Best Business Insurance for Bodyguards in 2026 (Top 10 Companies)

Discover the best business insurance for bodyguards from top providers like AAA, USAA, and Progressive. Enjoy exclusive discounts of up to 20% on multi-policy bundles, ensuring comprehensive protection for your security services with specialized coverage options designed to meet your unique needs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Michael Leotta

Updated February 2025

3,027 reviews

3,027 reviewsCompany Facts

Full Coverage for Bodyguards

A.M. Best Rating

Complaint Level

Pros & Cons

3,027 reviews

3,027 reviews 6,590 reviews

6,590 reviewsCompany Facts

Full Coverage for Bodyguards

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 13,285 reviews

13,285 reviewsCompany Facts

Full Coverage for Bodyguards

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviewsSecure your bodyguard business with the best and most affordable insurance coverage available, tailored to your specific requirements.

#1 – AAA: Top Overall Pick

Pros

- Extensive Roadside Assistance: AAA is renowned for its comprehensive roadside assistance services, offering a wide range of benefits, including towing, fuel delivery, and battery jump-starts.

- Membership Discounts: AAA members enjoy exclusive discounts on various services, such as travel, shopping, and attractions, providing added value beyond insurance coverage.

- Strong Reputation: With a long-standing reputation for reliability and customer service, AAA insurance review and ratings instills confidence in policyholders, knowing a trusted brand backs them.

Cons

- Membership Fee: To access AAA’s insurance services, individuals need to become members, and this may involve an additional annual membership fee.

- Limited Availability: AAA insurance may not be available nationwide, limiting its accessibility to individuals in specific regions.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

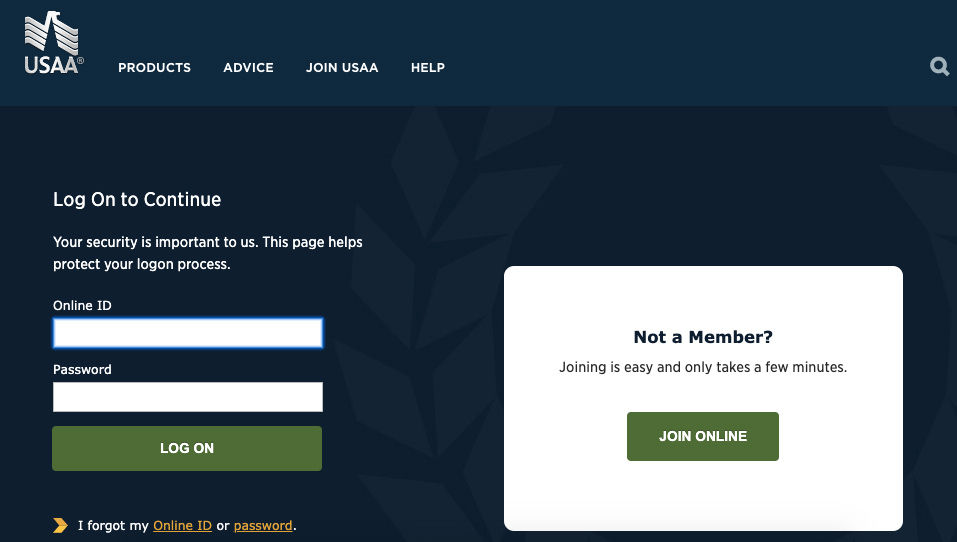

#2 – USAA: Best for Military Savings

Pros

- Tailored for Military Members: USAA insurance review and ratings is dedicated to serving military members and their families, providing specialized coverage and understanding the unique needs of this demographic.

- Competitive Rates: USAA is often praised for offering competitive rates, with military-focused discounts that can result in significant savings.

- Top-Notch Customer Service: With consistently high customer service ratings, USAA ensures that its policyholders receive excellent support and assistance.

Cons

- Exclusive to Military Members: USAA is only available to military members, veterans, and their families, limiting its accessibility to a specific demographic.

- Limited Physical Branches: USAA operates primarily online or over the phone, with limited physical branches, which may not suit individuals who prefer in-person interactions.

