Cheap Chevrolet Astro Passenger Car Insurance in 2026 (Big Savings With These 10 Companies!)

Erie, USAA, and AAA are the top providers for cheap Chevrolet Astro Passenger car insurance, with rates starting at $42. Erie offers tailored rates, USAA provides custom plans, and AAA excels in military benefits. These companies ensure affordable and comprehensive coverage for Chevrolet Astro Passenger owners.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated October 2024

1,883 reviews

1,883 reviewsCompany Facts

Min. Coverage for Chevrolet Astro Passenger

A.M. Best Rating

Complaint Level

Pros & Cons

1,883 reviews

1,883 reviews 6,590 reviews

6,590 reviewsCompany Facts

Min. Coverage for Chevrolet Astro Passenger

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 3,027 reviews

3,027 reviewsCompany Facts

Min. Coverage for Chevrolet Astro Passenger

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviewsThe top picks overall for cheap Chevrolet Astro Passenger car insurance are Erie, USAA, and AAA. Erie stands out with tailored rates starting at $42, making it one of best insurance companies for affordable coverage. USAA provides custom plans, perfect for those seeking personalized insurance solutions, while AAA excels in offering exceptional military benefits.

This article explores how these providers deliver the most affordable and comprehensive coverage for Chevrolet Astro Passenger owners.

Our Top 10 Company Picks: Cheap Chevrolet Astro Passenger Car Insurance

| Company | Rank | Monthly Rates | Good Driver Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $42 | 25% | Tailored Rates | Erie |

| #2 | $45 | 24% | Custom Plans | USAA | |

| #3 | $47 | 22% | Military Benefits | AAA |

| #4 | $50 | 20% | Agent Network | State Farm | |

| #5 | $52 | 20% | High Satisfaction | Progressive | |

| #6 | $55 | 18% | Discount Variety | Nationwide |

| #7 | $58 | 16% | Flexible Coverage | Liberty Mutual |

| #8 | $60 | 13% | Reliable Pricing | Auto-Owners | |

| #9 | $62 | 10% | Driver Discounts | American Family | |

| #10 | $65 | 10% | Mature Drivers | The Hartford |

Explore the factors that affect the cost of Chevrolet Astro Passenger car insurance, provide tips for finding affordable insurance, discuss different coverage options, compare quotes from multiple insurers, and delve into various other considerations that can help you navigate the world of car insurance for your Chevrolet Astro Passenger.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code above.

