Best Life Insurance Companies in Indiana

Are you looking for the best life insurance companies in Indiana? Look no further! This article provides a comprehensive list of top-rated insurers, helping you make an informed decision to protect your loved ones' future. Don't miss out on finding the perfect coverage for your needs!

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Kalyn Johnson

Updated August 2025

In today’s uncertain world, it’s more important than ever to protect your loved ones financially. Life insurance provides peace of mind by ensuring that your family is taken care of in the event of your passing. If you reside in Indiana and are looking for the best life insurance companies, you’re in luck. We’ve compiled a comprehensive list to help you make an informed decision and secure a policy that meets your specific needs.

Understanding Life Insurance In Indiana

Before diving into the specifics of the top life insurance companies in Indiana, it’s crucial to understand the importance of life insurance and how it works in the state.

The Importance Of Life Insurance

Life insurance offers financial protection to your loved ones if you were to pass away unexpectedly. It provides a lump sum payment, known as the death benefit, to your beneficiaries, which can be used to cover funeral expenses, pay off debts, replace lost income, or even fund your children’s education. Life insurance ensures that your family can maintain the same standard of living even after you’re gone.

Not only does life insurance provide financial security, but it also offers peace of mind. Knowing that your loved ones will be taken care of in the event of your untimely death can bring a sense of comfort during uncertain times. Life insurance acts as a safety net, protecting your family from the financial burden that may arise from your passing.

How Life Insurance Works In Indiana

Life insurance policies in Indiana typically fall into two main categories: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years. If you pass away during this period, your beneficiaries receive the death benefit. Term life insurance is often chosen by individuals who want coverage for a specific period, such as when they have young children or a mortgage to pay off.

Permanent life insurance, on the other hand, offers lifelong coverage and may also accumulate cash value over time. This type of insurance is often selected by individuals who want coverage that extends beyond a specific term and who may also want to build cash value that can be accessed during their lifetime.

When choosing a life insurance policy in Indiana, it’s important to consider your current financial situation, long-term goals, and the specific needs of your family. Evaluating your income, debts, and future financial obligations can help you determine the appropriate coverage amount and type of policy that will best suit your needs.

In addition to considering your personal circumstances, it’s also important to research and compare life insurance companies in Indiana. Factors such as financial stability, customer service, and policy options should all be taken into account. By selecting a reputable and reliable life insurance company, you can have confidence in the coverage you choose.

Furthermore, understanding the specific laws and regulations surrounding life insurance in Indiana is essential. Familiarize yourself with the state’s requirements and any additional provisions that may impact your policy. Being informed about the legal aspects of life insurance can help you make informed decisions and ensure that your policy aligns with your needs and preferences.

Ultimately, life insurance is a valuable tool that provides financial protection and peace of mind for you and your loved ones. By understanding how life insurance works in Indiana, evaluating your personal circumstances, and selecting a reputable company, you can secure the coverage that will best serve your needs and protect your family’s future.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors To Consider When Choosing A Life Insurance Company

When evaluating the best life insurance companies in Indiana, several factors come into play. These include financial stability, policy options, customer service, and more.

Financial Stability

One crucial aspect to consider is the financial stability of the life insurance company you choose. You want to ensure that the company has the financial resources to fulfill its obligations and pay out claims promptly when the time comes. Look for companies with strong financial ratings from independent rating agencies to give you peace of mind.

Financial stability is not just a measure of a company’s current financial health but also its long-term viability. A financially stable company will have a solid track record of financial performance and a robust investment portfolio. It will be able to weather economic downturns and continue to provide reliable coverage to its policyholders.

Furthermore, a financially stable life insurance company is more likely to offer competitive premiums. With a strong financial foundation, the company can better manage its risks and offer attractive pricing to its policyholders. This means that you can secure the coverage you need without breaking the bank.

