Best Life Insurance for Felons in 2026 (Find the Top 10 Companies Here!)

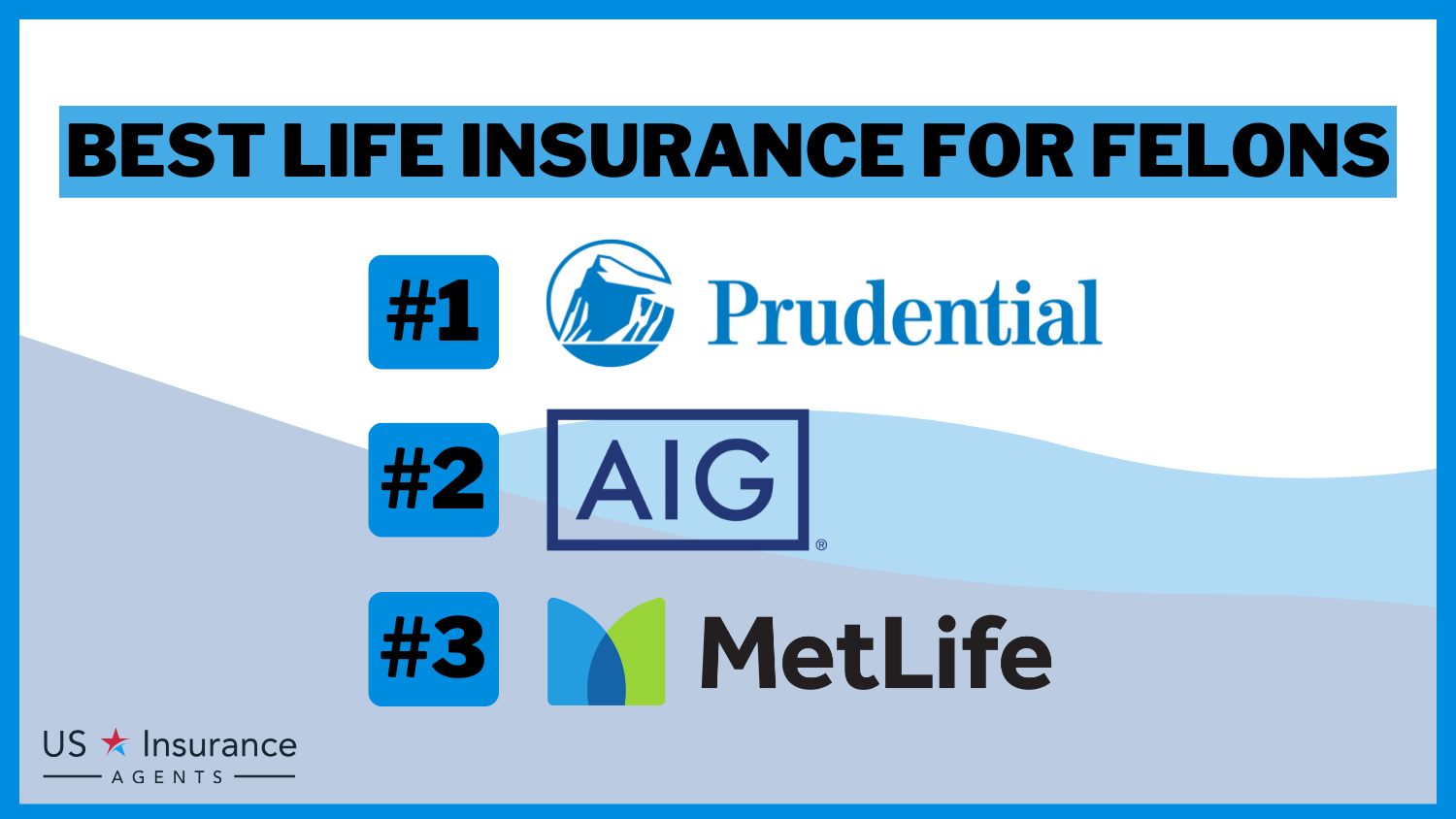

Prudential, AIG, and MetLife emerge as the top overall picks for the best life insurance for felons, offering rates as low as $45 per month. These companies provide specialized solutions with tailored policies and competitive rates, ensuring felons can secure reliable life insurance coverage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Feature Writer

Chris Tepedino is a feature writer that has written extensively about home, life, and car insurance for numerous websites. He has a college degree in communication from the University of Tennessee and has experience reporting, researching investigative pieces, and crafting detailed, data-driven features. His works have been featured on CB Blog Nation, Healing Law, WIBW Kansas, and Cinncinati.com. ...

