Cheapest Teen Driver Auto Insurance in Washington (Save With These 10 Companies in 2026)

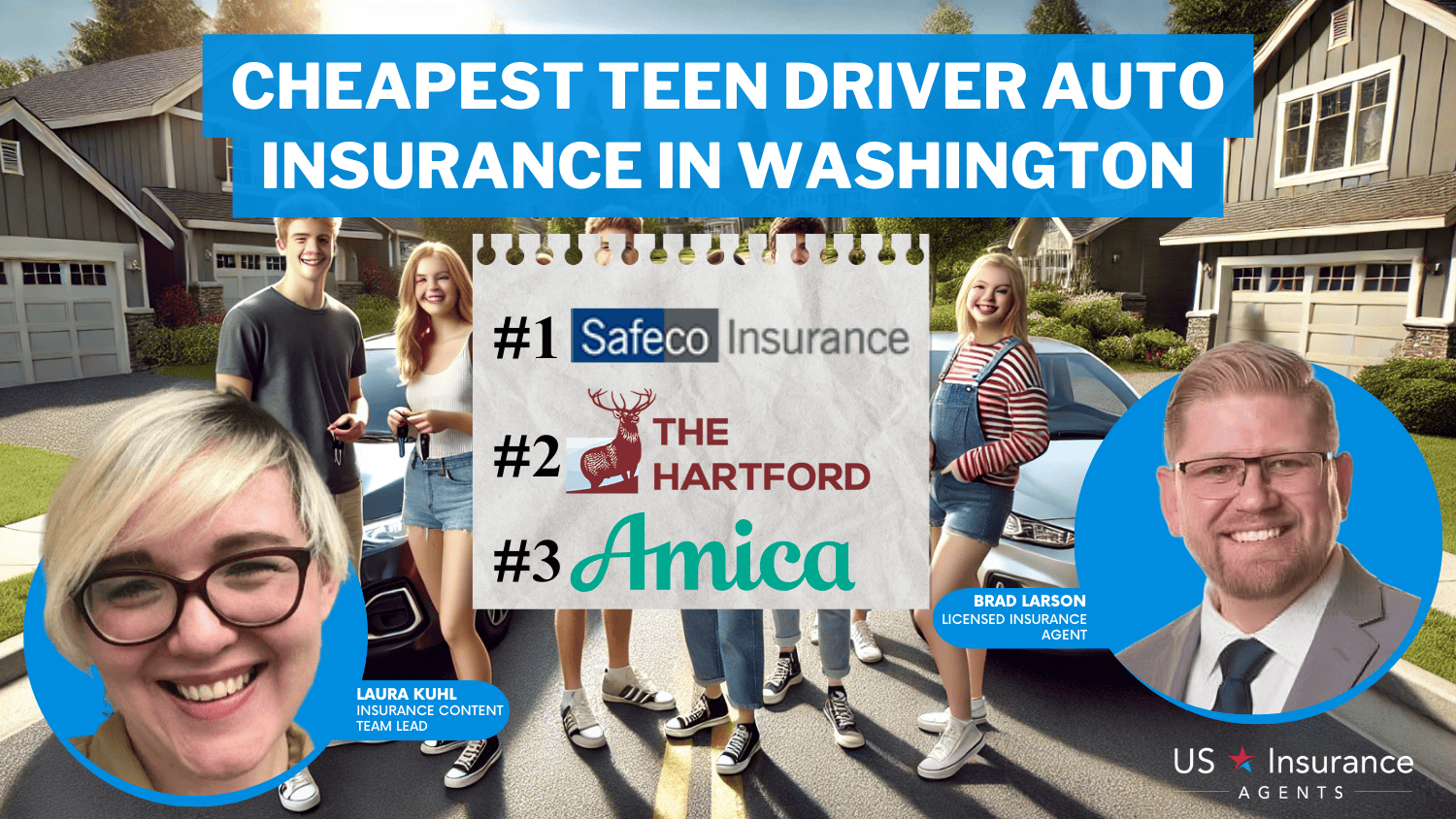

Safeco, The Hartford, and Amica offer the cheapest teen driver auto insurance in Washington, with rates starting at $125/month. With low costs, disappearing deductibles, and multi-policy discounts, these companies are the top choices for affordable full coverage in Washington state.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated October 2024

Company Facts

Min. Coverage in Washington

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage in Washington

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage in Washington

A.M. Best Rating

Complaint Level

The cheapest teen driver auto insurance in Washington are Safeco, The Hartford, and Amica providing rates starting at $125/month.

