Best Car Insurance for Drivers with Bad Credit in Texas (Top 10 Companies Ranked for 2026)

Liberty Mutual, Allstate, and American Family offer the best car insurance for drivers with bad credit in Texas. TX car insurance rates start at $51/mo. Liberty Mutual leads is our top pick due to its customizable policies. Allstate excels in non-standard coverage and American Family has flexible payment options.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. Through her years working in th...

Melanie Musson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Updated August 2025

3,792 reviews

3,792 reviewsCompany Facts

Full Coverage With Bad Credit in TX

A.M. Best

Complaint Level

Pros & Cons

3,792 reviews

3,792 reviews 11,640 reviews

11,640 reviewsCompany Facts

Full Coverage With Bad Credit in TX

A.M. Best

Complaint Level

Pros & Cons

11,640 reviews

11,640 reviews 2,235 reviews

2,235 reviewsCompany Facts

Full Coverage With Bad Credit in TX

A.M. Best

Complaint Level

Pros & Cons

2,235 reviews

2,235 reviewsLiberty Mutual, Allstate, and American Family are the best car insurance companies in Texas for drivers with bad credit. TX car insurance rates with these providers start at $51 monthly.

Liberty Mutual leads due to its customizable coverage that meets customers’ financial budgets.

Allstate is known for offering non-standard insurance and accident forgiveness. American Family offers flexible payment options and the best car insurance discounts for drivers with poor credit.

Check out the top 10 auto insurance companies for people with bad credit below for more options.

Our Top 10 Company Picks: Best Car Insurance for Drivers With Bad Credit in Texas

| Insurance Company | Rank | Bundling Discount | A.M. Best | Best for | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 25% | A | Custom Policies | Liberty Mutual |

| #2 | 25% | A+ | Comprehensive Plan | Allstate | |

| #3 | 25% | A | Low Rates | American Family | |

| #4 | 25% | A++ | Budget-Friendly Policy | Geico | |

| #5 | 20% | A | Customer Satisfaction | Farmers | |

| #6 | 10% | A+ | Diverse Coverage | Progressive | |

| #7 | 20% | A+ | Broad Discounts | Nationwide |

| #8 | 17% | A++ | Reliable Service | State Farm | |

| #9 | 13% | A++ | Policy Flexibility | Travelers | |

| #10 | 10% | A++ | Military Members | USAA |

In this car insurance guide, we will discuss the impact of bad credit on auto insurance in Texas, common challenges experienced by drivers with bad credit, and factors they should know that also contribute to determining premiums.

- Liberty Mutual offers customizable coverage and 30% savings with RightTrack

- Car insurance for drivers with bad credit in TX ranges from $51 to $346/mo

- The top 10 TX car insurers offer 10% to 25% discounts for bundling insurance

To compare bad credit car insurance quotes, enter your ZIP code in our free online tool.

#1 – Liberty Mutual: Top Overall Pick

Pros

- RightTrack Program: Texas drivers can qualify for savings of up to 30% for safe driving practices to offset higher premiums related to adverse credit.

- Bundling Savings Option: Bundling car insurance with other policies can benefit TX drivers who are trying to cut expenses by up to 25%.

- Customizable Coverage: Liberty Mutual customers can customize their bad credit auto insurance in Texas.

Cons

- Higher Premiums Than Competitors: Liberty Mutual car insurance coverage for bad drivers is roughly 7% higher than the national average.

- Low Service Ratings: Liberty Mutual reviews suggest problems with client satisfaction and service quality, with a higher-than-average complaint rate and an NAIC rating of 2.23.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Allstate: Best for Comprehensive Plan

Pros

- Availability of Non-Standard Insurance: According to our Allstate review, the company offers an SR-22 filing if proof of insurance is needed for legal requirements.

- Safe Driving Discounts: Several safe driving discounts, such as Drivewise and a bonus, essentially decrease the higher rates drivers with poor credit frequently incur.

- Flexible Coverage Options & Add-Ons: For drivers who want to customize their coverage, Allstate offers rideshare coverage, new car replacement, and vanishing deductibles.

Cons

- Fewer Discounts: Although discounts are available, car insurance coverage for poor credit drivers offers fewer savings opportunities.

- Higher Rates for Bad Credit: Allstate charges higher premiums for its policyholders, especially those with poor credit, than most insurers.

#3 – American Family: Best for Low Rates

Pros

- Comprehensive Discount Options: A 25% bundling insurance perk, which helps reduce premiums for drivers with bad credit. Check out all the discounts in the American Family review.

