Cheap Audi Q4 Car Insurance in 2026 (10 Most Affordable Companies)

Discover the best providers of cheap Audi Q4 car insurance: Farmers, Travelers, and AAA. Starting at just $250 per month, these companies offer the most affordable rates and comprehensive coverage for your vehicle, ensuring optimal financial protection and service excellence.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Professor & Published Author

D. Gilson is a writer and author of essays, poetry, and scholarship that explore the relationship between popular culture, literature, sexuality, and memoir. His latest book is Jesus Freak, with Will Stockton, part of Bloomsbury’s 33 1/3 Series. His other books include I Will Say This Exactly One Time and Crush. His first chapbook, Catch & Release, won the 2012 Robin Becker Prize from S...

D. Gilson, PhD

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Former Licensed Insurance Producer

Laura Berry has experience as a licensed producer selling life, health, and property insurance coverage for both Allstate and State Farm. She has dedicated many hours to helping her clients understand the insurance marketplace so they could find the best car, home, and life insurance products for their circumstances. While she currently helps businesses take advantage of the federal R&D tax...

Laura Berry

Updated January 2025

3,072 reviews

3,072 reviewsCompany Facts

Min. Coverage for Audi Q4

A.M. Best Rating

Complaint Level

Pros & Cons

3,072 reviews

3,072 reviews 1,734 reviews

1,734 reviewsCompany Facts

Min. Coverage for Audi Q4

A.M. Best Rating

Complaint Level

Pros & Cons

1,734 reviews

1,734 reviews 3,027 reviews

3,027 reviewsCompany Facts

Min. Coverage for Audi Q4

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviewsThe best providers for cheap Audi Q4 car insurance are Farmers, Travelers, and AAA. These companies stand out for their competitive pricing and excellent coverage options, tailored to meet the needs of Audi Q4 owners.

Exploring their offerings will reveal a range of benefits that enhance value while ensuring robust protection for your vehicle. By comparing these top insurers, Audi Q4 owners can secure the most suitable and affordable car insurance, tailored to their specific driving needs and circumstances.

Our Top 10 Company Picks: Cheap Audi Q4 Car Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $250 | A | Various Discounts | Farmers | |

| #2 | $255 | A++ | Unique Coverage | Travelers | |

| #3 | $261 | A | Roadside Assistance | AAA |

| #4 | $258 | A++ | Military Savings | USAA | |

| #5 | $265 | A+ | Simple Claims | Nationwide |

| #6 | $257 | A++ | Add-Ons | Auto-Owners | |

| #7 | $268 | A | Affinity Discounts | Liberty Mutual |

| #8 | $263 | B | Cheap Rates | State Farm | |

| #9 | $275 | A++ | High-Value Vehicles | Chubb | |

| #10 | $270 | A | High-Risk Coverage | The General |

In this comprehensive guide, we will explore the various aspects that influence Audi Q4 car insurance costs and provide you with valuable tips and advice on how to find the best deal.

Get the right car insurance at the best price — enter your ZIP code above shop for coverage from the top insurers.

#1 – Farmers: Top Overall Pick

Pros

- Diverse Discount Options: Farmers provides multiple discount opportunities, including safe driver and multi-vehicle discounts.

- Competitive Pricing: Offers one of the lowest monthly rates for Audi Q4 car insurance at $250.Discover more about offerings in our “Farmers Insurance Review & Ratings.”

- High Customer Satisfaction: Known for excellent customer service and policyholder satisfaction.

Cons

- Policy Limitations: Certain coverage options and discounts might not be available in all states.

- Rate Fluctuations: Premiums may increase upon renewal based on regional risk factors and claims history.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Travelers: Expert in Unique Coverage Solutions

Pros

- Tailored Coverage Options: Travelers offers a variety of unique coverage options that can be customized to individual needs.

- Financial Strength: Rated A++ by A.M. Best, indicating superior financial health and claim-paying ability.

- Discount for Hybrid/Electric Cars: Provides additional discounts for environmentally friendly vehicles. More information is available about this provider in our “Travelers Insurance Review & Ratings.”