Teenager car insurance discounts are essential for families seeking affordable coverage. In Washington, these insurance companies offer features like disappearing deductibles and savings for bundling multiple policies.

Our Top 9 Company Picks: Cheapest Teen Driver Car Insurance in Washington

Company Rank Monthly Rates A.M. Best Best For Jump to Pros/Cons

![]()

#1 $125 A Low Rates Safeco

#2 $201 A+ Multi-Policy Savings The Hartford

![]()

#3 $204 A+ Online Management Amica

![]()

#4 $208 A+ Multi-Policy Discounts Allstate

#5 $242 A Customer Service Liberty Mutual

#6 $278 A+ Accident Forgiveness Progressive

![]()

#7 $281 A Roadside Assistance American Family

![]()

#8 $299 A++ Coverage Options Travelers

![]()

#9 $316 A Competitive Rates The General

With such offerings, these insurers provide budget-friendly rates along with comprehensive protection tailored for teen drivers.

See which companies have the cheapest minimum auto insurance rates by entering your ZIP code into our free comparison tool above.

- Safeco offers the lowest rates starting at $125/month for teen drivers

- Vanishing deductibles are a key benefit with the cheapest teen driver insurance

- Provide competitive coverage options tailored for young drivers in Washington

#1 – Safeco: Top Overall Pick

Pros

- Budget-Friendly Rates: Safeco’s low starting rates make it a cost-effective choice for teen drivers in Washington. Find out more in our Safeco review.

- Affordable Minimum Coverage: Their minimum coverage rates for teen driver auto insurance in Washington are some of the most affordable, providing excellent value for residents.

- Attractive Discounts for Local Drivers: Safeco offers a number of discounts that can drive down Washington car insurance costs even further for those getting coverage.

Cons

- Gaps in Local Agent Network: Safeco could be low on local agents, which impacts how personalized the service might be for teen driver auto insurance in Washington.

- Coverage Availability: The coverage choices and discounts that Safeco offers for auto insurance with teen drivers in Washington vary by region, which can affect how cost-effective it may be overall.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – The Hartford: Multi-Policy Savings

Pros

- Savings from Bundling: The Hartford offers great discounts for bundling policies, including teen driver auto insurance in Washington. For a complete list, read our The Hartford review.

- Affordable Starting Rates for Young Drivers: Their competitive minimum coverage rates offer affordable options for teen driver auto insurance in Washington.

- Flexible Policy Options: The Hartford also has flexible teen driver auto insurance policy options in Washington.

Cons

- Lack of Certain Coverage Perks: The Hartford might not offer certain extra coverage benefits, such as vanishing deductibles, for teen driver auto insurance in Washington.

- Coverage Rates May Not Be the Best Value: Teen driver auto insurance in Washington is competitive, but full coverage might cost more than other options.

#3 – Amica: Best for Online Management

Pros

- Efficient Digital Tools: Amica’s robust online management platform simplifies policy handling for Washington teen drivers.

- Reasonable Rates for Teen Coverage: Offers competitive rates for teen drivers, ensuring affordability in Washington. Read more in our review of Amica.

- Strong Reputation for Customer Support: Amica’s top-rated customer service improves the auto insurance experience for teen drivers in Washington.

Cons

- Premiums Could Exceed Competitors: Depending on the level of coverage, Amica’s premiums for teen driver auto insurance in Washington could be higher than other available options.

- Limited Personal Interaction: The emphasis on online management may not suit Washington drivers who favor in-person support, particularly when it comes to teen driver auto insurance in Washington.

#4 – Allstate: Best for Multi-Policy Discounts

Pros

- Multi-Policy Discounts: Allstate’s multi-policy discounts can save Washington families money, including on teen driver auto insurance in Washington, which you can check out in our Allstate review.

- Safe Driving Discounts: Washington teen drivers can receive discounts for safe driving. This will help reduce costs and give you peace of mind each time your teenage driver hits the road.

- Extensive Agent Network: Allstate is one of the most well-known providers in Washington, so it has a strong agent network that provides personalized service and local support.

Cons

- Higher Cost for Comprehensive Coverage: The cost of comprehensive coverage for teen driver auto insurance in Washington might be the highest compared to some other companies.

- Complexity in Policy Details: The discounts and coverage details involved in teen driver car insurance Washington can get somewhat confusing to the consumer.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Customer Service

Pros

- Strong Customer Service: Liberty Mutual is known for excellent customer service, providing reliable support for teen drivers in Washington.

