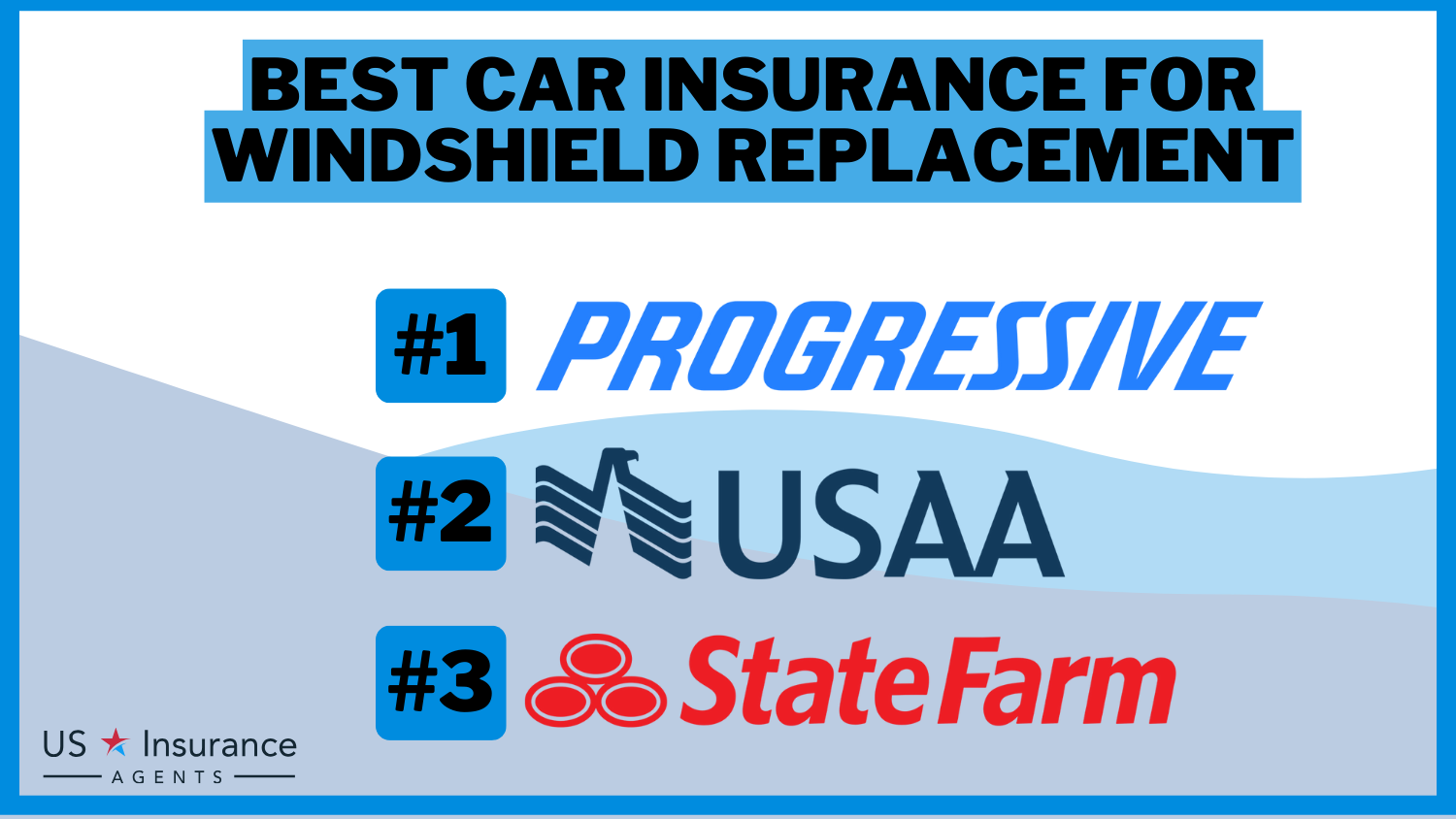

Best Car Insurance for Windshield Replacement in 2026 (Your Guide to the Top 10 Companies)

