Best Houston, TX Car Insurance Insurance (2026)

Houston, Texas auto insurance rates vary drastically depending on multiple factors, but on average they are generally between $500-$666/mo. The most expensive Houston car insurance quotes are found in Sharpstown ZIP code 77036, while the cheapest rates are in Clear Lake ZIP code 77059. Enter your ZIP code below to see how your Houston auto insurance costs compare.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Ty Stewart

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated January 2025

Welcome to our comprehensive guide on Houston, Texas auto insurance providers and coverage options. If you’re a vehicle owner in the bustling city of Houston, it’s crucial to have reliable and affordable auto insurance that offers the right level of coverage for your needs.

Whether you’re a new resident or a long-time Houstonian, understanding the ins and outs of auto insurance will empower you to make informed decisions about your coverage. Don’t miss out on the opportunity to save money and get the best protection for your vehicle. Enter your zip code now to compare rates from the leading insurance providers in Houston.

The Cost of Car Insurance in Houston, Texas

For quite some time, Houston has been a quickly growing Gulf Coast city., and for good reason. With an affordable cost of living and lots to offer, more and more folks are discovering how great it is to call the Capital of the Sunbelt home.

Our research shows that this affordability extends to Houstonians’ car insurance premiums. In the sections below, we’ll cover a lot of information about the cost of car insurance in Houston, Texas.

Read more: Texas Farm Bureau Car Insurance Discounts

Male Versus Female Versus Age

You might have heard that men and women pay different amounts for car insurance.

Often, it’s true, they do.

In most places, men will pay more than women, especially teenagers, who can pay substantially more than their female peers.

Six states — California, Hawaii, Massachusetts, Montana, North Carolina and Pennsylvania — have banned gender discrimination in car insurance premiums.

And though Texas isn’t one of these states, we believe the banning of gender discrimination in car insurance premiums will continue to expand to other states in the coming years.

But here’s some good news if you’re worried about gender discrimination: your age and marital status have a far larger effect on your car insurance premiums.

DataUSA reports that the median age of Houston’s residents is 33.1 years old.

The table below provides the average car insurance premiums for Houston’s residents of various genders, ages, and marital statuses.

| Demographic | Average Rate |

|---|---|

| Single 17-year-old male | $10,226.74 |

| Single 17-year-old female | $8,559.72 |

| Single 25-year-old male | $3,905.93 |

| Single 25-year-old female | $3,683.32 |

| Married 35-year-old male | $3,068.06 |

| Married 35-year-old female | $2,969.61 |

| Married 60-year-old male | $2,961.47 |

| Married 60-year-old female | $2,791.00 |

| Average | $4,770.73 |

Clearly, car insurance for teen drivers can be expensive, while 60-year-old motorists pay the cheapest rates out of all the age groups in our research.

But why do older drivers pay cheaper rates for car insurance? Research consistently shows that young drivers are not only inexperienced but also are more likely to engage in risky driving behavior.

Statistics consistently show that drivers in their teens and twenties are more likely to be in a car accident, and thus they cost more for insurance providers to ensure.

Cheapest ZIP Codes in Houston

Our research shows that your car insurance premium can vary not only by what city you call home but also by what part of that city your home is in.

Houston alone has 103 unique ZIP codes representing distinct parts of the city. And that doesn’t even include the other cities and towns that make up Houston’s metropolitan area.

Want the cheapest average car insurance premiums in The Big Heart? Look for a home in 77059, which has average yearly premiums of $6,254.85. ZIP code 77059 sits on the far south side of Houston, below the Sam Houston Tollway and near the Space Center.

Where are Houston’s most expensive average car insurance premiums? Those can be found in ZIP code 77036, where residents pay an average of $8,150.71 per year for car insurance.

ZIP code 77036 includes both the Chinatown and Sharpstown neighborhoods and is bordered by the Westpark Tollway to the north, Route 8 to the west, and Interstate 69 to the southeast.

The table below shows you the cheapest average car insurance premiums for Houston by ZIP code.