- Flexible Payment Options: American Family has flexible payment alternatives for drivers with poor credit who want to manage their monthly recurring premium payments.

- Extensive Coverage Opportunities: American Family offers non-standard insurance for high-risk drivers, bad credit on car insurance, and more add-on features.

Cons

- Higher Premiums for Bad Credit Drivers: American Family may charge higher premiums for drivers with bad credit, making coverage more expensive.

- Restricted Savings for High-Risk Drivers: American Family provides fewer savings options to help high-risk drivers with bad credit.

#4 – Geico: Best for Budget-Friendly Policy

Pros

- User-Friendly Online Resources: According to Geico’s mobile app review, the company’s mobile app has user-friendly online resources for getting quotes, insurance plans, and paying premiums.

- Reasonable Pricing For Bad Credit Drivers: Geico provides competitive and consistent minimum coverage rates, which could help drivers with poor credit.

- Generous Incentives and Discounts: Geico offers discounts for drivers with poor credit, including those for safe driving, military service, and bundling policies.

Cons

- Limited High-Risk Coverage Options: Geico might not provide as many specialty coverage options or auto insurance discounts for bad drivers with poor credit as other insurers.

- Payment Flexibility: Drivers with poor credit may find it more difficult to control their costs since Geico offers fewer flexible payment alternatives for the best car insurance for drivers with bad credit in Texas.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Farmers: Best for Customer Satisfaction

Pros

- Flexible Payment Options: Our Farmers review highlights flexible payment plans that help drivers with bad credit manage their premiums conveniently.

- Several Discounts and Perks: Auto insurance rates with bad credit drivers can significantly decrease through 20% bundling savings or defensive driving courses.

- Non-Standard Coverage Plan: This plan makes it easier for drivers with bad credit or a history of accidents to purchase the bad credit auto insurance coverage they need.

Cons

- Expensive Premium: Farmers’ policy rates are usually higher than those with fair or reasonable credit drivers compared to the best insurance for bad credit.

- Limited Specialized Options for High-risk Drivers: Compared to other insurers, Farmers offers fewer specialized options for drivers with poor credit, although it offers some discounts.

#6 – Progressive: Best for Diverse Coverage

Pros

- Flexible Payment Option: Progressive insurance review discusses options for those with a tight budget, such as low-down payments, customizable payment schedules, autopay, grace periods, and more.

- Non-Standard Coverage Availability: SR-22 policies are offered to insure drivers with bad credit who may have struggled to get insurance elsewhere.

- Competitive Price: Reasonable policy pricing compared to other providers, even considering the best insurance for bad credit.

Cons

- Higher Payment Plan: Additional fees for monthly or installment payments than upfront full payments on bad credit auto insurance premiums.

- Limited Low-Income Assistance: Special programs for low-income drivers are not available, unlike some state-run programs of regional insurers.

#7 – Nationwide: Best for Broad Discounts

Pros

- Vanishing Deductibles: This program reduces your annual deductible from $100 to $500 if you maintain a good driving record.

- Fewer Penalties: According to our Nationwide review, the company forgives those with poor driving records.

- Discount Opportunities: Nationwide lets you save in more ways, even with your low credit score, through SmartRide, SmartMile, paperless options, accident-free, and more.

Cons

- Geographical Limitations: Coverage and discounts may vary by location for the best insurance for bad credit drivers.

- Strict Discount Requirements: Telematics tracking is necessary in SmartRide and SmartMiles, which some drivers dislike.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – State Farm: Best for Reliable Service

Pros

- Personalized Service Through Local Agents: With over 19,000 local agents to assess your needs, discounts, and claims, receive one-on-one guidance.

- Discount Programs: To offset the high rates for bad record drivers, it offers various ways to lower them, like a 30% telematics discount, a defensive driving discount, and more.

- Reliable Claims Process: 24/7 smooth claims processing and high rates for customer satisfaction with a score of 710/1000 for drivers with bad driving records.

Cons

- Fees for Monthly Payments: Additional fees may be added when you don’t pay in full. Check the State Farm car insurance review for additional auto insurance fees.

- Expensive Bad-Credit Rates: State Farm essentially considers credit scores in its auto insurance pricing, so rates can be higher than those with good or fair credit scores.

#9 – Travelers: Best for Policy Flexibility

Pros

- Beneficial Flexible Options: In our Travelers review, learn more about the company’s customizable deductibles and coverage options, such as rideshare, gap, and accident forgiveness.

