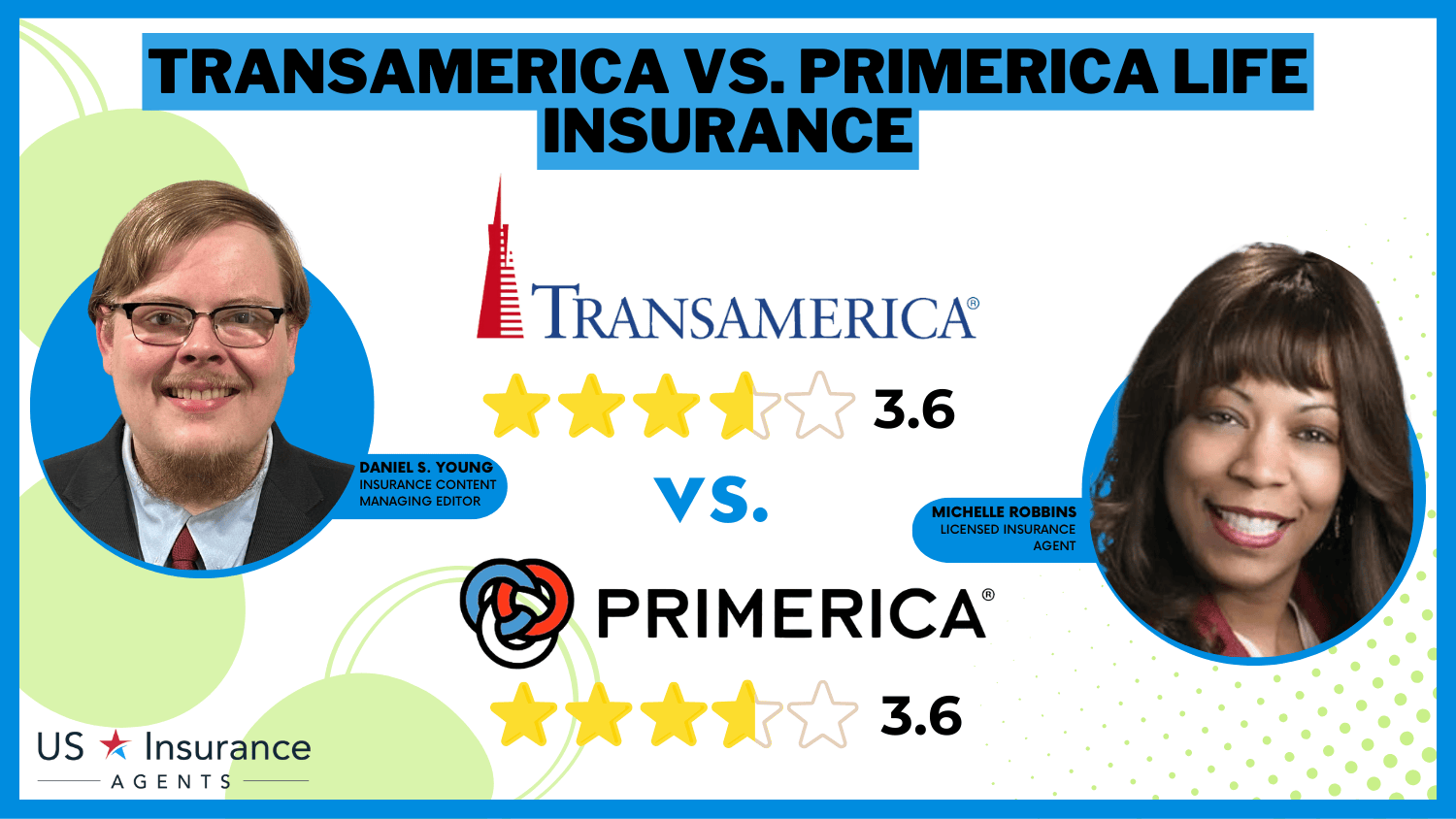

Transamerica vs. Primerica Life Insurance in 2026 (Head-to-Head Review)

