Cheap Buick Verano Car Insurance in 2026 (Save Big With These 10 Companies!)

Discover the best providers for cheap Buick Verano car insurance—Erie, State Farm, and Travelers stand out with rates starting at just $22 a month. These companies offer the most competitive premiums and comprehensive coverage options, making them the top choices for Buick owners seeking value and reliability.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Updated November 2024

Company Facts

Min. Coverage for Verano

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Verano

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Verano

A.M. Best Rating

Complaint Level

Pros & Cons

The top picks for cheap Buick Verano car insurance are Erie, State Farm, and Travelers, known for their affordable rates and robust coverage options.

These companies excel in providing cost-effective policies tailored specifically for Buick Verano owners, ensuring a blend of value and protection.

Our Top 10 Company Picks: Cheap Buick Verano Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

#1 $22 A+ Personalized Policies Erie

#2 $33 B Financial Strength State Farm

#3 $37 A++ Affordable Rates Travelers

#4 $39 A+ Competitive Rates Progressive

#5 $40 A Dividend Payments American Family

#6 $44 A+ Accident Forgiveness Nationwide

#7 $46 A+ Customer Service Amica Mutual

#8 $54 A Safe-Driving Discounts Farmers

#9 $58 A+ Multi-Policies Discount Allstate

#10 $64 A Customizable Policies Liberty Mutual

Understanding the various factors that affect insurance premiums, such as safety features, model year, and driver history, can help you navigate your choices better. This guide aims to equip you with the knowledge to secure the best possible deal on your car insurance, blending comprehensive coverage with affordability.

Searching for more affordable premiums? Insert your ZIP code above to get started on finding the right provider for you and your budget.

- Erie Insurance is the top pick for cheap Buick Verano car insurance

- Buick-specific factors like safety features impact insurance rates

- Tailored insurance options are essential for Buick Verano owners

#1 – Erie: Top Overall Pick

Pros

- Tailored Coverage: Erie excels in offering personalized insurance policies that suit individual customer needs.

- Competitive Pricing: Offers some of the lowest monthly rates at $22, making it highly affordable. Learn more in our Erie insurance review & ratings.

- Superior Claims Service: Known for quick and efficient claims processing, enhancing customer satisfaction.

Cons

- Limited Availability: Erie insurance is not available nationwide, which could be a limitation for some.

- Fewer Online Resources: Compared to larger insurers, Erie offers fewer online tools and resources for policy management.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for Financial Strength

Pros

- Bundling Policies: Offers significant discounts for bundling multiple insurance policies.

- High Low-Mileage Discount: Provides substantial discounts for low-mileage usage. See more details on our State Farm car insurance review & ratings.

- Wide Coverage: Offers a variety of coverage options tailored to different business needs.

Cons

- Limited Multi-Policy Discount: Their multi-policy discount is not as competitive as some rivals.

- Premium Costs: Despite discounts, premiums can still be relatively high for certain levels of coverage.

#3 – Travelers: Best for Affordable Rates

Pros

- Competitive Pricing: Known for its affordable rates with monthly premiums starting at $37. More information is available about this provider in our Travelers insurance review & ratings.

- Flexible Payment Options: Offers multiple payment plans to ease the financial burden on policyholders.

- Extensive Coverage Options: Provides a wide range of coverage options catering to diverse needs.

Cons

- Customer Service Variability: Customer service quality can vary significantly from one region to another.

- Complex Policy Offerings: Some customers may find their policy options and terms confusing.

#4 – Progressive: Best for Competitive Rates

Pros

- Customizable Plans: Progressive offers highly customizable plans to meet diverse customer needs.

- Loyalty Rewards: Provides discounts and perks for long-term customers. Read up on the “Progressive Car Insurance Review & Ratings” for more information.

- Strong Online Presence: Exceptional online tools and mobile app for convenient policy management.

Cons

- Higher Rates for High-Risk Drivers: Rates can be significantly higher for individuals with poor driving records.

- Inconsistent Agent Experience: Customer experience can vary depending on the agent or representative.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – American Family: Best for Dividend Payments

Pros

- Dividend Payments: Unique feature of returning a portion of the premium as dividends to policyholders.

