Does State Farm home insurance cover animal damage? (2026 Coverage Details)

Does State Farm home insurance cover animal damage? State Farm coverage typically includes damage from household pets like dogs and cats but excludes damage from pests or wild animals like rodents or raccoons. For instance, State Farm does not cover rodent damage, which affects approximately 14% of homeowners.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Maria Hanson grew up with a unique passion and understanding of both the automotive and insurance industries. With one grandfather in auto mechanics and another working in insurance, you could say automotive insurance is in her blood. Her love of research and finance serves her well in studying insurance trends and liability. Maria has expanded her scope of expertise to home, health, and life...

Maria Hanson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Former State Farm Insurance Agent

Benjamin Carr worked as a licensed insurance agent at State Farm and Tennant Special Risk. He sold various lines of coverage and informed his clients about their life, health, property/casualty insurance needs. Assessing risks and helping people find the best coverage to suit their needs is a passion of his. He appreciates that insurance was designed to protect people, particularly during times...

Benjamin Carr

Updated January 2025

If you’re wondering, “Does State Farm home insurance cover animal damage?” you’re not alone. Many homeowners face the challenge of dealing with unexpected animal-related incidents, whether caused by pets or wild animals.

State Farm’s home insurance may cover some animal damage, depending on the situation. Household pets are typically covered for damage to personal property. Some of the most common pet insurance claims include accident-related injuries, illnesses , and chronic conditions like allergies or arthritis.

Wild animals such as rodents, squirrels, or racoons are usually not covered unless the damage is sudden and accidental. Understanding the nuances of your policy is essential to ensure you’re adequately protected.

In some cases, you may need additional endorsements or policies to cover damages caused by wild animals or pests. Enter your ZIP code above for more information and see how State Farm’s animal damage insurance may apply to your home.

- State Farm covers some animal damage, mainly from household pets

- Wild animal damage often requires separate coverage or endorsements

- Review your policy for specific coverage related to animal-related incidents

Homeowners Insurance Coverage Explained

Before we explore specifics regarding home coverage from State Farm, does State Farm provide home insurance? The first thing we must look at is what home insurance is and why there are different types of cover offered. Homeowners insurance is a type of insurance policy that will protect someone from suffering a financial loss on account of certain risks and damages that may affect the property.

It is an important insurance that adds security and assists in recovery from certain unforeseen circumstances. Commonly, it covers risks from perils such as theft and arson as well as hail and strong winds. However, the options for coverage and the restrictions are governed by the insurer and the policy in question.

Animal Damage Coverage Options by Insurance Provider

| Company | Coverage | Notes |

|---|---|---|

| Covers injuries and illnesses resulting from animal encounters | Partners with Trupanion | |

| Covers injuries and illnesses caused by other animals | Includes behavioral coverage | |

| Covers injuries and illnesses resulting from animal interactions | Offers wellness add-ons | |

| Covers injuries and illnesses due to animal encounters | 100% reimbursement option | |

| Covers injuries and illnesses from animal interactions | No payout limits | |

| Covers injuries and illnesses caused by other animals | Fast claims processing | |

| Covers injuries and illnesses resulting from animal encounters | Customizable coverage options |

| Covers injuries and illnesses due to animal interactions | Covers exotic pets |

| Covers injuries and illnesses from animal interactions | Accident-only plans offered | |

| Covers injuries and illnesses caused by other animals | Preventive care packages | |

| Covers injuries and illnesses resulting from animal encounters | Direct vet payments |

Let us now summarize and analyze the different categories of home insurance cover available:

Dwelling Coverage

Dwelling coverage is a key part of your home insurance policy, protecting the structure of your home—everything from the walls and roof to the floors and attached spaces like garages or sheds. If something unexpected happens, like a fire or severe storm, State Farm’s dwelling coverage can help cover the costs of repairs or rebuilding.

