Best Car Insurance for Teens in Florida in 2026 (Your Guide to the Top 10 Companies)

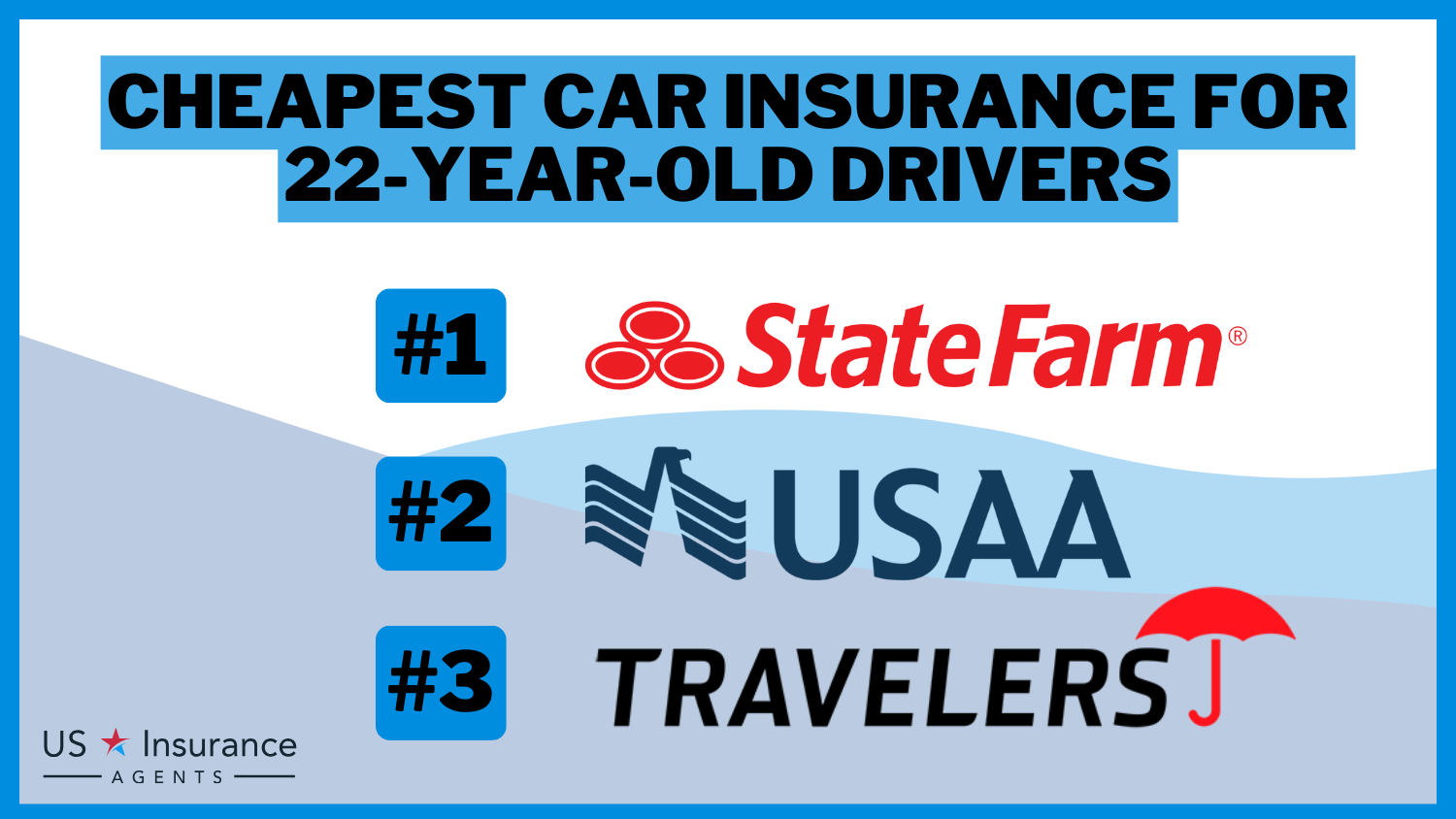

State Farm, Progressive, and Allstate are the top picks for the best car insurance for teens in Florida, with minimum monthly rates starting at $120. These companies stand out for their affordability, comprehensive coverage options, and tailored policies that cater specifically to the needs of teens in Florida.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywrite...