- Wide Range of Discounts: Offers a variety of discounts including for safety equipment and loyalty. Check out insurance savings in our complete American Family insurance review & ratings.

- Robust Online and Mobile Tools: Provides excellent digital resources for managing policies and claims.

Cons

- Higher Base Premiums: Basic coverage options may start at a higher price point.

- Limited Coverage Area: Not available in all states, which can restrict access for some customers.

#6 – Nationwide: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Nationwide offers accident forgiveness policies, preventing premium increases after the first at-fault accident.

- Multiple Discount Options: Provides various discounts, including for safe driving and anti-theft devices.

- Strong Financial Stability: High ratings for financial health, indicating reliability. Discover more about offerings in our Nationwide insurance review & ratings.

Cons

- Pricing Inconsistencies: Rates can vary significantly between states and individual circumstances.

- Average Customer Satisfaction: Customer feedback on service and claim processing is mixed.

#7 – Amica Mutual: Best for Customer Service

Pros

- Top-rated Customer Service: Amica is frequently recognized for its superior customer service and client satisfaction.

- Dividend Policies Available: Offers policies that can return a portion of the premium as dividends.

- High Customizability: Flexible policy options to suit a variety of needs and budgets. Access comprehensive insights into our Amica car insurance discounts.

Cons

- Higher Pricing: Generally, prices are on the higher side, especially for customized or comprehensive plans.

- Limited Physical Locations: Fewer local offices compared to other major insurers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Safe-Driving Discounts

Pros

- Safe-Driving Discounts: Provides significant discounts for safe drivers and those using telematics devices.

- Customizable Coverage: Allows detailed customization of policies to match specific needs. Delve into our evaluation of Farmers car insurance review & ratings.

- Educational Resources: Offers extensive resources and advice for risk management and safety.

Cons

- Higher Rates: Generally, rates are higher compared to competitors, particularly for basic coverage.

- Customer Service Issues: Some customers report dissatisfaction with claim resolutions and service.

#9 – Allstate: Best for Multi-Policies Discount

Pros

- Multi-Policy Discounts: Allstate offers competitive discounts for customers who bundle multiple policies.

- Innovative Tools: Provides innovative tools like Drivewise to help customers manage and improve driving habits.

- Strong Agent Network: Wide network of agents provides personalized service and support. Unlock details in our Allstate insurance review & ratings.

Cons

- Costlier Premiums: Premiums can be higher than average, particularly for single-policy holders.

- Variable Customer Reviews: Customer satisfaction can vary widely depending on the area and specific agents.

#10 – Liberty Mutual: Best for Customizable Policies

Pros

- High Customizability: Offers a high degree of policy customization to meet diverse customer needs.

- Accident Forgiveness: Includes accident forgiveness options to prevent rate increases after the first accident.

- Extensive Discount Offerings: Wide range of discounts available, enhancing affordability. Discover insights in our Liberty Mutual car insurance review & ratings.

Cons

- Inconsistent Pricing: Prices can vary greatly depending on geographic location and personal details.

- Mixed Customer Service Feedback: Customer service experiences can vary, with some reporting less satisfactory interactions.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

