Best Off-Street Parking Car Insurance Discounts

In the realm of car insurance, discounts play a crucial role in making policies more affordable while maintaining comprehensive coverage. This article delves into various Off-Street Parking Car Insurance discounts that can help you save on your premiums.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Dan Walker graduated with a BS in Administrative Management in 2005 and has been working in his family’s insurance agency, FCI Agency, for 15 years (BBB A+). He is licensed as an agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. He reviews content, ensuring tha...

Daniel Walker

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated September 2024

- Safe Parking Location Discount: Qualify for discounted rates by parking your car in secure, off-street locations.

- Gated and Covered Parking Discount: Enjoy reduced premiums when you store your vehicle in covered, gated parking facilities.

- Nighttime Parking Discount: Save on insurance costs by keeping your car off the streets during the night.

- Low-Crime Area Discount: Reside or work in neighborhoods with low crime rates to access lowered insurance rates.

- Commute Reduction Discount: Opt for off-street parking options closer to work and earn savings on your policy.

- Telematics and Parking Apps Discount: Utilize telematics devices or parking apps to improve your off-street parking habits and unlock discounts.

Understanding Car Insurance Discounts

Before diving into off-street parking discounts specifically, let’s talk about car insurance discounts in general. Car insurance companies offer various discounts to encourage safe driving habits and reduce the risk of accidents. These discounts can help drivers save money on their insurance premiums.

Car insurance discounts are price reductions that insurance companies offer to policyholders who meet specific criteria. These discounts can vary between insurance providers, but they commonly reward drivers for things like safe driving records, bundling policies, and vehicle safety features.

One of the most common car insurance discounts is the safe driving discount. Insurance companies often provide lower premiums to drivers who have maintained a clean driving record for a certain period of time. This discount is an incentive for drivers to be more cautious on the road and follow traffic laws.

Another popular discount is the multi-policy discount. Insurance companies offer this discount to policyholders who have multiple insurance policies with the same provider. For example, if a driver has both auto insurance and homeowner’s insurance with the same company, they may be eligible for a discount on both policies.

Vehicle safety features can also earn drivers a discount on their car insurance. Insurance companies recognize that certain safety features, such as anti-lock brakes, airbags, and anti-theft devices, can reduce the risk of accidents or theft. As a result, they offer discounts to policyholders whose vehicles are equipped with these features.

How Do Off-Street Parking Discounts Work?

Off-street parking discounts are a type of car insurance discount that rewards policyholders for parking their vehicles in secured, off-street locations such as driveways, garages, or parking lots. The rationale behind this discount is that vehicles parked off the street are less likely to be vandalized or involved in accidents.

When a driver parks their car in a secured off-street location, they are reducing the risk of theft or damage. Insurance companies consider this lower risk and offer a discount to policyholders who take this precaution. This discount can vary depending on the insurance provider, but it can be a significant savings for drivers who have access to off-street parking options.

It’s worth noting that not all off-street parking locations qualify for this discount. Insurance companies typically have specific criteria that must be met in order for the discount to apply. For example, the parking location may need to be within a certain distance from the driver’s residence or have certain security measures in place.

Drivers who are interested in taking advantage of off-street parking discounts should contact their insurance provider to learn more about the specific requirements and potential savings. By parking their vehicles in secured off-street locations, drivers can not only protect their cars but also enjoy the financial benefits of lower insurance premiums.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