Tonya Sisler

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated March 2025

Company Facts

Full Coverage for Teens in Florida

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Teens in Florida

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Teens in Florida

A.M. Best

Complaint Level

Pros & Cons

State Farm, Progressive, and Allstate are the best car insurance providers for teens in Florida, offering a combination of affordability, comprehensive coverage, and specialized policies.

These companies excel in catering to young drivers, offering discounts for good grades and safe driving. Teens in Florida benefit from reliable customer service and a vast network of agents.

Our Top 10 Company Picks: Best Car Insurance for Teens in Florida

Company Rank UBI Discount A.M. Best Best For Jump to Pros/Cons

#1 30% B Student Discounts State Farm

#2 30% A+ Snapshot Program Progressive

#3 40% A+ Local Agents Allstate

#4 30% A Accident Forgiveness Liberty Mutual

#5 40% A+ Vanishing Deductible Nationwide

#6 30% A Youthful Discounts Farmers

#7 30% A++ Specialized Coverage Travelers

#8 30% A Safe Driver American Family

#9 20% A++ Good Discounts Auto-Owners

#10 30% A+ Rate Lock Erie

This article explores why these three companies are the top choices for teen car insurance in the Sunshine State. See more details on our article called “Compare Car Insurance Quotes.”

Stop overpaying for car insurance. Our free quote comparison tool allows you to shop for quotes from the top providers near you by entering your ZIP code above.

#1 – State Farm: Top Overall Pick

Pros

- Bundling Policies: State Farm offers significant discounts for bundling multiple insurance policies, making it a cost-effective option for teens in Florida. Learn more in our article called “State Farm Insurance Review & Ratings.”

- High Low-Mileage Discount: State Farm provides a substantial discount for low-mileage usage, which is particularly beneficial for teens in Florida who don’t drive often.

- Good Student Discount: State Farm offers a good student discount, rewarding teens in Florida for maintaining high academic performance with lower premiums.

Cons

- Limited Multi-Policy Discount: State Farm’s multi-policy discount is lower compared to some competitors, which may not provide the best savings for teens in Florida with multiple insurance needs.

- Premium Costs: Despite the discounts, State Farm’s premiums might still be relatively higher for certain coverage levels, which can be a drawback for teens in Florida looking for the cheapest option.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Snapshot Program

Pros

- Usage-Based Discounts: Progressive’s Snapshot program offers significant discounts based on driving behavior, making it a great choice for safe-driving teens in Florida.

- Customizable Policies: Progressive provides flexible policy options that can be tailored to meet the unique needs of teens in Florida, allowing for personalized coverage.

- Good Grades Discount: Progressive offers discounts for maintaining good grades, providing an incentive for academic achievement among teens in Florida. See more details on our guide “Progressive Insurance Review & Ratings.”

Cons

- Higher Initial Premiums: Progressive may have higher initial premiums for teens in Florida until discounts from the Snapshot program are applied.

- Telematics Device: Teens in Florida might find the requirement to use a telematics device for the Snapshot program intrusive and inconvenient.

#3 – Allstate: Best for Local Agents

Pros

- Local Agent Support: Allstate offers personalized service through local agents, providing valuable assistance and guidance for teens in Florida navigating their insurance needs.

- Smart Student Discount: Allstate provides a smart student discount for teens in Florida with good academic performance, making it an affordable option for diligent students.

- Drivewise Program: The Drivewise program helps teens in Florida save money based on their driving habits, encouraging safe driving behavior. Check out insurance savings in our complete article called “Allstate Insurance Review & Ratings.”

Cons

- Higher Rates for Young Drivers: Allstate’s premiums might be higher for young drivers, which can be a disadvantage for teens in Florida looking for the most affordable insurance.

