Cheap Dodge Sprinter 3500 Cargo Car Insurance in 2026 (10 Most Affordable Companies)

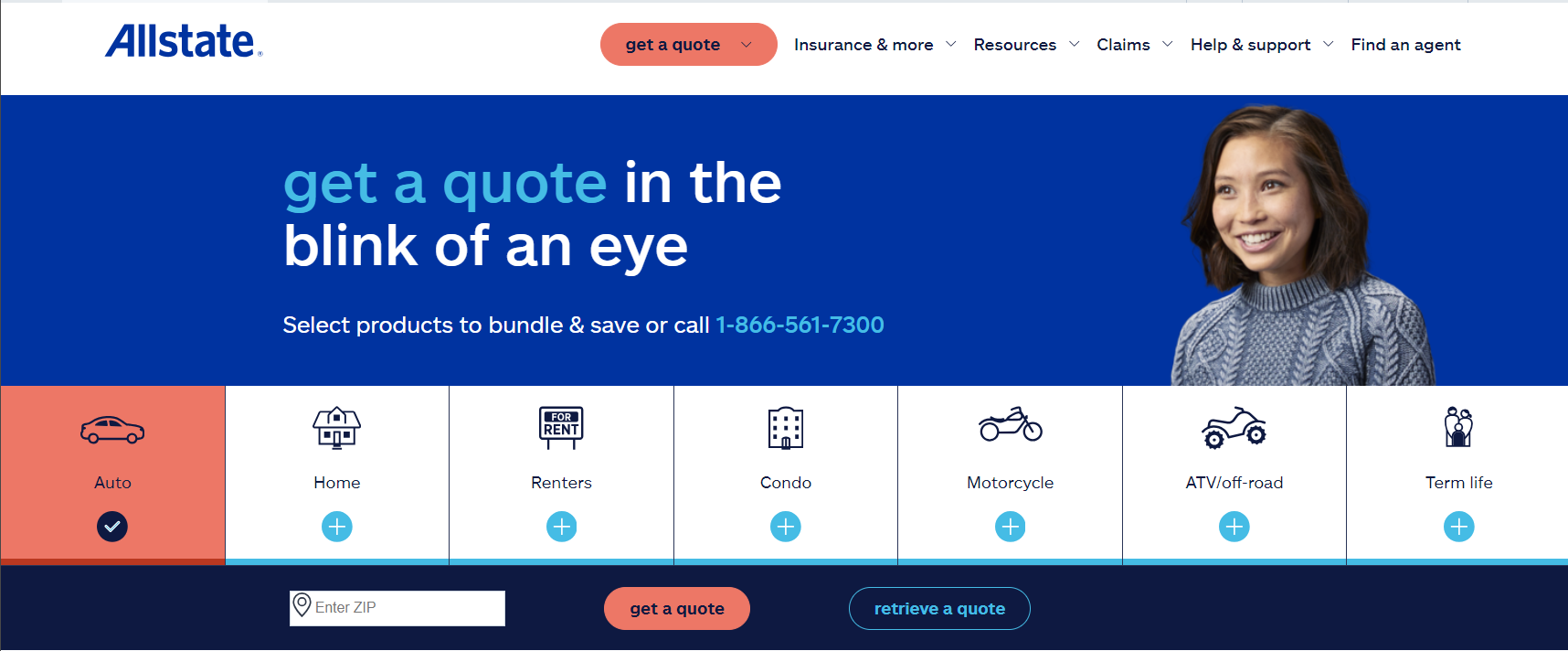

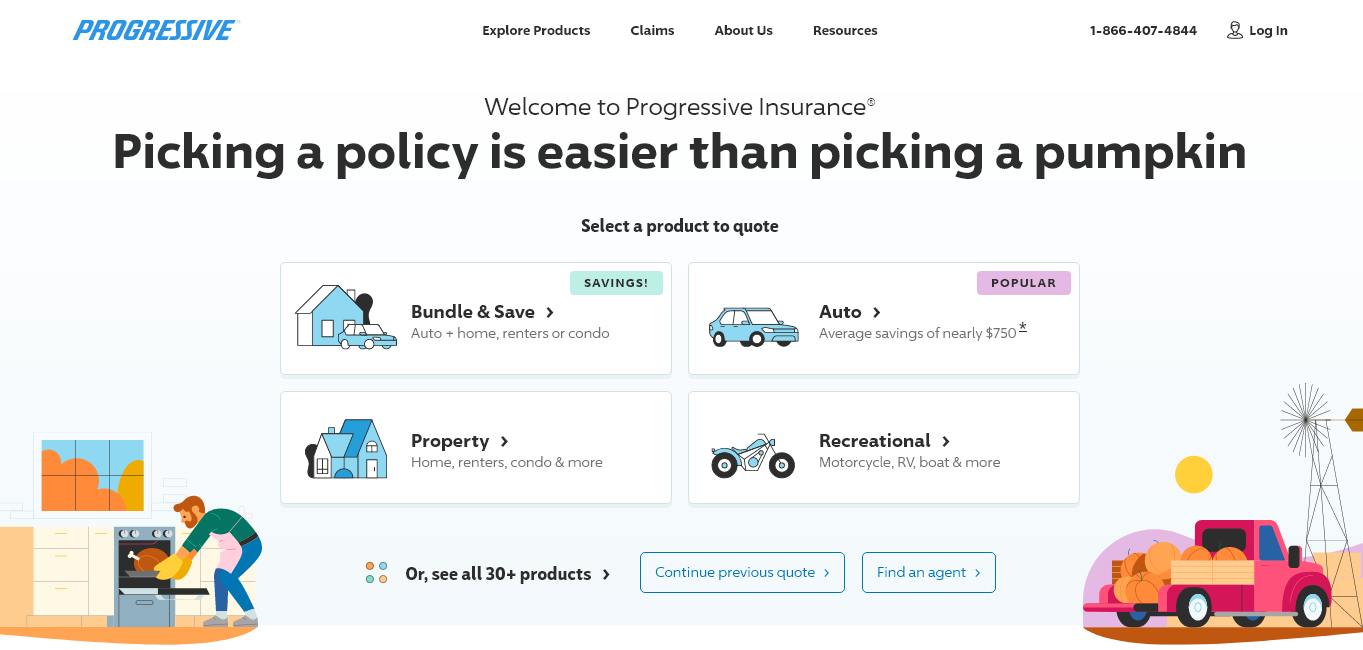

Progressive, Travelers, and Farmers offer the best options for cheap Dodge Sprinter 3500 Cargo car insurance, with rates starting at just $78 per month. These providers stand out due to their affordable premiums, comprehensive coverage options, and exceptional customer service.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Travis Thompson has been a licensed insurance agent for nearly five years. After obtaining his life and health insurance licenses, he began working for Symmetry Financial Group as a State Licensed Field Underwriter. In this position, he learned the coverage options and limits surrounding mortgage protection. He advised clients on the coverage needed to protect them in the event of a death, critica...

Travis Thompson

Updated October 2024

Company Facts

Min. Coverage for Dodge Sprinter 3500 Cargo

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Dodge Sprinter 3500 Cargo

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Dodge Sprinter 3500 Cargo

A.M. Best Rating

Complaint Level

Pros & Cons

The best providers for cheap Dodge Sprinter 3500 Cargo car insurance are Progressive, Travelers, and Farmers. These companies offer competitive rates, comprehensive coverage options, and excellent customer service.

This guide will help you understand the factors affecting insurance costs and explore various discounts and savings opportunities. Learn how to find the best coverage tailored to your needs. See more details on our “Best Car Insurance Discounts.”

Our Top 10 Company Picks: Cheap Dodge Sprinter 3500 Cargo Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $78 A+ Competitive Rates Progressive

![]()