- Financial Stability: With an A++ rating from A.M. Best and 24/7 claims support, Travelers ensures stable financial status and high customer service approval.

- Extensive Discounts: 30% IntelliDrive Program savings, multi-policy, safe driver, defensive driving, and more.

Cons

- Higher Minimum Rates: The overall base rates for the best car insurance with bad credit are higher than those of Geico and Progressive.

- IntelliDrive Drawback: Driving behaviors such as hard braking, late-night driving, and rapid acceleration may raise the premium rates for auto insurance for bad credit drivers.

#10 – USAA: Best for Military Members

Pros

- Competitive Pricing: The USAA review highlights the lower premiums offered compared to other insurance companies, even for those with bad credit drivers.

- Installment Options: Automatic payments and budget-wise installment with no fees for bad credit auto insurance, unlike other insurers that offer auto insurance with bad driving records.

- Stable Financial Standing: An A++ rating from A.M. Best proves its financial security during claims resolution and disbursements.

Cons

- Customer Service Complaints: Customers reported dissatisfaction over the claims handling and overall customer service, such as unfair fault determination and premium incremental over time.

- Eligibility Coverage Restrictions: As it is exclusive for military members, veterans, and their immediate family, not all bad credit drivers will qualify for their lowest offers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding the Impact Of Bad Credit on Car Insurance Rates in Texas

Most insurance companies consider credit scores indicators of a driver’s financial responsibility and likelihood of filing claims. Drivers with bad credit are perceived as higher-risk individuals and have higher chances of claims, leading to higher insurance premiums.

Chris Abram Licensed Insurance Agent

Therefore, drivers with bad credit in Texas must understand how their credit history impacts their car insurance rates. Check this table for the monthly premiums of the top insurance companies.

Car Insurance Monthly Rates for Drivers with Bad Credit by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $123 | $332 | |

| $122 | $330 | |

| $90 | $244 | |

| $99 | $268 | |

| $128 | $346 |

| $80 | $217 |

| $79 | $215 | |

| $70 | $190 | |

| $66 | $178 | |

| $51 | $139 |

For example, USAA had the lowest rates for minimum coverage and full coverage, but remember, this insurer is exclusive for military and veterans. So, we have Travelers at $66 minimum coverage and $178 full coverage for civilians.

Auto insurance companies in Texas estimate credit-based insurance scores, use this information to make credit reports, and focus on specific factors that correlate with future insurance claims. Factors like payment records, new accounts, unpaid obligations, length of credit account, and types of used credit all play a role in determining insurance rates.

When insurers offer plans and rates, drivers can request a copy of their credit report explaining why these rates are offered. Remember that insurance companies in Texas are legally required to inform drivers of their credit scores and history, which significantly impacts their premium rates.

Every customer should know that the first step towards getting the best coverage options for drivers in Texas is to know their credit score. Evaluating this and knowing if they have good or bad credit, they can brace themselves for the rates and potentially look for ways to lower them.

Car Insurance Discounts From the Top Providers for Drivers with Bad Credit

| Insurance Company | Bundling | Defensive Driving | Paperless | Pay-in-Full | Safe Driver |

|---|---|---|---|---|---|

| 25% | 10% | 3% | 10% | 18% | |

| 25% | 5% | 4% | 20% | 18% | |

| 20% | 10% | 3% | 10% | 20% | |

| 25% | 15% | 3% | 10% | 15% | |

| 25% | 10% | 3% | 12% | 20% |

| 20% | 10% | 3% | 15% | 12% |

| 10% | 31% | 4% | 15% | 10% | |

| 17% | 15% | 3% | 15% | 20% | |

| 13% | 20% | 3% | 15% | 17% | |

| 10% | 5% | 3% | 20% | 10% |

While improving credit takes time and effort, some strategies can help. Drivers with bad credit in Texas may wonder how to improve their credit and potentially lower their car insurance rates. These steps include taking advantage of discount opportunities as listed above.

Comment

byu/Emotional_Mission518 from discussion

inInsurance

Additionally, it’s a good idea to regularly review credit reports for errors or inaccuracies that can negatively impact credit scores. Texas drivers who take proactive measures to enhance their credit may experience an improvement in their auto insurance premiums. Maintaining low credit card balances and lowering outstanding debt can both improve credit ratings.

Read more: How does the insurance company determine my premium?

The Challenges of Getting Car Insurance With Bad Credit in Texas

While bad credit can make obtaining car insurance in Texas more difficult, it is not an insurmountable obstacle. Here are several strategies drivers with bad credit can employ to secure the coverage of the best car insurance for bad credit:

- Compare Rates: There are many insurance companies around, and shopping among them and evaluating which offer the best suits your needs can lead to favorable rates.

