Best Car Insurance for Rental Reimbursement Coverage in 2026 (Top 10 Companies Ranked)

Discover the best car insurance for rental reimbursement coverage with top picks State Farm, USAA, and Allstate, starting at just $70 monthly. These providers offer superior options and benefits tailored to keep you covered, ensuring comprehensive protection and cost-efficiency.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Tim Bain is a licensed life insurance agent with 23 years of experience helping people protect their families and businesses with term life insurance. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Tim Bain

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Jeff Root

Updated January 2025

18,157 reviews

18,157 reviewsCompany Facts

Full Coverage for Rental Reimbursement

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 6,590 reviews

6,590 reviewsCompany Facts

Full Coverage for Rental Reimbursement

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 11,640 reviews

11,640 reviewsCompany Facts

Full Coverage for Rental Reimbursement

A.M. Best

Complaint Level

Pros & Cons

11,640 reviews

11,640 reviewsThe top picks for the best car insurance for rental reimbursement coverage are State Farm, USAA, and Allstate, renowned for their comprehensive options and exceptional service.

These providers stand out by offering diverse rental choices, tailored benefits for military members, and enhanced coverage features.

Our Top 10 Company Picks: Best Car Insurance for Rental Reimbursement Coverage

| Company | Rank | Multi-Vehicle Discount | Safe Driver Discount | Best For | Jump Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | 30% | Rental Options | State Farm | |

| #2 | 10% | 20% | Military Affiliation | USAA | |

| #3 | 25% | 20% | Enhanced Benefits | Allstate | |

| #4 | 20% | 25% | Member Discounts | Nationwide | |

| #5 | 10% | 30% | Customizable Policies | Progressive | |

| #6 | 12% | 30% | Added Convenience | Liberty Mutual | |

| #7 | 10% | 25% | Bundle Savings | Farmers | |

| #8 | 8% | 20% | Comprehensive Coverage | Travelers | |

| #9 | 20% | 30% | Local Service | Erie |

| #10 | 10% | 20% | Accessibility | The General |

They ensure that policyholders can maintain mobility with minimal disruption when their primary vehicle is under repair. By focusing on affordability, flexibility, and reliable claims service, these insurers exemplify what consumers should look for in rental reimbursement coverage.

Get the right car insurance at the best price — enter your ZIP code above to shop for coverage from the top insurers.