Houston Cheapest Rates by ZIP

| ZIP Code | Average Annual Rate |

|---|---|

| 77059 | $6,254.85 |

| 77062 | $6,263.54 |

| 77058 | $6,308.38 |

| 77339 | $6,351.62 |

| 77079 | $6,441.61 |

| 77005 | $6,459.12 |

| 77094 | $6,513.47 |

| 77598 | $6,523.91 |

| 77336 | $6,538.79 |

| 77006 | $6,550.05 |

| 77098 | $6,594.26 |

| 77069 | $6,608.68 |

| 77046 | $6,623.26 |

| 77070 | $6,655.34 |

| 77025 | $6,664.14 |

| 77089 | $6,714.46 |

| 77007 | $6,724.72 |

| 77027 | $6,740.78 |

| 77056 | $6,743.45 |

| 77030 | $6,751.63 |

| 77024 | $6,766.97 |

| 77018 | $6,787.86 |

| 77489 | $6,794.35 |

| 77064 | $6,795.54 |

| 77068 | $6,797.24 |

The following table shows you the most expensive average car insurance premiums for Houston by ZIP code.

Houston Most Expensive Rates by Zip

| ZIP Code | Average Annual Rate |

|---|---|

| 77036 | $8,150.71 |

| 77072 | $7,909.04 |

| 77033 | $7,840.97 |

| 77053 | $7,747.72 |

| 77078 | $7,700.94 |

| 77076 | $7,684.94 |

| 77083 | $7,670.98 |

| 77037 | $7,670.41 |

| 77060 | $7,664.73 |

| 77091 | $7,644.01 |

| 77016 | $7,629.02 |

| 77067 | $7,613.31 |

| 77088 | $7,612.47 |

| 77081 | $7,609.75 |

| 77022 | $7,605.82 |

| 77039 | $7,601.85 |

| 77099 | $7,600.09 |

| 77093 | $7,592.70 |

| 77028 | $7,579.76 |

| 77038 | $7,567.20 |

| 77026 | $7,553.90 |

| 77020 | $7,514.53 |

| 77050 | $7,505.14 |

| 77004 | $7,497.22 |

| 77204 | $7,496.11 |

As you can see, Houston car insurance rates fall between just over $6,000 and just over $8,000. This range is likely determined by population density, economic status of the area, and risks assessed for motorists by car insurance providers.

What’s the best Houston, Texas auto insurance company?

Folks in Houston might say the Houston Astros are the best team in Major League Baseball.

And they may not be wrong. The Astros hold two very recent World Series championships, 2017 and 2019.

Astros fans love to represent, as you can see in the video below.

But who do residents in the Capital of the Sunbelt say is the best car insurance company?

The best car insurance company largely depends on what you want and need from your insurer, and what kind of company you want to do business with.

When shopping for car insurance, the key issues you need to prioritize include:

- The level of insurance coverage you need

- The amount of money you can afford to pay for your car insurance premium

- The type of insurance company you want to do business with

Let’s cover some of the factors that can help you figure out the best Houston car insurance company for you and your family.

Cheapest Car Insurance Rates by Company

Let’s take a look at some car insurance companies’ annual rates in Houston, shown in the table below.

Houston Rates by Company

| Company | Average Rate |

|---|---|

| $6,514.79 | |

| $6,846.57 | |

| $3,969.28 | |

| $4,409.62 |

| $5,257.10 | |

| $3,466.09 | |

| $2,931.67 |

USAA is one of the cheapest companies throughout the United States, and that’s true, too, in Houston. However, only members of the military (current or former) and their immediate families are eligible to enroll in USAA insurance.

If you’re not eligible for USAA, your cheapest car insurance provider in Houston will likely be State Farm.

Did you know car insurance companies also consider your commute mileage per year, coverage level, credit history, and driving record when setting premiums?

Read on to find out more.

Best Car Insurance for Commute Rates

How far do you drive to work each day?

Houstonians have an average one-way commute of 26.7 minutes, slightly above the national average of 25.5 minutes.

The length of your daily commute can affect your car insurance premium.

But no matter your commute, USSA or State Farm will probably be the most affordable car insurance provider for you.

The table below provides average premiums for Houston’s top insurers based on both a 10- and 25-mile average commute.

Houston Rates by Commute

| Company | 10-mile Commute/6,000 Miles Annually | 25-mile Commute/12,000 Miles Annually | Average |

|---|---|---|---|

| $6,353.51 | $6,676.06 | $6,514.79 | |

| $6,846.57 | $6,846.57 | $6,846.57 | |

| $3,895.17 | $4,043.38 | $3,969.28 | |

| $4,409.62 | $4,409.62 | $4,409.62 |

| $5,257.10 | $5,257.10 | $5,257.10 | |

| $3,466.09 | $3,466.09 | $3,466.09 | |

| $2,894.35 | $2,968.99 | $2,931.67 |

But you might be wondering: how much car insurance do I need?