- Discounts for New Graduates: Offers savings for new graduates, which can be beneficial for Washington families with teen drivers. Read our Liberty Mutual review to learn what else is offered.

- Versatile Coverage Choices: Liberty Mutual provides various state-based offerings for Washington drivers including teen driver car insurance.

Cons

- Insurance Costs May Be Higher: You may find that Liberty Mutual auto insurance rates for teen drivers in WA are higher with this company than they would be with some of the competition.

- Discount Application Can Be Complicated: State drivers in Washington may find it difficult and a hassle to apply for discounts when driving an auto insurance for teenage driver.

#6 – Progressive: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Progressive offers accident forgiveness, which can help to prevent a rate increase after one first accident; this could be particularly useful for teen drivers in Washington.

- Competitive Pricing for Minimum Coverage: Competitive pricing starts at $125 for minimum coverage, offering a great choice to buy teen driver auto insurance Washington residents will love.

- Diverse Coverage Options: Progressive offers various coverage options for Washington drivers, including teen driver auto insurance, which you can read more about in our review of Progressive.

Cons

- Less Emphasis on Safe Driving Discounts: Progressive may provide fewer discounts for safe driving to teen driver auto insurance policyholders in Washington compared to other insurers.

- Additional Coverage Can Be Costly: Adding more than just collision and liability can make overall premiums for your teen driver car insurance policy in Washington costlier.

#7 – American Family: Best for Roadside Assistance

Pros

- Reliable Roadside Assistance: American Family’s roadside assistance provides valuable support in emergencies for Washington teen drivers.

- Discounts for Safe Drivers: Offers discounts for safe driving, which can reduce costs for teen drivers in Washington. Read our American Family review for a full list.

- Customizable Insurance Policies: They provide customized coverage choices to help fulfill the specific needs of Washington teenage driver car insurance.

Cons

- Minimum Coverage Rates Can Be High: The price of minimum coverage for teen driver auto insurance in Washington may be higher than that offered by some other insurers.

- Regional Discount Limitations: Some discounts and features may not be offered in all regions of Washington for teen driver auto insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Coverage Options

Pros

- Extensive Coverage Options: Travelers has many options for coverage and feature-rich products that may be customizable to meet the needs of teenagers in Washington.

- Competitive Pricing: They have really affordable rates for teen driver auto insurance in Washington, whether you need just minimum coverage or full.

- Discounts for Safe Driving: Offers discounts for safe driving, which can help lower the cost of teen driver auto insurance for families in Washington. Learn more in our Travelers review.

Cons

- Higher Premiums for Additional Coverage: Additional coverage options can result in higher premiums for teen driver auto insurance in Washington compared to some other providers.

- Customer Service Quality Can Vary: Experiences with customer service can vary across different areas in Washington, especially when it comes to teen driver auto insurance.

#9 – The General: Best for Competitive Rates

Pros

- Low Rates in Washington: The General provides affordable options for teen driver auto insurance in Washington, with rates beginning at $316 for minimum coverage.

- Low Starting Premiums: Their minimum coverage rates for teen driver auto insurance in Washington begin at $316, making them competitive in the state. Find out more in our The General review.

- Tailored Discounts for Local Drivers: Discounts for teen driver auto insurance tailored for Washington drivers.

Cons

- Fewer Coverage Options Available: The General most likely offers a fewer selection of coverage options for teen driver car insurance than other companies in Washington.

- Higher Deductibles: Washington teen driver auto insurance providers can have deductibles higher than some of the other competition which may impact affordability for drivers in their state.

Auto Insurance Rates and Discounts for Teen Drivers in Washington

While insurance premiums for teenage Washington drivers can vary widely, the company a young driver picks matters just as much because of financial considerations. For a comprehensive analysis, refer to our detailed guide on full coverage car insurance.

Insurance providers offer what are generally called policies that range from the basic minimum coverage up to comprehensive plans with additional protections.

Washington Teen Driver Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $208 | $423 | |

| $281 | $572 | |

| $204 | $597 | |

| $242 | $493 |

| $278 | $565 | |

| $125 | $292 | |

| $316 | $734 | |

| $201 | $469 |

| $299 | $608 |

Monthly car insurance rates for teens in Washington depend on the company and coverage level. Minimum coverage ranges from $125 with Safeco to $316 with The General. For example, full coverage rates from Geico are as low as $267 and can be up to $734 with The General.

