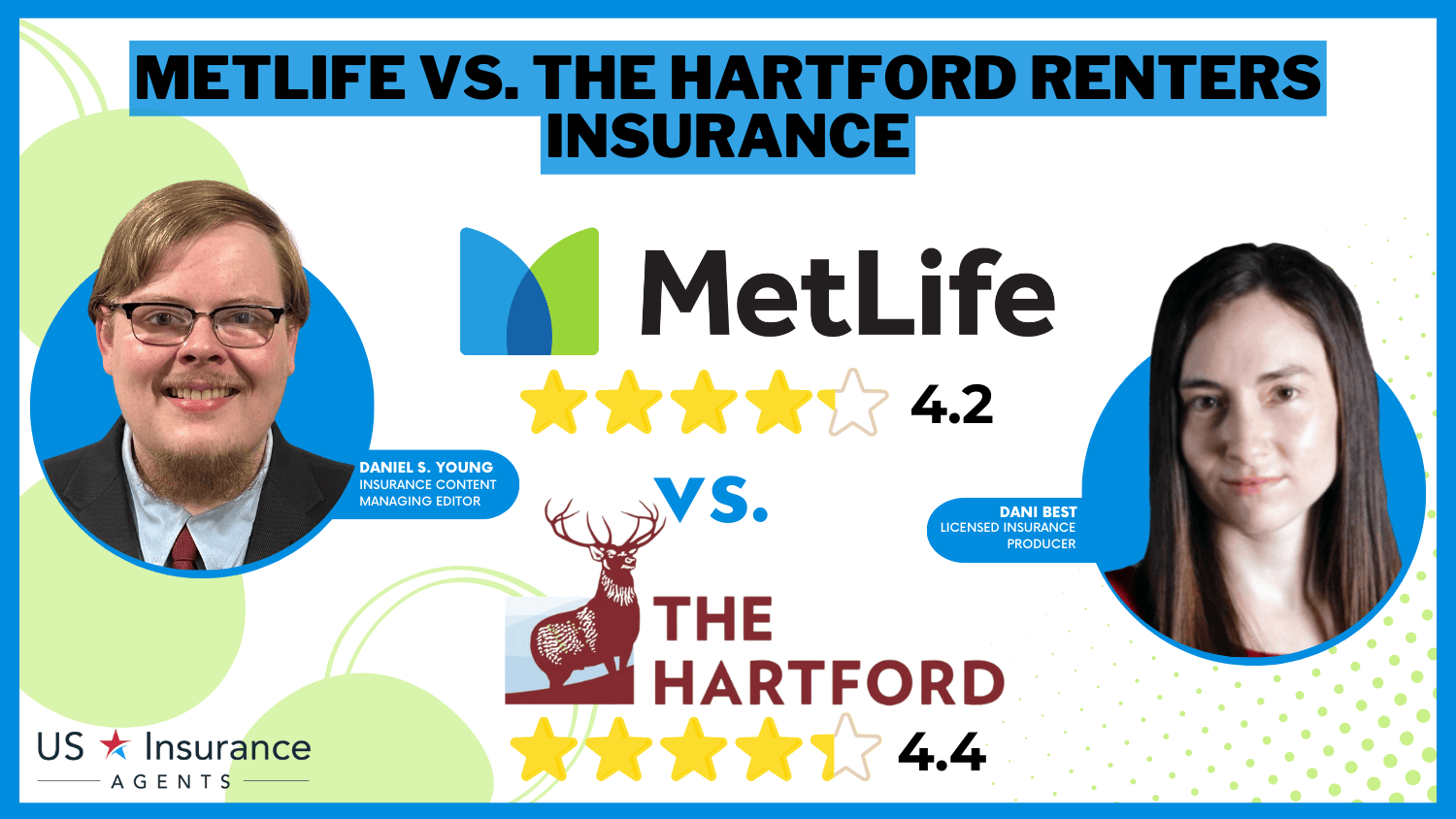

MetLife vs. The Hartford Renters Insurance for 2026 (See Who Wins)

Our review of MetLife vs. The Hartford renters insurance found The Hartford has more affordable rates and slightly better business ratings. Hartford's renters insurance rates start at $17/mo, compared to $21/mo at MetLife. Both companies offer comprehensive rental insurance options and discounts.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated January 2025

1,027 reviews

1,027 reviewsCompany Facts

Renters Policy Cost

A.M. Best Rating

Complaint Level

Pros & Cons

1,027 reviews

1,027 reviews 765 reviews

765 reviewsCompany Facts

Renters Policy Cost

A.M. Best Rating

Complaint Level

Pros & Cons

765 reviews

765 reviewsIn the dynamic realm of renters insurance, the choice between MetLife vs. The Hartford renters insurance holds significant weight, with each company offering distinctive advantages in coverages, rates, options, discounts, and customer reviews.

