Best Car Insurance for Teens in Wisconsin

Finding the Best Car Insurance for Teens in Wisconsin: A Comprehensive Guide to Protecting Your Teen Driver and Your Wallet

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Ty Stewart

Updated September 2024

Car insurance for teenage drivers in Wisconsin is an important consideration for both parents and teenagers alike. Teenagers are known to be high-risk drivers due to their inexperience behind the wheel, and insurance companies often charge higher premiums to compensate for this increased risk. However, with careful research and understanding of the factors involved, it is possible to find the best car insurance for teens in Wisconsin that offers the right balance of coverage and affordability. In this article, we will explore various aspects related to car insurance for teen drivers in Wisconsin to help you make an informed decision.

Understanding The Importance Of Car Insurance For Teen Drivers In Wisconsin

Car insurance for teenage drivers in Wisconsin is not only important but also legally required. In Wisconsin, like most states, it is mandatory to have minimum liability coverage to protect against potential accidents. Liability coverage helps pay for any damages or injuries caused by the teenage driver to others on the road. Without proper insurance, both the teen driver and their parents can face legal consequences, substantial financial liabilities, and difficulties in the event of an accident. It’s crucial to ensure that your teen has adequate car insurance coverage to meet the legal requirements and protect their interests.

One important aspect to consider when purchasing car insurance for teen drivers in Wisconsin is the cost. Insurance premiums for teenage drivers are typically higher than those for adult drivers due to their lack of driving experience and higher risk of accidents. However, there are ways to potentially lower the cost of insurance for teen drivers, such as maintaining good grades, completing a driver’s education course, and choosing a safe and reliable vehicle.

Another factor to keep in mind is the coverage options available for teen drivers. In addition to liability coverage, it may be beneficial to consider adding comprehensive and collision coverage to protect against theft, vandalism, and damage to the teen driver’s own vehicle. Additionally, uninsured/underinsured motorist coverage can provide financial protection in the event of an accident with a driver who does not have sufficient insurance coverage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors To Consider When Choosing Car Insurance For Teenagers In Wisconsin

When selecting car insurance for teenagers in Wisconsin, several factors should be taken into account to get the best coverage. One of the most important considerations is the cost of the premium. Premiums for teenage drivers are typically higher due to their increased risk profile, but some insurance providers may offer more competitive rates than others. It’s essential to compare quotes from different insurers to find the best value for money while maintaining adequate coverage.

In addition to the cost, it’s important to consider the type of coverage that is needed. While liability coverage is mandatory in Wisconsin, it may be wise to consider additional coverage options such as comprehensive and collision coverage. These coverages protect against damage to the teen driver’s vehicle, irrespective of who is at fault. While these additional coverages may increase the premium, they provide greater peace of mind and financial protection in the event of an accident.

Furthermore, the deductible, which is the amount the policyholder must pay out of pocket in the event of a claim, should also be considered. A lower deductible typically means a higher premium, so it’s important to strike a balance that suits your budget and risk tolerance. Exploring various deductibles and their impact on the premium is advised before making a final decision.

The reputation and reliability of the insurance provider should also be given due consideration. Reading reviews and seeking recommendations from friends, family, or experts can help determine the company’s customer service, claims handling, and overall satisfaction levels.

Another important factor to consider when choosing car insurance for teenagers in Wisconsin is the availability of discounts and incentives. Many insurance providers offer discounts for teen drivers who have completed driver’s education courses or maintain good grades in school. These discounts can significantly reduce the cost of the premium and make the insurance more affordable for young drivers. It’s worth exploring the various discounts and incentives offered by different insurers to maximize savings while still obtaining the necessary coverage.