It’s a good question. Do you need a little or a lot? This is something you’ll need to think about as you begin your car insurance research, and it certainly affects your premium.

Best Car Insurance for Coverage Level Rates

The more car insurance you need, the higher your premium will be.

That’s because we live under this thing called “capitalism.”

In Houston, USAA or State Farm will still likely be your cheapest provider whether you need a high, medium, or low level of car insurance.

The table below provides average rates for Houston’s biggest car insurers by coverage level, including high, medium, and low coverage.

Houston Rates by Coverage Level

| Company | High | Medium | Low | Average |

|---|---|---|---|---|

| $6,747.80 | $6,451.07 | $6,345.48 | $6,514.78 | |

| $7,693.82 | $6,550.06 | $6,295.82 | $6,846.57 | |

| $4,275.87 | $3,908.95 | $3,723.01 | $3,969.28 | |

| $4,269.74 | $4,219.83 | $4,739.31 | $4,409.63 |

| $5,526.99 | $5,234.74 | $5,009.56 | $5,257.10 | |

| $3,675.87 | $3,453.47 | $3,268.93 | $3,466.09 | |

| $3,063.36 | $2,917.54 | $2,814.10 | $2,931.67 |

So what’s your credit history?

Best Car Insurance for Credit History Rates

You might be wondering, why are we asking about your credit history?

Your credit history is one of the key factors car insurance companies will use to determine your car insurance premium.

This short video offers a great explanation as to how and why credit scores help determine car insurance premiums.

According to financial experts at Experian, Texas residents have an average credit score of 680, well below the national average of 703. You should know your credit score when shopping for insurance in the big ole Houston because it can greatly affect your car insurance premiums.

If you have really good credit in Houston, for instance, Geico and USAA will likely be your cheapest car insurance providers.

What if you have poor credit in the Capital of the Sunbelt? Well, you’ll want to check out State Farm and USAA.

The table below offers average premiums in Houston for those with good, fair, and poor credit histories.

Houston Rates by Credit History

| Company | Good | Fair | Poor | Average |

|---|---|---|---|---|

| $5,193.73 | $6,064.69 | $8,285.94 | $6,514.79 | |

| $5,253.86 | $6,015.71 | $9,270.13 | $6,846.57 | |

| $2,293.67 | $3,462.39 | $6,151.78 | $3,969.28 | |

| $3,684.52 | $4,248.38 | $5,295.97 | $4,409.62 |

| $4,736.52 | $5,113.92 | $5,920.85 | $5,257.10 | |

| $2,439.19 | $3,057.10 | $4,901.97 | $3,466.09 | |

| $2,013.20 | $2,496.22 | $4,285.58 | $2,931.67 |

But what affects your car insurance premium more than anything else? Your driving record.

Best Car Insurance for Driving Record Rates

Most of us don’t have spotless driving records. There might be a speeding ticket, an accident, or even a DUI in your past.

But did you know not all violations affect your car insurance premium in the same way?

Our research reveals that those with a DUI in their past, for instance, will likely find Geico to be by far their cheapest car insurance option in the city of Houston.

The following table provides the average rates for drivers of various histories in The Big Heart.

Houston Rates by Driving History

| Company | Clean Record | With One Speeding Violation | With One Accident | With One DUI | Average |

|---|---|---|---|---|---|

| $5,026.59 | $5,026.59 | $7,838.42 | $8,167.54 | $7,010.85 | |

| $6,204.20 | $6,204.20 | $7,997.66 | $6,980.21 | $7,060.69 | |

| $3,360.70 | $4,339.34 | $4,480.89 | $3,696.17 | $3,845.92 | |

| $3,820.09 | $4,319.57 | $3,820.09 | $5,678.74 | $4,439.64 |

| $4,576.28 | $5,159.92 | $5,935.65 | $5,356.54 | $5,289.49 | |

| $3,071.33 | $3,071.33 | $3,533.51 | $4,188.19 | $3,597.68 | |

| $2,174.69 | $2,498.87 | $3,238.80 | $3,814.31 | $3,075.93 |

Did you know that even if you’ve had a speeding ticket, accident, or DUI in your past, a defensive or safe driving course can often help negate increases in your car insurance premiums?

Make sure to look for defensive driving, advanced driving, and DUI awareness courses. And check with your insurance company to see what they consider to be important in a driving course.

