Best Business Insurance for Travel Agencies in 2026 (Top 10 Companies)

Travelers, Nationwide, and Chubb are the top providers of the best business insurance for travel agencies, offering competitive rates and discounts of up to 15%. Among them, Travelers leads the pack, known for its tailored policies and comprehensive coverage options designed specifically for travel agency needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Scott W Johnson is an independent insurance agent in California. Principal Broker and founder of Marindependent Insurance Services, Scott brings over 25 years of experience to his clients. His Five President’s Council awards prove he uses all he learned at Avocet, Sprint Nextel, and Farmers Insurance to the benefit of his clients. Scott quickly grasped the unique insurance requirements of his...

Scott W. Johnson

Updated February 2025

1,734 reviews

1,734 reviewsCompany Facts

Full Coverage for Travel Agencies

A.M. Best Rating

Complaint Level

Pros & Cons

1,734 reviews

1,734 reviews 3,071 reviews

3,071 reviewsCompany Facts

Full Coverage for Travel Agencies

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 82 reviews

82 reviewsCompany Facts

Full Coverage for Travel Agencies

A.M. Best Rating

Complaint Level

Pros & Cons

82 reviews

82 reviews

It’s crucial for travel agents to safeguard the safety and security of their clients as well as their company. Having the appropriate insurance protection is crucial, whether you run your business as an individual agent or oversee a team at a travel agency.

Our Top 10 Company Picks: Best Business Insurance for Travel Agencies

| Company | Rank | Business Insurance Discount | Multi-Policy Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 18% | 14% | Specialized Coverage | Travelers | |

| #2 | 13% | 16% | Commercial Auto Expertise | Nationwide |

| #3 | 14% | 9% | Global Reach | Chubb | |

| #4 | 17% | 14% | Industry Expertise | The Hartford |

| #5 | 16% | 14% | Local Presence | State Farm | |

| #6 | 14% | 18% | Coverage Options | Allstate | |

| #7 | 11% | 9% | Risk Management | Liberty Mutual |

| #8 | 16% | 9% | Variety of Coverages | Farmers | |

| #9 | 23% | 7% | Online Convenience | Geico | |

| #10 | 17% | 18% | Competitive Pricing | Progressive |

This article explores the significance of insurance for travel agencies, the particular forms of insurance they require, important financial factors, and efficient methods for acquiring complete coverage.

Our free quote tool above makes it easy to compare affordable coverage options for your business — simply enter your ZIP code to find the best commercial insurance company for you.

