Best Car Insurance for DoorDash Drivers in 2026 (Top 10 Companies Ranked)

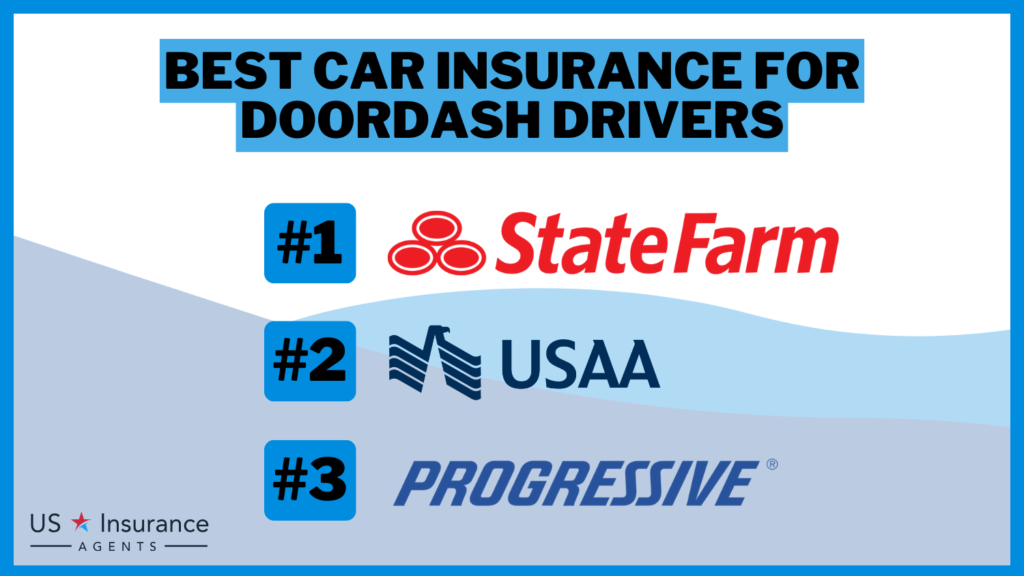

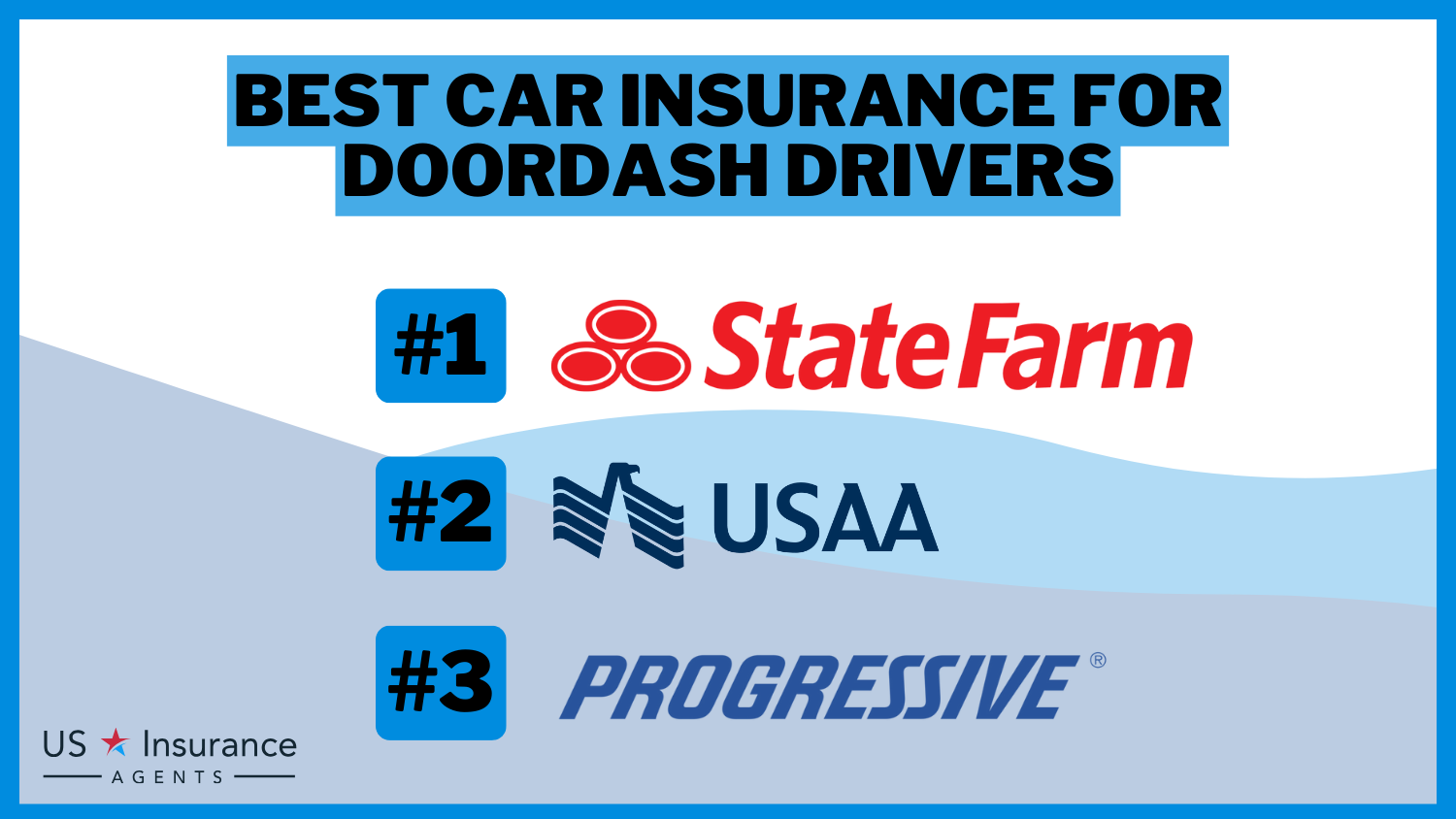

State Farm, USAA, and Progressive are offering the best car insurance for DoorDash drivers, with up to 15% discounts and rates starting at $33/month, ensuring tailored coverage. These companies excel for DoorDash drivers by blending affordable and comprehensive coverage, ensuring financial security on the road.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Tracey L. Wells

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Ty Stewart

Updated August 2025

18,157 reviews

18,157 reviewsCompany Facts

Full Coverage for DoorDash Drivers

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 6,590 reviews

6,590 reviewsCompany Facts

Full Coverage for DoorDash Drivers

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 13,285 reviews

13,285 reviewsCompany Facts

Full Coverage for DoorDash Drivers

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviews

Our Top 10 Company Picks: Best Car Insurance for DoorDash Drivers

| Company | Rank | Safe Driver Discount | Delivery Driver Discount | Best for | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | 10% | 15% | Policy Options | State Farm | |