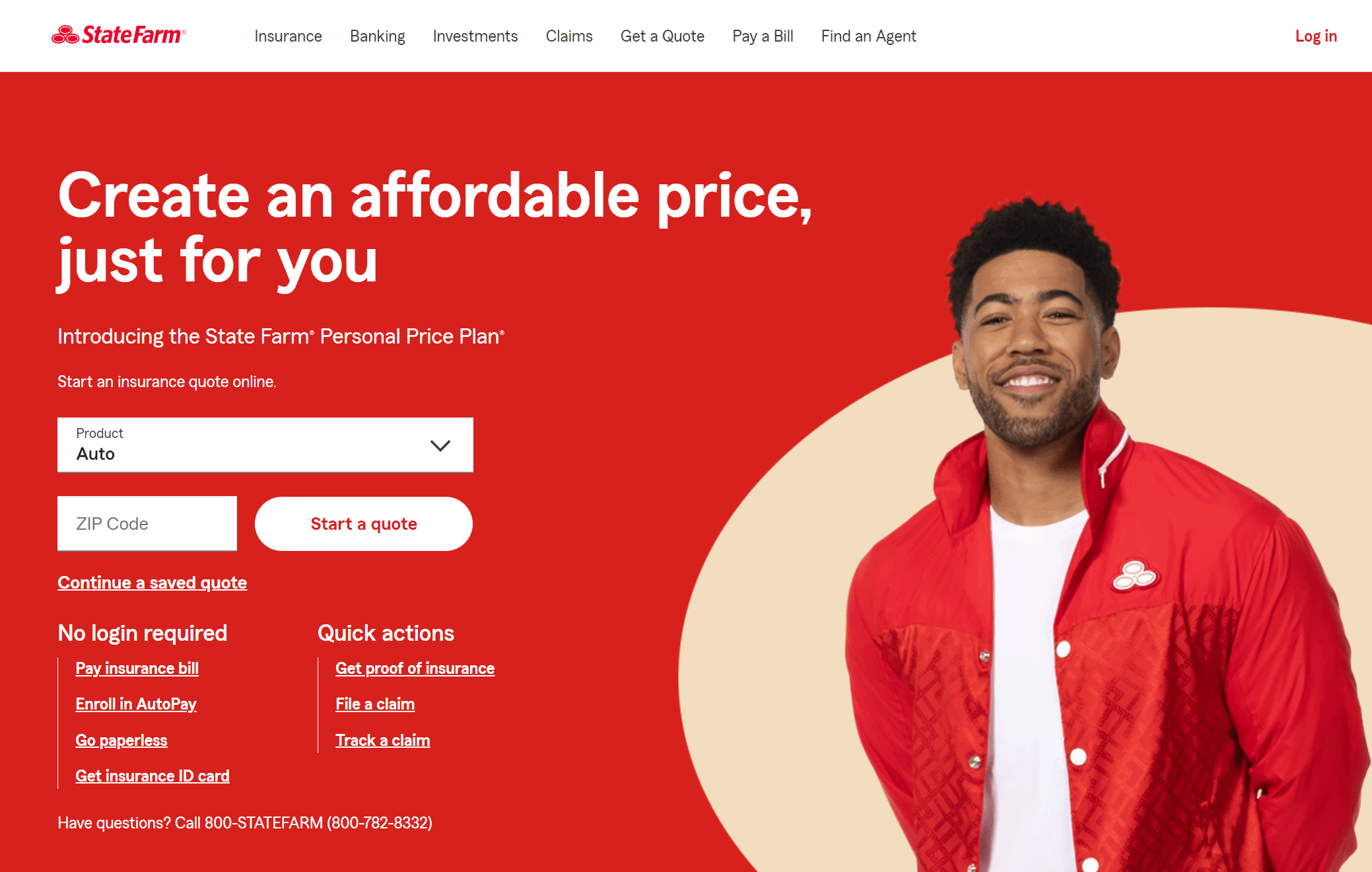

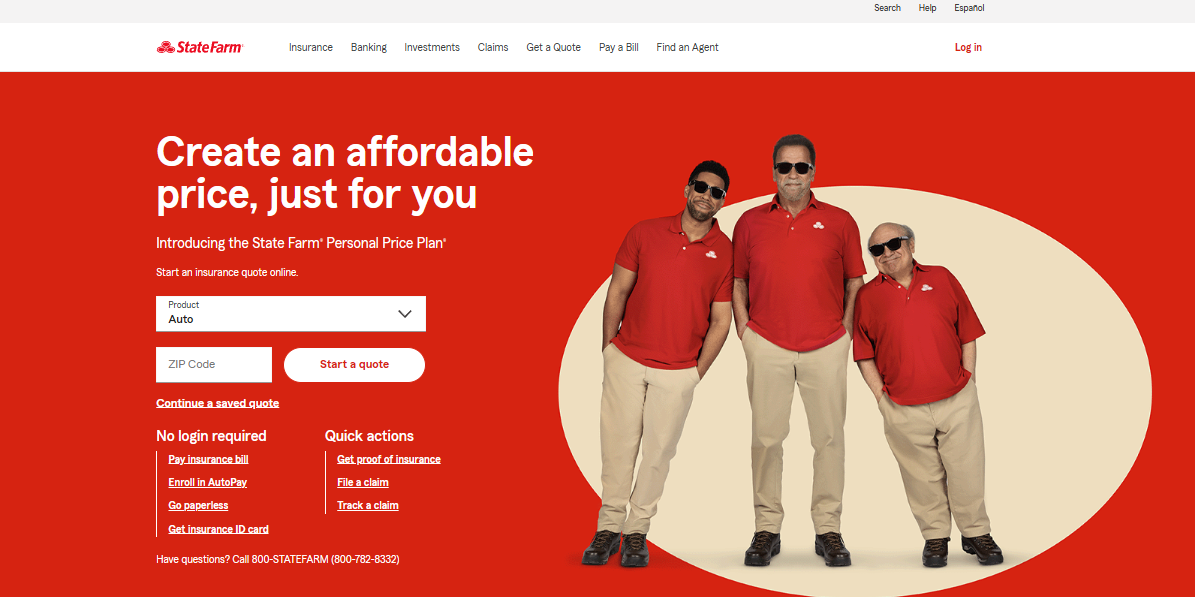

#1 – State Farm: Top Overall Pick

Pros

- Multi-Vehicle Discount: State Farm offers a 25% discount for insuring multiple vehicles.

- Safe Driver Discount: Provides a substantial 30% discount for safe drivers. Learn more in our State Farm insurance review & ratings.

- Comprehensive Rental Options: Specializes in diverse rental coverage solutions.

Cons

- Higher Premiums: Despite discounts, premiums can be higher for certain coverage levels.

- Limited Customizability: While offering broad options, customization might be less flexible compared to others.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Military Affiliation

Pros

- Military-Focused Benefits: Tailored discounts and benefits for service members and their families.

- Reliable Customer Service: Recognized for superior service within the military community.

- Moderate Discounts: Offers 10% multi-vehicle and 20% safe driver discounts. Discover insights in our USAA insurance review & ratings.

Cons

- Membership Limitation: Services are exclusive to military members, veterans, and their families.

- Limited Global Reach: Mainly serves the U.S., which might be restrictive for international needs.

#3 – Allstate: Best for Enhanced Benefits

Pros

- High Multi-Vehicle Discount: Provides a competitive 25% discount for multi-vehicle policies.

- Robust Benefits: Offers enhanced benefits, adding more value to policies.

- Safe Driver Incentives: Safe drivers enjoy a 20% discount. See more details on our Allstate insurance review & ratings.

Cons

- Costlier Premiums: Enhanced benefits come at higher premium costs.

- Complex Policies: Policy features might be complex and require thorough understanding.

#4 – Nationwide: Best for Member Discounts

Pros