Chris Tepedino

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Updated January 2025

Company Facts

Full Coverage for Felons

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Felons

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Felons

A.M. Best Rating

Complaint Level

Pros & Cons

Prudential, AIG, and MetLife are the top choices for the best life insurance for felons, offering competitive rates and tailored policies. Delve into their eligibility requirements, available discounts, and unique considerations for felons seeking the best life insurance.

Discover how these providers cater to the specific needs of felons and provide comprehensive coverage options. Learn about the importance of securing life insurance with a criminal record and how to navigate the application process.

Our Top 10 Company Picks: Best Life Insurance for Felons

Company Rank Multi-Policy Discount A.M. Best Best For Jump to Pros/Cons

![]()

#1 10% A+ Flexible Underwriting Prudential

![]()

#2 5% A High-Risk Policies AIG

#3 25% A Comprehensive Options MetLife

#4 15% A- Tailored Coverage Guardian Life

#5 25% A High Approval Rates Liberty Mutual

#6 20% A+ Inclusive Policies Nationwide

#7 20% A++ Personalized Service State Farm

#8 10% A++ Robust Options New York Life

#9 20% A Customizable Plans American Family

#10 20% A High Risk Expertise Farmers

Ensure your loved ones’ future by choosing the right life insurance policy tailored to your unique situation.

You can get free quotes for life insurance and secure financial protection for your loved ones by entering your ZIP code into our tool above.

- Discover the best life insurance for felons with eligibility tips

- Navigate unique challenges felons face when applying for life insurance

- Prudential offers tailored policies with up to 10% discount rates

#1 – Prudential: Top Overall Pick

Pros

- Variety of Policies: Offers term, whole, and universal life insurance, providing flexible options for different needs.

- Financial Stability: Prudential is known for strong financial ratings, ensuring reliability and peace of mind for policyholders. Read more about Prudential insurance review & ratings.

- Competitive Rates: Provides competitive pricing for felons, making it more accessible compared to other companies.

Cons

- Higher Premiums: Felons may face higher premiums due to perceived higher risk.

- Detailed Background Checks: Extensive background checks can be time-consuming and invasive.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – AIG: Best for Flexible Policy Options

Pros

- Flexible Policy Options: Offers various life insurance types, including guaranteed issue policies suitable for high-risk individuals.

- Multiple Discounts: Provides discounts such as multi-policy and healthy lifestyle, helping reduce premiums.

- Tailored Solutions: AIG is recognized for tailoring policies specifically for felons. Discover more in our AIG insurance review & ratings.

Cons

- Higher Monthly Premiums: Premiums can be higher compared to some competitors.

- Strict Eligibility Criteria: May have stringent criteria, making it harder for felons to qualify.

#3 – MetLife: Best for Lowest Rates

Pros

- Low Rates: Our MetLife insurance review & Ratings show the company offers some of the lowest rates for felons in the market.

- Discount Opportunities: Provides discounts for non-smokers and those with healthy lifestyles.

- Reputable Provider: Strong reputation and financial stability in the insurance industry.

Cons

- Limited Severe Felony Coverage: May have limited options for those with severe felony convictions.

- Thorough Background Checks: Extensive checks might deter some applicants.

#4 – Guardian Life: Best for Customer Service

Pros

- Competitive Coverage Rates: Offers favorable rates for both minimum and full coverage.

- Discount Availability: In our Guardian Life insurance review & ratings highlight how the company provides various discounts to help reduce insurance costs.

- Excellent Customer Service: Known for strong customer support and satisfaction.