But what if your driving record makes it impossible for you to find car insurance you can afford? Please know you’re not alone.

The Insurance Information Institute provides this helpful guide to help you explore your options, many of which are public and backed by the state.

Factors such as a city’s growth, prosperity, and poverty rates can also affect your car insurance premiums.

Let’s take a look at some of these specific factors that can affect how much you end up paying for car insurance in Houston.

Car Insurance Factors in Houston

As Houston continues to grow, the city is forging forward into the future quickly.

In the sections below, we’ll cover some of the factors of this growth.

These factors can affect your car insurance premiums in surprising ways, so it’s important to know about changing demographic trends in the Capital of the Sunbelt.

Houston Metro Report

As with almost all American cities, it’s not surprising to learn that Houston has seen its economic ups and downs.

Thankfully, the city is currently seeing a steady, sustainable resurgence of growth factors, according to The Brookings Institute. Sadly, the prosperity numbers for Houston are not as shining.

The figures below reflect Brookings’ most recent findings on issues of both growth and prosperity in the Houston-The Woodlands-Sugar Land metropolitan statistical area.

That metropolitan statistical area is home to over seven million people.

Growth

- Jobs: +0.9 percent (71st of 100)

- Gross metropolitan product (GMP): +0.4 percent (91st of 100)

- Jobs at young firms: +0.8 percent (76th of 100)

Prosperity

- Productivity: -0.4 percent (86th of 100)

- Standard of living: -0.9 percent (96th of 100)

- Average annual wage: -0.4 percent (98th of 100)

Despite setbacks for markers of prosperity, Houston is seeing some solid growth in jobs, especially at young firms. Thus, we think Houston’s brightest days are still ahead.

Median Household Income in Houston

According to DataUSA, “households in Houston, Texas, have a median annual income of $51,203, which is less than the median annual income of $61,937 across the entire United States. This is in comparison to a median income of $50,896 in 2017, which represents a 0.603 [percent] annual growth.”

With an average annual car insurance premium of $6,254.85, residents of Houston spend an average of 12.21 percent of their annual income on car insurance, more than the national average.

Use the handy calculator below to see what percent of your income could go to car insurance.

CalculatorPro

Homeownership in Houston

In 2018, Houston’s median property value grew to $179,100 from the 2017 value of $173,600.

According to DataUSA, “in 2018, 41.9 [percent] of the housing units in Houston, Texas, were occupied by their owner. This percentage declined from the previous year’s rate of 42.8 [percent].”

This means Houstonians are more likely to be renters than other Americans.

For those who want the big city life, remember, Houston is the country’s fourth-largest city.

Without New York or San Francisco prices, Houston may be a perfect place to rent or buy. Check out the short video below to see what $1,500 a month will get you in The Big Heart Versus The Big Apple.

Education in Houston

According to DataUSA, 37,779 college degrees were awarded in Houston in 2017. That’s a lot of learning.

Houston is home to some of the best universities around. Of particular note is The University of Texas Health Science Center at Houston as well as Rice University, one of the finest private research universities in the world.

And as you can see in the video below, Rice is also a gorgeous place to learn and play.

The Community of Accredited Online Schools offers the following list of Houston’s biggest colleges and universities:

- University of Houston

- University of Houston-Downtown

- Texas Southern University

- University of Houston-Clear Lake

- Rice University

- The University of Texas Health Science Center at Houston

- University of St Thomas Houston

- Houston Baptist University

- Baylor College of Medicine

- South Texas College of Law

- Remington College-North Houston Campus

- Remington College-Houston Campus

- College of Biblical Studies-Houston

Additionally, the Houston Community College system currently has over 92,000 students.

Wage by Race and Ethnicity in Common Jobs in Houston

Unfortunately, wages by race and ethnicity are not tracked on the city level for Houston.

DataUSA, however, provides state-wide data and reports that “in 2018, the highest paid race/ethnicity of Texas workers was Asian. These workers were paid 1.22 times more than White workers, who made the second highest salary of any race/ethnicity.”

The most common job types in Texas, they also explain, are miscellaneous managers; driver/sales workers and truck drivers; elementary and middle school teachers; retail salespersons; and cashiers.

Wage by Gender in Common Jobs in Houston

Though wages by gender are not tracked on the city level for Houston, DataUSA explains that, frustratingly, “in 2018, full-time male employees in Texas made 1.38 times more than female employees.”