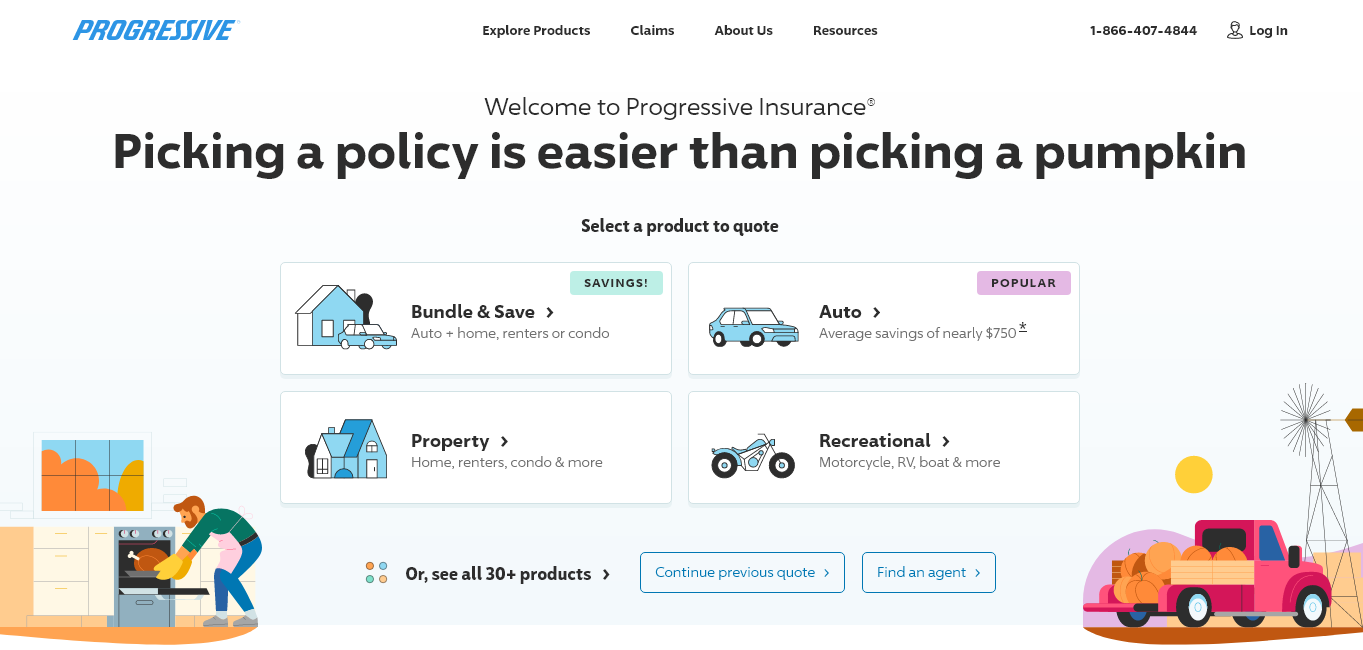

#3 – Progressive: Best for Multi-Policy Discounts

Pros

- Multi-Policy Discounts: Progressive insurance review and ratings incentivize customers to bundle multiple policies, such as auto and home insurance, with attractive discounts, providing cost-effective solutions.

- User-Friendly Online Tools: Progressive’s online platform offers intuitive tools for comparing quotes, managing policies, and filing claims, enhancing the overall customer experience.

- Snapshot Program: Progressive’s Snapshot program allows safe drivers to earn additional discounts based on their driving habits, potentially lowering premiums.

Cons

- Varied Customer Service Reviews: While some customers praise Progressive’s customer service, others have reported less positive experiences, indicating a degree of inconsistency.

- May not be the Cheapest Option: While Progressive offers competitive rates, it may not always be the absolute cheapest option for every individual, depending on specific circumstances.

#4 – Geico: Best for Online Convenience

Pros

- Online Convenience: Geico is known for its easy-to-use online platform, allowing customers to manage policies, make payments, and file claims seamlessly.