While both companies have similar ratings from customers and businesses, The Hartford stands out for its affordable rates and strong financial stability, making it the better option out of the two for the cheapest renters insurance.

MetLife vs. The Hartford Renters Insurance Rating

| Rating Criteria |  |

|

|---|---|---|

| Overall Score | 4.2 | 4.4 |

| Business Reviews | 4.0 | 4.5 |

| Claim Processing | 3.3 | 4.8 |

| Company Reputation | 4.0 | 4.5 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 4.0 | 4.3 |

| Customer Satisfaction | 4.0 | 4.1 |

| Digital Experience | 4.0 | 4.5 |

| Discounts Available | 5.0 | 5.0 |

| Insurance Cost | 4.1 | 3.9 |

| Plan Personalization | 4.0 | 4.5 |

| Policy Options | 4.7 | 4.1 |

| Savings Potential | 4.4 | 4.3 |

| MetLife | The Hartford |

Whether you prioritize comprehensive coverage, competitive rates, flexible options, enticing discounts, or stellar customer reviews, this analysis of MetLife vs. The Hartfordwill guide you towards the insurance solution that aligns best with your unique needs. Compare rates today to find affordable renters insurance for your needs.

- MetLife has a slightly larger market share than The Hartford

- The Hartford insurance for renters is cheaper on average

- Both MetLife and The Hartford have good ratings from businesses

MetLife vs. The Hartford Renters Insurance Rate Comparision

The cost of renters insurance can vary widely based on numerous factors, so it’s essential to obtain personalized insurance quotes online from both MetLife and The Hartford.

MetLife vs. The Hartford Renters Insurance Monthly Rates by Age & Gender

| Age & Gender |  |

|

|---|---|---|

| Age: 16 Female | $33 | $28 |

| Age: 16 Male | $35 | $30 |

| Age: 30 Female | $25 | $20 |

| Age: 30 Male | $27 | $22 |

| Age: 45 Female | $22 | $18 |

| Age: 45 Male | $24 | $20 |

| Age: 60 Female | $21 | $17 |

| Age: 60 Male | $23 | $19 |

MetLife offers competitive pricing for their renters insurance policies. They take into account various factors such as the location of your rental property, the value of your personal belongings, and your desired coverage limits. By providing accurate information, you can receive a personalized quote for renters insurance from MetLife that reflects your specific circumstances.

Similarly, The Hartford takes a personalized approach to pricing their renters insurance policies. They consider factors such as the size and location of your rental property, your claims history, and the amount of coverage you need. By providing detailed information, you can receive a quote that is tailored to your unique situation.

When comparing the prices of both insurers, it’s important to consider the coverage limits, deductibles, and any available discounts. By evaluating these factors, you can determine which option provides the most value for your money.

Free Rental Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

MetLife vs. The Hartford Renters Insurance Coverage Options

Both MetLife and The Hartford offer comprehensive coverage for personal property, liability, and loss of use. However, it’s essential to review the specific policy details and endorsements to ensure they align with your needs.

MetLife vs. The Hartford Renters Insurance Coverage Options

| Coverage Type |  |

|

|---|---|---|

| Personal Property | ✅ | ✅ |

| Liability | ✅ | ✅ |

| Loss of Use/Additional Living Expenses | ✅ | ✅ |

| Medical Payments | ✅ | ✅ |

| Replacement Cost Coverage | ✅ | ✅ |

| Scheduled Personal Property (for high-value items) | ✅ | ✅ |

| Water Backup | ✅ | ✅ |

| Identity Theft Protection | ✅ | ✅ |

| Earthquake Coverage | ✅ | ✅ |

| Pet Damage Liability | ✅ | ✅ |

MetLife’s coverage options include protection for personal property, such as furniture, electronics, and clothing. They also offer liability insurance coverage, which can protect you if someone gets injured in your rented home, as well as loss of use coverage.

