Guardian Life vs. MassMututal Life Insurance for 2026 (Best Value Revealed)

With rates starting as low as $18 per month, deciding between MassMutual vs. Guardian Life life insurance can be difficult. Both companies offer similar policy types, though MassMutual offers variable universal plans. However, Guardian Life is a better choice if you need no medical exam insurance.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Dani Best

Updated August 2025

0 reviews

0 reviewsCompany Facts

Term Policy

A.M. Best

Complaint Level

Pros & Cons

0 reviews

0 reviews 0 reviews

0 reviewsCompany Facts

Term Policy

A.M. Best

Complaint Level

Pros & Cons

0 reviews

0 reviewsTrying to decide between Guardian Life vs. MassMutual life insurance? Both companies come highly recommended, so you’ll need a little research to make the best decision.

Deciding between Guardian vs. MassMutual can be difficult because both companies offer many of the same benefits and count as some of the best life insurance companies on the market. For example, both companies offer dividend payouts on certain policies.

However, MassMutual may be a better option if you want to pay less, while Guardian Life has better no-exam types of life insurance.

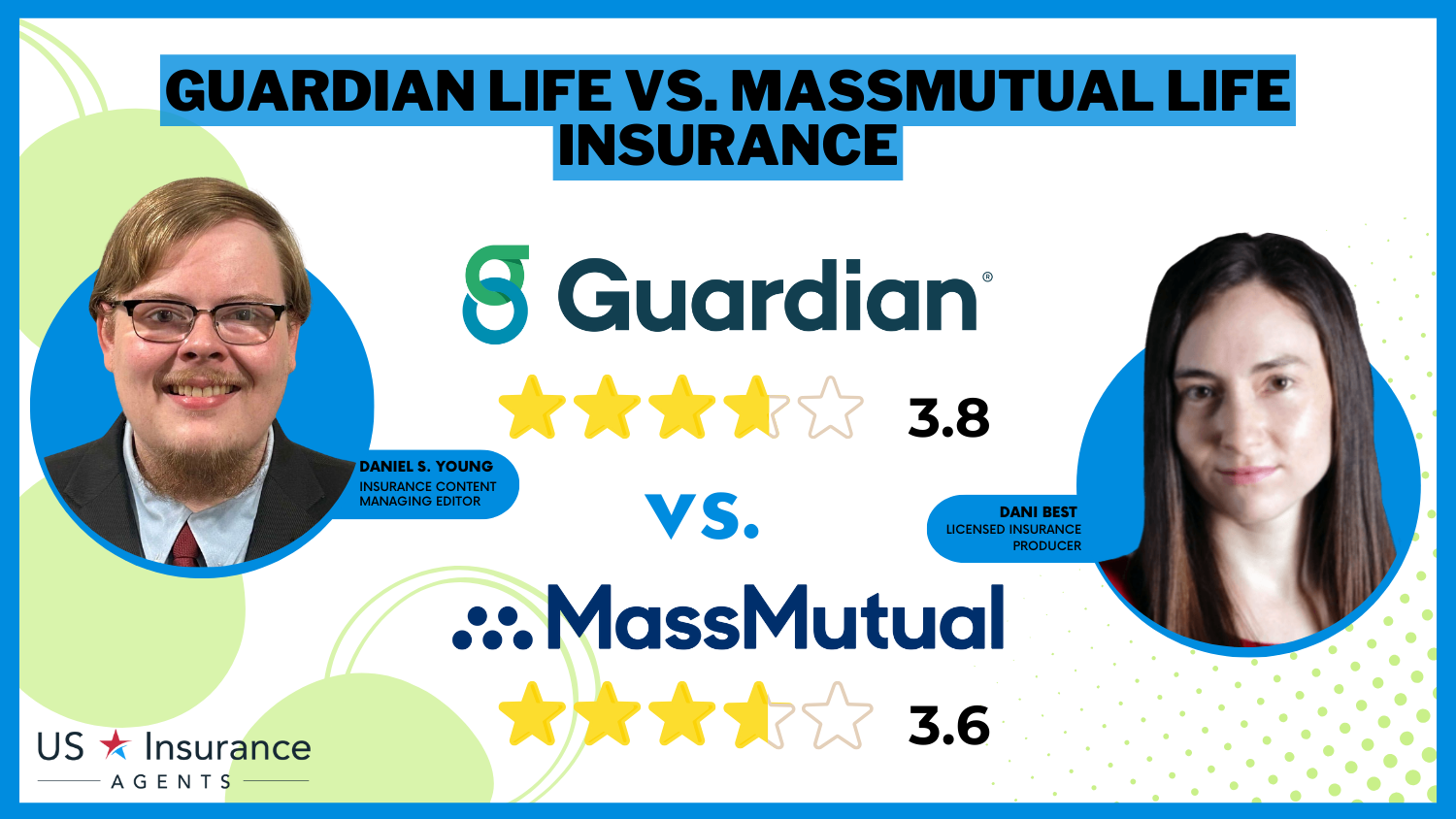

Guardian Life vs. MassMutual Life Insurance Rating

| Rating Criteria | ||

|---|---|---|

| Overall Score | 3.8 | 3.6 |

| Business Reviews | 4.2 | 4.0 |

| Claim Processing | 3.5 | 3.0 |

| Company Reputation | 4.0 | 4.0 |

| Coverage Availability | 4.5 | 5.0 |

| Coverage Value | 3.7 | 3.5 |

| Customer Satisfaction | 3.0 | 2.5 |

| Digital Experience | 3.8 | 4.0 |

| Discounts Available | 4.5 | 5.0 |

| Insurance Cost | 2.8 | 2.6 |

| Plan Personalization | 3.6 | 3.5 |

| Policy Options | 4.2 | 4.5 |

| Savings Potential | 3.6 | 3.4 |

| Guardian Life | MassMutual Review |

Read on to explore our MassMutual vs. Guardian Life review to see which company is right for your life insurance needs. Then, enter your ZIP code into our free life insurance comparison tool to find affordable rates.

- Starting at $18 per month, MassMutual is usually cheaper than Guardian Life

- While both sell similar policies, only MassMutual offers variable universal

- Guardian Life has better choices for no-medical-exam policies

Comparing Costs: Guardian Life vs. MassMututal Life Insurance Rates

One of the most important aspects of life insurance is how much it costs. Generally speaking, MassMutual life insurance quotes are a bit cheaper than Guardian Life. Take a look below to see how much a life insurance policy might cost you based on your age and gender.

Guardian Life vs. MassMutual Term Life Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| Age: 25 Female | $20 | $18 |

| Age: 25 Male | $24 | $22 |

| Age: 35 Female | $26 | $24 |

| Age: 35 Male | $30 | $28 |

| Age: 45 Female | $55 | $50 |

| Age: 45 Male | $65 | $60 |

| Age: 55 Female | $120 | $110 |

| Age: 55 Male | $140 | $130 |