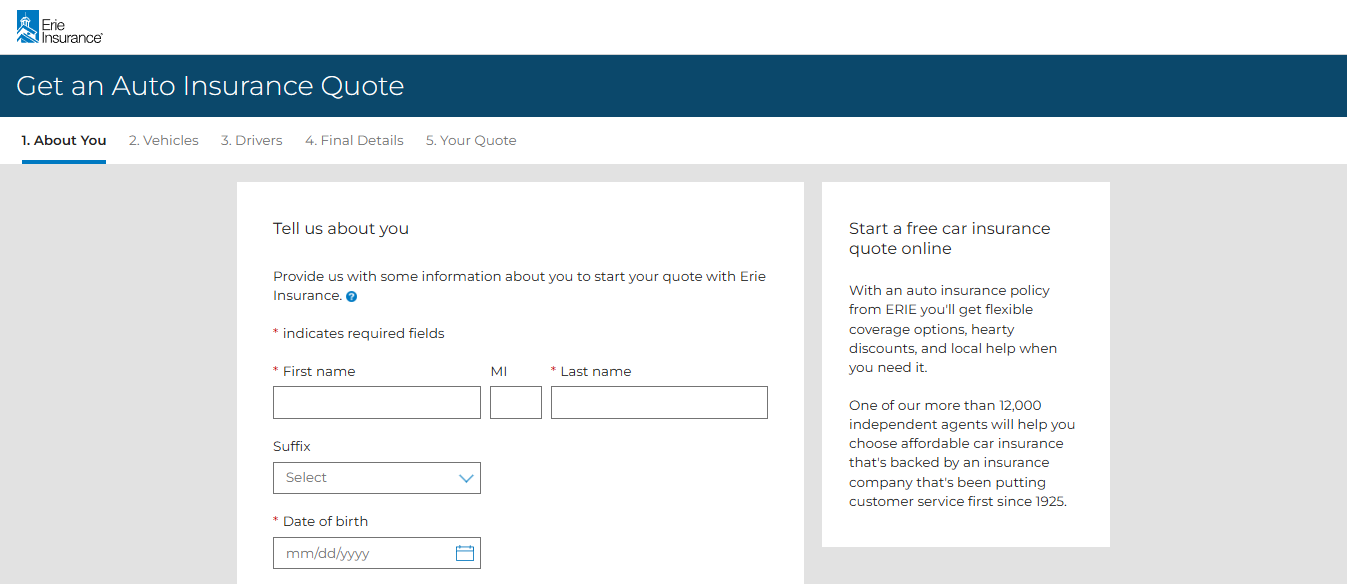

#1 – Erie: Top Overall Pick

Pros

- Customized Coverage: Erie offers tailored insurance plans to fit the specific needs of different customers.

- Affordable Rates: Erie insurance review & ratings provides some of the lowest monthly rates for Chevrolet Astro Passenger car insurance.

- Substantial Good Driver Discount: Erie offers a generous 25% discount for good drivers.

Cons

- Limited Availability: Erie is not available in all states, which can restrict access for some customers.

- Online Services: Erie’s online services and mobile app features are not as advanced as some competitors.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Custom Plans

Pros

- Military Benefits: USAA offers exclusive benefits and discounts for military members and their families.

- Excellent Customer Service: USAA is renowned for its exceptional customer service and claims satisfaction.

- Competitive Rates: USAA insurance review & ratings provides competitive rates with a significant good driver discount.

Cons

- Eligibility Restrictions: USAA is only available to military members, veterans, and their families.

- Limited Local Agents: USAA has fewer local agents compared to some other insurance providers.

#3 – AAA: Best for Military Benefits

Pros

- Comprehensive Coverage: AAA offers a wide range of coverage options, including unique benefits for military members.

- Roadside Assistance: AAA insurance review & ratings provides excellent roadside assistance services as part of their membership benefits.

- Multi-Policy Discounts: AAA offers significant discounts when bundling multiple policies together.

Cons

- Membership Fee: AAA requires an annual membership fee, which can add to the overall cost.

- Higher Premiums: AAA’s insurance premiums may be higher compared to some other providers.

#4 – State Farm: Best for Agent Network

Pros

- Extensive Agent Network: State Farm has a large network of local agents, providing personalized service and support.

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: State Farm insurance review & ratings provides a substantial discount for low-mileage usage.

Cons

- Limited Multi-Policy Discount: The multi-policy discount of State Farm is not as high compared to some competitors.

- Premium Costs: Despite discounts, State Farm’s premiums might still be relatively higher for certain coverage levels.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for High Satisfaction

Pros

- Innovative Tools: Progressive offers useful tools like the Name Your Price tool to help customers find suitable coverage within their budget.

- High Customer Satisfaction: Progressive insurance review & ratings has high satisfaction rates due to its customer service and claims process.

- Snapshot Program: Progressive’s Snapshot program allows for potential discounts based on driving behavior.

Cons

- Online Focus: Progressive’s emphasis on online services might not appeal to customers who prefer face-to-face interactions.

- Rate Increases: Some customers have reported significant rate increases after policy renewals.

#6 – Nationwide: Best for Discount Variety

Pros

- Wide Range of Discounts: Nationwide offers various discounts, including multi-policy, safe driver, and anti-theft discounts.

- On Your Side Review: Nationwide insurance review & ratings provides an annual policy review to ensure customers are getting the best coverage.

- Accident Forgiveness: Nationwide offers accident forgiveness to prevent rate increases after the first at-fault accident.

Cons

- Higher Premiums: Nationwide’s premiums can be higher compared to some other insurers.

- Customer Service Variability: Customer service experiences can vary depending on the agent or location.

#7 – Liberty Mutual: Best for Flexible Coverage

Pros

- Customizable Coverage: Liberty Mutual review & ratings has offer flexible coverage options to meet different needs and budgets.

- Accident Forgiveness: Liberty Mutual includes accident forgiveness to prevent premium hikes after an accident.

- New Car Replacement: Liberty Mutual provides new car replacement coverage for totaled cars less than a year old.

Cons

- Higher Rates: Liberty Mutual’s premiums can be on the higher side compared to other insurers.