- Digital ID Cards: Geico offers digital ID cards, making it convenient for customers to access and provide proof of insurance.

- Discounts and Savings: Geico provides various discounts, including those for safe driving, multi-vehicle policies, and military service members. For more information, read our “Do Geico Employees get Car insurance discounts?“.

Cons

- Average Customer Satisfaction: Geico’s customer satisfaction ratings are generally average, with some customers expressing concerns about claim processes.

- Limited Agent Interaction: Geico’s focus on online services may not suit customers who prefer more personal interactions with agents.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – State Farm: Best for Local Agents

Pros

- Local Agents: State Farm’s extensive network of local agents provides personalized service and easy accessibility for customers.

- Good Customer Satisfaction: State Farm consistently ranks well in customer satisfaction surveys, indicating positive customer experiences.

- Diverse Insurance Offerings: State Farm insurance review & ratings offer a wide range of insurance products beyond auto, including life and home insurance.

Cons

- Potentially Higher Premiums: Some customers report that State Farm’s premiums can be higher compared to other insurers.

- Strict Underwriting: State Farm’s underwriting guidelines may be more stringent, impacting eligibility for certain discounts.

#6 – Erie: Best for Bundling Policies

Pros

- Bundling Discounts: Erie Insurance review & ratings offer significant discounts for bundling multiple insurance policies, such as home and auto insurance.

- High Customer Satisfaction: The company is known for its excellent customer service, with high satisfaction ratings.

- Personalized Coverage: Erie allows policyholders to customize their coverage, ensuring they get the protection they need.

Cons

- Limited Availability: Erie’s insurance products are not available in all states, limiting its accessibility.

- Less Robust Online Presence: Compared to some competitors, Erie’s online tools and resources may be less comprehensive.

#7 – Travelers: Best for Customizable Policies

Pros

- Tailored Coverage: Travelers stands out for offering customizable insurance policies, allowing customers to tailor coverage to their specific needs.

- Wide Range of Products: Travelers insurance review & ratings provide various insurance products beyond just auto and home, offering a comprehensive selection.

- Strong Financial Stability: Travelers has a strong financial rating, indicating stability and the ability to meet policyholder claims.

Cons

- Potentially Higher Rates: Some customers may find Travelers’ rates to be slightly higher compared to other insurers.

- Varied Customer Service Reviews: While generally positive, customer service reviews for Travelers can vary, with some reporting less satisfactory experiences.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Nationwide: Best for Deductible Program

Pros

- Vanishing Deductible Program: Nationwide’s Vanishing Deductible Program is a standout feature, allowing policyholders to lower their deductible over time without filing claims.

- Bundling Discounts: Nationwide insurance review & ratings offer multiple policy discounts, encouraging customers to bundle and save on their insurance premiums.

- Financial Stability: With a strong financial standing, Nationwide provides reassurance that it can meet its financial obligations, including claims.

Cons

- Standard Coverage Options: Some customers may find Nationwide’s coverage options to be more conventional, with fewer customizable features compared to some competitors.

- Limited Availability: Nationwide’s products and services may not be available in all states, limiting its accessibility to potential customers.

#9 – Allstate: Best for Bundling Discounts

Pros

- Generous Bundling Discounts: Allstate Insurance review & ratings stand out for its substantial bundling discounts, providing customers with cost-effective solutions when combining various insurance policies.

- User-Friendly Technology: Allstate’s user-friendly online tools and mobile apps enhance customer experience, making policy management and claims processing convenient.

- Extensive Agent Network: With a vast network of agents, Allstate offers personalized assistance and guidance to customers, fostering a strong customer-agent relationship.

Cons

- Potentially Higher Premiums: Some customers may perceive Allstate’s premiums to be on the higher side, particularly for standalone policies without bundling discounts.

- Mixed Customer Service Reviews: While many customers praise Allstate’s customer service, there are occasional reports of inconsistent experiences, with some customers expressing dissatisfaction.