#2 $80 A++ Customizable Policies Travelers

#3 $82 A Comprehensive Coverage Farmers

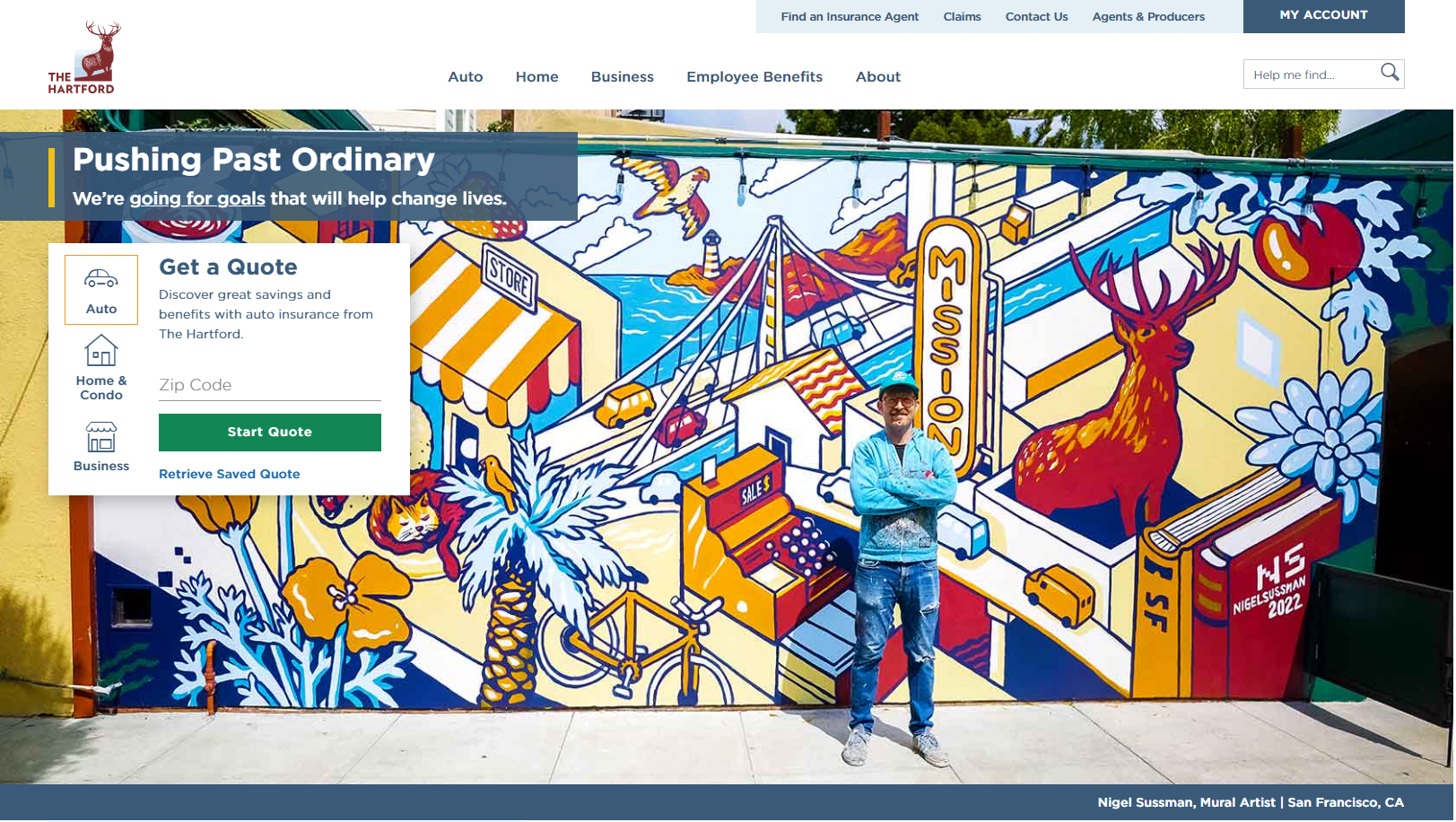

#4 $85 A+ Accident Forgiveness The Hartford

#5 $86 A+ SmartRide® Program Nationwide

#6 $87 B Local Agents State Farm

#7 $88 A++ Extensive Discounts Geico

#8 $90 A+ Customer Service Amica

#9 $93 A+ Drivewise® Program Allstate

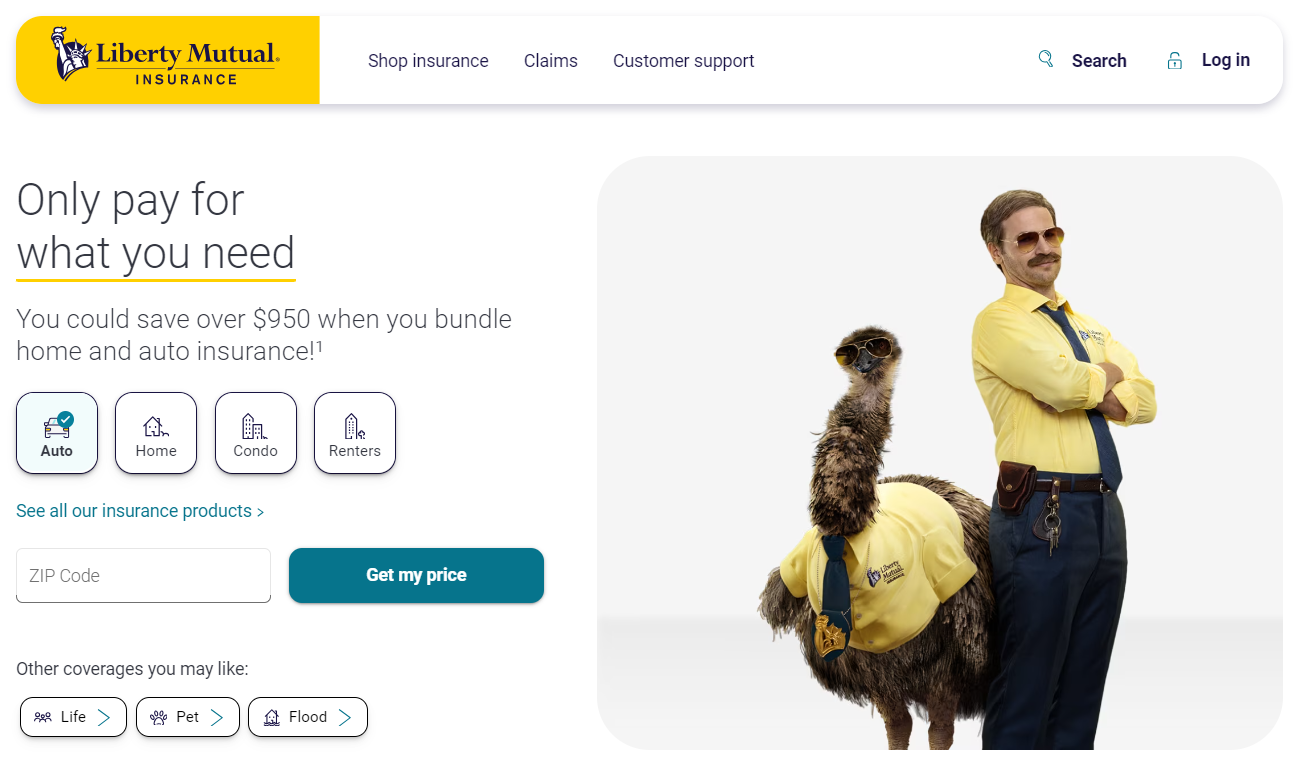

#10 $95 A Multi-Policy Discounts Liberty Mutual

Dodge Sprinter 3500 Cargo Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $93 $180

Amica $90 $180

Farmers $82 $178

Geico $88 $165

Liberty Mutual $95 $185

Nationwide $86 $175

Progressive $78 $170

State Farm $87 $175

The Hartford $85 $175

Travelers $80 $172

For minimum coverage, rates range from $78 (Progressive) to $95 (Liberty Mutual). This option offers basic protection as required by law.On the other hand, full coverage, which includes collision and comprehensive coverage, ranges from $165 (Geico) to $185 (Liberty Mutual), providing comprehensive protection for your vehicle.

This article explores aspects like types of coverage, shopping for quotes, driving records, location, provider comparisons, discounts, misconceptions, deductibles, coverage levels, modifications, and policy bundling benefits. Additionally, we will share tips to lower your car insurance premiums specifically tailored to owners of a Dodge Sprinter 3500 Cargo.

Factors That Influence the Cost of Car Insurance for Dodge Sprinter 3500 Cargo

Several elements come into play when determining the cost of car insurance for your Dodge Sprinter 3500 Cargo. Insurance providers take into account factors such as the vehicle’s make, model, and year, its value, the frequency of claims associated with that particular model, the cost of repairs, and the safety record. Other significant considerations include the driver’s age, gender, marital status, driving experience, and occupation.

These factors help insurers assess the risk of insuring your Dodge Sprinter 3500 Cargo and determine the appropriate premium to charge. For additional details, explore our comprehensive resource titled “What age do you get cheap car insurance?”

Additionally, the location where the vehicle is primarily driven and parked can also impact the cost of car insurance for your Dodge Sprinter 3500 Cargo. Insurance providers consider factors such as the crime rate in the area, the likelihood of accidents or theft, and the availability of repair services. If you live in an area with high crime rates or a higher risk of accidents, you may be charged a higher premium to offset the increased risk.

Furthermore, your driving history and record can play a significant role in determining the cost of car insurance for your Dodge Sprinter 3500 Cargo. Insurance providers will review your past driving violations, accidents, and claims to assess your level of risk as a driver. If you have a history of traffic violations or multiple at-fault accidents, you may be considered a higher risk and charged a higher premium as a result.

