Best Car Insurance Discounts by Age in 2026 (Biggest Savings for Each Age Group)

Best car insurance discounts by age are offered by top providers for different age groups. State Farm gives teen drivers 25% off for driver’s ed and good grades. Progressive rewards seniors over 60 with defensive driving discounts. These age-based savings lower costs and support coverage at every life stage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Jeffrey Manola is an experienced life insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for life insurance with the most affordable term life insurance, permanent life insurance, no medical exam life insurance, and burial insurance. Not only does he strive to provide consumers with t...

Jeffrey Manola

Updated August 2025

The best car insurance discounts by age lower premiums across life stages. State Farm leads for teens with up to 25% off for good grades and driver’s ed.

For the best car insurance discounts to ask for, Geico offers savings through safe driver and multi-policy discounts for adults, while Progressive provides top value for seniors with low-mileage and defensive driving discounts.

- Top providers offer age-specific discounts that help lower premiums at every stage

- Teens, adults, and seniors each qualify for unique savings based on driving habits

- Compare quotes by age to unlock the best car insurance discounts available

Choosing the right provider based on your age can lead to savings and personalized coverage with age-based car insurance discounts. Find cheap car insurance quotes by entering your ZIP code here.

Top Car Insurance Discounts for Teen Drivers (Ages 16-19)

Teen drivers tend to be most expensive to insure because of their inexperience and higher risk of having a car accident. A list of car insurance discounts like good student, driver’s education, and distant student help ease costs by rewarding safe habits and limited driving. These savings makes coverage cheaper for teens, and encourages responsibility on the road.

Best Good Student Discounts – 35%

The good student car insurance discount offers significant savings for teen drivers by rewarding academic performance, a trait linked to responsible driving. Most insurers require full-time enrollment and at least a 3.0 GPA or top 20% class rank.

Good Student Discount: Biggest Savings Potential

| Company | Rank | Discount | GPA Required | Requirements |

|---|---|---|---|---|

| #1 | 35% | 3.0 | Full-time students in top 20% class |

| #2 | 25% | 2.7 | All students under 25 | |

| #3 | 25% | 3.0 | Students with test scores in top 20% |

Country Financial offers the highest discount at 35% but with stricter academic criteria. Allstate provides a 25% discount for students under 25 with a 2.7 GPA, while State Farm offers the same rate for those with a 3.0 GPA or top 20% test scores.

Jeff Root Licensed Life Insurance Agent

These discounts help reduce high teen insurance premiums and promote safe, responsible habits, making it easier to find the best car insurance for college students as they navigate the challenges of being new drivers away from home.

Best Driver’s Education Discounts – 15%

The Driver’s Ed discount helps young drivers reduce high insurance costs by rewarding those who complete an approved education course. Geico offers a 15% discount for completing an approved course.

Driver’s Education Discount: Biggest Savings Potential

| Company | Rank | A.M. Best | Discount | Who Qualifies? |

|---|---|---|---|---|

| #1 | A++ | 15% | Young drivers completing approved education course | |

| #2 | A+ | 15% | New drivers completing approved education courses | |

| #3 | A++ | 12% | Drivers under 25 with clean records |

Allstate also provides 15% off but focuses on new drivers just getting licensed. USAA offers 12% off for drivers under 25 who complete driver’s education and maintain a clean driving record.

This discount is especially valuable for teens as it promotes safe driving habits and makes coverage more affordable, helping secure the cheapest car insurance for 18-year-old drivers.

Best Distant Student Discounts – 20%

Students attending college far from home without a car can qualify for significant savings through distant student discounts, making it the best auto insurance for students in this situation. State Farm offers a 20% discount for students living over 100 miles away with no vehicle.

Distant Student Discount: Biggest Savings Potential

| Company | Rank | A.M. Best | Discount | Requirements |

|---|---|---|---|---|

| #1 | A++ | 20% | Students living over 100 miles away, no vehicle | |

| #2 | A | 20% | Students living away, no regular vehicle access | |

| #3 | A+ | 10% | Students under 22, living 100+ miles away, no car |

Farmers balances this rate with greater flexibility, with no need for periodic vehicle access. Progressive offers a 10% discount for students under the age of 22 who meet similar distance and vehicle restrictions. This discount will help families save on premiums while also keeping coverage in place for college students.

