Best Life Insurance Policies for Lumberjacks

Are you a lumberjack looking for the best life insurance policy? Look no further! This article reveals the top-rated life insurance policies tailored specifically for lumberjacks, ensuring financial security for you and your loved ones. Discover the perfect coverage to protect your high-risk occupation.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. Through her years working in th...

Melanie Musson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated January 2025

Lumberjacking is a physically demanding and high-risk profession. It involves working in hazardous environments, handling heavy equipment, and dealing with unpredictable weather conditions. Due to these risks, it is essential for lumberjacks to have the appropriate life insurance coverage to protect themselves and their loved ones in case of any unforeseen accidents or injuries.

Understanding the Risks of Lumberjacking

Before delving into the best life insurance policies for lumberjacks, it is essential to understand the risks associated with this profession. Lumberjacking involves working with powerful chainsaws, felling trees, and operating heavy machinery in remote areas. The potential for accidents and injuries is high, making it crucial to have adequate insurance coverage to alleviate financial burdens for both the lumberjack and their family.

Common Injuries in the Lumberjack Profession

Some of the common injuries sustained by lumberjacks include chainsaw accidents, falling trees, back and knee injuries, and accidents involving heavy machinery. These injuries can be catastrophic, resulting in long-term disability or even death. It is important to note that chainsaw accidents can lead to severe lacerations and amputations, while falling trees pose a significant risk of blunt force trauma. Additionally, the repetitive strain on the back and knees from lifting heavy logs and operating machinery can cause chronic pain and long-term damage.

Considering these potential dangers, it becomes evident why life insurance is a crucial investment for lumberjacks. With the high-risk nature of their profession, having financial protection in place can provide peace of mind and security for both the lumberjack and their loved ones.

The Importance of Life Insurance for Lumberjacks

Life insurance is especially crucial for lumberjacks due to the inherent risks associated with their profession. It provides financial protection by offering death benefits to the beneficiaries in the event of the insured lumberjack’s death. These benefits can help cover funeral expenses, outstanding debts, mortgage payments, and provide ongoing financial support to the family left behind.

Furthermore, life insurance can serve as a safety net for lumberjacks who may suffer from long-term disabilities resulting from work-related injuries. In such cases, disability benefits can help replace lost income and cover medical expenses, ensuring that the lumberjack and their family can maintain their standard of living despite the challenges they may face.

It is worth noting that life insurance policies for lumberjacks often come with specific provisions tailored to their unique needs. These provisions may include coverage for accidents involving heavy machinery, chainsaw accidents, and even coverage for injuries sustained during transportation to and from remote work locations.

By investing in a comprehensive life insurance policy, lumberjacks can protect themselves and their loved ones from the financial hardships that may arise in the face of accidents or unfortunate events. It is essential to consult with insurance professionals who specialize in providing coverage for high-risk professions like lumberjacking to ensure that the policy meets all specific needs and offers the necessary level of protection.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Types of Life Insurance Policies

When considering life insurance options, there are various types of policies available for lumberjacks to choose from. Understanding the differences between them can help determine the best fit for individual needs.

Life insurance is a crucial financial tool that provides financial protection for your loved ones in the event of your death. It ensures that your family members are taken care of and can maintain their standard of living even in your absence. Let’s explore the different types of life insurance policies in more detail:

Term Life Insurance

Term life insurance offers coverage for a specific period, typically ranging from 10 to 30 years. This type of policy provides a death benefit if the insured passes away during the term of the policy. It is a popular choice among lumberjacks who want to ensure their families are protected during the years when they have significant financial responsibilities.

Term life insurance is often more affordable than other types of policies, making it an attractive option for younger lumberjacks who want coverage for a specific period. It provides peace of mind knowing that your loved ones will be financially secure if something were to happen to you.

Whole Life Insurance

Whole life insurance provides coverage for the entire lifetime of the insured. It includes a death benefit as well as a cash value component that grows over time. This type of policy offers lifelong protection and the potential to accumulate cash value that can be accessed during the insured’s lifetime.

