Does State Farm homeowners insurance cover wood stoves? (2026 Coverage Answers)

Does State Farm homeowners insurance cover wood stoves? Yes, State Farm covers wood stoves with proper installation and safety measures. A wood stove liability add-on is available for $15/month. Ensure building code compliance and regular maintenance to maintain coverage for fire risks, liability, and damage.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Published Insurance Expert

Melanie Musson is the fourth generation in her family to work in the insurance industry. She grew up with insurance talk as part of her everyday conversation and has studied to gain an in-depth knowledge of state-specific insurance laws and dynamics as well as a broad understanding of how insurance fits into every person’s life, from budgets to coverage levels. Through her years working in th...

Melanie Musson

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Michael Vereecke

Updated January 2025

Does State Farm homeowners insurance cover wood stoves? Yes, State Farm homeowners insurance does cover wood stoves, but specific conditions apply. To ensure coverage, your wood stove must be installed by a licensed professional and comply with local building codes.

Regular maintenance and safety features, like heat shields, may be required. This article explains how to secure coverage, ensure compliance, and add wood stove liability for $15/month.

Make sure your home is protected by entering your ZIP code into our home insurance comparison tool above today.

- State Farm covers wood stoves with proper installation and safety features

- Ensure compliance with building codes and regular maintenance for full coverage

- Add wood stove liability for $15/month to protect against fire risks and damages

Homeowners Insurance for Wood Stoves: Costs and Coverage Options

Homeowners insurance is a type of insurance policy that provides financial protection for your home and its contents in case of damage, theft, or other covered events. It offers peace of mind knowing that you have a safety net in place to help you recover from unexpected incidents that could otherwise lead to significant financial loss.

Homeowners insurance is a contract where you pay premiums for coverage on your home and belongings in case of covered events. While not legally required, it’s highly recommended to protect against costly repairs, replacements, and legal liabilities, including situations like furnace or appliance coverage.

Homeowners Insurance Monthly Costs and Coverage Options for Wood Stoves

| Coverage Option | Monthly Cost | Deductible | Coverage Limit | Included Features |

|---|---|---|---|---|

| Basic Fire Protection | $45 | $1,000 | $100,000 | Covers fire damage caused by stoves |

| Comprehensive Coverage | $85 | $500 | $250,000 | Fire, smoke, and property damage |

| Wood Stove Liability Add-On | $15 | $250 | $50,000 | Stove-related liability coverage |

| Enhanced Appliance Coverage | $60 | $750 | $150,000 | Fire, appliance replacement |

| Total Home Protection | $120 | $1,000 | $300,000 | Fire, theft, water damage |

Explore monthly costs and coverage options for homeowners insurance that includes wood stoves. Comprehensive coverage options range from basic fire protection at $45 per month to total home protection for $120, with varying deductibles and coverage limits tailored to your needs.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

State Farm Homeowners Insurance: Monthly Rates for Wood Stove Coverage by State

When it comes to protecting your home from wood stove damage, State Farm homeowners insurance offers varying monthly rates depending on your location. Rates for wood stove coverage differ across states, with significant differences that can affect your premiums. How does the insurance company determine my premium?

Factors such as your home’s location, the condition of your wood stove, and local fire regulations can all influence your premium rate. State Farm homeowners insurance monthly rates for coverage on wood stove damage vary by state. For instance, Alabama residents can expect rates around $75, while those in California may pay up to $120.

| State | Monthly Rate for Cover Wood Stoves Damage Coverage |

|---|---|

| Alabama | $75 |

| California | $120 |

| Florida | $95 |

| New York | $110 |

| Texas | $85 |

| Illinois | $80 |

| Georgia | $90 |

| Pennsylvania | $100 |

| Arizona | $105 |

| Washington | $115 |

Other states like Florida, New York, and Texas have rates ranging from $85 to $110. Rates for wood stove coverage also differ in Illinois, Georgia, Pennsylvania, Arizona, and Washington, with monthly payments ranging from $80 to $115.

Be sure to compare State Farm homeowners insurance rates for wood stove coverage in your state to find the best option for your needs. Start comparing rates today and secure the protection your home deserves.

