Cheap Buick Regal Car Insurance in 2026 (10 Most Affordable Companies)

Nationwide, The Hartford, and USAA offer the best options for cheap Buick Regal car insurance. These companies stand out with Nationwide providing the lowest rates for as low as $42/month. Minimum coverage includes liability and comprehensive options. Find affordable rates for your Buick Regal.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Insurance and Finance Writer

Laura Gunn is a former teacher who uses her passion for writing and learning to help others make the best decisions regarding finance and insurance. After stepping away from the classroom, Laura used her skills to write across many different industries including insurance, finance, real estate, home improvement, and healthcare. Her experience in various industries has helped develop both her ...

Laura Gunn

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Licensed Insurance Agent

Jeff is a well-known speaker and expert in life insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading...

Jeff Root

Updated October 2024

3,071 reviews

3,071 reviewsCompany Facts

Min. Coverage for Buick Regal

A.M. Best

Complaint Level

Pros & Cons

3,071 reviews

3,071 reviews 765 reviews

765 reviewsCompany Facts

Min. Coverage for Buick Regal

A.M. Best Rating

Complaint Level

Pros & Cons

765 reviews

765 reviews 6,590 reviews

6,590 reviewsCompany Facts

Min. Coverage for Buick Regal

A.M. Best

Complaint Level

Pros & Cons

6,590 reviews

6,590 reviewsThe best options for cheap Buick Regal car insurance are Nationwide, The Hartford, and USAA. Nationwide stands out with the lowest rates and comprehensive coverage, making it the top pick overall.

The cost of car insurance for a Buick Regal can vary significantly depending on several factors. Understanding these factors and how they influence insurance rates is essential for Buick Regal owners looking to obtain the right coverage at an affordable price.