Daniel Walker Licensed Insurance Agent

On the other hand, The Hartford’s coverage options are similar, offering protection for personal property, liability, and loss of use. They have customizable coverage limits, allowing you to tailor your policy to your specific needs.

The Hartford also provides additional coverage options for high-value items, such as jewelry or collectibles, so you can have peace of mind knowing your most valuable possessions are protected.

When comparing the coverage options of both insurers, it’s important to consider factors such as coverage limits, deductible options, and additional coverage options for high-value items or specific perils. Taking the time to thoroughly review and understand the policy details will help you make an informed decision.

MetLife Renters Insurance Coverages

MetLife is a well-known insurance company that offers a wide range of insurance products, including renters insurance. With over 150 years of experience in the industry, MetLife has built a strong reputation for providing reliable coverage and exceptional customer service. Let’s take a closer look at what MetLife has to offer.

MetLife’s renters insurance policies provide comprehensive coverage for personal property, liability, and loss of use. Their policies can also include additional endorsements to tailor coverage to individual needs, such as coverage for valuable items like jewelry or fine art.

When it comes to personal property coverage, MetLife allows policyholders to choose between actual cash value (ACV) or replacement cost value (RCV) coverage. ACV coverage pays for the depreciated value of your belongings at the time of loss, while RCV coverage reimburses you for the cost of replacing items with new ones. This flexibility ensures that you have the right coverage to protect your belongings.

The Hartford Renters Insurance Coverages

The Hartford is another reputable insurance company that offers comprehensive coverage for renters. Let’s explore what they bring to the table.

When it comes to protecting your personal belongings as a renter, The Hartford’s renters insurance policies have got you covered. They understand the importance of safeguarding your possessions and offer a range of coverage options to ensure that you are adequately protected.

The Hartford’s renters insurance policies cover personal property, liability, and loss of use, similar to MetLife. This means that not only will your personal belongings be protected in case of damage or theft, but you will also have coverage in case someone is injured in your rental property and you are found liable.

Additionally, if your rental becomes uninhabitable due to a covered event, The Hartford will provide coverage for your temporary living expenses.

But what sets The Hartford apart is their attention to detail. They offer standard coverage for a wide range of perils, including fire, theft, and vandalism. They understand that accidents happen, and they are prepared to help you recover from any unfortunate event.

Furthermore, policyholders have the option to add additional endorsements for specific needs like jewelry or high-value items. This means that if you have valuable possessions that require extra protection, The Hartford has you covered.

Renters Discounts at MetLife vs. The Hartford

The cost of renters insurance from MetLife and The Hartford can vary depending on factors such as the location of your rental, the coverage limits you choose, and your deductible. However, both companies understand the importance of affordability and offers several discounts that can help reduce your premium.

For example, they may offer multi-policy discounts if you bundle your renters insurance with another policy, such as auto insurance (Read More: Can I bundle my car insurance with other policies?). This not only saves you money but also simplifies your insurance management by having all your policies with one trusted provider.

MetLife vs. The Hartford Renters Insurance Discounts by Savings Potential

| Discount Name |  |

|

|---|---|---|

| Bundling Policies | 15% | 20% |

| Claims-Free Discount | 10% | 5% |

| Association Membership | 5% | 5% |

| Employer Affiliation | 5% | 5% |

| Protective Devices | 10% | 5% |

| Renewal Discount | 5% | 5% |

| AARP Membership Discount | X | 10% |

MetLife offers discounts for customers who have certain security features installed in their rental, such as smoke detectors or alarm systems. This encourages proactive measures to protect your property and can result in further savings on your insurance premium.

Like MetLife, the cost of The Hartford’s renters insurance varies depending on factors such as location, coverage limits, and deductible. However, The Hartford goes the extra mile to make their coverage affordable for renters. They offer various discounts that policyholders can take advantage of, such as bundling policies.

By combining your renters insurance with another insurance policy, such as auto insurance, you can save money on both. Additionally, The Hartford offers discounts for having certain safety features installed in your rental property. This means that by taking simple steps to enhance the safety of your home, you can enjoy even more affordable coverage.

