Best Auto Insurance for Teachers in 2026 (Top 10 Companies)

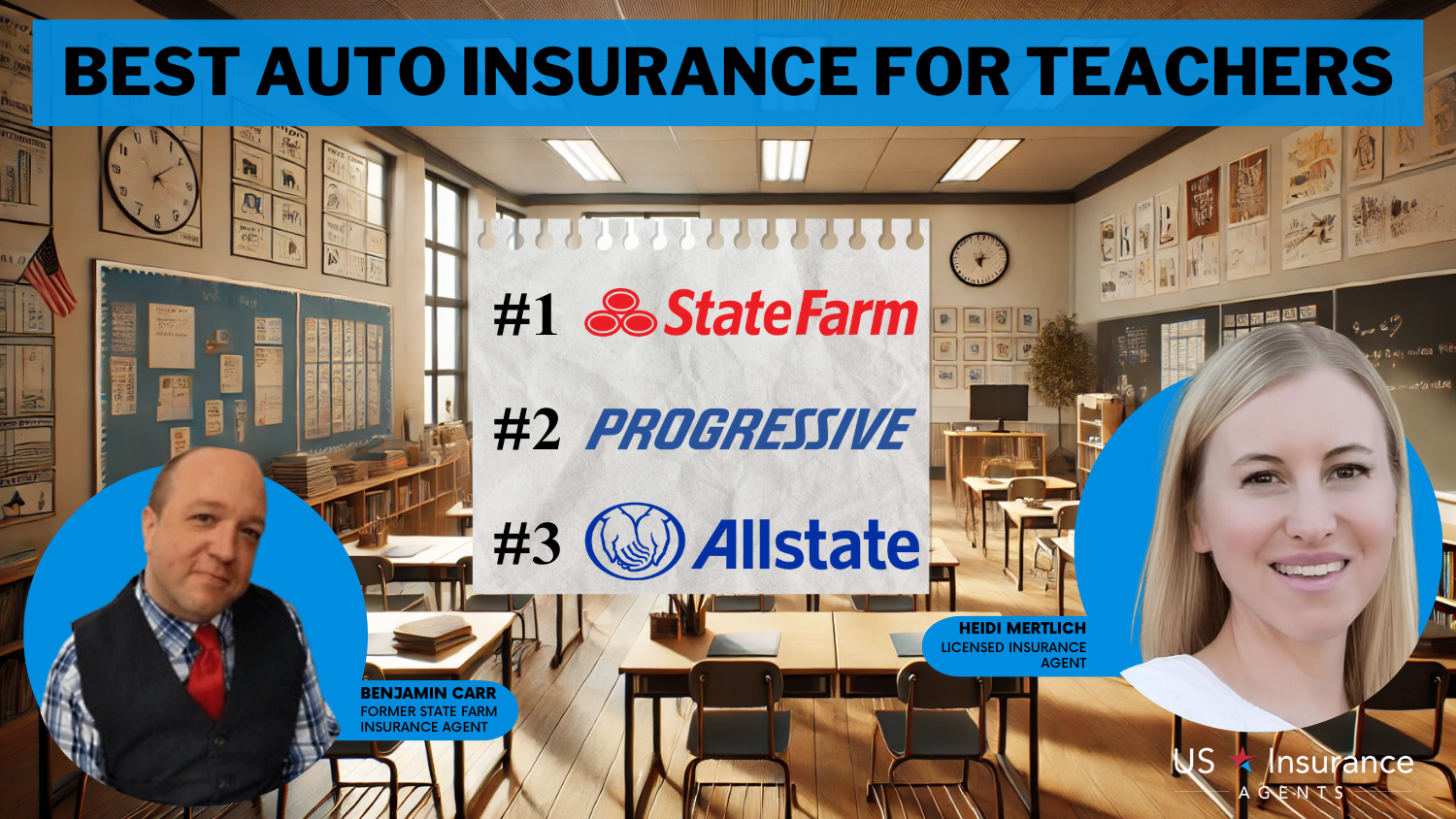

State Farm, Progressive, and Allstate offer the best auto insurance for teachers, offering rates as low as $39 per month. These companies provide the best auto insurance for educators, specialized coverage, and comprehensive liability protection, so educators can drive confidently knowing they're covered.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Former State Farm Insurance Agent

Benjamin Carr worked as a licensed insurance agent at State Farm and Tennant Special Risk. He sold various lines of coverage and informed his clients about their life, health, property/casualty insurance needs. Assessing risks and helping people find the best coverage to suit their needs is a passion of his. He appreciates that insurance was designed to protect people, particularly during times...

