Does State Farm home insurance cover septic tanks? (2026 Coverage Details)

Does State Farm home insurance cover septic tanks? State Farm covers septic tank damages caused by covered perils like fire or storms. Add-ons like service line coverage or a $150 premium protection plan extend State Farm coverage to septic repairs. Check policy limits and exclusions for complete protection.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. Through her years working in th...

Melanie Musson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated January 2025

Does State Farm home insurance cover septic tanks? Yes, but only for damages caused by covered perils such as storms or fire, not for wear and tear or neglect.

This article covers what standard policies include, key limitations, and optional $150 service line endorsements to enhance septic system protection. Learn how to safeguard your home and avoid costly repairs with the right coverage options.

Protect your home with confidence. Use our free quote comparison tool to find a reputable company offering the comprehensive coverage you need at low rates.

- State Farm covers septic tank damage caused by storms, fire, or other covered perils

- Optional $150 service line coverage extends protection for septic system repairs

- Learn to identify policy limits and add-ons to fully protect your septic system

Home Insurance Costs and Septic Tank Coverage Options Simplified

Home insurance provides financial protection against risks and perils that may affect your home, covering property damage and liability. Property damage coverage protects your home and belongings from covered events like fires or storms, while liability insurance coverage shields you from lawsuits and claims for injuries or property damage caused by you or your family.

Designed to safeguard homeowners from financial loss, home insurance includes various sections: dwelling coverage for your home’s structure, personal property coverage for belongings, other structures coverage for detached buildings, loss of use coverage for living expenses if your home is uninhabitable, personal liability protection, and medical payments to others.

Homeowners Insurance Monthly Costs and Coverage Options for Septic Tanks

| Coverage | Cost | Deductible | Limit | Features |

|---|---|---|---|---|

| Standard Home Insurance | $100 | $1,000 | $100,000 | Basic coverage for damages |

| Septic Tank Endorsement | $30 | $1,000 | $25,000 | Covers tank-specific repairs |

| Sewer Backup Rider | $50 | $500 | $15,000 | Protects against water damage |

| Comprehensive Water | $70 | $1,000 | $50,000 | Broad water damage coverage |

| Premium Protection Plan | $150 | $2,000 | $250,000 | Extensive coverage with extras |

Explore monthly homeowners insurance costs and septic tank coverage options, from basic plans starting at $100 to comprehensive $150 premium plans. Compare coverage limits, deductibles, and features like septic tank repairs, sewer backup protection, and water damage add-ons to safeguard your home effectively.

Understanding home insurance costs and septic tank coverage options ensures you’re prepared for unexpected expenses. Review your policy and explore add-ons to secure the protection you need.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comprehensive Guide to Septic Tank Insurance and Home Systems Protection With State Farm

When it comes to home insurance, many Michigan homeowners are considering options like plastic septic tanks for durability and cost-effectiveness. State Farm home system protection can help cover critical systems like plumbing and HVAC, and even sinkhole coverage is available in areas prone to ground shifts.

Some homeowners may also explore sump pump failure insurance under State Farm’s policies, which is highly rated in State Farm reviews. For added protection, well and septic insurance can be an essential addition, as septic tank repairs and maintenance are typically not covered under standard homeowner’s insurance.

State Farm home systems protection provides a home systems protection endorsement that helps cover unexpected breakdowns, with State Farm home systems protection reviews generally noting its value in safeguarding systems that can be costly to repair or replace.

Programs like septic insurance or specialized septic maintenance insurance can help offset the cost of repairs, and a septic tank insurance policy can be a wise investment for those with aging or complex septic systems. Some homeowners also refer to Septic Masters reviews for suggestions on contractors and services that enhance their septic coverage.

Septic Masters is a company for septic services, offering expert solutions for septic system maintenance and repairs. For additional protection, you can also consider State Farm home systems protection, which covers essential home systems like plumbing and HVAC, helping prevent costly repairs.

Additionally, septic tank insurance claims can help cover damage from external causes, and septic design insurance ensures your system is protected from installation-related issues. Finally, a home warranty that covers septic systems can be an alternative to traditional insurance for those who want to ensure comprehensive coverage for their septic tank.

Essential Home Insurance Coverage: Key Protections Every Homeowner Should Know

The specific coverage and exclusions of best homeowners insurance can vary depending on the insurance provider and policy. However, there are common areas that most home insurance policies cover.