Cons

- Higher Premiums for Felons: Premiums can be higher for individuals with a criminal record.

- Comprehensive Application Process: Detailed application requirements may be off-putting.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Affordable Minimum Coverage

Pros

- Affordable Rates: According to our Liberty Mutual review & ratings, the company offers competitive pricing, especially for minimum coverage.

- Annual Payment Discounts: Discounts available for annual payments, lowering overall costs.

- Financial Strength: Known for robust financial stability and wide insurance product range.

Cons

- Limited Policy Options: Fewer options for individuals with severe felony convictions.

- Detailed Background Information Required: Application process may be lengthy due to extensive background checks.

#6 – Nationwide: Best for Discount Opportunities

Pros

- Diverse Policy Offerings: Provides term and whole life insurance, offering flexibility.

- Discounts for Lifestyle Choices: Offers non-smoker and healthy lifestyle discounts.

- Good Customer Service: Read our Nationwide insurance review & ratings to see why the company is known for strong customer service and claims handling.

Cons

- Higher Rates for Felons: Premiums can be higher compared to some other providers.

- Strict Eligibility Requirements: Can be difficult for felons to qualify due to stringent criteria.

#7 – State Farm: Best for Unique Discount Programs

Pros

- Unique Discounts: Offers discounts like safe driver and good student, which are beneficial for various policyholders.

- Competitive Pricing: Check our State Farm insurance review & ratings to learn about their good rates for both minimum and full coverage options.

- Personalized Service: Strong reputation for personalized service through a vast network of agents.

Cons

- Higher Premiums for Felons: Felons may face higher premiums due to increased risk assessment.

- Invasive Application Process: Requires detailed background checks, which can be burdensome.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – New York Life: Best for Customizable Policies

Pros

- Variety of Products: Offers customizable life insurance policies to meet different needs.

- Annual Payment Discounts: Discounts for annual payments, reducing overall costs.

- Financial Stability: Discover in our New York Life insurance review & ratings how the company maintains a long-standing reputation for financial stability and reliability.

Cons

- Higher Felon Premiums: Premiums for felons can be higher compared to other companies.

- Extensive Background Checks: In-depth background checks can be time-consuming.

#9 – American Family: Best for Competitive Rates

Pros

- Competitive Rates: Offers favorable rates for both minimum and full coverage.

- Multiple Discounts: Provides discounts for multi-policy and non-smoker clients.

- Good Customer Support: Discover in our American Family insurance review & ratings how the company excels in reliable customer service and support.

Cons

- Higher Felon Premiums: Higher premiums for individuals with criminal records.

- Strict Eligibility: Stringent criteria can make it challenging for some felons to qualify.

#10 – Farmers: Best for Personalized Service

Pros

- Variety of Products: Offers diverse life insurance products, including term and whole life.

- Discounts Available: Our American Family insurance review & ratings show the company provides discounts like multi-policy and healthy lifestyle.

- Personalized Customer Service: Strong emphasis on personalized service and support.

Cons

- Higher Felon Rates: Premiums for felons are generally higher than some competitors.

- Detailed Application Process: Comprehensive background checks can be cumbersome.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Navigating Life Insurance Options With a Felony Conviction

You can buy life insurance if you have a felony, but qualifying for coverage requires a few extra steps. Insurance providers will run a criminal background check with your application, and each company has different criteria for risk and rates. They commonly consider factors like the nature of the felony charges, the time elapsed since the conviction, whether there are multiple felonies, and any charges on your driving record.

Schimri Yoyo Licensed Agent & Financial Advisor

Your answers to these questions will impact your life insurance rates, which are often higher for felons. You may need to shop with high-risk insurance companies to find the right policy. Speaking with local life insurance agents about your felony conviction can help you connect with the right provider for the right policy.

