Cheap Dodge Caravan Cargo Car Insurance in 2026 (Cash Savings With These 10 Providers!)

Progressive, State Farm, and Mercury are the top providers of cheap Dodge Caravan Cargo car insurance, with rates starting as low as $40 per month. These companies focus on offering affordable coverage options, catering to customers who seek value without compromising on quality protection for their peace of mind and security.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S...

D. Gilson, PhD

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Updated January 2025

Company Facts

Min. Coverage for Dodge Caravan Cargo

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Dodge Caravan Cargo

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Dodge Caravan Cargo

A.M. Best Rating

Complaint Level

Pros & Cons

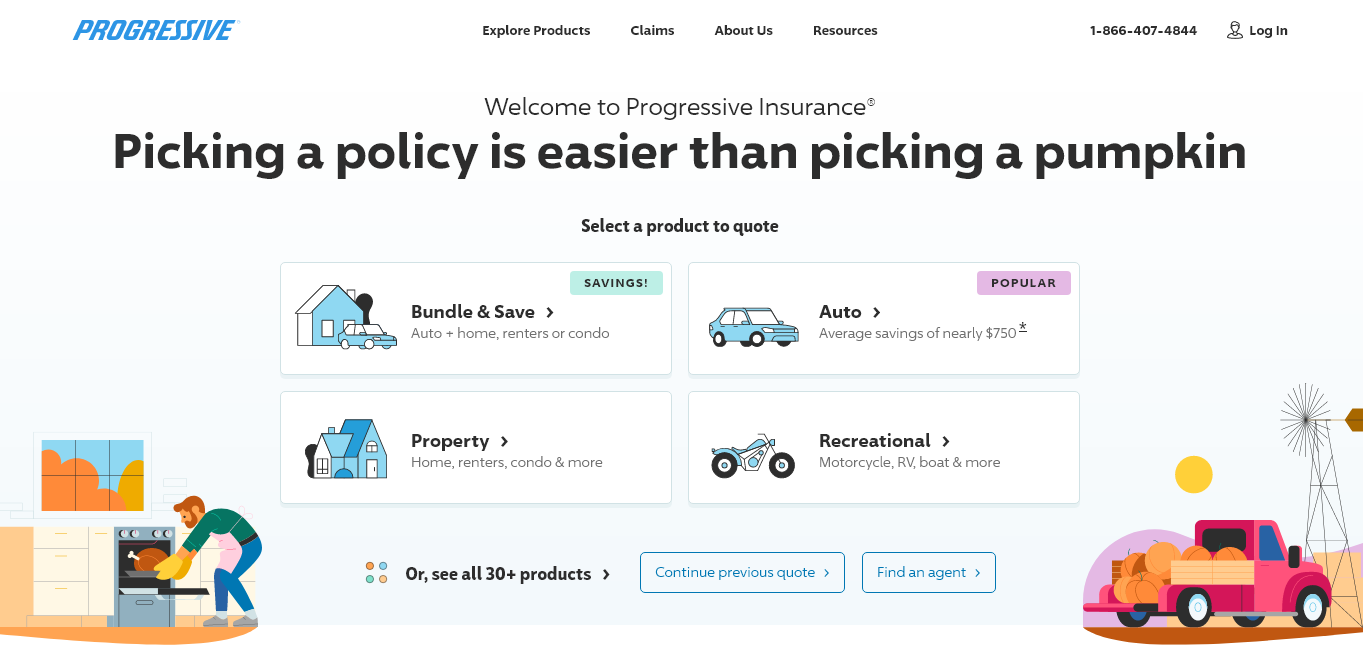

#1 – Progressive: Top Overall Pick

Pros

- Competitive Rates: Progressive offers affordable rates, starting as low as $40 per month, making it a budget-friendly choice for many drivers. Read more through our Progressive insurance review.

- Comprehensive Coverage Options: With a wide range of coverage options, Progressive allows customers to tailor their policies to meet specific needs.

- User-Friendly Online Tools: Progressive provides user-friendly online tools for managing policies, enhancing convenience and accessibility for customers.

Cons

- Variable Customer Service: Customer service may vary depending on location, with some customers reporting mixed experiences.

- Potential Rate Increases: Rates could increase after the initial term, impacting affordability for long-term policyholders.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Consistent Savings

Pros

- Established and Reputable: State Farm is an established and reputable company, instilling trust and confidence in its customers. Read more through our State Farm insurance review.

