Best Life Insurance Companies in Minnesota

Are you a Minnesota resident looking for the best life insurance coverage? Discover the top-rated life insurance companies in Minnesota and secure your future with peace of mind. Compare policies, rates, and benefits to find the perfect fit for your needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Kristine Lee is a licensed insurance agent and one of The Zebra’s in-house content strategists. With a background in copywriting, she covers the ins and outs of the home and car insurance industries. She has been a contributor to numerous publications focused on the nuances of insurance, including on The Points Guy.

Kristine Lee

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Ty Stewart

Updated January 2025

Life insurance is an essential financial tool that provides financial security and peace of mind to individuals and their families. It ensures that loved ones are taken care of financially in the event of the policyholder’s death. If you reside in Minnesota and are looking for the best life insurance company, this article will guide you through the process of choosing the right insurer and provide you with an overview of the top companies in the state.

Understanding Life Insurance In Minnesota

Before diving into the details, let’s first understand the importance of life insurance and the laws governing it in Minnesota.

Life insurance is a crucial financial tool that provides peace of mind and financial security for individuals who have dependents or financial obligations. It acts as a safety net, ensuring that your loved ones are financially protected when you are no longer there to support them. By paying regular premiums, you create a fund that can be used to cover various expenses, such as mortgage payments, education costs, and daily living expenses.

Now, let’s delve into the specific laws that govern life insurance in Minnesota.

Importance Of Life Insurance

Life insurance is invaluable for anyone who has dependents or financial obligations. It acts as a safety net, ensuring that your loved ones are financially protected when you are no longer there to support them. By paying regular premiums, you create a fund that can be used to cover expenses such as mortgage payments, education costs, and daily living expenses.

Moreover, life insurance provides a source of income replacement for your beneficiaries. In the event of your untimely demise, the death benefit from your life insurance policy can help replace the income you would have provided, ensuring that your loved ones can maintain their standard of living.

Life insurance also offers tax advantages. In most cases, the death benefit paid out to your beneficiaries is tax-free, providing them with a significant financial advantage during a difficult time.

Life Insurance Laws In Minnesota

Each state has its own set of laws and regulations regarding life insurance. In Minnesota, life insurance policies are regulated by the Minnesota Department of Commerce. The laws ensure that consumers are protected from unfair practices and guarantee that policies meet certain standards.

One important law in Minnesota is the “free look” period, which allows policyholders to review their policy after purchase and cancel it within a specified time frame without penalty. This provides consumers with the opportunity to carefully consider their decision and make any necessary changes.

Additionally, Minnesota law requires life insurance companies to provide policyholders with a detailed policy summary, outlining the key terms and conditions of the policy. This ensures transparency and helps consumers make informed decisions.

Furthermore, Minnesota law prohibits unfair discrimination in the underwriting and pricing of life insurance policies. This means that insurance companies cannot deny coverage or charge higher premiums based on factors such as race, gender, or disability.

It is important to familiarize yourself with these laws before making a decision regarding life insurance in Minnesota. Understanding the legal framework will empower you to make informed choices and ensure that you and your loved ones are adequately protected.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors To Consider When Choosing A Life Insurance Company

Now that you understand the importance of life insurance and the laws in Minnesota, let’s explore the key factors you should consider when selecting a life insurance company.

Life insurance is a vital financial tool that provides peace of mind and financial security for you and your loved ones. However, with numerous life insurance companies in the market, choosing the right one can be a daunting task. To help you make an informed decision, here are some additional factors to consider:

Financial Stability

The financial stability of an insurance company is crucial. You want to ensure that the company can fulfill its obligations and pay out claims when necessary. Look for companies that have high ratings from independent rating agencies such as A.M. Best, Standard & Poor’s, or Moody’s. These ratings provide insights into the financial strength and stability of the insurer.

A financially stable company not only guarantees the payment of claims but also demonstrates its ability to withstand economic downturns and financial challenges. By choosing a financially stable company, you can have confidence that your loved ones will receive the benefits they deserve in the event of your passing.

Coverage Options

Every individual has unique insurance needs. Consider what type of coverage you require – whether it’s term life insurance, whole life insurance, or universal life insurance. The company you choose should offer a range of coverage options to cater to your specific needs and budget.

Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years, while whole life insurance offers lifelong protection with a cash value component. Universal life insurance combines the benefits of both term and whole life insurance, allowing flexibility in premium payments and death benefit amounts.

Additionally, some insurance companies offer riders or add-ons that can enhance your coverage. These may include critical illness riders, which provide a lump sum payment if you are diagnosed with a specified illness, or disability income riders, which offer income replacement if you become disabled and unable to work. Assess your needs and ensure the company you choose can accommodate them.

Customer Service

Good customer service is essential when dealing with life insurance. You want a company that is responsive, helpful, and reliable. Before making a decision, read reviews and testimonials to gauge the company’s reputation for customer service. A company with excellent customer support will be there to assist you throughout the application process and will be available to answer any questions or concerns you may have.

Furthermore, consider the company’s claims process and how efficiently they handle claims. A company with a streamlined and transparent claims process can alleviate stress for your beneficiaries during a difficult time.

Remember, life insurance is a long-term commitment, and you want to choose a company that will be there for you and your loved ones when it matters the most.

By considering these factors, you can make a well-informed decision when selecting a life insurance company. Take your time, compare different companies, and choose the one that best aligns with your needs and priorities. Life insurance is an investment in your family’s future, so make sure you choose wisely.

Top Life Insurance Companies In Minnesota

Now that you know what to consider, let’s take a closer look at the top life insurance companies in Minnesota.

Company 1 Overview And Benefits

Company 1 is known for its exceptional customer service, competitive rates, and a wide range of coverage options. They have a strong financial rating and a solid reputation within the industry. With customizable policies and various riders available, Company 1 offers flexibility to meet your specific needs. Whether you are looking for term life insurance, whole life insurance, or universal life insurance, Company 1 has options that can fit your budget and provide the coverage you need.

One of the key advantages of choosing Company 1 is their excellent post-purchase support. Their dedicated team of customer service representatives is always available to answer any questions or concerns you may have. Additionally, their claim settlement processes are hassle-free, ensuring that you receive the benefits you are entitled to in a timely manner.

Company 2 Overview And Benefits

When it comes to reputation and financial stability, Company 2 stands out. They offer comprehensive coverage options at competitive rates and have a proven track record of honoring their commitments. Whether you are looking for term life insurance, whole life insurance, or universal life insurance, Company 2 has policies that can cater to your specific needs.

One of the standout features of Company 2 is their range of policy types. They understand that each individual’s insurance needs are unique, and therefore, offer a variety of options to choose from. Additionally, Company 2 provides flexible premium payment options, making it easier for customers to find a plan that aligns with their budget.

Customer service is another area where Company 2 excels. Their team of knowledgeable professionals is dedicated to providing exceptional service and addressing any concerns you may have. They strive to make the insurance process as smooth as possible, from the initial inquiry to the claim settlement.

Company 3 Overview And Benefits

Company 3 is renowned for its long-standing presence in the life insurance industry. With a wide range of coverage options tailored to different needs, they provide customers with flexibility and choice. Whether you are looking for term life insurance, whole life insurance, or universal life insurance, Company 3 has policies designed to meet your requirements.

One of the key advantages of choosing Company 3 is their strong financial stability. They have a solid financial rating, giving you peace of mind that your policy will be backed by a reliable company. Additionally, Company 3 has consistently received high customer satisfaction ratings, indicating their commitment to providing excellent service.

Company 3 also offers attractive rider options to enhance policy coverage and provide additional benefits. These riders can include features such as accelerated death benefits, which allow you to access a portion of your death benefit while still alive in case of a terminal illness. Such options provide added security and flexibility for policyholders.

Comparing Life Insurance Rates In Minnesota

Understanding the cost of life insurance is crucial when making a decision. Let’s explore the average cost of life insurance in Minnesota and the factors that affect the rates.

Average Cost Of Life Insurance In Minnesota

The average cost of life insurance in Minnesota can vary depending on factors such as age, health condition, coverage amount, and type of policy. On average, the cost of a term life insurance policy for a healthy individual in Minnesota could range from $XX to $XX per month.

However, it is important to note that these figures are just averages and individual rates may vary. Insurance companies take into account various factors to determine the final cost of a life insurance policy. Let’s delve deeper into these factors to understand how they can influence the rates.

