Best Car Insurance for Firefighters in 2026 (Top 10 Companies)

Consider USAA, State Farm, and Progressive as the best car insurance options for firefighters, offering competitive pricing starting from $22 per month. They provide extensive coverage and personalized benefits tailored to fit your unique needs, ensuring peace of mind on the road while staying within your budget.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Dan Walker graduated with a BS in Administrative Management in 2005 and has been working in his family’s insurance agency, FCI Agency, for 15 years (BBB A+). He is licensed as an agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. He reviews content, ensuring tha...

Daniel Walker

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent life insurance brokerage. His company specializes in life insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast...

Jimmy McMillan

Updated February 2025

6,590 reviews

6,590 reviewsCompany Facts

Full Coverage for Firefighters

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 18,157 reviews

18,157 reviewsCompany Facts

Full Coverage for Firefighters

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 13,285 reviews

13,285 reviewsCompany Facts

Full Coverage for Firefighters

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviewsDiscover the top contender for the best car insurance for firefighters: USAA stands out with competitive rates and tailored benefits, ensuring comprehensive protection at affordable prices.

Alongside other leading providers like State Farm and Progressive, USAA offers discounts of up to 15%, with monthly rates starting as low as $59. With a focus on firefighters’ unique needs, these companies provide reliable coverage options to safeguard against unforeseen risks on and off duty.

Our Top 10 Company Picks: Best Car Insurance for Firefighters

| Company | Rank | Firefighter Discount | Multi-Policy Discount | Best for | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 15% | 10% | Military Savings | USAA | |

| #2 | 10% | 17% | First-Responder Discount | State Farm | |

| #3 | 5% | 12% | Comprehensive Coverage | Progressive | |

| #4 | 8% | 15% | Safe-Driving Discounts | Allstate | |

| #5 | 12% | 20% | Local Agents | Liberty Mutual |

| #6 | 7% | 14% | Bundling Policies | Nationwide |

| #7 | 10% | 18% | Vanishing Deductibles | Farmers | |

| #8 | 6% | 11% | Customizable Coverage | Travelers | |

| #9 | 9% | 16% | Multi-Policy Discounts | American Family | |

| #10 | 5% | 13% | Customer Service | Erie |

Firefighters must secure suitable auto insurance for on and off-duty protection. This article explores key factors, top insurers with specialized coverage, discounts, and benefits, and essential coverage options, aiding informed decisions for firefighters.

To secure the most favorable rates and coverage customized to your requirements, kindly input your ZIP code above. Compare quotes from top-notch insurance providers, initiating the first step toward obtaining the ideal car insurance for yourself and your family.

- USAA, State Farm, and Progressive offer tailored car insurance for firefighters

- Tailored benefits, competitive rates ensure complete firefighter coverage

- USAA is the top pick, providing comprehensive protection and competitive rates

#1 – USAA: Top Overall Pick

Pros

- Generous Military Discounts: USAA provides a substantial military discount of up to 15%, demonstrating a strong commitment to serving the needs of military personnel and their families.

- Additional Savings Opportunities: Highlighted in the “USAA Insurance Review & Ratings,” USAA offers an extra 10% discount, potentially saving eligible customers up to 25%.

- Specialized Focus on Military Members: USAA’s exclusive focus on military members ensures tailored insurance products and services, understanding the unique challenges and needs of this specific demographic.

Cons

- Limited Eligibility: USAA membership is restricted to military members, veterans, and their families, excluding a significant portion of the general population from accessing their offerings.

- Potentially Limited Geographic Coverage: USAA may have a more limited physical presence compared to other insurers, potentially affecting the accessibility of in-person services for some customers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – State Farm: Best for First-Responder Discount

Pros

- Substantial First-Responder Discounts: As highlighted in the “State Farm Insurance Review & Ratings,” State Farm offers a generous discount of up to 17% for first responders, showing appreciation for their essential contributions.

- Additional Savings Potential: In addition to first-responder discounts, State Farm provides an extra 10% discount, potentially resulting in total savings of up to 27% for eligible customers.

- Diverse Range of Insurance Products: State Farm’s extensive range of insurance products allows customers to bundle policies, simplifying their insurance needs and potentially enjoying additional discounts.

