Amica vs. Chubb Homeowners Insurance in 2026 (Head-to-Head Review)

Amica and Chubb homeowners insurance offer unique benefits, starting at $167 and $221 monthly. Amica’s platinum choice home coverage adds expanded liability protection, while Chubb provides extended replacement costs for high-value homes. Explore Amica vs. Chubb homeowners insurance review now.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. Through her years working in th...

Melanie Musson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Justin Wright

Updated August 2025

768 reviews

768 reviewsCompany Facts

$200k Policy

A.M. Best Rating

Complaint Level

Pros & Cons

768 reviews

768 reviews 82 reviews

82 reviewsCompany Facts

$200k Policy

A.M. Best Rating

Complaint Level

Pros & Cons

82 reviews

82 reviewsAmica vs. Chubb homeowners insurance highlights two industry leaders offering distinct advantages.

Amica is noticeable for its varied policy discounts and dividend policies. This makes it perfect for families desiring affordability with extra savings added on top.

Chubb shines in providing extended replacement cost coverage and custom strategies for homes of high value or luxury properties.

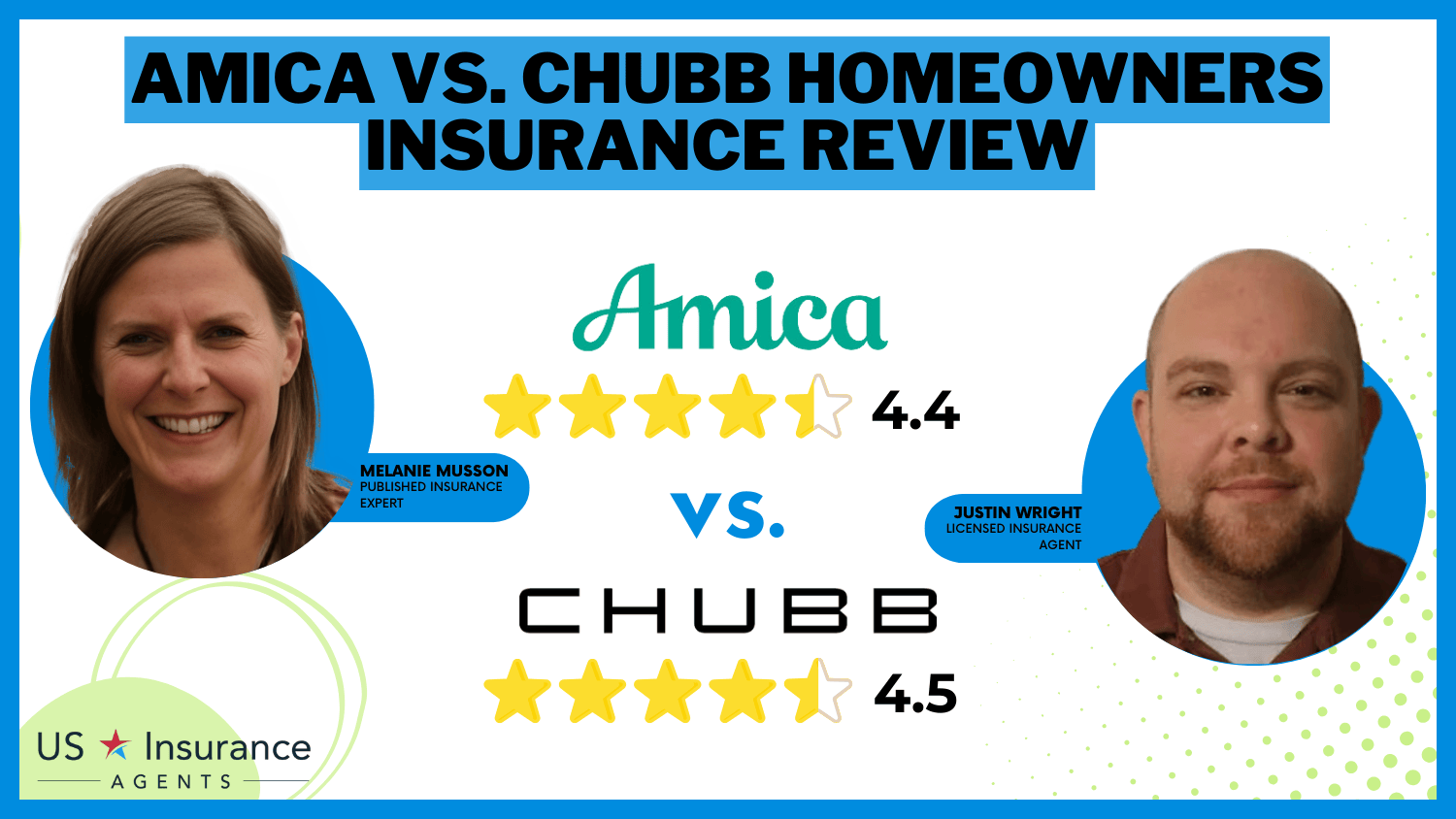

Amica vs. Chubb Homeowners Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 4.4 | 4.5 |

| Business Reviews | 4.5 | 5.0 |

| Claim Processing | 4.8 | 5.0 |

| Company Reputation | 4.5 | 5.0 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.3 | 4.5 |

| Customer Satisfaction | 4.2 | 4.2 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 3.9 | 4.1 |

| Plan Personalization | 4.5 | 5.0 |

| Policy Options | 4.1 | 3.8 |

| Savings Potential | 4.2 | 4.4 |

| Amica Review | Chubb Review |

The article investigates their advantages, contrasting program options, and customer-centered benefits. Find out which service supplier aligns with your house protection requirements. Find the best Chubb vs. Amica insurance rates with our free quote tool.

- Amica vs. Chubb rates start at $100 and $105 per month

- Amica offers dividend plans; Chubb covers rebuild costs

- Compare Amica discounts and Chubb’s luxury home programs

Understanding Amica vs. Chubb Homeowners Insurance Rates and Costs