Comprehensive Homeowners Insurance Coverage With State Farm

Homeowners insurance typically covers your home’s structure, personal belongings, liability insurance, and additional living expenses. State Farm’s policy includes coverage for other structures like garages and sheds, termite damage, and personal property loss from theft, ensuring comprehensive protection for your home and possessions.

Liability coverage safeguards you against legal fees and medical costs in case of injuries or lawsuits stemming from incidents on your property. Being ready for unforeseen accidents, such as slips or dog bites, is crucial.

With State Farm life insurance and wood stove coverage, you’re protected against legal, medical, and living expenses if your home becomes uninhabitable. Regularly reviewing your homeowners insurance ensures it meets your needs and provides peace of mind.

Customizable Coverage and Enhanced Protection with State Farm Homeowners Insurance

State Farm homeowners insurance offers comprehensive coverage, including protection for your home, belongings, liability, and additional living expenses. It also covers other structures on your property and allows for customizable options, such as high-value item coverage, identity theft, and earthquake protection.

How social media could impact your insurance is also an important factor to consider, as your online presence may influence your coverage and premiums. With exceptional 24/7 claims service, State Farm ensures a smooth claims process to support you during difficult times.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ensuring Safety and Insurance Coverage for Wood Stoves

Wood stoves provide warmth and ambiance, but they also pose risks, primarily the potential for fires due to improper use or maintenance. Regular cleaning, proper installation, and safe operation are crucial to minimizing fire hazards. Never leave a wood stove unattended to ensure safety and prevent accidents.

Michelle Robbins Licensed Insurance Agent

Due to the fire risks associated with wood stoves, insurance companies may have varying requirements for coverage. They often require safety features like heat shields or spark arrestors, professional installation, and regular inspections to ensure proper operation.

Homeowners should review their insurance policies and consult with providers to ensure adequate coverage and compliance with safety standards. For homes with wood stoves, it’s also crucial to review policies for fire protection and liability, which can be added for a fee.

Additionally, homeowners operating a business from their residence should consider home-based business insurance to protect against potential risks associated with running a business at home.