Cons

- Variable Customer Service: While State Farm has a vast network of agents, the quality of customer service may vary based on the individual agent, potentially leading to inconsistent experiences for policyholders.

- May Not be the Most Affordable for Non-Qualifying Groups: State Farm’s competitive advantage lies in its discounts for first responders, and those who do not qualify for these discounts may find other insurers more cost-effective.

#3 – Progressive: Best for Comprehensive Coverage

Pros

- Significant Comprehensive Coverage Discount: Referenced in the “Progressive Insurance Review & Ratings,” the Snapshot program, tracking driving behavior, may prompt privacy concerns among customers, questioning data security.

- Innovative “Name Your Price” Tool: Progressive’s “Name Your Price” tool allows customers to set their budget, helping them find a policy that matches their financial constraints, providing flexibility and transparency.

- Snapshot Program for Additional Discounts: Progressive’s Snapshot program tracks driving habits, potentially leading to additional discounts based on individual behavior, rewarding safe drivers with lower premiums.

Cons

- May Not be the Most Cost-Effective for Basic Coverage: While Progressive excels in comprehensive coverage, it may not be the most budget-friendly option for customers seeking basic and minimal coverage.

- Snapshot Program Privacy Concerns: Some customers may have privacy concerns regarding the Snapshot program, as it involves tracking driving behavior, raising questions about data security and usage.

#4 – Allstate: Best for Safe-Driving Discounts

Pros

- Substantial Safe-Driving Discounts: Allstate emphasizes safe driving and offers a generous discount of up to 15%, providing a strong incentive for policyholders to maintain good driving habits.

- DriveWise Program: Allstate’s DriveWise program allows safe drivers to earn additional discounts based on their driving behavior, offering a personalized and dynamic way to reduce premiums.

- Diverse Coverage Options: Allstate provides a range of insurance products, allowing customers to customize their coverage and potentially benefit from bundled policy discounts.

Cons

- Potentially Higher Base Premiums: While safe drivers can enjoy significant discounts, Allstate’s base premiums may be higher compared to some competitors, affecting the affordability for certain customers.

- May Lack Specialized Focus: As noted in the “Allstate Insurance Review & Ratings,” although catering to a wide range of customers, Allstate may not meet the preferences of those seeking insurers with a more specialized focus.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Liberty Mutual: Best for Local Agents

Pros

- High Local Agents Discount: Liberty Mutual’s focus on local agents comes with a substantial discount of up to 20%, offering personalized service and cost savings for customers who prefer face-to-face interactions.

- Extensive Network of Local Offices: Liberty Mutual’s widespread network of local offices enhances accessibility, providing customers with convenient and localized support.

- Diverse Range of Coverage Options: As detailed in the “Liberty Mutual Review and Ratings,” Liberty Mutual provides a range of insurance products, enabling customers to bundle policies and potentially increase their savings.

Cons

- Potentially Higher Premiums for Non-Local Agent Policies: Customers who opt for policies without utilizing local agents may miss out on the maximum discount, potentially resulting in higher premiums compared to other insurers.

- May Lack Specialized Focus: Similar to Allstate, Liberty Mutual’s broad customer base may limit its ability to provide highly specialized services for certain demographics or insurance needs.

#6 – Nationwide: Best for Bundling Policies

Pros

- Substantial Bundling Discounts: Nationwide offers a significant discount of up to 14% for customers who bundle multiple policies, providing both cost savings and convenience.

- Multi-Product Discounts: As outlined in the “Nationwide Insurance Review & Ratings,” Nationwide’s diverse insurance offerings enable customers to bundle policies, potentially maximizing discounts.

- Financial Stability: Nationwide’s long-standing presence in the insurance industry reflects financial stability, assuring customers of the company’s ability to fulfill its commitments.

Cons

- May Not be the Most Affordable for Single Policies: Nationwide’s strength lies in bundling discounts, and customers seeking standalone car insurance may find more cost-effective options elsewhere.

- Variable Customer Service: Similar to State Farm, the quality of customer service may vary depending on the individual Nationwide agent, potentially leading to inconsistent experiences for policyholders.

#7 – Farmers: Best for Vanishing Deductibles

Pros

- Unique Vanishing Deductibles Program: Farmers Insurance introduces a unique vanishing deductible program, rewarding safe driving by gradually reducing deductibles over time.