Benjamin Carr

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Heidi works with top-rated life insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the ...

Heidi Mertlich

Updated August 2025

18,157 reviews

18,157 reviewsCompany Facts

Full Coverage for Teachers

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 13,285 reviews

13,285 reviewsCompany Facts

Full Coverage for Teachers

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews 11,640 reviews

11,640 reviewsCompany Facts

Full Coverage for Teachers

A.M. Best

Complaint Level

Pros & Cons

11,640 reviews

11,640 reviewsState Farm, Progressive, and Allstate offer the best auto insurance for teachers. These companies give custom solutions with unique plans and comprehensive coverage, so educators can drive safe and protected.

From liability insurance for transporting students to specialized discounts for educators, these companies stand out for their commitment to providing reliable insurance solutions. This comprehensive guide explores how these top providers cater to teachers’ insurance needs.

Our Top 10 Company Picks: Best Auto Insurance for Teachers

| Company | Rank | UBI Discount | Multi-Policy Discount | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 20% | 15% | Educator Discount | State Farm | |

| #2 | 18% | 14% | Educator Rate | Progressive | |

| #3 | 25% | 22% | Student Discount | Allstate | |

| #4 | 16% | 24% | Teacher Insurance | Liberty Mutual |

| #5 | 21% | 19% | Educator Advantage | Nationwide | |

| #6 | 17% | 11% | Driving Discounts | Farmers | |

| #7 | 19% | 13% | Personalized Service | American Family | |

| #8 | 23% | 16% | Advantage Program | Travelers | |

| #9 | 12% | 18% | Membership Discounts | Geico | |

| #10 | 15% | 12% | Roadside Assistance | AAA |

Teachers have distinct insurance needs, making finding optimal teachers’ car insurance coverage challenging. Their profession exposes them to unique risks and responsibilities.

This article discusses why you might need specialized car insurance for teachers, essential considerations in coverage selection, and money-saving strategies tailored to educators.

Use our free comparison tool to see what the best car insurance for teachers looks like in your area.

- State Farm offers cheap car insurance for teachers, with monthly rates at $39

- Teachers need specialized car insurance to ensure coverage for unique risks

- Many insurance companies also offer specialized discounts for teachers

#1 – State Farm: Top Overall Pick

Pros

- High Discount Rates: Our State Farm insurance review indicates how motorists can receive 20% discounts on the auto insurance rates of teachers.

- Teacher-Centric Policies: Personalized policies demonstrate the company’s willingness to adjust to unique teacher needs.

- Diverse Coverage Options: State Farm provides varied coverages that can be adapted to a teacher’s personal choice.

Cons

- Discount Restrictions: Its auto insurance teacher discounts can be restricted because of certain qualification demands.

- Potential Regional Variations: Coverage choices and discounts may vary based on where teachers reside.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Progressive: Best for Educator Rate

Pros

- Competitive Rates: Progressive provides teacher auto insurance with competitive rates in the market.

- Flexibility: Progressive insurance review & ratings highlight the flexibility of their educator rate, supporting a variety of teaching careers.

- Online Tools: Progressive online tools allow for simple policy and claims administration by teachers.

Cons

- Discount Caps: The maximum discount available to teachers may be limited regardless of their qualifications.

- Limited Local Agents: Teachers in certain regions may have difficulty finding local insurance agents who are familiar with educator-specific policies.

#3 – Allstate: Best for Student Discount

Pros

- Allstate Teacher Discount: Allstate takes the lead with up to 25% discounts, particularly best suited for teachers with student dependents.

- Comprehensive Coverage: Explore Allstate’s insurance review to find a range of plans that suits teacher’s needs.

- User-Friendly App: The Allstate mobile app provides convenient policy management for on-the-go educator auto insurance.

