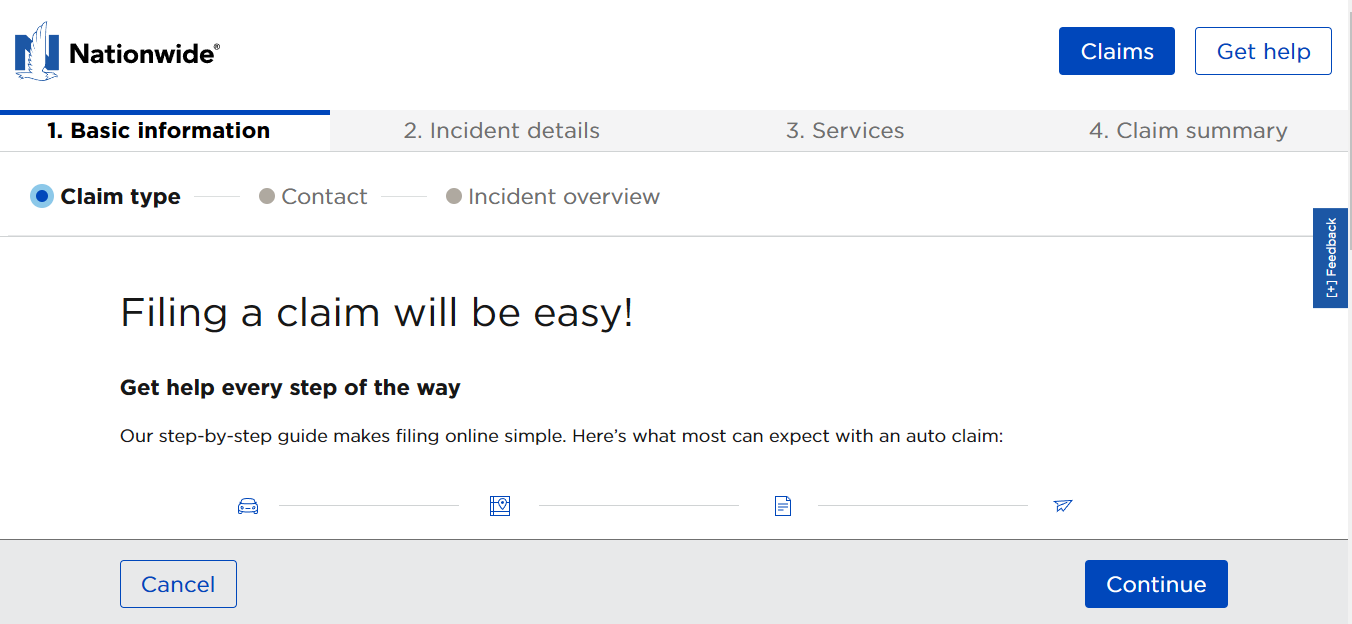

#1 – Nationwide: Top Overall Pick

Pros

- Vanishing Deductible: Nationwide insurance review & ratings demonstrates the company’s tailored coverage approach for drivers by highlighting the vanishing deductible feature, which adjusts deductibles based on safe driving behavior over time.

- Strong A.M. Best Rating: A+ rating indicates financial stability and reliability.

- Wide Range of Coverage Options: Provides various coverage options tailored to individual needs.

Cons

- Limited Availability: Not available in all states, which may limit options for some customers.

- Mixed Customer Service Reviews: Some customers report inconsistent experiences with customer service.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Benefits

Pros

- Military Benefits: Specializes in serving military members and their families with tailored insurance options.

- Exceptional Customer Service: USAA insurance review & ratings highlight the company’s tailored coverage for excellent customer service and efficient claims handling.

- Strong Financial Rating: A++ rating reflects excellent financial stability and reliability.

Cons

- Limited Membership: Only available to military personnel, veterans, and their families, excluding the general public.