Our Top 10 Company Picks: Cheap Buick Regal Car Insurance

Company Ranking Monthly Rates Good Driver Discount Best For Jump to Pros/Cons

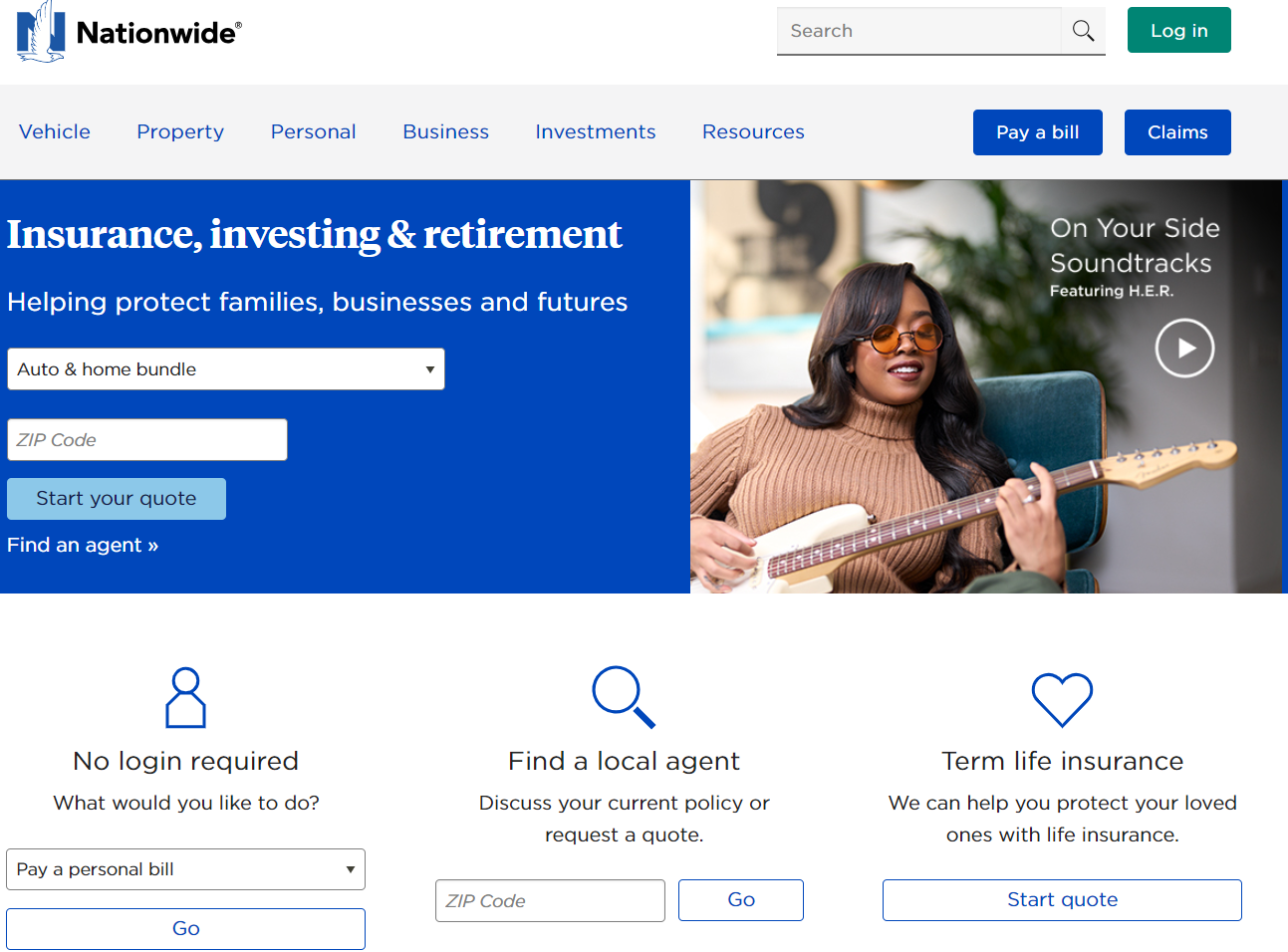

#1 $42 28% Discount Variety Nationwide

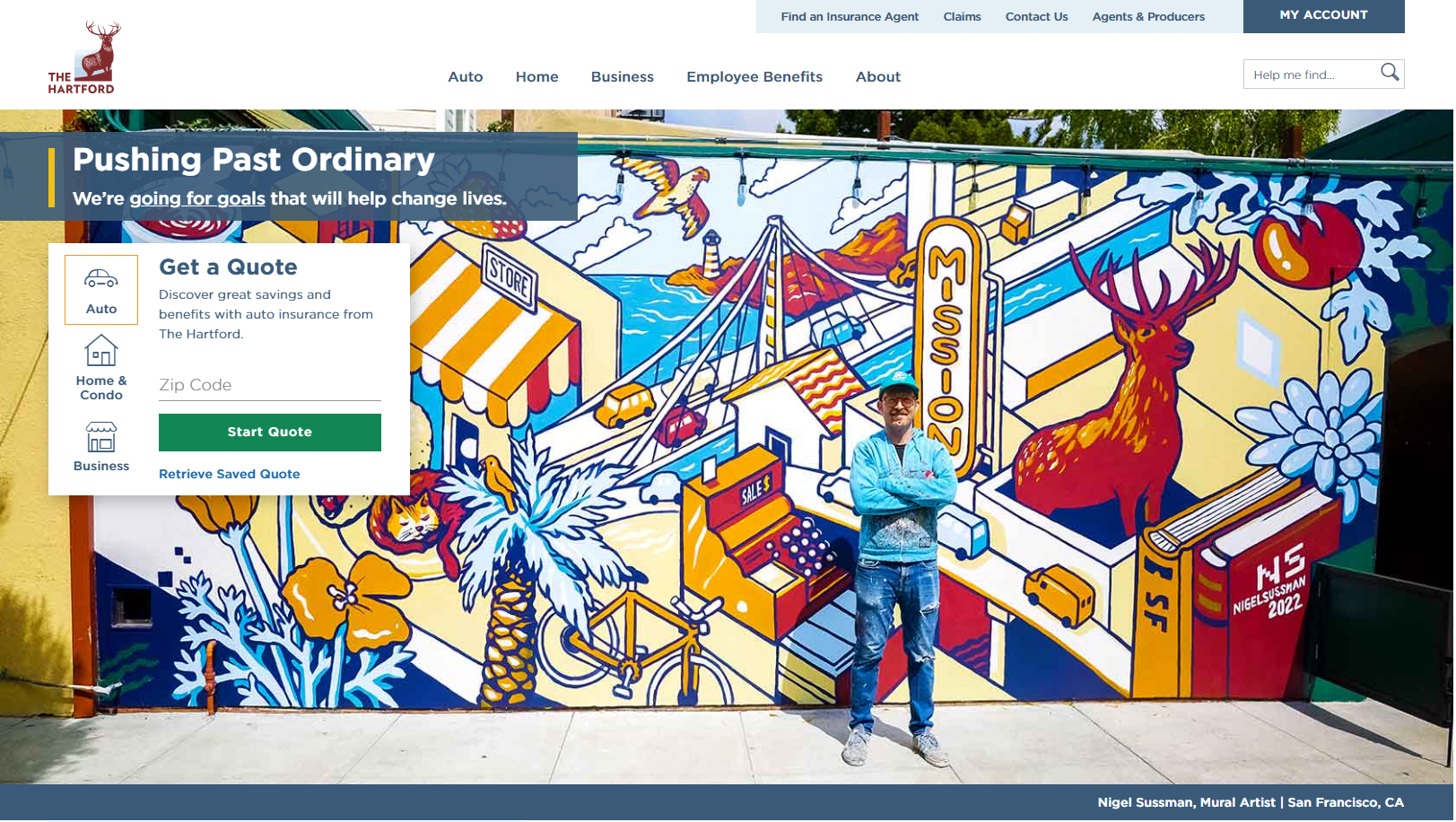

#2 $47 27% Mature Drivers The Hartford

#3 $50 24% Military Benefits USAA

#4 $52 22% Custom Plans Progressive

#5 $54 20% Agent Network State Farm

#6 $58 19% High Satisfaction Amica

#7 $60 18% Value Pricing Erie

#8 $65 15% Flexible Coverage Liberty Mutual

#9 $67 12% Reliable Pricing Auto-Owners

#10 $70 10% Driver Discounts American Family

In this article, we will explore the various aspects that impact the cost of Buick Regal car insurance, including coverage options, vehicle features, safety ratings, discounts, and more.

By the end of this comprehensive guide, you will have a better understanding of how insurance costs are determined and how you can save money without compromising coverage. Ready to find cheaper car insurance coverage? Enter your ZIP code below to begin.

#1 – Nationwide: Top Overall Pick

Pros

- Discount Variety: Nationwide insurance review & ratings offers a wide range of discounts, providing opportunities for policyholders to save money.

- Strong Financial Stability: Nationwide has a solid financial standing, which can provide peace of mind to customers.

- Nationwide Network: With a large network of agents and branches, Nationwide offers convenient access and personalized service to its customers.

Cons

- Limited Availability: Nationwide is not available in all states, which can be a drawback for customers looking for nationwide coverage.

- Customer Service: Some customers have reported issues with Nationwide’s customer service, citing long wait times and difficulty in reaching representatives.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – The Hartford: Best for Mature Drivers

Pros