Factors Affecting Life Insurance Rates

Insurance companies consider numerous factors when determining the rates for life insurance policies. These factors help insurers assess the level of risk associated with insuring an individual. By understanding these factors, you can better comprehend how they impact your premium rates.

1. Age: Age is a significant factor in determining life insurance rates. Generally, younger individuals tend to pay lower premiums as they are considered to be at a lower risk of developing health conditions or facing mortality in the near future.

2. Gender: Gender is another factor that can influence life insurance rates. Statistically, women tend to live longer than men, which means they are typically offered lower premiums compared to men of the same age and health condition.

3. Health Status: Your health condition plays a crucial role in determining life insurance rates. Insurers will evaluate your overall health, including any pre-existing medical conditions, to assess the risk of potential claims. Individuals with excellent health are likely to receive more favorable rates.

4. Smoking Habits: Being a smoker can significantly impact life insurance rates. Smoking is associated with various health risks and can lead to serious medical conditions. As a result, smokers are generally charged higher premiums compared to non-smokers.

5. Occupation: Your occupation can also affect life insurance rates. Certain professions may involve higher risks or exposure to hazardous conditions, which can lead to increased premiums. For example, individuals working in high-risk occupations such as firefighters or pilots may be subject to higher rates.

6. Lifestyle Choices: Insurers may also consider your lifestyle choices when determining life insurance rates. Factors such as alcohol consumption, participation in extreme sports, or engagement in risky activities can influence the premiums you are offered.

By considering these factors and understanding how they impact life insurance rates, you can make an informed decision when selecting a policy. It is essential to provide accurate information to insurers during the application process to ensure that you receive the most accurate quotes.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How To Apply For Life Insurance In Minnesota

Once you have selected the right life insurance company, it’s time to apply for a policy. Here are the necessary steps and documents you need to know.

Required Documents For Application

When applying for life insurance, you will typically need to provide documents such as identification proof, income proof, medical records, and beneficiary information. The exact documents required may vary depending on the insurer and the type of policy you choose. It’s always best to check with the company or agent to ensure you have all the required documents in order.

Understanding The Application Process

The application process for life insurance typically involves filling out an application form, undergoing a medical examination (depending on the policy), and providing the necessary documents. The insurer will evaluate your application, review your medical history, and assess your risk profile to determine the premium rates. The process may take a few weeks, but a good insurance company will guide you through the steps and keep you informed throughout.

In conclusion, choosing the best life insurance company in Minnesota requires careful consideration of factors such as financial stability, coverage options, customer service, and cost. By evaluating these criteria and understanding the application process, you can make an informed decision that provides security and peace of mind for you and your loved ones. Remember, life insurance is an investment in your family’s future, so take the time to research and choose wisely.

Frequently Asked Questions

What are the top life insurance companies in Minnesota?