This table compares monthly rates for homeowners insurance from Amica and Chubb. Amica gives lower prices to young and older women, beginning at $695 for those 16 years old and $136 for those 60.

Amica vs. Chubb Homeowners Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| Age: 16 Female | $695 | $250 |

| Age: 16 Male | $735 | $260 |

| Age: 30 Female | $168 | $180 |

| Age: 30 Male | $176 | $190 |

| Age: 45 Female | $153 | $170 |

| Age: 45 Male | $151 | $175 |

| Age: 60 Female | $136 | $160 |

| Age: 60 Male | $140 | $165 |

Chubb charges more for younger drivers but evens out costs for older ones. Males aged 60 pay $165 with Chubb, while the cost is only $140 with Amica.

The information shows pricing tendencies specific to gender. Younger men usually encounter more expenses, but this gap closes as they reach 30. By studying these rates, homeowners can determine which company matches their group and financial plan.

Amica vs. Chubb Home Insurance Monthly Rates by Policy

| Insurance Company | $200k Policy | $300k Policy | $500k Policy |

|---|---|---|---|

| $412 | $551 | $834 | |

| $167 | $222 | $333 | |

| $221 | $295 | $493 | |

| $201 | $268 | $401 | |

| $180 | $240 | $360 | |

| $184 | $245 | $368 |

| $189 | $252 | $378 |

| $201 | $268 | $401 | |

| $161 | $215 | $323 | |

| $168 | $224 | $336 |

This table focuses on the monthly home insurance costs for Amica, Chubb, and other competitive companies. It is divided according to policy values of $200k, $300k, and $500k.

Amica offers the lowest prices for all coverage levels, with a premium as low as $167 for a policy of $200k. This is much less than Chubb’s price of $221 for identical coverage. Even though Chubb’s rates are higher, they still remain competitive compared to other companies such as Allstate and Farmers. Hence, they are a strong choice if someone wants more varied options in their insurance policies.

Read more: Tips for How to Get Cheap Home Insurance

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing Chubb vs. Amica Insurance Reviews and Consumer Reports

This table compares ratings and reviews of Amica and Chubb’s business, providing ideas about customer happiness, monetary solidity, and grievance proportions.