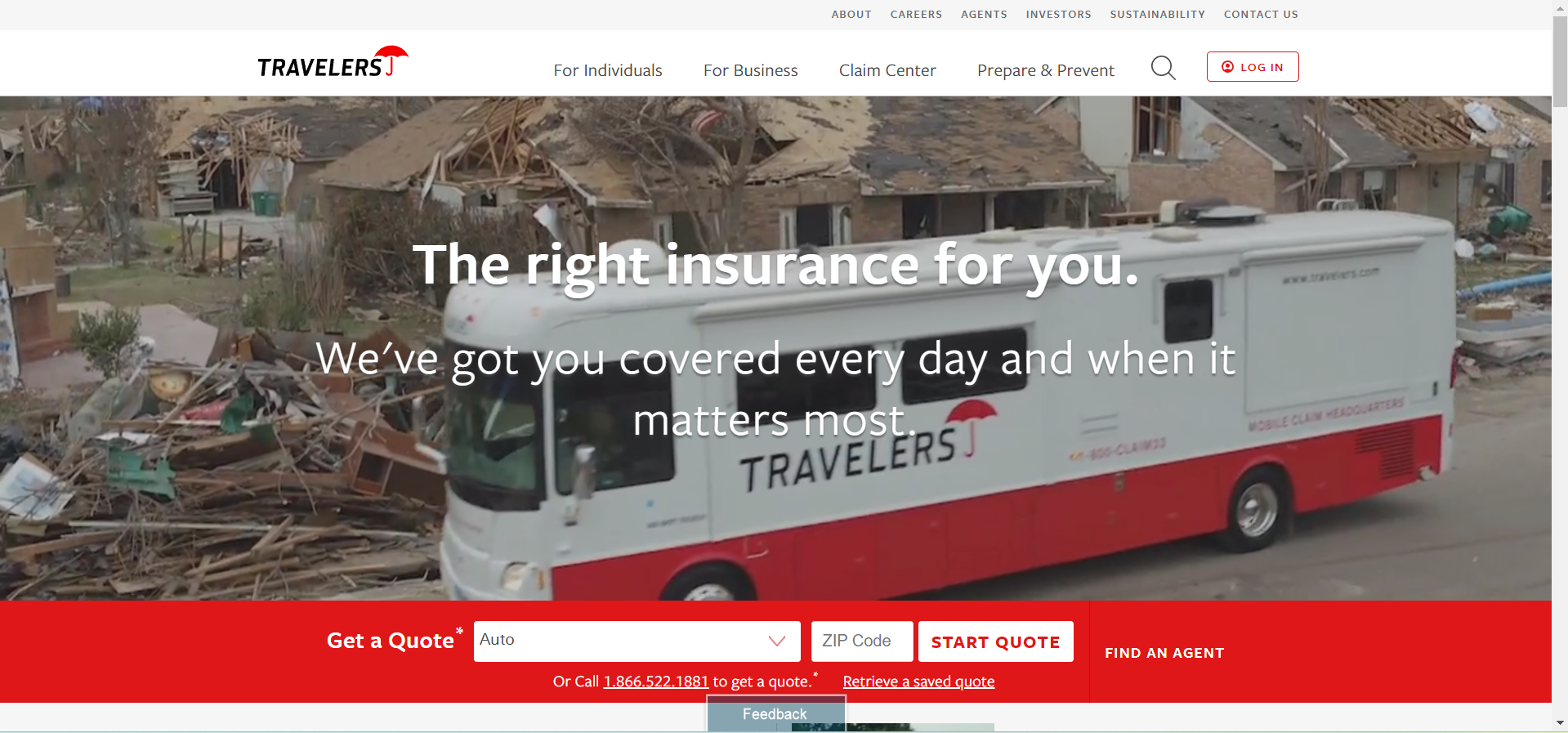

#1 – Travelers: Top Overall Pick

Pros

- Comprehensive Coverage: Travelers offers a broad spectrum of coverage options, addressing various needs of businesses.

- Strong Financial Stability: Our Travelers Insurance review & ratings show the company is highly regarded for its financial strength, ensuring reliability and security for policyholders.

- Industry Expertise: With experience in both automotive and insurance industries, Travelers brings valuable insights to its policies.

Cons

- Potentially Higher Premiums: Extensive coverage might come with higher premium costs.

- Limited Flexibility: Some businesses may find limited customization options in Travelers’ policies.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Nationwide: Best for Tailoring Insurance

Pros

- Tailored Coverage: Nationwide provides customized insurance solutions, allowing businesses to match coverage with their unique needs.

- Positive Customer Reviews: Our Nationwide insurance review & ratings reveal the company’s dedication to excellent service, as evidenced by positive customer feedback.

- Diverse Offerings: Nationwide offers a range of insurance products beyond business insurance, providing convenience for policy bundling.

Cons

- Potentially higher costs: Customization options may lead to higher premiums.

- Limited local presence: Nationwide might have a limited local presence, affecting accessibility for some businesses.

#3 – Chubb: Best for Safeguarding Reputations

Pros

- Specialized Expertise: Chubb specializes in addressing unique risks, especially in errors and omissions insurance.

- Global Reach: Chubb insurance review & ratings highlight its global presence, making it suitable for businesses operating internationally.

- Industry Recognition: Chubb’s reputation and industry awards showcase its commitment to excellence.

Cons

- Premium Costs: Specialized coverage from Chubb may come with higher premium expenses.

- Complex Policies: The intricacies of Chubb’s policies may be challenging for some businesses to navigate without expert assistance.

#4 – The Hartford: Best for Diverse Insurance

Pros

- Industry Experience: The Hartford’s long-standing presence in the insurance industry indicates a wealth of experience.

- Diverse Insurance Offerings: The Hartford provides a variety of insurance products, allowing for comprehensive coverage.

- Customer Service: Our The Hartford insurance review & ratings demonstrate the company’s commitment to customer satisfaction through positive customer service experiences.

Cons

- Potentially Higher Premiums: Extensive coverage and experience may lead to higher premium costs.

- Limited Digital Presence: The Hartford’s online tools and digital resources may be less advanced compared to some competitors.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – State Farm: Best for Financial Stability

Pros

- Strong Financial Stability: State Farm’s financial strength ensures stability and reliability for policyholders.

