New York Life vs. MassMutual Life Insurance for 2026 (Compare Costs Side-by-Side)

Comparing New York Life vs. MassMutual life insurance shows similar rates, but New York Life offers more add-ons. MassMutual’s rates start at $14/month for term life, only $1 more than New York Life. With coverage differences, MassMutual is better for whole life and New York Life for term policies.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Merriya Valleri is a skilled insurance writer with over a decade of professional writing experience. Merriya has a strong desire to make understanding insurance an easy task while providing readers with accurate and up-to-date information. Merriya has written articles focusing on health, life, and auto insurance. She enjoys working in the insurance field, and is constantly learning in order to ...

Merriya Valleri

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Brad Larson

Updated August 2025

0 reviews

0 reviewsCompany Facts

Term Policy

A.M. Best Rating

Complaint Level

Pros & Cons

0 reviews

0 reviews 0 reviews

0 reviewsCompany Facts

Term Policy

A.M. Best Rating

Complaint Level

Pros & Cons

0 reviews

0 reviewsComparing New York Life vs. MassMutual life insurance policy options, rates, and customer reviews is the best way to pick the perfect coverage for you.

When you compare MassMutual vs. New York Life, you’ll probably notice that they’re very similar. However, there are some key differences – for example, MassMutual tends to be a bit cheaper.

New York Life, on the other hand, has some of the best permanent life insurance plans on the market and is a more traditional provider with fewer online options.