Progressive, USAA, and State Farm are the top picks for the best car insurance for windshield replacement, with policies starting at just $40 monthly. They offer comprehensive coverage options and reliable service, ensuring optimal protection and high customer satisfaction for all windshield replacement needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Jimmy McMillan

Updated January 2025

13,285 reviews

13,285 reviewsCompany Facts

Full Coverage for Windshield Replacement

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 6,590 reviews

6,590 reviewsCompany Facts

Full Coverage for Windshield Replacement

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 18,157 reviews

18,157 reviewsCompany Facts

Full Coverage for Windshield Replacement

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviewsThe best car insurance for windshield replacement are Progressive, USAA, and State Farm. These top providers not only provide specialized coverage for windshield damage but also offer substantial savings.

This guide emphasizes the importance of windshield replacement coverage in car insurance, addressing both visual and safety concerns associated with damaged windshields. It covers key factors in insurance selection, showcases top companies providing this coverage, explains how it works, outlines benefits, and offers tips for filing claims.

Our Top 10 Company Picks: Best Car Insurance for Windshield Replacement

| Company | Rank | Multi-Policy Discount | Low-Mileage Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 30% | Online Convenience | Progressive | |

| #2 | 10% | 10% | Military Savings | USAA | |

| #3 | 17% | 30% | Many Discounts | State Farm | |

| #4 | 25% | 20% | Add-on Coverages | Allstate | |

| #5 | 20% | 20% | Usage Discount | Nationwide |

| #6 | 10% | 15% | Local Agents | Farmers | |

| #7 | 25% | 30% | Customizable Polices | Liberty Mutual |

| #8 | 13% | 10% | Accident Forgiveness | Travelers | |

| #9 | 20% | 20% | Student Savings | American Family | |

| #10 | 10% | 20% | Deductible Reduction | The Hartford |

To find the ideal car insurance rates and coverage tailored to your needs, enter your ZIP code above. Compare rates from top insurance providers and confidently drive, knowing you have the right coverage to protect your loved ones on the road.

- Progressive is the top choice for the best car insurance for windshield replacement

- Policies include options for both full and partial windshield coverage

- Discounts available for multiple policies and safe driving records

Understanding the Importance of Windshield Replacement Coverage

Having windshield replacement coverage is essential for any car owner. Windshield damage can occur unexpectedly, whether it’s due to a pebble flying off a passing truck or a stray baseball during a neighborhood game. Without coverage, you may find yourself paying out-of-pocket for expensive repairs or replacements.

Furthermore, a damaged windshield poses safety risks as it compromises the structural integrity of the vehicle. It’s crucial to understand the importance of windshield replacement coverage and how it can protect you from unexpected expenses and potential hazards. Learn more in our “What is included in comprehensive car insurance?”

Laura Walker Former Licensed Agent

One of the key benefits of windshield replacement coverage is that it can save you a significant amount of money. Windshield repairs or replacements can be costly, especially if you have a high-end vehicle or if the damage is extensive. With coverage, you can avoid the financial burden of these expenses and have peace of mind knowing that your insurance will take care of it.

In addition to financial protection, windshield replacement coverage also ensures your safety on the road. A damaged windshield can impair your visibility, making it difficult to see the road and other vehicles. This can increase the risk of accidents and jeopardize the safety of you and your passengers.

Factors to Consider When Choosing Car Insurance for Windshield Replacement

When selecting a car insurance policy that offers windshield replacement coverage, several factors should be taken into consideration. First, you should assess the level of coverage provided. Is it limited to only windshield replacement, or does it also cover repairs for minor damages? Next, focus on the deductible amount.

A lower deductible means you will pay less out-of-pocket in the event of a claim, but it usually comes with a higher premium. Additionally, check if there are any restrictions on the number of claims you can make within a specific period. Learn more on how does the insurance company determine my premium.

These factors, along with others such as customer service, reputation, and financial stability of the insurer, should be thoroughly evaluated before making a decision. Another important factor to consider when choosing car insurance for windshield replacement is the process for filing a claim. It is crucial to understand the steps involved and the ease of filing a claim.