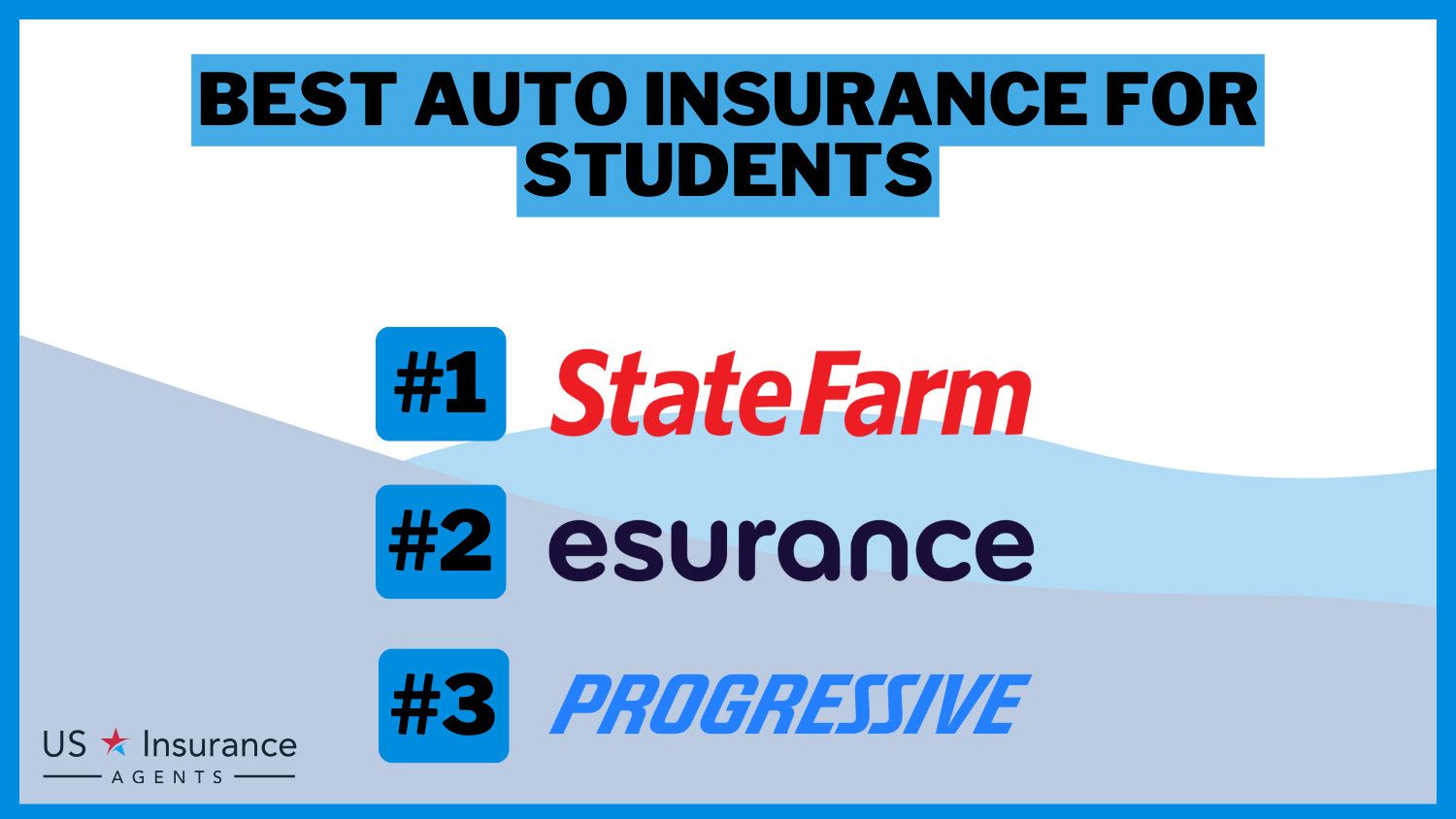

Top Car Insurance Companies Offering Off-Street Parking Discounts

Several top car insurance companies recognize the value of off-street parking and offer discounts to policyholders who take advantage of this safety measure. Here are three companies that provide off-street parking discounts:

Company 1

Company 1 understands the importance of off-street parking in reducing the risk of vehicle damage. They offer a substantial discount to policyholders who park their cars in secure locations overnight. This discount can add up to significant savings over time.

Furthermore, Company 1 recognizes that off-street parking not only reduces the risk of damage but also decreases the likelihood of accidents. By parking in a secure location away from the bustling streets, policyholders can avoid potential collisions with other vehicles or pedestrians. This added layer of safety not only benefits the policyholders but also contributes to the overall reduction of accidents on the road.

Company 2

Company 2 also values the safety benefits of off-street parking and rewards their policyholders accordingly. By storing your vehicle off the street, you can qualify for a discount on your insurance premium.

In addition to the discount, Company 2 goes the extra mile to ensure the peace of mind of their policyholders. They provide a comprehensive guide on finding secure off-street parking options, including information on reputable parking garages and private parking spaces. This way, policyholders can easily locate a safe parking spot and enjoy the added benefit of discounted insurance rates.

Company 3

Company 3 recognizes the decreased risk of accidents and theft that comes with parking off the street. They offer a competitive discount to policyholders who utilize secure parking options.