#10 – Liberty Mutual: Best for Customizable Coverage

Pros

- Customizable Coverage Options: Liberty Mutual review & ratings provide customizable coverage options, allowing policyholders to tailor their insurance plans to meet specific needs.

- Wide Range of Insurance Products: Offering various insurance products, Liberty Mutual provides customers with comprehensive coverage choices beyond standard auto and home insurance.

- Online Tools and Resources: Liberty Mutual’s robust online tools and resources contribute to a seamless customer experience, making it easy for policyholders to manage their accounts.

Cons

- Varied Customer Service Experiences: Similar to many large insurers, customer service experiences with Liberty Mutual can vary, with occasional reports of less satisfactory interactions.

- Potentially Higher Rates: Some customers may find Liberty Mutual’s rates to be relatively higher compared to other insurers, affecting the overall cost of coverage.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Securing the Ideal Coverage for Your Bodyguard Business

When it comes to securing the right insurance coverage for your bodyguard business, it’s crucial to work with insurers who understand the unique risks associated with your industry. Look for insurers experienced in providing coverage for security-related businesses, as they can tailor policies to suit your specific needs.

Consider the following five steps to find the coverage that best suits your bodyguard business:

- Assess Your Risks: Evaluate the potential risks and liabilities specific to your bodyguard business. This could include claims of negligence, false imprisonment, breach of contract, or excessive force.

- General Liability Insurance: Start with general liability insurance, which is essential for covering common risks such as bodily injury, property damage, and legal defense costs. Ensure the policy includes coverage for incidents that may occur both on and off your premises.

- Additional Coverage: Consider other types of insurance coverage depending on your business’s unique needs. Professional liability insurance protects against professional negligence claims, while workers’ compensation covers employees’ work-related injuries and illnesses.

- Customization Options: Look for insurers that offer customization options, allowing you to tailor the coverage to fit your specific requirements. This ensures that you are protected against the risks most relevant to your bodyguard business.

- Compare Cheap Bodyguard Insurance Quotes Online: Compare quotes from various insurance providers online to find affordable coverage options for your bodyguard business. By comparing quotes, you can identify cost-effective policies that offer the necessary coverage to protect your business and assets.

Remember, the right coverage goes beyond just fulfilling legal requirements; it provides comprehensive protection for your business, clients, and employees.

Jeff Root Licensed Life Insurance Agent

Take the time to carefully evaluate your needs and work with reputable insurers who can provide the coverage necessary to safeguard your bodyguard business.

Choosing the Right Insurance for Your Bodyguard Business

Ensuring adequate insurance coverage is crucial for bodyguard businesses. From general liability to workers’ compensation and commercial auto insurance, each policy plays a vital role in safeguarding against specific risks, providing comprehensive protection for the business and its employees.

General Liability Insurance for Bodyguards

General Liability Insurance for Bodyguards provides essential coverage for potential third-party claims of bodily injury, property damage, or personal and advertising injury. It serves as a foundational policy, protecting bodyguard businesses from financial losses arising from lawsuits, legal defense costs, settlements, and judgments.

This insurance is crucial for mitigating risks associated with accidents, property damage, or alleged negligence during the course of business operations.

Coverage Limits of General Liability Insurance for Bodyguards: General liability insurance for bodyguards typically offers coverage limits ranging from $1 million to $5 million per occurrence. These limits define the maximum amount the insurance company will pay for covered claims, including legal fees, settlements, and judgments.

Add-Ons to General Liability Insurance for Bodyguards: Additional coverage options for general liability insurance for bodyguards may include cyber liability insurance to protect against data breaches, assault and battery coverage to address incidents involving physical altercations, and employee dishonesty coverage to safeguard against theft or fraud committed by employees.

Professional Liability Insurance for Bodyguards

Professional liability insurance, also known as errors and omissions insurance, safeguards your bodyguard business against claims of negligence or errors in services provided. It provides financial protection if a client alleges harm due to mistakes or failures in professional duties.