Some insurance companies may have a streamlined online claim submission process, while others may require you to go through a lengthy and complicated process. Additionally, consider the turnaround time for claim processing and the availability of a network of approved repair shops. These factors can greatly impact your experience and convenience when it comes to getting your windshield replaced or repaired.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

A Comprehensive Guide to Finding the Best Car Insurance for Windshield Replacement

Finding the best car insurance for windshield replacement can seem like a daunting task, considering the numerous options available in the market. However, by following a systematic approach, you can simplify the process. Start by researching different insurers and their windshield replacement coverage options. Read customer reviews, compare prices, and evaluate the extent of coverage provided.

Additionally, consider seeking recommendations from friends, family, or trusted professionals in the automotive industry. By conducting thorough research and seeking expert advice, you can make an informed decision and find the best car insurance policy to protect your windshield. To find out more, explore our guide titled “How to Get Free Insurance Quotes Online.”

How Does Windshield Replacement Coverage Work

Windshield replacement coverage operates in a manner akin to other insurance types (read our “Types of Car Insurance Coverage” for more information). When opting for a policy inclusive of this coverage, you remit a premium to the insurance company. In return, they commit to covering expenses associated with repairing or replacing your damaged windshield.

In instances of substantial damage necessitating replacement, you would generally be responsible for the deductible, a predetermined amount set at the policy’s initiation. Subsequently, the insurance company shoulders the remaining costs. It is crucial to comprehend the precise terms and conditions of your policy to ascertain any constraints or limitations that may apply.

The Benefits of Having Windshield Replacement Coverage in Your Car Insurance Policy

Having windshield replacement coverage offers numerous benefits for car owners. Firstly, it provides financial protection by covering the costs associated with repairing or replacing a damaged windshield. This can save you from potentially high out-of-pocket expenses.

Additionally, when you have proper coverage, you can rest assured that the repair or replacement will be carried out by professionals to maintain the safety standards of your vehicle. Moreover, some policies may even offer additional benefits such as free chip repair or coverage for other glass components of your car. These benefits make windshield replacement coverage a vital aspect of any comprehensive car insurance policy.

Read more: Best Car Insurance for New Car Replacement Coverage

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips for Filing a Claim for Windshield Replacement With Your Car Insurance Provider

Filing a claim for windshield replacement with your car insurance provider can be a straightforward process if you follow a few essential tips. Start by reporting the damage to your insurance company as soon as possible. Take detailed photographs of the damage and provide all the necessary documentation requested by your insurer. Be prepared to pay the deductible if required.

Finally, choose an approved repair shop or glass technician recommended by your insurance company to ensure a seamless and hassle-free experience. By following these tips, you can expedite the claims process and get your windshield repaired or replaced efficiently. Unlock details on how can I track the progress of my car insurance claim.

Common Mistakes to Avoid When Choosing Car Insurance for Windshield Replacement

When selecting car insurance coverage for windshield replacement, it’s crucial to avoid common mistakes that can lead to inadequate coverage or unnecessary expenses. One common mistake is not thoroughly understanding the terms and conditions of the policy.

Be sure to read all the fine print and ask any questions you may have to clarify the coverage. Another mistake is choosing the lowest deductible without considering the impact on the overall premium. Finding the right balance between the deductible (read our “What is embedded deductible?” for more information) and premium is essential to ensure affordability without compromising on coverage.

Additionally, not comparing quotes from multiple insurers can result in missed opportunities to find better coverage at a more reasonable price. By avoiding these mistakes, you can make an informed decision when choosing car insurance for windshield replacement.

Exploring Different Types of Windshield Damage and Coverage Options

Windshield damage can occur in various forms, ranging from minor cracks and chips to extensive breaks. Different types of damage may require different repair or replacement methods, which may affect the insurance coverage options available. Some policies offer coverage for minor repairs, while others focus solely on replacement.

It’s important to understand the different types of windshield damage and their corresponding coverage options to ensure your policy adequately protects you in any situation. Consult with your insurance provider to clarify the specific details of your coverage and understand the extent of protection offered. See more details on our guide titled “Does my car insurance cover damage to my windshield?”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Deductibles and Premiums for Car Insurance With Windshield Replacement Coverage

Comparing deductibles and premiums is a crucial step when evaluating car insurance policies that offer windshield replacement coverage. Deductibles can vary significantly between insurers and policies. While a lower deductible may be desirable to minimize out-of-pocket expenses, it often results in a higher premium.