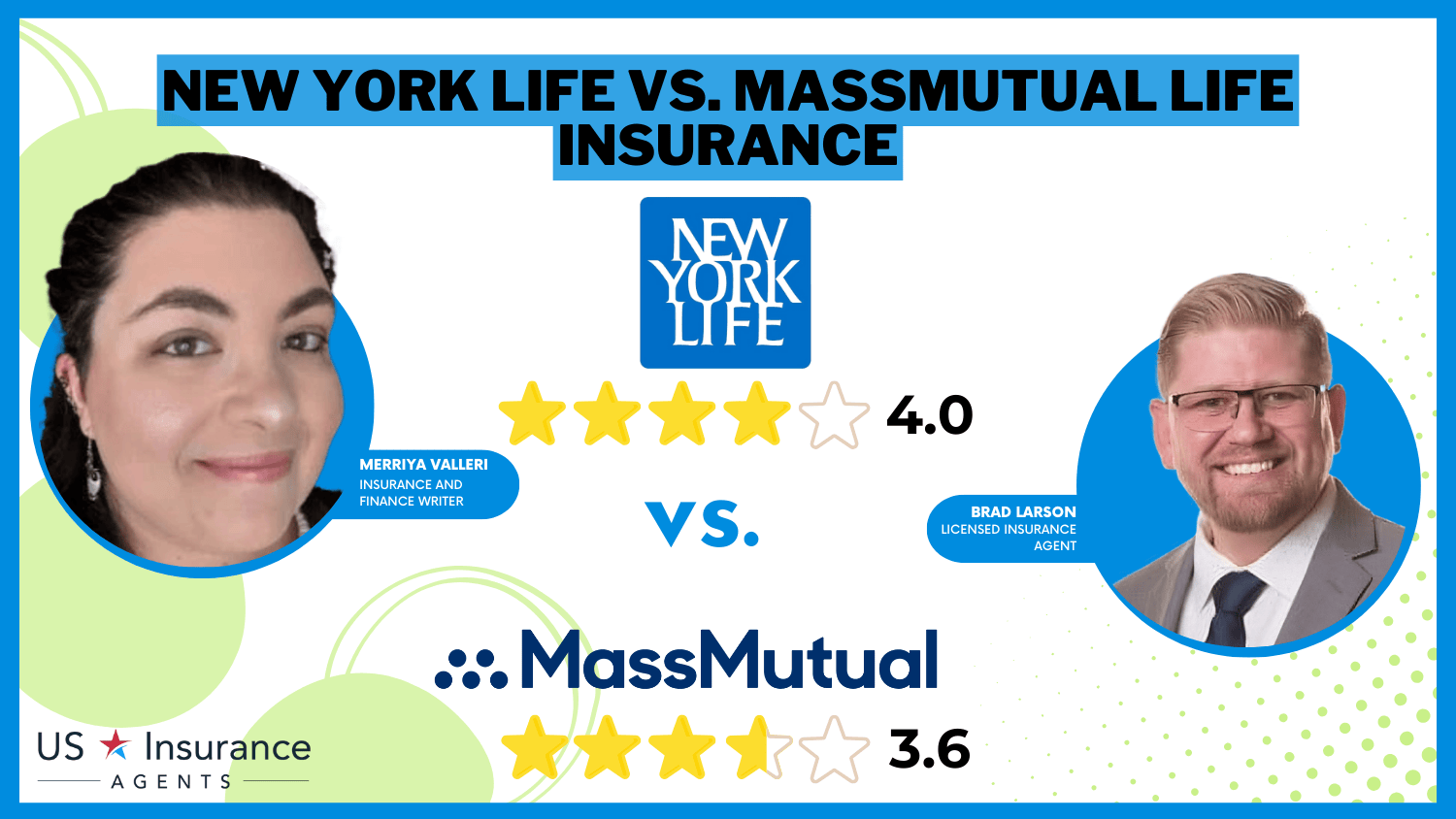

New York Life vs. MassMutual Life Insurance Rating

| Rating Criteria |  | |

|---|---|---|

| Overall Score | 4.0 | 3.6 |

| Business Reviews | 4.2 | 4.0 |

| Claim Processing | 3.8 | 3.0 |

| Company Reputation | 4.5 | 4.0 |

| Coverage Availability | 5.0 | 5.0 |

| Coverage Value | 3.7 | 3.5 |

| Customer Satisfaction | 4.3 | 2.5 |

| Digital Experience | 4.0 | 4.0 |

| Discounts Available | 3.4 | 5.0 |

| Insurance Cost | 3.0 | 2.6 |

| Plan Personalization | 4.7 | 3.5 |

| Policy Options | 4.6 | 4.5 |

| Savings Potential | 3.2 | 3.4 |

| New York Life Review | MassMutual Life Review |

Read on to see if New York Life or MassMutual is one of the best life insurance choices for your needs. Then, enter your ZIP code into our free comparison tool to find affordable life insurance in your area.

- MassMutual’s starting rate of $14 per month is a bit cheaper than New York Life

- New York Life is best for term life policies, while MassMutual has excellent whole life

- Both companies are highly rated for customer service and insurance payouts

Comparing Costs: New York Life vs. MassMutual Life Insurance Rates

Both MassMutual and New York Life are two of the best term and whole life insurance companies. While both companies offer excellent coverage at affordable rates, there are a few key differences to help you determine which is best for you.

For starters, you should consider which company has the lowest rates. You’ll need a personalized quote to see exactly how much you’ll be charged, but you can check average term life rates below.

New York Life vs. MassMutual Term Life Insurance Monthly Rates by Age & Gender

| Age & Gender |  | |

|---|---|---|

| Age: 25 Female | $15 | $14 |

| Age: 25 Male | $17 | $16 |

| Age: 35 Female | $18 | $17 |

| Age: 35 Male | $20 | $19 |

| Age: 45 Female | $35 | $33 |

| Age: 45 Male | $40 | $38 |

| Age: 55 Female | $85 | $82 |

| Age: 55 Male | $95 | $92 |

There are many factors that affect life insurance rates. One of the most impactful factors is how much coverage you need. Check below to see if MassMutual or New York Life has lower average rates by coverage level.

Life Insurance Monthly Cost by Coverage Amount for New York Life and MassMutual

| Coverage Amount |  | |

|---|---|---|

| $50,000 | $50 | $55 |

| $100,000 | $95 | $105 |

| $250,000 | $225 | $245 |

| $500,000 | $450 | $485 |

| $1,000,000 | $850 | $915 |

Keep in mind that the type of policy you buy will change your rates, even if you buy the same coverage amount. For example, a $100,000 term life policy will cost much less than a whole life plan with the same death beneficiary.

Chris Abrams Licensed Insurance Agent

Comparing average rates is normally a great way to see if a company is affordable for you, but New York Life and MassMutual rates are very close. To see which company is cheapest for you, you’ll need to get a personalized quote.

Requesting a quote is easy when you visit either MassMutual or New York Life’s website. However, you might need to complete a medical interview or exam before your application can be approved.

Both MassMutual and New York Life sell insurance in all 50 states, though you might see a different name based on where you live. For example, New York Life in Michigan is under the NYLMichigan site, while New York Life in Jacksonville is on the regular New York Life site.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Life Insurance Options From New York Life and MassMutual

When you’re comparing New York Life vs. MassMutual, you’ll have a variety of options. However, most people find the most popular type of life insurance is the best fit – term life.