| #2 | 12% | 17% | Military Savings | USAA | |

| #3 | 11% | 16% | Specialized Coverage | Progressive | |

| #4 | 10% | 15% | Safe-Driving Discounts | Allstate | |

| #5 | 9% | 14% | Vanishing Deductibles | Nationwide |

| #6 | 11% | 16% | Online Convenience | Farmers | |

| #7 | 9% | 14% | 24/7 Support | Liberty Mutual |

| #8 | 10% | 15% | Add-on Coverages | Travelers | |

| #9 | 8% | 13% | Organization Discount | AAA |

| #10 | 10% | 15% | Budgeting Tools | Esurance |

Your car insurance rates will likely increase after an at-fault accident, but you can find your cheapest coverage option by using our free quote comparison tool below today.

#1 – State Farm: Top Overall Pick

Pros

- Policy Options: State Farm offers a diverse range of policy options, providing DoorDash drivers the flexibility to customize coverage according to their specific needs.

- Safe Driver Discount: With a substantial up to 10% safe driver discount, State Farm rewards and incentivizes safe driving habits.

- Delivery Driver Discount: DoorDash drivers benefit from a significant up to 15% discount, acknowledging the unique risks associated with delivery services.

Cons

- Online Convenience: Compared to other insurers, State Farm may offer fewer online features, as highlighted in the State Farm insurance review & ratings.

