Allstate vs. Progressive Homeowners Insurance in 2026 (Side-by-Side Review)

Check out Allstate vs. Progressive homeowners insurance to see which fits your budget. Allstate, at $61/month, shines with solid liability and property coverage. Starting at $39/month, Progressive keeps things flexible with customizable options. Choose the coverage that fits your needs today.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Alexandra Arcand is an outreach administrator and insurance expert located in North Central Ohio. She has a passion for writing, investing, and education. As an insurance content writer for over three years, Alexandra has first-hand experience in business finance, economics, and real estate. She leads an outreach writing team that specializes in travel, real estate, healthcare, law, finance, an...

Alexandra Arcand

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated December 2024

11,640 reviews

11,640 reviewsCompany Facts

Min. Coverage

A.M. Best

Complaint Level

Pros & Cons

11,640 reviews

11,640 reviews 13,285 reviews

13,285 reviewsCompany Facts

Min. Coverage

A.M. Best Rating

Complaint Level

Pros & Cons

13,285 reviews

13,285 reviewsWhen it comes to Allstate vs. Progressive homeowners insurance, both offer strong options to help protect your home.

Allstate’s Claim RateGuard keeps your premium steady after a claim, and their Homeowners Plus package adds coverage for things like appliances and water backup. Progressive stands out with its Name Your Price tool and accessible bundling discounts, making it simple to build a policy that works for you.