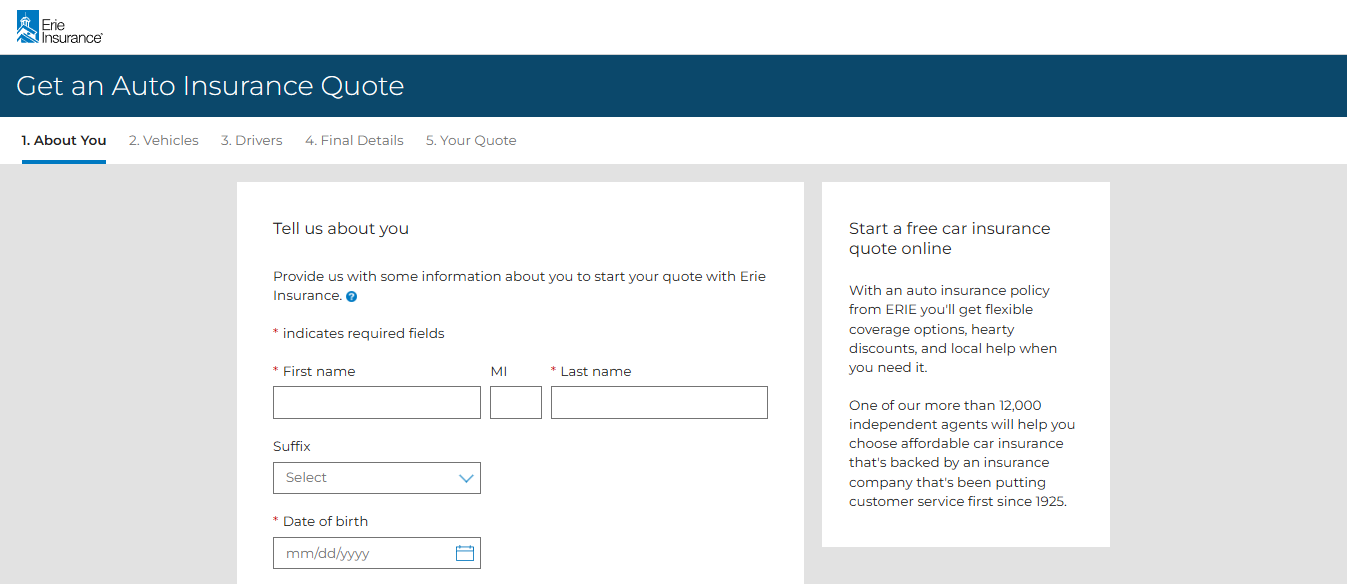

Comparative Monthly Insurance Rates for Buick Verano: Minimum vs. Full Coverage

Understanding the cost of car insurance for a Buick Verano based on coverage levels is essential for making an informed decision. The table below provides a detailed comparison of monthly rates for minimum and full coverage across various insurance providers.

Buick Verano Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $58 $145

American Family $40 $110

Amica Mutual $46 $122

Erie $22 $78

Farmers $54 $139

Liberty Mutual $64 $160

Nationwide $44 $115

Progressive $39 $105

State Farm $33 $86

Travelers $37 $95

When examining the monthly rates for minimum and full coverage for a Buick Verano, it becomes apparent that the costs can vary significantly between insurers. For minimum coverage, Erie offers the most competitive rate at just $22 per month, making it an attractive option for budget-conscious drivers.

In contrast, Liberty Mutual’s minimum coverage is the highest at $64 per month. When considering full coverage, Erie remains the most affordable with a rate of $78 per month, which is nearly half of what Liberty Mutual charges at $160 per month.

This stark contrast in pricing highlights the importance of comparing rates from different insurers to find the best deal that aligns with your coverage needs and financial constraints. Learn more in our “Compare Car Insurance Quotes.”

Factors That Influence the Cost of Buick Verano Car Insurance

When it comes to determining the cost of car insurance for your Buick Verano, there are several key factors that insurers take into consideration. One of the primary factors is the model of the car itself. Different models of cars have different levels of risk associated with them, based on factors such as their safety features, repair costs, and likelihood of theft.

Additionally, your personal driving record will play a significant role in the cost of your insurance. Insurers will assess your past driving history to determine how likely you are to be involved in an accident in the future. If you have a clean driving record with no accidents or traffic violations, you can generally expect lower insurance premiums.

On the other hand, a poor driving record with multiple accidents or violations can result in higher insurance rates. Your location also plays a role in determining the cost of insuring your Buick Verano. Urban areas with higher crime rates and congestion tend to have higher insurance rates than rural areas. Lastly, the coverage options you choose will also impact the cost of your insurance.

Higher levels of coverage will generally result in higher premiums. It is important to consider all of these factors when shopping for car insurance for your Buick Verano. See more details on our “How does the insurance company determine my premium?”

Understanding the Average Cost of Insuring a Buick Verano

Now that we have explored some of the factors that can influence the cost of insuring a Buick Verano, let’s take a closer look at the average cost of insurance for this car. According to recent data, the average monthly cost of car insurance for a Buick Verano is around $108.

However, it is important to note that this is just an average, and actual insurance rates can vary significantly based on the factors we discussed earlier. As mentioned earlier, the model of the car itself is a significant factor in determining insurance rates. The Buick Verano is considered a mid-size sedan, which generally falls into the lower to mid-range in terms of insurance costs compared to other car models.