- Complex Discounts: The discount structure can be complicated, making it challenging for teens in Florida to understand and maximize their savings with Allstate.

#4 – Liberty Mutual: Best for Accident Forgiveness

Pros

- Accident Forgiveness: Liberty Mutual offers accident forgiveness, which is beneficial for teens in Florida to avoid rate hikes after their first accident. Discover more about offerings in our article titled “Liberty Mutual Review & Ratings.”

- New Car Replacement: Teens in Florida can benefit from Liberty Mutual’s new car replacement coverage if their car is totaled within the first year, ensuring they get a new vehicle.

- Good Student Discount: Liberty Mutual provides a good student discount for teens in Florida with high academic performance, helping to reduce their insurance costs.

Cons

- Higher Premiums: Liberty Mutual’s premiums can be higher compared to other providers, which might not be the best for teens in Florida seeking the cheapest rates.

- Mixed Customer Reviews: Customer service reviews for Liberty Mutual vary, which could be a concern for teens in Florida looking for reliable support.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Vanishing Deductible

Pros

- Vanishing Deductible: Nationwide’s vanishing deductible feature helps teens in Florida save on out-of-pocket expenses over time by reducing their deductible.

- Good Student Discount: Nationwide offers a good student discount, making it more affordable for teens in Florida who maintain high grades. Check out insurance savings in our complete guide titled “Nationwide Insurance Review & Ratings.”

- Accident Forgiveness: Teens in Florida can benefit from Nationwide’s accident forgiveness program, which helps avoid rate increases after the first accident.

Cons

- Higher Rates: Nationwide’s rates can be higher than some competitors, which might not be the best option for teens in Florida looking for the lowest premiums.

- Mixed Customer Service: Customer service ratings for Nationwide are mixed, which may affect the experience of teens in Florida seeking dependable support.

#6 – Farmers: Best for Youthful Discounts

Pros

- Youthful Driver Discount: Farmers offers discounts specifically for young drivers, which is highly beneficial for teens in Florida looking to save on their premiums.

- Good Student Discount: Teens in Florida can save with Farmers’ good student discount, which rewards academic excellence with lower insurance costs.

- Driver Training Discount: Farmers provides discounts for teens in Florida who complete driver training courses, encouraging safer driving practices. Discover more about offerings in our article called “Farmers Insurance Review & Ratings.”

Cons

- Higher Premiums: Farmers’ premiums can be higher compared to other providers, which might not be ideal for teens in Florida searching for the most affordable insurance.

- Mixed Customer Service Reviews: Customer service reviews for Farmers are mixed, which could be a concern for teens in Florida seeking reliable assistance.

#7 – Travelers: Best for Specialized Coverage

Pros

- Specialized Coverage Options: Travelers offers various specialized coverage options, providing comprehensive protection for teens in Florida with unique insurance needs.

- Good Student Discount: Travelers provides a good student discount for teens in Florida, helping to lower their insurance premiums. Discover more about offerings in our guide titled “Travelers Insurance Review & Ratings.”

- Telematics Program: Travelers’ telematics program helps teens in Florida save money based on their driving behavior, encouraging safe driving habits.

Cons

- Higher Premiums: Travelers’ premiums can be higher compared to some competitors, which might not be the best option for teens in Florida seeking the lowest rates.

- Limited Local Agents: There may be fewer local agents available, impacting the personalized service experience for teens in Florida.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – American Family: Best for Safe Driver

Pros

- Safe Driver Discount: American Family offers discounts for safe driving, which is ideal for teens in Florida who maintain good driving records. Learn more in our article called “American Family Insurance Review & Ratings.”

- Good Student Discount: American Family provides a good student discount for teens in Florida with high academic performance, helping to reduce their premiums.

- Telematics Program: Teens in Florida can save through American Family’s telematics program, which rewards safe driving habits with lower rates.

