Cheap BMW Z3 Car Insurance in 2026 (Cash Savings With These 10 Companies!)

State Farm, Nationwide, and Erie are the top picks for cheap BMW Z3 car insurance. With minimum monthly rates starting at $60, these providers offer the best value. They stand out for their comprehensive coverage options, affordable premiums, and excellent customer service for best protection of your BMW Z3.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Dan Walker graduated with a BS in Administrative Management in 2005 and has been working in his family’s insurance agency, FCI Agency, for 15 years (BBB A+). He is licensed as an agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. He reviews content, ensuring tha...

Daniel Walker

Updated January 2025

Company Facts

Min. Coverage for BMW Z3

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for BMW Z3

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for BMW Z3

A.M. Best Rating

Complaint Level

Pros & Cons

State Farm, Nationwide, and Erie are the best providers for cheap BMW Z3 car insurance. These companies offer exceptional value with their comprehensive coverage options and affordable premiums.

Each provider stands out for its excellent customer service and tailored insurance plans that meet the needs of BMW Z3 owners. This article explores why these three insurers are the top choices for protecting your BMW Z3.

Our Top 10 Company Picks: Cheap BMW Z3 Car Insurance

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

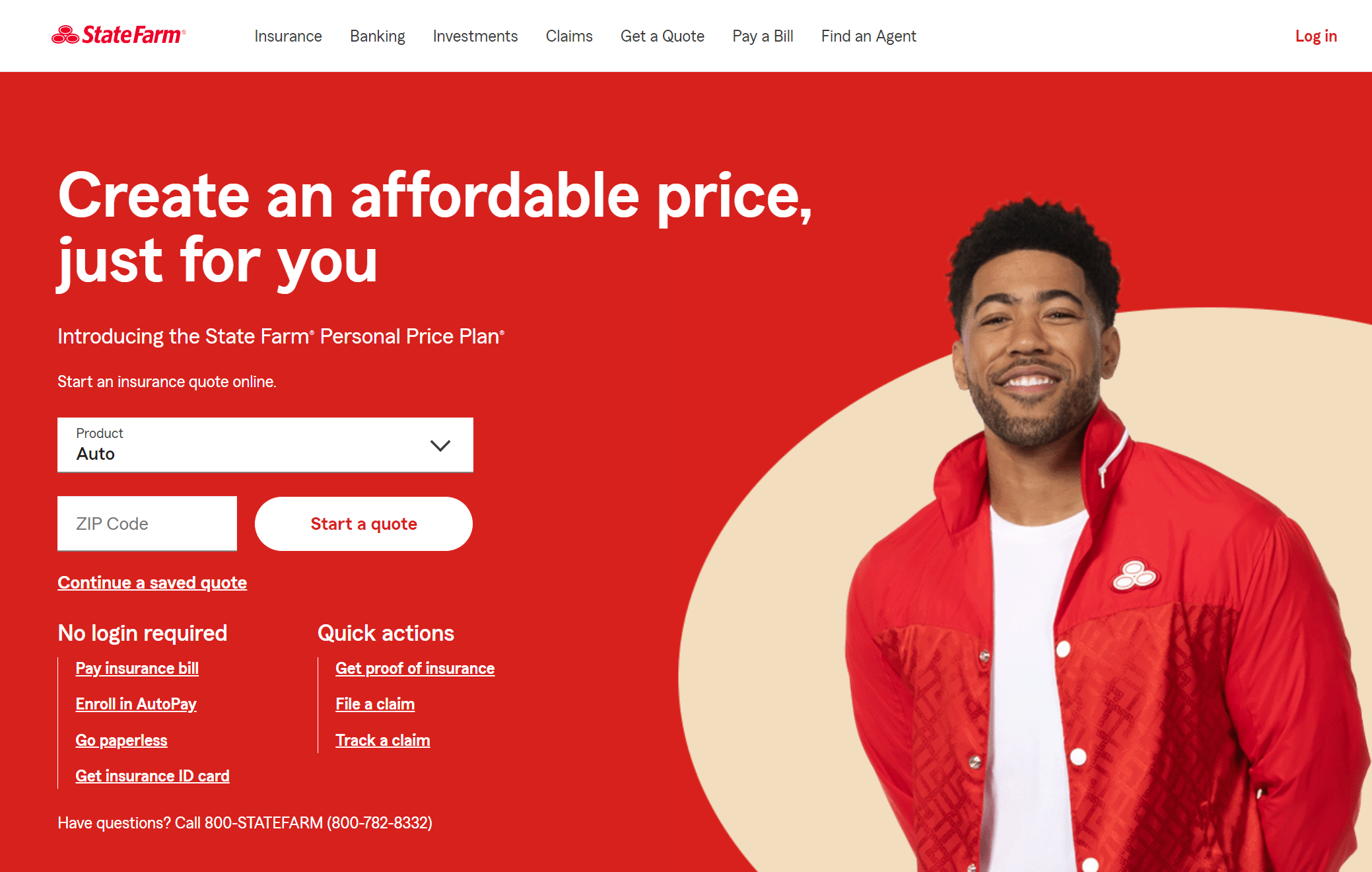

#1 $60 B Safe Driving State Farm

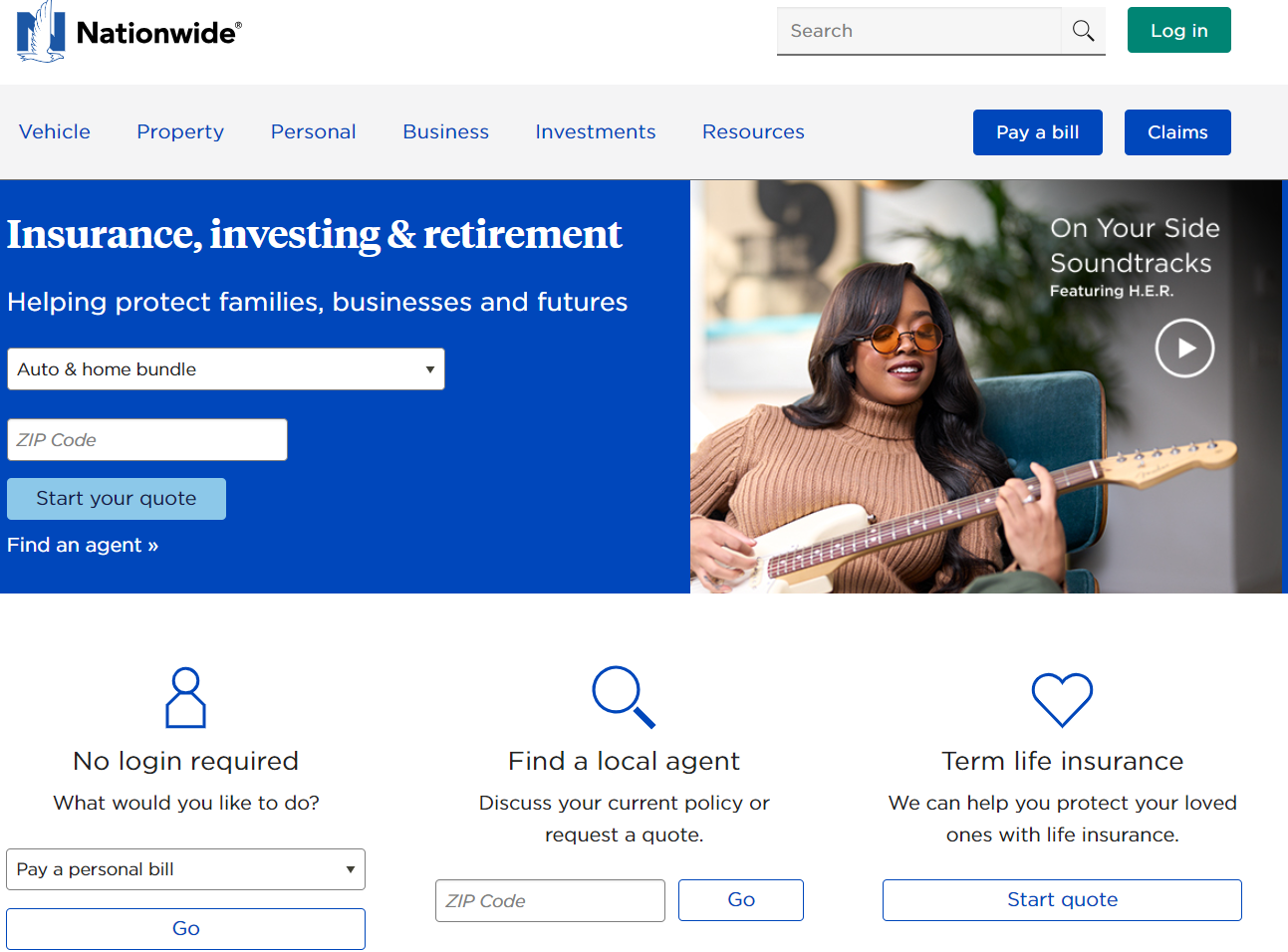

#2 $65 A+ Deductible Rewards Nationwide

#3 $68 A+ Competitive Pricing Erie

#4 $70 A+ Customer Loyalty Amica

#5 $72 A++ Bundling Discounts Auto-Owners

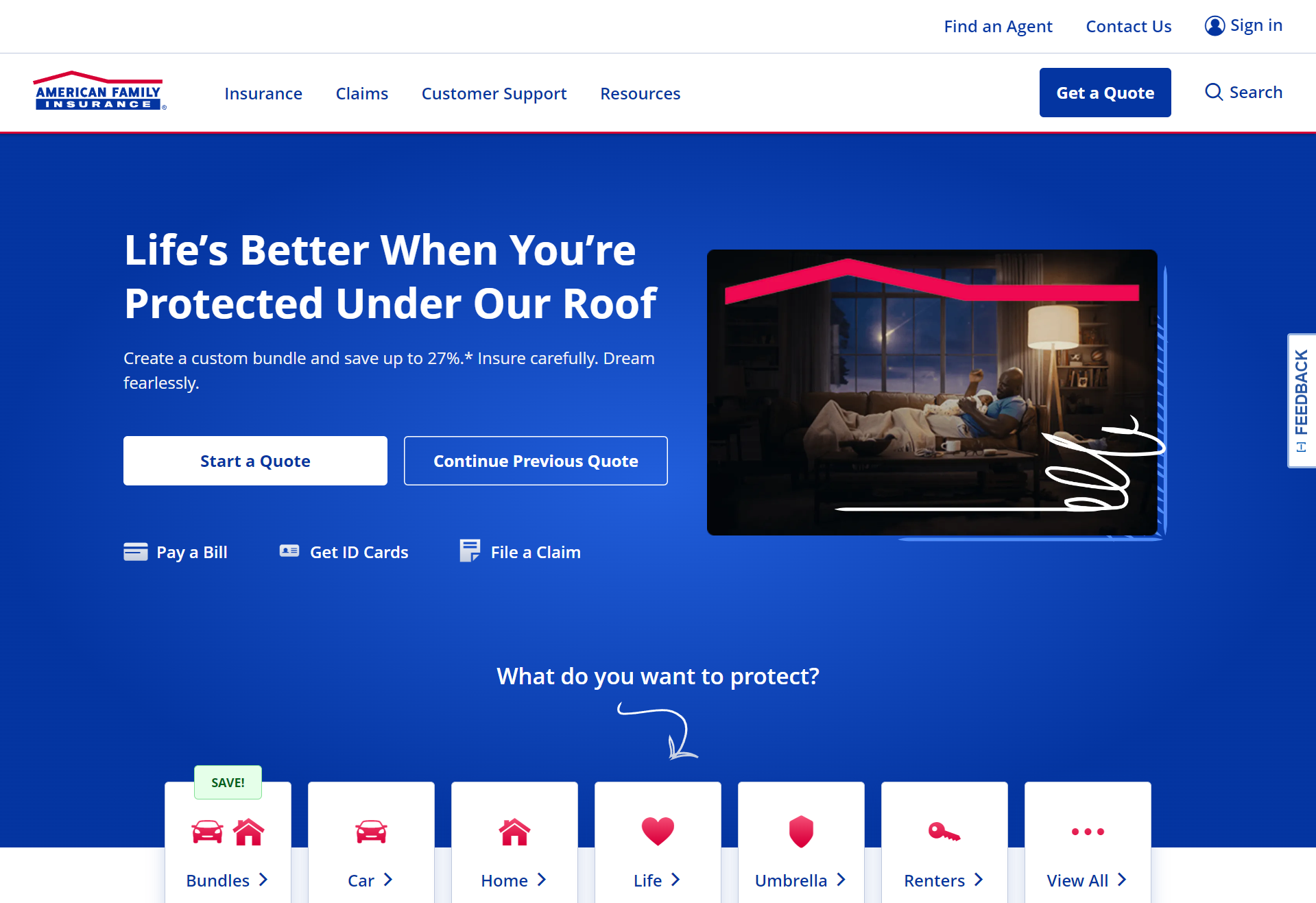

#6 $74 A Personalized Service American Family

#7 $75 A+ Multi-policy Savings The Hartford

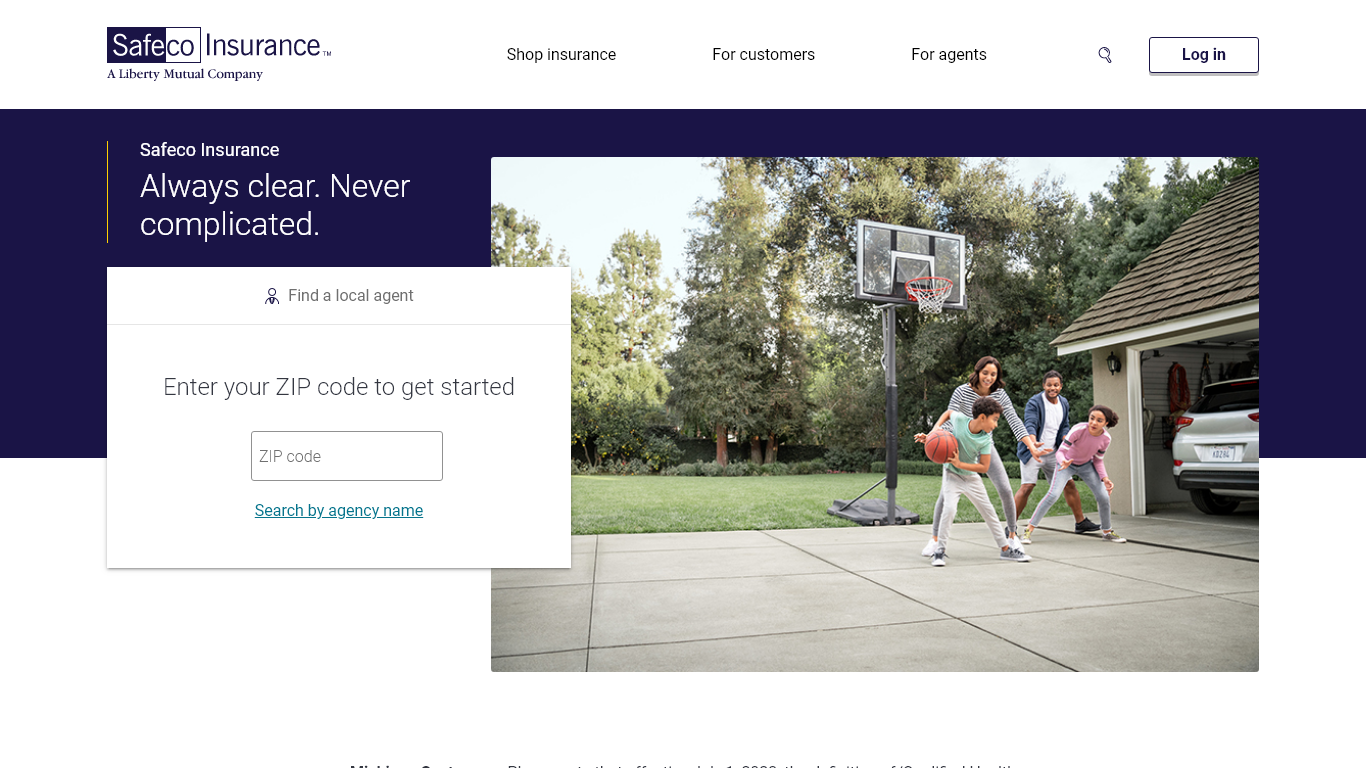

#8 $77 A Policy Bundling Safeco

#9 $80 A Multi-policy Discounts Farmers

#10 $85 A+ Safe Driver Allstate

BMW Z3 car insurance costs depend on various factors. This article examines these factors, types of coverage for BMW Z3 owners, tips for comparing quotes, and top insurance companies with competitive rates.

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

BMW Z3 Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $85 $175

American Family $74 $160

Amica $70 $160

Auto-Owners $72 $160

Erie $68 $155

Farmers $80 $170

Nationwide $65 $155

Safeco $77 $165

State Farm $60 $150