- Delivery Driver Discount: While offering a 15% discount for delivery drivers, it might be lower compared to other providers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – USAA: Best for Those Who Serve

Pros

- Military Savings: With up to 17% off for military personnel, USAA is an excellent choice for DoorDash drivers with military connections, thanks to the USAA premier driver discount.

- Delivery Driver Discount: USAA appreciates the unique circumstances of DoorDash drivers by offering up to a 12% USAA DoorDash discount.

- Comprehensive Coverage: While focusing on military members, USAA provides comprehensive coverage options to meet various needs.

Cons

- Eligibility Criteria: USAA is exclusively for military members and their families, limiting accessibility for the general public.

- Coverage Options: Although extensive, USAA insurance review & ratings may indicate that it lacks the breadth of coverage options available from other insurers.

#3 – Progressive: Best for Unique Risks

Pros

- Specialized Coverage: Progressive insurance review & ratings highlights how Progressive provides DoorDash drivers with tailored coverage options, offering thorough protection for their specific risks.

- Delivery Driver Discount: With an impressive up to 16% discount for delivery drivers, Progressive acknowledges the increased exposure during delivery activities.

- Innovative Services: Progressive is known for its innovative services, utilizing technology to streamline processes and enhance customer experience.

Cons

- Potential Higher Premiums: Some DoorDash drivers might find Progressive DoorDash premiums to be slightly higher compared to those of competitors.

- Organization Discounts: Discounts related to organizational memberships may be less available with progressive insurance DoorDash drivers.

#4 – Allstate: Best for Safe Drivers

Pros

- Safe-Driving Discounts: Allstate offers substantial safe-driving discounts, with up to 15% savings for DoorDash drivers, encouraging responsible behavior on the road.

- Coverage Variety: DoorDash drivers have access to a wide range of coverage options, allowing them to tailor their insurance to suit individual needs.

- Customer Satisfaction: Allstate consistently ranks high in customer satisfaction, providing DoorDash drivers with confidence in their chosen insurer.

Cons

- Higher Premiums: Some motorists may perceive the premiums from Allstate as being somewhat elevated, according to Allstate insurance review & ratings.

- Delivery Driver Discount: The 15% delivery driver discount, while decent, may be lower compared to certain competitors.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Deductible Reduction

Pros

- Vanishing Deductibles: Nationwide’s vanishing deductibles program incentivizes DoorDash drivers for safe driving over time, gradually reducing deductibles.

- Safe Driver Discount: DoorDash drivers enjoy up to 9% safe driver discounts, promoting and rewarding responsible driving habits.

- Financial Stability: Nationwide’s strong financial stability ensures that DoorDash drivers can rely on the company’s long-term ability to fulfill its financial obligations.

Cons

- Limited Add-On Coverages: Compared to its competitors, Nationwide may offer a more limited selection of additional coverage options, as noted in the Nationwide insurance review & ratings.

- Delivery Driver Discount: The 14% delivery driver discount might be slightly lower compared to other providers.

#6 – Farmers: Best for Online Convenience

Pros

Cons

- Higher Premiums: Some DoorDash drivers may find that Farmers’ premiums are relatively higher compared to other providers.

- Limited Add-On Coverages: In comparison to some of its rivals, Farmers may offer a more limited selection of additional coverage choices, as highlighted in the Farmers insurance review & ratings.

#7 – Liberty Mutual: Best for 24/7 Support

Pros

- 24/7 Support: Liberty Mutual offers round-the-clock support, ensuring DoorDash drivers have assistance at any time, promoting peace of mind.

- Safe Driver Discount: With up to 14% safe driver discount, Liberty Mutual encourages and rewards responsible driving habits.

- Coverage Options: Liberty Mutual provides a variety of coverage options, allowing DoorDash drivers to tailor their policies to their specific needs.

Cons

- Higher Premiums: For some DoorDash drivers, the premiums from Liberty Mutual review & ratings may be considered higher.