Understanding the Different Types of Car Insurance Coverage for Dodge Sprinter 3500 Cargo

Before diving into the cost of car insurance, it is vital to understand the different types of coverage available for your Dodge Sprinter 3500 Cargo. Typically, car insurance policies include liability coverage, which pays for injuries and damage you cause to others in an accident.

Additionally, comprehensive and collision coverage protect your vehicle in case of theft, vandalism, or accidents. Uninsured/underinsured motorist coverage comes into play when you are involved in an accident with someone who does not have sufficient coverage. Familiarizing yourself with these coverage options will help in selecting the right level of protection for your Dodge Sprinter 3500 Cargo.

Kristine Lee Licensed Insurance Agent

Another important type of car insurance coverage to consider for your Dodge Sprinter 3500 Cargo is medical payments coverage. This coverage helps pay for medical expenses for you and your passengers in the event of an accident, regardless of who is at fault. Medical payments coverage can help cover costs such as hospital bills, doctor visits, and even funeral expenses.

It provides an added layer of financial protection and peace of mind in case of injuries sustained in a car accident. Check out insurance savings in our complete “Car Accidents: What to do in Worst Case Scenarios.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Importance of Comparing Car Insurance Quotes for Dodge Sprinter 3500 Cargo

It is crucial to shop around and obtain multiple car insurance quotes for your Dodge Sprinter 3500 Cargo. Insurance rates can vary significantly between providers, and by comparing quotes, you can ensure that you are getting the best value for your money. Different insurers use various algorithms to calculate premiums, resulting in different premium amounts for identical coverage.

By taking the time to receive quotes from multiple providers, you can find the most competitive rates for your Dodge Sprinter 3500 Cargo.

Another reason why shopping around for car insurance quotes for your Dodge Sprinter 3500 Cargo is important is that different insurers may offer additional benefits or discounts that can save you money in the long run. For example, some insurers may offer a safe driver discount or a multi-policy discount if you have other insurance policies with them.

By exploring different options, you may be able to find an insurer that not only offers competitive rates but also provides additional perks that align with your needs and preferences. Check out insurance savings in our complete “Insurance Quotes Online.”

In addition, obtaining multiple car insurance quotes allows you to assess the customer service and reputation of different insurers. Reading reviews and checking ratings can give you insights into how responsive and reliable an insurer is when it comes to handling claims and providing assistance.

This information can be invaluable in making an informed decision about which insurer to choose for your Dodge Sprinter 3500 Cargo. Remember, it’s not just about the price; it’s also about the quality of service you can expect from your insurance provider.

Tips for Finding Affordable Car Insurance Rates for Dodge Sprinter 3500 Cargo

Finding affordable car insurance rates for your Dodge Sprinter 3500 Cargo involves a few key strategies. First, maintaining a good driving record is essential. Avoiding accidents and traffic violations will demonstrate to insurers that you are a responsible driver and can significantly lower your premiums. Secondly, considering your location is crucial.

If you live in an area with high crime rates or high incidents of accidents, your premiums may be higher.

Looking for discounts and savings opportunities, such as bundling policies or installing safety features in your vehicle, can also help reduce car insurance costs for your Dodge Sprinter 3500 Cargo. Learn more in our “How much is gap insurance?”

Ty Stewart Licensed Insurance Agent

Another important factor to consider when searching for affordable car insurance rates for your Dodge Sprinter 3500 Cargo is your age and driving experience. Younger drivers or those with less experience on the road may face higher premiums due to the perceived higher risk. However, some insurance companies offer discounts for completing driver’s education courses or maintaining a good academic record.

Additionally, it is beneficial to shop around and compare quotes from multiple insurance providers. Each company may have different criteria for determining rates, so obtaining quotes from various sources can help you find the most competitive price for your Dodge Sprinter 3500 Cargo. Online comparison tools and insurance brokers can assist in this process, making it easier to find the best deal.

Impact of Your Driving Record on Dodge Sprinter 3500 Cargo Insurance Costs

Your driving record plays a significant role in determining the cost of car insurance for your Dodge Sprinter 3500 Cargo. Insurance providers consider factors such as accidents, traffic violations, and claims history when assessing your risk profile. If you have a clean driving record with no accidents or violations, you are likely to receive lower premiums.