Coverage Limits of Professional Liability Insurance for Bodyguards: Professional liability insurance for bodyguards usually offers coverage limits ranging from $500,000 to $2 million per claim and aggregate. These limits specify the maximum amount the insurer will pay for covered claims during the policy period.

Workers’ Compensation Insurance for Bodyguards:

Required by law in most states, workers’ compensation insurance provides coverage for medical expenses, lost wages, and rehabilitation for employees who suffer work-related injuries or illnesses.

If one of your bodyguards gets injured while on the job, this insurance helps cover their medical costs and provides income replacement during their recovery period.

Coverage Limits of Workers’ Compensation Insurance for Bodyguards: Coverage limits for workers’ compensation insurance are defined by state laws and regulations, which specify the maximum benefits payable to injured or ill employees. Insurers typically offer coverage limits based on statutory requirements and the needs of the bodyguard business.

Add-Ons to Workers’ Compensation Insurance for Bodyguards: Supplemental coverage options for bodyguard businesses provide extended protection, including employer’s liability insurance, occupational accident insurance, return-to-work programs, Travel accident insurance, and mental health coverage, ensuring comprehensive support for employees’ well-being and recovery.

Commercial Auto Insurance for Bodyguards

Commercial auto insurance provides coverage for vehicles used in the course of business operations by bodyguard firms. This insurance protects against liabilities arising from accidents, injuries, property damage, and other covered events involving company-owned or leased vehicles.

Coverage Limits of Commercial Auto Insurance for Bodyguards: Coverage limits for commercial auto insurance vary depending on the specific policy terms, the types of vehicles insured, and the insurer’s underwriting criteria. Insurers typically offer coverage limits ranging from state-required minimums to several million dollars.

Add-Ons to Commercial Auto Insurance for Bodyguards: Additional coverage options for commercial auto insurance may include comprehensive coverage to protect against non-collision-related perils such as theft, vandalism, and natural disasters, as well as collision coverage to cover damage to the insured vehicles caused by collisions with other vehicles or objects.

Commercial Umbrella insurance

While general liability insurance provides a certain level of coverage, there may be circumstances where the claims exceed the policy limits. It also serves as an additional layer of protection. It provides coverage above and beyond the limits of your primary policies, ensuring that your business is adequately protected in case of a significant claim or lawsuit.

Commercial Property Insurance for Bodyguards

Commercial property insurance provides coverage for physical assets owned or leased by bodyguard businesses, including office space, equipment, furniture, and signage. This insurance protects against perils such as fire, theft, vandalism, and natural disasters.

Coverage Limits of Commercial Property Insurance for Bodyguards: Coverage limits for commercial property insurance for bodyguards vary depending on the value of the insured property and the specific policy terms. Insurers typically offer coverage limits ranging from $100,000 to several million dollars.

Add-Ons to Commercial Property Insurance for Bodyguards: Additional coverage options for commercial property insurance may include business interruption insurance to cover lost income and expenses if operations are temporarily suspended due to a covered loss, equipment breakdown coverage for essential business equipment, and inland marine insurance for property in transit.

Business Owner’s Policy for Bodyguards

A business owner’s policy (BOP) combines general liability insurance and commercial property insurance into a single package, offering comprehensive coverage for bodyguard businesses. This bundled policy often includes additional coverages tailored to the needs of small businesses, such as business interruption insurance and equipment breakdown coverage.

Coverage Limits of Business Owner’s Policy for Bodyguards: Coverage limits for a business owner’s policy for bodyguards depend on the specific policy terms and the insurer. However, typical coverage limits for general liability and property insurance in a BOP range from $1 million to $5 million per occurrence.

Add-Ons to Business Owner’s Policy for Bodyguards: Additional endorsements or riders may be available to enhance coverage under a business owner’s policy for bodyguards. These add-ons may include cyber liability insurance, professional liability insurance, and workers’ compensation insurance, depending on the needs of the business.

Tools and Equipment Insurance for Bodyguards

Tools and equipment insurance provides coverage for the tools, gear, and specialized equipment used by bodyguards in their professional duties. This insurance protects against perils such as theft, loss, damage, and malfunction of equipment.

