Gun Liability Insurance: A Complete Guide (2026)

Safeguard your peace of mind with comprehensive gun liability insurance. Don't leave your protection to chance – choose reliable and tailored insurance solutions that prioritize your security. Discover the importance of proper coverage and gain expert insights to protect yourself, your assets, and your loved ones.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Karen Condor is an insurance and finance writer who has degrees in both journalism and communications. She began her career as a reporter covering local and state affairs. Her extensive experience includes management positions in newspapers, magazines, newsletters, and online marketing content. She has utilized her researching, writing, and communications talents in the areas of human resources...

Karen Condor

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated January 2025

Are you considering the importance of gun liability insurance? It’s a critical question to ask yourself.

In this comprehensive article, we will address the significance of protecting yourself and your assets through proper coverage.

We’ll discuss the potential risks and liabilities involved, the benefits of comprehensive insurance, and expert insights on finding the right solutions for your needs. Don’t compromise your peace of mind – take control of your security today.

Enter your ZIP code below and compare rates from the best insurance providers in your area. It’s time to make an informed decision and ensure you have the necessary protection when it matters most.

- In the U.S., 500 people die from unintentional firearm injuries each year

- Most accidental or unintentional gun injuries and deaths can be prevented by storing firearms securely

- Gun liability insurance is available to cover damage associated with negligence and unintended shootings

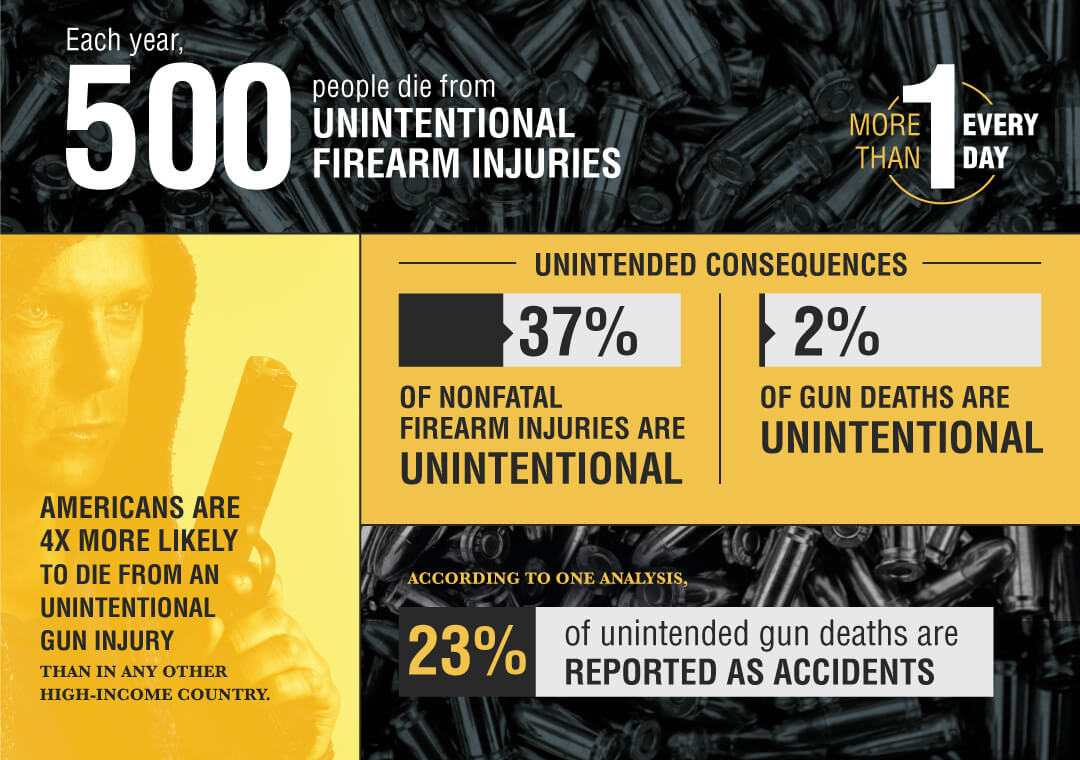

While legal gun ownership is a right, it still comes with a genuine degree of risk and responsibility. Let’s break down firearm injuries and gun deaths by the numbers. Each year, 500 people die from unintentional firearm injuries. That’s more than a person a day. Americans are four times more likely to die from an accidental gun injury than in any other high-income country.