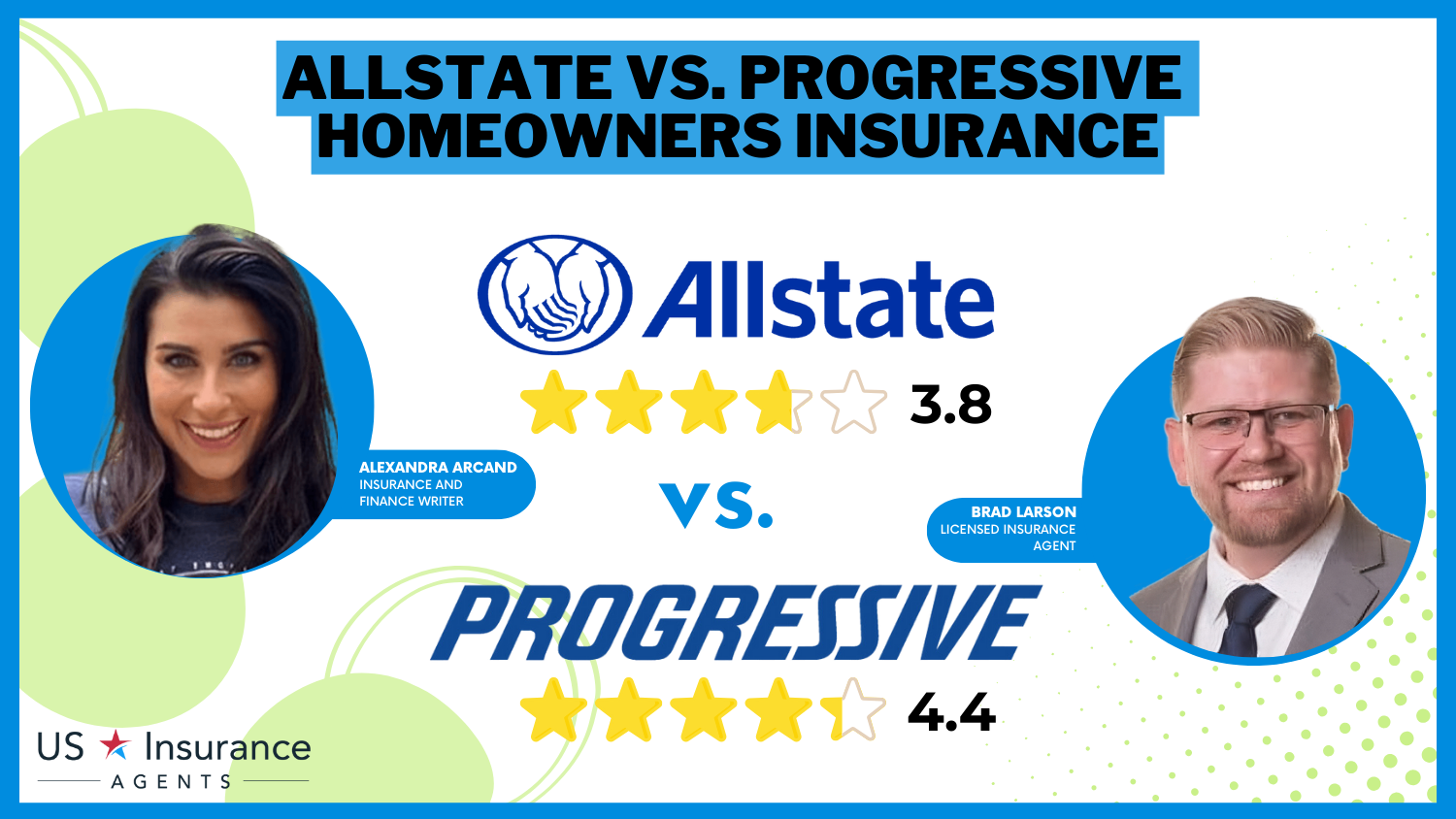

Allstate vs. Progressive Homeowners Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 3.8 | 4.4 |

| Business Reviews | 4.0 | 4.0 |

| Claim Processing | 3.0 | 3.5 |

| Company Reputation | 4.5 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 3.4 | 4.2 |

| Customer Satisfaction | 4.0 | 4.1 |

| Digital Experience | 4.5 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 3.2 | 4.3 |

| Plan Personalization | 4.5 | 4.5 |

| Policy Options | 3.4 | 5.0 |

| Savings Potential | 3.8 | 4.5 |

| Allstate Review | Progressive Review |

Both companies offer unique perks, so finding the best homeowners insurance depends on your needs. Take a closer look to see which one meets your needs.

Make sure your home is protected by entering your ZIP code into our home insurance comparison tool today.

- Allstate and Progressive homeowners insurance starts at $39/month

- Allstate offers Claim RateGuard for stable premiums after claims

- Progressive’s Name Your Price tool customizes policies to your budget

Homeowners Insurance: Allstate vs. Progressive Rates

When comparing Allstate vs. Progressive homeowners insurance, the monthly rates differ based on age and gender. The table below highlights how these factors influence what you’ll pay for full coverage.

Allstate vs. Progressive Full Coverage Homeowners Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| Age: 16 Female | $608 | $801 |

| Age: 16 Male | $638 | $814 |

| Age: 30 Female | $168 | $131 |

| Age: 30 Male | $176 | $136 |

| Age: 45 Female | $162 | $112 |

| Age: 45 Male | $160 | $105 |

| Age: 60 Female | $150 | $92 |

| Age: 60 Male | $154 | $95 |

For 16-year-olds, Progressive is much pricier, with female rates at $801 and males at $814, compared to Allstate’s $608 and $638. At 30, Progressive starts to pull ahead with lower rates—$131 for females and $136 for males, while Allstate’s rates are $168 and $176, making it easier to pay Progressive insurance premiums at this stage.

By age 45, Progressive takes the lead with $112 for females and $105 for males, beating Allstate’s $162 and $160. For 60-year-olds, Progressive continues its streak, with rates of $92 and $95, significantly less than Allstate’s $150 and $154. With these lower rates, it becomes easier to pay Progressive insurance premiums, making it a better deal as you age.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Allstate vs. Progressive: Finding the Best Fit

Choosing the correct homeowners insurance is a very important decision that requires careful consideration of coverage choices, prices, and customer satisfaction. When comparing big insurance companies like Allstate and Progressive, this detailed review helps you find the best option for your house and budget.

After looking closely at what Allstate and Progressive give for homeowners insurance, it is clear that Allstate is a better option. Here are the reasons why:

- Brief History and Reputation: Allstate, founded in 1931, has built a firm name for reliability and excellent customer service. The company’s extensive experience in insurance shows its promise to provide trustworthy coverage to people.