Cons

- Limited to Students: The emphasis on student discounts may not be as advantageous for teachers without student dependents.

- Potentially Higher Premiums: While offering discounts, auto insurance for educators may be relatively higher for certain profiles.

#4 – Liberty Mutual: Best for Teacher Insurance

Pros

- Teacher-Centric Policies: Liberty Mutual is teacher-centric, providing insurance only for teacher’s requirements.

- Balanced Discounts: Our Liberty Mutual insurance review shows that they offer fair discount rates, allowing teachers to get the coverage that they desire more easily.

- Addition Coverage Plans: Liberty Mutual offers additional coverage plans which can be accessed by teachers for additional protection.

Cons

- Potential for Higher Base Rates: While offering teacher-centric policies, teachers’ auto insurance could prove to be pricey, as minimum rates can be higher for certain demographics.

- Variability of Discounts: Discount rates for students may differ depending on some conditions, which leads to irregular saving by instructors.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Educator Advantage

Pros

- Comprehensive Educator Advantage: The Educator Advantage program from Nationwide offers teachers up to 21% discounts on car insurance and offers their own discounts with other policies.

- Multi-Policy Discounts: Our Nationwide insurance review highlights the potential savings for teachers from bundling options with other policies.

- Nationwide Network: A broad network of agents and branches facilitates ease of access for educators.

Cons

- Eligibility Requirements: To be a member of the Educator Advantage program, there are some things you must possess or accomplish.

- Minimum Rates Raised: The minimum rates can increase, and hence some teachers may pay higher for their premiums.

#6 – Farmers: Best for Driving Discounts

Pros

- Flexible Policies: Farmers lets you customize your policy, so educators can adjust their coverage to suit what they need.

- Coverage Bundling: Find out how bundling with other insurance policies can lead to additional savings for teachers in our Farmers insurance review.

- Driving Discounts: Farmers provides teacher car insurance discounts of up to 17% for safe driving.

Cons

- Limited Online Presence: Teachers have fewer online tools for managing their car insurance policies compared to other insurance rivals.

- Regional Variations: Teachers can get different discounts and coverage plans by region.

#7 – American Family: Best for Personalized Service

Pros

- Personalized Education Service: Personalized service is the primary concern of American Family forming a teacher-friendly atmosphere.

- Up to 19% Discounts: According to our American Family insurance reviews, you may get car insurance with up to 19% teacher discounts.

- Educational Resources: American Family offers educational resources to enable teachers to make wise decisions.

Cons

- Regional Availability: Teachers in certain places might not be able to get all the discounts and services that are offered to them.

- Higher Prices: When giving discounts, minimum prices can differ depending on the teacher’s situation.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Advantage Program

Pros

- Advantage Program: The Travelers’ Advantage Program gives teachers discounts of up to 23%, so they can save a good chunk of change.

- Additional Perks: Travelers may offer additional perks for teachers such as roadside assistance or rental car coverage.

- Coverage Flexibility: In our review of Travelers insurance, teachers can have flexibility in many diverse coverage options under the Advantage Program.

Cons

- Eligibility Criteria: The Advantage Program can have eligibility requirements, some teachers may not be able to get this.

- Limited Local Agents: In-person assistance may be limited in certain regions, making it harder for educators to reach them.

#9 – Geico: Best for Membership Discounts

Pros

- Membership Discounts: Geico provides discounts of up to 18% for teachers of certain educational organizations.

- Online Accessibility: How to appeal a car insurance claim with Geico gives a glimpse of Geico’s easy-to-use website, which is convenient for educators to process policies and file claims.

- Nationwide Availability: Geico’s teacher car insurance services are extremely available all over the country.

Cons

- Restricted Membership Choices: Teacher discounts may be limited to specific schools.

- Higher Minimum Costs: Minimum rates may differ based on circumstances for educators.

#10 – AAA: Best for Roadside Assistance

Pros

- Roadside Assistance: AAA offers roadside help as an extra benefit giving educators extra road safety.

- Up to 15% Discounts: Benefit from AAA’s teachers car insurance discounts of up to 15%, which equate to overall savings.