Moreover, Company 3 understands that parking off the street not only protects the policyholder’s vehicle but also contributes to the overall safety of the community. By encouraging their policyholders to opt for off-street parking, Company 3 actively promotes safer neighborhoods with fewer incidents of theft and vandalism. This commitment to community safety sets Company 3 apart from other insurance providers and demonstrates their dedication to their policyholders’ well-being.

How to Qualify for Off-Street Parking Discounts

To take advantage of off-street parking discounts, you need to meet certain eligibility criteria and follow specific steps. Let’s explore what those are:

Eligibility Criteria

Each insurance company may have its own eligibility requirements for off-street parking discounts. Generally, policyholders must have access to a secured parking spot, such as a locked garage or a monitored parking lot, at their residence or place of work.

Secured parking spots provide added protection for vehicles, reducing the risk of theft, vandalism, and damage caused by natural elements. Insurance companies offer discounts to policyholders who have access to these safer parking options. By ensuring that your vehicle is parked in a secure location, you can potentially save money on your insurance premiums.

When determining eligibility, insurance companies may also consider factors such as the location of the secured parking spot. For example, if you live in an area with a high crime rate, having access to a secured parking spot can be even more beneficial and may increase your chances of qualifying for a discount.

Steps to Apply

If you meet the eligibility criteria, applying for an off-street parking discount is usually a straightforward process. Contact your insurance company and provide them with the necessary information regarding your secured parking location.

When reaching out to your insurance company, be prepared to provide specific details about your secured parking spot. This may include the address, type of parking facility, and any additional security measures in place, such as surveillance cameras or access controls. The more information you can provide, the better equipped your insurance company will be to assess your eligibility and apply the discount.

Once you have provided all the necessary information, your insurance company will review your application and make the appropriate adjustments to your policy. They will notify you of any changes and inform you of the amount of discount you will receive. It’s important to note that the discount may vary depending on your insurance provider and the specific terms of your policy.

It’s worth mentioning that off-street parking discounts are just one of the many ways you can potentially save on your insurance premiums. Other factors such as your driving record, the type of vehicle you own, and your insurance coverage limits can also impact the cost of your policy.

Therefore, it’s always a good idea to explore all available options and speak with your insurance agent to ensure you are getting the best possible rates.

Benefits of Off-Street Parking Discounts

Off-street parking discounts offer several benefits to policyholders, both financially and in terms of safety. Let’s take a closer look:

One of the primary financial benefits of qualifying for an off-street parking discount is the opportunity to enjoy reduced insurance premiums. When you park your vehicle in a designated off-street parking area, such as a private garage or a secure parking lot, insurance companies view it as a lower risk compared to parking on the street.

As a result, they are more likely to offer you a discount on your car insurance policy. These savings may seem small at first, but over time, they can add up and make a significant difference in your overall car insurance costs. By taking advantage of off-street parking discounts, you can stretch your budget and maximize your savings.

In addition to the financial benefits, off-street parking also provides safety advantages for policyholders. When you park your car in a secure location, such as a well-lit parking garage with surveillance cameras or a gated parking lot with security personnel, you significantly reduce the risk of theft, vandalism, and accidents.

This added layer of security gives you peace of mind knowing that your vehicle is better protected. You can park your car without constantly worrying about its safety, allowing you to focus on other important aspects of your daily life.

Moreover, off-street parking facilities often have additional safety measures in place. For example, some parking garages have emergency call buttons strategically placed throughout the facility, allowing you to quickly reach out for help in case of an emergency. These facilities also tend to have clearly marked pedestrian walkways and well-maintained surfaces, reducing the risk of slips, trips, and falls.

Furthermore, off-street parking can also protect your vehicle from the elements. When you park on the street, your car is exposed to various weather conditions such as rain, snow, hail, and extreme heat.

Over time, these elements can take a toll on your vehicle’s exterior, causing paint damage, rust, and other issues. By parking in a covered off-street facility, you shield your car from these weather-related damages, helping to maintain its appearance and value.

Lastly, off-street parking discounts can also have a positive impact on the overall aesthetics of a neighborhood. When more people utilize off-street parking options, there is less congestion on the streets, allowing for smoother traffic flow.