On the other hand, if you have a history of accidents or traffic violations, your insurance rates may be higher due to the increased risk associated with insuring your Dodge Sprinter 3500 Cargo. Unlock details in our “How does my driving record affect my parents insurance rates?”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Impact of Location on Car Insurance Premiums for Dodge Sprinter 3500 Cargo

Your location also affects the cost of car insurance for your Dodge Sprinter 3500 Cargo. Insurance providers consider the crime rate, frequency of accidents, and other factors specific to your area when calculating your premiums. If you live in a densely populated area with a high incidence of accidents and thefts, your premiums may be higher to account for the heightened risk.

On the other hand, living in a rural area with fewer accidents and crime incidents may result in lower insurance rates for your Dodge Sprinter 3500 Cargo. Discover insights in our “Best Anti Theft System Car Insurance Discounts.”

Comparing Car Insurance Rates for Dodge Sprinter 3500 Cargo

Comparing car insurance rates from different providers is crucial in order to find the best deals for your Dodge Sprinter 3500 Cargo. Insurance companies have varying pricing strategies, which can result in significantly different premium amounts for identical coverage.

By obtaining quotes from multiple providers and comparing them side by side, you can identify the most competitive rates for insuring your Dodge Sprinter 3500 Cargo while maintaining the desired level of coverage.

Discounts and Savings on Car Insurance for Dodge Sprinter 3500 Cargo

Many insurance companies offer discounts and savings opportunities that can help lower the cost of car insurance for your Dodge Sprinter 3500 Cargo.

These discounts may include multi-policy discounts for bundling your car insurance with other policies such as homeowners or renters insurance, discounts for being a safe driver, having certain safety features in your vehicle, or even discounts for being a member of specific organizations.

Exploring these opportunities can potentially result in lower premiums and significant savings on car insurance for your Dodge Sprinter 3500 Cargo.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Common Misconceptions About Car Insurance Costs for Dodge Sprinter 3500 Cargo

There are several common misconceptions regarding car insurance costs for the Dodge Sprinter 3500 Cargo. One such misconception is that all insurance providers offer the same rates for the same coverage. As mentioned earlier, different insurance companies use different algorithms to calculate premiums, resulting in varying rates for identical coverage.

Additionally, some may believe that older vehicles automatically have lower insurance rates. While this may be the case for some cars, the factors mentioned earlier, such as the safety record and cost of repairs, can still impact the premiums for your Dodge Sprinter 3500 Cargo.

Delve into our evaluation of “Car Driving Safety Guide for Teens and Parents.”

Understanding the Deductible’s Impact on Dodge Sprinter 3500 Cargo Insurance Costs

The deductible is an essential factor to consider when deciding on car insurance coverage for your Dodge Sprinter 3500 Cargo. The deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Typically, higher deductibles result in lower premiums, while lower deductibles lead to higher premiums.

Melanie Musson Published Insurance Expert

It is important to find the right balance that suits your financial situation and risk tolerance. If you choose a high deductible to lower your premiums, ensure that you have sufficient funds in case of an accident or claim. Discover more about offerings in our “How to Document Damage for Car Insurance Claims?“

Factors to Consider for Choosing Coverage for Your Dodge Sprinter 3500 Cargo

When choosing the right level of coverage for your Dodge Sprinter 3500 Cargo, several factors need to be considered. Firstly, you should evaluate the current value of your vehicle and how financially devastating it would be to replace or repair it in case of an accident or theft.

Additionally, you should consider your budget and how much you are willing to pay for insurance premiums. It is also essential to consider any legal requirements for coverage in your area. Balancing these factors will help you determine the appropriate level of coverage for your Dodge Sprinter 3500 Cargo.

More information is available about this provider in our “Who gets in more car accidents, women or men?”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Effects of Modifications on Dodge Sprinter 3500 Cargo Insurance Rates

If you have made modifications or aftermarket additions to your Dodge Sprinter 3500 Cargo, it can impact your car insurance rates. Depending on the nature of the modifications, such as adding performance-enhancing features or altering the appearance of the vehicle, your insurance provider may consider it a higher risk.

It is crucial to inform your insurer about any modifications or additions made to your Dodge Sprinter 3500 Cargo and understand how it may affect your premiums.

Read up on the “Can I get car insurance for a car that is modified or customized?” for more information.