- Substantial Member Discounts: Offers a 20% discount for safe driving and 25% for multi-vehicle policies.

- Dedicated Member Services: Nationwide emphasizes benefits and services for its members.

- Wide Coverage Options: Broad array of insurance options to cater to different needs. More information is available about this provider in our Nationwide insurance review & ratings.

Cons

- Premium Variability: Premium rates may vary significantly between states and customer profiles.

- Focused on Members: Best benefits are primarily available to existing members, which might limit new customers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Progressive: Best for Customizable Policies

Pros

- Customizable Options: Progressive stands out for policy flexibility and customization.

- High Safe Driver Discount: Offers a substantial 30% discount for safe driving.

- Dynamic Pricing: Utilizes technology for personalized pricing models. Read up on the Progressive insurance review & ratings for more information.

Cons

- Variable Customer Service: Experience can vary widely depending on region and agent.

- Complex Pricing Structure: Customizable options may lead to complex pricing that can confuse some customers.

#6 – Liberty Mutual: Best for Added Convenience

Pros

- Comprehensive Safe Driver Discount: Offers a substantial 30% discount for safe driving.

- Enhanced Convenience Features: Focuses on adding features that improve user convenience.

- Moderate Multi-Vehicle Discount: Provides a 12% discount for multi-vehicle policies. Check out insurance savings in our complete Liberty Mutual insurance review & ratings.

Cons

- Higher Premium Rates: Despite the discounts, premium rates can be relatively high.

- Limited Policy Customization: Offers fewer options for policy customization compared to other insurers.