Life Insurance for Felons: Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

AIG $55 $130

American Family $49 $118

Farmers $51 $123

Guardian Life $52 $125

Liberty Mutual $48 $115

Metlife $45 $110

Nationwide $47 $113

New York Life $53 $128

Prudential $50 $120

State Farm $46 $112

The table below shows monthly rates for life insurance for felons from various providers, comparing minimum and full coverage options. AIG offers $55 for minimum and $130 for full coverage. American Family charges $49 for minimum and $118 for full coverage. Farmers’ rates are $51 for minimum and $123 for full coverage. Guardian Life provides $52 for minimum and $125 for full coverage.

Liberty Mutual offers $48 for minimum and $115 for full coverage. Metlife has the lowest rates at $45 for minimum and $110 for full coverage. Nationwide charges $47 for minimum and $113 for full coverage. New York Life’s rates are $53 for minimum and $128 for full coverage. Prudential offers $50 for minimum and $120 for full coverage. State Farm charges $46 for minimum and $112 for full coverage.

Understanding the Cost of Life Insurance for Felons

A felony conviction increases your level of risk. You can expect to pay substandard life insurance rates, which are 25% higher on average than the standard rate. Take a look at the table below to see how life insurance for felons compares to the standard life insurance rates:

Life Insurance for Felons: Monthly Rates by Coverage Level & Age

Age Minimum Coverage Full Coverage

25-Year-Old $157 $196

30-Year-Old $189 $236

35-Year-Old $230 $288

40-Year-Old $278 $347

45-Year-Old $349 $437

50-Year-Old $429 $536

55-Year-Old $550 $687

60-Year-Old $701 $876

65-Year-Old $913 $1,141

Bear in mind that these life insurance rates are just an industry average. Your life insurance premiums will be impacted by the type of felony conviction you have, as well as your age and family health history.

Factors Affecting Life Insurance Eligibility for Felons

A felony conviction doesn’t immediately disqualify you from life insurance, but you may have to wait to apply for coverage for up to a year after you’re sentenced. If you’re currently facing felony charges, life insurance companies will not accept your application until your charges are dismissed or the trial is over. Further, you cannot apply for life insurance if you are on probation or currently incarcerated.

There are a handful of insurance companies that will provide guaranteed-issue life insurance and accidental death and dismemberment coverage to inmates, but if you’re wondering how you can get life insurance for someone in jail, your best bet is to wait until your prison term is over before applying for life insurance.

The table lists available life insurance discounts from top providers for felons. AIG offers multi-policy, healthy lifestyle, and automatic payment discounts. American Family, Farmers, Guardian Life, and Metlife provide multi-policy, non-smoker, and healthy lifestyle discounts. Liberty Mutual includes annual payment discounts, while Nationwide offers healthy lifestyle and non-smoker discounts.

New York Life and Prudential also provide annual payment discounts. State Farm offers unique safe driver and good student discounts. These discounts can help felons find more affordable life insurance options.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Why Life Insurance Companies Consider Criminal Records in Policy Decisions

Those with criminal records tend to live riskier lives and often have lower life expectancy rates. According to some case studies, each year of incarceration can take two years off of one’s life, which isn’t in the best interest of the companies writing these policies.

Since felony convictions are punishable with one year or more in prison, some insurance companies consider convicted felons riskier to insure. To find affordable life insurance for felons, shop around for quotes from multiple companies. For small business insurance if you are a convicted felon, compare options from different insurers to find a suitable policy.

How to Buy Life Insurance for Felons

If you’re ready to buy life insurance, check with your employer to see if a group life insurance plan is offered. This is the easiest way to get life insurance for felons.

Shopping for term life, whole life, or universal life insurance quotes online will also connect you with providers in your area who offer life insurance for felons.

Empowering Felons: How Life Insurance Coverage Provides Security

Explore how life insurance for felons can provide essential coverage, offering peace of mind and financial security. Through real-life case studies, discover how top insurance providers offer specialized solutions tailored to meet the unique needs of individuals with felony convictions.

- Case Study #1 – Securing a Future: John, a 45-year-old with a felony conviction, needed life insurance. Prudential provided a comprehensive plan with multi-policy, healthy lifestyle, and annual payment discounts. Despite higher premiums, Prudential’s robust policy and excellent service ensured John received necessary coverage, reducing his overall cost and offering peace of mind.