Whole life insurance is a great option for lumberjacks who want permanent coverage and the ability to build cash value over time. The premiums for whole life insurance are generally higher than term life insurance, but the policy provides guarantees and stability that can be beneficial in the long run.

Universal Life Insurance

Universal life insurance is a flexible policy that allows the insured to adjust their coverage and premiums as their needs change over time. This type of policy combines a death benefit with a cash value component that has the potential to grow. It provides flexibility for lumberjacks who may require changes in their coverage due to fluctuating income or other life circumstances.

Universal life insurance offers a balance between the flexibility of term life insurance and the permanent coverage of whole life insurance. It allows policyholders to make changes to their coverage as their financial situation evolves, ensuring that their life insurance policy remains aligned with their needs.

Choosing the right life insurance policy is a personal decision that depends on your specific circumstances and financial goals. It is essential to evaluate your needs and consult with a qualified insurance professional who can guide you through the process and help you make an informed decision.

Remember, life insurance is not just about protecting yourself; it’s about protecting the ones you love and providing them with financial security when they need it the most.

Comparing Life Insurance Policies for Lumberjacks

When comparing life insurance policies for lumberjacks, several factors need to be considered to ensure the best fit for individual circumstances. These factors include coverage options, premium costs, policy terms and conditions, as well as additional considerations specific to the lumberjack profession.

Coverage Options

Each life insurance provider offers different coverage options. It is important for lumberjacks to assess their specific needs and ensure that the chosen policy provides sufficient coverage in case of death or disability. Consider factors such as the death benefit amount, additional riders, and any exclusions that may impact the coverage.

For lumberjacks, who work in a high-risk profession, it is crucial to have coverage that accounts for the unique hazards they face. This may include coverage for accidents that occur while operating heavy machinery, falling trees, or injuries caused by flying debris. Lumberjacks should also consider coverage for disability, as injuries sustained on the job can often result in temporary or permanent disability.

Premium Costs

Premium costs vary between life insurance policies, and it is important to consider affordability and budget when selecting coverage. Lumberjacks should obtain quotes from several providers and compare the premiums charged, keeping in mind that higher-risk professions may result in higher premium rates.

It is worth noting that some insurance providers may specialize in offering coverage specifically tailored to high-risk professions like lumberjacking. These providers may have a better understanding of the unique risks lumberjacks face and may offer more competitive rates compared to providers with a more general focus.

Policy Terms and Conditions

Reading and understanding the policy terms and conditions is crucial to ensure that the selected life insurance policy adequately meets the specific needs of lumberjacks. Pay close attention to factors such as policy length, renewal provisions, conversion options, and any potential exclusions or limitations.

Lumberjacks should also consider the flexibility of the policy. For example, if a lumberjack plans to retire from the profession in the future, it may be beneficial to choose a policy that allows for conversion to a different type of coverage, such as a retirement or long-term care policy.

Furthermore, lumberjacks should carefully review any exclusions or limitations within the policy. Some policies may have specific clauses that limit coverage for injuries sustained while engaging in certain activities, such as extreme sports or hazardous hobbies. It is important to ensure that the policy does not exclude coverage for activities related to lumberjacking.

In conclusion, when comparing life insurance policies for lumberjacks, it is essential to consider coverage options, premium costs, policy terms and conditions, as well as additional considerations specific to the lumberjack profession. By thoroughly evaluating these factors, lumberjacks can make an informed decision and choose a policy that provides the necessary protection for themselves and their loved ones.