Cons

- Higher Rates: American Family’s rates can be higher than some competitors, which might not be the best option for teens in Florida looking for affordable insurance.

- Limited Availability: American Family’s coverage options may be limited in some areas, impacting the availability for teens in Florida.

#9 – Auto-Owners: Best for Good Discounts

Pros

- Multiple Discounts: Auto-Owners offers various discounts, which can significantly benefit teens in Florida looking to save on their insurance premiums. Learn more in our article called “Auto-Owners Insurance Review & Ratings.”

- Good Student Discount: Auto-Owners provides a good student discount for teens in Florida with high academic performance, making it a cost-effective choice.

- Telematics Program: Teens in Florida can save through Auto-Owners’ telematics program, which rewards safe driving habits with lower insurance rates.

Cons

- Higher Rates: Auto-Owners’ rates can be higher than some competitors, which might not be ideal for teens in Florida seeking the lowest premiums.

- Limited Online Services: Teens in Florida may find Auto-Owners’ online services lacking compared to other insurance providers.

#10 – Erie: Best for Rate Lock

Pros

- Rate Lock: Erie’s rate lock feature helps teens in Florida maintain consistent premiums, providing financial stability.

- Good Student Discount: Erie provides a good student discount for teens in Florida with high academic performance, helping to lower their insurance costs.

- Accident Forgiveness: Erie’s accident forgiveness prevents rate hikes for teens in Florida after their first accident, making it a reliable choice. Learn more in our article called “How can I track the progress of my car insurance claim with Erie Insurance?“

Cons

- Limited Availability: Erie’s coverage options may be limited in some areas, impacting teens in Florida who may not have access to their services.

- Higher Rates: Erie’s rates can be higher compared to some competitors, which might not be the best option for teens in Florida looking for the cheapest insurance.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Monthly Car Insurance Rates for Teens in Florida by Provider

When choosing car insurance for teens in Florida, it’s essential to understand the different rates associated with both minimum and full coverage options. Below is a table highlighting the monthly rates for various insurance companies.

Florida Teens Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $235 $620

American Family $253 $667

Auto-Owners $215 $445

Erie $210 $440

Farmers $390 $1,029

Liberty Mutual $181 $478

Nationwide $148 $390

Progressive $191 $503

State Farm $118 $311

Travelers $472 $1,245

State Farm offers the most affordable minimum and full coverage rates for teens in Florida, with monthly premiums of $118 and $311, respectively. Conversely, Farmers and Travelers have the highest rates, with Farmers charging $390 for minimum coverage and $1,029 for full coverage, while Travelers charges $472 and $1,245, respectively.

Liberty Mutual, Nationwide, and Progressive also offer competitive rates, making them viable options for budget-conscious families. If you want to learn more about the company, head to our guide titled “What is premium subsidies?”

Understanding these rates can help Florida teens and their parents make informed decisions when selecting car insurance.

Understanding the importance of car insurance for teen drivers in Florida

It’s essential to understand the importance of car insurance for teen drivers in Florida. As inexperienced drivers, teenagers are more likely to be involved in accidents compared to older drivers. Car insurance provides financial protection in the event of an accident, covering medical expenses, property damage, and legal liabilities.

Unlock details in our article called “Collision Car Insurance: A Complete Guide.”

Without adequate insurance, parents may be held responsible for the costs of any damages or injuries resulting from their teen’s involvement in a car accident. Therefore, it’s crucial to ensure teens have proper car insurance coverage to safeguard against potential financial hardships.