#7 – Farmers: Best for Bundle Savings

Pros

- Significant Bundle Savings: Offers substantial savings for customers who bundle multiple policies.

- Safe Driver Benefits: Safe drivers can benefit from a 25% discount. Discover more about offerings in our Farmers insurance review & ratings.

- Diverse Policy Options: Provides a variety of insurance products that can be bundled.

Cons

- Limited Multi-Vehicle Discount: Only a 10% discount for multi-vehicle policies.

- Inconsistency in Service: Customer experience can vary greatly depending on the region and agent.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Comprehensive Coverage

Pros

- Comprehensive Policy Offerings: Known for offering extensive coverage options.

- Safe Driver Discount: Provides a 20% discount for maintaining a safe driving record.

- Stable Pricing: Known for stable and predictable insurance pricing. Access comprehensive insights into our Travelers insurance review & ratings.

Cons

- Lower Multi-Vehicle Discount: Offers a relatively low 8% discount for multi-vehicle policies.

- Complex Policy Details: Policies can be detailed and complex, requiring careful review.

#9 – Erie: Best for Local Service

Pros

- Strong Local Presence: Provides personalized service with a strong focus on local communities.

- High Safe Driver Discount: Offers a significant 30% discount for safe drivers. Delve into our evaluation of Erie insurance review & ratings.

- Dedicated Agent Network: Features a robust network of local agents providing personalized support.

Cons

- Limited Availability: Services are not available nationwide, which can be a limitation for some.

- Less Flexibility: Fewer options for policy customization compared to larger national providers.

#10 – The General: Best for Accessibility

Pros

- High Accessibility: Focuses on providing insurance to a wider range of drivers, including those with less-than-perfect driving records. Unlock details in our The General car insurance review & ratings.

- Safe Driver Discount: Offers a 20% discount for safe drivers.

- Flexible Payment Options: Provides flexible payment methods to accommodate different financial situations.

Cons

- Higher Premiums for High-Risk Drivers: Typically, premiums are higher for those considered high-risk.

- Limited Coverage Options: Offers fewer coverage options compared to other major insurers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Navigating Rental Reimbursement Coverage Rates: A Comprehensive Overview of Leading Car Insurance Providers

The quest for optimal coverage often hinges on the specific features offered by different providers. A critical aspect for many policyholders is rental reimbursement coverage, which ensures financial support for the cost of renting a replacement vehicle during repairs. Delving into the coverage rates of prominent insurance companies provides valuable insights for those seeking the best auto insurance with rental reimbursement.

Car Insurance Monthly Rates for Rental Reimbursement Coverage by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| Allstate | $90 | $120 |

| Erie | $75 | $105 |

| Farmers | $85 | $115 |

| Liberty Mutual | $100 | $130 |

| Nationwide | $75 | $105 |

| Progressive | $80 | $110 |

| State Farm | $80 | $110 |

| The General | $120 | $150 |

| Travelers | $90 | $120 |

| USAA | $70 | $100 |

A careful examination of the average monthly car insurance rates reveals noteworthy variations among leading providers. USAA emerges as a cost-effective choice, offering a minimum coverage rate of $70 and a full coverage rate of $100. Learn more in our “What is included in comprehensive car insurance?”

On the other end, Liberty Mutual and The General present higher premiums at $100-$130 and $120-$150, respectively. These figures demonstrate the nuanced balance between affordability and comprehensive coverage. Notably, State Farm, Nationwide, and Progressive fall within the mid-range, providing a mix of reasonable rates and robust protection.

As consumers navigate the intricate landscape of car insurance, these specific coverage rates serve as a crucial guide for making informed decisions tailored to individual needs. Whether prioritizing affordability with USAA or opting for broader coverage with Liberty Mutual and The General, understanding the specific coverage rates enables individuals to align their preferences with budget considerations.