Insurance Business Ratings & Consumer Reviews: Amica vs. Chubb

| Agency | ||

|---|---|---|

| Score: 870 / 1,000 Above Avg. Satisfaction | Score: 903 / 1,000 Above Avg. Satisfaction |

|

| Score: A++ Excellent Business Practices | Score: A+ Great Business Practices |

|

| Score: 82/100 Positive Customer Feedback | Score: 85/100 Excellent Customer Feedback |

|

| Score: 0.60 Fewer Complaints Than Avg. | Score: 0.73 Fewer Complaints Than Avg. |

|

| Score: A+ Superior Financial Strength | Score: A++ Superior Financial Strength |

Chubb is very good at making customers happy, having a J.D. Power score of 903 that beats Amica’s 870, showing a better experience for customers. Both companies have high financial strength, with A.M. Best rating them as A+ for Amica and A++ for Chubb.

Consumer Reports rates Chubb higher with a score of 85 out of 100 compared to Amica’s 82, indicating stronger customer feedback. Nonetheless, Amica has fewer complaints, having a ratio of 0.60 in contrast to Chubb’s 0.73, which makes it more attractive for customers who prioritize reliability.

The illustration above compares Amica and Chubb’s business ratings and customer feedback. It gives us some information about the satisfaction level of customers, their financial power or stability, plus the complaint ratio. The numbers show how both companies do on important industry standards that are generally trusted.

Comment

byu/Ok-Tonight-1251 from discussion

inInsurance

A Reddit post by JenOkie, an insurance veteran of 25+ years, praises Amica for leading customer satisfaction and retention surveys. Despite their excellence, affordability remains challenging for some, highlighting their premium focus.

Coverage Comparison of Amica vs. Chubb Homeowners Insurance

Insurance for homeowners protects your property and personal items against risks like fire, theft, and natural calamities. It also covers liability if someone gets injured in your place of living. Amica affords the basic coverages that are needed, like housing protection, personal belongings coverage, and insurance for liability issues, with special extras such as identity fraud expense coverage and help with home repair works.

Chubb, however, is a company that specializes in home insurance for high-value homes. It provides extended replacement cost coverage and options to get a cash settlement.

It also offers wide-ranging protection, including luxury items such as jewelry and fine art. In contrast, Amica offers affordable policies that are customizable for different types of homeowners, but Chubb’s primary focus is on superior coverage targeted at individuals with substantial assets who desire broad-based protection.

Learn more by checking out our guide: Best Homeowners Insurance

Exploring Amica vs. Chubb Home Insurance Discounts

This table shows discount chances given by Amica and Chubb, which offers a look at possible savings for people who own homes. It points out how different programs address specific customer actions and property characteristics. Find out how to get free insurance quotes online to save money on your next policy.

Amica vs. Chubb Home Insurance Discounts by Savings Potential

| Discount Name | ||

|---|---|---|

| Bundling | 25% | 15% |

| Claims-Free | 20% | 10% |

| Good Credit | 15% | 10% |

| Loyalty | 10% | 10% |

| Early Signing | 10% | 10% |

| New Home | 10% | 10% |

| Paid-in-Full | 10% | 5% |

| Protective Devices | 10% | 5% |

Amica offers bundling discounts of 25%, which is much better than Chubb’s offer of 15%. This makes it very appealing for customers who are combining policies. In addition, customers without claims also receive a good deal, as Amica gives them a 20% discount, whereas Chubb only gives them a 10% discount. This benefits homeowners who take precautionary measures.

Both providers give the same discounts of 10% for loyalty, early signing, and new homes. But again, Amica is better because it provides a discount of 10% for protective devices and pays in full options, while Chubb only offers 5%. This comparison shows that Amica gives more priority to providing significant savings to its customers.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding Homeowners Insurance

Homeowners insurance is a type of property insurance that protects your house and the stuff in it if it gets damaged or lost. This policy works as a monetary safety net against varied dangers such as fire, stealing, damaging property on purpose, and natural disasters. Find out why the best insurance companies are trusted for comprehensive protection.

Protecting your house is very important. Homeowners’ insurance plays a big part in this safeguarding. It gives you peace because it offers monetary safety for unforeseen situations. If there is damage to the property from fire or if items are taken through theft, homeowners insurance acts as an essential help for getting back on track and reconstruction of losses.

Moreover, if you look at reviews of Amica term life insurance and Chubb health insurance, they can give essential understandings about what they offer and the happiness of their customers.