While protecting yourself and your loved ones is a great idea, there are many unintended consequences when it comes to owning a firearm. According to one analysis, 23% of unintended gun deaths are reported as accidents. Additionally, 37% of nonfatal firearm injuries are unintentional, and 2% of gun deaths are unintentional.

Gun liability insurance offers gun owners important protection against various losses. Do you need gun insurance? Read on to learn more.

Comprehensive Coverage for Gun Owners

When considering the protection of your firearms, understanding whether your current policies provide adequate coverage is essential. Many people ask, does renters insurance cover guns? Typically, renters insurance and homeowners insurance include some coverage for firearms, but it often falls short in specific scenarios, such as intentional harm or acts of self-defense.

To fill these gaps, firearm liability insurance and personal firearms insurance offer specialized protection. These policies cover a range of incidents, from accidental discharges to negligent storage, ensuring that you, as a responsible gun owner, are protected.

Determining the right insurance coverage involves considering various options and costs. The gun insurance cost can vary based on the type and extent of coverage you need. For instance, self defense liability insurance specifically covers costs related to defending oneself legally in the event of using a firearm in self-defense.

For gun stores, gun store insurance is essential to cover potential liabilities arising from customer interactions and transactions. Additionally, firearm insurance and insurance for gun owners policies can be tailored to include theft, loss, and accidents. It’s crucial to compare offerings from gun insurance companies to find the best gun insurance for your needs.

Understanding are firearms covered under homeowners insurance and adding supplemental coverage if necessary will ensure comprehensive protection for your firearms and peace of mind for you.

Unintended Shootings are Preventable

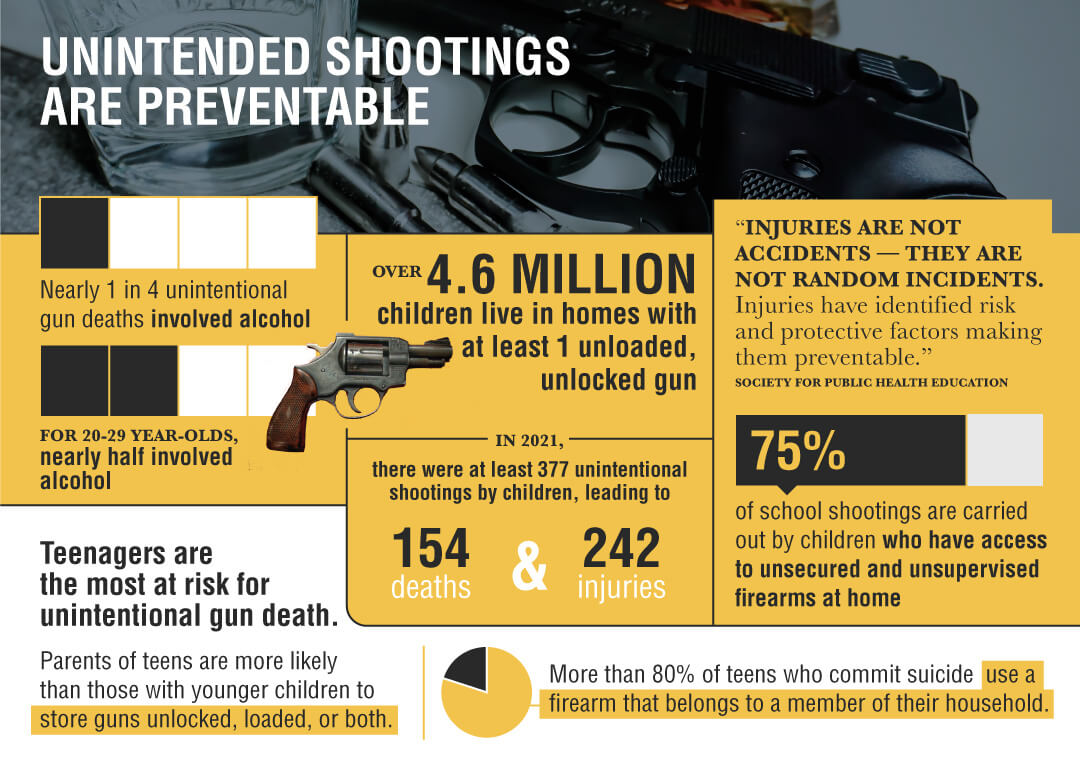

The good news is that unintended shootings are often preventable. Many shootings have extenuating circumstances. For example, nearly one in four unintentional gun deaths involved alcohol. For those aged 20-29, that number goes up to half of all cases.