These offers can drastically cut premiums and lower auto insurance rates by age, and help teen drivers form safe driving habits, followed by accountability on and off the road for families.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Car Insurance Discounts for Young Adults (Ages 20-25)

Young adults ages 20 to 25 can qualify for some of the best car insurance for young adults by demonstrating safe driving habits, managing multiple vehicles, and setting up automatic payments, all of which can help secure significant discounts and lower premiums.

Best Usage-Based Insurance (UBI) Discounts – 30%

Usage-Based Insurance (UBI) discounts offer some of the highest savings potential for drivers between 16 and 25, especially those with safe driving habits. These programs use telematics to track behaviors, such as speed, acceleration and braking, and time of day, making them better for reducing rates based on inexperience.

Usage-Based Insurance (UBI) Discount: Biggest Savings Potential

| Company | Rank | Discount | UBI Program | Requirements |

|---|---|---|---|---|

| #1 | $231/yr | Snapshot | Age 16-25 with safe driving habits | |

| #3 | 30% | Drive Safe & Save | Drivers 16-25 with safe driving pattern | |

| #2 | 30% | Drivewise | Young drivers based on driving behavior |

Progressive’s Snapshot offers average savings of $231/year for drivers who avoid risky habits like hard braking.

State Farm’s Drive Safe & Save and Allstate’s Drivewise each offer up to 30% off, using telematics to monitor driving patterns. These discounts give young drivers a chance to lower costs by proving their safety behind the wheel.