- Diverse Coverage Options: Farmers offers a variety of insurance products, allowing customers to tailor their coverage to specific needs and potentially benefit from bundled policy discounts.

- Educational Resources: As emphasized in the “Farmers Insurance Review & Ratings,” Farmers offers educational resources and tools to assist customers in comprehending insurance options, promoting informed decision-making.

Cons

- May Require Time for Maximum Deductible Reduction: While the vanishing deductible is a valuable feature, it may take time for policyholders to maximize the reduction, and in the short term, other insurers may offer more immediate savings.

- Potentially Higher Premiums for Certain Demographics: Farmers may not always offer the most competitive rates for certain demographic groups, and customers may need to compare quotes to ensure affordability.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Customizable Coverage

Pros

- Customizable Coverage Discounts: Travelers rewards customers who customize their coverage with a discount of up to 11%, providing flexibility and personalized options.

- Comprehensive Range of Coverage Options: Travelers offers a wide array of coverage options, allowing customers to build a policy that aligns with their specific needs.

- Financial Strength: Travelers’ financial strength and stability assure customers of the company’s ability to handle claims and meet its obligations.

Cons

- May be Overwhelming for Some Customers: The abundance of coverage options might be overwhelming for customers who prefer a more straightforward and streamlined insurance experience.

- May Not offer the Most Competitive Rates for Basic Coverage: Referencing insights from the “Travelers Insurance Review & Ratings“, customers focused on basic coverage over additional features might find other insurers more cost-effective.

#9 – American Family: Best for Multi-Policy Discounts

Pros

- Significant Multi-Policy Discounts: American Family provides a substantial discount of up to 16% for customers who bundle multiple policies, offering potential cost savings and simplified insurance management.

- Wide Range of Insurance Products: As indicated in the “American Family Insurance Review & Ratings“, American Family’s wide array of insurance offerings enables customers to bundle policies, potentially maximizing their discounts.

- Community Involvement: American Family is known for its community involvement and support, contributing to a positive brand image and reinforcing customer trust.

Cons

- May Not be the Most Affordable for Single Policies: Similar to Nationwide, American Family’s strength lies in multi-policy discounts, and customers seeking standalone car insurance may find more cost-effective options elsewhere.

- Variable Customer Service: As with many insurers, the quality of customer service may vary, and some customers may experience inconsistencies based on their interactions with individual agents.

#10 – Erie: Best for Customer Service

Pros

- Customer Service Discounts: Erie insurance review & ratings emphasizes customer service and offers a discount of up to 13%, recognizing and rewarding policyholders who prioritize a high level of service.

- High Customer Satisfaction Ratings: Erie has a strong reputation for high customer satisfaction ratings, reflecting its commitment to providing excellent service and support.

- Personalized Approach: Erie’s emphasis on personalized service, often facilitated through local agents, provides a more intimate and tailored experience for customers.

Cons

- Limited Geographic Availability: Erie Insurance is available in a limited number of states, potentially restricting access for customers in regions where the company does not operate.

- May Not Have as Many Discounts as Larger Competitors: While Erie focuses on customer service, it may not offer as many discounts as larger competitors, potentially affecting the overall affordability for some customers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Introducing Firefighter and Multi-Policy Discounts With Top 10 Car Insurers

Securing the right insurance coverage is a paramount concern for firefighters, given the unique risks associated with their profession. Understanding the nuances of insurance rates becomes crucial in ensuring financial protection.

Firefighters Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $61 | $160 | |

| $44 | $117 | |

| $22 | $58 |

| $45 | $139 | |

| $68 | $174 |

| $46 | $115 |

| $39 | $105 | |

| $33 | $86 | |

| $37 | $99 | |

| $24 | $59 |

The table illustrates average monthly car insurance rates for firefighters, highlighting minimum and full coverage options. USAA stands out with the most affordable full coverage at $59/month and a minimum coverage option at $22.

State Farm follows with full coverage at $86 and minimum coverage at $33. Other providers offer varying rates, like Allstate’s $160 for full coverage and Erie’s competitive $58 rate. This breakdown empowers firefighters to select coverage aligned with their needs and budgets.

