Cheapest Car Insurance for 19-Year-Old Drivers in 2026 (Save With These 10 Companies!)

State Farm, Progressive, and Farmers cater the cheapest car insurance for 19-year-old drivers, offering rates as low as $88. These companies understand the unique needs of 19-year-old drivers, providing tailored coverage options with their competitive rates and specialized policies.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Dan Walker graduated with a BS in Administrative Management in 2005 and has been working in his family’s insurance agency, FCI Agency, for 15 years (BBB A+). He is licensed as an agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. He reviews content, ensuring tha...

Daniel Walker

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated January 2025

Company Facts

Min. Coverage for 19-Year-Old Drivers

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for 19-Year-Old Drivers

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for 19-Year-Old Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

With their competitive rates and specialized policies, young drivers can find comprehensive coverage that fits their budget while providing peace of mind on the road.

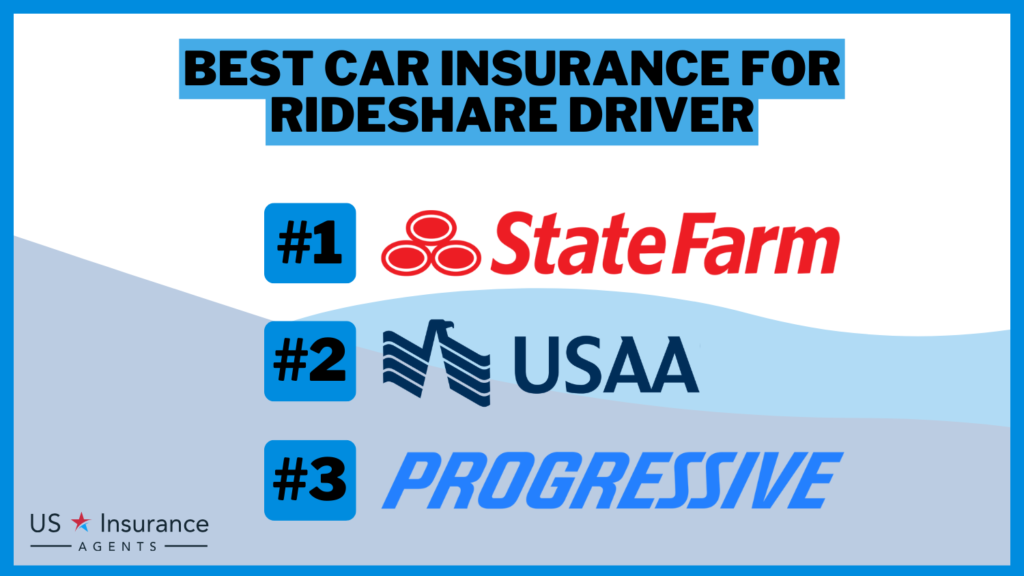

Our Top 10 Company Picks: Cheapest Car Insurance for 19-Year-Old Drivers

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $88 | A++ | Telematics Program | USAA | |

| #2 | $125 | A++ | Driver Discount | State Farm | |

| #3 | $162 | A | Online Tools | AAA |

| #4 | $165 | A++ | Online Discounts | Geico | |

| #5 | $167 | A+ | Vanishing deductible | Nationwide |

| #6 | $223 | A+ | Drivewise program | Allstate | |

| #7 | $226 | A+ | Customizable Polices | Esurance | |

| #8 | $271 | A | Customer Service | Farmers | |

| #9 | $279 | A | Membership Discounts | Liberty Mutual |

| #10 | $281 | A+ | Student Discount | Progressive |

Among these options, State Farm emerges as the top choice, offering not only affordability but also reliability and excellent customer service, making it the optimal selection for 19-year-old drivers seeking quality coverage at a great value.

Shield your business from financial setbacks. Enter your ZIP code above to shop for cheap commercial insurance rates from top providers near you.