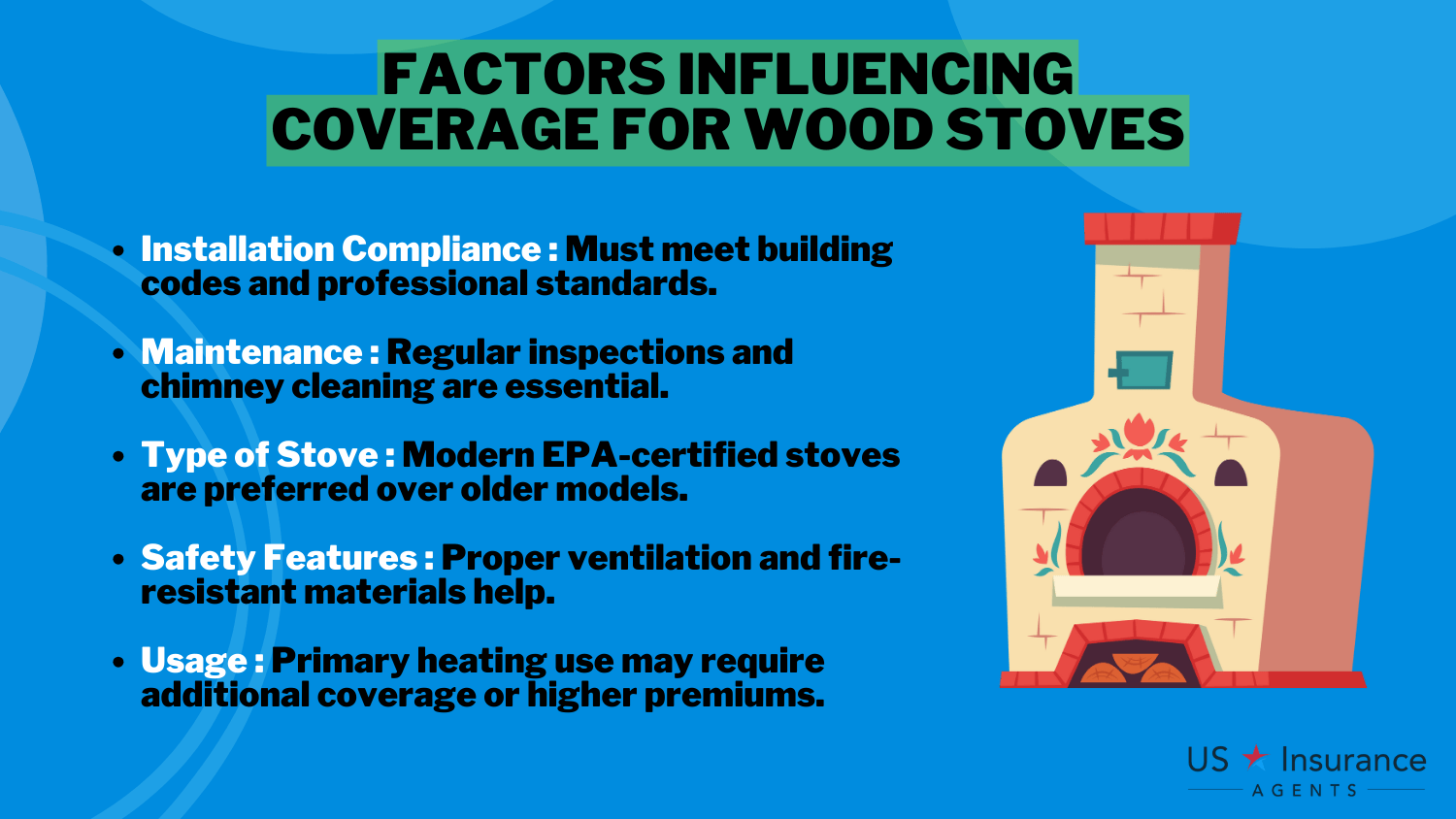

Factors That Influence Coverage for Wood Stoves

Factors that may influence coverage for wood stoves include the age and condition of the stove, the type of installation, and compliance with safety regulations. It is essential to communicate with your State Farm insurance agent to understand the specific requirements and conditions for coverage, including any potential home and car insurance discounts that may apply.

The age and condition of the wood stove can impact coverage. Older stoves may be more prone to malfunctions or may not meet current safety standards. State Farm may have specific guidelines regarding the maximum age of the stove or requirements for regular maintenance to ensure that it remains in good working condition.

The type of wood stove installation impacts coverage, with freestanding stoves having different requirements than those installed in fireplaces. Compliance with safety regulations, such as proper ventilation and clearance from combustibles, is essential for eligibility. By meeting State Farm’s requirements, homeowners can enjoy wood stove benefits with peace of mind, knowing they’re covered.

If you have a wood burning stove in a detached garage or mobile home, it’s essential to understand the insurance requirements associated with it. Insurance providers like State Farm may have specific stipulations, such as mandatory wood stove inspections for insurance coverage.

If you’re seeking a pellet stove installer, you may want to search for “pellet stove installers near me” to ensure the proper installation. For more details on coverage, visit “My StateFarm” or inquire about specific coverage options like termite protection, as State Farm typically does not cover termite damage.

Other insurance companies, such as Allstate, may also offer coverage for homes with wood stoves, but the specifics of the policy can vary.

Essential Safety Steps and Communication With State Farm

To ensure your wood stove is covered by State Farm homeowners insurance, follow safety measures, install properly, and keep your provider updated. State Farm insurance review & ratings offer insights into coverage and service.

When installing a wood stove in a mobile home, it’s important to check whether your policy covers it, as some providers, like State Farm, offer coverage options tailored for homes with wood stoves. Additionally, State Farm provides coverage for other structures, which can include detached garages or sheds.

Safety Measures for Wood Stove Owners

To ensure your wood stove is covered by State Farm homeowners insurance, there are several steps you can take. Firstly, have your wood stove installed by a licensed professional who will follow building codes and regulations.

To ensure coverage for your wood stove, have it professionally installed, maintain it regularly, and inform your agent of any changes. Following safety standards and considering additional coverage for wood furnaces will help protect your property.

Regularly inspect and maintain the stove, including cleaning the chimney, replacing any damaged parts, and using proper fuel. It is also important to communicate any changes or updates to your wood stove with your insurance agent. Your insurance agent’s role in the claims process is essential, as they can provide guidance on coverage options and help facilitate the claims if any issues arise.

State Farm insurance has specific wood stove requirements to ensure coverage under its wood stove policy. When installing a wood stove in a garage, it’s crucial to meet the safety standards set by State Farm to avoid any complications with your insurance.