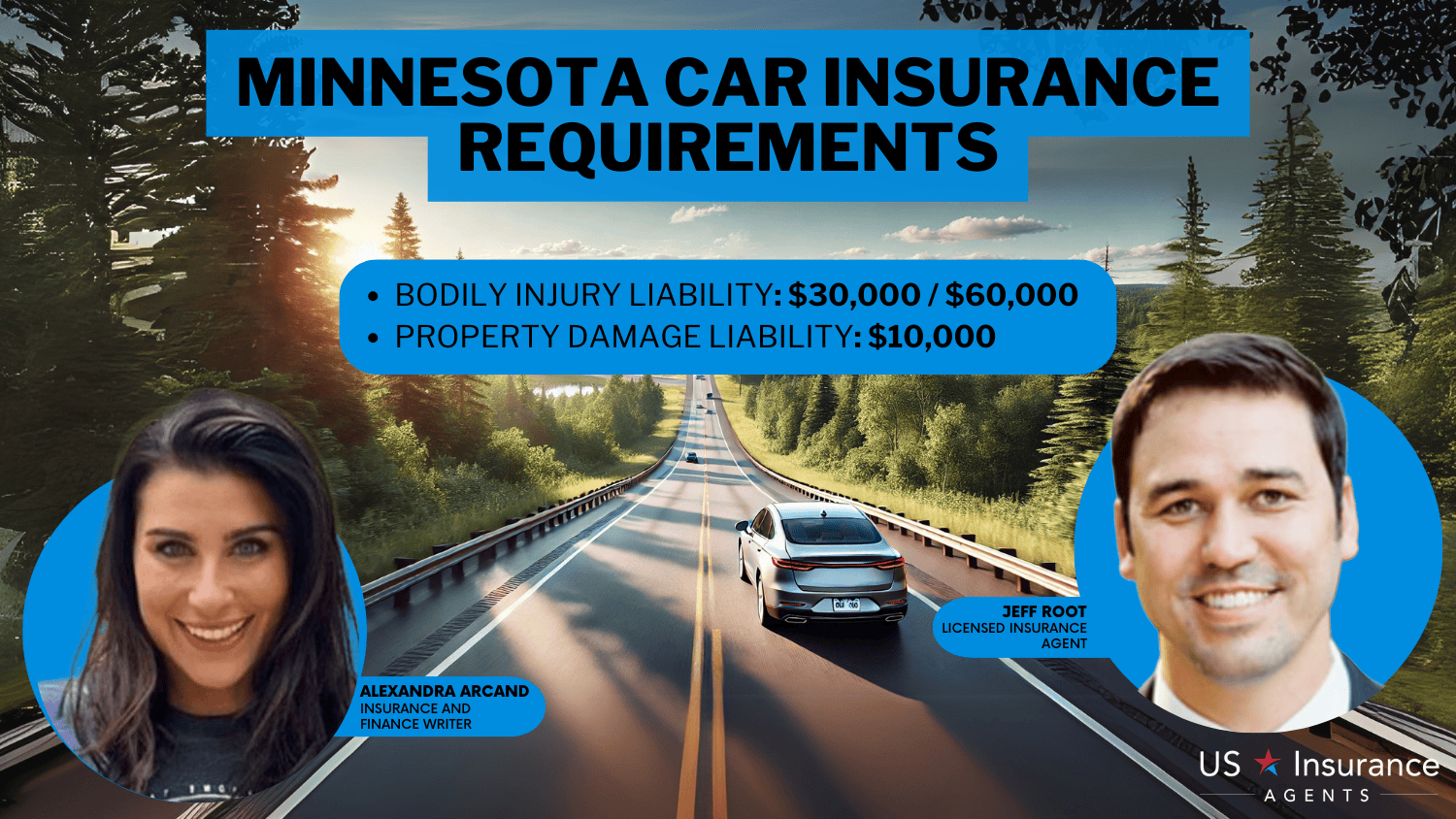

The Legal Requirements For Car Insurance Coverage For Teenagers In Wisconsin

As previously mentioned, Wisconsin law requires all drivers, including teenagers, to carry minimum liability coverage. The minimum liability coverage in Wisconsin consists of $25,000 for injury or death per person, $50,000 for total injury or death per accident, and $10,000 for property damage. These minimum coverage limits ensure that in the event of an accident caused by the teenage driver, there is sufficient financial protection to compensate the affected parties.

While the minimum liability coverage offers the basic legal requirement, it may not be sufficient in all situations. It’s important to evaluate your personal circumstances and financial capabilities to determine whether additional coverage is necessary. Consulting with insurance professionals can provide valuable guidance in determining the appropriate coverage levels for your teenager.

Additionally, it’s worth noting that Wisconsin law also requires uninsured motorist coverage. This type of coverage protects you and your teenager in the event of an accident caused by an uninsured or underinsured driver. It provides financial compensation for medical expenses, lost wages, and other damages that may result from such an accident. It’s important to review your policy and ensure that you have adequate uninsured motorist coverage to protect your teenager and yourself on the road.

