Best Auto Insurance Discounts for Postmates Drivers

Explore exclusive insurance discounts for Postmates drivers. Top companies offer tailored coverage and savings, securing comprehensive protection in the gig economy.

Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about life insurance when he got his first policy for his own family. He has been featured as a life insurance expert speaker at agent conventions and in top publications. As an independent licensed life insurance agent, he has helped clients nationwide to secure affordable coverage while making the...

Ty Stewart

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated September 2024

- Targeted Coverage for Postmates: Tailored discounts and coverage addressing the unique needs of Postmates drivers.

- Financial Protection Beyond the Norm: Ensuring comprehensive coverage for accidents, property damage, and liability.

- Roadside Assistance Benefits: Inclusion of valuable services like towing, fuel delivery, and lockout assistance.

- Factors in Choosing the Right Coverage: Discussion of crucial elements such as policy limits, liability, comprehensive and collision coverage, and deductible considerations.

- Money-Saving Tips: Insights on how Postmates drivers can maximize savings without compromising quality coverage, including bundling policies, maintaining a clean driving record, leveraging usage-based insurance, choosing an optimal deductible, and comparing quotes from various insurers.

- Key Insurers Offering Tailored Discounts: Highlighting top insurance companies providing specific benefits and discounts for Postmates drivers, emphasizing the importance of policy features and additional perks beyond discounts.

Understanding The Importance Of Auto Insurance For Postmates Drivers

Auto insurance is not just a legal requirement but also provides financial protection for Postmates drivers. Accidents can happen at any time, regardless of how skilled a driver is, and the expenses resulting from such incidents can be overwhelming. With the right auto insurance policy, Postmates drivers can have peace of mind knowing that their medical expenses and vehicle repairs will be covered in the event of an accident.

Furthermore, auto insurance helps protect drivers from liabilities if they cause damage to another person’s property or injure someone else while on the job. It acts as a safety net for Postmates drivers, reducing their financial burden and allowing them to focus on their work.

In addition to providing financial protection and peace of mind, auto insurance for Postmates drivers also offers other benefits. One such benefit is roadside assistance coverage, which can be extremely helpful in case of unexpected breakdowns or emergencies on the road. With roadside assistance, drivers can receive services such as towing, fuel delivery, and lockout assistance, ensuring that they can quickly get back on track and continue their deliveries.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors To Consider When Choosing Auto Insurance As A Postmates Driver

When it comes to selecting auto insurance as a Postmates driver, several factors should be taken into consideration. First and foremost, the coverage and limits of the policy should be adequate to protect both the driver and the vehicle. Liability coverage is a must, as it safeguards against damages caused to other individuals or property in case of an accident.

In addition to liability coverage, Postmates drivers should also consider the inclusion of comprehensive and collision coverage. Comprehensive coverage protects against non-accident-related damages, such as theft or natural disasters, while collision coverage covers the cost of repairs resulting from accidents with another vehicle or object.

Another crucial factor to consider is the deductible amount. A higher deductible can lead to lower premiums, but it’s essential to choose a deductible that Postmates drivers can comfortably afford in the event of a claim.

Furthermore, Postmates drivers should also take into account the reputation and financial stability of the insurance company. It is important to choose an insurer that has a good track record of handling claims efficiently and providing excellent customer service. Researching customer reviews and ratings can help in determining the reliability of an insurance company.

Additionally, Postmates drivers should consider any additional benefits or discounts offered by the insurance company. Some insurers may provide perks such as roadside assistance, rental car coverage, or discounts for safe driving records. These additional benefits can add value to the insurance policy and make it more cost-effective in the long run.

Exploring The Different Types Of Auto Insurance Coverage For Postmates Drivers

Auto insurance coverage can vary depending on the insurer and the policy. As a Postmates driver, it’s important to understand the different types of coverage available to ensure adequate protection. Below are some common types of coverage options for Postmates drivers:

– Bodily Injury Liability: This coverage pays for medical expenses and legal fees if you injure someone while operating your vehicle.

– Property Damage Liability: If you are at fault in an accident and cause damage to someone else’s property, this coverage will pay for the repairs or replacement.

– Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who either doesn’t have insurance or doesn’t have enough coverage to pay for damages.

– Comprehensive Coverage: This coverage protects against non-accident-related damages, such as theft, vandalism, or damage from natural disasters.

– Collision Coverage: This coverage pays for repairs to your vehicle if you are involved in an accident with another vehicle or object.

– Medical Payments Coverage: This coverage helps pay for medical expenses resulting from an accident, regardless of fault.