- State Farm emerges as the cheapest car insurance for 19-year-old drivers

- Specialized policies cater to the unique needs of 19-year-old drivers

- Discount programs alleviate the financial burden

#1 – State Farm: Top Overall Pick

Pros

- Competitive Rates: Affordable monthly rate. Get the full scoop on State Farm insurance review & ratings for in-depth review.

- Multi-Policy Discount: Offers up to 15%, ideal for multiple insurance needs.

- Driver Discount Focus: Strong emphasis on discounts for drivers.

Cons

- Higher Base Rate: More expensive compared to some competitors.

- Limited Student Discounts: Less focus on student-specific savings.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Student Discounts

Pros

- Student-Friendly: Specializes in discounts for students. Explore our Progressive insurance review & ratings to gain deeper insights.

- Moderate Pricing: Monthly rates is balancing cost and features.

- Multi-Policy Savings: Up to 10% off for bundling policies.

Cons

- Slightly Higher Rates: Not the cheapest option for all drivers.

- Narrower Discount Range: Less variety in discount offerings.

#3 – Farmers: Best for Customer Service

Pros

- Customer Service Excellence: Renowned for superior customer support.

- Competitive Monthly Rate: Attractive rate. Discover what sets our Farmers insurance review & ratings for detailed review.

- Significant Multi-Policy Discount: Up to 15% for various policies.

Cons

- Limited Niche Discounts: Fewer options for specific driver categories.

- Potential Coverage Limits: May not offer the widest range of coverage options.

#4 – Allstate: Best for Drive Wise Program

Pros

- Innovative Drive Wise Program: Rewards safe driving habits.

- Substantial Discounts: Offers up to 20% for multiple policies.

- Competitive Rate: Reasonable monthly premium. Learn more about Allstate insurance review & ratings for thorough review.

Cons

- Higher Rates for Some Profiles: May be pricey for certain drivers.

- Limited Discounts for Young Drivers: Fewer options specifically for the youth.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible Feature: Rewards safe driving over time.

- Attractive Multi-Policy Discounts: Up to 25%, one of the highest.

- Balanced Rate: monthly offers a middle ground in pricing. Refer to our Nationwide insurance review & ratings for a detailed overview of our offerings.

Cons

- Not the Cheapest Option: There are lower-priced alternatives.

- Specific Eligibility Criteria: Some discounts require meeting particular conditions.

#6 – Geico: Best for Online Discounts

Pros

- Competitive Rates: One of the lowest monthly.

- Up to 15% Online Discounts: Great savings for tech-savvy customers.

- Wide Coverage Options: Diverse policies catering to various needs.

Cons

- Basic Customer Service: May not match the level of personalized service of smaller companies.

- Limited Physical Presence: Relies more on online interaction, which might not suit all.

#7 – USAA: Best for Telematics Program

Pros

- Exceptionally Low Rate: USAA insurance review & ratings emphasized its monthly is highly affordable.

- Innovative Telematics Program: Encourages and rewards safe driving.

- Multi-Policy Discount Up to 12%: Significant savings for bundling.

Cons

- Limited Availability: Services primarily for military members and their families.

- Fewer Physical Locations: Not ideal for those preferring in-person service.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Membership Discounts

Pros

- Diverse Membership Discounts: Offers up to 18% for members of certain groups.

- Comprehensive Coverage Options: Wide range of policies.

- Competitive Monthly Rate: Liberty Mutual review & ratings boasts its balancing cost with features.

Cons

- Higher Pricing for Some: Can be expensive depending on the coverage.

- Limited Niche Discounts: Fewer specific discounts for unique driver profiles.

#9 – AAA: Best for Online Tools

Pros

- Advanced Online Tools: AAA insurance review & ratings highlights and facilitates easy management and learning.

- Reasonable Rates: Monthly is a good middle-ground option.

- Multi-Policy Discount Up to 13%: Offers savings for bundling services.

Cons

- Membership Requirement: Services available to AAA members only.

- Varied Customer Service: Experience can differ based on region.

#10 – Esurance: Best for Customizable Policies

Pros

- Highly Customizable Policies: Esurance insurance review & ratings emphasized its tailor-made options for individual needs.