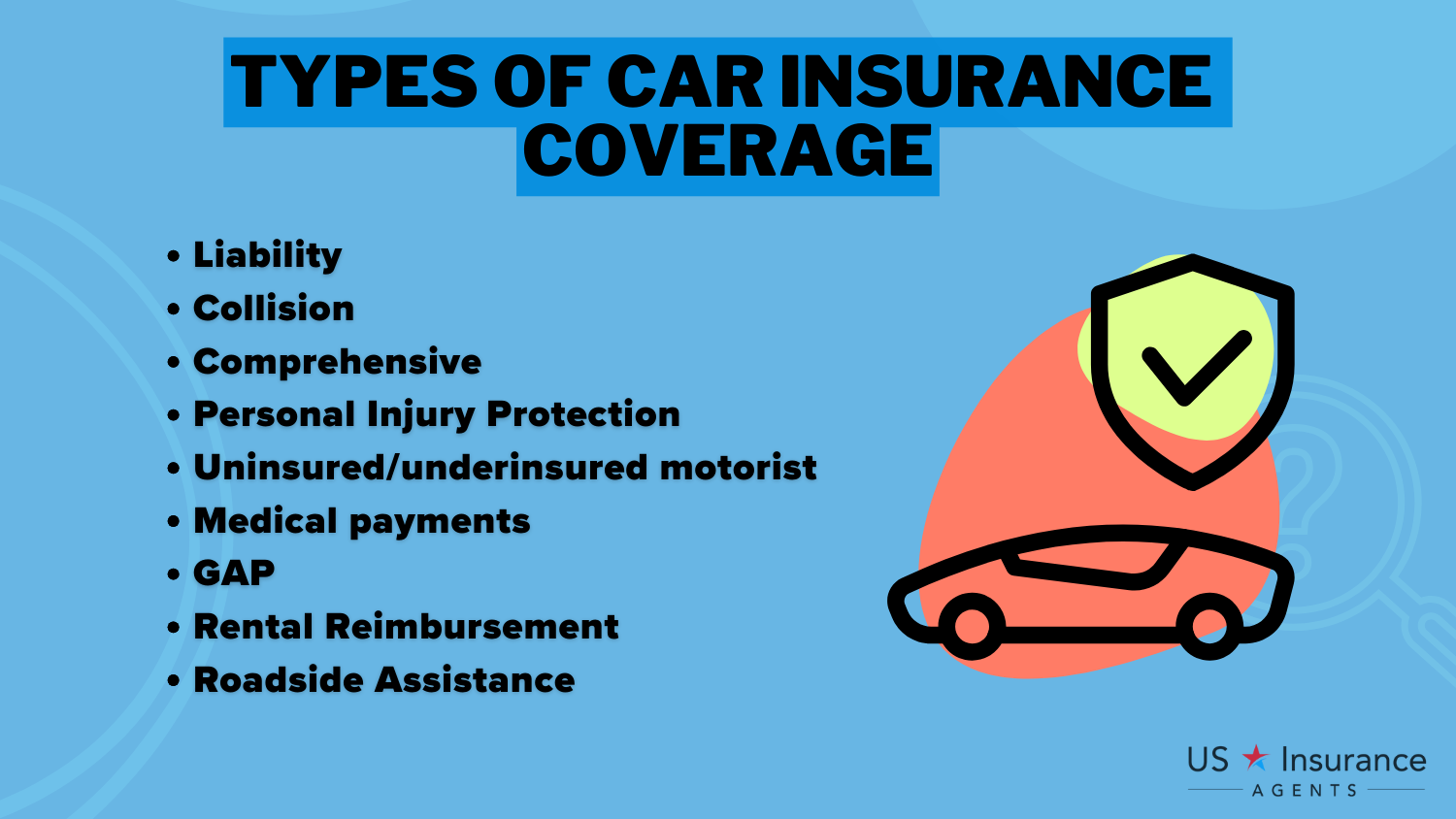

Factors to consider when choosing car insurance for teens in Florida

When choosing car insurance for teens in Florida, there are several important factors to consider. One such factor is the type of coverage needed. Comprehensive coverage offers the highest level of protection and covers a wide range of incidents, including theft, vandalism, and natural disasters.

Jeff Root Licensed Insurance Agent

Liability coverage, on the other hand, only covers damages and injuries sustained by other parties. Another factor to consider is the insurance company’s reputation and reliability.