- Network of Services: This AAA insurance review illustrates how AAA’s detailed network offers teachers something beyond auto insurance.

Cons

- Membership Fee: AAA is a membership company, and membership fees for teachers can be an extra cost.

- Limited Coverage Options: Coverage options for teachers can be more general than companies that offer more customized policies.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Coverage Rates Among Top Insurance Providers for Teachers

For educators, maintaining the expense of auto insurance at bay is a critical part of their financial plan. This section offers useful information on actual coverage rates directly for educators, providing a concise representation of the average monthly rates of minimum and full coverage policies for several insurance companies.

Car Insurance Monthly Rates for Teachers by Coverage Level & Provider

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $38 | $86 |

| $67 | $160 | |

| $51 | $117 | |

| $64 | $139 | |

| $32 | $80 | |

| $77 | $174 |

| $53 | $115 |

| $50 | $105 | |

| $39 | $86 | |

| $40 | $99 |

Teachers need to know the exact coverage rates for car insurance to balance coverage and budget. State Farm is reliable and has rates of $39 for minimum coverage and $86 for full coverage. Affordable options for teachers who want reliable coverage.

Progressive is flexible and has rates of $50 for minimum coverage and $105 for full coverage. Options for teachers who want flexible insurance. Allstate is one of the best car insurance companies for teacher discounts and has average rates of $67 for minimum coverage and $160 for full coverage car insurance.

Why Teachers Need Specialized Car Insurance

Teachers are unsung heroes of our society, shaping the minds of future generations. But their profession comes with an added risk when it comes to car insurance. Teachers transport students to and from school, participate in extracurricular activities and use their vehicles to haul teaching materials.

These unusual situations demand extra road coverage. One main reason teachers must have car insurance is their responsibility when they carry students. Whether teachers drive a school bus or share a car with students, they must keep passengers safe.

In the event of an accident, specialized car insurance can provide coverage for medical expenses, property damage, and legal fees that may arise. This includes car insurance for medical payments coverage, which specifically helps cover the cost of medical treatments needed due to a vehicle accident.

The table displays monthly car insurance rates for teachers, differentiated by coverage level and provider. For minimum coverage: AAA ($50), Allstate ($38), American Family ($67), Farmers ($51), Geico ($64), Liberty Mutual ($77), Nationwide ($53), Progressive ($50), State Farm ($39), and Travelers ($40).

For full coverage: AAA ($100), Allstate ($86), American Family ($160), Farmers ($117), Geico ($139), Liberty Mutual ($174), Nationwide ($115), Progressive ($105), State Farm ($86), and Travelers ($99). This provides an overview of the cost differences between providers and coverage levels.

Understanding the Unique Insurance Needs of Teachers

Teachers have a unique set of risks that distinguish their profession from the rest. For example, the risk of having children in their cars is extremely high due to their role. Secondly, they may require security for their textbooks and teaching tools—like laptops and books—which are mostly stored in their cars.

Jeff Root Licensed Life Insurance Agent

It is essential to understand the special requirements of high-risk drivers, such as high-risk driver car insurance, in choosing the most appropriate car insurance policy. Additionally, teachers have to commute from place to place for school events or field trips. What this implies is that they will be driving more and are at greater risk of accidents.

Teachers should take into account a full-coverage policy that covers personal and school use of their vehicles.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors to Consider When Choosing Car Insurance for Teachers

In selecting auto insurance for teachers, factors like adequate protection, liability, and full-coverage matter. Protection from uninsured/underinsured drivers is crucial to shield funds in the event of crashes with uninsured drivers.

Insurer reputation and educator discounts have to be balanced against one another. Educators pay deductible cost for the trade-off of reduced premiums for out-of-pocket expense. Convenient customer service and web presence provide insurance for working educators in a convenient and accessible manner.

Comparing Car Insurance Plans for Educators

Comparing car insurance plans is crucial to find the right coverage for educators. Get quotes from multiple insurance companies to compare the cost and benefits of each policy. Don’t just consider the premium but also the coverage limits, deductibles and any profession specific features.

One important thing to consider when comparing car insurance plans for educators is the discounts. Many insurance companies offer discounts for teachers such as good student discount or professional organization discount. These discounts can make a huge difference in the overall cost of insurance for educators.