- Online Convenience: The online convenience provided by Liberty Mutual might not be as extensive as some competitors.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Travelers: Best for Customizable Coverage

Pros

- Add-On Coverages: Travelers excels in offering extensive add-on coverages, allowing DoorDash drivers to customize their policies with additional protections.

- Safe Driver Discount: With up to 10% safe driver discount, Travelers promotes safe driving habits among DoorDash drivers.

- Reputation for Excellence: Travelers is recognized for its excellence in customer service and claims handling, providing DoorDash drivers with a reliable and trustworthy insurer.

Cons

- Organization Discount: Travelers may not offer specific discounts for organizational affiliations, limiting options for certain DoorDash drivers.

- Delivery Driver Discount: The delivery driver discount of 15% offered may be somewhat less than what other providers offer, as highlighted in the Travelers insurance review & ratings.

#9 – AAA: Best for Organizational Savings

Pros

- Organization Discount: AAA offers organization discounts, providing savings for DoorDash drivers affiliated with specific groups or associations.

- Roadside Assistance: AAA is renowned for its comprehensive roadside assistance, offering DoorDash drivers reliable support in case of emergencies.

- Established Reputation: AAA’s long-standing reputation in the insurance industry adds credibility and trust for DoorDash drivers seeking reliable coverage.

Cons

- Safe Driver Discount: With an 8% safe driver discount, AAA’s savings for safe driving might be lower compared to other providers.

- Coverage Options: Coverage options offered by AAA insurance may not be as comprehensive as those provided by its competitors. For further details, consult our AAA insurance review & ratings.

#10 – Esurance: Best for Financial Tools

Pros

Cons

- Limited Organization Discounts: Esurance discounts for specific affiliations with organizations may be lacking. Explore our Esurance insurance review & ratings for further insights.

- Online Convenience: The online convenience provided by Esurance might not be as extensive as some competitors.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding the Insurance Needs of Doordash Drivers

DoorDash Drivers need tailored liability coverage, with State Farm at $86, USAA at $59, and Progressive at $105, providing affordable DoorDash auto insurance. Allstate ($160/month), Farmers ($139/month), and Nationwide ($115/month) offer essential vehicle coverage for DoorDash car insurance needs.

Liberty Mutual and Travelers, with premiums of $174 and $99, address coverage gaps, potentially qualifying for DoorDash car insurance discounts and improving DoorDash driver savings.

Using a DoorDash car topper may access DoorDash driver discounts. Knowing the DoorDash claims phone number is vital for handling any DoorDash accident claim in Michigan or elsewhere, ensuring prompt support.

DoorDash Drivers Car Insurance Monthly Rates by Provider & Coverage Level

| Insurance Company | Minimum Coverage | Full Coverage |

|---|---|---|

| $32 | $86 |

| $61 | $160 | |

| $46 | $114 | |

| $44 | $139 | |

| $68 | $174 |

| $44 | $115 |

| $39 | $105 | |

| $33 | $86 | |

| $37 | $99 | |

| $22 | $59 |

This approach emphasizes DoorDash driver discounts and comprehensive DoorDash auto insurance, key to maximizing DoorDash driver savings.

Factors to Consider When Choosing Car Insurance for Doordash Drivers

Jeff Root Licensed Life Insurance Agent

Also, be aware of DoorDash roadside assistance and the age requirements for how old you gotta be for DoorDash to ensure full preparedness on the job.

The Importance of Adequate Coverage for Doordash Drivers

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Different Car Insurance Options for Doordash Drivers

DoorDash Driver Insurance Success Stories

Exploring how real DoorDash drivers navigated their insurance needs sheds light on the diverse strategies to secure the right coverage. These case studies highlight decisions made by drivers to balance affordability, comprehensive protection, and the specific challenges of gig economy driving.

- Case Study #1 – Liability Coverage: Maria needed affordable, effective liability coverage. She chose USAA at $59/month, meeting her coverage needs and providing financial protection.

- Case Study #2 – Comprehensive Protection: John wanted extensive vehicle coverage. At $160/month, Allstate offered him comprehensive protection, ensuring his vehicle was fully covered.