The amount of coverage you need also plays an important factor in your monthly premium, with higher coverage levels meaning higher rates. Compare Guardian Life and MassMutual rates for a variety of coverage limits below.

Life Insurance Monthly Cost by Coverage Amount: Guardian Life vs. MassMutual

| Coverage Amount | ||

|---|---|---|

| $50,000 | $25 | $28 |

| $100,000 | $45 | $50 |

| $250,000 | $80 | $85 |

| $500,000 | $150 | $160 |

| $1,000,000 | $280 | $300 |

Like any other type of insurance, there are many factors that determine the price of your life insurance. One of the most important is the type of policy you buy. Both companies sell a variety of policies, with some costing more than others.

Ty Stewart Licensed Insurance Agent

Whether you want the best whole life insurance or affordable term life, the easiest way to find a plan that meets your budget is to compare prices. The good news is that comparing life insurance quotes is simple. MassMutual and Guardian Life offer a quote request form on their websites.

Simply fill out this quote request form to get the process started. If you don’t want to spend the time filling out multiple request forms, try a free online quote comparison tool to see multiple rates at once.

Keep in mind that you may purchase insurance from a company with a slightly different name, depending on where you live. For example, residents in Oregon technically purchase from MassMutual Oregon. For Guardian Life, you may see your policy listed under Guardian Life Insurance Company of America.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Life Insurance Options From Guardian Life and MassMutual

The most basic types of life insurance are whole and term life insurance policies. While there are many types of whole life insurance and term policies, most people will get the coverage they need with either a basic whole or term plan. Your options with MassMutual and Guardian Life include:

- Term Life: MassMutual offers plans starting at $100,000 coverage for people 18 to 75 in terms of 10 to 30 years. Guardian Life sells policies in terms of 10 to 30 years.

- Whole Life: You can purchase whole life from MassMutual from birth to 90, with coverage starting at $25,000. Guardian Life sells a variety of whole life plans but has little information posted online.

MassMutual and Guardian Life also offer universal life insurance.

Guardian Life offers a universal life insurance plan, while MassMutual offers both universal and variable universal policies. MassMutual’s two universal plans are as follows:

- Universal: MassMutual’s universal life insurance can grow in cash value, but you won’t earn dividends. However, your premiums are flexible and you can increase or decrease your death benefitat any time.

- Variable Universal: The variable universal policy offers everything the standard universal plan has, but the accumulated cash value of your plan is invested in stocks. That means the cash value of your policy can change depending on the market.

