Best Business Insurance for Non-Profits in 2026 (Top 10 Companies Ranked)

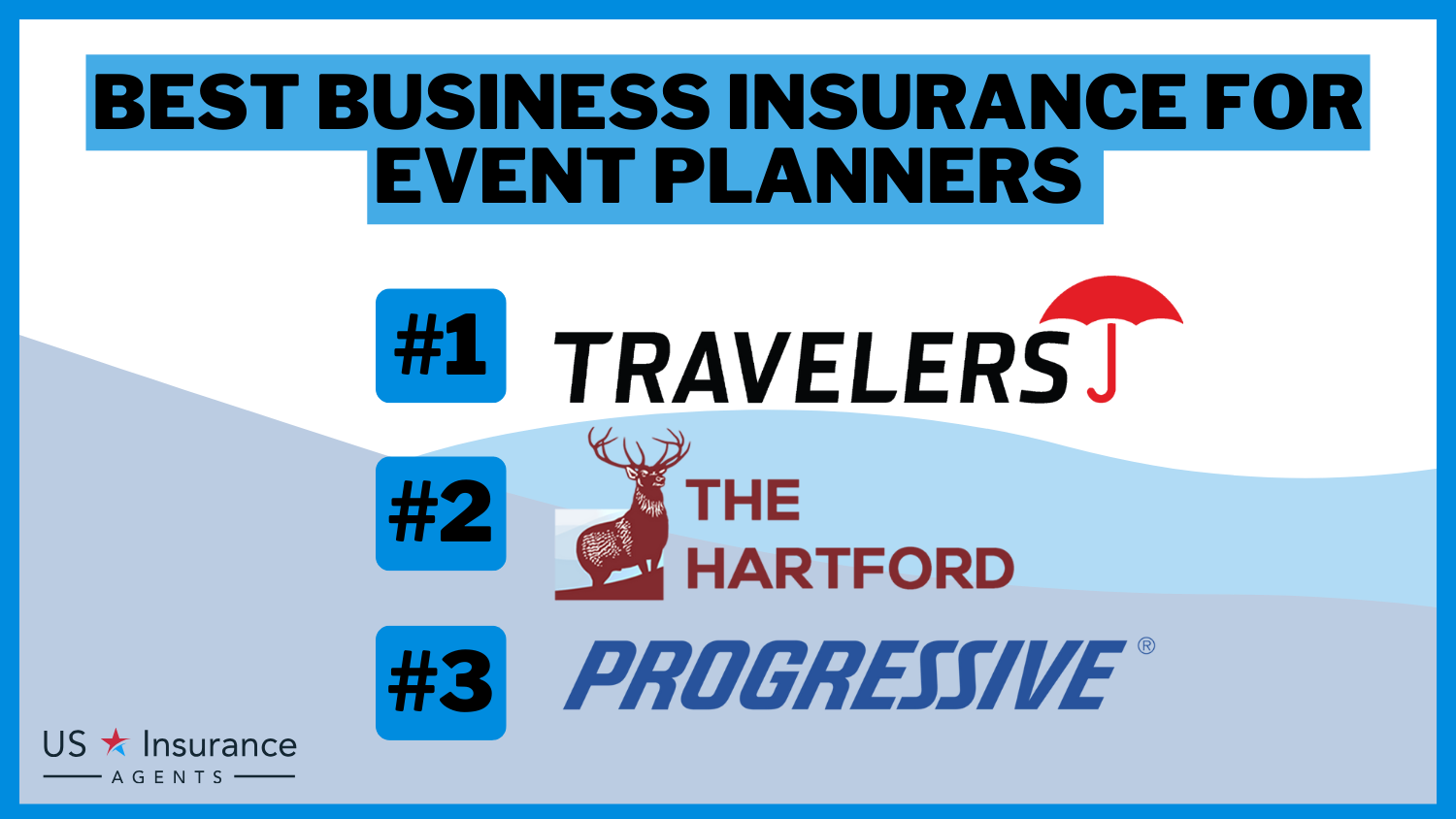

Travelers, Nationwide, and Liberty Mutual lead as the best business insurance for non-profits, starting at just $25 monthly. These companies offer reliable and affordable policies tailored for non-profits, ensuring comprehensive coverage and excellent value, making them top industry choices.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Chris Abrams

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Dan Walker graduated with a BS in Administrative Management in 2005 and has been working in his family’s insurance agency, FCI Agency, for 15 years (BBB A+). He is licensed as an agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. He reviews content, ensuring tha...

Daniel Walker

Updated February 2025

Company Facts

Full Coverage for Non-Profits

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Non-Profits

A.M. Best

Complaint Level

Pros & Cons

Company Facts

Full Coverage for Non-Profits

A.M. Best

Complaint Level

Pros & Cons

Nonprofits play a crucial role in society, yet they are subject to dangers just like any other company. Nonprofit groups can rely on specially crafted insurance to protect their security and viability.