Transamerica vs. Primerica life insurance is a choice between flexibility and affordability. Transamerica offers universal life at $64/month with cash value for long-term security. At $66/month, Primerica provides affordable term life with a conversion option, which is great for those seeking lower upfront costs.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Daniel S. Young began his professional career as chief editor of The Chanticleer, a Jacksonville State University newspaper. He also contributed to The Anniston Star, a local newspaper in Alabama. Daniel holds a BA in Communication and is pursuing an MA in Journalism & Media Studies at the University of Alabama. With a strong desire to help others protect their investments, Daniel has writt...

Daniel S. Young

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Michelle Robbins

Updated August 2025

0 reviews

0 reviewsCompany Facts

Term Policy

A.M. Best Rating

Complaint Level

Pros & Cons

0 reviews

0 reviews 0 reviews

0 reviewsCompany Facts

Term Policy

A.M. Best Rating

Complaint Level

Pros & Cons

0 reviews

0 reviewsTransamerica vs. Primerica life insurance chooses between universal life with cash value accumulation and term life with conversion options.

Transamerica offers indexed universal life, whole life insurance, and flexible premium options, ensuring long-term growth. Primerica, known for its affordable term policies, provides conversion benefits for future flexibility. While Transamerica builds wealth through cash value, Primerica caters to budget-conscious policyholders seeking lower upfront costs.