Coverage Limits of Tools and Equipment Insurance for Bodyguards: Coverage limits for tools and equipment insurance vary depending on the value of the insured items and the specific policy terms. Insurers typically offer coverage limits ranging from a few thousand to several hundred thousand dollars.

Add-Ons to Tools and Equipment Insurance for Bodyguards: Having the right combination of insurance coverage ensures that your bodyguard business is protected from various risks and potential financial losses. It’s important to consult with insurance professionals who specialize in security-related businesses to customize a comprehensive insurance portfolio that meets your specific needs.

Bodyguard businesses need more than just general liability insurance. They require additional coverage like professional liability, workers’ compensation, commercial auto, property, business owner’s policy, and tools and equipment insurance.

Each policy addresses specific risks such as negligence claims, work injuries, vehicle accidents, and property damage.

It’s essential to consult with insurance specialists to customize the right coverage for individual business needs.

Bodyguard Insurance Cost

The cost of insurance for bodyguards varies depending on factors such as the size of the business, the services offered, the location, the age, the gender, the coverage limits selected, and the insurer’s underwriting criteria. On average, bodyguard insurance costs can range from a few hundred to several thousand dollars per year.

Bodyguards Business Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $620 | $950 |

| $640 | $984 | |

| $614 | $934 |

| $632 | $960 | |

| $600 | $910 |

| $650 | $990 |

| $625 | $956 | |

| $630 | $970 | |

| $610 | $930 | |

| $648 | $980 |

These rates outline the monthly premiums for bodyguard insurance across various coverage levels offered by different insurance providers. Coverage ranges from minimum to full, with premiums varying between $600 to $650 for minimum coverage and $910 to $990 for full coverage. Consider reading “What is out-of-pocket costs?” for more.

Liberty Mutual offers the lowest rates for both minimum and full coverage, while Nationwide has the highest premiums. It’s essential for individuals or businesses seeking bodyguard insurance to compare these rates and coverage options to make informed decisions.

Decoding the Price of General Liability Insurance for Bodyguard Businesses

The cost of general liability insurance for bodyguards typically ranges between $400 and $700 per year for $1 million in coverage. However, several factors can influence the price of your policy. These factors include:

- Size of Your Business: Larger bodyguard businesses may have higher premiums due to increased risk exposure.

- Number of Employees: More employees may lead to higher premiums, as there is a higher likelihood of incidents or claims.

- Location of Operations: If you operate in an area with a higher risk of lawsuits or claims, your premiums may be higher.

- Claims History: If your business has a history of claims or incidents, insurers may consider you a higher risk, resulting in higher premiums. Find additional information. read our “What is Premium?” guide.

Purchasing general liability insurance as part of a business owner’s policy (BOP) may offer potential cost savings. BOPs combine multiple coverages into a comprehensive package, including general liability, business interruption, and property insurance.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Common Incidents Covered by General Liability Insurance

General liability insurance covers a wide range of common situations that may occur in your bodyguard business. Here are a few examples:

- Bodily Injuries: If a client or third party sustains injuries while under your protection, general liability insurance would cover their medical expenses and any related claims. Consider reading “How to Document Damage for Car Insurance Claims” for more.

- Property Damage: Accidentally damaging a client’s property during the course of your duties, such as breaking equipment or furniture, would be covered by general liability insurance.

- Personal and Advertising Injury: If your business inadvertently causes harm through defamation, slander, or copyright infringement, general liability insurance can provide coverage for legal defense costs and settlements.

- Slip and Fall Accidents: If a client or visitor slips, trips, or falls on your premises and sustains injuries, general liability insurance would cover their medical expenses and potential legal claims.

- Products Liability: If you provide security-related products or equipment and they cause harm or damage, general liability insurance can protect you against claims and lawsuits.

- Completed Operations: If an incident or injury occurs after you have completed your services, general liability insurance can cover any resulting claims or legal actions.

In summary, general liability insurance for bodyguard businesses safeguards against common incidents like bodily injuries, property damage, personal and advertising injury, slip and fall accidents, products liability, and completed operations.