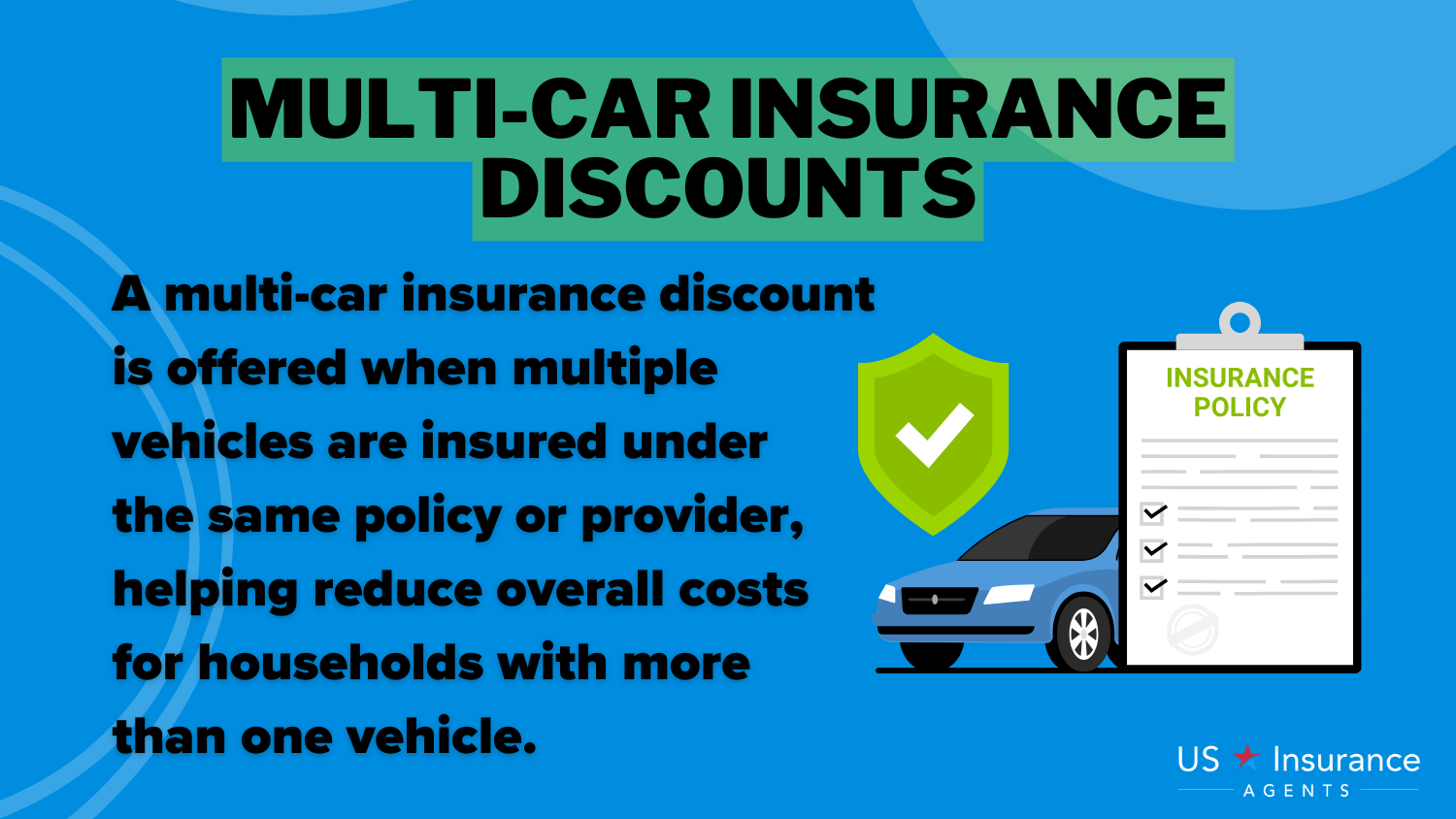

Best Multi-Car Discounts – 30%

Young adult drivers sometimes add multiple vehicles from the same household to their policy, which can earn them the group’s most valuable car insurance discount by age. This discount applies when multiple vehicles are insured under the same policy, and provides substantial savings for premiums.

Multi-Car Discount: Biggest Savings Potential

| Company | Rank | A.M. Best | Discount | Who Qualifies? |

|---|---|---|---|---|

| #1 | A+ | 30% | Multiple cars insured under one policy |

| #3 | A++ | 25% | Young adults with multiple cars insured | |

| #2 | A+ | 25% | Insuring more than one vehicle |

Country Financial provides the highest discount at up to 30%, while Allstate and Geico each offer 25%, with Geico focusing on young adult drivers.

This discount is especially useful for young adults who may be sharing cars within a household or adding a second vehicle to their policy, making it a great option for those looking to find the best car insurance by vehicle and maximize savings.

Best Automatic Payment Discount – 15%

The Automatic Payment discount helps young adult drivers save by enrolling in recurring payments, offering both convenience and lower premiums. Liberty Mutual provides the highest savings at 15% for eligible policyholders.

Automatic Payment (Auto Pay) Discount: Biggest Savings Potential

| Company | Rank | A.M. Best | Discount | Additional Requirements |

|---|---|---|---|---|

| #1 | A | 15% | Eligible for auto-pay discount on policies |

| #3 | A++ | 13% | Young adults with auto-pay set up | |

| #2 | A+ | 12% | Young adults enrolled in monthly auto-pay |

State Farm offers 13%, and Progressive gives 12% to young adults using monthly auto-pay. While the general requirement is setting up auto-pay, State Farm and Progressive specifically tailor this discount to younger drivers, making it an easy way to cut costs and stay organized.

As young drivers gain financial independence, insurers reward responsibility with lower rates, helping them save and build strong insurance records. Check our best car insurance discount guide for details on discounts based on driving habits and policy management.

Top Car Insurance Discounts for Adult Drivers (Ages 26-55)

Drivers ages 26 to 55 often benefit from lower base car insurance rates due to increased experience and reduced risk compared to younger drivers.

Best Good Driver Discount – 40%

Adult drivers often qualify for the Good Driver Discount, which rewards safe driving habits and helps lower premiums during their most active driving years. Nationwide offers the highest savings with up to 40% off for drivers with a clean record for over five years.

Good Driver Discount: Biggest Savings Potential

| Company | Rank | A.M. Best | Discount | Requirements |

|---|---|---|---|---|

| #1 | A+ | 40% | Clean driving record in 5+ years |

| #2 | A+ | 30% | No accidents in 3+ years | |

| #3 | A++ | 26% | Accident-free in 5+ years |

Progressive provides 30% off for those with no accidents in three years, while Geico offers 26% off for being accident-free for five years. These discounts make Progressive the best car insurance for 26-year-old drivers who maintain a clean driving history, helping to keep premiums low.