Understanding the Unique Insurance Needs of Firefighters

Firefighters face unique insurance needs due to their high-risk profession, involving large emergency vehicles and hazardous conditions. Their coverage should address these risks with comprehensive protection, including liability coverage for potential lawsuits.

Laura Walker Former Licensed Agent

Additionally, specialized coverage for personal belongings and equipment ensures full protection on duty. Understanding coverage limits and options tailored to firefighters is crucial for securing adequate financial protection.

Essential Coverage Options for Firefighters’ Vehicles

As a firefighter, your dedication to protecting others is unwavering. It’s essential to ensure you have comprehensive coverage tailored to your unique challenges. Explore insurance solutions designed for firefighters, offering peace of mind and financial security. Ensure your coverage matches your bravery with essential options like:

- Liability Coverage: Protects against damages and injuries in accidents.

- Comprehensive and Collision Coverage: Comprehensive and collision coverage covers theft, vandalism, or accidents.

- Uninsured/Underinsured Motorist Coverage: Protects against drivers with insufficient insurance.

- Personal Injury Protection (PIP) Coverage: Covers medical expenses and lost wages, regardless of fault.

- Rental Reimbursement Coverage: Covers rental costs if your vehicle needs repairs.

With these tailored coverage options, you can continue your vital work on the frontlines with confidence. Stay protected and focused on what matters most—serving your community.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Discounts and Benefits for Firefighters in Car Insurance Policies

Firefighters may be eligible for various discounts and benefits when purchasing car insurance. Insurance companies often offer special discounts for professionals in specific occupations, including firefighters. These discounts can help reduce premiums and make insurance more affordable.

Additionally, some insurers may provide additional benefits for firefighters, such as enhanced roadside assistance or rental car reimbursement. It is important to inquire about these offers to maximize your savings and coverage. Furthermore, firefighters may also qualify for additional benefits such as accident forgiveness or coverage for equipment and gear stored in their vehicles.

These added benefits can provide peace of mind and financial protection in the event of an accident or theft. It is recommended that firefighters compare different insurance policies and providers to find the best coverage options and discounts available to them. By taking advantage of these discounts and benefits, firefighters can ensure they have the necessary protection while saving money on their car insurance premiums.