– Personal Injury Protection: This coverage pays for medical expenses, lost wages, and other related costs for you and your passengers, regardless of fault.

– Rental Car Coverage: This coverage provides reimbursement for the cost of a rental car while your vehicle is being repaired after an accident.

How To Save Money On Auto Insurance As A Postmates Driver

Auto insurance premiums can often be substantial, especially for gig economy workers like Postmates drivers. However, there are several ways to save money on auto insurance without compromising on coverage.

One of the most effective ways to save money is by bundling your auto insurance policy with other insurance policies, such as homeowner’s insurance or renter’s insurance, with the same insurer. Many insurance companies offer discounts for customers who bundle multiple policies.

Additionally, maintaining a good driving record is crucial. Postmates drivers with a clean driving history, free from accidents or traffic violations, are often eligible for discounts on their premiums. Safe driving habits contribute not only to lower insurance costs but also to overall road safety.

Another way to save money on auto insurance is by taking advantage of telematics and usage-based insurance programs offered by some insurers. These programs use technology to monitor driving habits, such as speed, braking, and mileage. Postmates drivers who demonstrate safe driving behavior can receive significant discounts.

Moreover, considering the deductible amount is essential. Choosing a higher deductible can lower your premiums, but it’s crucial to have enough savings set aside to cover the deductible in case of an accident.

Lastly, regularly comparing quotes from different insurance companies can help Postmates drivers find the best rates. Insurance premiums can vary significantly, so it’s worth shopping around to ensure you’re getting the most competitive price for the coverage you need.

Furthermore, some insurance companies offer discounts for Postmates drivers who complete defensive driving courses. These courses provide valuable knowledge and skills that can help drivers avoid accidents and drive more safely. By completing a defensive driving course, Postmates drivers may be eligible for additional discounts on their auto insurance premiums.

Additionally, maintaining a low mileage on your vehicle can also help save money on auto insurance. Postmates drivers who limit their driving to shorter distances or use alternative transportation methods for personal trips can often qualify for lower premiums. Some insurance companies offer pay-per-mile insurance policies that charge drivers based on the number of miles driven, which can be a cost-effective option for Postmates drivers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