- Dwelling Coverage: Typically protects the structure of your home, including the walls, roof, floors, and attached structures like garages or sheds. This coverage ensures that if your home is damaged or destroyed by a covered peril, such as a fire or a severe storm, you will be able to repair or rebuild it.

- Personal Property Coverage: Helps replace or repair your belongings, such as furniture, electronics, clothing, and appliances, if they are damaged or destroyed by covered perils. Whether it’s a burst pipe causing water damage to your electronics or a burglary resulting in the loss of your valuable items, personal property coverage ensures that you can recover financially.

- Other Structures Coverage: Typically covers structures on your property that are not attached to your house, such as fences, detached garages, or guesthouses. This coverage ensures that if these structures are damaged or destroyed by covered perils, you can repair or rebuild them without incurring significant financial loss.

- Personal Liability Protection: Covers you for legal expenses and damages if someone is injured or their property is damaged due to your negligence or that of your family members. Accidents can happen, and if you are found legally responsible for someone else’s injuries or property damage, personal liability protection ensures that you are financially protected and can cover the associated costs.

- Medical Payments: Coverage is designed to cover medical expenses for guests who are accidentally injured on your property, regardless of who is at fault. Whether it’s a slip and fall accident or a dog bite, this coverage ensures that if someone sustains an injury on your property, their medical expenses are taken care of, reducing the risk of lawsuits and potential financial strain.

A comprehensive home insurance policy is crucial for safeguarding your most valuable asset and securing your financial well-being. It can cover various aspects, including State Farm service line coverage and septic issues covered by insurance.

Ty Stewart Licensed Insurance Agent

It’s important to review and understand the specific coverage and exclusions of your policy to ensure that you have adequate protection against the risks and perils that you may face as a homeowner.

State Farm Homeowners Insurance: Monthly Rates for Septic Tank Coverage by State

When considering homeowners insurance, it’s important to understand the additional coverage options available, such as septic tanks protection. State Farm offers varying rates for septic tank coverage depending on your state. This guide provides an overview of the monthly rates for this specific coverage, helping you make more informed decisions about your homeowners insurance policy.

Explore State Farm’s homeowners insurance monthly rates for septic tanks coverage across various states. The rates vary depending on your location, ranging from $15 in Alabama to $40 in Wyoming. Review the pricing for your state to better understand the costs associated with septic tank coverage and make informed decisions about your homeowners insurance.

State Farm Homeowners Insurance Monthly Rates for Septic Tanks Coverage by State

| State | Rates |

|---|---|

| Alabama | $15 |

| Alaska | $16 |

| Arizona | $16 |

| Arkansas | $17 |

| California | $17 |

| Colorado | $18 |

| Connecticut | $18 |

| Delaware | $19 |

| Florida | $19 |

| Georgia | $20 |

| Hawaii | $20 |

| Idaho | $21 |

| Illinois | $21 |

| Indiana | $22 |

| Iowa | $22 |

| Kansas | $23 |

| Kentucky | $23 |

| Louisiana | $24 |

| Maine | $24 |

| Maryland | $25 |

| Massachusetts | $25 |

| Michigan | $26 |

| Minnesota | $26 |

| Mississippi | $27 |

| Missouri | $27 |

| Montana | $28 |

| Nebraska | $28 |

| Nevada | $29 |

| New Hampshire | $29 |

| New Jersey | $30 |

| New Mexico | $30 |

| New York | $31 |

| North Carolina | $31 |

| North Dakota | $32 |

| Ohio | $32 |

| Oklahoma | $33 |

| Oregon | $33 |

| Pennsylvania | $34 |

| Rhode Island | $34 |

| South Carolina | $35 |

| South Dakota | $35 |

| Tennessee | $36 |

| Texas | $36 |

| Utah | $37 |

| Vermont | $37 |

| Virginia | $38 |

| Washington | $38 |

| West Virginia | $39 |

| Wisconsin | $39 |

| Wyoming | $40 |

Understanding State Farm’s monthly rates for septic tank coverage in your state helps you prepare for potential repairs. Consider replacement cost homeowners insurance for full protection. Explore your options to secure the right coverage.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Comparing State Farm’s Coverage to Other Insurers

When considering septic tank coverage, it is beneficial to compare State Farm’s offerings with those of other insurance providers. Different insurers may have different policies and coverage options available.