Poverty by Age and Gender in Houston

Whereas the national average of people living in poverty is 13.4 percent, Houston sadly has a pretty high poverty rate of 20.2 percent.

Women ages 25–34 make up a disproportionate amount of the people living below the poverty line in the Capital of the Sunbelt, DataUSA explains.

Poverty by Race and Ethnicity in Houston

According to DataUSA, “the most common racial or ethnic group living below the poverty line in Houston, Texas, is Hispanic, followed by white and black.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Driving in Houston

Like many post-industrial cities, Houston is the epitome of an American city, with one foot planted in the past and one forging swiftly ahead into the future.

Driving here, as the video below shows, gives you a distinct feeling of this old meets new attitude.

Did you know that a city’s road conditions, level of traffic congestion, and unique driving laws can all affect your car insurance premiums?

Don’t worry. In the sections below, we’ll provide you with some of the best information about driving safely in the Bayou City.

You can start your search for car insurance in Houston, Texas, today by entering your ZIP code below.

Roads in Houston

Thrillist includes Houston on their ist of American cities with the most sprawl.

They report that “Houston takes up 627 square miles, making it more than twice as large as Singapore with about 40 [percent] as many residents. Houston is sprawl defined, and that lack of density is the reason it makes our list.”

This sprawl leads to lots of driving and lots of roadways.

According to StreetsBlogUSA, Houston ranks third for American cities with the highest number of estimated highway lane miles per capita, coming in with .822 miles per 1,000 Houstonians.

So what kind of roads are they working with?

Major Highways

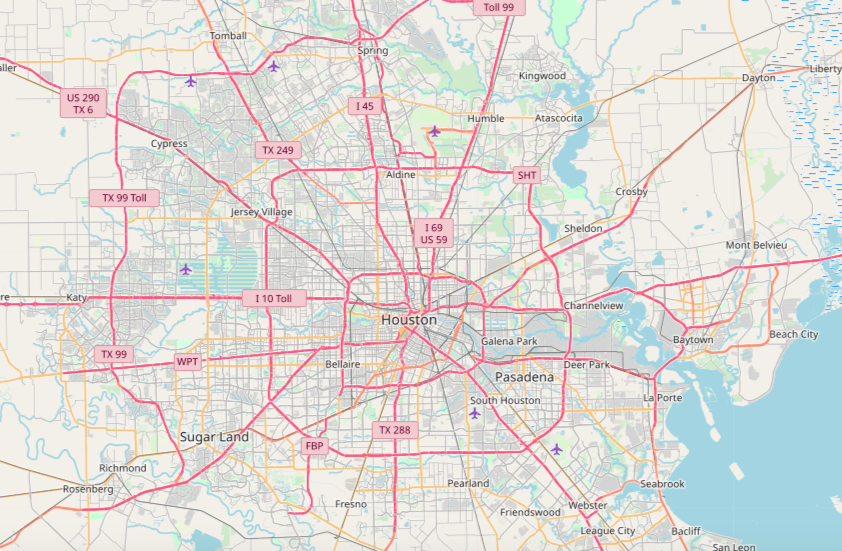

As you can see in the map below, Houston is the hub of several major roadways.

The following major highways are especially important for the flow of Houston traffic:

- I-10

- I-35

- I-45

- I-69

- I-410

- I-610

- I-345

Popular Road Trips/Sites

From the Houston Livestock Show and Rodeo to the Rothko Chapel, Houston has a load of activities to offer visitors of all stripes. Check out the video below for suggestions on how to spend a long weekend in The Big Heart.

https://www.youtube.com/watch?v=v1IydN76PjM

With so many beautiful beaches and cities within an easy drive of Houston, we also think it’s a great place to launch a roadtrip. Check out Trips to Discover’s guide to the 10 Best Weekend Getaways From Houston for a variety of options.

Road Conditions

No one likes to drive on roads in poor condition. Such roadways make for a bumpier, more dangerous riding experience.

So what can you expect to see on Houston roads?

Well, the National Transportation Research Group conducted a study to answer that very question.

According to their study, the following road conditions can be seen across the city of Houston:

- Poor – 24 percent

- Mediocre – 28 percent

- Fair – 11 percent

- Good – 38 percent

While a significant number of Houston roadways are rated in good condition, a majority of roads are rated either poor or mediocre. Houston has some work to do to improve the commute of the city’s residents and visitors.

Does Houston use speeding or red-light cameras?

Good news for drivers with a need for speed: Houston does not currently use speeding or red-light cameras.