Teenagers are the most at-risk age group for unintentional gun deaths. More than 80% of teen deaths by suicide were committed using a firearm belonging to a household member. Many of these deaths can be attributed to parents storing their guns unlocked, loaded, or both.

In 2021, at least 377 unintentional shootings by children led to 154 deaths and 242 injuries. In addition, more than 4.6 million children are living in homes that have, at the very least, one unloaded and unlocked gun. With this being the case, it is easy to see how 75% of school shootings are carried out by children with easy access to household firearms.

Does insurance make guns safer?

While insurance alone may not make guns safer, it does provide a domino effect to fewer deaths. Most unintentional shootings leading to injuries or deaths caused by firearms could have been prevented if owners properly stored their guns. Insurance companies reward good practices by providing lower premiums, and this incentive alone can cause more owners to adjust their gun safety.

Something as simple as not using a gun safe can triple the risk of death by suicide as it puts a barrier between thought and action. Another 31% of accidental deaths could be prevented by installing a child-proof safety trigger lock and a loaded chamber indicator. Additionally taking a gun safety course will help owners understand how to store their firearms properly.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Does homeowners insurance cover guns?

If you have standard homeowners insurance coverage, you may already have some coverage over firearms. Renters insurance also may include similar coverage for guns. However, even with coverage, there are several situations in which insurance will not cover the cost associated with damage.

Homeowners or renters insurance typically doesn’t cover intentional harm, crimes committed using a stolen firearm that was not reported, and any cost associated with acts of self-defense. Intentional harm includes property damage caused by firing a gun with intent.

So what is covered? Theft or loss of firearms is covered as guns are a high-value target for thieves. In fact, in 2020, more than $135 million worth of firearms were reported stolen.

Accidental shootings where the victim is not a member of the policyholder’s household are typically covered. Liability is also covered, though some instances are explicitly excluded.

Add-On Gun Insurance Coverage Options

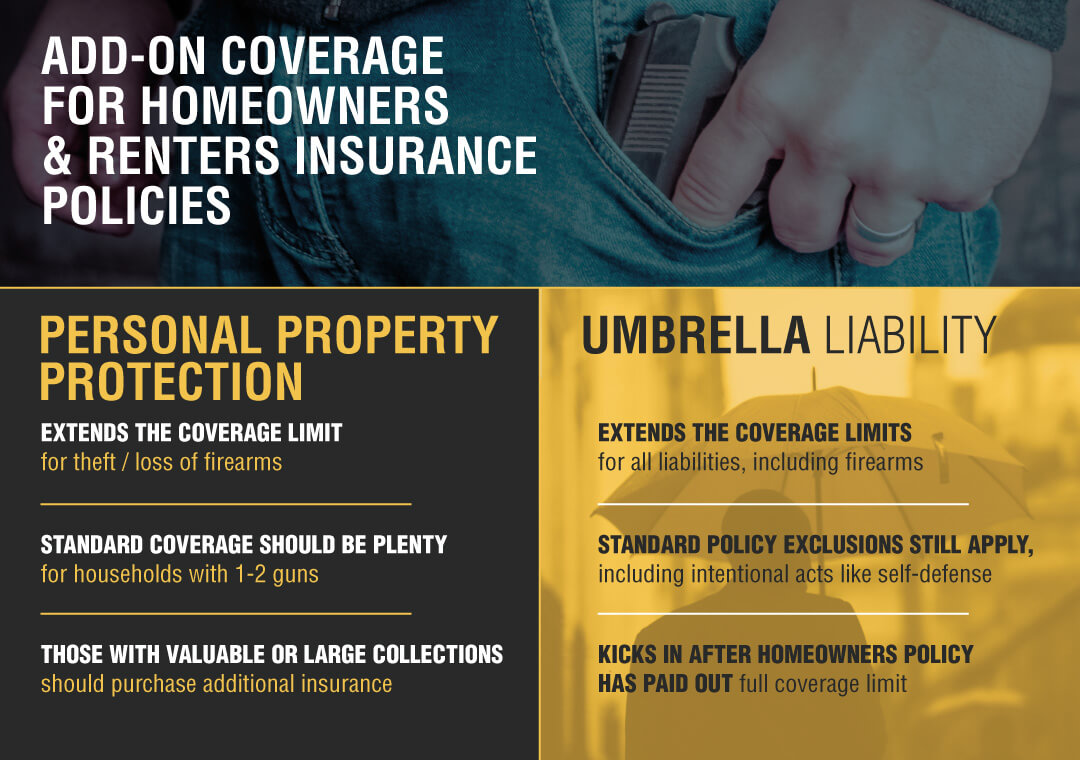

Besides your basic homeowners or renters insurance coverage, you can add additional coverage options to these policies. For example, additional coverage for your firearms offers greater protection.