One important thing to keep in mind is that dwelling coverage is usually based on the replacement cost, meaning the amount needed to rebuild your home if it were completely destroyed. To ensure you’re fully covered, it’s essential to get an accurate estimate of this cost, so you’re not left underinsured.

Personal Property Coverage

Beyond protecting the structure of your home, home insurance also covers your personal belongings. This includes everything like furniture and appliances to electronics, clothing, and more. If your items are damaged or stolen or maybe destroyed in a covered event, personal property coverage helps reimburse you for the cost.

Make sure you have enough coverage, always take a thorough check of your belongings and estimate their total value. Make sure you have sufficient coverage to replace and repair your belongings in case of damage or loss.

Liability Coverage

Liability coverage is a crucial part of your home insurance policy. It acts like a safety net, helping protect you financially if someone gets hurt or has an accident on your property and you’re found legally responsible.

This coverage can help take care of things like medical bills, legal expenses, and damages if someone decides to file a liability claim against you. It’s really about providing peace of mind, knowing you won’t be left to handle hefty costs all on your own.

For instance, if a guest falls or slips on your icy driveway or your dog bites a neighbor, liability coverage can help shield you from lawsuits and provide compensation to the injured party. It’s important to have enough coverage to save your assets and prevent financial struggles if an accident arises.

Coverage for Additional Living Expenses

If your home is becomes uninhabitable due to an event such as a fire or storm, additional living expenses coverage can be a lifesaver. This helps for temporary living arrangements such as hotel stays or rental housing, while your home is being rebuilt or repaired.

Thanks to this coverage, follows this type of disaster you and your family can find a place to stay which helps you establish some comfort and returning to normal while the damages are being addressed. Just remember to revise the coverage limits as well as the duration of this coverage so you are confident they meet your expectations and possible expenses.

It is essential to understand the different types of home insurance coverage to make informed decisions. Consulting with an experienced agent is helpful in customizing a policy that fits your needs.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

A Closer Look at State Farm Home Insurance

State Farm is one of the biggest providers of home insurance in the U.S., with a reputation built over its long history since 1922. They’re known for great customer service and a wide range of coverage options. When you choose State Farm, you’re choosing a company that genuinely cares about protecting your home and everything in it.

They offer comprehensive coverage for your home’s structure, personal belongings, and even liability protection if someone gets injured on your property. Your home is more than just a roof over your head—it’s where life happens, and State Farm is here to help keep it safe.

State Farm Home Insurance Policies

State Farm offers a variety of home insurance policies designed to meet the needs of homeowners. State Farm has you covered whether you own a single-family home, a condo, or a rental property. Their policies protect against a range of risks, including fire, theft, vandalism, hurricanes, and even earthquakes. They also provide additional coverage for things like water damage caused by busted pipes or sewer backups.

State Farm offers the option of replacement cost or actual cash value for personal belongings. This means that if your items are damaged or stolen, they’ll either reimburse you for items with their current cash value or replace them with items of similar value.

State Farm also covers damage caused by animals, though there are some limitations, such as specific rules for damage caused by wild animals like bears or deer.

State Farm Discounts and Packages for Animal Damage Coverage

| Insurance Type | Coverage | Discounts/Benefits | |

|---|---|---|---|

| Auto Insurance | Animal collision damage covered | Safe Driving, Bundling, Safety Features | 30% |

| General Bundling | Combine multiple policies | Premium discounts for all | 20% |

| Homeowners Insurance | Wild animal damage, no rodents | Protective devices like alarms | 15% |

| Pet Insurance | Medical expenses for pets | Discounts when bundled | 10% |

State Farm also offers optional add-ons to enhance your coverage, such as identity theft protection, home business insurance, and high-value items like jewelry or fine art. If you ever need to file a claim, State Farm makes the process easy, with access to a network of trusted contractors and service providers to help restore your home quickly and efficiently.

With its solid protection options, including liability coverage and a variety of add-ons, State Farm is a reliable choice for homeowners looking for comprehensive insurance. Reviewing your policy and talking with a State Farm agent will help ensure you have the coverage that fits your needs and gives you peace of mind.