This can lead to a more visually appealing and pedestrian-friendly environment, creating a sense of community and enhancing the overall quality of life for residents.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Common Misconceptions about Off-Street Parking Discounts

Despite the numerous benefits, there are some common misconceptions surrounding off-street parking discounts. Let’s address two of the most prevalent:

Misconception 1

Some people believe that off-street parking discounts only apply to homeowners. However, many insurance companies extend these discounts to renters who have access to secured parking options as well. It’s important to check with your insurance provider to determine if you are eligible, regardless of your homeownership status.

When it comes to off-street parking discounts, it’s not just about owning a home. Insurance companies recognize the value of providing incentives to policyholders who take proactive steps to protect their vehicles. By offering discounts to both homeowners and renters, insurance companies encourage responsible parking habits and reduce the risk of theft or damage to vehicles.

For renters, having access to secured parking options can be a significant advantage. It not only provides a safe place to park your vehicle but also makes you eligible for potential insurance discounts. This means that even if you don’t own a home, you can still enjoy the benefits of off-street parking discounts and save money on your car insurance premiums.

Misconception 2

Another misconception is that off-street parking discounts offer minimal savings. While the actual discount amount may vary between providers, every dollar saved counts. Over time, the cumulative savings can be substantial.

Off-street parking discounts may seem like a small benefit, but they can add up to significant savings. Even if the discount percentage is relatively low, it’s important to remember that it applies to your entire car insurance premium. So, while the savings on a monthly basis might not seem substantial, over the course of a year, they can make a noticeable difference in your overall expenses.

Furthermore, off-street parking discounts are just one piece of the puzzle. When combined with other discounts and safe driving habits, they can lead to even greater savings. Insurance companies often offer a range of discounts, such as good driver discounts, multi-policy discounts, and low mileage discounts.

By taking advantage of all available discounts, you can maximize your potential savings and lower your car insurance premiums even further.

It’s always beneficial to explore all available discounts to maximize your potential savings. Don’t underestimate the power of small discounts, as they can have a significant impact on your financial well-being in the long run.

In conclusion, off-street parking car insurance discounts offer significant savings and added safety for policyholders. By understanding how these discounts work, knowing which companies offer them, and following the necessary steps to qualify, drivers can take advantage of this often overlooked discount.

Don’t forget to compare insurance quotes with our free tool and review rates from different companies online to find the best deals. With off-street parking discounts, you can save money on your car insurance premiums while providing additional protection for your vehicle.

Frequently Asked Questions

What are off-street parking car insurance discounts?

Off-street parking car insurance discounts are special offers provided by insurance companies to policyholders who park their vehicles in secure off-street parking locations, such as garages or private driveways. These discounts aim to reward drivers for reducing the risk of theft, vandalism, and other damages that can occur when parking on the street.

How can I qualify for off-street parking car insurance discounts?

To qualify for off-street parking car insurance discounts, you typically need to have access to a secure off-street parking location for your vehicle, such as a garage or private driveway. Insurance companies may require proof of ownership or proof of regular use of the off-street parking space in order to grant the discount.

What are the benefits of off-street parking car insurance discounts?

Off-street parking car insurance discounts offer several benefits. Firstly, they can help you save money on your car insurance premiums. Additionally, parking in a secure off-street location reduces the risk of theft, vandalism, and other damages, which can result in lower claim rates and potentially protect your no-claims bonus.

Do all insurance companies offer off-street parking car insurance discounts?

No, not all insurance companies offer off-street parking car insurance discounts. However, many reputable insurers provide this type of discount as an incentive for drivers to park their vehicles in secure locations. It is advisable to check with different insurance providers to see if they offer such discounts and compare their offerings.

Can I still get an off-street parking car insurance discount if I don’t have a garage?

While having a garage is often preferred for off-street parking car insurance discounts, it is not always a strict requirement. Some insurance companies may consider other secure off-street parking options, such as private driveways or parking lots with controlled access, when evaluating eligibility for the discount. It is best to check with your insurance provider to understand their specific requirements.

Will off-street parking car insurance discounts lower my premium significantly?

The extent to which off-street parking car insurance discounts lower your premium depends on various factors, including the insurance provider, your location, and your overall risk profile. While these discounts can contribute to reducing your premium, the exact amount of savings may vary. It is recommended to discuss the potential discount with your insurance provider to understand the impact on your specific policy.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.