A personal property protection policy will extend the coverage limit for any theft or loss of your firearms. While the standard homeowners or renters coverage is most likely sufficient for a household with one to two guns, those with more valuables or larger collections will benefit from this additional coverage.

Another good option is umbrella liability, which extends coverage limits for all liability, including firearms. Umbrella liability kicks in after your homeowner’s policy has paid out even after its full coverage limit. However, be aware that standard policy exclusions will still apply, such as intentional acts, including self-defense.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

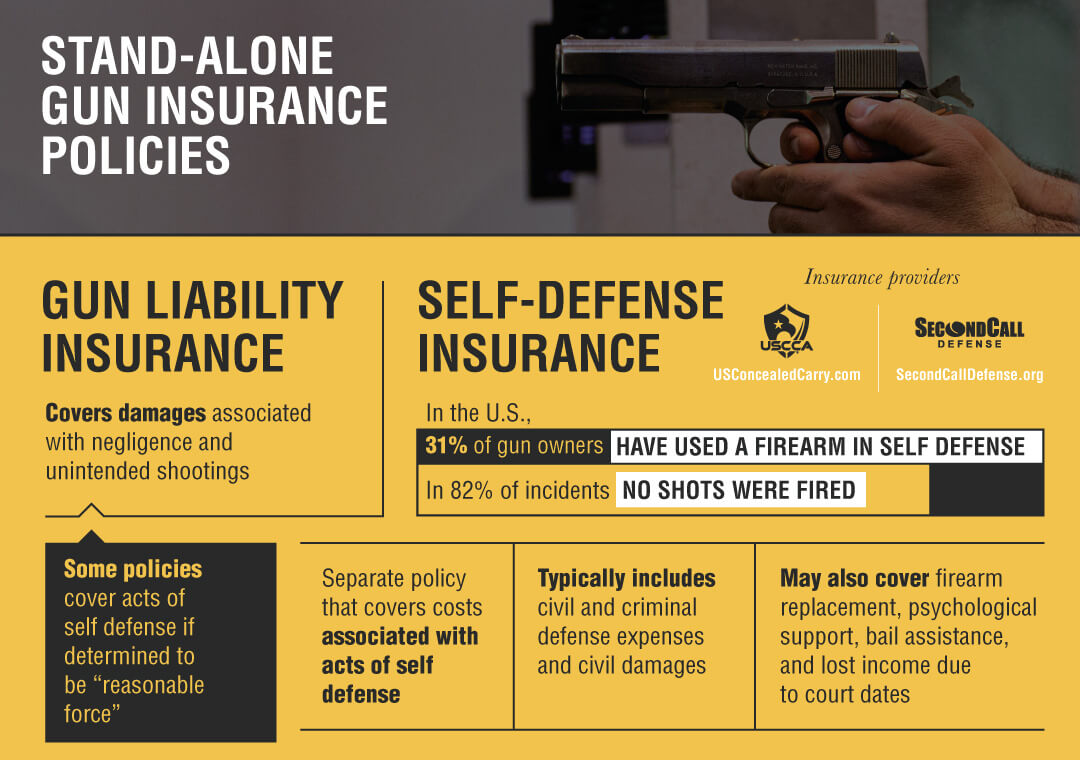

Separate Gun Insurance Policy Options

You can purchase a separate gun insurance policy if you feel that the homeowners or renters policies do not entirely cover your individual situation. A gun liability insurance policy covers any damages associated with negligence and unintended shootings. Some policies even cover acts of self-defense that are determined to be with “reasonable force.”

Another option for gun coverage is self-defense insurance. This is a separate policy that covers costs associated with acts of self-defense.

In the U.S. alone, 31% of gun owners have used a firearm for self-defense. In 82% of incidents, no shots were fired. This policy usually includes coverage for civil and criminal defense expenses and civil damages. Some policies will even cover firearm replacements, psychological support, bail assistance, and any loss of income that may have occurred due to required presence on a court day.

Do I need gun insurance?