Exploring The Different Types Of Car Insurance Policies Available For Teens In Wisconsin

When considering car insurance for teens in Wisconsin, it’s essential to understand the different types of policies available. There are various coverage options that car insurance companies offer, each with its own benefits and limitations. It’s important to carefully evaluate these options to determine which policy best meets your teen’s needs.

Liability-only policies, as the name implies, provide coverage only for damages or injuries caused by the teenage driver to others on the road. These policies do not cover any damage to the teen’s vehicle in the event of an accident. Liability-only policies are typically less expensive than comprehensive or collision policies but may not offer full protection against all potential risks.

Comprehensive coverage policies, on the other hand, provide protection for a wider range of risks, including theft, vandalism, and damage from non-accident events such as natural disasters. These policies are more comprehensive but also come at a higher cost.

Collision coverage policies cover damage to the teen driver’s vehicle resulting from an accident, regardless of who is at fault. This coverage can be valuable in protecting against repair or replacement costs for the teen’s vehicle.

It’s important to carefully evaluate the driving habits, vehicle value, and individual risk factors to determine the most suitable type of policy for your teen driver.

Another type of car insurance policy available for teens in Wisconsin is the uninsured/underinsured motorist coverage. This coverage provides protection in the event that your teen is involved in an accident with a driver who does not have insurance or does not have enough insurance to cover the damages. Uninsured/underinsured motorist coverage can help cover medical expenses, property damage, and other costs that may arise from such accidents.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing And Reviewing The Top Car Insurance Providers For Teenagers In Wisconsin

There are several car insurance providers in Wisconsin that offer specific coverage options for teenage drivers. It’s important to compare and review these providers to find the best car insurance for teens in the state.

Some factors to consider when comparing insurance providers include their financial stability, customer service reputation, and claims handling process. Seeking feedback from existing customers and review websites can provide valuable insights into the overall satisfaction levels with different insurance companies.

Furthermore, comparing policy features and coverage options is crucial to finding the best fit for your teen driver. Some insurers offer additional benefits such as discounts for good grades, safe driving programs, or coverage for roadside assistance, rental reimbursement, and gap insurance. Understanding these additional features and how they align with your teen’s needs can help make an informed decision.

It’s worth noting that while cost is a significant factor, it should not be the only consideration when selecting a car insurance provider. Balancing cost with coverage and service quality is key to ensuring the best outcome for your teen driver and your family in the long run.

When comparing car insurance providers for teenagers in Wisconsin, it’s also important to consider the specific requirements and regulations set by the state. Wisconsin has certain minimum coverage requirements that all drivers must meet, including teenage drivers. These requirements may vary from other states, so it’s crucial to ensure that the insurance provider you choose offers coverage that meets or exceeds these requirements.

Frequently Asked Questions

What factors should I consider when looking for car insurance for teens in Wisconsin?

When looking for car insurance for teens in Wisconsin, it’s important to consider factors such as coverage options, cost, discounts available for teen drivers, and the financial stability and reputation of the insurance company.

What are the minimum car insurance requirements for teen drivers in Wisconsin?

In Wisconsin, teen drivers are required to have liability insurance coverage with minimum limits of $25,000 for injury or death of one person, $50,000 for injury or death of two or more people, and $10,000 for property damage.

Are there any specific discounts available for teen drivers in Wisconsin?

Yes, there are often discounts available for teen drivers in Wisconsin. Some common discounts include good student discounts, safe driving discounts, driver’s education discounts, and discounts for completing a defensive driving course.

Is it possible to add a teen driver to my existing car insurance policy in Wisconsin?

Yes, it is usually possible to add a teen driver to your existing car insurance policy in Wisconsin. However, it’s important to contact your insurance provider to discuss the specific details and any potential changes in premiums.

What are some tips for reducing car insurance costs for teen drivers in Wisconsin?

To reduce car insurance costs for teen drivers in Wisconsin, consider encouraging your teen to maintain good grades, enroll in a driver’s education course, drive a safe and reliable car, and compare quotes from multiple insurance companies to find the best rates.

Are there any specific car insurance companies that specialize in providing coverage for teen

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.