Universal and variable universal life insurance plans aren’t commonly purchased, and are usually for people looking to use their policy as an investment tool.

Jeffrey Manola Licensed Insurance Agent

On top of the basic types of policies, each company offers a unique policy. Guardian Life offers coverage for HIV-positive patients in good health. MassMutual offers a free plan to low-income parents who want to guarantee their children’s future educational costs.

Guardian Life vs. MassMututal Life Insurance Add-on Options

Most life insurance companies offer add-ons so you can customize your coverage, and that’s true for MassMutual and Guardian Life. Compare your add-on options with MassMutual and Guardian Life below.

Life Insurance Add-Ons for Guardian Life vs. MassMutual

| Add-Ons | ||

|---|---|---|

| Accelerated Death Benefit | ✅ | ✅ |

| Accidental Death Benefit | ✅ | ❌ |

| Guaranteed Insurability | ✅ | ✅ |

| Life Insurance Supplement | ❌ | ✅ |

| Long-Term Care Access | ✅ | ✅ |

| Paid-up Additions | ✅ | ✅ |

| Renewable Term | ✅ | ✅ |

| Waiver of Premium | ✅ | ✅ |

| Yearly Term Purchase | ❌ | ✅ |

Guardian Life offers additional add-ons you won’t find at MassMutual. These include:

- DuoGuard: Your beneficiary will have the option to purchase their own life insurance policy after your death without needing a medical exam.

- Index Participation: Receive a dividend adjustment based on the S&P 500 Index using your paid-up additions.

- Policy Split Options: People with joint life insurance policies will have the option of splitting their plans into two policies in case of divorce.

Understanding which add-ons to purchase can be difficult, especially if it’s your first time buying a plan. Read our Guardian Life life insurance review to explore add-on options.

Guardian Life vs. MassMututal Customer Reviews

Learning about prices and the different types of term life insurance and whole life policies is important in choosing the right company for you. However, you should also look at customer reviews.

To start with MassMutual life insurance reviews, most customers report being satisfied with their service. In fact, the one concern people seem to have is that MassMutual can be pricier than other options, as this Reddit user discusses.

Worth Paying More for MassMutual vs Principal or Lincoln?

byu/luzhinlives inLifeInsurance

This Reddit user’s experience seems to be common, with many life insurance shoppers concerned by the higher prices. While you should always shop within your budget, other Reddit users offered assurance that the higher prices were worth MassMutual’s customer service.

Guardian Life doesn’t get the same glowing reviews that MassMutual receives, but it’s still considered a good choice for more budget-minded shoppers. Most customers appreciate the option of financial services like retirement planning with GLIC.

Whether you’re looking for standard life insurance or want to compare Guardian vs. MassMutual disability insurance, reviews are similar enough that you likely wouldn’t notice too much of a difference.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Guardian Life vs. MassMututal Business Reviews

Third-party rating companies offer excellent insights into the performances of insurance providers and can be extremely helpful in making a decision.

Check below to see how MassMutual and Guardian Life compare with the top third-party rating companies.

Insurance Business Ratings & Consumer Reviews Guardian Life vs. MassMutual

| Agency | ||

|---|---|---|

| Score: 781 / 1,000 Strong customer satisfaction | Score: 741 / 1,000 Solid customer satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 85 / 100 Good customer feedback | Score: 84 / 100 Good customer feedback |

|

| Score: 0.11 Low complaint ratio | Score: 0.12 Low complaint ratio |

|

| Score: A++ Superior Financial Strength | Score: A++ Superior Financial Strength |

As you can see, each company receives excellent ratings, especially in areas like customer complaints and financial stability. However, MassMutual life insurance ratings are a bit higher. See why MassMutual got such high ratings by exploring our MassMutual life insurance review.

Interested in seeing which company sells the most life insurance policies? Check their market shares below.

Despite having higher prices, MassMutual commands more than double the market share of Guardian Life.

Pros and Cons of Guardian Life Insurance

Like MassMutual, Guardian Life has areas where it shines and places where it could improve. Purchasing a Guardian Life policy comes with the following advantages:

- Low Complaints: Most customers seem to enjoy their Guardian Life policies as the company receives fewer complaints than many of its competitors.

- Affordable Rates: While it’s not the cheapest option on the market, Guardian Life is considered an affordable choice for life insurance.

- Unique Coverage Options: Guardian Life is one of the few life insurance companies that offers coverage to HIV-positive applicants.

Guardian Life is a great choice for many people looking for life insurance coverage, but it’s not the best for everyone. Take a look below at the drawbacks of shopping at Guardian Life:

- No Online Purchases: While you can start a free insurance quote online, you’ll need to speak with a Guardian Life representative to purchase a policy.