- Extensive Network: State Farm insurance review & ratings showcases the company’s vast network of agents, ensuring accessibility and personalized service.

- Diverse Insurance Products: State Farm offers a range of insurance products beyond business insurance.

Cons

- Agent Dependency: The reliance on agents may lead to variations in service quality based on individual agents.

- Limited Online Tools: State Farm’s online tools and digital platforms may be less advanced compared to some competitors.

#6 – Allstate: Best for Comprehensive Coverage

Pros

- Diverse Insurance Offerings: Allstate provides a range of insurance products, allowing for comprehensive coverage.

- Innovative Tools: Allstate is known for its innovative online tools and digital resources for policyholders.

- National Presence: Our Allstate insurance review & ratings emphasize the company’s national presence, ensuring accessibility for businesses across the country.

Cons

- Potentially Higher Premiums: Comprehensive coverage and innovative tools may lead to higher premium costs.

- Mixed Customer Reviews: Some customer reviews may highlight variability in service satisfaction.

#7 – Liberty Mutual: Best for Global Reach

Pros

- Global Presence: Liberty Mutual’s global reach makes it suitable for businesses with international operations.

- Comprehensive Coverage: Liberty Mutual offers a broad spectrum of coverage options to address various needs.

- Digital Platforms: Our Liberty Mutual insurance review & ratings feature the company’s advanced online tools and platforms for policy management.

Cons

- Potentially Higher Premiums: Comprehensive coverage and global operations may lead to higher premium costs.

- Mixed Customer Reviews: Some customers may express varying levels of satisfaction with service quality.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Diverse Offerings

Pros

- Local Presence: Farmers Insurance has a strong local presence, providing personalized service through a network of agents.

- Diverse Insurance Offerings: Farmers offers a variety of insurance products, allowing for comprehensive coverage.

- Discounts and Bundling: Our Farmers insurance review & ratings present the company’s various discounts and bundling options for cost-saving opportunities.

Cons

- Potentially Higher Premiums: Extensive coverage and personalized service may come with higher premium costs.

- Limited Digital Presence: Farmers’ online tools and digital resources may be less advanced compared to some competitors.

#9 – Geico: Best for Digital Convenience

Pros

- Competitive Pricing: Geico is known for offering competitive pricing, making it an attractive option for budget-conscious businesses.

- Digital Platforms: Geico provides advanced online tools and platforms for easy policy management.

- Discounts: Geico offers various discounts, providing cost-saving opportunities for policyholders. Learn more about what car insurance discounts does the GEICO Secure Insurance Company offers.

Cons

- Limited Agent Interaction: Geico’s emphasis on digital services may result in limited personal interactions with agents.

- Limited Commercial Focus: Geico’s primary focus is on personal insurance, and its commercial offerings may be less extensive.

#10 – Progressive: Best for Digital Innovation

Pros

- Comprehensive Commercial Coverage: Progressive offers a wide range of commercial insurance products, ensuring comprehensive coverage.

- Digital Innovation: Progressive insurance review & ratings for its innovative online tools and platforms, providing convenience for policyholders.

- Progressive Advantage Business Program: Tailored specifically for small businesses, this program offers competitive rates and coverage.

Cons

- Potentially Higher Premiums: Extensive coverage and innovation may lead to higher premium costs.

- Mixed Customer Reviews: Some customer reviews may express varying levels of satisfaction with service quality.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comprehensive Protection With a Business Owner’s Policy (BOP)

Travel agents face various risks in their day-to-day operations, from client injuries to property damage within their office premises. To address these challenges, comprehensive insurance solutions like the Business Owner’s Policy (BOP) are essential.

A Business Owner’s Policy (BOP) is a valuable insurance solution specifically tailored for travel agents. It combines general liability coverage and commercial property insurance, offering comprehensive protection against a range of common risks. The BOP is designed to provide cost-effective coverage, making it an ideal choice for travel agents.

It safeguards your business from potential liabilities, such as client injuries or property damage that may occur within your office premises. By bundling multiple coverages into a single policy, the BOP streamlines insurance management and offers convenience.

Jeff Root Licensed Life Insurance Agent

In addition to unforeseen events, other situations where a Business Owner’s Policy (BOP) provides valuable protection for travel agents include natural disasters, theft, liability claims from clients or third parties, and interruptions to business operations due to factors like equipment breakdowns or supplier issues.