How Other Insurers Handle Septic Tanks

Some insurance providers offer enhanced coverage options specifically tailored for septic tanks. These policies may cover repairs, replacements, or damage resulting from wear and tear, age, or gradual deterioration. It is worthwhile to research and compare the coverage offered by various insurers to find the policy that best meets your needs.

Choosing the Right Insurance for Your Needs

When choosing insurance, it’s important to review all coverage options, not just septic tank protection. Consider the insurer’s reputation, customer satisfaction, and financial stability. A.M. Best ratings explained can help evaluate an insurer’s financial strength. State Farm offers a broad range of insurance products and a solid reputation, making it a good choice for homeowners.

Compare septic tank coverage from different insurers, as some offer more comprehensive options, while State Farm covers damage from specific perils like storms and fire.

State Farm may cover septic tanks under certain conditions. Be sure to review your policy and consult with an agent to understand your coverage fully, ensuring comprehensive protection for your home and its components.

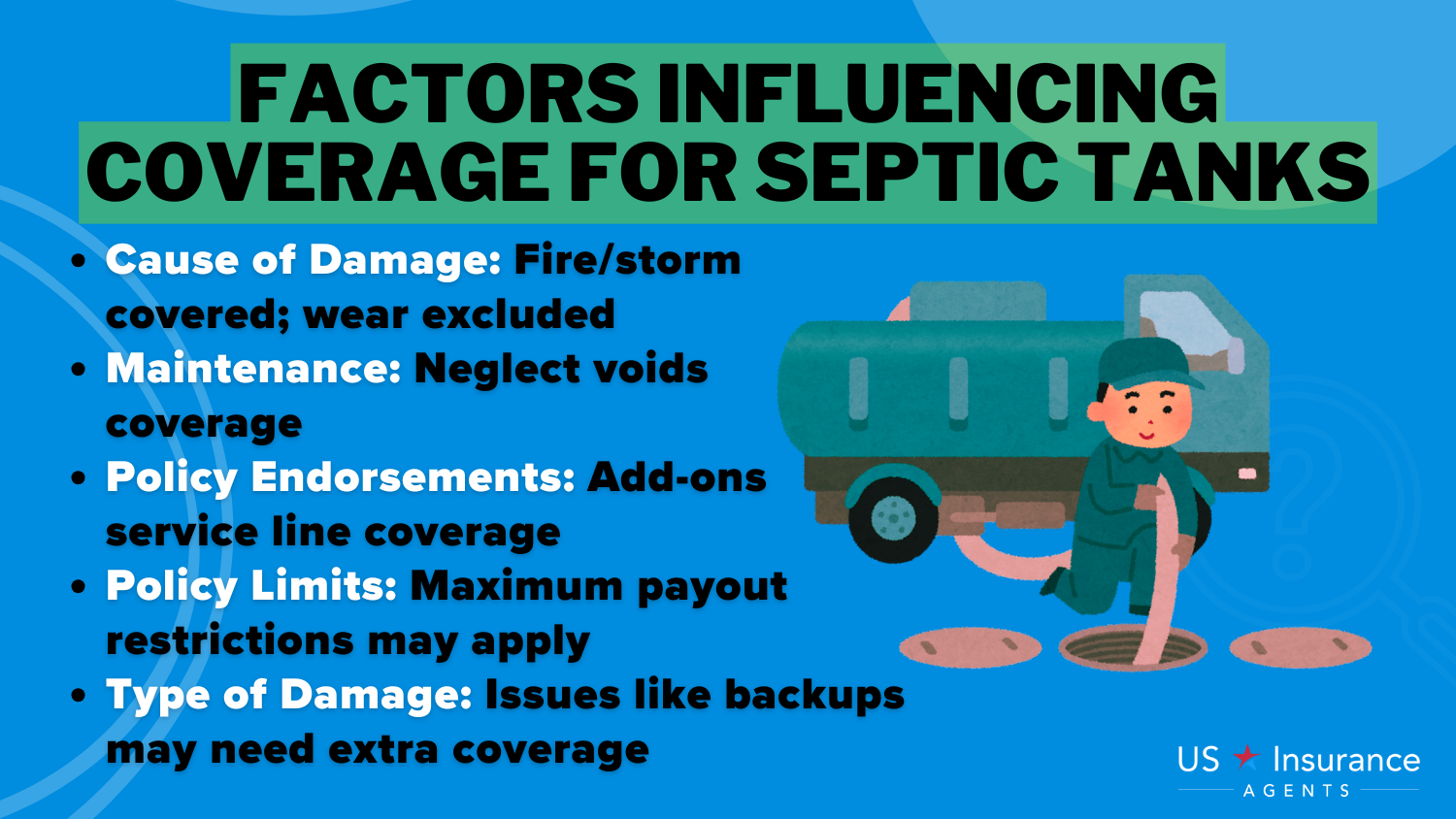

Factors Influencing Septic Tank Coverage in Homeowners Insurance

Several factors affect septic tank coverage in homeowners insurance, with damage from fire, storms, or natural disasters typically covered. Damage from wear and tear or neglect is usually excluded. How to document damage for homeowners insurance claims is important for a smooth claims process.

Maintenance is also a critical factor, as failing to regularly maintain the septic tank can void coverage. Additionally, homeowners may have the option to add endorsements, such as service line coverage, to extend protection for septic tanks. Policy limits are another consideration, as insurance policies often set a maximum payout for septic tank repairs or replacements.

Finally, the type of damage, such as backups or sewage-related issues, may require additional coverage or specialized endorsements to ensure full protection. Understanding these factors is essential for homeowners when reviewing their septic tank coverage options.

Affordable Septic Tank Coverage With State Farm Home Insurance

State Farm home insurance generally covers septic tanks for damage caused by covered perils such as fire, storms, and vandalism, including thunderstorm and severe weather homeowners insurance. However, it does not cover wear and tear, neglect, or maintenance-related issues.

To enhance coverage, you can add options like service line protection or a premium plan that includes septic repairs. Always review your policy for specific limits, exclusions, and the availability of additional coverage for septic backups or failures.

Protecting one of your most valuable assets doesn’t need to be expensive. Enter your ZIP code into our free comparison tool to find the cheapest home insurance rates.

Frequently Asked Questions

Are septic systems covered by homeowners insurance?