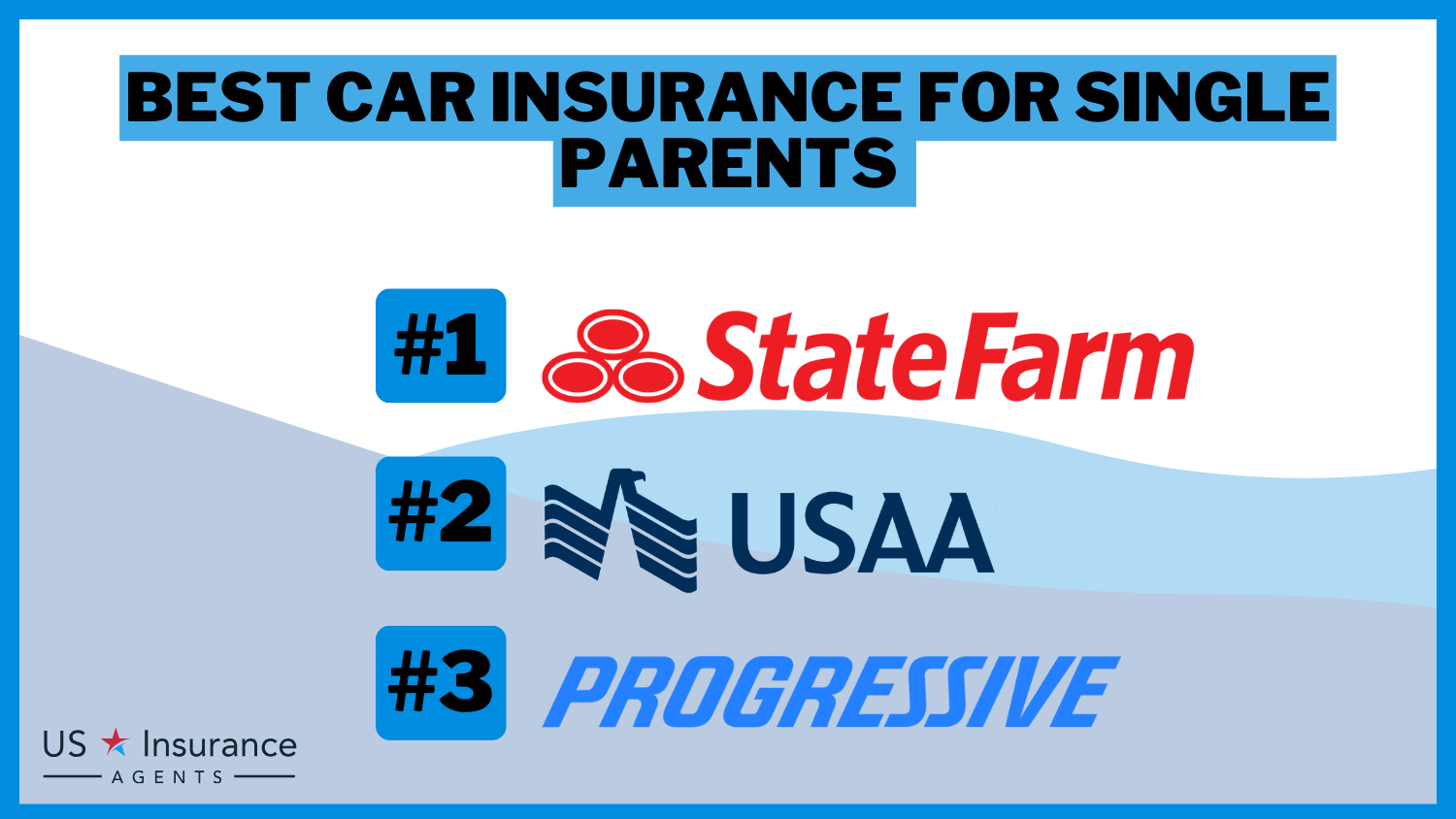

Top Auto Insurance Companies That Offer Discounts For Postmates Drivers

Several insurance companies provide specific discounts and benefits for gig economy workers like Postmates drivers. These companies understand the unique needs and risks associated with working in the on-demand delivery industry.

One prominent insurer offering discounts for Postmates drivers is State Farm. They provide various coverage options and discounts tailored specifically to gig economy workers. State Farm offers a significant discount for those who use their vehicles primarily for business purposes, which can be advantageous for Postmates drivers.

Another insurer worth considering is Geico. Geico offers discounts and coverage specifically designed for rideshare drivers, which can apply to Postmates drivers as well. Their rideshare insurance can provide additional protection when the driver is logged into the app and waiting for a job.

Progressive is also known for offering specialized auto insurance programs for gig economy workers. They provide competitive rates and discounts for Postmates drivers, ensuring that they have the coverage they need at an affordable price.

Other insurance companies to explore for Postmates drivers include Allstate, Liberty Mutual, and Farmers Insurance, which also offer various discounts and benefits specifically for gig economy workers.

When choosing auto insurance for Postmates drivers, it’s important to consider factors such as coverage limits and deductibles. Some insurance companies may offer higher coverage limits and lower deductibles specifically for gig economy workers, providing added peace of mind.

In addition to discounts and specialized coverage, many insurance companies also offer convenient online tools and mobile apps for managing policies and filing claims. This can be particularly beneficial for Postmates drivers who may need to access their insurance information on the go.

Frequently Asked Questions

What are some car insurance discounts available for Postmates drivers?

Some car insurance discounts available for Postmates drivers include low mileage discounts, safe driving discounts, multi-vehicle discounts, and bundling discounts.

How can Postmates drivers qualify for low mileage discounts?

Postmates drivers can qualify for low mileage discounts by driving fewer miles than the average driver. Insurance companies may require drivers to provide proof of their mileage, such as through mileage tracking apps or vehicle maintenance records.

What is a safe driving discount and how can Postmates drivers qualify for it?

A safe driving discount is a discount offered to drivers who have a clean driving record without any accidents or traffic violations. Postmates drivers can qualify for this discount by maintaining a safe driving history and avoiding accidents or violations.

Can Postmates drivers get multi-vehicle discounts?

Yes, Postmates drivers can qualify for multi-vehicle discounts if they have more than one vehicle insured under the same insurance policy. This discount is typically offered when insuring multiple vehicles, such as a personal vehicle and a Postmates delivery vehicle.

What are bundling discounts and how can Postmates drivers benefit from them?

Bundling discounts are discounts provided when a driver combines multiple insurance policies, such as car insurance and renter’s insurance, with the same insurance company. Postmates drivers can benefit from bundling discounts by obtaining multiple insurance policies from the same insurer, which can result in overall cost savings.

Are there any specific insurance companies that offer discounts for Postmates drivers?

While specific insurance companies may

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.