Ask for such discounts when you are getting quotes from different providers in order to get the best bargain.

The Benefits of Teacher-Specific Car Insurance Policies

Teacher-specific car insurance policies offer unique features that are appropriate for teachers. These policies can offer insurance coverage for teaching materials, liability protection when driving students, and teacher-specific insurance discount. Other perks like roadside assistance coverage, rental car coverage, or accident forgiveness for teachers are also offered by some insurers.

Another one of the greatest benefits of teacher-specific auto insurance policies is the coverage of educational materials. Teachers tend to have costly educational materials, such as textbooks, materials, and equipment, so insurance coverage aimed at these materials can be comforting. In the event of theft, damage, or loss, teachers can rest assured knowing that their teaching materials are protected.

Car Insurance Monthly Rates for Teachers by Age, Gender, & Provider

| Insurance Company | Age: 20 Female | Age: 20 Male | Age: 30 Female | Age: 30 Male | Age: 45 Female | Age: 45 Male |

|---|---|---|---|---|---|---|

| $120 | $140 | $100 | $115 | $90 | $100 |

| $220 | $255 | $185 | $210 | $170 | $190 | |

| $165 | $190 | $145 | $160 | $130 | $145 | |

| $190 | $220 | $160 | $180 | $150 | $165 | |

| $110 | $125 | $90 | $105 | $85 | $95 | |

| $240 | $275 | $205 | $230 | $190 | $210 |

| $160 | $185 | $135 | $155 | $125 | $140 |

| $145 | $170 | $125 | $140 | $115 | $130 | |

| $115 | $135 | $95 | $110 | $85 | $105 | |

| $135 | $155 | $115 | $130 | $105 | $120 |

Looking for car insurance that won’t break a teacher’s budget? Your age and experience in the classroom could unlock some sweet deals. The big names – AAA, Allstate, American Family, Farmers, Geico, Liberty Mutual, Nationwide, Progressive, State Farm, and Travelers – actually get what teachers need. Shop around, ask plenty of questions, and you’ll find coverage that works with your teaching salary.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Top Car Insurance Companies Catering to Teachers

These insurance companies step up their game for educators. They know you might be carting around expensive classroom supplies or driving to school events, so they’ve got your back. No more stressing about whether that box of science projects in your trunk is covered.

Additional perks include discounts for defensive driver car insurance discounts, which can be earned through defensive driving courses, and memberships in educational organizations, ensuring teachers find comprehensive coverage that adds value and security.

How to Save Money on Car Insurance as a Teacher

Your teaching salary shouldn’t limit your car insurance options. There are plenty of ways to keep more cash in your pocket without skimping on protection. Consider bundling your home and car insurance with one company – think of it as smart budgeting for smart educators.

Being a teacher already marks you as responsible (managing 30 students daily proves that), so insurance companies want to reward you. A clean driving record adds up to savings. Complete a defensive driving course for extra benefits. And those teaching association memberships in your wallet? They could be your ticket to better rates.

Exploring Discounts and Special Offers for Educators

Insurance companies recognize teachers as uniquely reliable customers, and they show it through specialized deals. Simply mentioning your role as an educator might unlock special rates like the educator car insurance discount. It turns out teaching makes you a trustworthy driver in their eyes.

Those teaching credentials and certifications on your wall serve double duty. Many insurance companies view your education degree or additional certifications as proof of responsibility behind the wheel. Don’t hesitate to ask about every available teacher discount. Think of it as doing your homework on savings opportunities.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips for Finding the Most Affordable Car Insurance for Teachers

Finding the cheapest car insurance companies as a teacher takes some smart shopping and planning. Just like you’d compare prices for classroom supplies, getting quotes from different insurance companies can make a big difference in your wallet. Each company looks at risk differently, so rates can vary a lot – sometimes by hundreds of dollars.

Keep your driving record as clean as your whiteboard – it’s one of the best ways to keep your rates down. Those safe driving habits you practice in the school zone? They pay off everywhere. Think of it as earning extra credit with your insurance company.