Protecting Your Travel Agency With General Liability Insurance

As travel agents navigate the dynamic landscape of the tourism industry, ensuring adequate protection against unforeseen liabilities becomes paramount, including travel insurance. Among the essential coverages, general liability insurance stands out as a cornerstone for financial security and peace of mind.

General liability insurance is vital for travel agents, offering crucial financial protection against third-party claims, including injuries or property damage incurred during client interactions. With this coverage, you can alleviate the financial strain of legal expenses and settlements.

Business insurance for travel agency, such as general liability insurance and commercial property insurance, can be conveniently bundled in a Business Owner’s Policy (BOP), maximizing convenience and cost-effectiveness. This combined coverage ensures comprehensive protection, addressing liability risks and property-related incidents seamlessly for your travel agency.

Ty Stewart Licensed Insurance Agent

For travel agents seeking comprehensive protection for their operations, including business insurance for travel agents, general liability insurance is essential. This coverage helps safeguard against various risks, ensuring uninterrupted service delivery and maintaining client satisfaction.

Travel Agencies Business Insurance Monthly Rates by Provider & Coverage Level

| Minimum Coverage | Full Coverage | |

|---|---|---|

| $600 | $940 | |

| $620 | $970 | |

| $610 | $950 | |

| $590 | $920 | |

| $630 | $980 |

| $580 | $910 |

| $600 | $940 | |

| $610 | $950 | |

| $590 | $920 |

| $620 | $970 |

Discover the most competitive monthly insurance rates designed specifically for travel agencies, offering both full and minimum coverage options. Compare top providers including Travelers, Chubb, and Farmers alongside others such as Geico, Nationwide, and Progressive. Safeguard your agency’s operations with comprehensive coverage while optimizing costs to meet your specific business requirements.

Errors and Omissions Insurance

Errors and omissions insurance (E&O insurance) is crucial for travel agents, safeguarding against potential lawsuits arising from unsatisfactory work. This specialized coverage covers legal defense costs associated with professional errors, omissions, or inaccuracies that may result in financial losses for clients. It is also known as professional liability insurance or professional indemnity insurance.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cyber Liability Insurance

In today’s digital era, travel agencies are increasingly vulnerable to data breaches and cyberattacks, which highlights the necessity of cyber liability insurance. This type of coverage offers financial protection by covering expenses related to data breaches, such as legal fees, client notifications, and credit monitoring services.

Given the sensitive nature of personal information handled by travel agencies, cyber liability insurance is crucial for safeguarding against potential financial losses and reputational damage. Securing adequate insurance for travel agents involves several essential steps. First, it’s crucial to assess the specific risks associated with your travel agency to determine the necessary coverage.

Research reputable insurance providers specializing in coverage for travel agents to find trusted options. Obtaining multiple quotes from different providers allows for comparison of coverage options and pricing, ensuring you find the best fit for your agency’s needs. Working closely with licensed insurance professionals, customize policies to address the unique risks and requirements of your travel agency.

Before finalizing any purchase decision, thoroughly review policy terms and conditions to ensure they align with your agency’s needs and preferences. Finally, regularly reassess your insurance coverage as your travel agency evolves, making adjustments as necessary to maintain comprehensive protection against potential risks and liabilities.

Case Studies: Demonstrating Insurance Benefits for Travel Agencies

In the fast-paced world of travel agencies, unforeseen challenges can arise, making robust insurance coverage a necessity for maintaining stability and reputation. Through real-life examples, we explore how different insurance types play a critical role in safeguarding travel agencies against diverse risks, ensuring their continued success and client satisfaction.

- Case Study #1 – Legal Protection: During a group tour, a participant suffered injuries, leading to a negligence lawsuit against the travel agency. Covered by general liability insurance, the agency managed legal costs and settlements, preserving financial stability.

- Case Study #2 – Reputation Management: A boutique travel agency faced legal action due to miscommunication with a partner hotel, risking reputation. With errors and omissions insurance, the agency swiftly covered legal expenses, settling with affected clients and protecting its reputation.

- Case Study #3 – Data Breach Mitigation: Golden Horizon Travel experienced a data breach, exposing client information, including sensitive details such as the age of traveler. Fortunately, their cyber liability insurance covered legal expenses, customer notification costs, and crisis management services.