The Hartford $75 $165

Among the providers, State Farm offers the lowest rates for both minimum and full coverage, at $60 and $150, respectively. American Family, Amica, and Auto-Owners follow closely with competitive rates for full coverage, all around $160. For minimum coverage, Erie stands out with a rate of $68, slightly lower than Nationwide at $65. Farmers and Allstate offer the highest rates for full coverage, at $170 and $175, respectively.

These rates are indicative and can vary based on factors like location, driving history, and the specific coverage options chosen. Learn more in our “How much is car insurance.”

Factors That Affect the Cost of BMW Z3 Car Insurance

When it comes to determining the cost of BMW Z3 car insurance, there are several factors that insurance companies take into account. One of the primary factors is the model and year of your BMW Z3. Newer models typically have higher insurance premiums due to their higher value and repair costs.

Additionally, the engine size and performance capabilities of your BMW Z3 can impact insurance rates. Sports cars like the BMW Z3 are often seen as higher risk by insurance companies, leading to higher premiums.

Your driving history and personal profile can also influence the cost of insurance for your BMW Z3. Insurance companies will assess factors such as your age, gender, marital status, and location to determine your risk level. Younger drivers or those with a history of accidents or traffic violations may face higher insurance premiums.

Access comprehensive insights into our guide titled “Why You Should Always Take Pictures After a Car Accident.”

The amount of coverage you choose for your BMW Z3 will also affect the cost of insurance. Higher coverage limits and additional types of coverage, such as comprehensive and collision, can result in higher premiums.

Your chosen deductible, which is the amount you pay out of pocket before insurance kicks in, can also impact the cost of insurance. Opting for a higher deductible can lower your premium but will require you to pay more if you need to make a claim.

Finally, insurance companies consider the specific insurance market in your area and competition among insurance providers. Insurance rates can vary from one company to another, so it’s important to compare quotes from different insurers to find the best rate for your BMW Z3.

Understanding the Different Types of Car Insurance Coverage for BMW Z3

When insuring your BMW Z3, it’s crucial to understand the different types of car insurance coverage available. The most basic type of coverage is liability insurance, which is required by law in most states. Liability insurance covers damages and injuries caused to others in an accident where you are at fault.

Collision insurance is another important coverage option for BMW Z3 owners. It helps cover the cost of repairs or replacement if your BMW Z3 is damaged in a collision with another vehicle or object, regardless of who is at fault.

Comprehensive insurance is additional coverage that protects your BMW Z3 against damages from non-collision incidents such as theft, vandalism, fire, or natural disasters. This coverage can provide peace of mind and help ensure that you are protected from a wide range of potential risks and damages.

Uninsured and underinsured motorist coverage is also worth considering for BMW Z3 owners. This coverage protects you if you are involved in an accident with a driver who does not have insurance or lacks sufficient coverage to pay for damages and injuries.

Other optional coverage options include roadside assistance, rental car coverage, and gap insurance. Roadside assistance can be particularly beneficial if you frequently travel and want help with services like towing, battery jumps, flat tire changes, and fuel delivery.

