Florida Car Insurance Requirements for 2026 (What FL Drivers Need)

Florida car insurance requirements include minimum liability coverage of $10,000 per person for personal injury protection (PIP) and $10,000 per accident for property damage liability coverage. Drivers in Florida can secure affordable car insurance coverage starting at just $16/month, meeting FL minimum limits.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated January 2025

Florida car insurance requirements mandate minimum coverage of 10/10, including $10,000 per person for personal injury protection, along with $10,000 for property damage liability coverage.

While these limits ensure legal compliance, additional coverage options like uninsured motorist protection and comprehensive insurance provide enhanced security.

Florida Minimum Car Insurance Coverage Requirements & Limits

| Coverage | Limits |

|---|---|

| Personal Injury Protection | $10,000 per person |

| Property Damage Liability | $10,000 per accident |

Florida drivers can find affordable rates by comparing top companies, with some offering policies as low as $16/month. Understanding your coverage needs and exploring available options ensures the best protection for your budget and peace of mind.

To ensure you have the right coverage at the best rates, enter your ZIP code and compare quotes from leading insurance providers. Don’t miss out on the opportunity to secure the ideal car insurance policy for your needs.

- Florida car insurance requirements mandate 10/10 minimum liability coverage

- USAA offers affordable rates at $16/month tailored to Florida drivers’ needs

- Penalties in FL for no insurance include fines, license suspension, and fees

Florida Car Insurance Requirements & What They Cover

All personal vehicles in Florida must meet specific liability insurance coverage requirements to comply with state laws and ensure adequate protection. Drivers are required to carry personal injury protection (PIP) coverage of at least $10,000 per person.

Additionally, property damage liability of $10,000 per accident is mandatory to pay for damages to another person’s property, such as their vehicle or other assets. These minimum requirements provide a baseline level of financial security, but many drivers opt for higher coverage limits or additional policies like uninsured motorist protection or comprehensive coverage to enhance their protection.

Understanding these requirements is essential to avoid penalties and ensure you’re adequately covered on Florida roads.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Cheapest Car Insurance in Florida

Finding the cheapest car insurance in Florida is essential for staying protected without breaking the bank. USAA offers the cheapest rates in the state, with minimum coverage starting at just $16/month, making it an excellent option for eligible military members and their families.

6,590 reviews

6,590 reviewsCompany Facts

Min. Coverage in Florida

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviews 18,157 reviews

18,157 reviewsCompany Facts

Min. Coverage in Florida

A.M. Best

Complaint Level

Pros & Cons

18,157 reviews

18,157 reviews 3,071 reviews

3,071 reviewsCompany Facts

Min. Coverage in Florida

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviewsState Farm follows as the second cheapest provider, with rates averaging $33/month, known for its broad range of discounts and reliable service. Nationwide secures the third spot with affordable rates at $34/month, providing flexible coverage options tailored to Florida drivers.

Florida Min. Coverage Car Insurance Monthly Rates by City

| City | Rates |

|---|---|

| Boca Raton | $96 |

| Cape Coral | $87 |

| Clearwater | $98 |

| Coral Springs | $102 |

| Davie | $99 |

| Fort Lauderdale | $103 |

| Gainesville | $80 |

| Hialeah | $108 |

| Hollywood | $104 |

| Jacksonville | $92 |

| Lakeland | $91 |

| Miami | $110 |

| Miami Gardens | $109 |

| Miramar | $107 |

| Orlando | $95 |

| Palm Bay | $89 |

| Pembroke Pines | $106 |

| Pompano Beach | $105 |

| Port St. Lucie | $88 |

| St. Petersburg | $97 |

| Sunrise | $106 |

| Tallahassee | $85 |

| Tampa | $101 |

| West Palm Beach | $100 |

Comparing these providers can help you find the most cost-effective policy that meets Florida car insurance requirements. Monthly rates can vary significantly depending on where you live in Florida.

For example, drivers in Gainesville enjoy some of the lowest rates at $80/month, while cities like Hialeah and Hollywood have higher averages of $108 and $104/month, respectively.

Other areas, such as Fort Lauderdale and Coral Springs, also see rates exceeding $100/month. To secure the best deal, it’s essential to compare quotes tailored to your location, driving history, and coverage needs.