- Online Only: Lacks physical branch locations, which may be inconvenient for some customers.

#3 – State Farm: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Offers accident forgiveness programs for qualifying policyholders.

- Extensive Agent Network: State Farm boasts an extensive network of agents, providing personalized and local customer service.

- Robust Coverage Options: In the State Farm insurance review & ratings, it’s evident that the company specializes in customized coverage for policyholders, offering a diverse range of options to meet specific needs and provide comprehensive protection.

Cons

- Average Rates: Rates are competitive but not always the lowest in the market.

- Limited Online Tools: Online services and tools may be less advanced compared to some competitors.

#4 – Geico: Best for Online Convenience

Pros

- Online Convenience: Geico offers a user-friendly online platform for managing policies and filing claims.

- Strong A.M. Best Rating: A++ rating indicates financial stability and reliability.

- Competitive Rates: Geico is known for offering competitive rates and discounts for various policyholders. To gain further insights, consult our comprehensive guide titled “Do Geico employees get car insurance discounts?.”

Cons

- Limited Agent Interaction: Geico primarily operates online and may have limited in-person agent interactions.

- Mixed Customer Service Reviews: Some customers report mixed experiences with customer service.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for Snapshot Program

Pros

- Snapshot Program: Progressive insurance review & ratings shows the company’s customized coverage for safe driving habits, featuring the Snapshot program with potential discounts.

- Strong A.M. Best Rating: A+ rating indicates financial stability and reliability.

- Customizable Policies: Provides options for customizing policies to fit individual needs and budgets.

Cons

- Average Rates: While competitive, Progressive’s rates may not always be the lowest available.

- Complex Claims Process: Some customers report challenges with the claims process and communication.

#6 – Farmers: Best for Free Discount

Pros

- Free Discount: Offers various discounts, including a free discount for policyholders who bundle multiple policies.

- Strong A.M. Best Rating: Farmers insurance review & ratings indicate the company’s specialized coverage options for meeting diverse insurance needs with financial stability and reliability.

- Personalized Service: Provides personalized service through a network of local agents.

Cons

- Limited Online Tools: Online tools and services may be less advanced compared to some competitors.

- Average Rates: While competitive, Farmers’ rates may not always be the lowest in the market.

#7 – Allstate: Best for Safe Driving

Pros

- Safe Driving Rewards: Offers rewards and discounts for safe driving behavior through programs like Drivewise.

- Strong A.M. Best Rating: A+ rating indicates financial stability and reliability.

- Comprehensive Coverage: Allstate insurance review & ratings showcases the company’s tailored coverage options for different needs and preferences

Cons

- Higher Rates: Allstate’s rates may be higher compared to some other insurers.

- Mixed Customer Service Reviews: Some customers report mixed experiences with claims processing and customer service.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Car Replacement

Pros

- Car Replacement Coverage: Offers car replacement coverage for qualifying policyholders.

- Strong A.M. Best Rating: A rating reflects financial stability and reliability.

- Multiple Discount Opportunities: Liberty Mutual insurance review & ratings showcases the company’s tailored coverage, including car replacement options for qualifying policyholders.

Cons

- Higher Rates: Liberty Mutual’s rates may be higher compared to some other insurers.

- Mixed Customer Service Reviews: Some customers report mixed experiences with claims processing and customer service.

#9 – American Family: Best for Loyalty Discount

Pros

- Loyalty Discount: American Family insurance review & ratings showcases its tailored coverage options for customers who have long-term policies and exhibit loyalty to the company.

- Strong A.M. Best Rating: A rating reflects financial stability and reliability.

- Personalized Service: Provides personalized service through a network of local agents.

Cons

- Average Rates: American Family’s rates may be competitive but not always the lowest in the market.

- Limited Online Tools: Online tools and services may be less advanced compared to some competitors.

#10 – Travelers: Best for Hybrid Discount

Pros

- Hybrid Discount: Offers discounts for hybrid vehicle owners.