Rental car coverage ensures that you have a vehicle to drive while your BMW Z3 is being repaired after an accident. Gap insurance covers the difference between your car’s value and the amount you owe on your loan or lease, helping you avoid out-of-pocket expenses in case of a total loss.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Car Insurance Quotes for BMW Z3: Tips and Tricks

Shopping around and comparing car insurance quotes is crucial when it comes to finding the best rate for your BMW Z3. Each insurance company has its own formula for calculating rates, so obtaining multiple quotes will give you a better understanding of the range of prices available to you.

When comparing car insurance quotes, it’s important to have a clear understanding of the coverage limits and types of coverage being offered. The cheapest quote may not necessarily provide the level of coverage you need to adequately protect your BMW Z3. Be sure to compare the quotes based on the same coverage options and deductible amounts to make an accurate comparison.

Laura Walker Former Licensed Agent

Additionally, consider the reputation and financial stability of the insurance companies you are comparing. Look for insurers with positive customer reviews and strong financial ratings to ensure they will be able to handle claims efficiently and provide excellent customer service.

It’s also worth considering any available discounts or incentives offered by insurers. Some insurance companies offer discounts for safe driving records, multiple policies, vehicle safety features, or membership in certain organizations. Taking advantage of these discounts can help reduce the cost of your BMW Z3 car insurance.

Top Insurance Companies Offering Competitive Rates for BMW Z3 Owners

When it comes to insuring your BMW Z3, there are several insurance companies that consistently offer competitive rates for owners of this particular vehicle. These companies have a reputation for providing quality coverage at affordable prices, making them worth considering in your search for BMW Z3 car insurance.

Company A is known for its excellent customer service and competitive rates for luxury vehicles like the BMW Z3. They have a variety of coverage options tailored to meet the needs of BMW owners and offer discounts for safe driving, bundling policies, and installing vehicle safety features.

Company B is another reputable insurance provider that offers attractive rates for BMW Z3 owners. They have a straightforward and user-friendly online quoting process, making it easy to obtain a customized quote for your BMW Z3. They also have a reputation for quick claims handling and responsive customer service.

Company C is a well-established insurer that specializes in coverage for high-performance vehicles like the BMW Z3. They have a team of knowledgeable agents who can help you customize your coverage to suit your specific needs and provide personalized assistance throughout the claims process.

While these companies are known for offering competitive rates, it’s still important to compare quotes from multiple insurers to find the best rate for your BMW Z3. Each insurance company evaluates risk factors differently, so obtaining quotes from different providers will give you a comprehensive view of your options.

To find out more, explore our guide titled “How can I pay my Grange Insurance insurance premium?.”

How to Save Money on BMW Z3 Car Insurance Without Compromising Coverage

While insuring a BMW Z3 may come with higher costs due to its luxury status and performance capabilities, there are several ways to save money on your car insurance without compromising coverage. Implementing these strategies can help reduce your insurance premiums and keep your BMW Z3 protected.

One effective way to save money on your BMW Z3 car insurance is to maintain a clean driving record. Insurance companies often offer lower rates to drivers with no accidents, traffic violations, or claims history. Avoiding speeding tickets and practicing safe driving habits can lead to significant savings on your insurance premiums.

Another way to save money is by opting for a higher deductible. By choosing a higher deductible, you agree to pay more out of pocket in the event of a claim, but your insurance premiums will be lower. This can be a cost-saving strategy if you have a good driving record and rarely make claims.

Bundling your BMW Z3 car insurance with other policies, such as homeowners or renters insurance, can also lead to savings. Many insurance companies offer discounts for bundling multiple policies with them. This can result in lower overall insurance costs without sacrificing coverage for your BMW Z3.

Installing safety features on your BMW Z3 can also help reduce insurance premiums. Features like anti-lock brakes, stability control, and anti-theft devices can lower the risk of theft or accidents, making your vehicle less expensive to insure.

Finally, taking advantage of available discounts and incentives is another effective way to save money on BMW Z3 car insurance. Insurance companies often offer discounts for safe driving, completing approved driver’s education courses, or maintaining a good credit score. It’s worth exploring these opportunities to maximize your savings.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Impact of Your Driving Record on BMW Z3 Car Insurance Premiums

Your driving record plays a significant role in determining the cost of insurance for your BMW Z3. Insurance companies consider factors such as accidents, traffic violations, and claims history to assess your risk as a driver. A clean driving record with no accidents or violations indicates that you are a responsible driver, reducing the likelihood of filing a claim and leading to lower insurance premiums.