Reviewing policy specifics is crucial to understand coverage and exclusions fully.

Taking Further Measures to Safeguard Your Business

In addition to having the right insurance coverage, there are several additional steps you can take to enhance the protection and resilience of your bodyguard business. By implementing these measures, you can minimize risks, ensure professionalism, and maintain the safety of your clients and employees. Consider the following five steps:

- Implement proper risk management. Conduct a thorough assessment of potential risks specific to your bodyguard business. Identify areas of vulnerability and develop protocols and procedures to minimize those risks. This may include conducting background checks on employees, implementing safety protocols during assignments, and regularly reviewing and updating security measures.

- Establish clear policies and procedures. Create comprehensive and well-documented policies and procedures for your bodyguards to follow. This includes guidelines on professionalism, code of conduct, conflict resolution, and emergency response protocols. Clearly communicate these policies to your team and provide regular training and reminders to ensure compliance.

- Regular training and certification. Invest in continuous training for bodyguards, covering threat assessment, defensive tactics, and emergency response. Keep them updated on industry best practices and legal requirements to ensure optimal preparedness. Find out more about “What is Emergency services?” to enhance your understanding.

- Maintain strong communication channels. Foster effective communication within your bodyguard team and with your clients. Encourage open dialogue, provide clear instructions, and establish reliable communication channels for real-time updates during assignments. Regularly communicate with clients to understand their security needs and promptly address any concerns.

- Stay informed about legal and industry changes. Keep yourself updated on relevant laws, regulations, and industry developments. Regularly review and assess your business practices to ensure compliance with legal requirements. Stay informed about emerging security threats and industry trends to adapt your strategies and maintain a competitive edge.

By combining insurance coverage with these proactive measures, you can create a robust framework for safeguarding your bodyguard business and providing the highest level of service to your clients.

Remember, security is a continuous process, and regularly reassessing and refining your strategies will help you stay ahead of potential risks.

Case Studies: Insurance Solutions for Bodyguard Businesses

Executive protection poses numerous challenges for bodyguards each day. From cybersecurity breaches to physical altercations, unexpected incidents can occur, bringing risks for both the bodyguard and their client. However, with the right insurance coverage, such as professional liability and general liability policies, bodyguard businesses can safeguard themselves and their clients from financial harm.

- Case Study #1– Cybersecurity Breach Incident: While offering executive protection, a bodyguard encounters a cybersecurity breach compromising client data. USAA’s professional liability insurance covers legal expenses and potential settlements from the ensuing lawsuit, safeguarding the bodyguard’s reputation and finances.

- Case Study #2– General Liability Claim for Slip and Fall: During a public event, a bystander trips and falls due to the crowd’s chaos, sustaining injuries. AAA’s general liability insurance covers legal defense costs and potential settlement or damages awarded to the injured party, protecting both the bodyguard and their client from significant financial loss.

- Case Study #3– Property Damage Incident: While on duty, a bodyguard accidentally damages a client’s property. Progressive’s property damage coverage addresses the costs associated with the damaged client property. Progressive’s comprehensive coverage and multi-policy savings ensure efficient handling of the incident, reducing the financial burden on the bodyguard business.

- Case Study #4– Physical Altercation Resulting in Injury: During duty, a bodyguard engages in a physical altercation, resulting in the bodyguard sustaining a serious injury. Progressive’s general liability insurance covers the legal and medical expenses related to the injury incident. Progressive’s comprehensive coverage and multi-policy savings ensure protection against potential financial losses.

Insurance is vital for bodyguard businesses, shielding them from risks like cybersecurity breaches, accidents, or legal claims. Companies like USAA and Progressive provide tailored coverage, helping bodyguard firms manage challenges and avoid financial losses. Investing in the right insurance ensures the success and resilience of businesses in this risky industry.