According to the IIHS, the city of Houston actually has a ban on the use of cameras, as you can see from the video below.

Though remember, moving violations are one of the easiest ways to raise your car insurance premiums. So slow down and stop at red lights.

Vehicles in Houston

If you call Houston home, chances are you live in a two-car household, have a commute of 26.7 minutes each way, and drive alone to work.

In the sections below, we’ll look at the particulars of the Capital of the Sunbelt’s car culture.

Most Popular Vehicles Owned

According to YourMechanic, the Ford F-250 is Houston’s most popular vehicle.

According to DataUSA, 41 percent of Houston households own two vehicles. They also report that 29.8 percent own a single vehicle, while 16.5 percent own three.

Cars per Household

DataUSA reports that in 2018, 41 percent of Houston households owned two vehicles. 29.8 percent owned one vehicle, while 16.5 percent owned three.

Households Without a Car

So how many households in Houston don’t own a motor vehicle?

About 4 percent of American households nationwide don’t own a motor vehicle. In Houston, about 3.87 percent of households own no vehicle.

Speed Traps in Houston

Houston residents report that their city is home to some of the worst speed traps in the state of Texas.

Many of these speed traps lie along the busy Interstate 10 corridor, which runs right through the middle of downtown Houston.

But what is a speed trap in the first place? Check out the short video below to find out more.

Speed trap or no speed trap, it’s always important to drive at a safe and legal speed.

Follow posted speed limits to keep you and your family safe and your car insurance premiums affordable.

Vehicle Theft in Houston

The Federal Bureau of Investigation reported that in 2017, a whopping 11,596 vehicles were stolen in the city of Houston, more than any other city in the state of Texas.

According to NeighborhoodScout, crime is pretty high in Houston.

The Big Heart is safer than only 4 percent of other cities in the United States. Also, Houston has a violent crime rate of 10.46 per 1,000 residents.

But what’s the traffic situation like in Houston?

Traffic in Houston

You might have heard that Houston is a driving nightmare. And though traffic here is a problem, you might be surprised how the traffic situation rates given Houston’s size.

Read on to find out some more particulars about driving in this great American city.

Traffic Congestion in Houston

Houston is the 13th-most congested city in the United States.

Traffic monitoring agency INRIX reports that folks in this region spent an average of 98 hours in congestion in 2018, with an average financial cost of $1,365 to each commuter because of traffic.

TomTom explains that Houston drivers face an average congestion level of 23 percent.

This means that residents of The Big Heart end up spending an extra 13 minutes in congestion during the peak morning commute period, and an extra 18 minutes during the peak evening commute hours.

According to Numbeo, those living in the Capital of the Sunbelt face a traffic index of 203.81, a time index of 41.42 minutes, and an inefficiency index of 239.93.

Transportation

As DataUSA explains, folks in Houston face a 26.7-minute, one-way commute on average.

They report that “employees in Houston, Texas, have a longer commute time (26.7 minutes) than the normal US worker (25.7 minutes). Additionally, 1.88 [percent] of the workforce in Houston, Texas, have ‘super commutes’ in excess of 90 minutes.”

They also found that “in 2018, the most common method of travel for workers in Houston, Texas, was Drove Alone (78.1 [percent]), followed by those who Carpooled (10 [percent]) and those who Worked At Home (3.92 [percent]).”

How safe are Houston’s streets and roads?

Though the National Highway Traffic Safety Administration doesn’t track city-specific roadway safety statistics, they do provide countywide statistics for Harris County, which includes the city of Houston.

In 2018, 389 traffic fatalities were reported on the county’s roadways, meaning Harris County led Texas counties in roadway deaths.

The table below provides the number of traffic fatalities in Harris County from 2014 to 2018.

Houston Traffic Fatalities

| Year | 2014 | 2015 | 2016 | 2017 | 2018 |

|---|---|---|---|---|---|

| Traffic Fatalities | 417 | 391 | 447 | 458 | 389 |

We hope that the drop in Harris County roadway fatalities between 2017 and 2018 is a trend that continues in the years to come.

Allstate America’s Best Drivers Report

When it comes to “best drivers,” Houston could be doing better.

According to Allstate America’s Best Drivers Report for 2019, The Big Heart ranked as the 158th safest driving city in the United States out of 200.

On average, residents of the city also went around 7.7 years between filing each car insurance claim.