Best Bundling Discount – 30%

Bundling discounts offer major savings for adult drivers who carry multiple insurance policies. Amica provides the highest discount at 30% for bundling auto with home, renters, and umbrella coverage, helping you save on types of car insurance coverage while simplifying your policy management.

Bundling Discount: Biggest Savings Potential

| Company | Rank | A.M. Best | Discount | Coverage to Bundle |

|---|---|---|---|---|

| #1 | A+ | 30% | Auto, Home, Renters & Umbrella | |

| #2 | A++ | 25% | Auto, Renters, Home, Umbrella & Boat | |

| #3 | A+ | 25% | Auto, Home, Renters, Umbrella, Condo & Boat |

Geico and Allstate follow with up to 25% off for combining auto with various options like home, renters, condo, umbrella, or boat insurance.

This discount is especially valuable for adults ages 26 to 55 who are more likely to have assets to insure. Requirements vary by provider, but all policies must typically be held with the same insurer.

Best Loyalty Discount – 18%

Loyalty car insurance discounts offer valuable savings for adult drivers who maintain long-term coverage with the same insurer. American Family provides the highest discount at 18% for drivers with five or more years of continuous coverage.

Loyalty Discount: Biggest Savings Potential

| Company | Rank | A.M. Best | Discount | Requirements |

|---|---|---|---|---|

| #1 | A | 18% | 5+ years, continuous coverage | |

| #2 | A+ | 15% | 2+ years, no recent claims | |

| #3 | A+ | 13% | 5+ years, no at-fault accidents |

Allstate offers 15% for two or more years of coverage without recent claims, while Progressive gives 13% to five+ years of coverage, no at-fault crashes. These discounts reward drivers who keep their policy and avoid making claims and keep insurance costs down in the most expensive years, when a driver is on the road the most often.

These age-relevant discounts offer meaningful savings while encouraging smart, consistent insurance management.

Top Car Insurance Discounts for Senior Drivers (Ages 55+)

Senior drivers can save with discounts that reward safe habits, experience, and low mileage. The best safe driver car insurance discounts, along with defensive driving and pay-in-full options, help secure affordable coverage for seniors over 60 without sacrificing quality.

Best Defensive Driving Discount – 31%

Senior drivers can lower premiums with a defensive driving course car insurance discount by completing a state-approved course within three years. Progressive offers 31%, while Travelers and Geico provide up to 20%. This course helps reduce insurance costs while promoting safer driving.

Defensive Driving Discount: Biggest Savings Potential

| Insurance Company | Rank | A.M. Best | Discount | Requirements |

|---|---|---|---|---|

| #1 | A+ | 31% | Online or in-person state-approved course within 3 years | |

| #2 | A++ | 20% | In-person state-approved course within 3 years | |

| #3 | A++ | 20% | Online state-approved course within 3 years |

Travelers mandates in-person classes, Geico allows for online courses, adding in flexibility. This much-needed discount enables seniors to remain safe while saving money as they continue to drive confidently.

Best Low-Mileage Discount – 50%

Low-mileage car insurance discounts are a great fit for senior drivers who typically spend less time on the road, reducing their overall risk. These savings are based on annual driving distance and reward those who drive less frequently.

Low-Mileage Discount: Biggest Savings Potential

| Insurance Company | Rank | A.M. Best | Discount | Who Qualifies? |

|---|---|---|---|---|

| #1 | A- | 50% | Drivers who travel fewer than 10,000 miles yearly | |

| #2 | A+ | 40% | Drivers with pay-per-mile insurance |

| #3 | A++ | 30% | Drivers who maintain low annual mileage |

Metromile offers up to 50% off for drivers traveling under 10000 miles per year. Nationwide gives 40% off with its pay per mile program, and State Farm offers 30% for low annual mileage without tracking. This discount suits seniors who drive less and want lower insurance costs.

Best Pay-in-Full Discount – 20%

The Pay-in-Full (Upfront) car insurance discount offers major savings for drivers who pay their full premium at the start of the policy. It’s especially valuable for senior drivers looking to simplify payments and reduce overall costs.