- Discount Limitations: The availability and amount of discounts may vary based on the state.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Auto-Owners: Best for Reliable Pricing

Pros

- Consistent Pricing: Auto-Owners offers reliable and stable pricing, helping customers avoid unexpected rate hikes.

- Broad Coverage Options: Auto-Owners insurance review & ratings provides various coverage options tailored to individual needs.

- High Financial Strength: Auto-Owners has a strong financial rating, ensuring claims are paid promptly.

Cons

- Limited Online Tools: Auto-Owners lacks some of the advanced online tools and features available from other insurers.

- Regional Availability: Auto-Owners is not available nationwide, limiting access for some customers.

#9 – American Family: Best for Driver Discounts

Pros

- Diverse Discounts: American Family offers numerous discounts, including those for good students, safe drivers, and loyalty.

- Personalized Service: American Family insurance review & ratings provides personalized service with dedicated local agents.

- Teen Safe Driver Program: This program helps monitor and improve teenage driving habits, potentially reducing rates.

Cons

- Higher Rates for High-Risk Drivers: American Family tends to have higher premiums for drivers with less-than-perfect records.

- Limited Availability: American Family’s insurance products are not available in all states.

#10 – The Hartford: Best for Mature Drivers

Pros

- AARP Partnership: The Hartford offers exclusive benefits and discounts to AARP members.

- RecoverCare: This unique coverage helps with home services if you’re injured in an accident.

- Lifetime Renewability: The Hartford insurance review & ratings guarantees policy renewals as long as required premiums are paid.

Cons

- Age Restrictions: Some of The Hartford’s benefits and discounts are only available to older drivers.

- Higher Premiums: The Hartford’s premiums can be higher compared to other insurers, especially for younger drivers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors That Affect the Cost of Chevrolet Astro Passenger Car Insurance

There are several key factors that can influence the cost of insuring your Chevrolet Astro Passenger car. These factors include your age, driving record, location, vehicle age and condition, and the amount of coverage you choose. For example, younger drivers may face higher insurance rates due to their lack of driving experience, while drivers with a history of accidents or traffic violations may also see an increase in rates.

Additionally, the geographical location where you live can impact insurance costs, as areas with higher crime rates or more traffic congestion tend to have higher insurance premiums. Furthermore, the age and condition of your Chevrolet Astro Passenger car can also affect rates, as older vehicles may have a higher risk of mechanical issues or be more susceptible to theft.

Chevrolet Astro Passenger Car Insurance: Monthly Rates by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $47 | $130 |

| American Family | $62 | $150 |

| Auto-Owners | $60 | $145 |

| Erie | $42 | $115 |

| Liberty Mutual | $58 | $145 |

| Nationwide | $55 | $140 |

| Progressive | $52 | $135 |

| State Farm | $50 | $132 |

| The Hartford | $65 | $155 |

| USAA | $45 | $125 |

Lastly, the amount of coverage you select will impact the cost of your insurance, as more comprehensive coverage options often come with higher premiums. Another factor that can affect the cost of insuring your Chevrolet Astro Passenger car is your credit score. Insurance companies often consider credit history as an indicator of financial responsibility.

A lower credit score may result in higher insurance premiums, as it is seen as a higher risk for the insurance company. On the other hand, a higher credit score may lead to lower insurance rates, as it suggests a lower risk of filing claims. It is important to maintain a good credit score to potentially save on your Chevrolet Astro Passenger car insurance.

Understanding the Insurance Premiums for Chevrolet Astro Passenger Car

Insurance premiums for your Chevrolet Astro Passenger car are the regular payments you make to maintain your coverage. These premiums are determined based on a variety of factors, including the ones mentioned earlier.

Insurance companies use complex algorithms and actuarial calculations to assess risk and assign a premium amount accordingly. Learn more insights on our “How does the insurance company determine my premium?“.

These premiums can vary significantly from person to person, so it’s essential to understand the factors that contribute to your specific premium. By understanding these factors, you will have a clearer idea of what you can expect to pay for your Chevrolet Astro Passenger car insurance coverage.

Top Tips for Finding Affordable Chevrolet Astro Passenger Car Insurance

While insurance costs can add up, there are ways to find more affordable options for insuring your Chevrolet Astro Passenger car. Here are some top tips to help you save on your car insurance premiums:

- Shop Around: Compare car insurance quotes from multiple insurance companies to find the best rates for your Chevrolet Astro Passenger car.