As the automotive insurance market evolves, this comprehensive overview empowers consumers to navigate the intricacies of coverage rates and make decisions that best suit their unique requirements.

Understanding Rental Reimbursement Coverage: What Is It and Why You Need It

Rental reimbursement coverage is an optional add-on to your car insurance policy that helps cover the cost of renting a replacement vehicle while your car is undergoing repairs due to a covered accident. It provides financial assistance to ensure that you can continue with your daily activities without disruption, even if your car is out of commission for an extended period.

This coverage is particularly useful when you heavily rely on your vehicle for commuting, running errands, or attending work or school. Without it, you may find yourself stranded or burdened with significant expenses if your car becomes unusable due to an accident or damage. See more details on our “Best Renters Insurance: A Complete Guide.”

The Importance of Rental Reimbursement Coverage in Car Insurance

Rental reimbursement coverage plays a crucial role in ensuring that you are not left without transportation in case of an accident. It offers peace of mind and financial support during challenging times, ensuring that you can swiftly get back behind the wheel and resume your daily routine. By providing access to a rental car, it minimizes the inconvenience and potential loss of productivity associated with being without a vehicle.

Furthermore, rental reimbursement coverage can also save you money in the long run. While the cost of adding this coverage to your car insurance policy may lead to a slightly higher premium, it can be well worth the investment when compared to the out-of-pocket expenses associated with renting a vehicle independently. Unlock details on how does the insurance company determine my premium.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring the Benefits of Rental Reimbursement Coverage

One of the primary benefits of rental reimbursement coverage is the convenience it offers. Rather than spending time and effort arranging a rental car yourself, this coverage enables a seamless transition between your damaged vehicle and a temporary replacement.

Moreover, rental reimbursement coverage generally does not place a strict limit on the duration of the rental. This means that if your car requires extensive repairs, you can keep the rental vehicle for as long as it takes until your car is back on the road. This flexibility ensures that you are not rushed to return the rental car prematurely and can genuinely focus on getting your car repaired properly. Delve into our evaluation of “Best Car Insurance.”

How Rental Reimbursement Coverage Works in Car Insurance Policies

It is essential to understand how rental reimbursement coverage works within the context of your car insurance policy. Generally, this coverage provides a daily limit for rental expenses, which can range from $20 to $50 per day. Additionally, there is typically a maximum limit on the number of days for which the coverage applies, such as 30 days.

When your car is undergoing repairs, you will need to rent a vehicle from a licensed rental car company. Keep in mind that the coverage does not extend to personal vehicle rentals from friends or family members. Once you have rented the vehicle, save the rental agreement and receipts, as they will be necessary for filing a claim with your insurance provider. See more details on our “Your Insurance Agent’s Role in the Claims Process.”

Comparing Different Car Insurance Providers’ Rental Reimbursement Coverage Options

When looking for the best auto insurance for rental reimbursement coverage, it is crucial to compare the options offered by different providers. While the coverage itself may have some commonalities across providers, there can be variations in terms of daily limits, maximum coverage duration, and the cost of adding this coverage to your policy.

Jeff Root Licensed Life Insurance Agent

Some insurance companies offer rental reimbursement coverage as a standard inclusion in their comprehensive or collision policies, while others offer it as an optional add-on. Furthermore, certain providers may include rental reimbursement coverage only in their higher-tier policies.

As you compare different car insurance providers, make sure to consider the specific rental reimbursement coverage offered, the associated costs, and the overall reputation and reliability of the insurer. Learn more in our “How much insurance coverage do I need?”

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors to Consider When Choosing the Best Car Insurance for Rental Reimbursement Coverage

When selecting the best car insurance for rental reimbursement coverage, several factors should be taken into account. First and foremost, consider the applicable daily limit and maximum coverage duration. Ensure that the limits are reasonable for your needs and match your expected expenses if you were to rent a replacement vehicle.