- Coverage Options: Allstate and Progressive offer many options similar to those in a typical homeowners insurance policy covers. These include protection for the home itself, coverage for personal belongings, liability protection if someone gets hurt on your property, and coverage for extra living costs if you can’t live in your home because it’s damaged.

- Pricing Transparency and Discounts: Pricing depends on where the house is, what it looks like, and the types of coverage. Allstate gives personalized pricing estimates that are special for each customer. They look at local details, such as how big the home is and what materials were used in building it, so that homeowners get fair prices made just for them.

- Customer Satisfaction: While customer satisfaction can be different for everyone, Allstate is known for good service. They have been around a long time, and people say many nice things about them in reviews and feedback. This shows that they really care about their clients and try hard to keep them happy.

Allstate and Progressive have good homeowners insurance, but Allstate is better because it offers robust coverage options, transparent pricing, and cares about its customers. If you want reliable service with personalized plans and a company that focuses on making the customer happy for many years, then Allstate is the best choice for homeowners.

Understanding Homeowners Insurance

Homeowners insurance is a type of property insurance that provides financial protection in the event of damage to your home or its contents, as well as liability for injuries or damages that occur on your property. It is crucial for homeowners to have insurance coverage to safeguard their investment and mitigate potential risks.

When it comes to homeowners insurance, there are various types of policies available to suit different needs. These policies typically cover damage caused by perils, such as fire, theft, vandalism, windstorms, and certain types of water damage. They may offer extra coverage for valuables and living expenses during a covered event.

For example, let’s say you have a homeowners insurance policy that includes coverage for personal valuables. If your engagement ring gets stolen during a break-in, your insurance policy can help reimburse you for the value of the ring. This additional coverage can provide peace of mind and financial support during challenging times.

Furthermore, homeowners insurance also extends liability insurance. This means that if someone gets injured on your property, your insurance policy can help cover the medical expenses and legal fees associated with the incident. This coverage is especially important in today’s litigious society, where lawsuits can arise from unexpected accidents.

Homeowners Insurance and Mortgage Requirements

Homeowners insurance is essential because it offers financial security when unexpected events occur. Your home is likely one of the most significant investments you’ll ever make, and having insurance coverage ensures that you are protected from potential financial losses.

Imagine a scenario where a severe storm damages your roof, causing leaks and extensive water damage to your home’s interior. Without insurance, you would be responsible for covering the costs of repairs and restoration out of pocket. However, with homeowners insurance, you can file a home insurance claim to receive the necessary funds to restore your home to its pre-damaged condition.

Jeff Root Licensed Insurance Agent

In addition to property damage, homeowners insurance can also provide coverage for personal liability. Let’s say a guest slips and falls on your icy driveway, resulting in injuries. Your insurance policy can help cover the medical expenses and legal fees if the injured party decides to sue you for negligence. This type of coverage can save you from significant financial burden and protect your assets.

Many mortgage lenders require homeowners insurance to protect the property and reduce risk. It not only secures your investment but also provides financial protection and peace of mind. Choosing the right policy ensures long-term stability and safeguards your future.

Brief History of Allstate Homeowners Insurance

Let’s begin with Allstate, a company that has been a household name in the insurance industry since its establishment in 1931. Over the years, Allstate has built a strong reputation for providing reliable coverage and exceptional customer service. With a wide range of insurance products, including homeowners insurance, Allstate has become a go-to choice for many homeowners.

When it comes to homeowners insurance, Allstate understands the importance of protecting not just your home but also your personal property and personal liability. They offer different coverage levels to cater to the specific needs of homeowners, ensuring that you have the peace of mind you deserve, even when it’s time to pay your Allstate insurance premium, knowing you’re covered for unexpected events like natural disasters or theft.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brief History of Progressive Homeowners Insurance

Now, let’s turn our attention to Progressive, a company that was founded in 1937 and is widely recognized for its innovative approaches to insurance. While Progressive is predominantly associated with auto insurance, they also offer comprehensive homeowners insurance that shouldn’t be overlooked.