What You Need to Know About Liability Coverage for Teachers

When it comes to car insurance, liability insurance is your financial shield on the road. Think of it as the same kind of protection you provide in your classroom, but for your driving life. As a teacher, you’re already trusted with big responsibilities – now imagine if an accident happened on your way to a field trip or during your daily commute.

Good liability coverage protects you from the what-ifs. Maybe a student’s parent gets injured in a fender bender near the school, or your car accidentally damages school property during an event. These situations could lead to medical bills or legal headaches that most teaching salaries aren’t built to handle.

Understanding Comprehensive and Collision Coverage Options for Educators

Think of comprehensive and collision car insurance as your car’s security system. Comprehensive coverage steps in when life throws unexpected curves – like a storm dropping a tree on your car in the school parking lot, a break-in during parent-teacher night, or that unexpected hailstorm during outdoor graduation.

Collision coverage handles the more common scenarios – like when that distracted parent backs into your car during morning drop-off, or when you slide on ice in the school parking lot. For teachers who rely on their vehicles to get to work and transport classroom materials, these coverages offer crucial protection.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Importance of Uninsured/Underinsured Motorist Coverage for Teachers

On your educator’s salary, dealing with medical bills or car repairs because another driver skipped on proper insurance could be tough. That’s why having uninsured/underinsured insurance coverage is as essential as your lesson plan backup – it’s there when Plan A falls through.

Getting this coverage means you can focus on teaching, and not worrying about whether the other driver in a crash can pay for damages.

Expert Advice on Choosing the Right Deductible for Teacher Car Insurance

Selecting the appropriate deductible is a significant choice in the case of teacher car insurance. But the catch here is to ensure that you have enough money set aside to pay for that deductible if you need to make a claim. Just like keeping an emergency fund for classroom supplies, you need a safety net for those unexpected car troubles.

Consider it like balancing your checkbook and paying a little more every month for a lower deductible, or having more cash available to cover a higher deductible when the trouble comes.

How Your Driving History Impacts Car Insurance Rates as a Teacher

A clear record behind the wheel shapes your insurance rates as an educator. Think of it as building your professional reputation, but on the road. Insurance companies look at every detail of your driving past – from minor fender benders to traffic tickets – to determine how much risk you present as a driver. Just as you invest time in professional development, think of safe driving as an investment in lower insurance costs.

Insurance providers notice patterns of responsible behavior, and they’re willing to offer better rates to teachers who demonstrate consistency in safe driving. Going the extra mile by taking defensive driving courses shows initiative – much like pursuing additional certifications in teaching – and often unlocks extra discounts.

Additionally, consider researching how traffic school can lower car insurance rates for further savings.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Benefits of Bundling Home and Car Insurance for Educators

Bundling home and car insurance with one provider streamlines your coverage while offering valuable savings. Like organizing your classroom efficiently, bundling simplifies insurance management by giving you a single point of contact for all policies.

Before you bundle, do your research. Check how the total package price stacks up against getting individual policies. Be careful about the cost, but not at the expense of considering value: levels of coverage, deductibles, and teacher discounts, if available. Some insurance carriers even include some special educator goodies that make it worthwhile to bundle.

Common Mistakes to Avoid When Purchasing Car Insurance as a Teacher

While buying car insurance as a teacher, it is crucial to steer clear of typical errors that may leave you underinsured or paying higher premiums than you would have liked.

Choosing only minimum coverage can leave you vulnerable, especially when you’re responsible for transporting teaching materials or driving to school events. Adding uninsured/underinsured motorist coverage provides an extra layer of protection that many educators need but often ignore.

Tips for Filing Claims and Dealing With Car Accidents as an Educator

Teachers should be able to file a claim and proceed through the process if they have an accident. Start by collecting all relevant information at the site of the accident, such as contact information of the parties involved, witnesses, and the relevant authorities. Notify your insurance company of the accident as soon as possible to kick off the process of filing a claim.

Teachers should keep detailed records of all correspondence and documentation throughout the claims process, including what documentation is needed to file a car insurance claim. Moreover, understanding the coverage included in the policy like State Farm’s accident forgiveness policy and any limitations or exclusions will help facilitate a smoother claims experience.