- Case Study #3 – Affordability and Coverage: Lisa sought a balance between cost and coverage. Farmers provided comprehensive vehicle coverage at $139/month, fitting her budget perfectly.

- Case Study #4 – Delivery Phases: Concerned about coverage gaps, Michael picked Travelers at $99/month. This protected him across all delivery phases, addressing gig economy nuances.

- Case Study #5 – Tailored Solutions: Sarah prioritized extensive protection. With Liberty Mutual at $174/month, she received coverage surpassing basic needs, filling potential gaps for complete peace of mind. See “Is Gap Insurance transferable from one vehicle to another?” for more details.

Frequently Asked Questions

What types of insurance coverage are crucial for DoorDash drivers?

DoorDash drivers should prioritize liability coverage to protect against potential financial liabilities in accidents. Additionally, comprehensive vehicle coverage, including collision and comprehensive options, is essential for safeguarding their vehicles during food delivery activities. For more information, consult our guide titled “Liability Insurance: A Complete Guide.”

How does the average monthly car insurance rate vary among top providers for DoorDash drivers?

The average monthly car insurance rates for DoorDash drivers vary among top providers. State Farm offers a competitive rate of $86, USAA stands at $59, Progressive at $105, and other providers like Allstate, Nationwide, and Farmers offer different rates. The choice depends on individual preferences and coverage needs.

Is DoorDash’s insurance coverage sufficient for drivers, or should they consider additional coverage?

DoorDash provides limited car insurance coverage, primarily during active deliveries. However, DoorDash drivers should consider additional coverage, such as liability, collision, and comprehensive options, to ensure comprehensive protection during various phases of their work, including waiting for requests or transporting food.

How can DoorDash drivers balance affordability and coverage when selecting insurance?

DoorDash drivers can strike a balance by comparing quotes from different providers. USAA, for instance, offers competitive rates at $59, while Farmers provides a balanced option at $139. It’s crucial to consider both affordability and coverage to make an informed decision based on individual budget constraints. Uncover affordable auto insurance rates from the top providers by entering your ZIP code below.

Why is it important for DoorDash drivers to consider insurance options that address specific phases of the delivery process?

DoorDash drivers interact with different phases of the delivery process, and standard personal auto insurance may not cover all situations. Providers like Travelers and Liberty Mutual offer solutions with monthly rates of $99 and $174, respectively, addressing potential gaps in coverage during various delivery phases. For more details, check out our “Best Auto Insurance Discounts for Delivery Driver” guide.

How do I find the best insurance for DoorDash delivery activities?

To find the best insurance for DoorDash, compare quotes from different insurance providers that offer coverage for gig economy workers, focusing on policies that cover delivery activities.

Do I need insurance for DoorDash, or does the company cover me?

Yes, you need your own auto insurance policy as a DoorDash driver. While DoorDash does provide some insurance, it only covers certain situations and may not be sufficient on its own.

Does DoorDash ask for car insurance during the application process?

Yes, DoorDash asks for proof of car insurance when you sign up to become a driver, as having valid auto insurance is a requirement.

Does DoorDash ask for insurance details from its drivers?

Yes, DoorDash requires drivers to submit insurance details to ensure they meet the platform’s requirements for valid coverage. For more information, read our “Will having an expired drivers license affect your car insurance?“

Does DoorDash have roadside assistance for its drivers?

As of my last update, DoorDash does not offer roadside assistance directly to its drivers, but drivers can obtain this service through their personal auto insurance or a third-party provider.

Does DoorDash insure their drivers for accidents that occur while delivering?

Does DoorDash offer insurance coverage for its drivers?

Does DoorDash offer roadside assistance if I have a breakdown during a delivery?

Does DoorDash provide insurance all the time, or only during deliveries?

Does DoorDash require insurance for drivers to sign up and start delivering?

What does DoorDash insurance cover, and are there any limitations?

What exactly is auto insurance for DoorDash drivers, and what’s the reason for its necessity?

How does the pricing of car insurance DoorDash compare to traditional personal auto insurance?

Does State Farm cover DoorDash delivery activities under their personal auto insurance policies?

What exactly is DoorDash insurance, and how does it operate for drivers?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.