Progressive homeowners insurance provides protection for your dwelling, personal belongings, and liability in the event of property damage or injury. What sets Progressive apart is their emphasis on flexibility and customization. They offer flexible options and customized policies to fit each homeowner’s needs.

So whether you choose Allstate or Progressive for your homeowners insurance needs, rest assured that you will be in good hands. Both companies have a rich history, a commitment to customer satisfaction, and a range of coverage options to meet your specific requirements. Unlock details in our article titled,”Does Progressive homeowners insurance go up after a claim?”

Coverage Options

When it comes to protecting your home and personal belongings, Allstate and Progressive offer a wide range of coverage options to ensure that you have the peace of mind you deserve. Let’s take a closer look at what each of these insurance providers has to offer.

Coverage Options Offered by Allstate

Allstate homeowners insurance policies go above and beyond to provide you with comprehensive coverage. They understand that your home is more than just a building; it’s your sanctuary. With Allstate, you can rest easy knowing that your dwelling is protected.

One of the coverage options offered by Allstate is dwelling protection. This means that not only is your home’s structure covered, but also any detached structures on your property, such as garages or sheds. So, whether it’s your main residence or a separate structure, Allstate has you covered.

Allstate covers personal belongings, liability for injuries, and living expenses if a covered event forces you to leave your home.

Coverage Options Offered by Progressive

Progressive’s homeowners insurance policies are designed to give you comprehensive coverage, ensuring that your home and personal assets are protected from unexpected events.

Melanie Musson Published Insurance Expert

Similar to Allstate, Progressive offers dwelling protection. This means that not only is your home’s structure covered, but also any other structures on your property, such as a detached garage or shed. With Progressive, you can have peace of mind knowing that all aspects of your property are protected.

Progressive covers personal belongings, liability for injuries, and living expenses during home repairs. Both Allstate and Progressive offer protection for your home, valuables, and financial security—choose the one that best suits your needs. Learn more in our article called, “How To File a Claim With Progressive Homeowners Insurance.”

Pricing Comparison

Allstate and Progressive homeowners insurance keep things affordable with competitive pricing and discounts. Allstate personalizes rates based on your home’s size, materials, and location, while Progressive makes it easy to customize your policy and see costs upfront. Both give you great options to protect your home without breaking the bank.

Allstate Homeowners Insurance Pricing

The cost of Allstate homeowners insurance policies can vary depending on factors such as your home’s location, size, construction materials, and the coverage options you select. Allstate offers competitive rates, and they provide discounts for bundling multiple insurance policies, installing security systems or fire alarms, having a claims-free history, and more.

Allstate understands that every homeowner’s insurance needs are unique, and they strive to provide personalized pricing estimates that cater to your specific circumstances. Whether you live in a bustling city or a peaceful suburban neighborhood, Allstate has coverage options tailored to your location. They take into account the local weather patterns, crime rates, and other factors that could affect your insurance premium.

When it comes to the size and construction materials of your home, Allstate recognizes that these factors can influence the cost of your insurance. Larger homes need more coverage, and certain materials are more prone to disaster damage. Allstate’s pricing considers these variables to ensure you have adequate protection, and if disaster strikes, you can file a claim with Allstate homeowners insurance to get the support you need.

Allstate offers discounts for bundling policies, installing security systems, and maintaining a claims-free history. Contact an Allstate agent for a personalized quote tailored to your needs and budget.

Progressive Homeowners Insurance Pricing

Progressive homeowners insurance premiums are determined by various factors such as the location and age of your home, the amount of coverage you select, and your claims history. Progressive offers pricing transparency, allowing you to easily customize your policy and view the associated costs.

When it comes to the location of your home, Progressive takes into account the specific risks associated with your area. Whether you live in a region prone to hurricanes, wildfires, or other natural disasters, Progressive understands the importance of tailoring your coverage to address these unique challenges. By considering these factors, Progressive ensures that you have the appropriate level of protection.