- Mature Driver Discounts: The Hartford offers significant discounts for mature drivers, making it an attractive option for older individuals.

- Customizable Policies: The Hartford provides a range of coverage options that can be tailored to individual needs.

- Strong Reputation: The Hartford has a reputation for excellent customer service and claims handling. Read our “The Hartford insurance review & ratings” to gain more insights.

Cons

- Limited Availability: Like Nationwide, The Hartford is not available in all states, which can be a drawback for some customers.

- Pricing: Some customers have reported that The Hartford’s premiums can be higher compared to other insurers, especially for younger drivers.

#3 – USAA: Best for Military Benefits

Pros

- Military Benefits: USAA offers a range of benefits specifically tailored for military members and their families.

- Customer Satisfaction: USAA consistently receives high ratings for customer satisfaction and claims handling. Learn more by checking our guide titled “USAA insurance review & ratings“.

- Financial Stability: USAA is known for its strong financial standing, providing reassurance to policyholders.

Cons

- Eligibility Requirements: USAA is only available to military members, veterans, and their families, which limits its accessibility to the general public.

- Limited Coverage Options: Some customers have reported that USAA’s coverage options are not as comprehensive as those offered by other insurers.

#4 – Progressive: Best for Custom Plans

Pros

- Customizable Plans: Progressive insurance review & ratings offers a range of coverage options that can be customized to suit individual needs.

- Discounts: Progressive provides various discounts, including multi-policy, safe driver, and student discounts.

- Online Tools: Progressive offers a range of online tools and resources to help customers manage their policies and claims.

Cons

- Pricing: Some customers have reported that Progressive’s premiums can be higher compared to other insurers.