- Improve Credit Scores: Paying bills on time, reducing outstanding debts, and being mindful of credit utilization ratios are a few steps bad credit drivers can take.

- Adjust Policies and Deductibles: This helps to balance the budget and coverage. Drivers are encouraged to know what coverage and add-ons they need to pay for what they need alone.

- Seek Guidance from an In-Agent or Broker: These professionals have insights into the insurance market and can find solutions to meet the unique needs of drivers with bad credit in Texas.

Some insurance companies may offer the best defensive driver car insurance discounts to those with bad credit who complete defensive driving courses or maintain a clean driving record. These options improve one’s driving abilities and let them save money as a large chunk of the sum is removed from their bill.

Tracey L. Wells Licensed Insurance Agent & Agency Owner

Additionally, drivers with bad credit should regularly review their insurance policies, stay proactive and informed to overcome challenges, and ensure they still get the best rates and coverage.

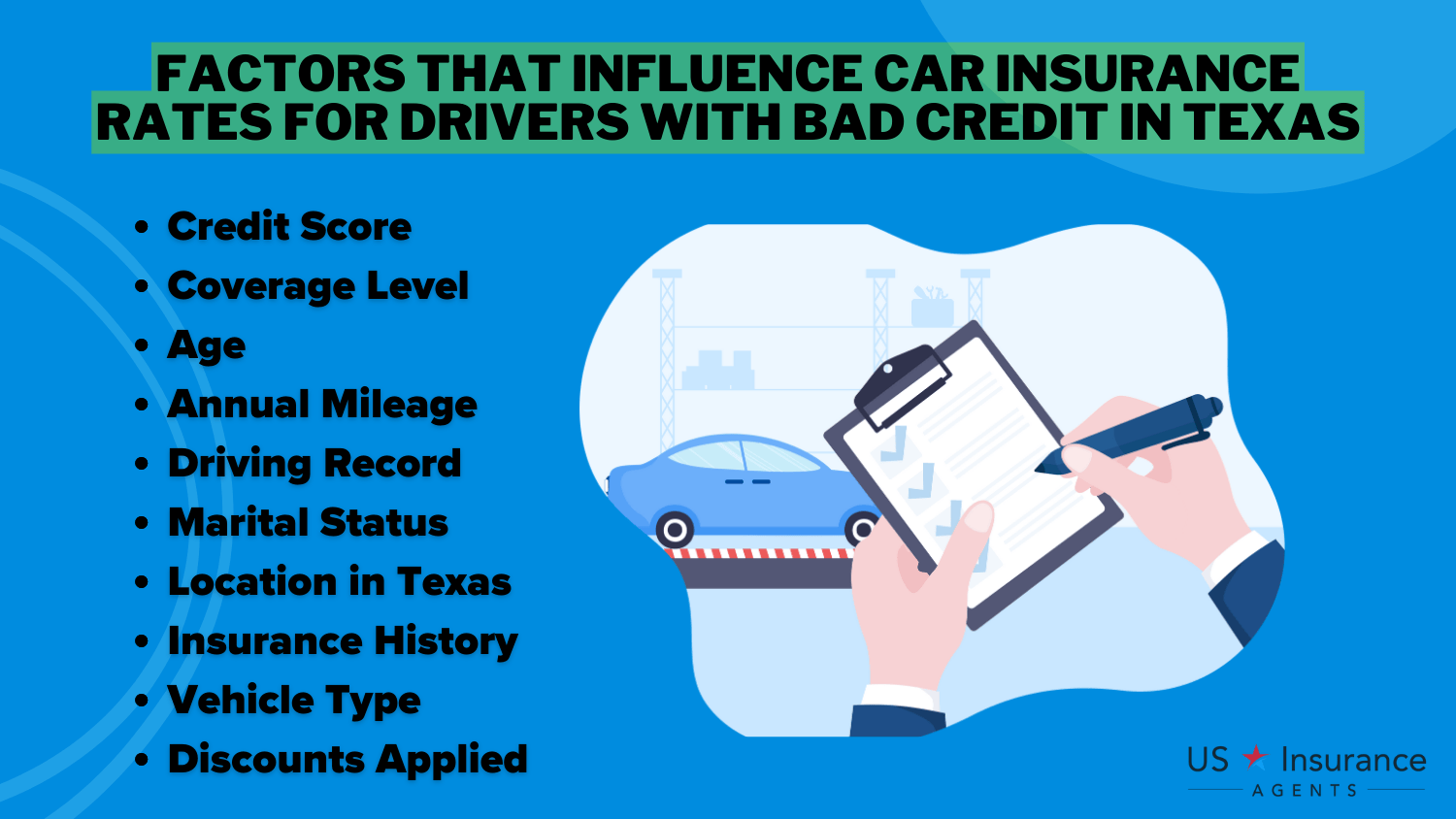

Factors That Influence Insurance Rates for Drivers With Bad Credit in TX

Auto insurance rates are shaped by several factors for those with poor credit in Texas. Drivers aware of these factors can make better decisions when choosing coverage alternatives and potentially take action to get less expensive rates.

These are further discussed below, which can help drivers with bad credit in Texas understand why their insurance rates may be higher and make informed decisions when selecting coverage options.

- Age and Gender: Inexperienced young drivers and male drivers tend to get higher insurance premiums as they are statistically more likely to drive under the influence and get involved in accidents.

- Credit History: High scores could lower premiums, and lower scores could result in higher premiums.

- Driving Record: Traffic violations, DUIs, accidents, and bad credit can cause even higher premiums.

- Insurance Coverage: More comprehensive coverage options typically result in higher premiums. The type of coverage and add-ons the driver selects also impacts insurance rates.

- Location: Urban areas and regions with higher crime rates may have higher premiums due to road types, weather, etc.

- Marital Status: Married drivers often receive lower insurance rates than single drivers because they engage less with risky drivers based on statistics. Insurers also offer a car insurance discount for married couples.

- Vehicle Type: Certain car makes, models, and years attract higher rates because they are prone to auto theft and require expensive repairs.

Always do enough research and gain knowledge to find the best auto insurance for bad credit drivers and coverage for individual needs.

Factors That Influence Car Insurance Rates for Drivers with Bad Credit in Texas

| Factor | Impact on Insurance Rates |