Read More: State Farm Insurance Review & Ratings

Protecting Your Home From Animal Damage: What You Need to Know

Dealing with animal damage can be frustrating for homeowners, and understanding how insurance companies handle these situations is key. Animal damage can range from small nuisances to serious issues that need major repairs. Knowing the common types of animal damage can help you take the right steps to protect your home and minimize potential damage..

Common Types of Animal Damages

Animal damage in homes can lead to issues like chewed electrical wires, holes in walls or ceilings, and damaged furniture. These problems not only hurt the look of your home but can also create safety hazards.

Rodents, such as rats and mice, often chew on wires, which can cause power outages or even fires, making repairs costly and requiring an electrician. Squirrels, raccoons, or birds might make holes in your walls or ceilings while looking for a place to nest.

Kristine Lee Licensed Insurance Agent

Holes and openings in your home can compromise its structure and attract pests. Wildlife like bats and rodents may damage insulation while creating nests, reducing your home’s energy efficiency, raising utility costs, and even impacting your HVAC systems.

Pets can be challenging, often scratching or chewing on furniture and causing damage. Additionally, pet waste can carry harmful bacteria or parasites that affect our homes. To keep our living spaces safe and clean, it’s crucial to regularly clean and sanitize as part of pet ownership.t to make cleaning and sanitizing a regular part of pet ownership.

How Insurance Companies Handle Animal Damage

Insurance companies have different policies regarding coverage for damage caused by animals. It is important to carefully review your policy or reach out to your provider for specific details.

Understanding your insurance coverage is key to protecting your home. Some policies don’t cover damage from animals, seeing it as preventable. Others might offer limited coverage for issues like chewed wires or holes, which might not fully cover repair costs.

If you want broader protection, you may need to purchase additional endorsements, but keep in mind these can increase your expenses. It’s important to assess what you need and what fits your budget before deciding.

Be sure to thoroughly document any damage to your home, including taking photos or videos, and keep records of all repairs and related expenses. Having clear documentation makes filing a claim much easier and helps ensure smoother interactions with your insurance company.

Also, taking proactive steps, like getting the right insurance coverage, can really help protect your home and keep your finances secure. It’s an important way to safeguard what matters most to you.

Read More: Pet Insurance for Farm Animals

State Farm’s Policy on Animal Damage

State Farm home insurance usually covers damage caused by common household pets like dogs and cats. Just a heads up: damage caused by wild animals or exotic pets isn’t covered in most insurance policies. While pets typically have some coverage, there are a few things to keep in mind.

For instance, if your furry friend accidentally breaks something, you might have to cover the repair costs yourself since your personal property policy. It’s a good idea to take a closer look at your policy details so you’re clear on what’s covered and what isn’t. However, if your pet causes structural damage to your home, such as chewing through drywall or damaging wiring, these repairs may not be covered.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Animal Damage Coverage With State Farm

It’s a relief to have that extra layer of security when dealing with unpredictable situations. The damage caused by animals can be frustrating and often results in unexpected repair costs. That’s why it’s good to know what your insurance policy covers. State Farm provides comprehensive coverage options that can help protect you against certain types of damage caused by animals.

Understanding the full scope of State Farm home insurance coverage is key to ensuring proper protection for your home and belongings. The State Farm home protection plan adds extra security by covering home systems and appliances. Event insurance from State Farm helps cover unforeseen incidents during events, while personal property insurance ensures valuables are protected.

Homeowners should also be informed about specific situations like squirrel damage house insurance, as coverage details can vary. Moreover, car owners should be aware that rodents chewing car wires insurance State Farm can address issues caused by pests damaging vehicle wiring.

State Farm also offers a Nest discount for homeowners using Nest products to enhance safety and efficiency.Overall, State Farm house insurance delivers robust protection and ranks among the best homeowners insurance Delaware options.