Customer Reviews of MetLife vs. The Hartford Renters Insurance

Both MetLife and The Hartford have mixed customer reviews, despite offering various communication channels for support and claims-related inquiries. While MetLife prides itself on its excellent customer service and offers multiple options of communication via phone, email, or online chat, there are some complaints from customers, such as the Yelp review below.

The Hartford also places a strong emphasis on customer service, offering 24/7 claims reporting or emergencies and accidents. However, not all customers are happy with the customer service of The Hartford, and several complaints on Yelp discuss home rate increases despite intitally low quotes (Read More: Does The Hartford homeowners insurance go up after a claim?).

When comparing the customer service of both insurers, it’s beneficial to read customer reviews or reach out to each company directly to get a sense of their responsiveness and helpfulness. This will give you a better understanding of the level of support you can expect throughout your renting journey.

Free Rental Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Business Reviews of MetLife vs. The Hartford

It’s important to also review market shares and business ratings to find the best renters insurance. MetLife has the larger market share, almost twice that of The Hartford, as you can see below.

However, a larger market share doesn’t necessarily make MetLife the better insurance company for renters. If you compare MetLife vs. Geico, for example, Geico will have the bigger market share, but MetLife may still be the better choice for your needs. See how businesses rate MetLife and The Hartford below.

Insurance Business Ratings & Consumer Reviews: MetLife vs. The Hartford

| Agency |  |

|

|---|---|---|

| Score: 886 / 1,000 Above Avg. Satisfaction | Score: 905 / 1,000 Above Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 76/100 Good Customer Feedback | Score: 74/100 Good Customer Feedback |

|

| Score: 1.00 Avg. Complaints | Score: 1.10 Avg. Complaints |

|

| Score: A Excellent Financial Strength | Score: A+ Superior Financial Strength |

While both companies have similar ratings from J.D. Power, BBB, and Consomer Reports, The Hartford has a better A.M. Best rating for financial stability.

MetLife Renters Insurance Pros and Cons

Pros

- Comprehensive Coverage Options: MetLife offers robust coverage for personal property, liability, and loss of use, with the flexibility to include endorsements for specific needs like jewelry or fine art.

- Flexible Personal Property Coverage: Policyholders can choose between Actual Cash Value (ACV) or Replacement Cost Value (RCV) coverage for personal property, providing options based on individual preferences (Learn More: Actual Cash Value Homeowners Insurance).

- Ease of Contact: With over 150 years of industry experience, MetLife takes pride in delivering excellent customer service through various channels, including phone, email, online chat, and a user-friendly mobile app.

Cons

- Policy-Specific Limitations: While offering flexible coverage, some policy-specific limitations may apply, and it’s crucial for policyholders to thoroughly review and understand the terms to ensure alignment with their needs.

- Affordability: While MetLife’s rates are still on the lower end, The Hartford is cheaper than MetLife. Always get quotes for companies, whether you are shopping at MetLife vs. Erie or MetLife vs. Safe Auto.

The Hartford Renters Insurance Pros and Cons

Pros

- Comprehensive Coverage: The Hartford provides extensive coverage for personal property, liability, and loss of use, distinguishing itself with standard coverage for a wide range of perils and the option to add endorsements for high-value items.

- Affordability with Discounts: Similar to MetLife, The Hartford emphasizes affordability and offers discounts, including bundling policies for additional savings and rewards for safety features in the rental property.

- Business Ratings: The Hartford has a superior A.M. Best rating, as well as solid ratings from other businesses, making it ideal for long-term renters looking for a reliable company (Read More: Best Renters Insurance for Long-Term Renters).

Cons

- Policy-Specific Details: Policyholders should carefully review The Hartford’s policy details, including coverage limits, deductibles, and any additional endorsements, to ensure a comprehensive understanding of the offered protection.

- Mixed Customer Reviews: While The Hartford has 24/7 claims reporting, multiple communication channels, there are some negative reviews from customers.

Free Rental Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Overview of MetLife Renters Insurance

MetLife takes pride in delivering excellent customer service. They understand that accidents and emergencies can happen at any time, and they are committed to being there for their policyholders when they need assistance after an emergency.