- Strong A.M. Best Rating: Travelers insurance review & ratings reflect the company’s tailored coverage options, highlighting its financial stability and dependability with an A++ rating.

- Personalized Service: Provides personalized service through a network of local agents.

Cons

- Higher Rates: Travelers’ rates may be higher compared to some other insurers.

- Mixed Customer Service Reviews: Some customers report mixed experiences with claims processing and customer service.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors Affecting Dodge Viper Insurance Costs

When considering insurance for your Dodge Viper, several key factors come into play that affect the cost. Understanding these factors can help you make informed decisions about your coverage.

- Vehicle Value: The high market value of the Dodge Viper contributes to higher insurance premiums. The more expensive the vehicle, the more it will cost to insure.

- Driving History: Your driving record plays a significant role in determining your insurance premiums. If you have a history of accidents or traffic violations, you may be considered a higher risk driver and face higher insurance rates.

- Age and Model Year: The age and model year of your Dodge Viper can impact insurance costs. Newer models may have higher insurance rates due to higher replacement costs, while older models may have lower rates. For additional details, explore our comprehensive resource titled “What age do you get cheap car insurance?“

Factors such as your location, the type of coverage you choose, and your deductibles can also influence insurance costs for your Dodge Viper.

Dodge Viper Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $130 $260

American Family $140 $280

Farmers $125 $255

Geico $115 $235

Liberty Mutual $135 $270

Nationwide $95 $230

Progressive $120 $250

State Farm $110 $240

Travelers $150 $290

USAA $100 $220

Understanding these factors and working with your insurance provider can help you find the right coverage at a competitive rate.

Navigating Car Insurance Options for Your Dodge Viper

As you prepare to insure your Dodge Viper, understanding the essential coverage options is paramount. From legal requirements to comprehensive protection, each policy aspect plays a crucial role in safeguarding your high-performance vehicle.

When insuring your Dodge Viper, you have several coverage options to consider:

- Liability Coverage: Protects against damages to others or their property in accidents where you’re at fault, often a legal requirement.

- Collision Coverage: Pays for your Viper’s damages in collisions, regardless of fault, ensuring your investment is safeguarded. To learn more, explore our comprehensive resource on commercial auto insurance titled “Collision Car Insurance: A Complete Guide.”

- Comprehensive Coverage: Shields your vehicle from non-collision damages like theft, vandalism, or natural disasters, offering comprehensive protection.

By prioritizing liability, collision, and comprehensive coverage, you can navigate the complexities of car insurance confidently, ensuring your Dodge Viper is adequately protected in various scenarios. Consulting with insurance experts can further tailor your coverage to suit your specific needs and provide peace of mind on the road.

Securing Your Dodge Viper: The Vital Role of Car Insurance

Owning a Dodge Viper means embracing high-performance driving, but it also brings potential risks. Car insurance isn’t just a legal necessity; it’s your shield against unexpected financial burdens. With its substantial repair costs, a Dodge Viper demands comprehensive coverage.

From protecting your vehicle to ensuring liability coverage, insurance safeguards you from potential financial turmoil. Don’t leave your prized possession vulnerable—secure proper car insurance to safeguard your investment and peace of mind. To delve deeper, refer to our in-depth report titled “Liability Insurance: A Complete Guide.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Smart Strategies for Affordable Dodge Viper Insurance

Finding affordable insurance for your Dodge Viper is crucial. Here are some smart strategies to help you secure cost-effective coverage without compromising quality.

- Shop Around: Obtain quotes from multiple insurers to compare rates and coverage options effectively.

- Adjust Deductibles: Consider raising your deductibles to potentially lower premiums, ensuring you can manage the deductible amount in case of a claim. For a thorough understanding, refer to our detailed analysis titled “What is embedded deductible?“

- Utilize Discounts: Take advantage of available discounts, such as safe driver incentives, policy bundling discounts, or vehicle security features to reduce insurance costs.