- Decent Multi-Policy Discount: Up to 10% off.

- Competitive Pricing: Monthly rate offering a balance between cost and customization.

Cons

- Higher Rates for Certain Profiles: Can be costly for specific customer types.

- Limited Physical Offices: Primarily online, which might not suit everyone’s preference.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Navigating Rates: Comparative Analysis of Monthly Car Insurance Costs for 19-Year-Old Drivers

Navigating the complexities of car insurance, the table below elucidates the average monthly rates for 19-year-old drivers, distinguishing between minimum and full coverage car insurance plans provided by various insurance companies.

Car Insurance Monthly Rates for 19-Year-Old Drivers by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| AAA | $162 | $378 |

| Allstate | $223 | $519 |

| Esurance | $226 | $526 |

| Farmers | $271 | $629 |

| Geico | $165 | $254 |

| Liberty Mutual | $279 | $638 |

| Nationwide | $167 | $387 |

| Progressive | $281 | $662 |

| State Farm | $125 | $284 |

| USAA | $88 | $203 |

Understanding the High Insurance Costs for 19-Year-Old Drivers

It’s no secret that car insurance for 19-year-old drivers tends to be more expensive compared to other age groups. This is because statistically, young drivers are more prone to accidents and violations. Insurance companies consider younger drivers to be riskier to insure due to their relative inexperience behind the wheel.

Additionally, teenagers are often seen as more prone to reckless driving behavior, which further increases insurance costs. While these factors can make finding affordable car insurance challenging for 19-year-olds, there are strategies that can help in reducing premiums. To gain more knowledge, check out our guide “How does the insurance company determine my premium?”

One strategy to reduce insurance premiums for 19-year-old drivers is to take a defensive driving course. These courses provide additional training and education on safe driving practices, which can help young drivers improve their skills and reduce the likelihood of accidents. Insurance companies often offer discounts to drivers who have completed a defensive driving course, making it a cost-effective way to lower insurance costs.

Tips to Find Affordable Car Insurance for 19-Year-Olds

Finding cheapest car insurance for 19-year-olds can be challenging, but comparing quotes from different companies is key. Each insurer’s rate calculation varies, so shopping around helps identify the best deal. Utilize discounts and programs for young drivers to lower costs.

When deciding between an individual policy or joining a parent’s, consider the advantages and disadvantages of each. While joining a family policy may offer lower rates, it’s essential to review the primary policyholder’s driving record and credit to ensure the best overall cost.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Compare Car Insurance Quotes for 19-Year-Old

Comparing car insurance quotes for 19-year-olds can indeed be a bit of a task, but it’s essential to find the right balance between affordability and sufficient coverage. Here’s a simplified guide:

- Price Comparison: Start by gathering quotes from multiple insurance providers. Online comparison tools can make this process easier by allowing you to input your information once and receive quotes from several companies.

- Coverage Evaluation: Look beyond the price and assess the coverage options offered by each insurer. Consider factors like liability coverage, collision coverage, comprehensive coverage, and any additional benefits like roadside assistance or rental car reimbursement.

- Deductible Consideration: The deductible is the amount you’ll have to pay out of pocket before your insurance kicks in after an accident. Generally, opting for a higher deductible can lower your premiums, but make sure you can afford the deductible in case you need to make a claim.

- Discounts and Incentives: Many insurers offer discounts for young drivers. These may include good student discounts, defensive driving course discounts, and multi-policy discounts if you bundle your car insurance with other types of insurance, like renters or homeowners insurance.

- Reviews and Reputation: Research the reputation of each insurance company. Look for customer reviews and ratings to get an idea of their customer service quality and claims process efficiency. A company with a good reputation may be worth paying slightly higher premiums for if it means better service when you need it.

- Avoid Common Mistakes: Be honest and accurate when providing information for your quotes. Providing incorrect information could lead to issues with your policy or claims down the line. Also, don’t skimp on coverage just to save a few dollars in the short term. Adequate coverage is essential for protecting yourself financially in case of an accident.