MassMutual customers can buy term life insurance policies with up to 30 years of coverage. If you shop at New York Life, you can buy coverage in terms of up to 20 years.

The other most popular type of life insurance is whole life, which both companies offer.

Whole life is usually much more expensive than term life, which is why it’s less popular. However, it’s a great option for people who don’t want to worry about life insurance coverage in the future.

While whole and term life policies are the most popular, New York Life and MassMutual life insurance quotes are also available in other types of whole life insurance. These are:

- Universal: A universal life insurance policy allows you to adjust the death benefit at your discretion. You also have flexibility with your premiums, so long as you always pay a minimum.

- Variable Universal: A variable universal policy offers the same flexibility as a standard universal plan, but it also invests your accumulated cash value into stocks.

Aside from these life insurance options, each company has specialty plans based on specific needs. For example, MassMutual offers a free life insurance plan for low-income parents to ensure their kids’ education costs will be paid. New York Life offers disability and long-term care insurance alongside its life insurance policies.

New York Life vs. MassMutual Life Insurance Add-on Options

When you get MassMutual or New York Life insurance quotes, you’ll have the option of adding riders. Riders or add-ons increase the coverage in your policy but also make your monthly rates higher. Check below to compare New York Life and MassMutual’s add-on selection.

New York Life also offers a few add-ons that MassMutual does not. These include:

- Spouse’s Paid-Up Rider: Purchase this add-on to give your spouse the option to purchase their own guaranteed coverage using the payout from your policy.

- Insurance Exchange: Pick this policy add-on and you can transfer your coverage to someone else, so long as they’re in good health.

- Child’s Protection Benefit: If you purchase a life insurance policy for your child, New York Life will waive the premium until they turn 25 if you become disabled or die.

Although New York Life offers a bigger selection of add-ons, there are still plenty of reasons to check out MassMutual. Read our MassMutual life insurance review to learn more.

New York Life vs. MassMutual Life Customer and Business Reviews

Generally speaking, each company gets positive reviews. New York Life gets better reviews for the types of term life insurance it offers, while MassMutual has a reputation for valuable whole life policies.

Like all companies, neither New York Life nor MassMutual are perfect. Take, for example, this Reddit user’s confusion about New York Life’s terminology.

New York life custom whole life…explain please

byu/ohiobicpl3738 inLifeInsurance

Although this Reddit user was confused about their policy, other users insisted the policy was worth keeping.

As for MassMutual, most customers seem happy with their policy, especially since the company helps people take preventative health measures.

For both companies, affordability is an important part of customer reviews. Whether you look at MassMutual or New York Life competitors, it’s hard to find more affordable coverage.

Besides customer reviews, looking at third-party ratings can offer up valuable information. These companies rate insurance providers on everything from the shopping experience to the number of customer complaints received.

Heidi Mertlich Licensed Insurance Agent

To see how some of the top third-party rating companies rate New York Life and MassMutual, take a look below.

Insurance Business Ratings & Consumer Reviews: New York Life vs. MassMutual

| Agency |  | |

|---|---|---|

| Score: 805 / 1,000 Avg. Satisfaction | Score: 795/1000 Above Industry Average in Customer Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A++ Excellent Business Practices |

|

| Score: 80/100 Very Good Customer Feedback | Score: 89/100 Very Good Policy Satisfaction |

|

| Score: 0.45 Below Avg. Complaints | Score: 0.12 Below Avg. Complaints |

|

| Score: A+ Superior Financial Strength | Score: A++ Superior Financial Strength |

For many customers, a company’s size is also important. Check below to compare the size of MassMutual and New York Life Insurance vs. competitors.

With nearly 7% of the market, New York Life is currently the largest life insurance company in America. MassMutual trails behind with a respectable 5th place. Learn more about why New York Life is so big in our New York Life insurance review.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros and Cons of New York Life Insurance

As you saw above, all companies have their pros and cons. When you shop at the New York Life Insurance Company, you’ll get access to the following advantages:

- Dividend Payouts: Some policies are eligible for a dividend payout in years when the company does well.

- Low Customer Complaints: Compared to its size, New York Life receives fewer complaints than expected.

- Solid Disability Choices: New York Life is a great choice for shoppers worried about becoming disabled as it offers a few coverage options.