- Customer Service: There have been reports of issues with Progressive’s customer service, including delays in claims processing and difficulty in reaching representatives.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – State Farm: Best for Agent Network

Pros

- Agent Network: State Farm has a vast network of agents and branches, providing personalized service and support to its customers.

- Bundling Discounts: State Farm offers significant discounts for bundling multiple insurance policies. For more information, read our “State Farm insurance review & ratings“

- Low-Mileage Discount: Provides a substantial discount for drivers who have low annual mileage.

Cons

- Pricing: Some customers have reported that State Farm’s premiums can be relatively higher compared to other insurers.

- Limited Discounts: While State Farm offers bundling discounts, some customers have reported that its other discounts are not as competitive as those offered by other insurers.

#6 – Amica: Best for High Satisfaction

Pros

- High Customer Satisfaction: Amica consistently receives high ratings for customer satisfaction, indicating a strong commitment to customer service.

- Flexible Coverage Options: Amica offers a range of coverage options that can be tailored to individual needs.

- Strong Financial Stability: Amica has a solid financial standing, providing reassurance to policyholders. Read on our “What car insurance discounts does Amica Mutual Insurance Company offer?“

Cons

- Pricing: Some customers have reported that Amica’s premiums can be higher compared to other insurers.

- Limited Availability: Amica is not available in all states, which can be a drawback for customers seeking nationwide coverage.

#7 – Erie: Best for Value Pricing

Pros

- Value Pricing: Erie is known for its value pricing, offering competitive rates for various coverage options. To learn more, read our “Erie insurance review & ratings“

- Strong Customer Service: Erie has a reputation for excellent customer service, with quick and efficient claims handling.

- Range of Coverage Options: Erie offers a variety of coverage options, allowing customers to choose the level of protection that suits their needs.

Cons

- Limited Availability: Erie is only available in select states, which can be a drawback for customers outside of its coverage area.

- Discounts: Some customers have reported that Erie’s discount offerings are not as extensive as those of other insurers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Liberty Mutual: Best for Flexible Coverage

Pros

- Flexible Coverage Options: Liberty Mutual insurance review & ratings offers a range of coverage options that can be customized to suit individual needs.

- Discounts: Liberty Mutual provides various discounts, including multi-policy, safe driver, and student discounts.

- Online Tools: Liberty Mutual offers a range of online tools and resources to help customers manage their policies and claims.

Cons

- Pricing: Some customers have reported that Liberty Mutual’s premiums can be higher compared to other insurers.

- Customer Service: There have been reports of issues with Liberty Mutual’s customer service, including delays in claims processing and difficulty in reaching representatives.

#9 – Auto-Owners: Best for Reliable Pricing

Pros

- Stable Pricing: Auto-Owners is known for its stable pricing, with relatively small premium increases over time.

- Personalized Service: Auto-Owners offers personalized service through its network of agents, providing tailored recommendations and support.

- Strong Financial Stability: Auto-Owners has a solid financial standing, providing reassurance to policyholders. Check our comprehension guide titled “Auto-Owner insurance review & ratings” to learn more.

Cons

- Limited Availability: Auto-Owners is only available in select states, which can be a drawback for customers outside of its coverage area.

- Discounts: Some customers have reported that Auto-Owners’ discount offerings are not as extensive as those of other insurers.

#10 – American Family: Best for Driver Discounts

Pros

- Driver Discounts: American Family offers a range of discounts for drivers, including safe driver and multi-policy discounts.

- Customizable Policies: American Family provides a variety of coverage options that can be tailored to individual needs. Read on our “American Family insurance review & ratings“.

- Strong Customer Service: American Family has a reputation for excellent customer service, with quick and efficient claims handling.

Cons

- Limited Availability: American Family is not available in all states, which can be a drawback for customers seeking nationwide coverage.

- Pricing: Some customers have reported that American Family’s premiums can be higher compared to other insurers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Factors That Influence the Cost of Buick Regal Car Insurance

When determining the cost of car insurance for a Buick Regal, several factors come into play. These factors can vary between insurance providers but generally include:

- Driver’s age and driving history

- Location

- Mileage

- Credit score

- Insurance deductibles and coverage limits

Insurance providers assess these factors to determine the level of risk associated with insuring a Buick Regal. Drivers with a clean driving record, lower mileage, and good credit score are often considered less risky and may enjoy lower insurance premiums. On the other hand, younger drivers, high-risk locations, and poor credit scores can lead to higher insurance costs.

