Post

PostBest Life Insurance for Motorcycle Riders in 2024 (Top 10 Companies)

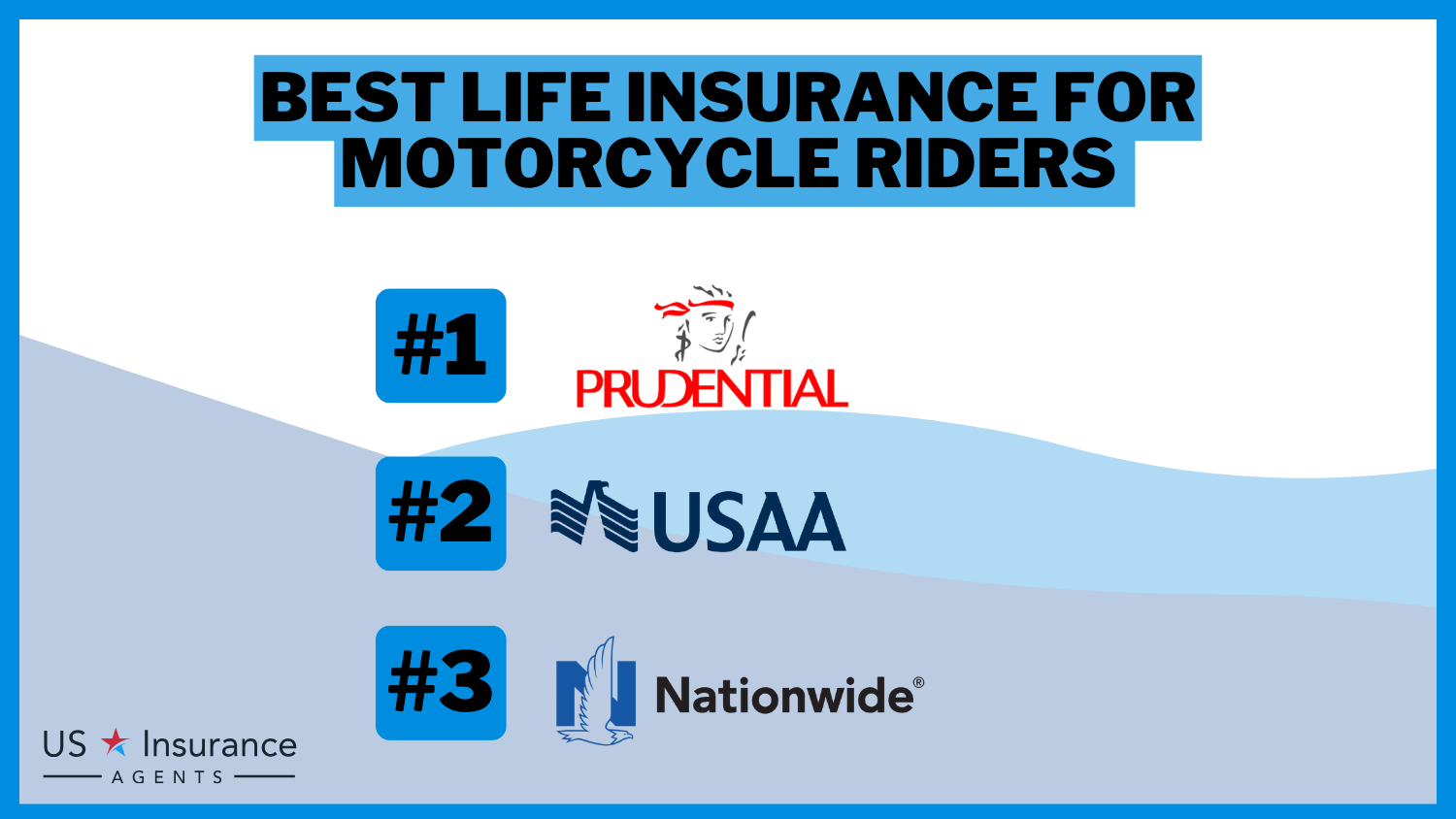

When it comes to finding the best life insurance for motorcycle riders, Prudential emerges as the top pick overall, offering competitive rates and tailored affordable coverage to ensure financial security. Alongside Prudential, USAA and Nationwide also stand out as top choices, providing comprehensive protection with discounts of up to 20%. In our comprehensive guide, we...

When it comes to finding the best life insurance for motorcy...