- Continuous Review: As you grow older and gain more driving experience, periodically review your insurance coverage and compare quotes again. Your insurance needs may change over time, and you may be eligible for additional discounts as you demonstrate responsible driving behavior.

By following these steps and being diligent in your research, you can find the right car insurance policy for your needs as a 19-year-old driver.

Continuously review your policy and consider updating it as you gain more driving experience and potentially qualify for additional discounts. Remember, safe driving not only keeps you protected on the road but can also help keep your insurance premiums low in the long run.

Strategies to Lower Car Insurance Costs for 19-Year-Old Drivers

Navigating the world of car insurance can be particularly daunting for 19-year-old drivers, who often face higher premiums due to their age and lack of driving experience. However, by understanding the various factors that influence insurance costs and implementing strategic approaches, young drivers can take proactive steps to lower their insurance expenses.

In this guide, we’ll explore ten effective strategies tailored specifically to help 19-year-olds reduce their car insurance costs and make informed decisions about coverage.

- Graduated Driver Licensing (GDL) Program: Highlighting the importance of gaining experience gradually through different stages of the program, which can lead to favorable insurance rates.

- Usage-Based Car Insurance Programs: Discussing how young drivers can save money by demonstrating safe driving habits through telematics or pay-as-you-go insurance.

- Driving Record: Emphasizing the significance of maintaining a clean driving record to lower insurance costs.

- Credit Score: Noting the impact of credit score on insurance rates and suggesting ways to improve it.

- Safe Driving Habits: Encouraging young drivers to prioritize safe driving practices to potentially qualify for lower insurance rates.

- Bundling Policies: Exploring the benefits of bundling car insurance with other types of insurance to avail multi-policy discounts.

- Vehicle Choice: Discussing how the type of vehicle selected can influence insurance premiums.

- Deductibles and Coverage Limits: Advising on the importance of understanding deductibles and coverage limits to ensure adequate protection.

- Good Student Discounts: Highlighting the potential savings for young drivers who maintain good academic standing.

- Defensive Driving Courses: Exploring how completing defensive driving courses can improve driving skills and lead to discounts on insurance premiums.

As 19-year-old drivers embark on their journey behind the wheel, it’s crucial to prioritize both safety and financial responsibility. By leveraging the insights provided in this guide and implementing the outlined strategies, young drivers can not only save money on car insurance but also cultivate safer driving habits for a lifetime.

Whether it’s through leveraging usage-based insurance programs, maintaining a clean driving record, or pursuing discounts for academic achievement, there are various avenues available for 19-year-olds to explore in their quest for affordable and reliable car insurance coverage. Check out our guide “What age do you get cheap car insurance?”

Case Studies: Unveiling Car Insurance for 19-Year-Old Drivers

These case studies highlight different scenarios and approaches to car insurance for 19-year-old drivers, small businesses, and high-risk drivers. Let’s analyze each case and draw some insights:

- Case Study #1– Small Business Fleet Insurance: Jackson’s Catering Services needed affordable insurance for their delivery vans. They chose Progressive, which offered good coverage at a lower cost. With Progressive, they saved 15% on insurance and had easy claim processing.

- Case Study #2– Personal Car Insurance: The Robinson Family had to insure multiple cars, including one for their 19-year-old, Sarah. State Farm gave them discounts for young drivers and multiple cars. As a result, they saved 20% on insurance, and Sarah got a discount for being a good student.

- Case Study #3– High-Risk Driver Insurance: Alex had a bad driving record, so finding affordable insurance was tough. Geico helped by offering lower rates and a program to improve driving habits. Alex’s insurance became cheaper over time as he drove better.

These case studies illustrate the importance of researching and comparing insurance providers to find the best fit for specific needs. It’s also clear that some insurers offer specialized programs or discounts tailored to certain demographics or risk profiles, such as young drivers or high-risk individuals.