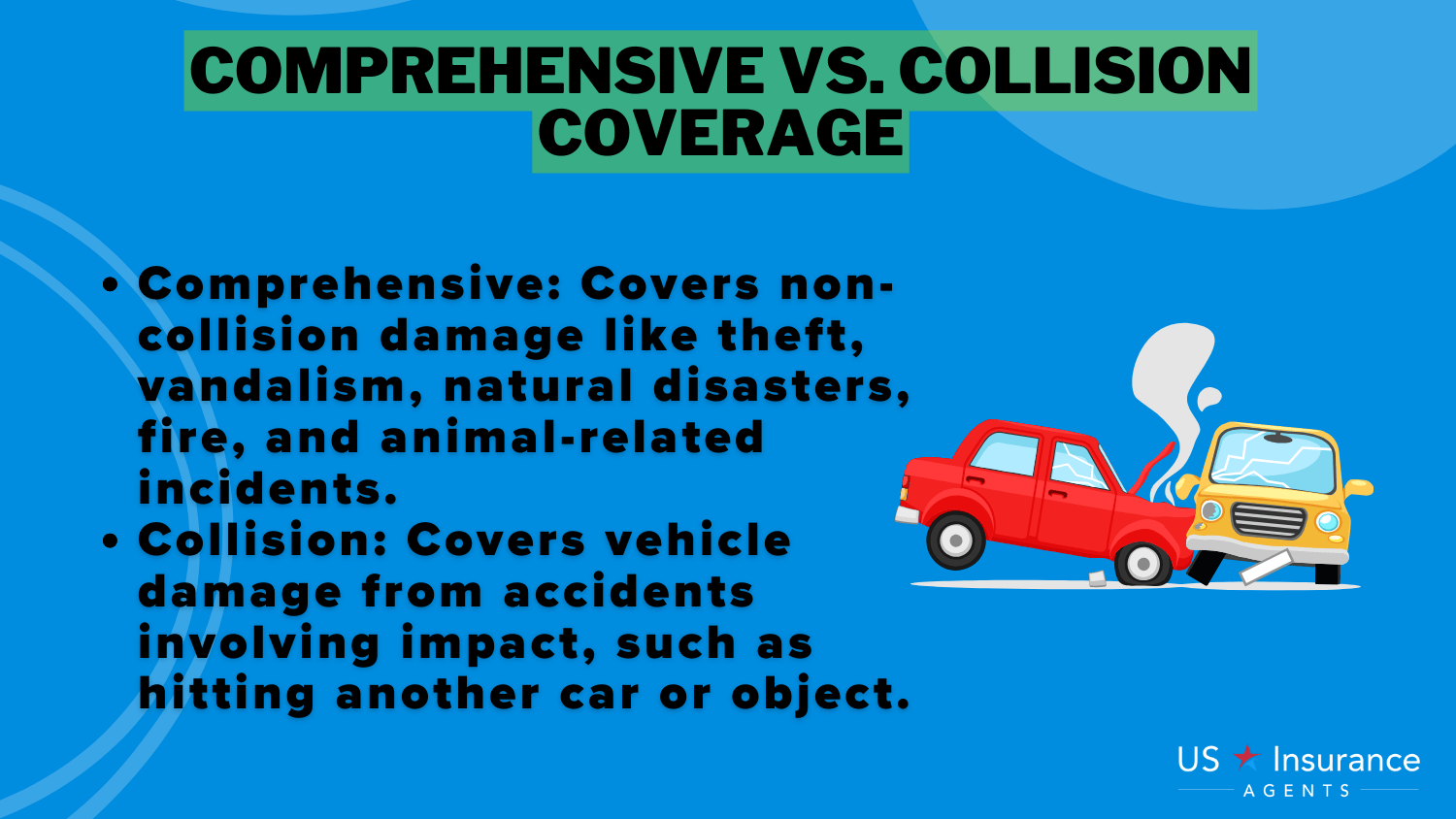

Other Coverage Options to Consider in Florida

When choosing car insurance in Florida, understanding additional coverage options can help you stay protected beyond the state’s minimum requirements. While Personal Injury Protection (PIP) is mandatory, other types of coverage can provide broader financial security in case of accidents, theft, or unexpected damages. Below are the key options to consider:

- Uninsured/Underinsured Motorist Coverage: Personal injury protection protects you if you’re involved in an accident with a driver who has little or no insurance. This coverage can cover medical expenses and damages once your PIP limits are exceeded.

- Collision Coverage: Comprehensive coverage pays for repairs or replacement of your vehicle after an accident, regardless of who is at fault.

- Comprehensive Coverage: Collision car insurance covers non-accident-related damages such as vandalism, theft, or natural disasters. It’s particularly beneficial for high-risk vehicles or areas prone to severe weather.

Florida drivers should also be aware of the Financial Responsibility Law, which mandates full liability coverage in specific situations, including at-fault accidents involving injuries, license suspensions due to excessive points, and DUI-related revocations.

Adding these optional coverages can provide peace of mind and financial protection, ensuring that you are fully prepared for any situation on the road. Evaluating your needs and comparing options tailored to your budget will help you secure the right policy.