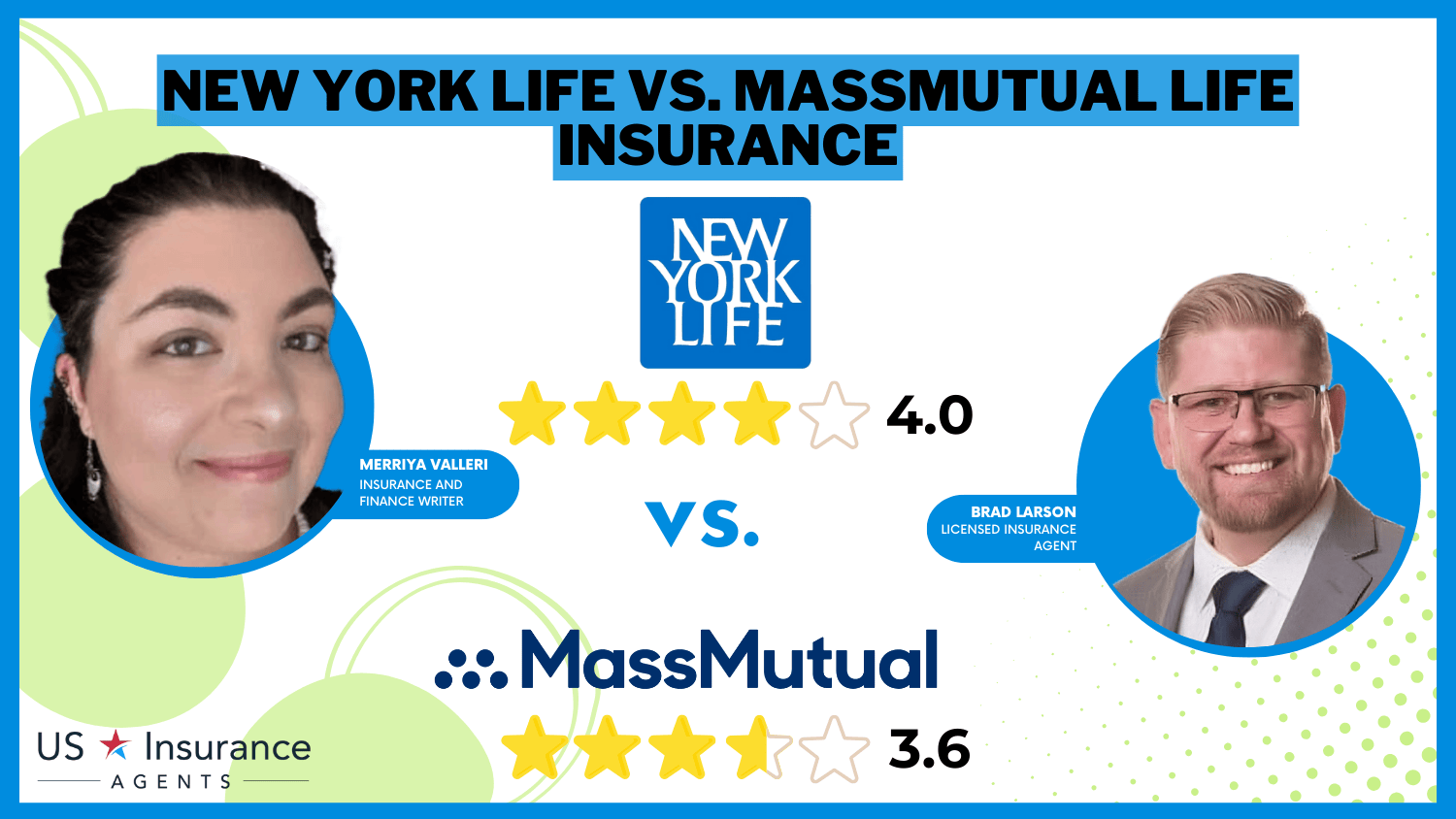

Life Insurance Customer Reviews & Ratings: Transamerica vs. Primerica

| Rating Criteria | ||

|---|---|---|

| Overall Score | 3.6 | 3.6 |

| Business Reviews | 3.5 | 4.0 |

| Claim Processing | 3.3 | 3.0 |

| Company Reputation | 3.5 | 3.5 |

| Coverage Availability | 5.0 | 4.7 |

| Coverage Value | 3.6 | 3.5 |

| Customer Satisfaction | 2.5 | 2.5 |

| Digital Experience | 3.5 | 4.0 |

| Discounts Available | 3.8 | 3.8 |

| Insurance Cost | 3.6 | 3.5 |

| Plan Personalization | 3.5 | 3.5 |

| Policy Options | 4.0 | 3.5 |

| Savings Potential | 2.4 | 3.6 |

| Transamerica Review | Primerica Review |

Choosing between them depends on whether you value investment potential or straightforward coverage with the ability to convert later.

Uncover cheap term life insurance rates near you by entering your ZIP code into our free quote tool.

- Transamerica offers universal and whole life with flexible premiums

- Primerica provides term life with a conversion option for flexibility

- Rates start at $64/month for Transamerica and $66/month for Primerica

Comparing Transamerica vs. Primerica Life Insurance Costs

Age and gender-based differences in life insurance premiums affect long-term expenses. Transamerica and Primerica life insurance prices for various age groups are contrasted in the table below to provide light on pricing variations.

Transamerica vs. Primerica Whole Policy Life Insurance Monthly Rates by Age & Gender

| Age & Gender | ||

|---|---|---|

| 16-Year-Old Female | $235 | $240 |

| 16-Year-Old Male | $245 | $250 |

| 30-Year-Old Female | $190 | $190 |

| 30-Year-Old Male | $195 | $195 |

| 45-Year-Old Female | $175 | $175 |

| 45-Year-Old Male | $180 | $180 |

| 60-Year-Old Female | $165 | $165 |

| 60-Year-Old Male | $170 | $170 |

Younger applicants, like 16-year-old males, face higher premiums at $245 with Transamerica and $250 with Primerica, reflecting risk factors insurers consider. Women generally pay less, with 30-year-old females at $190 for both companies, while males of the same age pay a slightly higher $195.

As age increases, insurance premiums decrease slightly, with 60-year-old females paying $165 and males $170 across both insurers. While rates remain competitive, Transamerica’s whole-life policies may offer cash value benefits, whereas Primerica’s term plans keep upfront costs low.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Real Customer Reviews of Transamerica vs. Primerica

Customer satisfaction, complaints, and financial stability matter when picking a life insurance provider. The table below shows how Transamerica and Primerica perform, with Transamerica reviews offering insight into policy variety, pricing, and service quality.