Understanding Animal Damage Coverage With State Farm Home Insurance

What does State Farm homeowners insurance cover? State Farm’s homeowners insurance generally covers damage from pets like dogs and cats, but may have limitations for wild animals. For example, damage caused by raccoons can be complicated and might not always be fully covered.

Always State Farm homeowners insurance coverage to understand what is included and to discuss any specific concerns with your agent. Additionally, considering a State Farm home warranty can provide extra protection for household systems and appliances, complementing your existing policy.

If you’re living in Virginia and dealing with pest issues, it might be worth checking out the pest control services offered by State Farm. Just a heads up, though—most standard insurance policies usually don’t include coverage for infestations. If you’re renting, State Farm’s renters insurance could also be a smart choice since it provides coverage for any damage caused by pets.

For homeowners interested in enhancing their properties, State Farm’s energy efficiency upgrade programs provide incentives for making energy-efficient improvements. Additionally, reviewing State Farm’s pet insurance options can help pet owners understand the coverage available for their pets’ health and medical needs.

Read More: How much does homeowners insurance cost?

State Farm vs. Other Insurance Providers

Choosing the right insurance provider can feel really overwhelming, but State Farm makes the process a bit easier for a few important reasons. They offer a wide range of coverage options across the country, so you can find just what you need to feel protected. Plus, they focus on making the claims process as smooth as possible, which can be a huge relief during a stressful time.

Here’s what makes State Farm stand out:

- Flexible Coverage Options: State Farm gives you the ability to customize your policy with helpful add-ons like identity theft protection or coverage for your high-value items. While other insurers might offer similar features, State Farm really shines when it comes to flexibility, allowing you to tailor your policy to fit your unique situation.

- Competitive Pricing & Discounts: State Farm is known for its solid pricing and a variety of savings opportunities. You can save money by bundling policies, installing safety devices, or keeping a clean claims record. Just keep in mind that how much you can save may vary based on where you live.

- Reliable Claims Process: When it comes to handling claims, State Farm is recognized for its efficiency. They work with a network of trusted contractors, ensuring repairs get done quickly. This gives them an edge over companies that may take longer to process claims, making your experience less frustrating.

When you’re shopping for an insurance provider, it’s a good idea to compare their coverage options, pricing, and how they handle claims. Taking the time to research and consider these factors will help you find a provider that meets your needs and gives you peace of mind.

Jeffrey Manola Licensed Insurance Agent

Although State Farm excels in customer service and coverage options, comparing multiple insurers based on factors like pricing and unique features is important. This ensures you find the best coverage for your specific needs at a competitive rate.

Pros and Cons of State Farm’s Animal Damage Coverage

When considering State Farm’s coverage for animal damage, it’s essential to weigh both the benefits and its limitations. A major advantage is that it covers damage caused by household pets, offering peace of mind for pet owners.

However, it may not cover damage from wild animals or pets that aren’t typically considered household pets. To see if this coverage fits your needs, it’s a good idea to review your situation and speak with a State Farm agent for more details.

State Farm home insurance does cover damage caused by household pets; however, there are some limitations that you should be aware of. It’s essential to have a clear understanding of your policy and to contact your insurance provider if you have any questions or concerns.

By comprehensively understanding your home insurance coverage, including how it addresses animal damage, you can ensure that you have the necessary protection for your property.

Read More:

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

State Farm: Comprehensive Protection Against Animal Damage

When it comes to protecting your home, State Farm goes above and beyond basic insurance. They offer you peace of mind with policies that you can customize to fit your needs. Plus, their team is always ready to lend a hand when you need support. With comprehensive coverage and flexible add-ons, State Farm truly stands out as a reliable choice for homeowners.

They care about your satisfaction, making sure you feel secure in your protection against unexpected events like animal damage. Explore the best homeowners insurance options for safeguarding your property.

Comparing options ensures you find the perfect fit for your needs that will give you confidence in every corner of your property. Enter your ZIP code below to see more coverage options and secure the protection your home deserves.

Frequently Asked Questions

Does State Farm home insurance cover animal damage?