Policy Options

Another factor to consider is the variety of policy options offered by the life insurance company. Different individuals and families have different needs, so it’s essential to find a company that offers policies that align with your specific requirements. Whether you’re looking for term or permanent coverage, make sure the company has the options that suit your situation.

Policy options go beyond just the type of coverage offered. A comprehensive life insurance company will provide a range of riders and add-ons that allow you to customize your policy to fit your unique circumstances. These may include options for accelerated death benefits, which allow you to access a portion of your death benefit if you become terminally ill, or riders that provide additional coverage for specific events like accidental death.

Additionally, a life insurance company that offers flexible policy options can adapt to your changing needs over time. As your life circumstances evolve, you may need to increase or decrease your coverage, change beneficiaries, or adjust your policy in other ways. Having a company that can accommodate these changes will save you time and effort in the long run.

Customer Service

Lastly, don’t overlook the importance of excellent customer service when selecting a life insurance company. You want a company that not only provides a smooth and efficient application process but also offers reliable customer support after the policy is issued. Look for companies with a reputation for exceptional customer service and a track record of promptly assisting policyholders.

Customer service encompasses several aspects, including responsiveness, accessibility, and transparency. A good life insurance company will have knowledgeable and friendly representatives who can answer your questions and guide you through the application process. They will be available to assist you with any concerns or issues that may arise during the life of your policy.

In addition to direct customer service, consider the company’s digital capabilities. A life insurance company that offers online account management, mobile apps, and other digital tools can make it easier for you to access your policy information, pay premiums, and make changes to your coverage. These technological advancements can greatly enhance your overall experience as a policyholder.

Remember, choosing a life insurance company is a significant decision that will have long-term implications for you and your loved ones. By considering factors such as financial stability, policy options, and customer service, you can make an informed choice that provides you with the peace of mind and financial protection you need.

Top Life Insurance Companies In Indiana

Now that we’ve discussed the factors to consider when selecting a life insurance company, let’s dive into the top insurers in Indiana. These companies have demonstrated excellence in providing reliable coverage and outstanding service to their policyholders.

Company Profiles And Reviews

Company A: XYZ Life Insurance Company has been a trusted name in the industry for over 50 years. With exceptional financial ratings and a wide range of policy options, they strive to meet the unique needs of Indiana residents.

XYZ Life Insurance Company understands that life insurance is a vital part of financial planning. They offer a variety of policies tailored to individual needs, whether it’s term life insurance for temporary coverage or whole life insurance for long-term protection. Their team of experienced professionals is dedicated to helping customers find the right policy for their specific circumstances.

With a strong presence in Indiana, XYZ Life Insurance Company has built a reputation for reliability and customer satisfaction. Their commitment to prompt and efficient claims processing ensures that policyholders receive the support they need during difficult times. Whether it’s providing financial assistance for funeral expenses or helping beneficiaries navigate the claims process, XYZ Life Insurance Company goes above and beyond to support their customers.

Company B: ABC Life Insurance Company has a reputation for exceptional customer service and a strong commitment to policyholder satisfaction. Their comprehensive coverage options make them a popular choice among Indiana residents.

ABC Life Insurance Company understands that every individual has unique insurance needs. That’s why they offer a wide range of coverage options, including term life insurance, whole life insurance, and universal life insurance. Their policies are designed to provide financial protection for loved ones in the event of death, as well as additional benefits such as cash value accumulation and flexible premium payments.

What sets ABC Life Insurance Company apart is their dedication to customer service. Their team of knowledgeable agents is readily available to answer any questions and provide guidance throughout the policy selection process. Additionally, their efficient claims processing ensures that beneficiaries receive the necessary funds in a timely manner, allowing them to focus on healing and moving forward.

Company C: 123 Life Insurance Company offers affordable rates and flexible policy terms, making them an attractive option for those on a budget. Their strong financial stability ensures that your loved ones will be taken care of, even in uncertain times.