J.D. Power and Associates insurance company ratings rate both companies below average for satisfaction, with Transamerica scoring 747/1,000 and Primerica slightly higher at 766/1,000. Consumer Reports gives Primerica an 80/100, while Transamerica follows with 72/100, showing Primerica has more substantial customer feedback.

Life Insurance Customer Reviews & Ratings: Transamerica vs. Primerica

| Agency | ||

|---|---|---|

| Score: 747 / 1,000 Below Avg. Satisfaction | Score: 766 / 1,000 Below Avg. Satisfaction |

|

| Score: A+ Excellent Business Practices | Score: A+ Excellent Business Practices |

|

| Score: 72/100 Fair Customer Feedback | Score: 80/100 Strong Feedback |

|

| Score: 1.09 Avg. Complaints | Score: 0.28 Fewer Complaints than Avg. |

|

| Score: A Excellent Financial Strength | Score: A+ Superior Financial Strength |

Complaint ratios also vary—Transamerica averages 1.09 complaints, while Primerica sits at just 0.28, meaning fewer customer issues. On the financial side, Transamerica holds an “A” rating from A.M. Best, while Primerica earns an A+, reflecting more substantial financial stability.

Primerica scores higher in customer satisfaction and has fewer complaints, while Transamerica remains a solid, financially strong provider.

The chart below shows Transamerica holds 6% of the life insurance market, slightly ahead of Primerica’s 5%, while other providers dominate 89%. Transamerica’s more expansive range of policies, like indexed universal and whole life insurance, gives it an edge.

In contrast, Primerica distinguishes itself with its Financial Needs Analysis (FNA), a free tool that assists clients in evaluating their financial status and determining how much coverage is appropriate for their requirements. When paired with reasonably priced term life insurance, Primerica caters to consumers on a tight budget who want simple protection.

A Reddit user questioned whether Primerica’s term life policies provide enough value, pointing out that they don’t build cash value like whole or indexed universal life plans. While Primerica is budget-friendly, it lacks long-term growth options, which some buyers might need.

Comment

byu/LokiBonk from discussion

inLifeInsurance

This is a common discussion on Reddit—some prefer affordable term coverage, while others want a policy that grows over time. If long-term financial security is a priority, it’s worth comparing multiple life insurance providers before making a decision.

Understanding Life Insurance: Term vs. Permanent Coverage

Life insurance isn’t one-size-fits-all—it depends on what you need. Primerica keeps it simple with budget-friendly term policies, which is excellent for those who want coverage for a set number of years. Conversely, Transamerica provides whole and universal life insurance, two types of life insurance that offer both cash value growth and long-term protection.

It is a more flexible alternative because policyholders can borrow against their insurance to pay for significant expenses like retirement or property purchases. Primerica is a solid choice if you want a straightforward, affordable plan, but Transamerica might be a better fit if you’re after lifelong security with financial benefits.

Choosing Between Term and Permanent Life Insurance

Picking between Transamerica and Primerica comes down to what kind of coverage you need. Both companies offer term life insurance, but Transamerica also provides whole life, universal life, and final expense insurance, giving you more options for long-term protection. Primerica sticks to affordable term life policies, keeping things simple for those who want coverage for several years.

Transamerica vs. Primerica Life Insurance Coverages

| Coverage | ||

|---|---|---|

| Term Life Insurance | ✅ | ✅ |

| Whole Life Insurance | ✅ | ❌ |

| Universal Life Insurance | ✅ | ❌ |

| Final Expense Insurance | ✅ | ❌ |

| Accidental Death Benefit | ✅ | ✅ |

| Critical Illness Rider | ✅ | ❌ |

| Living Benefits | ✅ | ❌ |

One big difference is cash value—something only Transamerica offers through its whole and universal life policies. This means a portion of your premiums builds up over time, acting like a savings account you can borrow against for significant expenses like home improvements, medical bills, or retirement.