Benefits of Bundling Insurance Policies for Your Dodge Sprinter 3500 Cargo

Bundling your car insurance with other policies can offer several benefits for your Dodge Sprinter 3500 Cargo. Many insurance companies provide discounts for bundling policies, such as combining your car insurance with homeowners or renters insurance.

Bundling not only simplifies your insurance coverage but can also result in significant savings on premiums. It is crucial to review the coverage and pricing of bundled policies to ensure that you are still getting the best value for your Dodge Sprinter 3500 Cargo.

Tailored Tips to Lower Dodge Sprinter 3500 Cargo Insurance Premiums

As an owner of a Dodge Sprinter 3500 Cargo, there are specific tips you can follow to lower your car insurance premiums. Firstly, maintaining a clean driving record by practicing safe driving habits can significantly impact your rates. Secondly, installing safety features in your vehicle, such as anti-theft devices and anti-lock brakes, can make it less prone to accidents and theft, resulting in lower premiums.

Additionally, exploring potential discounts and savings opportunities for owners of commercial vehicles, such as those who use their Dodge Sprinter 3500 Cargo for business purposes, can help reduce insurance costs. More information is available about this provider in our “Best Safe Driver Car Insurance Discounts.”

Find cheap car insurance quotes by entering your ZIP code below.

Frequently Asked Questions

What factors affect the cost of insurance for a Dodge Sprinter 3500 Cargo?

The cost of insurance for a Dodge Sprinter 3500 Cargo can be influenced by various factors such as the driver’s age, driving history, location, coverage options, deductible amount, and the insurance provider’s pricing policies.

For additional details, explore our comprehensive resource titled “What age do you get cheap car insurance?”

Are there any specific safety features of the Dodge Sprinter 3500 Cargo that can help reduce insurance costs?

Yes, the Dodge Sprinter 3500 Cargo comes equipped with several safety features that can potentially lower insurance costs. These features may include anti-lock brakes, stability control, airbags, rearview cameras, and advanced driver assistance systems.

How can I find the best insurance rates for a Dodge Sprinter 3500 Cargo?

To find the best insurance rates for a Dodge Sprinter 3500 Cargo, it is recommended to obtain quotes from multiple insurance providers. Comparing the coverage options, deductibles, and premiums offered by different insurers can help you identify the most competitive rates.

Does the cost of insurance for a Dodge Sprinter 3500 Cargo vary by location?

Yes, the cost of insurance for a Dodge Sprinter 3500 Cargo can vary based on the location where the vehicle is primarily driven or stored. Factors such as local crime rates, traffic congestion, and the prevalence of accidents in the area can impact insurance rates.

Are there any discounts available for insuring a Dodge Sprinter 3500 Cargo?

Insurance providers may offer various discounts that can help reduce the cost of insuring a Dodge Sprinter 3500 Cargo.

To find out more, explore our guide titled “Best Car Insurance Discounts to Ask.”

What kind of insurance do you need for a Sprinter van?

Physical Damage Insurance: This policy covers physical damage to your sprinter van in the event of a collision, theft, or animal encounter. Cargo Insurance: Typically, you will also need cargo insurance to protect your freight against theft or damage.

How much insurance do you need for a cargo van?

Regardless of the type of cargo van you own, it’s essential to have both liability and cargo insurance with substantial coverage. For cargo insurance, you should plan to have coverage ranging from $100,000 to $300,000 for non-hazardous cargo.

Is a Sprinter van an investment?

Taking into account its fuel efficiency, established durability, and advanced features, the Sprinter Van represents a top-tier investment for any business.

What type of insurance do I need for a Sprinter van?

Liability insurance protects your business and cargo vans when they are driven by you or your employees. This insurance covers costs for injuries or damages to other people or property if you are responsible for an accident. Additionally, physical damage coverage can safeguard your van in the event it is damaged in an accident.

To learn more, explore our comprehensive resource on “How much insurance coverage do I need?”

Which van is the cheapest to insure?

Affordable insurance vans include the Mercedes Vito, Peugeot Expert, Renault Trafic, Volkswagen Transporter, Toyota Proace, Vauxhall Vivaro, Ford Transit Custom, and Nissan NV300.

What is the life expectancy of a Sprinter van?

Are Mercedes Sprinter vans expensive to fix?

Do general accidents insure vans?

Who pays for cargo insurance?

Is cargo insurance worth it?

How much cargo insurance is required?

Who can buy cargo insurance?

What is the calculation of cargo insurance?

What is the calculation of cargo insurance?

What is the calculation of cargo insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.