Another factor that can influence the cost of Buick Regal car insurance is the model year of the vehicle. Insurance providers may consider newer models to be more expensive to repair or replace, which can result in higher insurance premiums. To gain further insights, read on our “How does the insurance company determine my premium?“.

Buick Regal Car Insurance: Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

American Family $70 $160

Amica $58 $145

Auto-Owners $67 $155

Erie $60 $150

Liberty Mutual $65 $152

Nationwide $42 $120

Progressive $52 $137

State Farm $54 $140

The Hartford $47 $130

USAA $50 $135

The safety features and anti-theft devices in the Buick Regal can affect insurance costs. Vehicles with advanced safety features like lane departure warning and automatic emergency braking may qualify for insurance discounts. Anti-theft devices such as alarm systems and GPS tracking can also lower insurance rates by reducing the risk of theft.

Understanding the Insurance Coverage Options for a Buick Regal

When purchasing car insurance for your Buick Regal, it’s essential to understand the different coverage options available. Common coverage options for car insurance include:

- Liability coverage

- Collision coverage

- Comprehensive coverage

- Uninsured/underinsured motorist coverage

- Personal injury protection

Each coverage option offers different levels of protection and comes with its own cost. Liability coverage is typically required by law and protects you financially if you are at fault in an accident, while collision and comprehensive coverage protect your vehicle against damage or theft. Understanding the coverage options available will help you tailor your insurance policy to your specific needs and budget.

Liability coverage is an important aspect of car insurance as it helps protect you financially if you cause an accident and are held responsible for the damages. This coverage typically includes bodily injury liability, which covers medical expenses and lost wages for the other party involved, and property damage liability, which covers the cost of repairing or replacing the other party’s property.

Collision coverage, on the other hand, helps cover the cost of repairing or replacing your Buick Regal if it is damaged in a collision with another vehicle or object. This coverage is especially important if you have a newer or more expensive vehicle, as the cost of repairs can be significant.

Comparing Insurance Rates for Different Models of the Buick Regal

If you’re considering purchasing a Buick Regal, it’s important to note that insurance rates can vary depending on the specific model. Different models of the Buick Regal may have varying safety features and specifications that can impact insurance rates.

More expensive models or those with higher-performance characteristics may attract higher insurance premiums due to increased repair costs or potential for accidents. It’s advisable to compare insurance rates for the different Buick Regal models you’re interested in to ensure you understand the potential insurance costs associated with each.

Dani Best Licensed Insurance Producer

Age and driving history significantly impact insurance rates for Buick Regal models, with younger or accident-prone drivers facing higher costs than older, experienced counterparts.

Read more: Car Accidents: What to do in Worst Case Scenarios

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips for Finding Affordable Car Insurance for a Buick Regal

While car insurance is a necessary expense, there are several strategies you can employ to find affordable coverage for your Buick Regal:

- Shop around and compare quotes from multiple insurance providers

- Consider increasing your deductibles to lower your premiums

- Ask about available discounts and incentives offered by insurance providers

- Bundle your Buick Regal car insurance with other policies (such as home insurance)

- Take advantage of safe driving programs

Implementing these tips can help you find the most cost-effective insurance coverage for your Buick Regal without sacrificing essential protection. For more information, read our “What age do you get cheap car insurance?”

Another strategy to find affordable car insurance for your Buick Regal is to maintain a good driving record. Insurance providers often offer lower rates to drivers with a clean history of accidents and traffic violations. By practicing safe driving habits and avoiding any incidents, you can potentially qualify for discounted premiums.

Additionally, it can be beneficial to consider the type of coverage you need for your Buick Regal. While it’s important to have adequate protection, you may be able to save money by opting for a higher deductible or adjusting your coverage limits. Assess your driving habits and the value of your vehicle to determine the appropriate level of coverage that meets your needs and budget.

Exploring the Average Insurance Premiums for Buick Regal Owners

While it’s difficult to provide an exact average insurance premium for Buick Regal owners due to the numerous factors that influence insurance rates, it can be helpful to have a general idea. On average, Buick Regal car insurance premiums can range from a few hundred dollars to over a thousand dollars per year, depending on the aforementioned factors.

By obtaining quotes from multiple insurance providers and comparing the offers, you will be better equipped to determine the average insurance premiums for your specific circumstances. To gain further insights, read on our “compare car insurance quotes“.