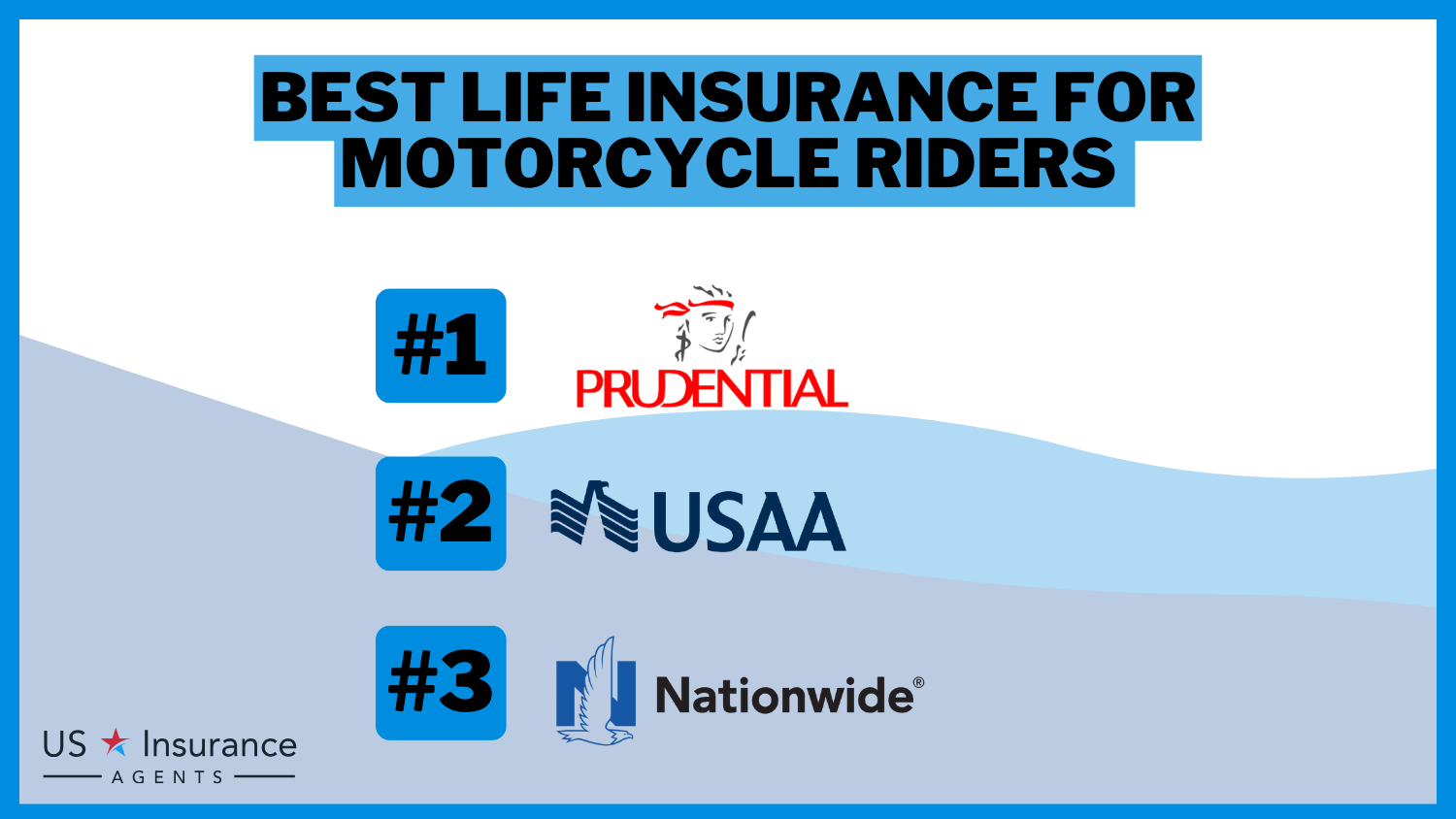

The top life insurance companies in Minnesota include State Farm, Northwestern Mutual, New York Life, Allstate, and Prudential.

How do I choose the best life insurance company in Minnesota?

Choosing the best life insurance company in Minnesota involves considering factors such as financial stability, customer reviews, policy options, coverage limits, and premiums. It is recommended to compare quotes and research each company’s reputation and offerings before making a decision.

What types of life insurance policies are available in Minnesota?

Minnesota offers various types of life insurance policies, including term life insurance, whole life insurance, universal life insurance, and variable life insurance. Each policy type has its own features and benefits, so it’s essential to understand the differences before choosing one.

Can I purchase life insurance in Minnesota if I have pre-existing health conditions?

Yes, you can still purchase life insurance in Minnesota if you have pre-existing health conditions. However, the availability and cost of coverage may vary depending on the severity of the condition and the insurance company’s underwriting guidelines. It is recommended to work with an insurance agent who specializes in high-risk cases to find the best options.

What factors can affect the cost of life insurance in Minnesota?

Several factors can influence the cost of life insurance in Minnesota. These include the individual’s age, gender, health condition, occupation, lifestyle choices (such as smoking), policy type and coverage amount, as well as the insurance company’s underwriting guidelines and pricing structure.

Can I change my life insurance policy in Minnesota if my needs change?

Yes, you can change your life insurance policy in Minnesota if your needs change. Many life insurance policies offer flexibility and options for adjustments. You can typically increase or decrease coverage, convert term policies to permanent ones, add riders for additional benefits, or even switch to a different insurance company if necessary. It is important to review your policy regularly and consult with your insurance agent to ensure it aligns with your current needs.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.