Cheap Chevrolet Express 3500 Passenger Car Insurance in 2026 (Low Rates With These 10 Companies!)

Discover cheap Chevrolet Express 3500 Passenger car insurance. Explore top-rated options from Nationwide, USAA, and Travelers, offering competitive rates starting at just $75 per month. Discover why these insurers are ideal for Chevrolet Express 3500 Passenger car insurance coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated November 2024

Company Facts

Min. Coverage for Chevrolet Express 3500 Passenger

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Chevrolet Express 3500 Passenger

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Chevrolet Express 3500 Passenger

A.M. Best Rating

Complaint Level

Pros & Cons

Our Top 10 Company Picks: Cheap Chevrolet Express 3500 Passenger Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

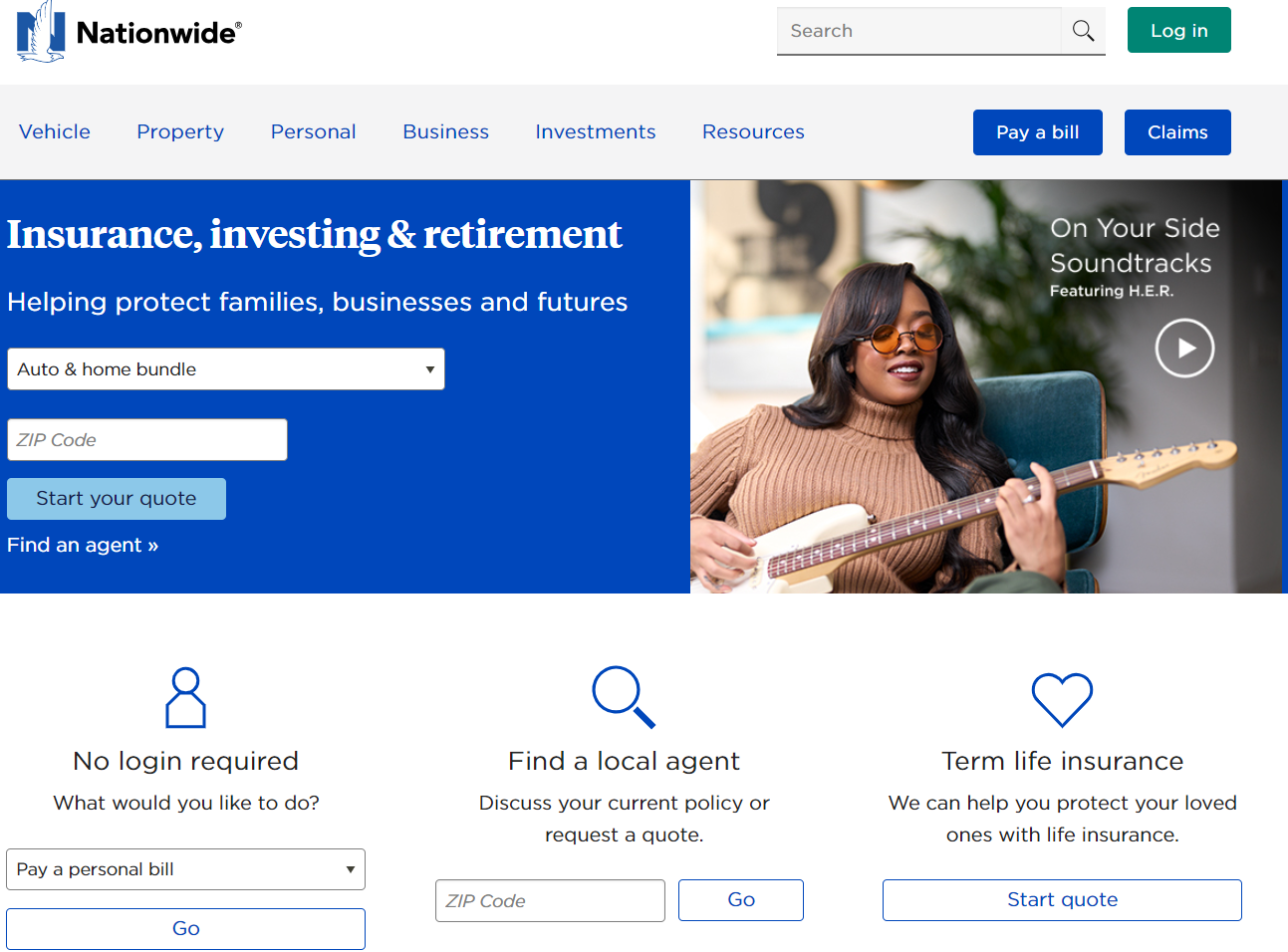

#1 $75 A+ Bundling Discounts Nationwide

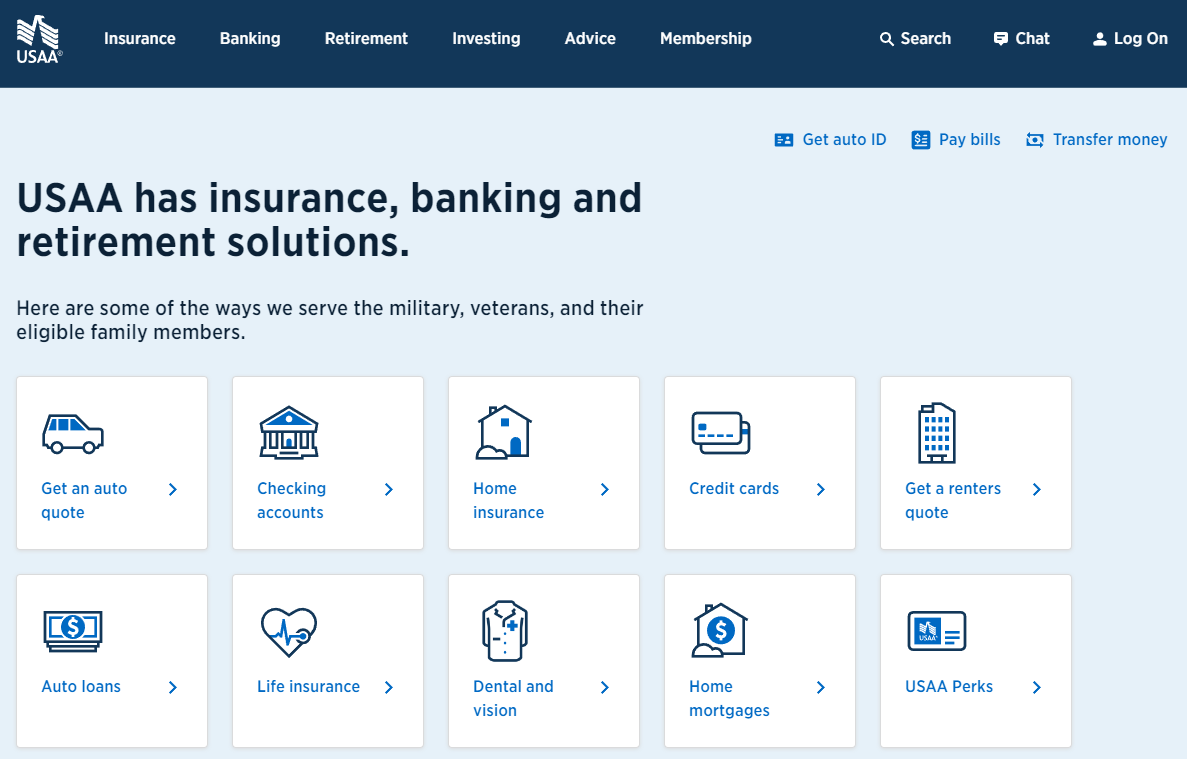

#2 $80 A++ Military Discounts USAA

#3 $85 A++ Mileage-Based Travelers

#4 $88 A++ Online Tools Geico

#5 $89 A Roadside Assistance AAA

#6 $90 A+ Flexible Plans Progressive

#7 $92 A New Car Liberty Mutual

#8 $95 A+ Safe Driving Allstate

#9 $100 A Custom Options Farmers

#10 $105 B Customer Service State Farm

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors That Affect the Cost of Chevrolet Express 3500 Passenger Car Insurance

Understanding the Insurance Requirements for Chevrolet Express 3500 Passenger

Comparing Different Insurance Providers for Chevrolet Express 3500 Passenger

To find the best insurance rates for your Chevrolet Express 3500 Passenger, it is essential to compare quotes from multiple insurance providers. Each insurance company has its own underwriting criteria, which means the rates can vary significantly. Take the time to research and request quotes from different insurers to ensure you’re getting the best coverage at the most competitive rates.