- Increase Your Deductible: Consider raising your deductible, which is the amount you pay out of pocket before your insurance kicks in. Higher deductibles typically lead to lower premiums.

- Look for Discounts: Many insurance companies offer discounts for factors such as safe driving records, installation of safety features, and bundling multiple insurance policies together.

- Maintain a Good Credit Score: Insurance companies often consider credit scores when determining premiums, so maintaining good credit can help you secure lower insurance rates.

By following these tips and actively seeking out the best options, you can effectively reduce your insurance costs and ensure that you have affordable coverage for your Chevrolet Astro Passenger car.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Different Types of Coverage Options for Chevrolet Astro Passenger Car Insurance

When it comes to insuring your Chevrolet Astro Passenger car, there are several coverage options to consider. These options include liability coverage, which is required by law in most states and helps cover damages and injuries you cause to others in an accident.

Additionally, collision coverage can help pay for repairs or replacements to your Chevrolet Astro Passenger car if it is damaged in a collision. Comprehensive coverage protects your vehicle from non-collision-related damages, such as theft, vandalism, or weather-related incidents.

Lastly, uninsured/underinsured motorist coverage can provide financial protection if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough coverage to pay for your damages. It’s essential to evaluate your needs and consider factors such as your vehicle’s value, your budget, and state requirements when selecting the right coverage options for your Chevrolet Astro Passenger car.

Comparing Quotes From Multiple Insurers for Chevrolet Astro Passenger Car Insurance

One of the most effective ways to find the best rates for your Chevrolet Astro Passenger car insurance is to compare quotes from multiple insurers. (Read more: How To Get Free Insurance Quotes Online)

Each insurance company has its own way of assessing risk and determining premiums, so getting quotes from several companies allows you to compare and find the best coverage and rates for your specific needs.

This process can be time-consuming, but the potential savings are well worth the effort. Online comparison tools and working with independent insurance agents can make this process more convenient and help you find the most competitive rates.

The Importance of Comprehensive Coverage for Your Chevrolet Astro Passenger Car

When insuring your Chevrolet Astro Passenger car, it’s important to consider adding comprehensive coverage to your insurance policy. Comprehensive coverage protects you from a wide range of risks that may not be covered by other types of insurance, such as collisions or liability coverage. Learn more on our guide titled “Collision vs. Comprehensive Car Insurance”

It provides invaluable financial protection against damages caused by events like theft, vandalism, natural disasters, or other unforeseen circumstances. While comprehensive coverage may come at an additional cost, it can provide peace of mind and save you from significant financial burdens in the event of a covered incident.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors to Consider When Choosing the Right Deductible for Your Chevrolet Astro Passenger Car Insurance

When selecting your Chevrolet Astro Passenger car insurance policy, it’s crucial to consider the deductible amount. A deductible is the amount you are responsible for paying out of pocket before your insurance coverage kicks in to cover the remaining costs. Choosing the right deductible involves balancing your immediate financial capabilities and your willingness to take on a higher deductible in exchange for lower premiums.

Higher deductibles generally result in lower premiums, but you must ensure that you can comfortably afford to pay the deductible amount if you need to file a claim.

It’s important to evaluate your budget and factor in potential scenarios when selecting the deductible that’s right for your Chevrolet Astro Passenger car insurance policy. Read thoroughly our guide “What is the difference between a deductible and a premium in car insurance?”

How Your Driving Record Affects the Cost of Chevrolet Astro Passenger Car Insurance

Your driving record plays a significant role in determining the cost of insurance for your Chevrolet Astro Passenger car. Insurance companies consider factors such as accidents, traffic violations, and driving history to assess your risk as a driver.

If you have a history of accidents or traffic violations, insurance companies may view you as a higher risk and charge higher premiums as a result. To gain more information, read our guide titled “Personal Injury Protection (PIP) Insurance“

On the other hand, a clean driving record with no accidents or violations can help you secure lower insurance rates. Maintaining a safe driving record is not only important for your safety but also for your wallet when it comes to insuring your Chevrolet Astro Passenger car.

The Impact of Vehicle Age and Condition on Chevrolet Astro Passenger Car Insurance Rates

The age and condition of your Chevrolet Astro Passenger car can influence the cost of your insurance rates. Older vehicles typically have lower market values, which can result in lower insurance premiums. However, if your older Chevrolet Astro Passenger car is in poor condition or lacks safety features, insurers may consider it a higher risk to insure.