It is also important to assess the cost of adding rental reimbursement coverage to your car insurance policy. While a higher daily limit may seem appealing, keep in mind that it will result in a higher premium. Strike a balance between coverage limits and affordability to find the option that suits your budget and requirements.

Additionally, investigate the reputation and customer service track record of the insurance provider. Read reviews, check customer satisfaction ratings, and inquire about the claim process to ensure a smooth experience if you ever need to utilize your rental reimbursement coverage. See more details on our “Types of Car Insurance Coverage.”

Top Car Insurance Companies With Excellent Rental Reimbursement Coverage

While numerous car insurance companies offer rental reimbursement coverage, some stand out in terms of providing excellent options and customer service. It is advisable to consider reputable insurers such as Allstate, State Farm, Geico, Progressive, and Nationwide, as they consistently offer comprehensive coverage with competitive rates.

However, remember that the best car insurance for rental reimbursement coverage ultimately depends on your individual needs and preferences. Before making a decision, obtain quotes from multiple providers, review their coverage options, and assess their overall suitability for your specific circumstances.

Learn more: Insurance Quotes Online

Tips for Finding Affordable Car Insurance With Rental Reimbursement Coverage

While having rental reimbursement coverage is valuable, it is essential to find affordable car insurance that fits within your budget. Here are some tips to help you secure the best rates:

- Shop around and compare quotes from multiple insurers to find the most competitive rates for the coverage you need.

- Consider bundling your car insurance with other policies, such as homeowners or renters insurance, as this can often result in significant discounts.

- Maintain a clean driving record and a good credit score, as these factors can positively influence your insurance premiums.

- Opt for a higher deductible if you can afford it, as this can lower your premium.

- Explore available discounts, such as safe driver discounts or discounts for completing defensive driving courses.

- Review your coverage regularly and adjust it based on changes in your circumstances to ensure you are not paying for unnecessary coverage.

Finding affordable car insurance with rental reimbursement coverage can significantly ease financial stress in times of need. By diligently comparing rates, bundling policies, and optimizing your coverage, you can enjoy robust protection without overspending, ensuring peace of mind whenever your vehicle is off the road.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Common Mistakes to Avoid When Selecting Car Insurance for Rental Reimbursement Coverage

When selecting car insurance with rental reimbursement coverage, it is important to avoid common mistakes that could potentially result in inadequate or costly coverage. Some of these mistakes include:

- Failing to thoroughly understand the terms and limitations of the rental reimbursement coverage, such as daily limits and coverage duration.

- Not considering the potential rental costs in your area when choosing the appropriate coverage limits.

- Overlooking the reputation and customer service of the insurance provider, which can significantly impact your experience when filing a claim.

- Not reviewing your car insurance policy regularly and ensuring that the coverage still meets your needs.

By avoiding these mistakes, you can ensure that you make an informed decision and select the best car insurance policy for your rental reimbursement coverage needs. Unlock details in our “Commonly Misunderstood Insurance Concepts.”

Understanding the Claim Process for Rental Reimbursement Coverage in Car Insurance

If you find yourself in a situation where you need to utilize your rental reimbursement coverage, understanding the claim process is essential. Firstly, contact your insurance provider to report the accident and initiate the claims process. They will guide you through the necessary steps and provide you with the relevant claim forms and instructions.

Once you have obtained a rental vehicle, keep all the documentation related to the rental, including the rental agreement, mileage information, and receipts. These documents will be required when submitting a claim for reimbursement. Discover insights in our “How to Document Damage for Car Insurance Claims.”

When your car is finally repaired and you no longer require the rental vehicle, contact your insurance provider to notify them of the end of the rental period. They will review the documentation and process the reimbursement accordingly, subject to the terms and conditions of your policy.

How to Maximize Your Benefits With Rental Reimbursement Coverage in Car Insurance

To maximize the benefits of rental reimbursement coverage, it is crucial to be proactive and familiarize yourself with the specific terms and conditions outlined in your car insurance policy. Here are some tips to help you make the most out of this valuable coverage:

- Understand the daily limits and maximum coverage duration provided by your policy.