Ty Stewart Licensed Insurance Agent

Following these are Allstate and American Family, with Allstate at approximately $208 for minimum or $423 for full coverage, while American Family ranges around $281 for minimum coverage, reaching $572 for full coverage.

Car Insurance Discounts From the Top Providers for Teen Drivers in Washington

| Insurance Company | Available Discount |

|---|---|

| Multi-Policy Discount, Safe Driving Club Discount, New Car Discount, Early Signing Discount | |

| Multi-Policy Discount, Teen Safe Driver Discount, Loyalty Discount, Defensive Driver Discount | |

| Multi-Policy Discount, Legacy Discount, Good Student Discount, Electronic Billing Discount | |

| Multi-Policy Discount, Newly Married Discount, Hybrid Vehicle Discount, New Graduate Discount |

| Multi-Policy Discount, Snapshot Usage-Based Discount, Continuous Insurance Discount, Homeowner Discount | |

| Multi-Policy Discount, Accident Forgiveness Discount, Diminishing Deductible, Telematics Discount | |

| Multi-Policy Discount, Homeowner Discount, Good Student Discount, Military Discount | |

| Multi-Policy Discount, AARP Member Discount, Defensive Driver Discount, Vehicle Safety Features Discount |

| Multi-Policy Discount, Safe Driver Discount, Home Ownership Discount, IntelliDrive Program Discount |

In Washington, teen drivers also benefit from various discount opportunities offered by top insurers. Options include Allstate’s multi-policy and safe driving discounts, American Family’s teen safe driver and loyalty discounts, and Geico’s good driver and military discounts. Other providers, like Liberty Mutual, Progressive, and Safeco, offer savings for new graduates, usage-based programs, and accident forgiveness.

Select companies offer specific discounts that are key for helping young drivers lower the cost of insurance. Just as important, Washington teen drivers can keep their insurance costs affordable by investigating discounts and rate quotes from a variety of providers to get the coverage that meets their budget.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Washington Auto Insurance Premiums

Teen drivers in Washington can secure affordable car insurance by keeping a clean driving record, completing driver education or defensive driving courses, and achieving good grades, all of which may qualify them for discounts. Opting for an older, less costly vehicle can also help reduce premium rates. Best car insurance discounts to ask for include these options to maximize savings.

Washington Report Card: Auto Insurance Premiums

| Category | Grade | Explanation |

|---|---|---|

| Claims Processing Speed | A | Efficient claims processing within 10 days |

| Coverage Options | A- | Diverse options, including comprehensive and add-ons |

| Average Premiums | B+ | Moderate premium costs relative to U.S. average |

| Discounts Available | B+ | Wide variety of discounts for various drivers |

| Customer Service | B | Generally good, with room for improvement |

The table below reviews essential components of an insurance company, like time to process claims, coverages available, average rate and discounts as well as customer service. This provider is strongest in claims speed and variety of coverage, but balances those with low to moderate car insurance premiums and a wide range of discounts.

You also might want to consider shopping around at various insurance companies and comparing rates. Different insurance companies have different fees and discount rates so shopping around can assist you locate one of the most budget-friendly alternative. You can get multiple quotes from online comparison tools or by contacting insurance agents directly to help you make an informed choice.

Key Factors Affecting Cheap Teen Driver Insurance Rates in Washington

Affordable auto insurance for teen drivers in Washington is more about understanding what influences rates by factor. Check out our ranking of the top providers: “Companies With the Cheapest 16-Year-Old Auto Insurance.”

All of these factors are important to the final premium and can vary widely from one insurance company to the next.

- Coverage Type and Provider: There are different price points depending on if you get minimum coverage vs full-coverage and which carrier you chose. Different providers will have different rates and ways of covering everything, you need to make sure if your final policy does offer you coverage.

- Available Discounts: Common discounts include good driver, multi-policy, and safe driving. Every provider will have different discounts available, and some even provide teen driver car insurance discount options.

- Driving Record: Expect your premiums to stay lower if you maintain a squeaky-clean driving record, but rates can increase significantly with any traffic violations or accidents. Insurance companies factor in driving history to assess how much of a risk a driver may be.

- Vehicle Type and Safety Features: The make, model, and age of the vehicle being insured impact the rate. Cars with advanced safety features or lower repair costs may qualify for lower premiums.

- Location: Different towns have different rates because of things like traffic or accident numbers, crime statistics, etc. Location and time of day are also factors that impact the cost.