These case studies highlight how different types of insurance, such as general liability, errors and omissions, and cyber liability, are instrumental in safeguarding travel agencies from various risks, ensuring financial stability, reputation preservation, and business continuity.

Chris Abrams Licensed Insurance Agent

Comprehensive insurance solutions benefit travel agencies by mitigating risks, ensuring smooth operations, and providing peace of mind. With the right coverage, agencies can navigate industry challenges while prioritizing exceptional service for travelers. A summary of benefits would outline coverage limits, deductibles, and exclusions, offering a concise overview of the policy’s protection.

In Review: Key Points on Business Insurance

In conclusion, securing the right business insurance is essential for travel agencies to protect themselves from potential liabilities and ensure smooth operations. Travel agents need insurance to cover risks such as lawsuits, injuries, data breaches, and property damage. Key insurance policies include general liability, errors and omissions, workers’ compensation, commercial auto, and cyber liability insurance.

It is crucial to evaluate specific risks, research reputable insurance providers, obtain multiple quotes, customize coverage, and regularly reassess insurance needs.

By prioritizing business insurance, travel agencies can mitigate risks, protect their reputation, and ensure continuity of operations. Don’t overlook the importance of insurance—secure the right coverage to safeguard your travel agency and provide peace of mind for your clients.

Shield your business from financial setbacks. Enter your ZIP code below to shop for cheap commercial insurance rates from top providers near you.

Frequently Asked Questions

What is the difference between a travel agent and a travel agency?

Most travel agents will work for a travel agency, even those who work as a home-based travel advisor. Travel agencies provide travel advisors with the resources they need to become successful travel salespeople. Agencies will provide initial training, mentorships and ongoing education for travel agents.

Are there specific insurance requirements for home-based travel agencies?

Insurance requirements may vary based on location and regulations. It’s crucial for home-based travel agencies to consult with insurance professionals to determine the necessary coverage based on their specific circumstances.

Enter your ZIP code below to get personalized insurance quotes tailored to your needs and budget.

Can I customize my insurance coverage based on the unique needs of my travel agency?

Yes, insurance providers often offer flexibility to tailor coverage based on your specific requirements. Working with licensed insurance professionals, such as insurance agents, can help you customize policies to address the risks specific to your travel agency.

To gain further insights, consult our detailed guide titled “Insurance Agents” for expert advice and guidance on customizing insurance coverage for your travel agency.

How much does insurance for travel agencies typically cost?

The cost of insurance coverage for travel agencies depends on factors such as agency size, revenue, services offered, and types of coverage required. It’s recommended to obtain multiple quotes from reputable providers to compare costs and coverage options.

Is cyber liability insurance necessary for my travel agency if I don’t handle much customer data?

While the extent of cyber liability risks may vary, any travel agency that stores personal information, such as client names and payment details, is potentially vulnerable to data breaches. It’s advisable to assess the level of risk and consult with insurance professionals to determine if cyber liability insurance is necessary for your agency’s protection.

Is travel insurance included in the coverage for travel agencies?

No, travel insurance for clients is a separate product. Insurance coverage for travel agencies primarily focuses on protecting the agency itself from various risks and liabilities.

To learn more, explore our comprehensive resource on commercial auto insurance titled “What is travel insurance?” or reach out to one of our experienced insurance agents for personalized assistance.

What is the main function of a travel agency?

A travel agency’s main function is to act as an agent, selling travel products and services on behalf of a supplier. They are also called Travel Advisors.

What if travel agency won’t refund my money?

If you contact the airline or ticket agent to obtain a required refund and you are refused that refund, you should file a complaint against the airline or ticket agent with the Department at https://secure.dot.gov/air-travel-complaint.

What to do if scammed by travel agency?

Complaints about travel agents and travel agencies. If you are using an online booking service, complain to their customer service department. If your complaint is not resolved, you can contact the state consumer protection office where you live or where the travel company is located. Your local Better Business Bureau.

To delve deeper, refer to our detailed report titled “Business Insurance” for thorough insights and guidance on securing the right coverage for your travel agency.

What is a travel agency and how does it work?

A travel agency is a private retailer or public service that provides travel and tourism-related services to the general public on behalf of accommodation or travel suppliers to offer different kinds of travelling packages for each destination.

Wondering if another provider has lower rates? Find out by entering your ZIP code into our free quote comparison tool above.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.