Empowering Educators: How Tailored Insurance Transformed Teacher Experiences

See how customized insurance policies has changed the experience of teachers, giving them the coverage they need. Through real-life examples, explore how the top insurance companies have given teachers specialized solutions to fit their needs.

- Case Study #1 – Empowering an Educator with Tailored Coverage: Mrs. Anderson, a high school teacher, wanted custom car insurance. State Farm offered a teacher car insurance discount of up to 20%, which addressed her higher liability. The policy gave her comprehensive coverage, flexibility and peace of mind for teachers like her.

- Case Study #2 – Navigating the Complexities: Ms. Garcia, a teacher of art, desired car insurance that recognized her. Progressive’s Educator Rate provided a competitive price. Having more than one responsibility, she appreciated Progressive’s online features for managing policy. The rate flexibility worked in her favor, indicating Progressive’s support for teachers.

- Case Study #3– Supporting Educational Journey: Mr. Johnson, a college instructor, required insurance for his student-dependent requirements. Geico’s teacher discount, which is a maximum of 25% off, provided her with complete coverage. Policy management was convenient through the mobile app. Geico’s support for teachers was reflected in its personalized service.

As you can see from these case studies, custom insurance for teachers gives you financial protection and peace of mind. Whether it’s through discounts, comprehensive coverage or easy tools, good insurance companies like State Farm, Progressive and Allstate are with teachers every step of the way.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tailored Protection: Finding the Best Auto Insurance Companies for Educators

Getting the best auto insurance for teachers requires specialized coverage options. Given the risks and difficulties they encounter, teachers must assess their options very carefully and opt for the most suitable car insurance for their situation.

By realizing the significance of liability car insurance, comprehensive and collision coverage, uninsured/underinsured motorist protection, deductibles, and other discounts offered, teachers can be well protected while getting low rates.

Taking the time to research different auto insurance companies catering to teachers, comparing quotes, and understanding claims procedures equips educators with the knowledge they need to make informed decisions and secure the best car insurance coverage.

Explore car insurance quotes for teachers by entering your ZIP code into our free comparison tool below today.

Frequently Asked Questions

What is the best insurance for teachers?

State Farm is the best overall insurance for teachers, offering monthly rates of $39 for minimum coverage and $86 for full coverage. Finding suitable car insurance coverage type is crucial for educators. We can help you find the top auto insurance companies that cater specifically to teachers.

Which auto insurance company offers the best insurance for educators?

State Farm is the best insurance company for educators; they also provide specialized coverage for teaching materials and flexible payment options. Discover which insurance company stands out as the best option for educators.

Read More: The Best Ways to Get the Cheapest Car Insurance Quotes

Do insurance companies offer discounts for teachers?

Yes, many insurance companies provide discounts for teachers, such as Geico’s discounts for teachers. Discover how you can benefit from teacher car insurance discounts and save on your premiums.

Learn more: How does the insurance company determine my premium?

What factors should teachers consider when choosing car insurance?

Teachers have unique needs when it comes to car insurance. Find out which factors to prioritize and consider for the best coverage tailored to educators.

Where can teachers get auto insurance quotes?

Teachers looking to get auto insurance quotes can explore various options. Learn about reputable insurance companies for teachers and how to obtain a quote.

How can teachers get cheap car insurance?

Securing affordable car insurance as a teacher is possible. Learn about discounts and special offers tailored to educators to find the cheapest car insurance for teachers.

Are there nationwide auto insurance options specifically for teachers?

Nationwide car insurance options for teachers are available. Explore insurance companies that provide nationwide coverage tailored to educators’ needs.

What are the benefits of specialized car insurance for teachers?

Specialized car insurance for teachers offers unique benefits and coverage options. Learn how tailored insurance solutions can benefit educators.

Enter your ZIP code into our free quote tool below to find the best auto insurance providers for your needs and budget.

How can teachers save money on car insurance premiums?

Teachers can take advantage of various strategies to reduce their car insurance costs. Explore tips and tricks to secure cheap insurance for teachers. Find out how much car insurance costs.

Why is it important for teachers to have auto insurance tailored to their profession?

Teachers face specific risks and responsibilities that warrant specialized auto insurance. Discover the importance of customized educator car insurance.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.