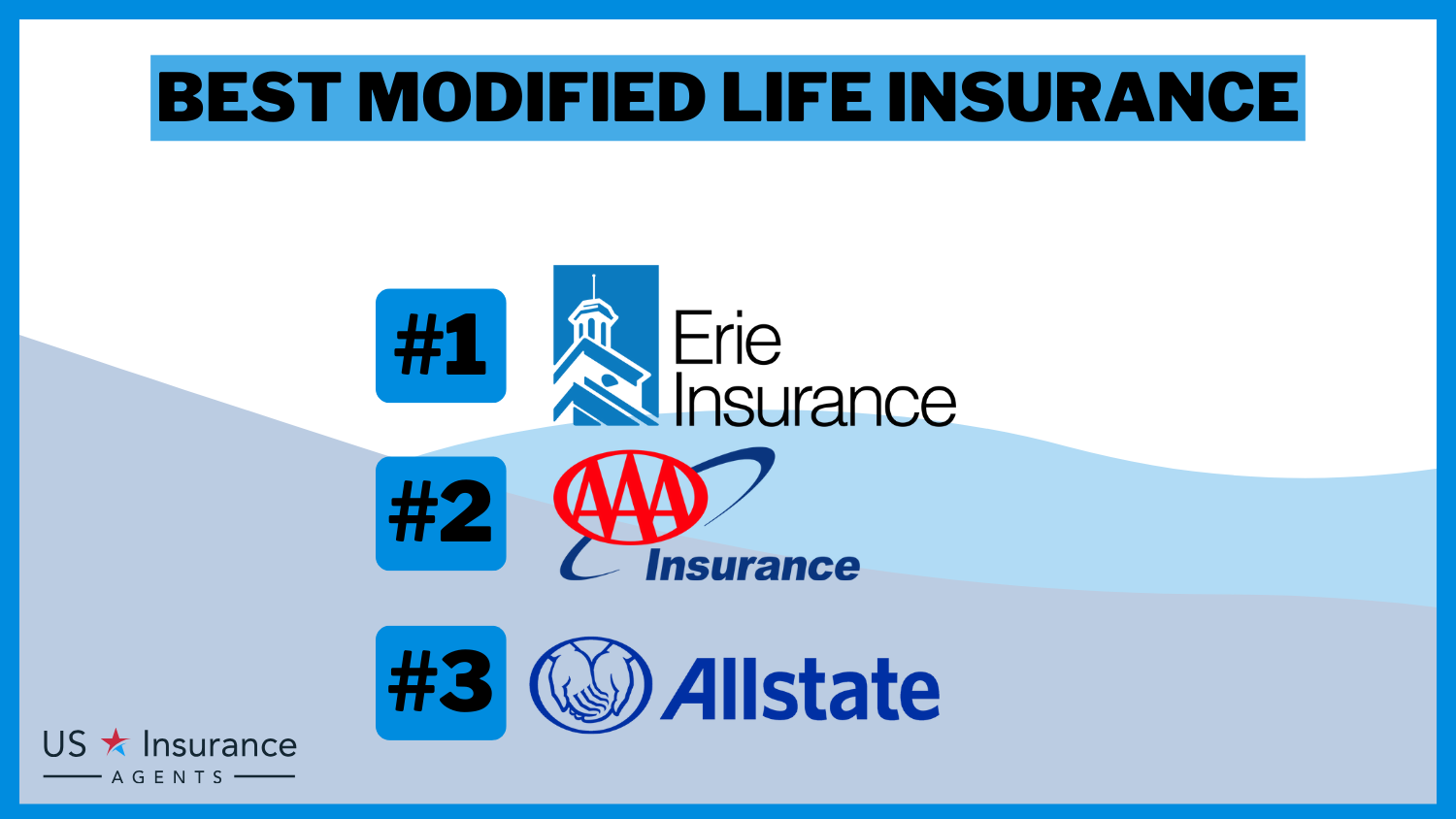

Top Life Insurance Providers for Lumberjacks

When it comes to choosing the best life insurance provider for lumberjacks, it is important to consider not only the policy options but also the reputation and financial stability of the insurer. Lumberjacks, who work in one of the most dangerous professions, face unique risks that require specialized coverage. Here, we will explore three top life insurance providers known for their commitment to serving high-risk professions like lumberjacking.

Provider 1 Review

Provider 1 has a long-standing reputation for offering comprehensive life insurance coverage to lumberjacks. Their policies come with competitive premiums, flexible coverage options, and exceptional customer service. With a deep understanding of the lumberjacking profession, Provider 1 ensures that their coverage addresses the specific risks associated with the job. They take into account factors such as the use of heavy machinery, exposure to extreme weather conditions, and the potential for accidents in remote locations.