Ty Stewart Licensed Insurance Agent

However, rates can still vary depending on the specific trim level and options you choose. Your personal driving record and location will also play a role in determining your individual insurance rates. Overall, it is important to get personalized quotes from insurance companies to get a more accurate estimate of how much insuring your Buick Verano will cost. Unlock details in our “Car Driving Safety Guide for Teens and Parents.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Importance of Shopping Around for Buick Verano Car Insurance Quotes

When it comes to getting the best deal on car insurance for your Buick Verano, shopping around is key. Insurance rates can vary significantly from one insurer to another, so it is important to get quotes from multiple companies to ensure you are getting the best rate. Each insurance company has its own unique underwriting guidelines and pricing models, so the rates they offer can vary widely.

By getting quotes from multiple insurers, you can compare the rates and coverage options they offer and choose the one that best meets your needs at an affordable price. It is recommended to get at least three quotes from different insurance companies to have a good range of comparison. Discover insights in our “How much insurance coverage do I need?”

Additionally, don’t forget to consider other factors such as the insurer’s reputation for customer service, claims handling, and financial stability. It can be helpful to read reviews and seek recommendations from trusted sources to ensure you are choosing a reputable insurer. Taking the time to shop around and compare quotes can save you a significant amount of money on your Buick Verano car insurance.

How Does the Model Year Affect the Cost of Buick Verano Car Insurance

The model year of your Buick Verano can have a significant impact on the cost of your car insurance. Generally, newer models tend to have higher insurance rates than older models. This is because newer cars typically have higher repair costs, more advanced technology, and are more likely to be targeted by thieves.

Additionally, new cars are often more expensive to replace in the event of a total loss. Insurance companies take all of these factors into consideration when determining rates. If you have a brand-new Buick Verano, it is important to be prepared for higher insurance premiums. However, as your car gets older, its value decreases and the insurance rates may also decrease as a result.

It is always a good idea to ask your insurance provider how the model year of your Buick Verano will impact your insurance rates and consider this factor when budgeting for your car insurance costs. Delve into our evaluation of “Does your car insurance rate go up the more cars you have?”

Identifying the Safety Features That Can Lower Your Buick Verano Car Insurance Premium

One important consideration when insuring your Buick Verano is the safety features it offers. Cars equipped with advanced safety features can often qualify for lower insurance premiums because they are considered to be less likely to be involved in accidents and to cause fewer injuries in the event of a collision. Access comprehensive insights into our “Determining Fault in a Multiple Car Accident.”

The Buick Verano comes with a wide range of safety features that may help reduce your insurance premium. These features may include but are not limited to, forward collision alert, lane departure warning, blind-spot monitoring, rearview camera, and anti-lock brakes.

By investing in a Buick Verano with these advanced safety features, you can not only enhance your safety on the road but also potentially lower your insurance rates. Many insurance companies offer discounts for vehicles equipped with safety features, so it is worth researching these options and discussing them with your insurance provider to determine if you are eligible for any premium reductions.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips for Finding Affordable Buick Verano Car Insurance Rates

When it comes to finding affordable car insurance rates for your Buick Verano, there are several strategies you can employ to help reduce your premiums. Here are some tips to consider:

- Shop around and compare quotes from multiple insurance companies to ensure you are getting the best rate.

- Consider bundling your car insurance with other policies, such as home or renters insurance, to potentially qualify for a multi-policy discount.

- Take advantage of any available discounts, such as safe driver discounts, good student discounts, or discounts for completing a defensive driving course.

- Consider increasing your deductible, but make sure it is an amount you can comfortably afford to pay in the event of a claim.

- Keep your driving record clean and avoid accidents and traffic violations as they can significantly impact your insurance rates.

- Consider opting for a higher deductible and paying for minor repairs out of pocket to lower your overall insurance costs.

- Ask about any available group or affiliation discounts, such as discounts for being a member of certain organizations or alumni associations.

- Additionally, maintaining a good credit score can also help you secure lower insurance rates.