Penalties for Driving Without Auto Insurance in Florida

Driving without car insurance in Florida can lead to serious consequences. For a first offense, your license and registration will be suspended until you pay a $150 fee and show proof of insurance. A second offense increases the fee to $250, and a third or later offense raises it to $500. You must show proof of insurance to get your license back.

Penalties for Driving Without Auto Insurance in Florida

| Violation | Penalty |

|---|---|

| First Offense | Suspension of license and registration until $150 reinstatement fee is paid and proof of insurance is provided. |

| Second Offense | Suspension of license and registration until $250 reinstatement fee is paid and proof of insurance is provided. |

| Third or Subsequent Offense | Suspension of license and registration until $500 reinstatement fee is paid and proof of insurance is provided. |

| Uninsured Accident | Additional penalties, including possible SR-22 filing and court fees. |

| Other Consequences | Potential impoundment of vehicle, additional fines, and suspension periods. |

If you’re uninsured and cause an accident, you could face extra penalties, like having to file special insurance forms (SR-22), paying court fees, or even losing your vehicle. Other consequences might include fines, longer suspensions, or vehicle impoundment.

Heidi Mertlich Licensed Insurance Agent

To avoid these issues, always keep your car insured and carry proof of insurance with you. You’ll need it during traffic stops, when registering your car, or to reinstate your license if it’s suspended. Staying insured keeps you legal and protects you financially.

Read more: Defensive Driving Courses Can Lower Your Car Insurance Rates

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Get Car Insurance in Florida

Getting car insurance in Florida is simple when you know the basics. Start by making sure your policy includes the required minimum coverage of 10/10 for PIP and PDL. Think about adding extra coverage, like uninsured motorist, collision, or comprehensive, to better protect yourself and your car.

Shop around and compare car insurance quotes from different companies to find the best price. Look at options like USAA, State Farm, and Nationwide, which are known for offering good rates and reliable service. Be sure to pick a policy that fits your budget and meets your needs based on your driving habits and location.

By comparing plans and understanding your options, you can find affordable coverage that keeps you safe and follows Florida’s laws. Don’t forget to carry proof of insurance to avoid fines or penalties. Shop for the best liability-only car insurance with our free quote comparison tool. Enter your ZIP code to begin.

Frequently Asked Questions

What are the minimum requirements for car insurance in Florida?

Florida requires a minimum of 10/10 coverage, which includes personal injury protection (PIP) coverage of $10,000 per person and $10,000 for property damage liability.

Read more: What does car insurance cover?

What is the new car insurance law in Florida?

The most recent changes to Florida car insurance laws include increased enforcement of minimum liability requirements and stricter penalties for uninsured drivers. Be sure to review current regulations with your provider to stay compliant. See if you’re getting the best deal on car insurance by entering your ZIP code here.

Can someone drive my car if they are not on my insurance in Florida?

Yes, in most cases, your car insurance follows the vehicle rather than the driver. However, it’s important to check your policy as restrictions or exclusions may apply.

Do I need a Florida driver’s license to get car insurance?

No, you can obtain car insurance in Florida with a valid driver’s license from another state or country, but you must eventually switch to a Florida license if you establish residency.

Why is Florida car insurance so expensive?

Florida’s high rates are due to its no-fault insurance system, frequent natural disasters, high traffic density, and a significant number of uninsured drivers.

Read more: Most Stolen Cars in Florida

Which insurance is mandatory in Florida?

Florida requires Personal Injury Protection (PIP) and Property Damage Liability (PDL) as mandatory coverages for all drivers.

What is the 90-day rule in Florida insurance?

The 90-day rule refers to a period when insurance companies may deny certain claims if the driver was not disclosed as a regular user of the insured vehicle.

What is the cheapest car insurance in Florida?

USAA offers the cheapest car insurance rates in Florida, starting at $16/month, though eligibility is limited to military members and their families (Read more: USAA Insurance Review & Ratings).

Can you go without car insurance in Florida?

No, driving without car insurance in Florida is illegal and can result in fines, license suspension, and other penalties.

What happens if someone who isn’t on your insurance crashes your car in Florida?

If someone crashes your car and is not listed on your policy, your insurance may still cover the damages, depending on the terms of your policy. However, exclusions may apply.

How does Florida car insurance work?

Can I drive a car I just bought without insurance in Florida?

Is Florida a no-fault state?

What are the requirements to get an insurance license in Florida?

What insurance is required for a financed car in Florida?

How much is car insurance in Florida?

What is full coverage car insurance in Florida?

How much does it cost to register a car in Florida and get plates?

What is the most basic car insurance in Florida?

Do you need insurance to register a car in Florida?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.