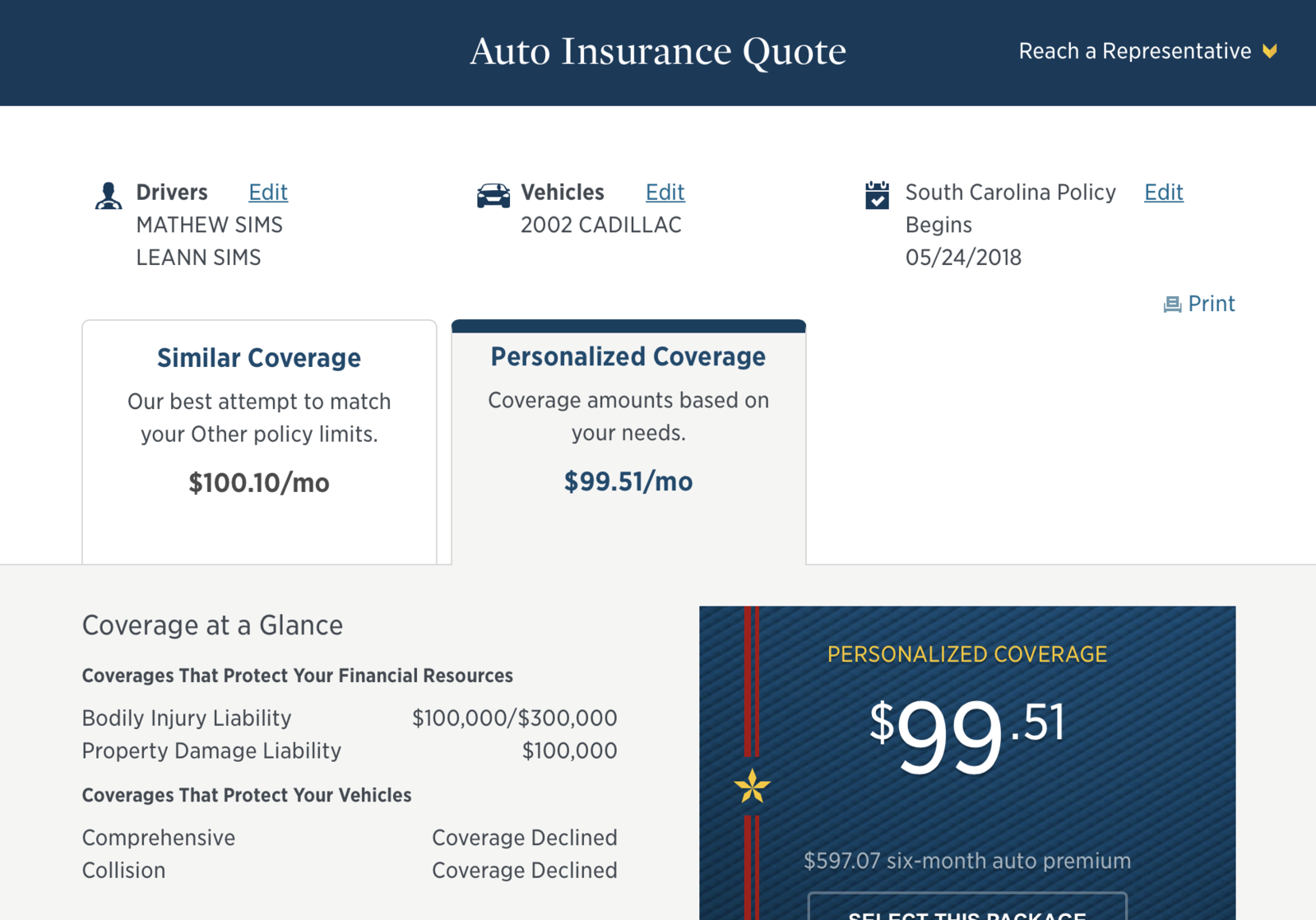

Obtaining Quotes: Finding the Most Affordable Car Insurance for Firefighters

Obtaining an online quote for car insurance is quick and easy, allowing you to compare rates and coverage options from top providers like USAA, State Farm, and Progressive.

- Visit the website of your preferred insurance provider.

- Navigate to the car insurance section.

- Enter your personal details, including your name, address, and contact information.

- Input information about your vehicle, such as make, model, and year.

- Select the coverage options you desire, such as liability, comprehensive, and uninsured motorist coverage.

- Submit the form to receive your personalized quote.

By following these simple steps, you can easily obtain an online quote for car insurance and make an informed decision about protecting your vehicle and yourself on the road.

Factors to Consider When Choosing Car Insurance for Firefighters

For firefighters, securing the right car insurance involves careful consideration of various factors. Here’s a concise guide to help firefighters navigate the process and find the best coverage options.

- Coverage Options: Evaluate liability, comprehensive, uninsured motorist and collision coverage.

- Cost Comparison: Compare premiums and deductibles across different insurers.

- Firefighter Discounts: Inquire about special discounts tailored for firefighters.

- Customer Service: Choose insurers known for efficient claims handling and responsive customer support.

- Add-On Coverages: Consider additional protections like coverage for firefighting equipment.

By prioritizing coverage options, cost comparison, firefighter discounts, customer service, and add-on coverages, firefighters can ensure they have comprehensive protection on and off duty. Take the time to explore different insurers and policies to find the best fit for your unique needs as a firefighter.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips for Saving Money on Car Insurance as a Firefighter

For firefighters seeking to balance comprehensive coverage with cost savings, there are several strategies to consider. Firstly, it’s essential to shop around and compare quotes from different insurers to find the most competitive rates and suitable coverage options.

Additionally, take advantage of any discounts available specifically for firefighters, and consider bundling policies for additional savings. While opting for higher deductibles can lower premiums, ensure you have sufficient savings to cover potential out-of-pocket costs.

Lastly, maintaining a clean driving record by practicing safe driving habits can help keep insurance rates affordable over time. By implementing these tips, firefighters can achieve the right balance between comprehensive coverage and cost-effective insurance solutions.

Read More: Best Car Insurance Discounts to Ask for

Understanding the Claims Process for Firefighters’ Car Insurance Policies

Understanding the claims process is crucial for firefighters when it comes to their car insurance policies. In case of an accident or damage to your vehicle, knowing how to file a claim, the necessary documentation, and the expected timeline for claim resolution is essential.