- Select an appropriate rental vehicle that meets your needs without exceeding the coverage limits. Learn more in our “What is annual limit?”

- Keep the rental period as short as possible by promptly returning the rental vehicle once your car is repaired.

- Consider utilizing public transportation or ridesharing services during the repair process if it is a more cost-effective option.

By being proactive and utilizing the coverage efficiently, you can minimize the financial impact of renting a replacement vehicle and ensure a smooth and seamless experience during the repair process.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Additional Features and Add-Ons Related to Rental Reimbursement Coverage

In addition to basic rental reimbursement coverage, some car insurance providers offer additional features and add-ons that can further enhance your experience and protection. These extras may include access to premium rental vehicles, trip interruption coverage, or coverage for loss-of-use charges imposed by the rental car company.

Read more: What is out-of-pocket costs?

While these upgrades can provide additional peace of mind, it is crucial to evaluate the cost and necessity of these add-ons based on your specific circumstances. Consider if the benefits justify the extra expense, and only opt for them if they align with your requirements and budget.

Comparing the Costs and Savings of Different Car Insurance Providers’ Rental Reimbursement Coverage Plans

When comparing the costs and savings associated with different car insurance providers’ rental reimbursement coverage plans, it is essential to evaluate the overall value offered. While some insurers may offer lower premiums, they may have more restrictive coverage limits or shorter maximum durations.

Laura Walker Former Licensed Agent

Consider the potential costs incurred if you were to rent a vehicle out of pocket for a specific period in your area. This will help you gauge how the coverage limits of different providers align with your expectations and budget. Additionally, factor in any potential savings resulting from bundling policies or eligibility for other discounts offered by the insurer.

Ultimately, the goal is to strike the right balance between affordable premiums and adequate coverage that meets your rental reimbursement needs in various scenarios. See more details on our “Your Insurance Agent’s Role in the Claims Process.”

The Future of Rental Reimbursement Coverage: Trends and Innovations in the Industry

The car insurance industry is continually evolving, adapting to new technologies, and incorporating innovative features into its offerings. While rental reimbursement coverage itself remains a valuable add-on, future trends and innovations may further enhance the overall experience.

One emerging trend is the integration of rental reimbursement coverage with digital platforms and mobile apps. This allows for seamless communication, claim processing, and rental vehicle booking, providing a more streamlined and efficient experience for policyholders.

In addition to technological advancements, there is also increased focus on environmental sustainability. As electric vehicles become more prevalent, car insurance providers may offer specialized rental reimbursement coverage for electric rental vehicles, further supporting the transition to greener transportation options.

These trends indicate that the future of rental reimbursement coverage is likely to bring enhanced convenience, efficiency, and tailored options to policyholders. Choosing the best car insurance for rental reimbursement coverage requires careful consideration of various factors, including coverage limits, cost, and the reputation of the insurance provider.

Melanie Musson Published Insurance Expert

By understanding the ins and outs of rental reimbursement coverage, you can make an informed decision that ensures you have access to a temporary replacement vehicle in case of a car accident or damage.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Best Car Insurance for Rental Reimbursement Coverage

Selecting the right car insurance is vital, especially when it comes to rental reimbursement coverage. The following case studies, based on real-world scenarios, illustrate how State Farm, USAA, and Allstate effectively meet the needs of their customers.

- Case Study #1 – Seamless Transition With State Farm: John’s car was in the shop for a week following a collision. He contacted State Farm, who quickly arranged a rental car that matched his own vehicle’s class, ensuring minimal disruption to his daily routine.

- Case Study #2 – Tailored Assistance From USAA: Sarah, an active-duty military member stationed far from home, experienced a car breakdown. USAA immediately coordinated a rental vehicle that met her specific needs for space and features, recognizing the unique circumstances of military life.