Free Business Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Summing Up: Empower Your Bodyguard Business With Comprehensive Insurance Protection

Obtaining the right insurance coverage is essential for protecting your bodyguard business from potential risks, liabilities, and legal complications. General liability insurance is a foundational policy, covering incidents such as injuries, property damage, and legal defense costs. Explore “Will my insurance costs increase if I file an car insurance claim?” for insights.

By working with insurers who understand the unique needs of the security industry, you can find personalized and affordable coverage options that meet your specific requirements. Acquiring insurance as part of a business owner’s policy for bodyguards can offer comprehensive coverage and potential cost savings.

Additionally, implementing additional measures such as proper risk management, clear policies and procedures, regular training, strong communication channels, and staying informed about legal and industry changes further strengthens the security and resilience of your bodyguard business. Remember, insurance should be combined with proactive steps to protect your business comprehensively.

Jimmy McMillan Licensed Insurance Agent

By prioritizing safety, professionalism, and adhering to industry best practices, you can enhance the overall security of your bodyguard business, provide the highest level of service to your clients, and ensure peace of mind for both you and your team. Protect your business today by entering your ZIP code below into our comparison tool for free commercial insurance quotes.

Frequently Asked Questions

Why is insurance important for a bodyguard business?

Insurance is crucial for a bodyguard business as it provides protection against potential risks and liabilities. Whether it’s claims of negligence, false imprisonment, or property damage, the right insurance coverage ensures that your business is safeguarded, offering peace of mind and financial security.

What are the key types of insurance coverage recommended for bodyguard businesses?

General liability insurance is the foundation, covering risks like injuries, property damage, and legal defense costs. In addition to this, other essential coverage includes professional liability insurance, cybersecurity insurance, and property damage coverage. These policies work together to offer comprehensive protection for various risks.

For additional information, check out “Professional Liability (Errors & Omissions) Insurance: A Complete Guide“

How do I choose the right insurance for my bodyguard business?

It’s essential to work with insurers experienced in providing coverage for security-related businesses. Look for companies that understand the unique risks associated with the industry and can tailor policies to suit your specific needs. Additionally, consider factors such as reputation, customer service, and cost when making your decision.

See how much you could save on coverage by entering your ZIP code into our free quote comparison tool below.

What is the cost of general liability insurance for bodyguard businesses?

The cost of general liability insurance for bodyguards typically ranges between $400 and $700 per year for $1 million in coverage. However, several factors can influence the price, including the size of your business, location, and specific services offered. Purchasing insurance as part of a business owner’s policy (BOP) may offer potential cost savings.

Do bodyguards need specialized insurance for firearms and weapons?

Yes, it’s essential for bodyguards to have insurance coverage specifically tailored to firearms and weapons they use in their professional duties to ensure adequate protection in case of accidents or liabilities.

Discover more about “Gun Liability Insurance: A Complete Guide” for comprehensive details.

Do bodyguards need insurance?

Yes, insurance is essential for bodyguards to protect themselves, their clients, and their business from potential risks and liabilities.

What is the bodyguard policy?

The bodyguard policy typically refers to a comprehensive insurance coverage tailored to the unique needs of bodyguard businesses, including general liability, professional liability, workers’ compensation, and commercial auto insurance.

To find out more, visit “Best Health Insurance For Bodyguards“

Is personal injury coverage included in general liability insurance for bodyguards?

Yes, general liability insurance typically covers personal injury claims such as bodily harm to third parties. However, it’s essential to review policy details to ensure comprehensive coverage.

Learn more from “Commercial General Liability (CGL) Insurance: A Complete Guide“

Are there insurance options that cover the costs of legal defense for bodyguards facing lawsuits?

Yes, professional liability insurance often includes coverage for legal defense costs in case of lawsuits alleging errors, omissions, or negligence in providing security services as a bodyguard.

How can I enhance the protection of my bodyguard business beyond insurance?

In addition to insurance, consider implementing proactive measures such as proper risk management, clear policies and procedures, regular training, strong communication channels, and staying informed about legal and industry changes. These steps, combined with the right insurance coverage, create a robust framework for safeguarding your business.

Ready to find the perfect plan? Get instant insurance quotes from our free comparison tool below.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.