Ridesharing

According to RideGuru, the following rideshare services are available in the city of Houston:

- Arro

- Blacklane

- Carmel

- Jayride

- Limos.com

- Lyft

- SuperShuttle

- Talixo

- Traditional taxis

- Uber

Arro, Lyft, Uber, and traditional taxis are available to pick you up from or take you to the area’s airports, including George Bush Intercontinental Houston Airport (IAH) and William P. Hobby Airport (HOU).

Weather in Houston

With an average annual high temperature of 78.3 degrees, Houston, enjoys a subtropical climate. The table below provides some of the atmospheric averages for the Capital of the Sunbelt.

Houston Weather

| Houston Weather Averages | Details |

|---|---|

| Annual High Temperature | 78.3°F |

| Annual Low Temperature | 59.8°F |

| Average Temperature | 69.05°F |

| Average Annual Precipitation – Rainfall | 45.28 inches |

| Days per Year With Precipitation – Rainfall | 106 days |

| Annual Hours of Sunshine | 2,633 hours |

With 2,633 hours of sunshine, there are lots of bright days in H-Town. But all that heat also means an increased rate of natural disasters.

As you can see in the video from MSNBC below, Houston is especially prone to hurricanes, such as Hurricane Harvey, which devastated the area in August and September of 2017.

Public Transit in Houston

The Metropolitan Transit Authority of Harris County, Texas, or METRO, provides public transportation for Houston and the surrounding area in the form of buses, trolleys, and lift vans.

But the METRO isn’t the only option available for public forms of transportation in the Houston area. Check out the table below to see some of the options we’ve compiled that are available to you in the Capital of the Sunbelt.

Houston Public Transit

| Transportation Option | Cost | Routes / Details (if listed) |

|---|---|---|

| METRO Bus System | Local Service Fare – $1.25 One-Way Fare – ranges from $2–4.50 depending on distance | • Local services runs mostly on city streets • Park & Ride Service is for long-distance commuting • METRO's 28 Park & Ride lots provide bus service to key destinations |

| METRORail | $1.25 | • Red Line (25 Stations) – Northline Transit Center to Fannin South • Green Line (9 Stations) – Downtown to Magnolia Park Transit Center • Purple Line (10 Stations) – Downtown to Palm Center Transit Center |

| Ridesharing Services | Depends on service | Depends on service |

| SuperShuttle | Ranges from $23–200 depending on destination | • Shared Ride • Non-Stop Ride • Black Car |

| Taxi | $6 | Flat taxi fare for all trips in the downtown area |

The METRO will likely be your cheapest public transportation option in Houston, but it’s good to know it’s not your only option.

Parking in Houston

Downtown Houston is a crowded area, and a frustrating aspect of driving is trying to find parking spots in busy or expensive regions.

Despite the downtown crowds at work or Astros games, rest assured that there are many parking options available to you in the downtown Houston area.

A good number of large parking garages, both public and private, are located conveniently throughout the city, with approximately 100,000 parking spaces available in total.

Prefer to park on the street? Here are some tips we’ve found to help make sure you stay legally parked:

- On-street metered parking is available during the day and on most downtown streets.

- You can park for up to three hours, and after that, you’ll have to move your vehicle.

- Meters are FREE after 6 p.m. Monday through Saturday and are free all day on Sunday.

Air Quality in Houston

The Environmental Protection Agency (EPA) provides air quality reports for all cities and counties across the nation.

The agency designates an area’s air quality as good, moderate, unhealthy for certain groups, unhealthy, and very unhealthy for every day of the year.

Air quality in Houston is pretty good, we’re happy to report, with a vast majority of days designated good or moderate.

The table below shows the number of days in Houston with each EPA designation for the years 2015 to 2018.

Houston Air Quality

| Year | Number of "Good" Days | Number of "Moderate" Days | Number of "Unhealthy for Sensitive Groups" Days | Number of "Unhealthy" Days | Number of "Very Unhealthy" Days |

|---|---|---|---|---|---|

| 2015 | 144 | 176 | 30 | 14 | 1 |

| 2016 | 164 | 179 | 22 | 1 | 0 |

| 2017 | 184 | 156 | 22 | 3 | 0 |

| 2018 | 166 | 164 | 26 | 7 | 2 |

Sadly, 2018 saw an increase in “very unhealthy” days for Houston’s air quality. We hope this is a temporary trend.

Military/Veterans

According to DataUSA, Houston “has a large population of military personnel who served in Vietnam, 1.41 times greater than any other conflict.”