- Case Study #2 – Reliable Coverage: Sarah, a 38-year-old felon, sought affordable life insurance. AIG offered Sarah a policy with competitive rates and discounts for being a non-smoker and maintaining a healthy lifestyle. The financial stability and affordable rates of AIG provided Sarah with the coverage she needed, making it a suitable and economical choice.

- Case Study #3 – Affordable Protection: Mike, a 50-year-old with a felony record, explored life insurance options. MetLife provided Mike with a reliable policy featuring multi-policy, non-smoker, and healthy lifestyle discounts. The combination of comprehensive coverage and low complaint levels made MetLife an ideal choice for Mike, offering him the protection he needed at a reasonable cost.

These case studies illustrate how felons can secure life insurance by leveraging discounts and comparing quotes from top providers, ensuring they make informed decisions to protect their loved ones’ future.

Tim Bain Licensed Insurance Agent

By understanding the options available, felons can find reliable and affordable coverage that meets their unique needs, providing peace of mind and financial security.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Finding Life Insurance Solutions for Felons

Securing life insurance as a felon is challenging but achievable. By understanding eligibility requirements, comparing insurance quotes online, and leveraging available discounts, felons can find coverage that meets their needs.

Top providers offer specialized solutions, ensuring financial security and peace of mind for those with a criminal record. Compare rates from multiple companies to make an informed decision and protect your loved ones’ future.

Stop overspending on life insurance. Use our tool below to compare rates from top providers near you.

Frequently Asked Questions

Can felons get life insurance?

Yes, felons can get life insurance. There are life insurance companies that accept felons and offer coverage options. However, the rates may be higher, and the application process may be more stringent due to the increased risk associated with a felony conviction.

Which life insurance companies accept felons?

Several life insurance companies accept felons, including Prudential, AIG, and MetLife. These companies provide tailored policies and competitive rates specifically for individuals with a felony record.

Enter your ZIP code into our free quote comparison tool below to instantly compare life insurance quotes from trusted insurers near you.

What options are available for car insurance for felons?

There are car insurance companies that accept felons and offer policies tailored to their needs. It is advisable to shop around and compare quotes from multiple insurers to find the best rates and coverage options.

To enhance your understanding, explore our comprehensive resource on business insurance titled “If I’ve been convicted of a non-driving related felony, can an insurance company deny me car insurance coverage?” and get the answers you need.

Do life insurance companies check criminal records?

Yes, life insurance companies check criminal records during the application process. This helps them assess the risk associated with insuring an individual with a felony conviction.

How can someone get life insurance with a felony?

Getting life insurance with a felony involves comparing quotes from different life insurance companies that insure felons. It’s important to provide accurate information about your criminal record to find the most suitable policy.

Is there health insurance for felons?

Yes, health insurance for felons is available. Many insurance companies offer health insurance plans for individuals with felony convictions. It’s important to compare options and find a plan that fits your needs and budget.

For more information, check out our detailed guide titled “Individual Health Insurance: A Complete Guide” for all the specifics.

What types of life insurance policies are available for convicted felons?

Life insurance policies for convicted felons include term life, whole life, and universal life insurance. Companies like Prudential, AIG, and MetLife offer these policies with specific considerations for individuals with a criminal record.

Are there life insurance companies that insure felons with assault convictions?

Yes, there are life insurance companies that insure felons with assault convictions. These companies may offer specialized policies with tailored terms and conditions to accommodate the increased risk.

Don’t settle for high life insurance rates. Shop for low rates and ensure your loved ones are protected by entering your ZIP code below.

What should felons consider when looking for insurance for convicted individuals?

When looking for insurance for convicted individuals, it’s crucial to compare quotes from multiple insurers, check the policy terms, and understand the eligibility requirements. Life insurance companies for felons, as well as car insurance companies that accept felons, offer various options tailored to their needs.

To delve deeper, refer to our in-depth report titled “Best Life Insurance: A Complete Guide” for further information.

Can felons get life insurance with no background check?

While it is rare, some life insurance companies offer policies with no background check. These policies typically have higher premiums and limited coverage options compared to standard policies.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.