Cons

- Higher Premiums for Certain Risks: Premiums can be higher for drivers with poor credit or a history of claims.

- Complexity of Policy Options: The wide range of options can be overwhelming for new insurance buyers.

#3 – AAA: Best for Roadside Assistance

Pros

- Superior Roadside Assistance: AAA is renowned for its comprehensive roadside help, included in many of its insurance packages.

- Member Benefits: Offers numerous additional benefits and discounts to its members.

- Strong Insurance Ratings: Holds an A rating from A.M. Best, ensuring reliability. Discover insights in our “AAA Insurance Review & Ratings.”

Cons

- Membership Required: Must purchase a membership to qualify for insurance, adding to overall costs.

- Variable Service Quality: Service levels can vary significantly between regional clubs.

#4 – USAA: Optimal for Military Savings

Pros

- Exclusive Military Discounts: Offers substantial discounts and benefits specifically for military personnel and their families.

- Exceptional Customer Service: Consistently rated highly for customer service and claims satisfaction.

- Competitive Rates: Offers competitive pricing with a rate of $258 for monthly premiums. Learn more in our “USAA Insurance Review & Ratings.”

Cons

- Eligibility Restrictions: Insurance is only available to military members, veterans, and their families.

- Limited Physical Locations: Fewer local offices, which could be a drawback for those preferring face-to-face service.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Simplified Claims Process Expert

Pros

- Easy Claim Filing: Nationwide is recognized for a user-friendly and efficient claims process. Check out insurance savings in our complete “Nationwide Insurance Review & Ratings.”

- Variety of Discounts: Offers a range of discounts, including for accident-free driving and vehicle safety features.

- Strong Financial Stability: Rated A+ by A.M. Best, indicating a strong ability to fulfill financial commitments.

Cons

- Average Customer Satisfaction: Scores around the industry average in customer satisfaction surveys.

- Policy Cost Variability: Costs can vary more significantly than some competitors based on driver profile and location.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