By implementing these strategies, you can navigate the insurance market more effectively and find the best coverage options at reasonable rates for your Dodge Viper.

Driving Records Impact on Viper Insurance

Your driving record is one of the most significant factors insurance companies consider when determining your insurance premium for a Dodge Viper. A clean driving record, free of accidents and traffic violations, demonstrates to insurance providers that you are a responsible driver and may result in lower insurance rates.

On the other hand, a history of accidents or traffic infractions can lead to higher insurance premiums, as it suggests a higher risk of future claims.

Kristine Lee Licensed Insurance Agent

It is important to drive safely and follow traffic laws to maintain a clean driving record and keep your insurance rates as low as possible. To expand your knowledge, refer to our comprehensive handbook titled “Car Driving Safety Guide for Teens and Parents.”

Special Considerations for Vehicle Like Dodge Viper

Insuring a high-performance vehicle like the Dodge Viper comes with some special considerations. These considerations include:

1. Specialized Repairs: Repairs on high-performance vehicles can be more expensive due to the need for specialized parts and expertise. It is important to ensure that your insurance policy adequately covers these potential costs.

2. Increased Risk: High-performance vehicles are often associated with a higher risk of accidents due to their powerful engines and speed capabilities. This increased risk may result in higher insurance premiums.

3. Storage and Security: Some insurance companies may require additional security measures, such as proper storage or alarm systems, for high-performance vehicles like the Dodge Viper. These measures can reduce the risk of theft and potentially lower insurance rates.

Be sure to discuss these considerations with insurance providers when obtaining quotes for your Dodge Viper to ensure you have the appropriate coverage in place. To gain profound insights, consult our extensive guide titled “Compare Car Insurance Quotes.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Impact 0f Location 0n Dodge Viper Car Insurance Rates

Where you live can impact the cost of insuring your Dodge Viper. Insurance rates can vary from one geographic location to another due to factors such as traffic congestion, crime rates, and the prevalence of natural disasters.

- High traffic congestion or high crime rates can increase your risk of accidents or theft. For a comprehensive overview, explore our detailed resource titled “Best Anti Theft System Car Insurance Discounts.”

- Insurance companies may view you as a higher risk in such areas.

- This can result in higher insurance premiums.

Conversely, living in a rural area with lower traffic and crime rates may lead to lower insurance rates for your Dodge Viper.

Dodge Viper Insurance: The Impact of Deductibles on Your Premium

Deductibles are the amount you must pay out of pocket before your insurance coverage begins. Choosing a higher deductible can lower your insurance premium, as you are taking on more financial responsibility in the event of a claim. To enhance your understanding, explore our comprehensive resource on business insurance titled “Full Coverage Car Insurance: A Complete Guide.”

For example, if you have a $1,000 deductible and a claim for $5,000 in damages, you would need to pay $1,000 out of pocket, and your insurance company would cover the remaining $4,000. The higher the deductible you choose, the lower your insurance premium will be.

It is important to carefully consider your deductible and ensure that you can comfortably afford it in case of an accident or damage to your Dodge Viper.

Discounts for Insuring Your Dodge Viper

Insurance companies often offer various discounts and savings options that can significantly reduce the cost of insuring your Dodge Viper. For instance, safe driver discounts are available for those with a clean driving record free of accidents and traffic citations.

Bundling discounts can be obtained by combining multiple policies, such as auto and home insurance, with the same provider, leading to substantial savings. Additionally, installing security features like alarms or tracking systems on your Dodge Viper can qualify you for discounts on your insurance premiums.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Budget-Friendly Dodge Viper Insurance

Delve into practical insurance options and crucial policies to shield your Dodge Viper against unforeseen challenges and liabilities. From basic coverage to comprehensive protection, equip yourself with the insights to safeguard your vehicle’s well-being.