Does State Farm cover animal damage? Yes, State Farm home insurance typically covers animal damage. However, coverage may vary depending on the specific policy and the circumstances of the damage. It is recommended to review your policy or contact State Farm directly for more information.

What types of animal damage does State Farm home insurance cover?

State Farm home insurance generally covers damage caused by domestic animals, such as dogs or cats. It may also cover damage caused by wildlife, such as raccoons or squirrels. However, coverage for certain types of animals or specific damages may vary, so it’s important to consult your policy or contact State Farm for clarification.

To find out how animal damage is covered under your specific policy, enter your ZIP code below for personalized details and coverage options.

Are there any exclusions to animal damage coverage in State Farm home insurance?

There are specific exclusions to animal damage coverage in State Farm home insurance. Common exclusions include damage caused by pests like termites or bedbugs. Additionally, intentional damage inflicted by the homeowner’s pets may also be excluded.

For those with pets, especially show or sporting animals, read our article “Pet Insurance for Sporting and Show Animals.

Does State Farm home insurance cover damage caused by wild animals?

Yes, State Farm homeowners insurance may cover damage from wild animals like raccoons, squirrels, or birds. However, coverage can vary, so it’s best to review your policy or contact State Farm for details.

What should I do if my property is damaged by an animal?

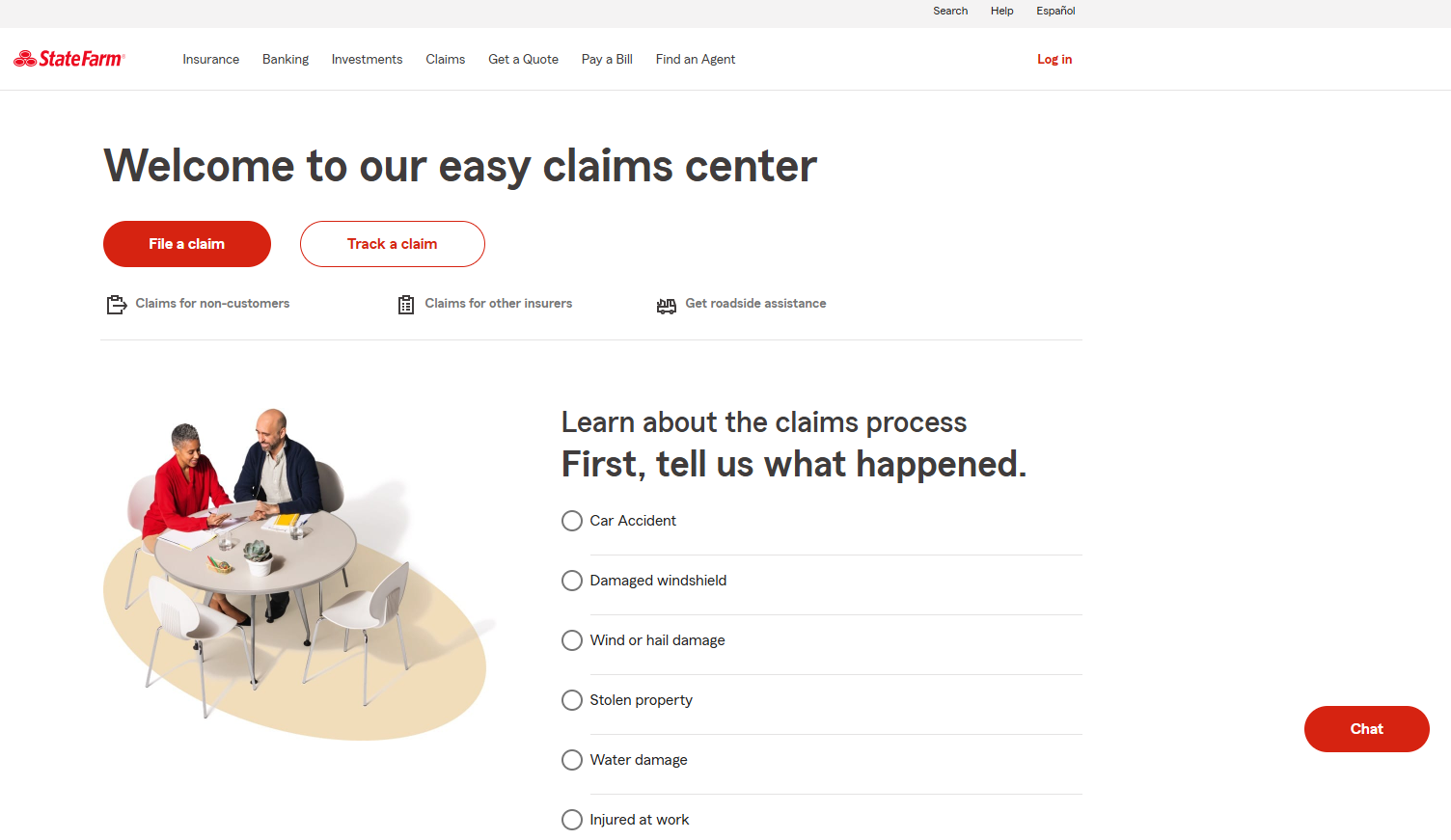

If an animal damages your property, act quickly to minimize further issues and ensure safety. Document the damage with photos or videos, then contact State Farm to report the incident and begin the claims process. They will guide you through the next steps.

Does State Farm home insurance cover rodent damage?

State Farm home insurance typically covers damage caused by rodents like mice or rats, such as chewed wires or structural damage. However, coverage may vary, so it’s advisable to review your policy or contact State Farm for clarification. Learn how to file a home insurance claim to ensure a smooth process.

Does State Farm homeowners insurance cover raccoon damage?