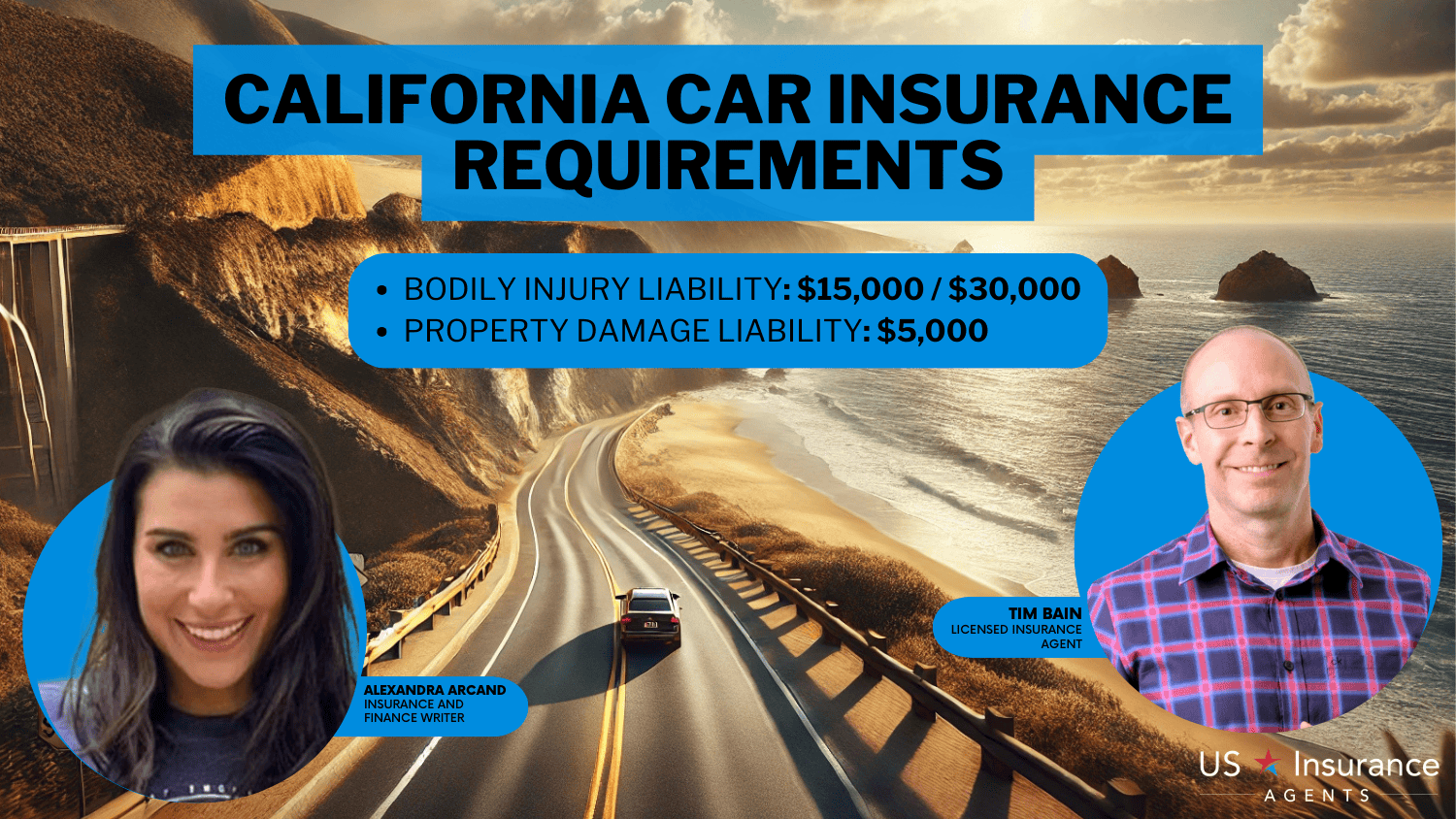

Audi Q4 Insurance Costs: Minimum vs Full Coverage Comparison

The table below provides a detailed comparison of monthly car insurance rates for the Audi Q4, segmented by coverage level and provider. This information is essential for drivers seeking to balance affordability with comprehensive protection.

Car Insurance Monthly Rates for Audi Q4 by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AAA $261 $330

Auto-Owners $257 $327

Chubb $275 $318

Farmers $250 $340

Liberty Mutual $268 $325

Nationwide $265 $315

State Farm $263 $328

The General $270 $320

Travelers $255 $335

USAA $258 $322

For the Audi Q4, insurance costs vary significantly between providers and coverage types. For minimum coverage, the rates range from $250 with Farmers being the most affordable, to $275 with Chubb as the highest. In terms of full coverage, Farmers presents the highest rate at $340 per month, reflecting its comprehensive nature, while Nationwide offers the most economical option at $315.

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code below.

This diversity in pricing underscores the importance of comparing rates based on personal needs and the specific coverage levels desired. Learn more in our “Full Coverage Car Insurance: A Complete Guide.”

Factors That Influence Audi Q4 Car Insurance Costs

When it comes to determining the cost of car insurance for your Audi Q4, several key factors play a significant role. These factors include but are not limited to:

- Your age and driving experience

- Your location

- The model year of your Audi Q4

- Your driving record

- The level of coverage you choose

- The deductibles and coverage limits

- Your credit history

- The number of miles you drive annually

Insurance providers take these factors into consideration when calculating your premium. For example, younger drivers with less experience and a history of traffic violations may face higher insurance costs compared to older, more experienced drivers with a clean driving record. See more details on our “Best Car Insurance Discounts for Drivers With No Tickets.”

Another factor that can influence the cost of car insurance for your Audi Q4 is the safety features and anti-theft devices installed in your vehicle. Insurance providers often offer discounts for vehicles equipped with features such as anti-lock brakes, airbags, and alarm systems.