By implementing these tips and being diligent in your efforts, you can increase your chances of finding affordable car insurance rates for your Buick Verano. Learn more in our “Best Car Insurance by Vehicle.”

Exploring Different Coverage Options for Your Buick Verano

When it comes to car insurance, there are several coverage options available to ensure you have the right level of protection for your Buick Verano. It is important to understand these coverage options and determine which ones are necessary for your specific needs. The most basic form of car insurance is liability coverage, which covers the costs associated with injuries or property damage you may cause to others in an accident.

This coverage is required in most states. However, it is highly recommended to consider additional coverage options to protect yourself and your vehicle. Collision coverage, for example, will cover the cost of repairs or replacement if your Buick Verano is damaged in an accident. Similarly, comprehensive coverage will protect you from non-collision-related damages such as theft, vandalism, or natural disasters.

Other coverage options to consider include uninsured/underinsured motorist coverage, medical payments coverage, and personal injury protection. It is important to carefully review your options and consult with your insurance provider to determine the best coverage options for your Buick Verano. Discover more about offerings in our “Uninsured/Underinsured Motorist Insurance Coverage.”

How Does Your Location Impact the Cost of Insuring a Buick Verano

Where you live can have a significant impact on the cost of insuring your Buick Verano. Insurance rates are determined based on factors such as crime rates, traffic congestion, and the number of accidents in your area. If you live in an urban area with a high population density and a high number of accidents, you can generally expect higher insurance rates.

On the other hand, if you live in a rural area with a lower population density and fewer accidents, you may be able to secure lower insurance rates. Additionally, certain areas may have higher rates of auto theft, which can also impact your insurance premiums. It is important to consider your location when shopping for car insurance and discuss how it may impact your rates with your insurance provider.

Keep in mind that even within the same city or state, rates can vary based on specific zip codes, so it is important to provide your exact address when getting insurance quotes to get the most accurate rates. Check out insurance savings in our complete “Insurance Quotes Online.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Relationship Between Your Driving Record and Buick Verano Car Insurance Rates

Your driving record is one of the most significant factors that insurance companies consider when determining your car insurance rates. A clean driving record with no accidents or traffic violations indicates that you are a responsible and safe driver, and insurance companies reward this with lower premiums.

On the other hand, a poor driving record with accidents, speeding tickets, or other violations suggests a higher risk of future accidents and claims, resulting in higher insurance rates. It is important to maintain a clean driving record by obeying traffic laws, practicing safe driving habits, and being cautious on the road.

Melanie Musson Published Insurance Expert

Even a single accident or violation can significantly impact your insurance rates, so it is crucial to drive defensively and avoid risky behaviors. If you have a blemish on your driving record, don’t worry—improving your record by driving safely for a certain period of time can lead to rate reductions.

Some insurance companies also offer accident forgiveness programs, which may help you avoid a premium increase after your first accident. It is important to ask your insurance provider about any available discounts or programs for safe driving. Learn more in our “Car Accidents: What to do in Worst Case Scenarios.”

Understanding the Deductible Options for Your Buick Verano Car Insurance Policy

The deductible is the amount you are responsible for paying out of pocket before your insurance coverage kicks in. In general, the higher your deductible, the lower your insurance premiums will be. When it comes to choosing a deductible for your Buick Verano car insurance policy, it is important to consider your personal financial situation and comfort level with risk.

A higher deductible can help you save money on premiums, but it also means you will have a higher out-of-pocket expense if you need to file a claim. On the other hand, a lower deductible may result in higher premiums, but it can provide peace of mind knowing that you will have less to pay in the event of an accident.

It is important to carefully evaluate your options and choose a deductible that aligns with your budget and risk tolerance. Discussing your options with your insurance provider can help you make an informed decision and find the right balance between premiums and potential out-of-pocket expenses. See more details on our “What is the difference between a deductible and a premium in car insurance?”

Comparing Different Insurance Companies’ Rates for Insuring a Buick Verano

When it comes to finding the best deal on car insurance for your Buick Verano, it is important to compare rates from different insurance companies. Each insurance company uses its own unique underwriting guidelines and pricing models, so rates can vary significantly. By obtaining quotes from multiple insurers, you can compare the coverage options and premiums they offer to find the best rate for your specific needs.