Melanie Musson Published Insurance Expert

Choosing the best car insurance for comprehensive coverage is crucial. Whether you’re a small business owner insuring a fleet, a family with a young driver, or an individual with a less-than-perfect driving record, there are options available to find affordable and comprehensive car insurance coverage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Summary of Affordable Car Insurance for 19-Year-Olds

A thorough examination of the car insurance landscape for 19-year-old drivers, offering insights into the factors influencing insurance costs, such as driving record, vehicle choice, and coverage options. It highlights key strategies for young drivers to secure affordable insurance, including comparing quotes from multiple providers, taking advantage of discounts, and considering usage-based insurance programs.

Additionally, the piece discusses the benefits of defensive driving courses, the importance of maintaining a clean driving record, and the impact of credit score on insurance rates, ensuring the best car insurance discounts without compromising quality coverage.

Overall, it emphasizes the importance of research and careful consideration to find the most suitable and budget-friendly insurance coverage for young drivers. Enter your ZIP code into our quote comparison tool below to secure cheaper insurance rates for your business.

Frequently Asked Questions

What factors affect the cost of car insurance for 19-year-old drivers?

The cost of car insurance for 19-year-old drivers is influenced by several factors including the driver’s location, driving history, types of car insurance coverage, coverage options, and insurance provider’s policies.

How can 19-year-old drivers find the cheapest car insurance?

19-year-old drivers can find the cheapest car insurance by comparing quotes from multiple insurance providers, maintaining a clean driving record, opting for a car with lower insurance rates, taking advantage of available discounts, and considering higher deductibles.

Don’t overpay for your commercial insurance – enter your ZIP code below to find the cheapest rates possible

Are there any specific discounts available for 19-year-old drivers?

Yes, some insurance providers offer specific discounts for 19-year-old drivers. These may include good student discounts, safe driver discounts, discounts for completing a driver’s education course, or discounts for bundling car insurance with other policies.

Is it possible for 19-year-old drivers to get full coverage car insurance?

Yes, it is possible for 19-year-old drivers to obtain full coverage car insurance. However, it is important to note that full coverage insurance tends to be more expensive. It may be beneficial for young drivers to assess their needs and budget before deciding on the coverage options.

What are some tips for 19-year-old drivers to lower their car insurance premiums?

To lower car insurance premiums, 19-year-old drivers can consider the following tips: maintain a good driving record, choose a car with lower insurance rates, take advantage of available discounts, consider increasing deductibles, and compare quotes from different insurance providers.

To find out more, explore our guide titled “Best Car Insurance for Teens in California“

What makes State Farm the best choice for 19-year-old drivers?

State Farm stands out for its competitive rates, notably a monthly average of $86 for good drivers. Additionally, it offers driver discounts and boasts an A+ A.M. Best Rating, making it a reliable and affordable choice for young drivers.

How does Progressive cater to the needs of student drivers?

Progressive is known for its student-friendly policies, offering an average monthly rate of $109 for good drivers and up to 10% student discounts. This makes it a cost-effective option for 19-year-olds, particularly those in school.

Are there affordable insurance options for high-risk drivers like those with a history of speeding tickets?

Yes, companies like Geico specialize in providing competitive rates for high-risk drivers. Their policies, including telematics programs, can help reduce premiums over time based on improved driving habits, making them a suitable choice for individuals with a less-than-perfect driving record.

For further guidance, consult our article titled “The Best Methods for Obtaining Affordable Quotes for Car Insurance.”

Can small businesses find suitable car insurance that’s budget-friendly?

Insurers like Progressive offer tailored plans for small businesses, including those requiring fleet insurance. These plans are designed to be comprehensive yet cost-effective, with features like multi-policy discounts, making them ideal for small business needs.

What are the benefits of telematics programs in car insurance policies?

Telematics programs, offered by insurers like USAA and Geico, monitor driving behavior and can lead to lower insurance premiums for safer driving. They encourage and reward good driving habits, potentially reducing the cost of insurance for careful drivers.

To find cheap business insurance, enter your ZIP code into our free quote comparison tool below and get covered today.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.