In addition, your insurance premium may also be affected by your marital status and whether you have any additional drivers listed on your policy. Married individuals may be eligible for lower rates, as they are considered to be more responsible and less likely to engage in risky driving behavior. Similarly, adding a young or inexperienced driver to your policy may result in higher premiums due to the increased risk associated with their lack of driving experience.

Understanding the Importance of Car Insurance for Audi Q4 Owners

Car insurance is not just a legal requirement in most jurisdictions; it also provides financial protection and peace of mind for Audi Q4 owners. Accidents can happen unexpectedly, and without insurance, you could be responsible for covering the cost of repairs, medical expenses, or even legal fees.

Car insurance acts as a safety net, ensuring that you are protected from significant financial losses in the event of an accident or unforeseen circumstances. It allows you to drive with confidence, knowing that you have adequate coverage in place.

One of the key benefits of car insurance for Audi Q4 owners is the coverage it provides for theft or vandalism. Unfortunately, luxury vehicles like the Audi Q4 can be attractive targets for thieves. With comprehensive car insurance, you can have peace of mind knowing that you are protected in case your vehicle is stolen or damaged due to vandalism.

In addition to financial protection, car insurance for Audi Q4 owners often includes additional benefits such as roadside assistance. This can be particularly helpful in case of a breakdown or if you run out of fuel while on the road. With roadside assistance coverage, you can easily get help and support when you need it, ensuring that you are not left stranded in an unfamiliar location.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Car Insurance Quotes for the Audi Q4: Tips and Tricks

When it comes to finding the best car insurance rates for your Audi Q4, it’s essential to compare quotes from multiple insurance providers. Here are some tips to help you get started:

- Research and gather quotes from at least three different insurance companies.

- Consider the coverage options and limits provided by each insurer.

- Compare the deductibles and determine if they are affordable for you.

- Take note of any additional benefits or discounts offered by each insurance provider.

- Consider reading online reviews and customer experiences to gauge the quality of service provided by the insurers.

Remember, the cheapest insurance option may not always be the best. It’s essential to find a balance between affordability and quality coverage that meets your specific needs as an Audi Q4 owner.

Additionally, it’s important to consider the reputation and financial stability of the insurance companies you are comparing. Look for insurers with a strong track record of customer satisfaction and prompt claims processing. You can check their ratings and reviews from independent rating agencies such as A.M. Best or J.D. Power.

The Average Cost of Audi Q4 Car Insurance: A Comprehensive Guide

Pinpointing the exact average cost of Audi Q4 car insurance can be challenging due to the multiple variables involved. However, we can provide a comprehensive guide to give you an idea of what to expect:

The average annual insurance premium for an Audi Q4 ranges from $1,300 to $2,500. However, keep in mind that this is just an estimate, and your individual rate could be higher or lower based on the factors mentioned earlier. Additionally, different insurance companies may offer varying rates, so it’s crucial to consider multiple quotes.

Jeff Root Licensed Life Insurance Agent

One of the key factors that can influence the cost of Audi Q4 car insurance is the driver’s age and driving history. Younger drivers or those with a history of accidents or traffic violations may face higher insurance premiums compared to older, more experienced drivers with clean records.

Delve into our evaluation of “Car Accidents: What to do in Worst Case Scenarios.”

Another factor that can impact the cost of Audi Q4 car insurance is the location where the vehicle will be primarily driven and parked. Insurance rates can vary significantly depending on factors such as the crime rate in the area, the frequency of accidents, and the availability of repair shops.

Expert Tips to Get the Best Deal on Audi Q4 Car Insurance

Here are some expert tips that can help you secure the best deal on Audi Q4 car insurance:

- Shop around and compare quotes from different insurance providers to find the best rates.

- Consider increasing your deductibles to lower your premium, but ensure you can afford to pay the deductible in case of a claim.

- Ask about available discounts, such as bundling multiple policies, safe driver discounts, or loyalty rewards.

- Improve your credit score as a good credit history can lead to lower insurance premiums.

- Consider installing anti-theft devices or safety features that can lower the risk of theft or accidents, hence reducing your insurance costs.