On the other hand, a history of accidents, traffic violations, or claims will likely result in higher insurance premiums. Insurance companies perceive drivers with a poor driving record as a higher risk and charge higher premiums to offset potential future claims.

Melanie Musson Published Insurance Expert

If you have a less-than-perfect driving record, you may still be able to find affordable insurance for your BMW Z3. Some insurance companies specialize in providing coverage to high-risk drivers and offer competitive rates tailored to their specific circumstances. While the premiums may be higher compared to drivers with clean records, shopping around and comparing quotes will help you find the best possible rate.

It’s also important to note that your driving record is not a static factor when it comes to insurance premiums. Most insurance companies review your driving record periodically and adjust your premiums accordingly. If you maintain a clean driving record over time, you may be eligible for lower rates in the future.

Discover more about offerings in our “Collision vs. Comprehensive Car Insurance: Which coverage is right for you?.”

Factors to Consider When Choosing the Right Deductible for Your BMW Z3 Insurance

Choosing the right deductible for your BMW Z3 car insurance is an important decision that can affect your premiums and out-of-pocket expenses in the event of a claim. The deductible is the amount you must pay upfront before your insurance coverage kicks in.

When deciding on a deductible amount, there are a few factors to consider. One factor is your financial situation and ability to pay a higher deductible out of pocket. If you have sufficient savings to cover a higher deductible, opting for a higher amount can lower your insurance premiums.

Another factor to consider is your driving history and risk tolerance. If you have a clean driving record and rarely make claims, choosing a higher deductible can be a cost-saving strategy. On the other hand, if you anticipate making frequent claims due to past incidents or driving in a high-risk area, a lower deductible may be more appropriate to limit out-of-pocket expenses.

It’s also important to consider the value of your BMW Z3 when choosing a deductible. If your vehicle is older or has a lower market value, it may not be worth paying higher premiums for a low deductible. In such cases, choosing a higher deductible can help reduce overall insurance costs.

Lastly, evaluate the impact of a potential claim on your future premiums. Insurance companies may raise your rates if you file a claim, and this increase can persist for several years. If you have a history of making claims or anticipate making frequent claims in the future, it may be beneficial to choose a higher deductible to avoid potential rate hikes.

Discover more about offerings in our “Defensive Driving Courses Can Lower Your Car Insurance Rates.”

How Modifications and Upgrades Can Affect Your BMW Z3 Car Insurance Costs

If you have made modifications or upgrades to your BMW Z3, it’s important to understand how these changes can impact your car insurance costs. Modifying your BMW Z3 can make it more unique and personalized to your preferences, but it can also affect insurance rates.

When it comes to modifications, insurance companies typically categorize them as either performance-enhancing or cosmetic. Performance-enhancing modifications include changes to the engine, suspension, exhaust system, or other components that can improve the vehicle’s speed, handling, or performance.

Cosmetic modifications, on the other hand, focus on the appearance of the vehicle, such as aftermarket body kits, spoilers, or custom paint.Performance-enhancing modifications can increase the risk associated with your BMW Z3 in the eyes of insurance companies.

These modifications may lead to higher insurance premiums due to the perception that a modified vehicle is more likely to be driven aggressively or involved in accidents. Additionally, modified vehicles can be more expensive to repair or replace, leading to higher insurance costs.

Cosmetic modifications may have less impact on insurance premiums compared to performance-enhancing modifications. However, it’s still important to disclose all modifications to your insurer to ensure your coverage accurately reflects the value and condition of your BMW Z3.

Insurance companies may require you to purchase additional coverage specifically for your modified BMW Z3. This coverage, often referred to as special equipment coverage, protects against damages or theft of the aftermarket parts and modifications. Without this coverage, your policy may only cover the factory-installed components of your BMW Z3.

See more details on our “Anti Theft System Car Insurance Discount.”