Learn More: Does renters insurance cover tornado damage?

They provide various channels for customers to reach out, including phone, email, and a MetLife online chat, ensuring that you can easily connect with a knowledgeable representative who can address your questions or concerns. Their customer service team is known for their responsiveness and expertise, making the insurance experience seamless and stress-free.

MetLife also offers a mobile app that allows policyholders to manage their coverage, file claims, and access policy documents conveniently. This user-friendly app puts the power of insurance management in the palm of your hand, allowing you to handle your renters insurance needs on the go.

With MetLife rental insurance, you can have peace of mind knowing that your personal belongings are protected, and you have a trusted partner to rely on in times of need. Whether you’re a renter looking for basic coverage or someone with unique needs, MetLife offers flexible options and exceptional service to meet your requirements.

Overview of The Hartford Renters Insurance

When it comes to customer service, The Hartford strives to provide top-notch assistance. They understand that dealing with insurance matters can be overwhelming, and they are committed to making the process as smooth as possible for their policyholders.

They offer multiple channels of communication, including phone, email, and online chat, to assist policyholders with any questions or concerns they may have about their coverage.

Read More: Will renters insurance cover you and your belongings if there is ever a fire theft or vandalism?

Furthermore, their claims process is designed to be hassle-free. The Hartford has dedicated claims representatives available to guide customers through the process and provide prompt assistance. Whether you need to file a claim for property damage or liability, you can rest assured that The Hartford will be there to support you every step of the way.

Choosing The Hartford for Your Renters Insurance: A Winning Decision

In the MetLife vs. The Hartford showdown for renters insurance, The Hartford emerges as the clear winner, backed by several decisive factors.

- Coverage Options: The Hartford’s meticulous attention to detail and commitment to providing standard coverage for a diverse range of perils set it apart. While both companies offer comprehensive options, The Hartford’s additional endorsements for high-value items make it a robust choice for those seeking tailored protection.

- Pricing and Discounts: The Hartford takes the lead in the pricing arena, offering not only competitive rates but an extensive array of discounts. Its commitment to affordability and incentives for safety features, coupled with personalized pricing structures, gives renters a cost-effective and flexible insurance option.

- Customer Service and Claims Process: In the realm of customer service, The Hartford’s 24/7 claims reporting and a streamlined claims process demonstrate a commitment to customer convenience and responsiveness. While both companies excel in this aspect, The Hartford’s detailed approach to claims handling stands out.

The Hartford’s meticulous coverage options, competitive pricing structure with diverse discounts, and customer-centric approach collectively position it as the top choice for renters insurance.

Read More: The Hartford Insurance Review & Ratings

It’s a winning combination that caters to the needs of renters, providing not just coverage but a comprehensive and reliable safeguard for the unexpected.

Free Rental Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Understanding Renters Insurance

Renters insurance is a type of insurance policy that protects individuals who rent homes, apartments, or other types of dwellings. While landlords typically have their own insurance policies to protect the property itself, these policies do not cover the personal belongings of renters.

Michelle Robbins Licensed Insurance Agent

Renters insurance fills this gap, offering coverage for personal property and liability, among other things.In exchange for a monthly premium, the rental insurance company agrees to pay for covered losses up to the policy limit if you make a claim.

Read More: How to Document Damage for a Renters Insurance Claim

Additionally, renters insurance typically includes liability coverage, which protects policyholders if someone is injured on their property and sues them for damages. Liability coverage can also extend to incidents that occur away from the insured property.

Why Renters Insurance is Important

So, why is renters insurance so important? Renters insurance is important for several reasons. Firstly, it provides coverage for your personal property. Imagine returning home to find that your apartment has been burglarized, and your valuable electronics, jewelry, and furniture are all gone. Without renters insurance, you would be responsible for replacing these items out of pocket.

However, with the right policy in place, your insurance company would reimburse you for the value of your losses, making it easier to recover.

Secondly, renters insurance offers liability protection. Accidents happen, and if someone were to get injured in your rented space and hold you responsible, the costs can quickly add up. Liability coverage can help cover legal expenses, medical bills, and damages awarded in a lawsuit, up to the limits of your policy.