The age of your home can also impact your insurance premium. Older homes may have outdated electrical systems or plumbing, increasing the risk of fire or water damage. Progressive’s pricing reflects these considerations, ensuring that you have coverage that adequately addresses the potential risks associated with older properties.

Progressive’s platform lets you customize policies and view costs in real time, ensuring transparency. Discounts like bundling, security systems, and claims-free history can lower premiums. Contact a Progressive agent for a personalized quote tailored to your needs and budget.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Discounts and Savings

Allstate and Progressive make it simple to save money on homeowners insurance using different discounts. Allstate gives you savings if you combine policies, put in security systems, or have no claims for a while. On the other hand, Progressive has special benefits like their home lock discount which is unique. Both help you get great coverage without spending a fortune.

Discounts Available With Allstate

Allstate offers a range of discounts to help homeowners save on their insurance premiums. These include home and car insurance discounts through bundling policies, protective device discounts for security systems or fire alarms, and claims-free discounts for those without recent claims.

Additional discounts may be available based on factors such as being a new homeowner, having a newly constructed home, being over the age of 55, or completing home upgrades to enhance safety and security. Discussing these options with an Allstate agent will help you determine the available discounts for your specific circumstances.

Discounts Available With Progressive

Progressive homeowners insurance includes several discounts to help policyholders save money. These discounts may include bundling home and auto policies, installing safety devices like smoke detectors or security systems, being claims-free for a set period, having a new home, or being a loyal customer.

Progressive also offers unique discounts such as the home lock discount, which rewards homeowners for having strong and secure door locks. To find out which discounts apply to your situation and to obtain the best savings, it is advisable to contact a Progressive representative directly.

In conclusion, both Allstate and Progressive offer comprehensive homeowners insurance policies with various coverage options, pricing structures, and discounts. Understanding the importance of homeowners insurance and weighing the benefits offered by each company is crucial when selecting a policy.

By reviewing this comprehensive comparison, you are now equipped to make an informed decision that best suits your specific needs and preferences. Remember to reach out to Allstate and Progressive representatives to obtain accurate pricing quotes tailored to your circumstances.

Financial Strength Comparison

When comparing Allstate vs. Progressive homeowners insurance, customer feedback and business ratings clearly show their strengths. The table shows how each company measures trust and service quality.

Insurance Business Ratings & Consumer Reviews: Allstate vs. Progressive

| Agency | ||

|---|---|---|

| Score: 832 / 1,000 Avg. Satisfaction | Score: 832 / 1,000 Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 74/100 Good Customer Satisfaction | Score: 72/100 Avg. Customer Feedback |

|

| Score: 1.45 More Complaints Than Avg. | Score: 1.11 Avg. Complaints |

|

| Score: A+ Superior Financial Strength | Score: A+ Superior Financial Strength |

Both companies earn top marks for financial strength, with an A+ rating from A.M. Best. Allstate leads in customer satisfaction with a J.D. Power score of 832, while Progressive shows average satisfaction. Consumer Reports rates Allstate slightly higher at 74/100, compared to Progressive’s 72/100.

Progressive wins in complaint ratios, reporting 1.11 compared to Allstate’s higher 1.45. These scores show Allstate’s edge in satisfaction but highlight Progressive’s strength in fewer complaints.

Allstate and Progressive homeowners insurance are big names in the industry, but their market shares show just how differently they compete. This breakdown looks at how they compare and where other providers fit in.

The market share numbers make it clear that Progressive leads, but Allstate is a strong contender. Knowing where they stand can help you choose the right company with confidence.

A Reddit user, WestAppointment2484, talked about having a good experience after changing from Progressive to Allstate. They liked Allstate’s customer service and mentioned that their ride-sharing app is more forgiving.

After beginning their policy in February, they saved 14% using the app. Their feedback highlights Allstate’s ability to save money and its simplicity.

Learn more: “Do auto and renters insurance claims affect my home insurance rates?”

Allstate Homeowners Insurance

Pros

- Complete Coverage: Allstate has full coverage, which includes protection for your home, personal belongings insurance, liability security, and extra living costs.