Moreover, Provider 1 goes beyond the standard coverage and offers additional benefits tailored to the needs of lumberjacks. These benefits may include coverage for medical expenses resulting from work-related injuries, rehabilitation costs, and even vocational training if a lumberjack is unable to continue working due to a disability. By providing comprehensive coverage and additional benefits, Provider 1 aims to provide financial security to lumberjacks and their families in the face of unforeseen circumstances.

Provider 2 Review

Provider 2 is another reputable life insurance company that offers specialized coverage for high-risk professions like lumberjacking. They understand the unique challenges faced by lumberjacks and have designed their policies to provide the necessary protection. With a range of policy options and customizable features, Provider 2 offers flexibility to meet the specific needs of lumberjacks.

Provider 2 also prioritizes customer satisfaction and ensures that lumberjacks have access to a dedicated team of professionals who understand the intricacies of their profession. Their representatives are knowledgeable about the risks involved in lumberjacking and can provide personalized guidance to help lumberjacks make informed decisions about their life insurance coverage.

Provider 3 Review

Provider 3 is known for its expertise in providing tailored life insurance solutions for lumberjacks. They recognize that lumberjacking is physically demanding and can lead to injuries or disabilities that may prevent a lumberjack from working. As such, Provider 3 offers comprehensive coverage that includes both death benefits and disability benefits.

Provider 3 also understands that the financial needs of lumberjacks and their families can vary greatly. To address this, they offer customizable policies that allow lumberjacks to choose the coverage amount and duration that best suits their individual circumstances. Additionally, Provider 3 provides options for riders that can enhance the coverage, such as critical illness coverage or accelerated death benefits in case of terminal illness.

In conclusion, lumberjacking is a high-risk profession, and having the right life insurance coverage is essential. Understanding the risks, exploring various types of policies, and comparing offerings from top providers will help lumberjacks make an informed decision. By selecting the best life insurance policy, lumberjacks can have peace of mind knowing that their loved ones will be protected financially in case of any unfortunate events. It is crucial for lumberjacks to prioritize their safety and financial well-being by choosing a reputable life insurance provider that specializes in serving high-risk professions like theirs.

Frequently Asked Questions

What are the key factors to consider when choosing a life insurance policy for lumberjacks?

When selecting a life insurance policy for lumberjacks, it is crucial to consider factors such as coverage amount, premium affordability, policy flexibility, and the inclusion of hazardous occupation coverage.

Are there specific life insurance companies that specialize in providing coverage for lumberjacks?

While there may not be insurance companies exclusively catering to lumberjacks, some insurers offer policies that consider the risks associated with occupations like logging. It is recommended to research and compare policies from multiple insurers to find the best fit.

What types of life insurance policies are suitable for lumberjacks?

Lumberjacks may find term life insurance or permanent life insurance options suitable for their needs. Term life insurance provides coverage for a specific period, while permanent life insurance offers lifelong coverage with potential cash value accumulation.

How does the occupation of lumberjack affect life insurance premiums?

The occupation of a lumberjack can impact life insurance premiums due to the higher risk involved. Insurance companies may charge higher premiums to compensate for the increased likelihood of accidents or injuries associated with logging work.

What is hazardous occupation coverage, and why is it important for lumberjacks?

Hazardous occupation coverage is an additional feature in life insurance policies that provides extra protection for individuals engaged in high-risk occupations like lumberjacks. It ensures that in the event of an accident or death related to the occupation, the policyholder or their beneficiaries receive the intended benefits.

Can lumberjacks with pre-existing medical conditions still obtain life insurance?

Yes, lumberjacks with pre-existing medical conditions can still obtain life insurance. However, the availability and cost of coverage may vary depending on the severity of the condition. It is advisable to consult with insurance providers who specialize in underwriting policies for individuals with specific health conditions.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.