Introduction to Amica Homeowners Insurance

Amica homeowners insurance, which was started in 1907, is one of the most experienced and respected insurers in the country. Having more than a hundred years of know-how, Amica is famous for its excellent customer service and all-inclusive insurance solutions that are designed to meet different needs homeowners may have.

Whether your home is a small cottage or a large estate, policies from Amica can be customized according to your specific needs. This dedication to personalization is often complimented in client evaluations, even on BBB, where property owners emphasize the company’s focus on custom coverage options. Selecting Amica means guaranteeing security and calm for your most precious asset, your house.

Overview of Amica Homeowners Insurance Policies

Amica offers powerful protection for home ownership. It covers a range of risks, like damage to the building, theft, and fire incidents concerning personal belongings, and even legal problems. It also supports living costs if your house cannot be lived in anymore due to an incident. Discover key insights with this Amica vs. Hippo homeowners insurance review overview.

What makes Amica different is its emphasis on particular dangers, such as water damage and identity theft, in addition to flexible deductibles and optional protections. Amica’s adjustable policies assure every house owner that they require extra safety for their precious items or higher liability limits.

Introduction to Chubb Homeowners Insurance

Chubb insurance started in 1882 and is a worldwide leader in the field of insurance. It is well-known for its top-grade coverage and customized service. With more than a hundred years of experience in this industry, Chubb has built up a name as an honest provider. They offer insurance for homes, automobiles, and prized assets. Reviews often bring attention to their emphasis on high-value home insurance and superb support services.

Laura Walker Former Licensed Agent

Chubb they are dedicated to providing high-quality coverage and claims support. They customize their policies according to the unique needs of each homeowner. It does not matter if you have a small home or a luxurious property, Chubb’s knowledge makes sure there is complete protection that fulfills the different requirements of homeowners.

Overview of Chubb Homeowners Insurance Policies

Chubb’s homeowner’s insurance strongly safeguards your home and personal items in Florida. It goes past simple coverage. They concentrate on homes with high value, and their policies give more elevated coverage limits. There are also cash settlement choices and coverage to replace costs, ensuring that all of your expensive assets are guarded.

We hope you and your family are safe if you were in the path of the California wildfires. If you have a home in the area, you can enter your address into our imagery tool at https://t.co/dobE62q5hx to see aerial photos of your property. pic.twitter.com/80sI6L1TNc

— Amica Insurance (@Amica) January 13, 2025

Chubb gives you the same service. They also include liability coverage and protection for extra living costs to cover temporary accommodation if your house becomes unlivable.

One unique feature is their extended replacement cost cover. This will pay rebuilding costs that go over policy limits, providing financial reassurance after a disaster. To compare, Chubb and Amica homeowners insurance reviews offer helpful information on what they provide.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Amica Homeowners Insurance Pros and Cons

Pros:

- Saver Maximizer: Bundling together home, car, and life insurance policies can reduce costs. This makes Amica a good selection for homeowners who keep an eye on their expenses.

- Receiving Dividend Payment: If your policy is eligible, you will receive dividend payments every year, which can pile up over time and give you a financial advantage in the extended run.

- Customer Trust: High ratings of approval and positive comments show that people trust Amica’s customer service, satisfaction with the claims process, and financial stability, making sure they give dependable protection to homeowners.

Cons:

- Cost Concern: Amica’s premium rates are often more expensive than those of its economic competitors, which might be less appealing to homeowners who are searching for the cheapest monthly costs.

- Limited Luxury Choices: Unlike top-quality insurers, Amica offers a smaller selection of specialized coverage options for luxury residences, uncommon collectibles, or one-of-a-kind valuables, which narrows down the choices available to homeowners with high net worth.

Read more: Amica Homeowners Insurance Review

Chubb Homeowners Insurance Pros and Cons

Pros:

- Expert of Luxurious Houses: Gives special premium for homes with high worth, giving specific protection for art pieces, jewelry, and unique collectibles, which are often not included in standard policies.

- Total Security: The extended replacement cost insurance assures homeowners can completely reconstruct their properties, even if it costs more than the policy limit because of inflation or lack of materials.