The presence of safety features in your vehicle, such as anti-lock brakes, airbags, or an alarm system, can often result in lower insurance rates. It’s crucial to consider not only the age but also the overall condition and safety features of your Chevrolet Astro Passenger car when determining insurance rates. Explore our guide titled “Best Safety Features Car Insurance Discounts”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Special Considerations for Insuring a Used or Older Model of Chevrolet Astro Passenger Car

Insuring a used or older model of a Chevrolet Astro Passenger car may present some unique considerations. As mentioned earlier, older vehicles typically have lower market values, which can result in lower insurance premiums. However, it’s important to factor in the condition and safety features of your vehicle.

If your used or older Chevrolet Astro Passenger car lacks certain safety features or is in poor condition, insurance rates may be higher due to the increased risk. Additionally, if you have made modifications or enhancements to your Chevrolet Astro Passenger car, such as installing performance parts or customizing the vehicle, insurance rates may also be affected.

It’s crucial to discuss these factors with insurance providers to ensure proper coverage and accurate pricing for your used or older Chevrolet Astro Passenger car. For additional details, explore our comprehensive resource titled “Best Safe Driver Car Insurance Discounts.”

Exploring Discounts and Savings Opportunities on Chevrolet Astro Passenger Car Insurance

Insurance companies often offer discounts and savings opportunities that can help you save on insuring your Chevrolet Astro Passenger car.

These discounts can vary depending on the insurer and your specific circumstances. Some common discounts include safe driver discounts for maintaining a clean driving record, multi-policy car insurance discounts for bundling different insurance policies with the same company, or discounts for having safety features installed in your Chevrolet Astro Passenger car.

Additionally, some insurers offer discounts for completing defensive driving courses or being a part of specific professional affiliations. Exploring these discount opportunities and discussing them with various insurance providers can help you find additional savings on your Chevrolet Astro Passenger car insurance.

Common Misconceptions About Insuring a Chevrolet Astro Passenger Car

There are several common misconceptions about insuring a Chevrolet Astro Passenger car that are important to address. One common misconception is that all insurance companies offer the same rates and coverage options. In reality, insurance companies can vary significantly in terms of pricing and coverage, so it’s essential to compare quotes and policies from multiple insurers to find the best fit for your specific needs.

Another misconception is that the cost of insurance is solely determined by the make and model of the vehicle; typically, homeowners or renters insurance covers these items. While the make and model do play a role, factors such as your driving record, location, and selected coverage options also impact the cost of insurance.

By understanding and dispelling these misconceptions, you can make more informed decisions when it comes to insuring your Chevrolet Astro Passenger car.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips for Maintaining a Good Credit Score to Lower Your Chevrolet Astro Passenger Car Insurance Rates

Your credit score can play a role in determining the cost of your Chevrolet Astro Passenger car insurance rates. Insurance companies often consider credit scores when assessing risk and determining premiums. Maintaining a good credit score is essential for securing lower insurance rates. Gain more insight with our guide “Does USAA credit score affect home insurance?”

Some tips to help maintain a good credit score include paying bills on time, keeping credit card balances low, minimizing credit inquiries, and checking your credit report regularly for errors or discrepancies. By maintaining a good credit score, you demonstrate responsibility and financial stability, which can positively impact your Chevrolet Astro Passenger car insurance rates.

Understanding the Role of Location in Determining Chevrolet Astro Passenger Car Insurance Costs

Your location is a critical factor in determining the cost of your Chevrolet Astro Passenger car insurance. Insurance companies consider elements such as traffic density, crime rates, and the cost of living in your area when assessing risk and determining premiums. To gain further insights, consult our comprehensive guide titled “Best Car Insurance Discounts to Ask.”

Areas with higher traffic congestion or higher crime rates tend to have higher insurance premiums, as the likelihood of accidents, theft, or vandalism increases. Additionally, areas with high costs of living can also result in higher insurance rates. It’s important to consider your location and the associated insurance costs when insuring your Chevrolet Astro Passenger car.