123 Life Insurance Company understands that cost is an important factor when considering life insurance. They strive to provide affordable rates without compromising on the quality of coverage. With a range of policy terms to choose from, customers can find a plan that suits their needs and budget.

Despite their competitive rates, 123 Life Insurance Company maintains a strong financial stability. This reassures policyholders that their loved ones will be protected, even in challenging economic times. By prioritizing financial security, 123 Life Insurance Company ensures that their customers can have peace of mind knowing that their beneficiaries will be taken care of when they need it most.

Detailed Comparison Of Indiana Life Insurance Companies

Now, let’s take a closer look at the top life insurance companies in Indiana and compare them based on coverage options, pricing, and customer satisfaction.

Coverage Options

Company A offers a wide range of coverage options, including term life and permanent life insurance. They also provide additional riders for added flexibility and customization.

Company B specializes in term life insurance, offering various policy durations to cater to different needs. They also have options for convertible policies, allowing you to convert your term policy into a permanent one without medical underwriting.

Company C focuses on permanent life insurance, offering both whole life and universal life policies. These policies provide lifelong coverage and cash value accumulation over time.

Pricing

When it comes to pricing, all three companies offer competitive rates. However, it’s important to note that the cost of life insurance varies based on several factors, including your age, health, and the amount of coverage you need.

We recommend obtaining quotes from each company to compare prices and determine the most affordable option that meets your specific requirements.

Customer Satisfaction

All three companies boast high customer satisfaction ratings, indicating a positive experience for policyholders. However, it’s always wise to read reviews and gather feedback from existing customers to gauge their overall satisfaction with the claims process and customer service.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips For Buying Life Insurance In Indiana

Before finalizing your life insurance policy in Indiana, here are a few tips to keep in mind:

Understanding Your Needs

Assess your financial situation and determine the amount of coverage you need to protect your loved ones adequately. Consider existing debts, future financial goals, and potential expenses, such as your children’s education or mortgage payments.

Shopping Around For The Best Rates

Obtain quotes from multiple insurance companies to compare rates and find the best value for your money. Remember, the cheapest option may not always provide the ideal coverage, so consider the overall package offered by each company.

By taking the time to evaluate your needs and compare the top life insurance companies in Indiana, you can ensure that your loved ones are well-protected in the face of life’s uncertainties. Choose a company with a strong financial standing, a wide range of policy options, and a reputation for excellent customer service. With the right life insurance policy in place, you can have peace of mind knowing that your family’s future is secure.

Frequently Asked Questions

What are the best life insurance companies in Indiana?