Jeff Root Licensed Insurance Agent

Primerica’s term policies don’t build cash value but offer an accidental death benefit rider for extra protection. If you want budget-friendly, no-frills coverage, Primerica is a solid choice. Conversely, Transamerica is better suited for those who wish for lifelong security, cash value growth, and a policy they can tap into over time—though it’s essential to factor in deductible costs when considering policy loans.

Bundling Policies for Bigger Savings on Life Insurance

Saving money on your policy is just as important as obtaining life insurance. In the comparison between Primerica vs. Transamerica, both companies offer discounts, but the amount you save depends on your policy type and lifestyle. To find the best deal, comparing free insurance quotes online can help you maximize your savings.

Life Insurance Discount Options & Percentages at Transamerica vs. Primerica

| Discount | ||

|---|---|---|

| Bundling | 15% | 10% |

| Healthy Lifestyle | 10% | 5% |

| Non-Smoker | 20% | 15% |

| Long-Term Policyholder | 5% | 5% |

| Military | 5% | 10% |

Transamerica is an outstanding choice for policyholders who do not use tobacco because it provides the most significant break for non-smokers, with a 20% reduction compared to Primerica’s 15%. Transamerica offers a 15% reduction when you bundle numerous policies, greater than Primerica’s 10% discount.

Conversely, military members get a better deal with Primerica, which offers a 10% discount, while Transamerica only gives 5%. Both companies reward long-term policyholders with a 5% discount, so the best option depends on which savings apply to you.

Comparing Transamerica and Primerica Life Insurance Policies

Choosing between Transamerica vs. Primerica life insurance depends on what you need. Primerica keeps it simple with 20-year term life insurance policies and a conversion option, which is great for those seeking affordable, temporary coverage.

Conversely, Transamerica offers more options, including whole life, universal life, and indexed universal life, making it a better fit for long-term planning.

- Coverage Choices: Transamerica offers whole life and universal life with cash value, while Primerica focuses on term life with the flexibility to convert.

- Financial Strength: Transamerica Financial Life Insurance Company, backed by Aegon N.V., provides long-term security, while Primerica Financial Coverage keeps costs low with term-based plans.

- Industry Experience: Transamerica has over 100 years of experience in the industry, while Primerica has built a solid reputation for serving middle-income families.

- Agent Support: With the Transamerica Agent Network, policyholders get expert guidance from licensed agents, making it easier to choose the right plan.

Primerica might be better if you want an affordable term life with future flexibility. But if you want more coverage options, cash value growth, and personalized guidance, Transamerica stands out.

Free Life Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Pros and Cons of Transamerica Life Insurance

Pros

- Variety of Policies: Offers term, whole, universal, and indexed universal life insurance, giving you plenty of options to match your needs. Discover insights in our Transamerica insurance review.

- Cash Value Growth: Indexed universal life policies let you build cash value by tying funds to market performance, potentially boosting savings.

- Financial Strength: Supported by parent company Aegon N.V. and A.M. Best’s “A” rating, which guarantees dependable coverage and payouts.

Cons

- Higher Costs for Permanent Policies: Whole life and universal life policies come with significantly higher premiums than term plans, which may not suit budget-conscious buyers.

- Complexity of Advanced Policies: Indexed universal life products require more financial literacy, making them less accessible for first-time buyers.

Pros and Cons of Primerica Life Insurance

Pros

- Affordable Term Life Policies: Offers competitive rates, with 20-year term life insurance providing accessible coverage for middle-income families.

- Flexibility in Conversion: Term life insurance is flexible enough to accommodate policyholders’ evolving demands because it can be converted into permanent insurance without requiring further medical examinations.

- Additional Financial Tools: Programs like the Financial Needs Analysis, MyPrimerica.com, and Primerica Secure provide valuable resources for debt management, financial planning, and insurance tracking.