- Flexible Claim Choices: Options to get cash settlements let homeowners receive full payment instead of rebuilding the home after a total loss, offering them greater monetary liberty.

Cons:

- High Cost: Chubb’s insurance policies are more expensive than everyday insurers. This is because they provide broad coverage and cover properties of high value.

- Not Ideal for Saving Money: There are few opportunities to get discounts, which makes it unattractive for people searching for an economical home policy. It cannot compete accurately with other providers, such as Amica.

The Clear Winner in Amica vs. Chubb Homeowners Insurance

When choosing the best homeowners insurance provider between Amica and Chubb, it is essential to consider different factors carefully. Even though both companies are respected because of their good reputation, great customer service, and a broad range of coverage options, a profound look reveals particular differences that could influence your decision.

When we do a detailed check of Amica and Chubb homeowners insurance, we see that Amica company is the better choice when we think about everything. Compare multiple providers instantly with insurance quotes online tools.

From deepfakes to phishing, consumers must be alert to a growing range of scams associated with digital payments.

Find out how fraud is impacting consumer purchase behavior in our new report: https://t.co/MmuUv8tT3f pic.twitter.com/rT9n8EptHZ

— Chubb (@Chubb) October 14, 2024

Even though Chubb performs well in serving the requirements of individuals with high wealth through specialized coverage, Amica’s wider attractiveness, cost-effective strategy, and excellent customer service make it the superior overall option for homeowners insurance.

Amica is a top choice when comparing coverage, cost, and the general customer experience. They offer homeowners the chance to protect their investments while staying within budget. This judgment remains correct even when we look at competitors such as Chubb and Son Insurance, highlighting that Amica has a high rating in this sector. Compare Amica vs. Chubb homeowners insurance reviews by entering your ZIP code.

Frequently Asked Questions

What are the main differences between AAA vs. Amica homeowners insurance?

Amica offers multi-policy discounts and dividend options, starting at $100 monthly. AAA focuses on membership perks and bundling discounts, making it ideal for frequent travelers. Learn how AAA membership reviews highlight exclusive perks and benefits.

How does State Farm vs. Amica compare for homeowners insurance?

State Farm offers broad availability and customizable policies, while Amica stands out with superior customer satisfaction and dividend options.

How does Amica vs. Allied homeowners insurance compare?

Amica provides customizable policies and dividend payouts. Allied focuses on bundling discounts and affordability, catering to budget-conscious homeowners.

How does USAA vs. Amica compare for homeowners insurance?

USAA specializes in military families with tailored benefits, while Amica provides customizable coverage and dividends for broader customer needs. Get personalized Chubb vs. Amica insurance quotes by entering your ZIP code now.

Which is better, Allstate vs. Amica, for homeowners insurance?

Allstate provides extensive add-ons like identity theft and flood coverage, while Amica focuses on customer satisfaction and dividends.

How does Safeco vs. Amica compare in terms of pricing and coverage?

Safeco insurance offers competitive rates with bundling discounts, while Amica provides dividend options and starts at $100 monthly for tailored coverage.

What sets Farmers vs. Amica homeowners insurance apart?

Farmers emphasizes customizable coverage and unique endorsements, while Amica offers dividend policies and multi-policy discounts.

How does 21st Century vs. Amica homeowners insurance stack up?

Amica provides better customer satisfaction and dividends, starting at $100 monthly, while 21st Century focuses on competitive rates and basic coverage options.

What are the key differences between Amica vs. Geico homeowners insurance?

Amica stands out with dividend payouts and customizable policies, starting at $100 monthly, while Geico offers lower premiums and focuses on bundling discounts.

How does MetLife vs. Amica homeowners insurance compare?

MetLife insurance provides a variety of riders and global coverage options, while Amica offers dividends and personalized service, with monthly rates starting at $100.

How does Nationwide vs. Amica compare for homeowners insurance?

What are the differences between Safe Auto vs. Amica homeowners insurance?

How does Chubb vs. AIG compare for high-value home insurance?

What do Amica insurance reviews BBB highlight about the company?

What do Chubb insurance reviews say about its services?

What does Amica insurance in Maine offer homeowners?

How can you identify the best and worst homeowners insurance companies?

What does the Amica insurance review in Florida highlight about the company?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.