- Less Transparency: Guardian Life hasn’t posted much information about its life insurance policies online, especially compared to MassMutual.

Using the information above can help you make a quick decision. For example, you’ll know that Guardian Life is an excellent option if you have a positive HIV diagnosis, but may not be the best choice if you want a digital life insurance experience.

Pros and Cons of MassMutual Life Insurance

While an in-depth look at an insurance company is the best way to decide which provider is best for you, looking at pros and cons can give you some quick information. When you shop at MassMutual, you’ll get access to the following pros:

- Excellent Customer Service: MassMutual customer service has a reputation for being helpful, friendly, and efficient.

- Online Claims: Beneficiaries can file a MassMutual life insurance claim online in most cases.

- Wide Variety of Coverage Options: MassMutual has term, whole, universal, and variable universal life insurance, including one of the best 10-year term life insurance policies on the market.

Like any other insurance company, MassMutual isn’t perfect. A MassMutual policy comes with the following disadvantages:

- Medical Exams: Most MassMutual policies require a medical exam or interview before you can purchase a plan.

- Higher Rates: While MassMutual rates start low, only people in the highest rating will see those prices. MassMutual rates for everyone else can be a bit higher than the national average.

While you’ll need more information before making a decision, comparing the pros and cons listed above for MassMutual with the ones below with Guardian Life can point you in the right direction.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Compare Guardian Life vs. MassMutual Life Insurance Rates Today

Deciding between MassMutual and Guardian Life is a big decision, particularly since life insurance plays such an integral role in protecting your loved ones financially. Hopefully, you have a better idea of which one would best suit your needs now, whether you want the best permanent life insurance or the shortest term possible.

Of course, comparing rates is still a crucial step in finding the perfect life insurance coverage. Whether you want Guardian Life’s low rates or MassMutual’s superior customer service, you can enter your ZIP code into our free tool to start comparing rates today.

Frequently Asked Questions

Which company is better, Guardian Life or MassMutual?

When comparing Guardian vs. MassMutual, both are top-tier insurance companies offering a wide range of life and disability insurance products. MassMutual is known for its strong financial stability and customizable policies, while Guardian excels in customer service and dividend-paying whole life insurance policies.

How do Guardian vs. Aflac compare?

Guardian provides comprehensive life and disability insurance options, whereas Aflac is well-known for its supplemental insurance products, including accident, cancer, and hospital indemnity insurance. Check out our Aflac life insurance review to compare.

Who is better, MassMutual or Northwestern Mutual?

Both MassMutual and Northwestern Mutual are solid choices for life insurance, and the right provider for you depends on your unique circumstances. Check out our MassMutual vs. Northwestern Mutual life insurance review to learn more.

Does MassMutual sell car insurance?

While the company sells a variety of life insurance financial planning services, MassMutual car insurance is not an option.

Does Guardian Life sell health insurance?

Yes, Guardian Life sells a variety of health insurance plans. These plans include individual health insurance policies, supplemental coverage like the Guardian Life Family Indemnity plan, and health benefits options for small businesses.

Is MassMutual a good place to work?

If you’re interested in a MassMutual career, you’ll be happy to know MassMutual is generally considered a good place to work. You can use the MassMutual careers login to look for jobs and manage applications. However, just like insurance rates, you should research MassMutual careers before making a decision.

How do MassMutual and Guardian disability insurance compare?

MassMutual offers comprehensive disability insurance with a variety of riders and benefits. Guardian is also a strong competitor in the disability insurance market, known for its superior customer service and policyholder dividends.

Is MassMutual a reputable company?

When you’re wondering, “Is MassMutual life insurance good? you can let the rating speak for themselves. MassMutual has an A++ rating from A.M. Best, meaning it’s a financially stable company. It also received a low customer complaint score from the NAIC, and an A+ for its customer service from the BBB. According to MassMutual term life insurance reviews, customers are particularly happy with its standard term policies.

How long does Guardian Life Insurance take to pay out?

Guardian Life Insurance typically processes claims and pays out benefits within a few weeks, depending on the complexity of the claim and the submission of necessary documentation. Learning how to file a Guardian Life life insurance claim before you start the process can help speed things up.

What types of life insurance policies does MassMutual offer?

Massmutual offers a variety of life insurance policies to cater to different needs. They provide term life insurance, whole life insurance, universal life insurance, and variable universal life insurance. Each policy type has its own features and benefits, allowing individuals to choose the coverage that suits them best.

Does Guardian Life offer any additional benefits or features with their life insurance policies?

Can I customize my life insurance coverage with MassMutual?

Does Guardian Life offer any online tools or resources to manage life insurance policies?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.