Opting for a well-established insurance provider with a good track record can ensure prompt claims processing and excellent customer service. Additionally, parents should take into account the cost of premiums, deductibles, and any available discounts for teen drivers. Read up on the “What is the difference between a deductible and a premium in car insurance?” for more information.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Minimum Car Insurance Requirements for Teen Drivers in Florida

In Florida, teen drivers are required to meet specific minimum car insurance requirements. The state mandates that every driver carry a minimum of $10,000 in Personal Injury Protection (PIP) coverage and $10,000 in Property Damage Liability (PDL) coverage. PIP coverage helps pay for your medical expenses and lost wages in the event of an accident, regardless of who is at fault.

PDL coverage, on the other hand, covers damage caused by your vehicle to someone else’s property. These minimum requirements ensure that teen drivers have some level of financial protection, but it’s important to note that they may not offer sufficient coverage in more severe accidents.

Delve into our evaluation of “Best Car Insurance for Drivers After an Accident in South Carolina.”

The Best Auto Insurance Companies for Teen Drivers in Florida

When it comes to finding the best auto insurance companies for teen drivers in Florida, there are a few key players that consistently offer competitive rates and comprehensive coverage. State Farm, Allstate, and Geico are among the top insurers in Florida for teen drivers.

Discover more about offerings in our article called “Financial Literacy for Kids & Teens: Saving, Investing, Budgeting & Beyond.”

These companies understand the unique risks associated with insuring young drivers and often offer specialized policies tailored to meet the needs of teenage drivers. By choosing a reputable insurance company that specializes in teen driver coverage, parents can find peace of mind knowing their teen is protected by a reliable insurer.

Comparing Car Insurance Rates for Teenagers in Florida

Comparing car insurance rates for teenagers in Florida is essential to finding the most affordable coverage. Insurance companies take various factors into account when determining rates for teen drivers, such as their driving record, age, the type of vehicle they drive, and even their grades in school.

If you want to learn more about the company, head to our article called “How much is car insurance?”

Parents should obtain quotes from multiple insurance companies to compare prices and coverage options. It’s worth noting that while some companies may offer lower premiums, they may also provide less comprehensive coverage, so it’s crucial to consider both the cost and the level of protection when comparing rates.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips for Lowering Car Insurance Premiums for Teenagers in Florida

As the cost of car insurance for teenagers in Florida can be quite high, there are several strategies parents can employ to lower premiums. Encouraging teens to maintain good grades can often result in a “good student” discount from insurance providers. Completing a driver’s education course can also help reduce insurance costs, as it demonstrates a commitment to safe driving practices.

Additionally, choosing a safe and reliable vehicle, equipping it with anti-theft devices, and limiting the frequency of teen’s driving can result in lower premiums. It’s important to consult with insurance providers and explore all available discounts to ensure the best possible rates for teen drivers.

Learn more in our guide titled “Defensive Driving Courses Can Lower Your Car Insurance Rates.”

Evaluating the Coverage Options for Teen Driver Insurance in Florida

When evaluating the coverage options for teen driver insurance in Florida, parents should consider both liability coverage and comprehensive coverage. Liability coverage protects against damages and injuries caused to others, while comprehensive coverage provides additional protection for the teen’s vehicle and covers events such as theft, vandalism, and natural disasters.

Delve into our evaluation of “Best Anti Theft System Car Insurance Discounts.”

It’s essential to strike a balance between adequate coverage to minimize financial risk and affordability. By working closely with insurance providers, parents can tailor the coverage options to suit their specific needs and budget, ensuring that both the teen driver and their vehicle are well-protected.

Key Features and Benefits of Teen Car Insurance in Florida

Car insurance policies for teens in Florida should include several must-have features and benefits. One important feature is uninsured/underinsured motorist coverage, which protects against drivers who don’t have insurance or whose coverage is insufficient to cover damages. This coverage is particularly crucial for teen drivers who may be more vulnerable on the road.