If you add on a wood furnace, your insurance policy may cover it, but this will come with additional requirements for proper installation and maintenance. To find the best-rated State Farm agent near me, it’s a good idea to consult local reviews or ask for referrals.

Communicating With Your Insurance Provider

Communicate with your insurance provider about your wood stove, providing documentation of professional installation and maintenance. Keep records of inspections, cleaning, and repairs, and promptly report any updates. Additionally, if you operate a cleaning service, make sure to discuss cleaning service business insurance to ensure your business is properly covered.

By following safety guidelines and maintaining clear communication with your insurance provider, you can ensure that your wood stove is fully covered under your State Farm homeowners insurance policy. Keep your stove in good condition, stay informed, and enjoy the warmth and comfort it provides without worry.

For those seeking cheap safety clothing for wood burning, there are many affordable options to ensure you stay protected while handling the stove. A house insurance with wood stove typically covers fire risks and potential damage, but you must comply with installation guidelines.

State Farm also offers appliance insurance, which could include protection for items like wood burner covers. If you own a wood burning stove, ensure that your home insurance includes this feature by discussing it with your agent to secure comprehensive coverage.

Free Home Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Everything You Need to Know About Wood Stove Coverage With State Farm

State Farm homeowners insurance generally covers wood stoves, provided they are professionally installed and meet safety standards. Coverage includes protection against fire risks and potential damage, with the option to add liability coverage for $15/month. Additionally, mobile home insurance policies may offer similar coverage for wood stoves, depending on the terms and conditions.

Rates vary by state, typically ranging from $75 to $120 per month, depending on location and policy specifics. Regular maintenance and compliance with building codes are crucial to maintaining coverage. Always consult your State Farm agent to confirm coverage details for your wood stove.

Your home deserves adequate protection. If you’re looking for home insurance coverage that won’t break your budget, enter your ZIP code into our quote comparison tool below to get started.

Frequently Asked Questions

Does State Farm allow wood stoves?

Yes, State Farm allows wood stoves in homeowners insurance policies, provided they are professionally installed and meet local safety codes.

Does home insurance cover stove fires?

Stove fires are typically covered by homeowners insurance, as long as the fire results from a covered peril and the stove is properly maintained.

Does a fireplace increase home insurance?

A fireplace may lead to higher premiums because of the potential fire risk, but safety precautions like regular chimney cleaning can help reduce costs. Home fire safety guides and educational resources can further assist in minimizing fire hazards and ensuring proper safety measures are in place.

Do log burners affect house insurance?

Log burners may increase your home insurance premiums due to the added fire risk, but proper installation and maintenance can help mitigate the impact. Avoid overpaying for your home insurance by entering your ZIP code below into our free comparison tool to see the lowest rates in your neighborhood.

Do pellet stoves raise insurance rates?

Installing a pellet stove can raise insurance premiums because of the increased fire hazard, though rates depend on installation and safety compliance.

Does homeowners insurance cover wood stoves?

Yes, homeowners insurance generally covers wood stoves, provided they are installed according to building codes and maintained properly. For more details, you can check out the builders insurance group insurance review & ratings.

Does a wood burning stove increase insurance?

A wood burning stove can increase your home insurance premiums due to the potential for fire damage, but coverage can be adjusted with safety measures.

Does having a fireplace affect insurance?

Yes, having a fireplace may affect your home insurance by raising premiums, primarily due to the higher risk of fire.

Does Progressive home insurance cover AC units?

Progressive homeowners insurance typically covers AC units if they are damaged by a covered event, such as fire or wind. For more detailed information on coverage options and customer experiences, check out the Progressive insurance review & ratings.

Does State Farm home insurance cover furnaces?

State Farm home insurance may cover furnace damage if the cause of the damage is a covered peril under your policy.

Does State Farm homeowners insurance cover AC units?

Does State Farm insurance cover termite damage?

Does State Farm homeowners insurance cover fire?

How much does a wood fireplace increase insurance?

Does State Farm insure homes in Florida?

What insurance companies cover wood stoves?

Will a pellet stove increase homeowners insurance?

Does State Farm insure manufactured homes?

Does Geico home insurance cover wood stoves?

Does Nationwide insurance cover wood stoves?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.