Texas is home to a swath of military installments, including:

- Camp Bullish

- Dyess Air Force Base

- Fort Bliss

- Fort Hood

- Fort Sam Houston

- Goodfellow Air Force Base

- Joint Base San Antonio

- Lackland Air Force Base

- Laughlin Air for Base

- Naval Air Station Corpus Christi

- Naval Air Station Joint Reserve Base Fort Worth

- Randolph Air Force Base

- Red River Army Depot

- Sheppard Air Force Base

Read more: Army Car Insurance Discount

You should keep in mind that our research shows how many car insurance companies offer discounts to either active or retired military personnel.

These companies include Allstate, Esurance, Farmers, Geico, Liberty Mutual, MetLife, Safe Auto, Safeco, State Farm, and The General.

USAA is consistently ranked as one of the best auto insurance companies, and they insure only military personnel, active or retired, and their immediate family members.

In Houston, they consistently provide premiums lower than all other insurers.

Read more: Air Force Car Insurance Discount

Unique City Laws

Texas has some strange laws. For instance, Texas-based Triangle Reality explains that “it is illegal to sell Limburger cheese on Sunday.” So stick to the cheddar.

Texas is also quickly evolving. In 2011, the state upped the speed limit on many major roadways to have a top speed limit of 85 mph, with truck drivers no longer having a lower nighttime speed limit.

The state also requires driver’s education instructors to pass a background, criminal, and sexual predator check.

Oh, and you might find it interesting to know that Houston is the largest city in the United States without formal zoning laws, a fact that certainly affects Houston drivers and residents.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Conclusion

Now that you understand the basics of driving, living, and working in The Big Heart, it’s time to put your knowledge to work by getting the best deal on car insurance for you and your family.

We know understanding car insurance is no simple task, but by carrying some basic knowledge, you are better equipped to handle the challenges it brings.

And that’s why we created this guide: to help you obtain that basic knowledge.

What part of this Houston car insurance guide was the most helpful?

Was there something we could explain better so that you can make a better car insurance decision?

We hope this guide helps you get started on finding the best car insurance rates in Houston, Texas for you and your family.

Ready to compare rates now? Enter your zip code above for FREE.

Frequently Asked Questions

What are the state minimums for car insurance in Texas?

The state minimums for car insurance in Texas are 30/60/25. This means that drivers must have liability coverage of at least $30,000 per person for bodily injury, $60,000 per accident for bodily injury, and $25,000 per accident for property damage.

What’s the best Houston, Texas, auto insurance company?

There is no one best auto insurance company in Houston, Texas, as the best one for you will depend on your specific needs and circumstances. Some top providers in Houston include State Farm, USAA, and Geico.

What are the teenage driving laws in Texas?

In Texas, teenage drivers must hold a learner’s permit for at least six months before they can get their driver’s license. They must also complete a driver’s education course, have a certain number of supervised driving hours, and pass a driving test.

Does Houston use speeding or red-light cameras?

Houston has red-light cameras but not speeding cameras. However, there have been debates over whether or not to keep the red-light cameras in the city.

What are the most popular vehicles owned in Houston?

The most popular vehicles owned in Houston include the Ford F-150, the Chevrolet Silverado, and the Toyota Camry.

What are the cheapest ZIP codes for car insurance in Houston?

The cheapest ZIP codes for car insurance in Houston are 77059 (Clear Lake) and 77084 (Addicks/Park Ten).

Who handles the utilities in Houston?

The City of Houston provides this great guide to setting up utilities in the Capital of the Sunbelt.

Do I need to get a resident parking permit?

If you live on a block designated a “Residential Permit Parking area,” the City of Houston explains you must obtain a permit. They offer comprehensive information on how to get a permit.

What are the state minimums for car insurance in Texas?

Texas requires drivers to have car insurance that meets or exceeds the following minimum coverage levels:

- $30,000 for Bodily Injury Liability (or BI) per individual and $60,000 per accident

- $25,000 for Property Damage Liability (PD)

And remember, these are minimums. Additional coverage might be beneficial for you and your family.

What are the teenage driving laws in Texas?

AAA provides a great guide to teenage driving laws in Texas, including a helpful explanation of the state’s graduated licensing laws.

What’s the sales tax like in Houston?

Where is the airport?

How many people live in the Houston-The Woodlands-Sugar Land metropolitan statistical area?

Is there anything to do in Houston?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.