Additionally, roadside assistance and rental car reimbursement can prove invaluable in case of breakdowns or accidents. It’s also worth considering policies that offer accident forgiveness, allowing for a certain number of accidents without raising rates. By carefully reviewing the features and benefits of available policies, parents can select coverage that provides the best possible protection for their teen driver.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Discounts & Savings on Teen Car Insurance in Florida

Insurance companies often offer special discounts and savings opportunities on car insurance for teenagers in Florida. Good student discounts, discounts for completing driver’s education courses, and discounts for limited driving are commonly available for young drivers.

Check out insurance savings in our complete “Best Safe Driver Car Insurance Discounts.”

Additionally, some companies offer discounts for installing tracking devices that monitor driving habits or for equipping vehicles with certain safety features. Taking advantage of these discounts can result in substantial savings on insurance premiums while still maintaining comprehensive coverage for teen drivers. It’s important to inquire with insurance providers about all available discounts to maximize savings.

Risks and Liabilities of Insuring Teen Drivers in Florida

Insuring a teen driver in Florida comes with its fair share of risks and liabilities. Due to their inexperience on the road, teen drivers are more prone to accidents. In the event of an accident, parents may be held financially responsible for any damages or injuries caused by their teen driver. To learn more, explore our comprehensive resource on “Car Accidents: What to do in Worst Case Scenarios.”

Laura Walker Former Licensed Agent

It’s crucial to ensure that insurance coverage is sufficient to protect against potential liabilities. Parents must also educate their teen drivers about the importance of safe driving habits, the potential consequences of reckless driving, and the impact their actions can have on insurance rates. By understanding the risks and liabilities involved, parents can take proactive steps to mitigate potential issues.

Post-Accident Steps for Teen Drivers in Florida

In the unfortunate event of a car accident involving a teenage driver in Florida, it’s essential to follow specific steps to ensure the well-being of all parties involved and protect legal and insurance interests. Immediately after the accident, both parties should exchange insurance and contact information.

If possible, take photos of the accident scene and any damages to the vehicles. It’s crucial to report the accident to the police and, if necessary, seek medical attention for injuries. Contacting the insurance company to report the accident promptly is vital to begin the claims process.

Unlock details in our guide titled “Your Insurance Agent’s Role in the Claims Process.”

Throughout the entire process, it’s advisable to consult with an experienced insurance attorney to understand rights and responsibilities and ensure a fair resolution.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Common Mistakes to Avoid When Insuring a Teenage Driver in Florida

When insuring a teenage driver in Florida, there are several common mistakes that parents should avoid. One of the most significant mistakes is overlooking the importance of exploring different coverage options and comparing rates from multiple insurance providers. Unlock details in our article called “Types of Car Insurance Coverage.”

Choosing the first policy that comes along without considering alternatives can result in higher premiums and inadequate coverage. It’s also important to accurately disclose all relevant information about the teen driver, such as their driving history and the number of miles they will typically drive.

Failure to provide accurate information might result in denied claims or non-renewal of the policy. Lastly, parents should avoid purchasing only the minimum required coverage, as this may leave them exposed to significant financial liabilities in the event of an accident.

How to Teach Responsible Driving Habits to Your Teenager in Florida

Teaching responsible driving habits to your teenager in Florida is essential for their safety and for maintaining affordable insurance rates. Parents can start by setting a good example through their own driving behavior. Reinforcing the importance of obeying traffic laws, avoiding distractions while driving, and respecting other drivers can have a lasting impact on teens.

Additionally, enrolling teens in comprehensive driver’s education courses can provide them with essential knowledge and skills necessary for safe driving. It’s also crucial to establish clear rules and consequences for breaking them, such as limiting the number of passengers allowed in the car and enforcing restrictions on nighttime driving.

By actively engaging with your teen driver and providing guidance and support, you can help shape responsible driving habits that will benefit them for a lifetime. Check out insurance savings in our complete “Safety Features Car Insurance Discount.”

GDL Program: A Guide for Florida Parents and Teens

The Graduated Driver Licensing (GDL) program is an essential tool for parents and teens in Florida. The GDL program is designed to gradually introduce young drivers to the responsibilities and skills necessary for safe driving. It consists of three stages: a learner’s permit stage, an intermediate stage, and a full license stage.