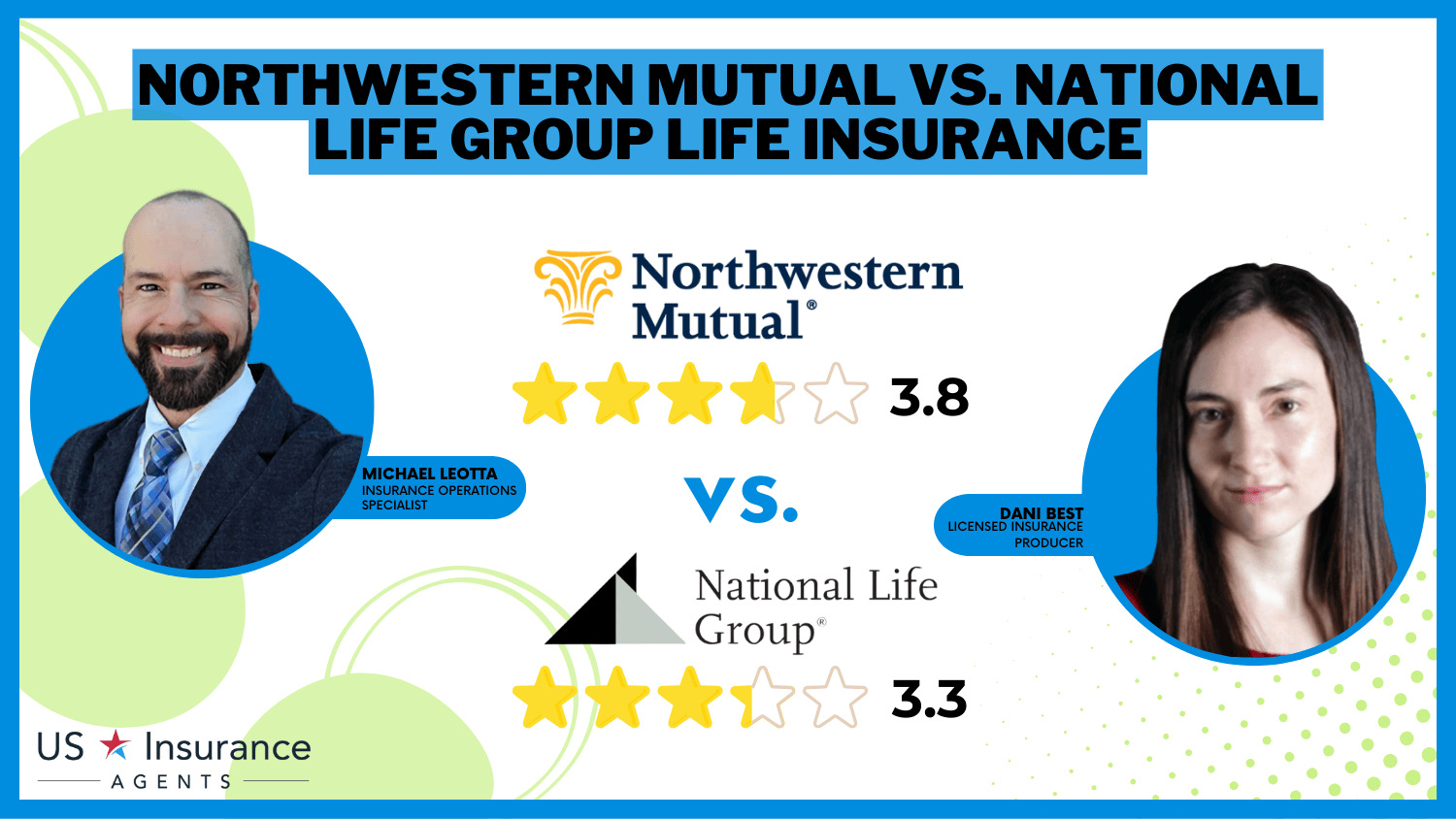

Some of the best life insurance companies in Indiana include State Farm, Northwestern Mutual, New York Life, Mutual of Omaha, and Prudential.

What factors should I consider when choosing a life insurance company in Indiana?

When choosing a life insurance company in Indiana, it is important to consider factors such as financial stability, customer service, policy options, coverage amounts, premium rates, and the company’s reputation.

What types of life insurance policies are offered by these companies?

The mentioned companies offer various types of life insurance policies, including term life insurance, whole life insurance, universal life insurance, and variable life insurance. Each type has its own features and benefits.

How can I determine the right amount of life insurance coverage for me?

Determining the right amount of life insurance coverage depends on several factors, including your financial obligations, income replacement needs, outstanding debts, future education expenses, and any specific goals you may have. It is recommended to assess your financial situation and consult with a financial advisor or insurance agent to determine the appropriate coverage amount.

What are some additional factors to consider when comparing life insurance companies?

In addition to the aforementioned factors, it is also important to consider the company’s claims process, policy flexibility, riders and additional benefits offered, underwriting process, and any specific features or discounts that may be relevant to your needs.

Can I get life insurance coverage if I have pre-existing health conditions?

While having pre-existing health conditions may affect the availability and cost of life insurance coverage, many companies still offer options for individuals with such conditions. It is advisable to consult with insurance agents or brokers who can help you find companies that specialize in providing coverage for individuals with pre-existing conditions.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.