It is important to provide accurate information when requesting quotes to ensure you are getting an accurate estimate. In addition to comparing rates, it is also important to consider other factors such as the insurer’s reputation for customer service, claims handling, and financial stability. Reading customer reviews and seeking recommendations from trusted sources can help you make an informed decision.

Remember, the lowest rate may not always be the best option, so it is important to weigh all factors when comparing insurance companies. Unlock details in our “How To Get Free Insurance Quotes Online.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Explaining Comprehensive and Collision Coverage for Your Buick Verano Car Insurance

When it comes to insuring your Buick Verano, two important coverage options to consider are comprehensive and collision coverage.

Comprehensive coverage protects you against non-collision-related damages such as theft, vandalism, fire, or weather-related events. Collision coverage, on the other hand, covers the cost of repairs or replacement if your car is damaged in a collision, regardless of fault. Both of these coverage options can provide valuable protection for your Buick Verano. Discover insights in our “Collision vs. Comprehensive Car Insurance.”

Jeff Root Licensed Life Insurance Agent

However, it is important to note that they are typically not required by law unless you have a lease or loan on your vehicle. If you own your Buick Verano outright and it is older, you may choose to forgo these coverages to save money on your insurance premiums. However, if your Buick Verano is new or of significant value, it is generally recommended to carry comprehensive and collision coverage to protect your investment.

It is important to carefully review the terms and conditions of these coverages and consult with your insurance provider to determine the best options for your specific needs.

Enter your ZIP code below to compare rates from the top providers near you.

Frequently Asked Questions

What factors affect the cost of car insurance for a Buick Verano?

The cost of car insurance for a Buick Verano can be influenced by various factors such as the driver’s age, location, driving record, coverage options, deductible amount, and the insurance provider’s rates.

For additional details, explore our comprehensive resource titled “Can you lend your car to an uninsured driver?”

Are there any specific safety features on the Buick Verano that can help lower insurance costs?

Yes, the Buick Verano comes equipped with several safety features that may help reduce insurance costs. These features can include anti-lock brakes, traction control, stability control, airbags, and a rearview camera.

Does the cost of car insurance for a Buick Verano vary by model year?

Yes, the cost of car insurance for a Buick Verano can vary depending on the model year. Generally, newer models may have higher insurance costs due to their higher value, while older models may have lower insurance costs.

Is it possible to get discounts on car insurance for a Buick Verano?

Yes, it is possible to obtain discounts on car insurance for a Buick Verano. Insurance providers often offer discounts for factors such as having multiple policies with the same company, being a safe driver, having anti-theft devices installed, or completing a defensive driving course.

To find out more, explore our guide titled “Is car theft covered by car insurance?”

Can I compare quotes from different insurance providers to find the best rate for my Buick Verano?

Yes, it is highly recommended to compare quotes from multiple insurance providers to find the best rate for your Buick Verano. Different insurance companies may offer varying rates and discounts, so comparing quotes can help.

Are Buicks more expensive to insure?

Buick vehicles generally incur higher insurance premiums reflecting their status as a premium brand. The typical monthly cost for insuring a Buick is approximately $160. This guide will assist you in discovering insurance rates for various Buick model years.

What type of car insurance is cheapest?

Generally, fully comprehensive insurance tends to be the most affordable option, although individual situations can affect the costs.

Who is cheaper, Geico or Progressive?

Generally, Geico offers lower rates than Progressive for most types of drivers.

To learn more, explore our comprehensive resource on “Can I change my Progressive car insurance coverage at any time?”

Who typically has the cheapest insurance?

Obtain estimates from the most affordable insurers. State Farm and Geico offer low-cost car insurance for many drivers; however, eligibility for USAA requires a military connection.

Stop overpaying for your insurance by entering your ZIP code below to find the lowest rates in your area.

Are Buicks cheap to fix?

Actually, they are less expensive than the national average for maintenance expenses. According to RepairPal, a prominent resource for car owners, Buick vehicles typically incur about $51 per month in maintenance costs.

Why was Buick Verano discontinued?

Is a Buick Verano a good car?

Is Buick premium or luxury?

Why are Buicks so popular?

Is Buick nicer than Chevy?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.