You will want to consider these factors and tailor down your specific options and find the most affordable and appropriate insurance company for 16-year-old drivers. By evaluating each of these aspects, you can make informed decisions and potentially save on insurance costs while ensuring your teen is adequately protected.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Securing Affordable Teen Driver Auto Insurance in Washington

Affordable insurance for teens is tough to find since you are stuck with high premiums while having limited experience on the road.

- Case Study #1 – Maximizing Savings for a High-Risk Teen Driver: Sarah, a 17-year-old new driver in Seattle, faced high insurance premiums due to her age and inexperience. The Johnsons used a comparison tool, found Geico’s $131/month rate with discounts, and managed to secure affordable, comprehensive coverage for her.

- Case Study #2 – Balancing Coverage and Cost for a Multi-Driver Household: The Martins needed affordable insurance for their 16-year-old son and multiple vehicles. The Hartford gave them a low starting price of $201/month for their teen driver along with multi-policy discounts that cut costs and covered the needs.

- Case Study #3 – Reducing Costs With a Safe Driving Focus: Jessica, a 17-year-old driver, and her parents chose Safeco for its usage-based insurance program, which tracked and rewarded safe driving. This was a lower premium decision at $125/month which made insurance more affordable and provided an expanded coverage option.

Being able to navigate the world of teen car insurance discounts will help you save money on your premium. These case studies are tailored to demonstrate how families lower their costs on insurance with discounts, bundle policy options and safe driving programs. Read more about the cheapest car insurance companies for 17-year-olds here.

Washington Report Card: Auto Insurance Discounts

| Discount Name | Grade | Savings | Participating Providers |

|---|---|---|---|

| Multi-Policy Discount | A | 20% | Allstate, State Farm, Farmers |

| Good Driver Discount | A- | 15% | Geico, Progressive, Nationwide |

| Defensive Driver Course | B+ | 10% | Liberty Mutual, Safeco, American Family |

| Anti-Theft Discount | B | 8% | USAA, Travelers, Nationwide |

| New Car Discount | B- | 5% | Allstate, Progressive, State Farm |

This table highlights popular auto insurance discounts, rated by effectiveness and potential savings. Multi-policy discounts offer the highest savings at 20% and are available from Allstate, State Farm, and Farmers.

Good driver discounts provide a 15% savings rate, followed by defensive driving courses, anti-theft devices, and new car discounts with savings ranging from 5% to 10% across top providers like Geico, USAA, and Progressive.

Factors to Consider When Choosing Car Insurance for Teens in Washington

When choosing car insurance for teen drivers in Washington, consider coverage options like comprehensive, collision, and liability, along with premium costs, company reputation, customer service, and claim filing ease. Another important factor to consider when choosing car insurance for teens in Washington is the deductible amount.

Jeff Root Licensed Insurance Agent

Your deductible refers to how much money you personally have to pay out of pocket before the insurance company starts picking up costs. When it comes to choosing your deductible, you need to strike a balance between low and high — one that will lead paying cheaper premiums but without making the deductibles so expensive in an accident.

Furthermore, it is advisable to inquire about the best available discounts for teenage drivers. Yet some insurance companies actually have benefits that they offer to students, such as lower premiums for good grades or having finished a driver’s education class. By using these discounts, you can cut down the cost of policy to a great extent.

Exploring the Minimum Car Insurance Requirements for Teen Drivers in Washington

In Washington, as is the case in almost every other state, there are car insurance requirements that you need to meet. Teen drivers must be covered with liability insurance of at least $25,000 for bodily injury or death to one individual ($50,000 per accident – involving two or more people) and covering property damage up to a minimum of $10,000.

While it is possible to meet legally set minimum standards with these levels of coverage, many drivers elect to carry higher limits in order to ensure additional protection. The following table ranks the five most common auto insurance claims in Washington and includes a breakdown of each type’s share of total claims as well as average cost per claim.

5 Most Common Auto Insurance Claims in Washington

| Claim Type | Portion of Claims | Cost per Claim |

|---|---|---|

| Collision | 34% | $3,500 |

| Comprehensive | 23% | $1,600 |

| Property Damage | 18% | $2,400 |

| Bodily Injury | 15% | $15,000 |

| Personal Injury | 10% | $5,000 |

Collision claims make up the largest portion at 34% with an average cost of $3,500, while bodily injury claims, though less common, have the highest cost per claim at $15,000.