Does home insurance cover raccoon damage? State Farm homeowners insurance may cover damage caused by raccoons, such as holes in walls or damage to property. However, coverage specifics can vary by policy, so it’s essential to review your coverage details.

Does homeowners insurance cover raccoon damage?

Homeowners insurance from various providers may cover raccoon damage, including damage to structures or personal property. However, coverage can differ, so it’s essential to check your policy for details. For more information on how filing a claim can affect your premiums, read our article “Does State Farm homeowners insurance go up after a claim?”

Does home insurance cover wildlife damage?

Home insurance often covers damage caused by wildlife, such as raccoons, squirrels, or birds. This can include damage to structures, personal property, or landscaping. However, coverage may vary, so it’s essential to review your policy.

Is woodpecker damage covered by insurance?

Does homeowners insurance cover woodpecker damage? Woodpecker damage may be covered by home insurance if it causes damage to the structure of your home, such as siding or roofing. However, coverage specifics can vary, so it’s advisable to review your policy or consult with your insurance provider.

Does homeowners insurance cover squirrel damage?

Does home insurance cover animal damage?

Does State Farm homeowners insurance cover animal damage?

Does State Farm renters insurance cover pet damage?

Does State Farm car insurance cover rodent damage?

Does home insurance cover raccoon removal and damage replacement?

Does State Farm insurance cover termite damage?

What does State Farm homeowners insurance not cover?

Does State Farm cover rodent damage to cars?

Does State Farm homeowners insurance cover bat removal?

Does State Farm cover structural damage?

Does State Farm homeowners insurance cover landscaping?

Does State Farm homeowners insurance cover dog bites?

Does homeowners insurance cover bird damage?

Does State Farm home insurance cover mold?

Does State Farm renters insurance cover mold?

Does State Farm homeowners insurance cover asbestos?

Does State Farm homeowners insurance cover AC units?

Does State Farm homeowners insurance cover foundation repair?

Does insurance cover animal damage to the roof?

Does State Farm home insurance cover vandalism?

Does State Farm homeowners insurance cover fire?

Does State Farm homeowners insurance cover tornado damage?

Does State Farm cover mouse damage?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.