- Personalized Service: State Farm offers personalized service from local agents, providing tailored support to policyholders.

- Multi-Policy Discounts: State Farm provides multi-policy discounts for bundling with other insurance products, offering potential savings for customers.

Cons

- Slightly Higher Rates: Starting at $45 per month, State Farm’s rates may be slightly higher compared to some competitors, potentially impacting affordability for budget-conscious customers.

- Limited Online Account Management: State Farm’s online account management features may be more limited compared to some competitors, potentially reducing convenience for tech-savvy customers.

#3 – Mercury: Best for Local Focus

Pros

- Competitive Rates: Mercury offers competitive rates starting at $47 per month, providing affordability for many drivers.

- Quick Claims Processing: Mercury is known for quick and efficient claims processing, ensuring prompt resolution for policyholders. Find out more through our Mercury insurance review.

- Various Discounts: Mercury offers various discounts to help lower premiums, offering additional savings opportunities for customers.

Cons

- Limited Coverage Options: Coverage options may not be as comprehensive as other providers, potentially limiting choices for customers seeking specific coverage.

- Regional Availability: Mercury’s availability may be limited in certain regions, restricting access for some potential customers.

#4 – American Family: Best for Customer Service

Pros

- Customized Coverage: American Family offers customized coverage options to meet individual needs and preferences. Learn more through our American Family insurance review.

- Strong Customer Support: Known for its reliable customer service, American Family provides consistent support to its policyholders.

- Innovative Tools: American Family offers innovative tools and resources to help customers understand and manage their policies effectively.

Cons

- Potentially Higher Rates: Starting at $48 per month, American Family’s rates may be slightly higher compared to some competitors, potentially impacting affordability for budget-conscious customers.

- Limited Availability: American Family insurance may not be available in all regions, limiting access for some potential customers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Allstate: Best for Discount Availability

Pros

- Discount Availability: Allstate offers various discounts, making it possible for customers to save on their premiums.

- Broad Coverage: With comprehensive coverage options, Allstate provides protection for a wide range of risks and scenarios. Read more through our Allstate insurance review.

- Strong Financial Stability: Allstate is known for its strong financial stability, instilling confidence in its policyholders.

Cons

- Higher Starting Rates: Starting at $50 per month, Allstate’s rates may be higher compared to some competitors, potentially impacting affordability for budget-conscious customers.

- Mixed Customer Reviews: Some customers report mixed experiences with claims processing and customer service, indicating variability in service quality.

#6 – Farmers: Best for Customized Plans

Pros

- Competitive Rates: Farmers offers competitive rates, making it a budget-friendly choice for many drivers. Further details can be found in our Farmers insurance review.

- Comprehensive Coverage Options: With a wide range of coverage options, Farmers allows customers to tailor their policies to meet specific needs.

- Strong Customer Service: Known for its reliable customer service, Farmers provides consistent support to its policyholders.

Cons

- Limited Availability: Farmers insurance may not be available in all regions, limiting access for some potential customers.

- Mixed Reviews: Some customers report mixed experiences with claims processing, indicating variability in service quality.

#7 – Nationwide: Best for Broad Coverage

Pros

- Broad Coverage: Nationwide offers broad coverage options, providing protection for a wide range of risks and scenarios. For more information, refer to our Nationwide insurance review.

- Discount Opportunities: Nationwide provides various discount opportunities, allowing customers to save on their premiums.

- Financial Stability: Nationwide is known for its strong financial stability, instilling confidence in its policyholders.

Cons

- Potentially Higher Rates: Starting at $52 per month, Nationwide’s rates may be higher compared to some competitors, potentially impacting affordability for budget-conscious customers.

- Limited Availability: Nationwide insurance may not be available in all regions, limiting access for some potential customers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Financial Stability

Pros

- Financial Stability: Travelers is known for its strong financial stability, providing assurance to its policyholders.

- Broad Coverage: Travelers offers a wide range of coverage options, ensuring protection for various risks and scenarios.

- Discounts Available: As per our Travelers insurance review, Travelers provides discounts that help customers save on their premiums.

Cons

- Potentially Higher Rates: Starting at $53 per month, Travelers’ rates may be higher compared to some competitors, potentially impacting affordability for budget-conscious customers.