Parents play a crucial role in supervising and guiding their teen drivers throughout these stages. By understanding the requirements and restrictions of the GDL program, parents can ensure their teen drivers comply with the rules and progress safely through each stage.

Familiarizing themselves with the program’s guidelines can help parents develop a structured approach to teaching their teens to drive responsibly. Learned more in our article called “Car Driving Safety Guide for Teens and Parents.”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Adding a Teen Driver to Your Florida Car Insurance Policy

Adding a teen driver to an existing car insurance policy in Florida can be a complex process, but by following a few essential steps, parents can navigate this task more smoothly. First, contact the insurance provider to notify them of the intention to add a teen driver. The insurance company will inquire about the teenager’s driving record, school performance, and other relevant details to determine the impact on premiums.

Discover insights in our article called “Traffic School Can Lower Your Car Insurance Rates.”

It’s important to discuss coverage options and any available discounts specifically aimed at teen drivers. In some cases, it may be more cost-effective to move the teenager to their own policy. It’s crucial to carefully review all terms and conditions of the policy and make any necessary adjustments to ensure proper coverage for the teen driver.

Exploring Alternatives to Traditional Car Insurance for Teens in Florida

Parents and teens in Florida looking for alternatives to traditional car insurance have a few options to consider. One alternative is usage-based insurance, which determines rates based on driving behavior and mileage. This can be an effective option for responsible teen drivers who maintain good driving habits and limited mileage.

Additionally, some insurance companies offer pay-as-you-go policies, where premiums are based on the actual mileage driven. Certain organizations also provide insurance coverage specifically tailored for teen drivers, offering lower rates and specialized protection. Exploring these alternatives can help parents find insurance options that best suit their teenager’s needs, driving habits, and budget.

As a parent navigating the world of car insurance for teen drivers in Florida, it’s crucial to be well-informed about the available options and the unique factors that influence rates and coverage. Discover more about offerings in our guide titled “The Most and Least Car-Dependent States.”

By thoroughly exploring the various aspects discussed in this article, you can make informed decisions about the best car insurance for your teenager in Florida. Remember, adequate coverage and responsible driving habits are essential for protecting your teen driver and providing peace of mind for yourself.

Get the right car insurance at the best price — enter your ZIP code below to shop for coverage from the top insurers.

Frequently Asked Questions

What factors should I consider when looking for the best car insurance for teens in Florida?

When searching for the best car insurance for teens in Florida, it is important to consider factors such as cost, coverage options, discounts for good grades or driver training, customer reviews, and the financial stability of the insurance company.

For additional details, explore our comprehensive resource titled “Best Car Insurance for College Students.”

Are there any specific car insurance companies that are known for offering good coverage for teen drivers in Florida?

While there are several insurance companies that offer coverage for teen drivers in Florida, some companies that are often recommended for their coverage options and competitive rates include State Farm, Geico, Allstate, Progressive, and USAA (for military families).

What are some ways to lower the cost of car insurance for teen drivers in Florida?

To lower the cost of car insurance for teen drivers in Florida, you can consider adding your teen to your existing policy, choosing a safe and reliable car for them to drive, encouraging good grades to qualify for good student discounts, completing a driver training course, and comparing quotes from multiple insurance companies to find the best rates.

Do car insurance rates for teens in Florida differ based on gender?

Car insurance rates for teens in Florida can vary based on several factors, but gender is not typically one of them. Insurance companies primarily consider factors such as driving record, type of vehicle, location, and age when determining rates for teen drivers.

What is the importance of having adequate liability coverage for teen drivers in Florida?

Adequate liability coverage for teen drivers in Florida is crucial as it protects against financial losses from at-fault accidents, covering damages and medical expenses, and ensures compliance with state insurance requirements.

To find out more, explore our guide titled “Liability Insurance: A Complete Guide.”

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.