Standard homeowners insurance generally does not cover septic systems, especially for issues like wear and tear. However, some insurers may offer additional coverage options or endorsements.

Does home insurance cover septic tank replacement?

Most home insurance policies do not cover septic tank replacement unless the damage is caused by a covered peril, such as fire or storm damage. If you’re looking to protect your most valuable asset with home insurance, compare rates now with our free quote tool.

Does State Farm homeowners insurance cover septic systems?

State Farm homeowners insurance typically covers septic systems if they are damaged due to covered perils, such as fire, storms, or vandalism. However, wear and tear or neglect is usually not covered. Tropical storm homeowners insurance may provide additional protection if septic system damage is caused by a tropical storm or similar event.

Does home warranty cover septic?

Some home warranty plans may offer coverage for septic systems, including repairs and maintenance. It’s important to check the specifics of your home warranty policy.

Does homeowners insurance cover failed septic systems?

Homeowners insurance typically does not cover septic system failures unless caused by a covered peril. Maintenance issues and gradual wear and tear are usually excluded.

Does Allstate homeowners insurance cover septic systems?

Allstate insurance review & ratings may offer coverage for septic systems under certain conditions, typically covering damage caused by covered perils like fire or windstorms. Review your specific policy for details.

Does homeowners insurance cover drain fields?

Drain fields, part of the septic system, are typically not covered under standard homeowners insurance policies unless damage is caused by a covered peril.

Does homeowners insurance cover leach fields?

Leach fields are generally not covered by homeowners insurance. However, some additional coverage options may be available through endorsements for septic system protection.

What does State Farm home insurance cover?

State Farm home insurance covers damage to the structure of your home, personal injury protection, liability protection, and additional living expenses if your home becomes uninhabitable due to a covered event.

Does homeowners insurance cover septic backup?

Septic backup may be covered under certain conditions, depending on the cause. Many homeowners policies do not include septic backup unless an additional endorsement, like sewer backup coverage, is added.

Does homeowners insurance cover septic fields?

Does AIG offer enhanced public housing contents insurance?

Does homeowners insurance cover septic problems?

Does homeowners insurance cover septic tank collapse?

Can I add a rider on State Farm renters insurance for clothing?

Are septic tanks covered by homeowners insurance?

What is covered under Farmers septic tank service insurance?

What is septic tank indemnity insurance?

Does Allied Cesspool provide septic tank services?

Does AAA offer dependable cesspool insurance coverage?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.