If you own firearms, it’s important to consider gun insurance coverage. We all want to keep ourselves and our loved ones safe, so it is understandable why legal gun ownership is important for your peace of mind. It is good to know all of your gun insurance options and whether or not it is already covered under your current insurance plans or if you need supplemental coverage.

While gun liability insurance may not be required where you live, it is possible that local legislation may soon change. It’s best to be prepared and consider all of your options to make the best decision for your situation.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Case Studies: Gun Liability Insurance: A Complete Guide

Case Study 1: The Smith Family

The Smith family, residing in a suburban neighborhood, owned a firearm for home protection. Unfortunately, their teenage son accidentally discharged the weapon, injuring a neighbor. Thanks to their gun liability insurance policy, the Smiths were covered for the resulting medical expenses, legal fees, and potential damages.

The insurance not only provided financial protection but also ensured that the injured party received proper compensation.

Case Study 2: The Gun Store Incident

In a case involving a local gun store, a customer purchased a firearm but failed to follow the necessary safety precautions. While handling the weapon, the customer unintentionally fired a round, causing significant property damage. The gun store had comprehensive liability insurance coverage, which enabled them to reimburse the affected individuals for the property damage and related costs.

The incident highlighted the importance of gun liability insurance for businesses involved in the firearms industry.

Case Study 3: The Sporting Event Accident

During a shooting event, an inexperienced participant’s firearm mishandling caused severe injuries to another competitor. The event organizers had gun liability insurance, which protected them from lawsuits and compensated the injured party for medical expenses and damages. This case emphasized the importance of liability insurance for organizers of gun-related activities.

Case Study 4: The Domestic Dispute

In a domestic dispute, a heated argument escalated, leading to a gun being discharged unintentionally, injuring one of the parties involved. The individuals had gun liability insurance, which covered the medical expenses for the injured party and legal representation for both parties. The case highlighted the importance of having liability insurance in scenarios where firearms are present within a household.

Case Study 5: The Stolen Firearm

A firearm was stolen from a homeowner’s residence and later used in the commission of a crime. Despite taking reasonable precautions, the homeowner faced legal challenges and potential liabilities. However, their gun liability insurance policy provided the necessary legal defense, protecting them from financial repercussions. This case highlighted the value of gun liability insurance in mitigating the risks associated with stolen firearms.

Frequently Asked Questions

Does renters insurance cover firearms?

Yes, renters insurance typically covers firearms, but the coverage is often limited to theft or damage and may not cover liability for accidental discharges.

Does owning a gun affect insurance?

Yes, owning a gun can affect insurance premiums and policies, as insurers may consider the increased risk associated with firearm ownership.

Does homeowners insurance cover self-defense?

Homeowners insurance usually does not cover self-defense incidents, as intentional acts, even in self-defense, are often excluded from standard policies.

What is gun insurance?

Insurance for guns is a specialized insurance policy that provides coverage for liability, theft, and accidents related to firearm ownership and usage.

How much does firearm insurance cost?

The cost of firearm insurance varies widely based on factors such as coverage limits, type of policy, and the insurer, typically ranging from $100 to several hundred dollars per year.

What is gun liability insurance?

Gun liability insurance is a type of insurance that provides coverage for damages and injuries that may result from the use of a firearm, such as accidental shootings or negligent firearm storage.

Do I need gun liability insurance?

Whether or not you need gun liability insurance depends on your individual situation and state laws. Some states may require gun owners to carry liability insurance, while others do not. Additionally, gun owners who have significant assets may choose to carry liability insurance to protect themselves in case of a lawsuit resulting from a shooting or other incident involving their firearm.

What does gun liability insurance cover?

Gun liability insurance typically covers damages and injuries caused by the policyholder’s firearm, including accidental shootings, negligent storage or maintenance of firearms, and use of firearms in self-defense. Coverage limits and exclusions may vary depending on the insurance policy.

How much does gun liability insurance cost?

The cost of gun liability insurance can vary widely depending on factors such as the type and amount of coverage, the policyholder’s location and personal circumstances, and the insurance provider. Some policies may be as low as $100 per year, while others can cost several hundred dollars or more.

Where can I purchase gun liability insurance?

Gun liability insurance is typically available through specialized insurance providers that offer coverage for gun owners. It may also be available as a rider or add-on to a homeowner’s insurance policy. It is recommended that you compare policies and prices from multiple providers before purchasing gun liability insurance to ensure that you are getting the best coverage at the best price.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.