Overall, understanding the factors that affect the cost of insurance for your Chevrolet Astro Passenger car, exploring coverage options, comparing quotes, and taking advantage of available discounts can help you secure affordable and comprehensive insurance coverage. By considering these key factors and tips, you can ensure that you make an informed decision when it comes to insuring your Chevrolet Astro Passenger car.

Case Studies: Affordable Chevrolet Astro Passenger Car Insurance

These case studies illustrate how different drivers found affordable Chevrolet Astro Passenger car insurance by leveraging tailored rates, custom plans, and comprehensive coverage options.

- Case Study #1 – Tailored Rates With Erie: John, a 35-year-old with a clean driving record, secured tailored rates starting at $42 per month with Erie. Their comprehensive coverage and excellent customer service provided John with affordable peace of mind.

- Case Study #2 – Custom Plans With USAA: Sarah, a military veteran, chose USAA for her Chevrolet Astro Passenger. USAA offered personalized coverage that met her needs and budget, benefiting from military-specific plans and exceptional customer support.

- Case Study #3 – Comprehensive Coverage With AAA: Mark, a 45-year-old driver, needed comprehensive coverage for his vehicle. AAA provided a plan with collision car insurance, liability, and uninsured motorist coverage, plus additional benefits for military families, all at an affordable rate.

These case studies highlight how tailored rates, custom plans, and comprehensive coverage can help you find cheap Chevrolet Astro Passenger car insurance.

Melanie Musson Published Insurance Expert

By choosing Erie, USAA, or AAA and comparing quotes, you can find the best insurance solution for your needs. See if you’re getting the best deal on car insurance by entering your ZIP code below.

Frequently Asked Questions

What factors affect the cost of Chevrolet Astro Passenger car insurance?

The cost of Chevrolet Astro Passenger car insurance can be influenced by various factors including the driver’s age, driving record, location, coverage options, deductible amount, and the insurance company’s rates. Check out our guide titled “What age do you get cheap car insurance?“

Are there any discounts available for Chevrolet Astro Passenger car insurance?

Yes, many insurance companies offer discounts that can help reduce the cost of Chevrolet Astro Passenger car insurance. These discounts may include safe driver discounts, multi-policy discounts, good student car insurance discounts, and anti-theft device discounts, among others.

How can I find the most affordable Chevrolet Astro Passenger car insurance?

To find the most affordable Chevrolet Astro Passenger car insurance, it is recommended to compare quotes from multiple insurance companies. You can either contact insurance agents directly or use online comparison tools to easily compare rates and coverage options.

By entering your ZIP code below, you can get instant car insurance quotes from top providers.

What type of coverage options are available for Chevrolet Astro Passenger car insurance?

Common coverage options for Chevrolet Astro Passenger car insurance include liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and personal injury protection. The specific coverage options and limits can vary depending on the insurance company and individual policy.

Does the Chevrolet Astro Passenger car model affect insurance rates?

Yes, the make and model of a car, such as the Chevrolet Astro Passenger, can impact insurance rates. Factors like the car’s safety features, repair costs, and historical claims data for that particular model can influence the insurance premiums. For a thorough understanding, refer to our detailed analysis titled “How to Document Damage for Car Insurance Claims.”

Can I adjust my Chevrolet Astro Passenger car insurance coverage?

Yes, you can typically adjust your Chevrolet Astro Passenger car insurance coverage to better meet your needs. Discuss your options with your insurance provider to make necessary adjustments.

Are there special considerations for insuring a used or older Chevrolet Astro Passenger?

Yes, insuring a used or older Chevrolet Astro Passenger may come with lower premiums due to its reduced market value. However, the condition and safety features of the vehicle can also impact insurance rates.

How does my driving record affect my Chevrolet Astro Passenger car insurance rates?

A clean driving record with no accidents or traffic violations can help lower your insurance rates, while a history of accidents or violations can increase your premiums. Learn more insights on our “How does the insurance company determine my premium?“.

What is the importance of comprehensive coverage for my Chevrolet Astro Passenger car?

Comprehensive coverage protects your vehicle from non-collision-related damages such as theft, vandalism, and natural disasters, providing invaluable financial protection.

Can my credit score affect my Chevrolet Astro Passenger car insurance rates?

Yes, your credit score can influence your car insurance rates. A higher credit score often results in lower premiums, while a lower credit score can lead to higher rates. See how much you’ll pay for car insurance by entering your ZIP code below into our free comparison tool.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.