- Limited Availability: Travelers insurance may not be available in all regions, limiting access for some potential customers.

#9 – Liberty Mutual: Best for Flexible Policies

Pros

- Flexible Policies: Written in our Liberty Mutual insurance review, Liberty Mutual offers flexible policy options, allowing customers to customize their coverage to meet their specific needs.

- Strong Customer Support: Known for its reliable customer service, Liberty Mutual provides consistent support to its policyholders.

- Discount Opportunities: Liberty Mutual provides various discount opportunities, helping customers save on their premiums.

Cons

- Higher Starting Rates: Starting at $55 per month, Liberty Mutual’s rates may be higher compared to some competitors, potentially impacting affordability for budget-conscious customers.

- Mixed Customer Reviews: Some customers report mixed experiences with claims processing and customer service, indicating variability in service quality.

#10 – The General: Best for Affordable Options

Pros

- Affordable Options: The General offers affordable options, making it accessible for drivers seeking budget-friendly coverage. Learn more through our The General insurance review.

- Quick and Easy Quotes: The General provides quick and easy quotes, simplifying the process for customers.

- Specialized Coverage: The General offers specialized coverage for high-risk drivers, catering to those with unique insurance needs.

Cons

- Limited Coverage Options: Coverage options may be limited compared to other providers, potentially restricting choices for customers seeking specific coverage.

- Mixed Customer Reviews: Some customers report mixed experiences with claims processing and customer service, indicating variability in service quality.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors that Affect the Cost of Dodge Caravan Cargo Car Insurance

Understanding the Insurance Requirements for a Dodge Caravan Cargo

The Importance of Shopping Around for Car Insurance Quotes for a Dodge Caravan Cargo

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding the Claims Process and Coverage Limits When Insuring a Dodge Caravan Cargo

Frequently Asked Questions

What factors affect the cost of insurance for a Dodge Caravan Cargo?

The cost of insurance for a Dodge Caravan Cargo can be influenced by various factors such as the driver’s age, driving history, location, coverage limits, deductible amount, and the level of insurance coverage chosen.

Are Dodge Caravan Cargo vehicles expensive to insure?

The insurance cost for a Dodge Caravan Cargo can vary depending on the factors mentioned earlier. However, generally speaking, minivans like the Dodge Caravan Cargo tend to have lower insurance rates compared to sports cars or luxury vehicles. Enter your ZIP code now to begin.

Is it possible to get cheap insurance for a Dodge Caravan Cargo?

Yes, as per our AIG insurance review, it is possible to find affordable insurance for a Dodge Caravan Cargo. By comparing quotes from different insurance providers, maintaining a clean driving record, opting for higher deductibles, and taking advantage of available discounts, you can help reduce the cost of insurance for your Dodge Caravan Cargo.

What are the starting rates for Progressive, State Farm, and Mercury for Dodge Caravan Cargo insurance?

Progressive offers rates starting at $40 per month, while State Farm starts at $45 and Mercury at $47.

What distinguishes Progressive as a top choice for Dodge Caravan Cargo insurance?

Progressive stands out for offering competitive rates and a wide range of coverage options, coupled with user-friendly online tools for policy management. Enter your ZIP code now to start.

What are some factors influencing the cost of Dodge Caravan Cargo insurance?

Factors include the driver’s age, driving record, location, lending your car to an uninsured driver, coverage options, deductible amount, and the vehicle’s model year and safety features.

Why is it important to understand state-specific insurance requirements for insuring a Dodge Caravan Cargo?

Understanding these requirements ensures compliance with minimum liability coverage, while additional coverage like renters insurance and comprehensive policies can provide better protection.

What tips are provided for saving money on Dodge Caravan Cargo insurance?

Tips include comparing quotes from different providers, maintaining a good driving record, opting for higher deductibles, and taking advantage of available discounts. Enter your ZIP code now to start comparing.

What should policyholders understand about the claims process and coverage limits when insuring a Dodge Caravan Cargo?

As per our The Hartford insurance review, policyholders should familiarize themselves with filing procedures, required documents, claim processing timelines, coverage limits, and exclusions for a smooth claims experience.

What distinguishes The General as a provider of Dodge Caravan Cargo insurance?

The General stands out for offering affordable options, quick and easy quotes, and specialized coverage for high-risk drivers, though coverage options may be more limited compared to other providers.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.