Familiarize yourself with the claims process outlined by your insurer and keep all relevant information readily available. Being well-prepared will help you navigate the process efficiently and get back on the road as soon as possible.

Read More:

- How to Document Damage for Car Insurance Claims

- How to File a Car Insurance Claim

- Why You Should Always Take Pictures After a Car Accident

Protecting Heroes: Tailored Firefighter Insurance Narratives

Explore real-life scenarios showcasing how insurers like USAA, State Farm, and Progressive cater to the unique needs of firefighters with personalized coverage solutions.

- Case Study #1 – Secure Coverage: Sarah, an active-duty firefighter, chose USAA for its military-focused benefits. With discounts of up to 15% and a monthly rate as low as $59, USAA provided Sarah with comprehensive coverage.

- Case Study #2 – Trusted Protection: John, a seasoned firefighter, opted for State Farm’s generous 17% discount for frontline workers, securing dependable coverage at a competitive rate.

- Case Study #3 – Personalized Solution: Lisa, a dedicated firefighter, found Progressive’s customizable plans matched her lifestyle needs perfectly, providing dynamic coverage.

These cases illustrate how insurers like USAA, State Farm, and Progressive tailor their offerings to meet the specific needs of firefighters, ensuring comprehensive protection at affordable rates.

Jeff Root Licensed Life Insurance Agent

With discounts, competitive rates, and tailored solutions, these companies ensure that heroes like Sarah, John, and Lisa receive the protection they deserve.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Firefighter’s Verdict

In conclusion, as a firefighter, it is crucial to choose the best car insurance coverage that meets your unique needs. Evaluating coverage options, comparing quotes, considering additional coverages, and understanding the claims process are all essential steps to finding the best car insurance policy.

By being proactive and well-informed, you can protect yourself and your vehicle while on duty or off, allowing you to focus on your important role of serving your community. Easily find inexpensive car insurance quotes by entering your ZIP code into our free comparison tool below.

Frequently Asked Questions

What factors should firefighters consider when looking for car insurance?

Firefighters should consider factors such as coverage options, discounts, customer service, and the financial stability of the insurance company when looking for car insurance.

Are there any specific car insurance companies that offer special discounts for firefighters?

Yes, some car insurance companies offer special discounts for firefighters. These discounts can vary, so it is recommended to compare quotes from different insurers. Start by entering your ZIP code below to find the best car insurance for firefighters.

What types of coverage should firefighters consider for their car insurance?

Firefighters should consider comprehensive coverage, collision coverage, liability coverage, uninsured/underinsured motorist coverage, and personal injury protection (PIP) when selecting car insurance.

Are there any additional benefits or coverage options that firefighters may need?

Firefighters may benefit from additional coverage options such as emergency roadside assistance, rental car reimbursement, and coverage for equipment or personal belongings used for firefighting purposes.

Can firefighters get discounts on car insurance based on their profession?

Yes, many car insurance companies offer discounts based on the profession of the insured. Firefighters may be eligible for special discounts due to their occupation.

What steps can firefighters take to lower their car insurance premiums?

Firefighters can lower their car insurance premiums by maintaining a good driving record, bundling their car insurance with other policies, taking advantage of available discounts, increasing deductibles, and considering usage-based insurance programs.

What is the best car insurance for first responders?

The best car insurance for first responders varies based on individual needs and preferences. However, there are companies offer specialized discounts and coverage tailored for first responders like Progressive first responder discount, State Farm first responder discount and Farmers insurance first responder discount.

How can I find cheap auto insurance for firefighters?

To find cheap auto insurance for firefighters, it’s essential to compare quotes from multiple insurance companies. Look for providers offering discounts and specialized coverage options for firefighters.

What types of coverage are included in firefighter insurance policies?

Firefighter insurance policies typically include coverage for vehicles, liability protection, and optional add-ons such as equipment coverage and professional liability insurance.

Do State Farm and Progressive offer any discounts specifically for first responders?

Yes, both State Farm and Progressive offer discounts such as the State Farm first responder discount and the Progressive first responder discount to provide savings for firefighters and other first responders.

Are there any discounts on firefighter auto insurance policies?

What is firefighter liability insurance, and why is it important?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.