The Impact of Vehicle Features and Safety Ratings on Insurance Costs for the Buick Regal

The safety features and ratings of a vehicle can greatly affect car insurance costs. The Buick Regal, with advanced safety features like lane-keeping assist, blind-spot monitoring, and rearview cameras, often results in lower premiums. Insurers see these features as reducing accident risks and injury severity. Learn more by checking “Does my car insurance cover damage caused by my own negligence?”

Additionally, the Buick Regal’s high safety ratings from reputable organizations like the Insurance Institute for Highway Safety (IIHS) can further contribute to lower insurance costs.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

How to Save Money on Buick Regal Car Insurance Without Sacrificing Coverage

If you’re looking to save money on your Buick Regal car insurance without compromising coverage, consider the following strategies:

- Take advantage of available discounts, such as multi-policy, good student, or safe driver discounts

- Opt for a higher deductible to lower your premiums

- Drive responsibly and maintain a good driving record

- Consider bundling your Buick Regal car insurance with other policies for a potential discount

By combining these money-saving tactics, Buick Regal owners can find ways to reduce their insurance costs while maintaining the necessary coverage to protect their investment. To learn more read our “Good Student Car Insurance Discount”

Factors to Consider When Insuring a Used Buick Regal

Insuring a used Buick Regal may present slightly different considerations compared to a new vehicle (read our “New Car Insurance Discount” for more information). Factors To Consider When Insuring A Used Buick Regal include:

- The age and condition of the vehicle

- The mileage on the car

- Potential maintenance and repair costs

Older vehicles may have higher premiums due to increased repair costs and damage risks. However, depreciation can lower overall premiums. To get the best rates for a used Buick Regal, compare quotes from different providers and carefully analyze coverage options.

Discounts Available Specifically for Buick Regal Car Insurance

Insurance discounts for Buick Regal owners can vary by provider and region. It’s worth asking about loyalty discounts for long-term owners or discounts for specific safety features. Membership in professional organizations or alumni associations may also offer additional savings.

Ty Stewart Licensed Insurance Agent

To obtain the most accurate information about available discounts, it is advisable to contact insurance providers directly and inquire about any Buick Regal-specific incentives they may offer. Read our “Lesser Known Car Insurance Discounts” to learn more.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Analyzing the Cost of Comprehensive and Collision Coverage for a Buick Regal

Comprehensive and collision coverage are key factors in the cost of Buick Regal car insurance. Comprehensive covers non-accident-related damage, like theft or natural disasters, while collision covers damage from accidents with other vehicles or objects. For more information, read our “Collision vs. Comprehensive Car Insurance: Which Coverage is Right For You?“.

Both these coverage options can contribute to higher insurance premiums due to the increased level of protection they provide. It’s recommended to assess your specific needs and consider your budget when deciding whether comprehensive and collision coverage is necessary for your Buick Regal.

The Role of Driving History and Location in Determining Insurance Rates for a Buick Regal

Driving history and location play significant roles in determining insurance rates for a Buick Regal. Insurance providers typically consider the number of years a driver has been licensed, any previous accidents or traffic violations, and the location where the car is primarily driven and parked.

Drivers with a clean record and those located in safer areas may enjoy lower insurance rates compared to individuals with a history of accidents or those residing in high-risk locations. It’s important to be aware of how your driving history and location can influence insurance costs for your Buick Regal. Read our “Best Car Insurance Discounts For Drivers With No Tickets” to learn more.

Common Mistakes to Avoid When Purchasing Car Insurance for a Buick Regal

When purchasing car insurance for your Buick Regal, it’s crucial to avoid common mistakes that could lead to higher costs or inadequate coverage. Some common mistakes to avoid include:

- Not comparing quotes from multiple insurance providers

- Opting for insufficient coverage to save money

- Ignoring available discounts and incentives

- Forgetting to update your insurance policy when there are changes in your driving circumstances

- Failure to disclose accurate information to insurance providers

By being proactive and avoiding these mistakes, Buick Regal owners can ensure they secure the right level of coverage at the most reasonable price. Read on our “Full Coverage Car Insurance” for more information.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Specialized Insurance Options for Luxury Vehicles Like the Buick Regal

For owners of luxury vehicles like the Buick Regal, specialized insurance options may be available to provide additional protection. Insurance providers often offer coverage options tailored to the specific needs of luxury car owners, including high-value vehicle coverage, enhanced liability limits, and coverage for customizations or modifications.