On the other hand, a higher deductible can lower your premium but may require a larger upfront payment in the event of a claim. It’s important to consider your budget, risk tolerance, and the potential savings over the long term when comparing deductibles and premiums for car insurance with windshield replacement coverage. Unlock details in our guide titled “Is a broken windshield covered by car insurance?”

Understanding the Fine Print: Exclusions and Limitations in Windshield Replacement Coverage

Reading and understanding the fine print of your car insurance policy is crucial to avoid any surprises or misunderstandings when it comes to windshield replacement coverage. Policies may have certain exclusions or limitations that can limit your coverage. For example, coverage may not apply to damages caused intentionally or due to neglect.

Jeff Root Licensed Life Insurance Agent

Additionally, there may be restrictions on the number of claims you can make within a specific period. By thoroughly reviewing the fine print, you can ensure that you are aware of any exclusions or limitations and make informed decisions accordingly.

Learn more by reading our guide: Can I get car insurance for a car that is modified or customized?

How to Save Money on Car Insurance With Comprehensive Windshield Replacement Coverage

While having comprehensive windshield replacement coverage is important, it’s also essential to find ways to save money on car insurance premiums. One way to achieve this is by bundling multiple policies with the same insurance company, such as car and home insurance. Companies often offer discounts for bundling, resulting in overall savings.

Additionally, safe driving habits and maintaining a clean driving record can lead to lower premiums. Some insurers also offer discounts for using approved repair shops or completing defensive driving courses. Exploring such options and discussing them with your insurance provider can help you find ways to save money without compromising on the coverage you need.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Expert Advice: What to Look for When Evaluating Car Insurance Quotes for Windshield Replacement Coverage

When evaluating car insurance quotes for windshield replacement coverage, there are several key factors to consider. Firstly, assess the extent of coverage offered. Look for comprehensive coverage that includes both repairs and replacements. Next, compare deductibles and premiums to find the right balance between affordability and coverage (For more information, read our “Compare Car Insurance Quotes”).

Additionally, consider the reputation and financial stability of the insurer. You want to ensure that the company has a strong track record of fair claims handling and reliable customer service. Seeking expert advice from insurance professionals or consulting reputable online resources can provide further guidance on what to look for when evaluating car insurance quotes.

Case Studies: Exemplary Windshield Replacement Assistance From Top Insurance Companies

Windshield damages can be a significant inconvenience for any driver, requiring prompt and efficient solutions. The following case studies exemplify how best insurance companies like Progressive, USAA, and State Farm provide exemplary windshield replacement services, highlighting their dedication to customer satisfaction and efficient claim handling.

- Case Study #1 – A Seamless Online Journey for Swift Recovery: Sarah Johnson, a Progressive policyholder, recently faced the challenge of a severely cracked windshield caused by road debris. Sarah took advantage of Progressive’s up to 30% coverage for windshield replacement by initiating the claim online. The insurer’s user-friendly platform ensured a seamless process. With a reasonable deductible, Progressive swiftly coordinated the replacement, highlighting the company’s commitment to efficient online services and ensuring a rapid recovery for Sarah.

- Case Study #2 – Military Precision in Windshield Replacement: John Anderson, a proud USAA member and military servicemember, encountered a damaged windshield during a cross-country move. Utilizing USAA’s up to 10% military savings on windshield replacement, John experienced the insurer’s commitment to precision and efficiency. USAA’s dedicated support for military personnel ensured a smooth process, showcasing the company’s commitment to serving those who serve.

- Case Study #3 – Many Discounts, One Satisfied Customer: Emily Rodriguez, a State Farm policyholder, found herself with a cracked windshield after a rock kicked up from the road. Benefiting from State Farm’s up to 30% discount on windshield replacement, Emily appreciated the company’s extensive coverage options. State Farm’s straightforward claims process and substantial discounts made the entire experience hassle-free, demonstrating the insurer’s commitment to customer satisfaction.