Washington Accidents & Claims per Year by City

| City | Accidents per Year | Claims per Year |

|---|---|---|

| Bellevue | 4,200 | $3,700 |

| Seattle | 12,000 | $10,500 |

| Spokane | 7,800 | 6,900 |

| Tacoma | 5,400 | $4,800 |

| Vancouver | 3,600 | $3,200 |

This table provides a snapshot of yearly accident and claim statistics across major cities in Washington, showing the number of accidents and associated claims per year. Seattle has the highest rates, with 12,000 accidents and $10,500 in claims, while Vancouver has the lowest at 3,600 accidents and $3,200 in claims.

Kristine Lee Licensed Insurance Agent

Washington’s minimum car insurance for teen drivers is only a baseline. Higher coverage can better protect less experienced drivers in serious accidents.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Navigating Affordable Auto Insurance for Teen Drivers in Washington

If you have a Washington teen in need of affordable auto insurance, the task can seem almost impossible. Top Providers like Safeco, Geico and The Hartford provide quotes as low as $125 per month when you compare multiple homeowners insurance quotes.

Taking advantage of discounts, ensuring safe driving habits, and choosing vehicles with strong safety features are essential strategies for managing costs effectively. With careful planning and research, it’s possible to balance budget and comprehensive coverage for young drivers.

Looking for cheap auto insurance rates can be difficult for high-risk drivers, but you don’t have to do it alone. Enter your ZIP code below to find the most affordable quotes in your area.

Frequently Asked Questions

What is the best car insurance for teens in Washington?

The top car insurance for teenagers in Washington might differ depending on the teenager’s driving history, what kind of automobile they drive and just how much coverage is demanded. We recommend getting quotes from several insurers to find the most comprehensive coverage at a reasonable price for teen drivers in Washington.

What factors should I consider when choosing car insurance for a teen in Washington?

When choosing car insurance for a teen in Washington, it is important to consider factors such as the teen’s driving record, the type of car they drive, the coverage options available, the insurance provider’s reputation, and the cost of the insurance policy.

Are there any discounts available for car insurance for teens in Washington?

Indeed, many insurance carriers do offer teen driver discounts on Washington car insurance. These discounts can include good car student discounts, driver training discounts, and discounts for completing safe driving courses. Check with your insurance company to see if they offer any reductions.

Who has the cheapest auto insurance in Washington state?

Safeco, Geico and The Hartford are the cheapest providers of car insurance for teen drivers in Washington. Minimum starting rates with these companies can start at around $125 per month. However, for the greatest deal, you will need to get quotes from numerous insurers and compare them with regard to your situation.

How much is auto insurance for a 17-year-old in Washington state?

Auto insurance rates for a 17-year-old in Washington state can vary significantly based on the provider and coverage type. Minimum coverage can be as low as about $125 per month with insurers like Safeco, but full-coverage prices range between $267 and $734 monthly, depending on the insurer in question.

Enter your ZIP code below and shop for flexible premiums from the top companies.

What are the legal requirements for car insurance for teens in Washington?

A financial responsibility (liability coverage) insurance policy is required in order to drive legally in Washington, even for teenage drivers. Minimum limits for teen drivers 25/50/10. Knowing the types of car insurance coverage is crucial for meeting these legal requirements.

What happens if you drive without insurance in Washington state?

Failure to have Washington auto insurance can lead to fines, license suspension, and your vehicle’s impoundment. Like most states in the union, Washington law requires that drivers are covered by insurance which can pay for potential damages and medical bills caused or generated through an accident.

What age pays the most for auto insurance?

Typically, teen drivers, especially those aged 16 and 17, pay the highest auto insurance premiums. Providers consider this age group to be high-risk due to their lack of experience and higher likelihood of accidents.

What is the minimum auto insurance coverage in Washington state?

For drivers in Washington state, minimum auto insurance requirements consist of $25,000 for injury or death of a single person, $50,000 for injuries or fatalities affecting multiple people, and $10,000 for property damage. This ensures basic liability insurance in case of an car accidents.

Can a 16-year-old own a car in Washington state?

Yes, a 16-year-old can own a car in Washington state, but they must have an adult co-signer for the vehicle’s title and registration. Additionally, the insurance policy will likely need to be in the name of the parent or guardian to comply with legal and insurance requirements.

Do permit drivers need insurance in Washington state?

Do you need insurance to buy a car in Washington?

Why is Washington auto insurance so expensive?

Is it illegal to not have auto insurance in Washington?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.