- Long Time Reputation:Since 1931, Allstate has been known for good coverage and very nice customer service. Explore ways to save in our Allstate insurance review and ratings.

- Discount Options: Allstate offers discounts such as bundling, security systems savings, and claims-free savings, which help homeowners reduce their insurance premiums.

Cons

- Price Change: The cost of Allstate homeowners insurance can vary depending on where you live, the size of your house, and the coverage options you choose.

- Higher Starting Rates: Premiums for some demographics, such as younger homeowners, can be higher than competitors.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Progressive Homeowners Insurance

Pros

- Flexible Coverage Options:Progressive values flexibility and personalization. It allows homeowners to modify coverage choices according to their specific needs.

- Transparent Pricing: Progressive gives simple pricing, allowing customers to create policies and see prices immediately. Learn more in our review Progressive insurance.

- Innovative Way:Progressive is famous for its creative thinking in insurance. It also applies this thinking to homeowners insurance, looking at particular dangers and problems that people might face.

Cons

- Less Known for Home Insurance: Progressive is a massive name in car insurance, but it might be less well-known for home insurance.

- Potential for Policy Customization Complexity: The emphasis on flexibility may result in a more complex policy customization process, requiring homeowners to navigate various options.

Finding the Right Fit for Your Needs

Both Allstate and Progressive provide reasonable solutions; however, they meet different demands. Allstate’s Claim RateGuard and its fame for pleased customers make it an excellent choice for dependable coverage.

On the other hand, Progressive’s Name Your Price tool and lower costs for older homeowners suit those who are attentive to budget details well. With both backed by A+ financial ratings, it comes down to what matters most to you—steady premiums, flexible policies, or saving more based on your situation.

To determine how much homeowners insurance costs in your area, enter your ZIP code into our free comparison tool below to find the most affordable rates.

Frequently Asked Questions

What are the key differences between Allstate vs. Progressive homeowners insurance?

Allstate offers Claim RateGuard and strong liability coverage, while Progressive provides customizable policies and lower starting rates.

How does Progressive vs. Allstate compare for homeowners insurance?

Progressive is the best at price and policy flexibility, while Allstate is notable for its comprehensive coverage and high client satisfaction rate.

How does Allstate vs. Progressive car insurance differ?

Allstate focuses on robust coverage options. Progressive typically offers lower rates and innovative tools like the Progressive Snapshot review program, which helps drivers earn discounts based on their driving habits.

What do Progressive home insurance ratings reflect?

Progressive home insurance ratings highlight financial strength with an A+ from A.M. Best and competitive policy customization options.

What does a Progressive home insurance rating indicate?

Progressive home insurance ratings reflect solid financial strength and affordability but mixed customer service reviews.

Does Progressive home insurance offer a security system discount?

Yes, Progressive home insurance offers discounts for installing security systems and other savings for bundling policies and being claims-free. They also provide home fire safety guides and educational resources to enhance safety.

How does Progressive vs. Allstate home insurance stack up?

Progressive is ideal for flexible budgets, while Allstate provides steady premiums and additional living expense coverage.

What do Progressive home insurance reviews highlight?

Progressive home insurance reviews often praise affordability and customization but note room for improvement in claims service.

Is Allstate better than Progressive for homeowners insurance?

Allstate is better for steady premiums and robust coverage. At the same time, Progressive is better for flexible and budget-friendly options, which can vary based on how an insurance company determines my premium.

What does an Allstate home insurance review highlight?

An Allstate home insurance review highlights substantial liability insurance, Claim RateGuard, and additional living expense coverage.

Is Allstate cheaper than Progressive for homeowners insurance?

Are Allstate and Progressive the same company?

Is Progressive home insurance good?

What do reviews of Allstate homeowners insurance highlight?

Who is Progressive’s biggest competitor?

Is Progressive better than Allstate for homeowners insurance?

How good is Allstate at paying claims?

Why is Allstate more expensive?

What is Allstate’s ranking in the US?

Why is Progressive so expensive?

Who is Allstate’s most significant competitor?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.