In conclusion, while modifications and upgrades can enhance your BMW Z3, they can also affect your car insurance costs. It’s crucial to inform your insurance company about any modifications and discuss the specific coverage options available for your modified vehicle. This will ensure that you have appropriate coverage in place and accurately reflect the value of your BMW Z3.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Discounts and Incentives Available for BMW Z3 Car Insurance Policies

When it comes to insuring your BMW Z3, there are various discounts and incentives available that can help lower your insurance premiums. Insurance companies offer these discounts as a way to reward responsible behavior and reduce the risk associated with insuring high-value vehicles like the BMW Z3. Here are some common discounts and incentives you may be eligible for:

Safe driver discounts: Insurance companies often provide discounts to drivers with a clean driving record. If you have not been involved in accidents or received traffic violations, you may qualify for a safe driver discount.

Ty Stewart Licensed Insurance Agent

Multiple policy discounts: Many insurance companies offer discounts for bundling multiple insurance policies with them. If you have other insurance needs, such as homeowners or renters insurance, combining them with your BMW Z3 car insurance can lead to significant savings.

Vehicle safety feature discounts: The BMW Z3 is equipped with various safety features, such as anti-lock brakes, airbags, and stability control. Insurance companies typically offer discounts for such safety features, as they

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

Frequently Asked Questions

What factors affect the cost of BMW Z3 car insurance?

The cost of BMW Z3 car insurance can be influenced by various factors such as the driver’s age, location, driving history, credit score, coverage options, deductible amount, and the insurance company’s pricing policies.

For additional details, explore our comprehensive resource titled “Best Car Insurance for 21-Year-Old Drivers.”

Does the age of the driver impact BMW Z3 car insurance rates?

Yes, the age of the driver can impact BMW Z3 car insurance rates. Typically, younger drivers tend to have higher insurance premiums due to their lack of driving experience and higher risk of accidents.

How does the location affect BMW Z3 car insurance costs?

The location where the BMW Z3 is primarily driven and parked can affect insurance costs. Areas with higher rates of accidents, theft, or vandalism may result in higher insurance premiums.

Can my driving history impact the cost of BMW Z3 car insurance?

Yes, your driving history plays a role in determining BMW Z3 car insurance costs. If you have a history of accidents, traffic violations, or claims, insurance companies may consider you a higher risk and charge higher premiums.

Does my credit score affect BMW Z3 car insurance prices?

Yes, your credit score can impact the cost of BMW Z3 car insurance. Insurance companies often use credit information to assess risk and determine premiums. A higher credit score may result in lower insurance rates.

To find out more, explore our guide titled “Defensive Driving Courses Can Lower Your Car Insurance Rates.”

Are old BMW Z3 reliable?

In general, owners don’t report any major problems with the Z3, which is great news if you’re considering buying a used one.

How long will a BMW Z3 last?

The estimated lifespan of a BMW Z3 is 150,000 miles, which is considered the upper limit of its life expectancy. The type of fuel used is a significant factor when evaluating a vehicle’s lifespan.

Is a BMW 3 Series expensive to run?

Maintaining a 3-Series BMW can be costly once it is no longer covered by the factory or CPO warranty. It is typical to spend approximately $700 to $800 annually on maintenance and repairs for a used BMW 3-Series.

Is the BMW Z3 becoming a classic?

Enjoyable to drive and boasting impressive aesthetics, the Z3 is not only a future classic but also an affordable one. When BMW embarked on its mission to design a modern two-seat roadster in the early 1990s, it had a specific target in mind: the Mazda Miata.

To learn more, explore our comprehensive resource on “Full Coverage Car Insurance: A Complete Guide.”

Is a BMW Z3 a sports car?

The BMW Z3 is a line of two-seater sports cars manufactured between 1995 and 2002.

Is the BMW Z3 a good buy?

How much is a Z3 worth?

What is the top speed of a Z3?

How long does Z3 clutch last?

Are Z3 increasing in value?

Is insurance high on a BMW?

Are BMW more expensive to repair?

Are parts for a BMW expensive?

Is the BMW Z3 becoming a classic?

What color of vehicle gets in the most accidents?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.