Moreover, renters insurance provides peace of mind. Knowing that you have financial protection in case of unexpected events can alleviate stress and allow you to focus on enjoying your home. Whether it’s a fire, a burst pipe, or a break-in, having renters insurance can help you recover more quickly and easily.

Last but not least, renters insurance can provide additional living expenses if your rental becomes uninhabitable due to a covered loss. This coverage can help with costs such as temporary accommodation, meals, and transportation while your home is being repaired or rebuilt. In a time of crisis, having this support can make a significant difference in your ability to navigate through the challenges.

In conclusion, renters insurance is a valuable investment for anyone who rents a home or apartment. It offers protection for your personal belongings, liability coverage, and assistance with additional living expenses in case of a covered loss. By securing renters insurance, you can have peace of mind and be prepared for the unexpected.

Choosing Between MetLife and The Hartford Renters Insurance

Ultimately, when comparing MetLife and The Hartford renters insurance, it’s crucial to evaluate their coverage options, pricing, and customer service to determine the best fit for your needs. The Hartford stands out as the better company, with cheaper rates and slightly better business ratings.

Laura Berry Former Licensed Insurance Producer

Renters insurance is an important coverage to have, no matter which company you purchase it from (Read More: Reasons Why You Need Renters Insurance).

Ready to dive into shopping for renters insurance? Use our free quote tool to get started. It will help you quickly sort through companies in your area to find the best deal on rental insurance.

Frequently Asked Questions

What is the difference between MetLife and The Hartford renters insurance?

MetLife and The Hartford are both insurance providers that offer renters insurance. However, they may differ in terms of coverage options, pricing, customer service, and additional features.

It is recommended to always compare policies to determine which company best suits your needs, whether you are contrasting MetLife vs. AAA or MetLife vs. 21st Century.

What does renters insurance typically cover?

Renters insurance typically covers personal property protection, liability protection, and additional living expenses in case your rented property becomes uninhabitable. It can help replace or repair your belongings in case of theft, fire, vandalism, or certain natural disasters. It is important to review the specific policy details to understand the coverage provided.

Is MetLife good at paying claims?

Yes, MetLife has an above average satisfaction score from J.D. Power for claims satisfaction. Learn more in our MetLife insurance review and ratings.

Does MetLife renters insurance offer replacement cost coverage?

MetLife renters insurance offers optional replacement cost coverage, which means they will reimburse you for the cost of replacing your belongings with new items of similar kind and quality, rather than providing the actual cash value (ACV) of the items at the time of loss. This can be beneficial in ensuring you can fully recover from a covered loss.

Can I cancel my renters insurance policy with MetLife or The Hartford?

Yes, you can typically cancel your renters insurance policy with MetLife or The Hartford. However, the specific cancellation process and any applicable fees or refunds may vary. It is recommended to contact the insurance provider directly to discuss the cancellation process and any potential consequences.

What discounts are available with The Hartford renters insurance?

The Hartford offers various discounts on their renters insurance policies. These may include multi-policy discounts, protective devices discounts (such as smoke alarms or security systems), claims-free discounts, and age-related discounts. It is advisable to inquire with The Hartford or your insurance agent to understand the specific discounts you may be eligible for.

Bear in mind that your rates will be affected by several factors besides discounts, such as your age, location, and credit score (Read More: Cheap Renters Insurance With No Credit Check).

Is Hartford a good insurance company?

Yes, The Hartford Insurance is a good insurance company. However, you should still always compare it to other companies to find the best deal for your partilcar needs, such as State Farm vs. The Hartford.

Does MetLife have renters insurance?

Yes, MetLife has renters insurance. You can also purchase life insurance from Metropolitan Life Insurance Company or home and auto insurance from Metropolitan Property & Casualty Insurance Co. We recommend comparing renters insurance quotes between your top two companies to find the best deal, such as MetLife vs. Safeco or Esurance vs. MetLife.

What is Hartford insurance known for?

Hartford Fire Insurance Company is known for providing discounted rates to AARP members, with a special focus on car insurance (Learn More: AARP Auto Insurance Program from The Hartford Review).

Why would MetLife deny a claim?

MetLife may deny a claim if you don’t have the proper coverage to cover the damages.

Is MetLife insurance expensive?

Which insurance company has the best claim settlement?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.