Our Top 10 Company Picks: Best Business Insurance for Non-Profits

| Company | Rank | Multi-Policy Discount | Non-Profit Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | 10% | Customized Policies | Travelers | |

| #2 | 20% | 15% | Non-Profit Experience | Nationwide |

| #3 | 25% | 12% | Diverse Coverage | Liberty Mutual |

| #4 | 15% | 10% | Comprehensive Protection | Chubb | |

| #5 | 10% | 8% | Risk Management | The Hartford |

| #6 | 20% | 12% | Specialized Solutions | CNA | |

| #7 | 15% | 10% | International Coverage | Zurich | |

| #8 | 20% | 12% | Broad Coverage | AIG | |

| #9 | 15% | 10% | Industry Expertise | Hanover | |

| #10 | 20% | 15% | Global Presence | Allianz |

We will examine the crucial insurance policies that charities need, who should think about getting coverage, the costs involved, and how this insurance protects the resources, staff, and business operations of nonprofit organizations in this post. Keep yourself informed and secure the future of your nonprofit with the proper insurance.

Our free quote tool above makes it easy to compare affordable coverage options for your business — simply enter your ZIP code to find the best commercial insurance company for you.

- Travelers is the top pick for non-profits seeking the best rates

- Coverage addresses specific risks like fundraising event liabilities

- Policies include volunteer accident protection, crucial for non-profits

Nonprofit insurance is vital for all organizations operating in the nonprofit sector. Whether you run a charity, educational institution, religious organization, or any other nonprofit entity, having insurance coverage is crucial.

It provides protection against potential liabilities, lawsuits, property damage, and other risks that may arise from your operations.

Learn more: Best Business Insurance for Schools and Educational Institutions

What Kind of Insurance Does a Nonprofit Need

Nonprofit organizations require specific types of insurance coverage to mitigate potential risks. Here are the key types of insurance recommended for nonprofits:

- General Liability Insurance: This coverage protects your organization from third-party claims of bodily injury, property damage, personal injury, or advertising injury. It is a fundamental coverage that every nonprofit should have. Discover more insights in our “Commercial General Liability (CGL) Insurance: A Complete Guide.”

- Property Insurance: Property insurance safeguards your nonprofit’s physical assets, including buildings, equipment, and supplies, from risks such as fire, theft, vandalism, or natural disasters.

- Directors and Officers (D&O) Insurance: D&O insurance provides coverage for the directors and officers of your nonprofit organization. It protects them from personal liability arising from their decisions and actions while serving in their roles.

Nonprofit organizations need specific insurance to protect against different risks.

Laura Walker Former Licensed Agent

It’s important for them to have general liability insurance, property insurance, and directors and officers insurance.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Safeguarding Your Nonprofit Property

Nonprofit organizations possess physical assets that require protection. Here are two common scenarios where nonprofit insurance coverage is crucial:

- Stolen Furniture: Nonprofit insurance covers the loss or damage resulting from theft, ensuring your organization can replace stolen furniture and other valuable items.

- Fire Damage: In the event of a fire, nonprofit insurance provides coverage for repairing or rebuilding your organization’s property, ensuring minimal disruption to your operations (For more information, read our “Home insurance for a house damaged by fire”).

Nonprofit insurance is important because it helps replace stolen items and repair damage from fires. This protection keeps the organization running smoothly even when unexpected problems occur.

Ensuring the Safety of Your Nonprofit Team

The well-being of your nonprofit team is paramount. Nonprofit insurance can provide coverage for various incidents, including:

- Carpal Tunnel: If one of your team members develops carpal tunnel syndrome due to repetitive tasks, nonprofit insurance can cover their medical expenses and related costs.

- Car Accident: In the unfortunate event of car accidents involving a nonprofit team member during work-related activities, nonprofit insurance can cover medical expenses and potential liability.

Nonprofit insurance helps cover the costs of medical expenses and other related issues if your team faces problems like carpal tunnel or car accidents during work.

This makes sure that your team members are protected and can get the help they need.

Safeguarding Your Nonprofit Operations

Nonprofit organizations conduct various operations that require protection. Here are two critical areas where nonprofit insurance is essential:

- Stolen Client Data: Nonprofit insurance can provide coverage in the event of a data breach or theft, protecting your organization from financial losses and potential lawsuits.

- Customer Injury: If a customer or visitor sustains an injury on your nonprofit’s premises, nonprofit insurance can cover medical expenses and potential legal claims.

To protect your nonprofit organization, it’s important to have insurance for situations like data theft and customer injuries.

Jeff Root Licensed Life Insurance Agent

This insurance helps cover costs and legal issues, keeping your operations safe and secure. To learn more, explore our comprehensive resource on “What is the difference between property owners liability insurance and public liability insurance?”

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Study: Business Insurance in Action for Non-Profits

This discussion explores various real-world scenarios demonstrating the critical role of business insurance in protecting non-profit organizations. Through a series of case studies, we observe how different types of insurance coverage safeguard these entities and their missions from unexpected setbacks.