Chris Abrams Licensed Insurance Agent

When comparing insurance providers, consider factors beyond just pricing. Look for companies with a strong financial stability rating and a good reputation for customer service. Reading reviews and seeking recommendations can help you make an informed choice.

Additionally, it’s important to consider the specific coverage options offered by each insurance provider. Some insurers may offer additional benefits or discounts that could be beneficial for your Chevrolet Express 3500 Passenger. For example, you may want to look for providers that offer roadside assistance, rental car coverage, or accident forgiveness. Enter your ZIP code now to start.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips to Save Money on Chevrolet Express 3500 Passenger Car Insurance

The Importance of Comprehensive Coverage for Chevrolet Express 3500 Passenger

Comprehensive coverage is a vital aspect of insurance policies for Chevrolet Express 3500 Passenger owners, offering protection beyond basic liability coverage by encompassing non-collision incidents like theft, vandalism, fire, and severe weather damage.

While opting for comprehensive coverage may result in higher premiums, it provides essential peace of mind and financial security against unexpected events, including car driving safety. This coverage also extends to damages from animal collisions and windshield damage caused by debris, offering comprehensive protection for drivers, particularly those residing in wildlife-prone areas.

How Your Driving Record Affects Your Chevrolet Express 3500 Passenger Insurance Rates

A clean driving record with no accidents or violations typically results in lower insurance premiums. On the other hand, a history of accidents or traffic violations can lead to higher rates, as it indicates a higher likelihood of future claims. Enter your ZIP code now to start.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Discounts and Incentives for Insuring a Chevrolet Express 3500 Passenger: The Bottom Line

In conclusion, the cost of insuring your Chevrolet Express 3500 Passenger depends on various factors such as your driving record, location, age, and the coverage options you choose. Remember, selecting the right insurance coverage is crucial to protect yourself and your vehicle, so make an informed decision based on your individual needs and circumstances. Enter your ZIP code now to start.

Frequently Asked Questions

What is the cheapest level of car insurance?

The cheapest level of car insurance typically refers to liability coverage, which provides protection for bodily injury and property damage to others in the event of an accident for which you are at fault.

What type of car insurance is cheapest?

Liability car insurance is often the cheapest type available, as it only covers damages to other parties involved in an accident and does not include coverage for your vehicle.

What is the lowest level of car insurance?

The lowest level of car insurance typically refers to state-mandated minimum liability coverage, which varies depending on your location but generally includes coverage for bodily injury and property damage to others.

Which car insurance group is the cheapest?

The cheapest car insurance group depends on various factors, including your driving history, the type of vehicle you own, and your location. However, liability-only coverage tends to be the most affordable option. Enter your ZIP code now to start.

Which car insurance type is best?

The best car insurance type depends on individual needs and preferences. While liability coverage is the most basic, comprehensive coverage offers the most extensive protection, including coverage for your vehicle in various situations beyond accidents.

Which category of car insurance is best?

The best category of car insurance varies based on factors such as budget, driving habits, and risk tolerance. Comprehensive coverage is often considered the most comprehensive and offers the highest level of protection.

What is the lowest form of car insurance?

The lowest form of car insurance typically refers to state-required liability coverage, which provides minimal protection by covering damages to others in accidents where you are at fault. Enter your ZIP code now to start.

What is the best level of car insurance?

The best level of car insurance depends on individual needs and preferences. Comprehensive coverage is generally considered the most comprehensive, providing protection for a wide range of incidents beyond collisions.

What are the 3 levels of insurance?

The three primary levels of car insurance are liability coverage, which is the minimum required by law, collision coverage, which covers damage to your vehicle in accidents, and comprehensive coverage, which provides additional protection for non-collision incidents.

What is the lowest category for car insurance?

The lowest category for car insurance typically refers to state-mandated minimum liability coverage, which offers basic protection by covering damages to others in accidents where you are at fault. Enter your ZIP code now to start.

Which type of life insurance is the cheapest?

Which type of car is cheapest to insure?

Who typically has the cheapest insurance?

What is the best car insurance?

What is the highest type of car insurance?

What is the most basic type of insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.