Pay-in-Full (Upfront) Discount: Biggest Savings Potential

| Insurance Company | Rank | A.M. Best | Discount | Accepted Payments |

|---|---|---|---|---|

| #1 | A++ | 20% | Bank Account, Credit Card, PayPal | |

| #2 | A+ | 20% | Credit Card, Debit Card, PayPal, Bank Transfer | |

| #3 | A | 15% | Credit Card, Debit Card, Venmo, Mobile Wallet |

Geico and Progressive give up to 20% off, and they allow you to pay either by credit card, bank transfer or PayPal. Liberty Mutual accepts mobile wallets like Venmo and offers up to a 15% discount. This discount encourages financial preparedness and allows drivers to circumvent monthly billing fees.

By taking advantage of these senior-focused discounts, drivers over 55 can significantly cut their premiums. Comparing top providers ensures the best deal while supporting affordable, reliable coverage in later driving years.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Why Age Impacts Car Insurance Rates

Car insurance rates vary by age as insurers assess risk and predict accident likelihood. Understanding these factors and knowing how to file a car insurance claim can help you make informed decisions and stay prepared.

Teens Pay Less When Added to a Parent’s Policy

Adding a teen to a parent’s policy is usually much cheaper than an individual policy, as insurers see teens as high-risk drivers. For the cheapest car insurance companies, bundling policies can help lower premiums even further.

Teen Car Insurance Rates: Individual vs. Parent’s Policy

| Policy Type | Minimum Coverage | Full Coverage | Pros & Cons |

|---|---|---|---|

| Teen Individual Policy | $220 | $583 | Standalone, higher risk, no discounts |

| Parent's Policy + Teen | $118 | $292 | Shared policy, multi-car discounts |

As the table shows, a single teen policy starts at $220 for minimum coverage and $583 for full coverage. On the other hand, adding a teen to a parent’s policy could substantially lower those rates — $118 for minimum and $292 for full coverage.

The shared policy allows for the benefit of multi-car discounts, making it a more affordable option for families. Therefore, it’s usually more cost-effective to add a teen to a parent’s policy rather than purchasing an individual policy.

Young Drivers Don’t See Lower Rates Until 25

Young drivers often pay high car insurance rates because of their lack of driving experience and the greater risk of an accident. A 16-year-old could pay $220 for minimal coverage, as the chart shows, but rates decrease significantly by 25, when rates drop to about $100 for a 25-year-old.

The decrease in risk as drivers gain experience is reflected in this decline. Older drivers, such as those aged 45 and 55, qualify for lower rates because they have an established driving record.

For seniors, finding the cheapest car insurance for seniors over 70 becomes possible, especially if they have a safe driving record and drive less frequently. Young drivers don’t see meaningful rate cuts until they reach the age of 25, a moment in time that signifies a transition in premium pricing.

Seniors Can Get Cheaper Car Insurance, but Not Always

Generally, some of the reasons seniors have lower car insurance rates are because of few miles driven, a safe driving history and defensive driving course discounts. But if you are older, risks that come with age can drive up your premiums.

How Age Affects Car Insurance Rates for Seniors

| Factor | Impact | Description |

|---|---|---|

| Fewer miles driven | Lowers rates | Seniors often drive less, reducing risk |

| Safe driving history | Lowers rates | Long-time drivers may have clean records |

| Defensive driving courses | Lowers rates | Many insurers offer discounts for courses |

| Health-related risks | Raises rates | Declining vision or slower reflexes increase risk |

| Advanced age (e.g., 75+) | Raises rates | Insurers may see older seniors as higher risk |

Health-related issues, such as declining vision or slower reflexes, raise risk, and seniors over 75 may face higher rates due to perceived increased risk.

Tonya Sisler Insurance Content Team Lead

While discounts help, age-related factors often offset savings, making premiums complex for older drivers. Exploring lesser known car insurance discounts, like low-mileage or defensive driving, that might save you extra money to offset these increases.

Car Insurance Discounts Not Based on Age

Other than age-based discounts, several car insurance discounts are available to all drivers. Anti-theft discounts offer up to 20% for installing security devices like alarms or tracking systems. A claim-free record can save you as much as 30%, and using telematics to log safe driving habits can earn you 15% off.