These case studies underscore the effectiveness of tailored insurance solutions in managing auto repairs with ease and precision. Progressive, USAA, and State Farm not only deliver substantial financial benefits but also ensure a seamless and satisfactory service experience, reinforcing their commitment to supporting their policyholders through every challenge.

Real Stories: How Car Insurance With Windshield Replacement Coverage Saved the Day

Real-life stories can provide powerful testimonials for the benefits of having car insurance with windshield replacement coverage. These stories highlight how individuals’ financial burdens were alleviated and their safety ensured by having the right coverage in place.

Tales of accidents, unexpected events, and instances where windshield replacement coverage acted as a lifeline can serve as a reminder of the importance of this coverage. By sharing real stories, we hope to inspire readers to take action and safeguard their vehicles and well-being through adequate car insurance coverage.

Melanie Musson Published Insurance Expert

In summary, securing optimal car insurance for windshield replacement is paramount for both financial protection and road safety. A comprehensive understanding of coverage significance, thoughtful policy selection, thorough research on leading insurers, familiarity with coverage mechanics, heeding expert advice, and drawing insights from real experiences empower you to make informed decisions.

Be diligent in comparing quotes, delving into policy details, and leveraging discounts to achieve cost savings without compromising comprehensive protection. With the appropriate windshield replacement coverage, you can drive confidently, assured that unforeseen damages will be promptly and efficiently addressed. To learn more, explore our comprehensive resource on “Insurance Quotes Online.”

Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

Frequently Asked Questions

What is windshield replacement coverage?

Windshield replacement coverage is an optional add-on to car insurance policies that covers the cost of replacing a damaged or broken windshield.

For additional details, explore our comprehensive resource titled “Will my insurance company cover the replacement of my windshield?“

Does car insurance cover windshield replacement?

Yes, some car insurance policies offer coverage for windshield replacement. However, it may be an optional add-on and not included in every policy.

How do I know if my car insurance covers windshield replacement?

To determine if your car insurance covers windshield replacement, you should review your policy documents or contact your insurance provider directly. They will be able to provide you with specific information regarding your coverage.

What factors should I consider when choosing the best car insurance for windshield replacement?

When selecting car insurance for windshield replacement, consider factors such as the coverage limits, deductible amount, premium cost, and any additional benefits or discounts offered by the insurance provider.

Are there any limitations to windshield replacement coverage?

Yes, there may be certain limitations to windshield replacement coverage. These limitations can vary depending on the insurance policy and may include restrictions on the number of replacements allowed within a specific time period or limitations on the types of damage covered.

To find out more, explore our guide titled “Does it make more sense to increase my car insurance limits or buy an umbrella policy?“

Can I choose any windshield replacement service provider?

Insurance policies may have preferred or approved service providers for windshield replacement. It is important to check with your insurance provider to determine if there are any restrictions or requirements regarding the choice of service provider.

Can you claim a windscreen on insurance?

If your windscreen is chipped, cracked or smashed, windscreen insurance could pay for the cost of repairs or replacement. Having windscreen cover as part of your car insurance policy will help you to avoid out-of-pocket expenses for repairs but you may still need to pay an excess.

Does Liberty Mutual cover cracked windshields?

Yes, Liberty Mutual offers coverage for cracked windshields as part of its comprehensive auto insurance policies, subject to your deductible.

Are windshields covered under warranty?

Because the windshield is generally categorized as a “wear item,” much in the same way brake pads, tires, and seatbelts are, even comprehensive warranties won’t usually cover them. The good news is that a chipped or cracked windshield will probably be categorized as accidental damage.

To find out more, explore our guide titled “Liability Insurance: A Complete Guide.”

Does windscreen replacement affect insurance?

The majority of insurers won’t increase your renewal premium if you make a claim for a windscreen repair or replacement. Just remember that there’s always an exception to every rule and you might be the unlucky exception.

How much does insurance increase after a claim?

Are windscreen repairs free?

Is it worth getting a OEM windshield replacement?

Should I replace windshield with OEM?

Can you claim a windscreen on insurance?

How important is it to replace windshield?

Does a windscreen claim count as a claim?

Does insurance cover windshield calibration?

Should I make a claim for windscreen replacement?

How much is excess for windscreen replacement?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.