- Case Study #1 – Safe Driver Savings: Alex, a responsible driver with a spotless driving record, enjoys substantial savings on his Dodge Viper insurance premiums. His impeccable history qualifies him for a significant safe driver discount, slashing his insurance expenses by 25% annually.

- Case Study #2 – Policy Bundle Advantage: Maria opts to bundle her Dodge Viper insurance with her homeowner’s policy, simplifying her insurance costs. By combining her insurance needs, Maria secures a bundle discount of 20%. For a comprehensive analysis, refer to our detailed guide titled “Homeowners Insurance: A Complete Guide.”

- Case Study #3 – Enhanced Security Discount: Jack installs top-notch security features in his Dodge Viper to deter theft and vandalism. His proactive measures earn him a 15% discount on his car insurance premiums, acknowledging his efforts to enhance vehicle protection and minimize risks.

Ensure the resilience and security of your Dodge Viper with appropriate insurance coverage. From safe driving discounts to policy bundles and security device savings, acquiring cost-effective and comprehensive car insurance is essential for your peace of mind and financial stability.

Chris Abrams Licensed Insurance Agent

Frequently Asked Questions

How much is insurance for a Dodge Viper, and which company offers the cheapest rates?

Insurance rates for a Dodge Viper can vary based on factors like location, driving record, and coverage options. Companies like Nationwide, USAA, and State Farm often provide competitive rates for high-performance cars like the Viper.

Is the Dodge Viper considered a safe car to insure?

While the Dodge Viper is known for its performance, insurance companies may view it as a higher risk due to its power and speed capabilities. Ensuring comprehensive coverage is essential for protecting your investment and mitigating risks.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

Which type of car insurance is typically the cheapest for a Dodge Viper?

Basic liability insurance is usually the cheapest option for a Dodge Viper, covering damages to others in an accident. However, comprehensive coverage offers more protection, albeit at a higher cost.

To gain in-depth knowledge, consult our comprehensive resource titled “What is comprehensive coverage?”

Why did Dodge discontinue the Viper, and does this impact insurance costs?

Dodge ceased production of the Viper due to various factors. While discontinuation may not directly impact insurance costs, it can affect the availability of parts and repair options, potentially influencing insurance rates.

Can a Dodge Viper be driven daily, and does this affect insurance rates?

Some Viper owners use their cars as daily drivers. However, this usage may affect insurance rates due to increased mileage and exposure to potential risks. Consulting with insurance providers can clarify coverage options.

What is the average lifespan of a Dodge Viper, and how does this impact insurance coverage?

Dodge Vipers can last for many years with proper maintenance. However, older vehicles may require specialized insurance coverage or higher premiums due to increased risk of mechanical issues or accidents.

For a comprehensive analysis, refer to our detailed guide titled “Roadside Assistance Coverage: A Complete Guide.”

Is the Dodge Viper considered a supercar, and does this influence insurance rates?

The Dodge Viper is often classified as a supercar due to its performance characteristics. Insurance rates may reflect this classification, as supercars typically have higher insurance premiums due to their value and risk factors.

Can foreigners purchase car insurance for a Dodge Viper in the USA?

Foreigners can typically purchase car insurance for a Dodge Viper in the USA. However, insurance requirements and rates may vary based on factors such as residency status and driving history.

What is the cheapest car insurance available in the USA, and how can drivers find it?

The cheapest car insurance in the USA varies based on individual factors. Drivers can find affordable rates by comparing quotes from multiple insurance companies, taking advantage of discounts, and choosing appropriate coverage levels for their needs.

To broaden your understanding, explore our comprehensive resource on insurance coverage titled “Cheapest Car Insurance Companies.”

What factors besides the car itself can affect insurance costs for a Dodge Viper?

Factors such as age, driving record, location, coverage options, and vehicle modifications can all influence insurance costs for a Dodge Viper. Shopping around and comparing quotes can help find the best rates.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.