Car Insurance Discounts Not Determined by Driver's Age

| Discount | Savings Potential | Discount Requirements |

|---|---|---|

| Anti-Theft | 20% | Install anti-theft devices like alarms or tracking systems |

| Claim-Free | 30% | No insurance claims for a set period |

| Drive Easy | 15% | Use telematics devices to monitor safe driving habits |

| Early Shopper | 5% | Obtain a quote before your current policy expires |

| Federal Employee | 10% | Be a government employee |

| Garaging | 10% | Park your car in a secure garage rather than on the street |

| Green Vehicle | 10% | Drive a hybrid or electric car |

| Homeowner | 10% | Own a home (even without bundling with home insurance) |

| New Car | 10% | Insure a brand-new vehicle |

| Pay-Per-Mile | 15% | Participate in a pay-per-mile insurance program |

Other discounts include early shopper savings, garaging, and green vehicle discounts, each offering up to 10%. Seniors can also benefit from the government-mandated auto insurance discount for seniors, which helps lower premiums.

Homeowners and federal employees can also enjoy savings, while pay-per-mile programs offer up to 15% for low-mileage drivers. These discounts provide opportunities for significant savings, regardless of age.

Maximize Car Insurance Discounts by Age

The best car insurance discounts by age can significantly reduce premiums for drivers at every stage of life. State Farm offers up to 25% off for good students and driver’s ed discounts for teens. Adult drivers can save up to 30% on car insurance premiums through safe driver savings and multi-policy discounts available through Geico and Progressive.

Progressive gives seniors a discount for defensive driving or low mileage, providing potential savings of up to 50% off their rates. By taking advantage of these age-based discounts, drivers can save money while ensuring comprehensive coverage that meets their needs and provides reliable protection.

Comparing quotes is the simplest way to find affordable car insurance. Simply enter your ZIP code into our free comparison tool to see cheap rates in your area.

Frequently Asked Questions

Who has the best car insurance discount for young drivers with a clean record?

Geico offers a safe driver discount for young drivers with no accidents or violations, giving up to 26% off. This is an ideal choice for those looking to keep rates low with a clean record.

Who has the best car insurance discount for seniors taking defensive driving courses?

Progressive offers the best discount for seniors taking defensive driving courses, providing up to 31% off. This discount encourages safe driving and helps seniors keep their premiums low.

Avoid expensive premiums by using our free comparison tool to find the lowest rates possible.

Does your car insurance go up when you turn 65 if you drive less?

Driving less can reduce premiums for seniors, especially with the best low mileage car insurance discounts. This discount helps offset age-related increases, particularly if you have a clean driving record and drive fewer miles each year.

Who has the best car insurance rates for seniors over 65?

For seniors over 65, AARP’s auto insurance program with The Hartford offers competitive rates along with tailored benefits, like senior-specific discounts and a focus on mature drivers.

Can senior drivers qualify for safe driver discounts with a past accident?

Senior drivers with a past accident may still qualify for a safe driver discount if the accident occurred several years ago and they’ve maintained a clean record since. It often depends on the insurer’s policies and the severity of the past incident.

Does AARP give senior discounts?

Yes, AARP offers senior discounts on car insurance through partners like The Hartford. The Hartford insurance review & ratings show its competitive rates and benefits tailored to seniors, helping them save on coverage.

Does Progressive offer a senior discount on car insurance premiums?

Yes, Progressive provides special discounts for seniors, particularly for those who have completed a defensive driving course or who drive fewer miles annually.

Who has the best car insurance discount for teens based on driving behavior?

Geico provides excellent discounts for teen drivers who maintain safe driving habits, offering up to 15% off through its DriveEasy telematics program, which monitors driving behavior and rewards safe driving.

At what age is car insurance cheapest for young drivers?

The age you get cheap car insurance is typically 25, when insurers start offering reduced rates. As drivers gain more experience and have fewer accidents or claims, insurers see them as lower risk, which leads to more affordable premiums.

At what age can you no longer be on your parents’ car insurance?

You can generally stay on your parents’ car insurance policy until you turn 26, as long as you’re a full-time student or living at home. Once you’re no longer a dependent, you’ll need to get your own insurance policy.

Do car insurance rates go down when you turn 25?

At what age is car insurance the most expensive?

How much will my insurance go down when I turn 25?

Does having an older car lower insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.