|---|---|

| Credit Score | Lower credit scores lead to higher premiums. |

| Age | Younger drivers with bad credit pay more. |

| Driving Record | Accidents, tickets, or DUIs increase rates significantly. |

| Location in Texas | Urban areas (e.g., Houston, Dallas) have higher rates than rural areas. |

| Vehicle Type | Expensive or high-performance cars cost more to insure. |

| Coverage Level | Full coverage costs more than minimum liability. |

| Annual Mileage | More miles driven increases premiums. |

| Marital Status | Married drivers may get lower rates. |

| Insurance History | Lapses in coverage can lead to higher rates. |

| Discounts Applied | Bundling, defensive driving courses, and good student discounts can help reduce costs. |

Enter your ZIP code to get early quotes on the best car insurance for drivers with bad credit in Texas. Shop around.

Frequently Asked Questions

What is the cheapest car insurance in Texas with bad credit?

USAA and Travelers offer the cheapest monthly rates of $139 and $178, respectively.

What is the best car insurance for people with bad credit?

Liberty Mutual, Allstate, and American Family offer the best car insurance in Texas for people with bad credit.

Does credit score affect car insurance in Texas?

Yes, having bad credit impacts everything from your cell phone bill to car insurance in Texas.

Does Progressive check credit?

Yes, Progressive does credit checks on drivers.

Does Allstate use credit scores?

Yes, Allstate uses credit scores to determine the drivers’ monthly rates.

What is the minimum car insurance required in Texas?

Texas requires a minimum 30/60/25 liability coverage of $30,000 per person, $60,000 for bodily injury in each accident, and $25,000 for property damage.

Does Geico use credit scores?

Yes, Geico uses credit scores for background checks and monthly rates.

What is the best car insurance with bad credit drivers in Texas?

The best car insurance for bad credit drivers in Texas may vary depending on individual circumstances and preferences. However, some popular options include Liberty Mutual, Allstate, American Family, and Geico.

How can I lower my car insurance in Texas?

You can lower your car insurance through safety insurance discounts and savings options, such as multi-policy, safe driving discounts, continuous insurance loyalty discounts, good student discounts, and many more.

What is the best insurance company for high-risk drivers?

Progressive, State Farm, and The General are the best insurance companies for high-risk drivers. Progressive is fantastic for flexible coverage and SR-22 filings. State Farm offers reliable service with a more forgiving credit impact, and The General specializes in high-risk drivers needing quick, no-hassle approval.

What is the lowest form of car insurance?

Who is considered high risk for insurance?

How much is car insurance in Texas per month?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.