- Case Study #1 – Property Insurance: A non-profit organization, “Community Outreach Center,” operates a facility that provides meals and temporary shelter to homeless individuals. Unfortunately, a fire breaks out in the kitchen due to an electrical malfunction, causing significant damage to the building.

- Case Study #2 – Directors and Officers (D&O) Insurance: The “Youth Empowerment Foundation” is a non-profit dedicated to providing mentorship programs for underprivileged youth. A disgruntled former volunteer sues the organization, alleging mismanagement and financial impropriety.

- Case Study #3 – Event Insurance: The “Arts and Culture Society” organizes an annual fundraising gala to support local artists. Unfortunately, severe weather conditions force them to cancel the event at the last minute. Without event insurance, the organization would have suffered significant financial losses.

- Case Study #4 – Workers’ Compensation Insurance: The “Healthcare Assistance Network” operates a clinic that provides medical services to low-income individuals. While performing their duties, one of the healthcare professionals slips and injures themselves. Thanks to workers’ compensation insurance, the injured employee receives appropriate medical care and compensation during their recovery.

These case studies highlight the invaluable safety net that insurance provides for non-profits, ensuring they continue to operate effectively despite unforeseen challenges. By embracing comprehensive coverage (read our “What is comprehensive coverage?” for more information) insurance strategies, non-profit organizations can secure their operations and continue to make a positive impact in their communities.

In Review: Safeguarding Nonprofit Organizations

Nonprofit organizations face risks that can jeopardize their operations and sustainability. Fortunately, nonprofit insurance provides tailored coverage to mitigate liabilities, protect assets, and ensure the well-being of personnel. By investing in the right insurance, nonprofits can focus on their objectives without worry. This not only provides financial protection but also enhances trust and credibility among stakeholders.

In an uncertain world, nonprofit insurance offers a shield, allowing organizations to make a positive impact. Take the necessary steps to secure your nonprofit’s future by exploring insurance options that align with your unique needs. With proper coverage, nonprofits can confidently pursue their mission and continue making a difference. To find out more, explore our Insurance quotes online.

Enter your ZIP code into our quote comparison tool below to secure cheaper insurance rates for your business.

Frequently Asked Questions

What types of discounts does Travelers Insurance offer?

Travelers Insurance provides competitive discounts, including a substantial 15% discount for bundled policies and a 10% discount for low-mileage usage.

For additional details, explore our comprehensive resource titled “How to Get Free Insurance Quotes Online.”

How does Nationwide cater to non-profit organizations?

Nationwide demonstrates a commitment to non-profit organizations by providing a generous 20% discount, showcasing its non-profit experience.

What sets Liberty Mutual apart in terms of coverage options?

Liberty Mutual stands out with a diverse range of coverage options, offering a broad 25% discount for bundled policies and providing customized solutions.

How often should nonprofit insurance be reviewed and updated?

Nonprofit insurance should be reviewed annually or whenever there are significant changes to the organization, such as new programs, expansion, or changes in the nature of operations. Regularly assessing insurance needs ensures that coverage aligns with the evolving risks and requirements of the nonprofit.

What considerations should non-profit organizations keep in mind when choosing insurance coverage?

Non-profit organizations should prioritize insurance providers with specialized experiences and ratings in serving their sector. Look for insurers offering tailored policies and substantial discounts, like Nationwide, which provides a generous 20% discount for non-profit organizations, showcasing a commitment to the unique needs of the non-profit sector.

To find out more, explore our guide titled “A.M. Best Ratings Explained.”

What is the best insurance for nonprofits?

The best insurance for nonprofits offers comprehensive coverage tailored to the specific risks and needs of non-profit organizations, with Travelers often cited as a top provider.

How do I choose the best nonprofit insurance?

When selecting the best nonprofit insurance, consider coverage options, customer service, premium costs, and specifically the discounts and customizations available for nonprofits.

Which insurance companies for nonprofit organizations are most recommended?

Highly recommended insurance companies for nonprofit organizations include Travelers, Nationwide, and Liberty Mutual, known for their specialized non-profit policies.

Find the best commercial car and truck insurance for your business needs by entering your ZIP code below into our free comparison tool today.

What should I look for in insurance for non-profits?

Look for insurance for non-profits that includes liability coverage, property protection, and specific endorsements like volunteer accident coverage to address unique nonprofit needs.

To learn more, explore our comprehensive resource on “Liability Insurance: A Complete Guide.”

Are there specialized non profit car insurance companies?

Yes, some non profit insurance companies offer specialized car insurance designed for nonprofit organizations, focusing on affordability and covering vehicles used for nonprofit activities.

How do non profit insurance companies differ from regular insurers?

What is the most profitable non profit company?

What does general insurance cover?

How can insurance help small businesses?

What is the best type of nonprofit?

How can I be successful in insurance business?

What do nonprofits need most?

What is insurance as used in business?

How does insurance work for businesses?

What type of insurance is used the most?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.