Cons

- Narrow Product Range: Focuses primarily on term life insurance, lacking options for whole life or universal life coverage. Discover more about offerings in our Primerica insurance review.

- Lower Market Share: Holds only 5% of the life insurance market, which reflects limited influence compared to larger competitors like Transamerica.

Transamerica vs. Primerica: Policy Options Compared

The Transamerica vs. Primerica life insurance review highlights how Transamerica’s diverse policy options, like indexed universal life, compare to Primerica’s focus on affordable 20-year term policies while considering key factors like the role of a life insurance beneficiary in each plan.

Though premiums can be higher, Transamerica Life Insurance Company is great for long-term planners with its cash value growth options. Primerica Life Insurance Company keeps things simple with budget-friendly rates and flexible conversion features but lacks Transamerica’s variety. Primerica’s low complaint ratio of 0.28 is a standout feature, reflecting intense customer satisfaction.

Transamerica Corporation is ideal for investment growth and financial planning, while Primerica, Inc. suits budget-conscious buyers looking for straightforward term coverage. To find the best fit, compare quotes from multiple life insurance companies online and discover the right policy for your needs. Find the best term life insurance rates with our free comparison tool.

Frequently Asked Questions

How do Transamerica vs. Primerica compare in terms of policy options?

Transamerica offers term, whole, universal, and indexed universal life insurance, while Primerica focuses mainly on term life policies with conversion options.

What documents are needed for a Primerica life insurance payout?

Beneficiaries must submit a death certificate, claim form, and any required policy documents to receive the payout.

Which company has better cash value growth in Prudential Life vs. Transamerica?

Transamerica offers strong cash value growth in whole and indexed universal life policies, while Prudential’s indexed options also provide market-linked growth potential. A Prudential insurance review highlights the company’s versatile policy options and affordable rates, making it a good alternative for consumers looking for both affordability and long-term financial rewards.

Does Primerica offer whole life insurance?

No, Primerica only provides term life insurance. They do not offer full life insurance because they focus on affordable, interim coverage with conversion opportunities.

Is Primerica good life insurance?

Primerica offers affordable term life insurance with flexible conversion options, making it a solid choice for budget-conscious buyers. However, it lacks whole life or universal life policies, which some may prefer for long-term financial growth.

Which company has better financial planning tools, Primerica vs. Fidelity?

Primerica provides Financial Needs Analysis and MyPrimerica.com, while Fidelity integrates life insurance with investment and retirement planning. A Fidelity life insurance review highlights its term and final expense policies, making it a strong option for those seeking affordable coverage with added financial planning benefits.

Can I bundle auto and life insurance with Primerica?

No, Primerica auto insurance isn’t available for bundling. Primerica specializes in term life insurance, while referral partners handle auto policies.

Is Transamerica a good life insurance company?

Yes, Transamerica is a well-established provider with an A.M. Best rating that provides term, whole, universal, and indexed universal life insurance with various premium options and cash value growth.

What companies are better than Primerica?

Companies like Transamerica, New York Life, and Northwestern Mutual offer more coverage options, including whole and indexed universal life policies, which Primerica lacks, making them better for long-term financial planning.

A Northwestern Mutual insurance review highlights its substantial dividend payouts and cash value growth, making it a top choice for those seeking lifetime coverage and investment potential.

How long does Primerica life insurance take to pay out?

Primerica typically processes claims within 14-30 days, but delays can occur if additional documents, like medical reports or autopsy results, are required.

What life insurance company pays the most claims?

How long does it take for Transamerica life insurance to pay out?

Is Transamerica commission-based?

Which insurance companies deny the most claims?

Who is the number one life insurance company in the US?

Is Primerica and Transamerica the same company?

Is Transamerica a good company for life insurance?

Who has the best whole life insurance?

What do Transamerica life insurance reviews on BBB say?

What do discussions about Transamerica vs. Primerica on Reddit reveal?

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.