- Take defensive driving courses to demonstrate your commitment to safe driving and potentially qualify for additional discounts. Unlock details in our “Defensive Driving Courses Can Lower Your Car Insurance Rates.”

By implementing these expert tips, you can increase your chances of finding affordable Audi Q4 car insurance without compromising on the coverage you need.

In conclusion, the cost of Audi Q4 car insurance can vary significantly depending on various factors such as age, location, driving record, and the level of coverage. To find the best deal, it’s crucial to compare quotes from multiple insurers, consider additional benefits, and explore available discounts.

By taking these steps and following expert advice, you can secure the right insurance coverage for your Audi Q4 at a competitive rate. Remember, while cost is important, it’s also essential to ensure you have adequate coverage to protect yourself and your vehicle in case of an accident or unexpected events.

Additionally, it is important to regularly review and update your car insurance policy to ensure it still meets your needs. As your circumstances change, such as moving to a new location or purchasing a new vehicle, your insurance requirements may also change. By staying proactive and keeping your policy up to date, you can ensure that you are always getting the best deal on Audi Q4 car insurance.

Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

Frequently Asked Questions

What factors affect the cost of Audi Q4 car insurance?

The cost of Audi Q4 car insurance can be influenced by several factors, including the driver’s age, driving history, location, coverage options, deductible amount, and the insurance provider’s pricing policies.

For additional details, explore our comprehensive resource titled “Best Car Insurance for 21-Year-Old Drivers“

Are Audi Q4 cars more expensive to insure compared to other models?

Insurance costs can vary depending on the specific model of the Audi Q4 and its safety features. Generally, more expensive models may have higher insurance premiums due to the increased cost of repairs or replacement.

How can I find affordable insurance for my Audi Q4?

To find affordable insurance for your Audi Q4, it is recommended to compare quotes from multiple insurance providers. Additionally, maintaining a clean driving record, opting for higher deductibles, and taking advantage of available discounts can help reduce insurance costs.

What are some common discounts available for Audi Q4 car insurance?

Common discounts that may be available for Audi Q4 car insurance include safe driver discounts, multi-policy discounts (if you have multiple insurance policies with the same provider), anti-theft device discounts, and good student discounts for young drivers with good academic records.

Does the location where I live impact the cost of Audi Q4 car insurance?

Yes, the location where you live can impact the cost of Audi Q4 car insurance. Insurance providers consider factors such as crime rates, population density, and the frequency of accidents in your area when determining insurance premiums.

To find out more, explore our guide titled “Why You Should Always Take Pictures After a Car Accident.”

How much is insurance for the Audi Q4 e tron?

The typical monthly insurance expense for the Audi Q4 E-tron is estimated at $213, amounting to an annual cost of approximately $2,556.

How much would the insurance cost for an Audi A4?

The average yearly insurance premium for an Audi A4 is $1544, which equates to monthly payments of $129. Although this is about $25 higher per year compared to certain other vehicles, safe drivers could potentially save around $637. Generally, the insurance rates for the Audi A4 are considered competitive.

Who is Audi Q4 competitor?

How much does it cost to fully charge a Q4?

Typically, charging an Audi Q4 e-tron 35 at home on a standard UK tariff costs around £15.40. But, if you opt for an EV-specific tariff, the price can drop to about £4.13.

To learn more, explore our comprehensive resource on “Best Electric Vehicle (EV) Car Insurance Discounts.”

Is Audi Q4 a luxury car?

Overview. When considering a compact luxury EV SUV that offers an extensive driving range, the 2025 Q4 e-tron and Q4 e-tron Sportback may not be your top picks, as they do not excel in this category.

How long to charge an Audi Q4 at home?

What is the best charger for Audi Q4 e-tron?

Is insurance higher on an Audi?

How much does it cost to insure an Audi e-tron?

Why choose Audi?

Is Audi e-tron a luxury car?

What is the tax credit for Q4 e-tron in 2024?

Should I charge my Audi e-tron to 100%?

How much does it cost to replace the battery in an Audi e-tron?

Which is the best Audi car?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.