- Case Study #3 – Comprehensive Coverage With Allstate: After an accident left Tom’s car undrivable, he was concerned about the impact on his commute. Allstate not only provided a rental car swiftly but also ensured the rental period covered the entire duration of his car repairs, alleviating his worries.

These scenarios highlight the importance of choosing car insurance that offers comprehensive rental reimbursement coverage, ensuring that policyholders can maintain their mobility and routine without hassle. To learn more, explore our comprehensive resource on “Best Car Insurance Discounts to Ask.”

Explore your car insurance options by entering your ZIP code below and finding which companies have the lowest rates.

Frequently Asked Questions

What is rental reimbursement coverage, and why is it important in car insurance?

Rental reimbursement coverage is an optional add-on to your car insurance policy that covers the cost of renting a replacement vehicle while your car is undergoing repairs due to a covered accident. It ensures you have access to transportation during the repair process, preventing disruptions to your daily activities.

Access comprehensive insights into our guide titled “Can I buy car insurance online?“

How does rental reimbursement coverage work, and what are the key features to consider?

Rental reimbursement coverage provides a daily limit for rental expenses, usually ranging from $20 to $50 per day, with a maximum coverage duration (e.g., 30 days). To utilize the coverage, you must rent a vehicle from a licensed rental car company. Key features to consider include daily limits, coverage duration, and any additional benefits offered by the insurance provider.

Which car insurance providers offer the best rental reimbursement coverage, and what are their distinctive features?

State Farm, USAA, and Allstate are recognized for their rental reimbursement coverage. State Farm provides a diverse selection of rental choices, USAA offers tailored benefits for military members, and Allstate includes enhanced benefits such as trip interruption coverage. The choice depends on individual preferences and needs.

Avoid overpaying for your car insurance by entering your ZIP code below in our free comparison tool to find which company has the lowest rates.

How can policyholders maximize the benefits of rental reimbursement coverage?

To maximize benefits, policyholders should understand coverage limits, choose a rental vehicle within those limits, and keep the rental period as short as necessary. Additionally, being proactive, saving documentation, and considering alternative transportation options can contribute to a smooth experience during the repair process.

Learn more by reading our guide titled “How to Get Free Insurance Quotes Online.”

Are there any limitations or exclusions to rental reimbursement coverage?

Yes, rental reimbursement coverage may have certain limitations and exclusions. Common limitations include daily or total maximum reimbursement limits, a specified time limit for coverage, and requirements to use authorized rental providers. Exclusions may apply if the accident was caused by certain factors, such as driving under the influence or intentional damage.

What is the best way to cover rental car excess?

Most thorough travel insurance plans, whether for domestic or international travel, include coverage for rental car excess, either as a standard feature or for an additional fee. It’s important to note, though, that there may be a cap on the amount your travel insurance provider will contribute towards the rental car excess, and these caps can differ among insurers.

Will insurance pay for rental cars during repairs in the USA?

Under certain comprehensive or collision car insurance policies, the expense of a rental car while your vehicle is being repaired may be automatically covered. However, this inclusion should not be assumed. In some cases, you might have to add rental car reimbursement as an additional rider to your policy.

To find out more, explore our guide titled “Compare Car Insurance Quotes.”

Is it better to have higher or lower excess on car insurance?

What is damage refund insurance?

Damage Refund is an insurance policy that covers the costs a beneficiary might be responsible for under their vehicle rental agreement if the rented vehicle is damaged or lost during the rental period, along with any specified incidental losses mentioned in the policy.

What is excess reimbursement insurance?

Most insurance policies include a deductible, which is the amount you must pay out-of-pocket for a claim under your main insurance policy. Excess Reimbursement is intended to reimburse you for the deductible amount you pay when you successfully file a claim under your primary insurance policy.

To find out more, explore our guide titled “What is the difference between a deductible and a premium in car insurance?”

Can I claim directly from third party insurance?

What does car excess cover?

What is the excess reduction coverage?

What is refundable excess on a rental car?

What is excess cover in car insurance?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.