However, you’ll have to find the following disadvantages acceptable to be happy with a New York Life insurance policy:

- Smaller Term Limits: Unlike most of its competitors, the maximum term limit New York Life insurance offers is 20 years.

- Medical Exam Requirements: New York Life does not sell no-medical-exam life insurance policies.

Before you decide New York Life is – or isn’t – for you, make sure to look at the pros and cons for MassMutual below.

Pros and Cons of MassMutual Life Insurance

MassMutual is generally regarded as a trustworthy life insurance option. Although it’s a bit smaller than New York Life, most customers are pleased with MassMutual pros. These include:

- Coverage Options: MassMutual is known for its excellent variety of coverage options, so much so that it’s considered to have one of the best 10-year term life insurance policies

- Online Quotes: While you may need to complete a medical interview, MassMutual makes it easier than most companies to get an online quote.

- Strong Customer Service: MassMutual has a reputation for its helpful, professional customer service representatives.

On the other hand, you’ll need to look out for the following disadvantages when you shop with MassMutual:

- Higher Rates: MassMutual is an affordable option, but primarily for people with high table ratings. If you have health issues, smoke, or are older, you’ll pay higher rates.

- Limited Customer Support: If having access to 24-hour customer support is important to you, MassMutual may not be right.

While these pros and cons are a great place to start looking, you should compare rates before you make a decision. Life insurance is a long commitment, so you should make sure to get the right price and the best coverage.

Compare New York Life vs. MassMutual Insurance Rates Today

When you compare New York Life vs. MassMutual insurance, you’ll likely notice that the companies are fairly similar. Whether you have reasons to buy term life insurance or want a whole life policy, picking the best for you comes down to small details.

Regardless of what coverage would be best for you, you should always compare rates with as many companies as possible. Enter your ZIP code into our free comparison tool to get started today.

Frequently Asked Questions

Who is better, MassMutual or New York Life?

Both New York Life and MassMutual Life Insurance offer comprehensive life insurance coverage. The better option depends on individual needs, preferences, and specific policy details. It is recommended to compare the coverage options, policy terms, premiums, and riders offered by both companies to determine which one suits your requirements better.

Is MassMutual a reputable company?

Wondering, “Is MassMutual a good company?” The answer is yes — MassMutual is one of the highest-rated life insurance companies in America. With an A++ from A.M. Best and a low number of customer complaints, MassMutual competitors have a hard time keeping up with this life insurance provider.

Is New York Life a good company?

Similar to MassMutual, New York Life has an A++ from A.M. Best and a low level of customer complaints. It’s also currently the largest life insurance company in the U.S., which is usually a good sign for insurance providers.

Is MassMutual cheaper than New York Life?

New York Life tends to be a little bit more expensive than MassMutual. For example, rates at MassMutual start at $14 per month, while term life starts at $15 per month at New York Life. However, it depends on your unique circumstances. To see which company has the cheapest rates for you, enter your ZIP code into our free comparison tool.

Is MassMutual available in Arizona?

Yes, you can purchase MassMutual in Arizona. Visit the MassMutual Arizona website for more information specific to the Grand Canyon state.

Is MassMutual cheaper than Northwestern Mutual?

While you’ll need to compare personalized quotes, MassMutual is usually the cheaper option when you look at MassMutual vs. Northwestern Mutual. However, you can explore how these companies compare in our Northwestern Mutual vs. MassMutual life insurance review.

How long does New York Life take to pay out?

For a standard claim, New York Life typically pays claims within 30 days. If an investigation is needed, you might have to wait longer. You can help the claims process go as quickly as possible by providing any documentation New York Life requests. Learning how to file a a life insurance claim with New York Life insurance company can make the process even easier.

Is New York Life better than Northwestern Mutual?

Comparing New York Life vs. Northwestern Mutual can be difficult because both companies are highly rated. However, New York Life has a larger customer base than Northwestern Mutual and is usually cheaper. To learn more, check out our Northwestern Mutual vs. New York Life insurance review.

Is New York Life better than Humana?

Humana is a reputable company, but it’s better known for its health care coverage than for life insurance. Many shoppers prefer New York Life for life insurance, but our Humana insurance review can help you determine if Humana is a better choice for you.

Can I get a quote for life insurance from New York Life and MassMutual online?

Yes, both New York Life and MassMutual Life Insurance provide online quote tools on their respective websites. By entering relevant information, such as age, gender, health, and coverage needs, you can receive a personalized life insurance quote from each company.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.