Exploring these specialized insurance options can help Buick Regal owners ensure they have comprehensive coverage that aligns with the unique features and value of their vehicle.

Case Studies: Real-World Insights Top Three Insurance Providers

These case studies offer insights into how three distinct individuals navigated the complexities of selecting car insurance. Through their experiences with Nationwide, The Hartford, and USAA, we delve into the unique features and benefits that shaped their choices, shedding light on the diverse needs and priorities of insurance seekers.

- Case Study #1 – Nationwide’s Discount Variety: Emma, a 30-year-old graphic designer, moved to a bustling city seeking affordable car insurance with diverse discounts. Choosing Nationwide, she benefited from a 28% good driver discount, reducing her monthly rate to $42. Nationwide’s broad discount range allowed Emma to secure comprehensive coverage at a reasonable price.

- Case Study #2 – The Hartford’s Mature Drivers: Richard, a 67-year-old retiree, sought tailored insurance for older drivers and opted for The Hartford. With a 27% good driver discount, his monthly rate was $47. The Hartford’s emphasis on mature drivers and supportive services, like lifetime renewability, ensured Richard had coverage suited to his needs.

- Case Study #3 – USAA’s Military Benefits: Lena, a 25-year-old Navy officer, chose USAA insurance review & ratings for its military-specific benefits. Despite a 24% good driver discount, her $50 monthly rate was justified by perks such as flexible payment options during deployment and car storage discounts. USAA’s tailored services provided Lena with essential coverage for her military lifestyle.

In conclusion, these case studies underscore the importance of considering individual needs and preferences when choosing a car insurance provider. Whether it’s seeking discount variety, specialized services for mature drivers, or military-specific benefits, the right insurer can offer tailored solutions that provide peace of mind and financial security on the road.

The Benefits of Bundling Your Buick Regal Car Insurance With Other Policies

Bundling your Buick Regal car insurance with other policies, such as home or renters insurance, can offer numerous benefits. Insurance providers often offer discounts for combining policies, providing cost savings for policyholders. Bundling your Buick Regal insurance with other policies can simplify the process and potentially save you money by dealing with one company for multiple coverages.

In conclusion, the cost of Buick Regal car insurance is influenced by various factors, including driver details, coverage options, vehicle features, safety ratings, and the location of the insured vehicle. By understanding these factors and exploring the available options, Buick Regal owners can find affordable car insurance that meets their specific needs.

Remember to compare quotes, take advantage of available discounts, and make informed decisions when selecting coverage levels and deductibles. With thorough research and attention to detail, you can secure the right insurance coverage for your Buick Regal while keeping costs in check.

Take the first step toward cheaper car insurance rates. Enter your ZIP code below to see how much you could save.

Frequently Asked Questions

What factors affect the cost of Buick Regal car insurance?

The cost of Buick Regal car insurance can be influenced by various factors such as the driver’s age, driving history, location, coverage options, deductibles, and the specific model and year of the Buick Regal.

Get the car insurance at the best price — enter your ZIP code below to shop for right coverage from the top insurers.

Is Buick Regal car insurance more expensive than insurance for other car models?

The cost of Buick Regal car insurance can vary depending on several factors, but it is generally in line with insurance costs for similar midsize sedans. Insurance rates can differ based on the car’s safety features, repair costs, and theft rates.

Are there any discounts available for Buick Regal car insurance?

Insurance companies often offer various discounts that can help lower the cost of Buick Regal car insurance. These discounts may include safe driver discounts, multi-policy discounts, anti-theft device discounts, and good student discounts, among others.

To gain further insights, read on our “Good student car insurance discount“.

What are the average insurance rates for a Buick Regal?

The average insurance rates for a Buick Regal can vary depending on the driver’s profile and location. It is recommended to obtain personalized quotes from insurance providers to get an accurate estimate of the insurance rates for a specific Buick Regal model.

How can I find affordable insurance for my Buick Regal?

To find affordable insurance for your Buick Regal, it is advisable to shop around and compare quotes from multiple insurance providers. Additionally, maintaining a clean driving record, opting for higher deductibles, and taking advantage of available discounts can help reduce insurance costs.

What coverage options are available for Buick Regal car insurance?

Common coverage options for Buick Regal car insurance include liability coverage, collision coverage, comprehensive coverage, and additional options like uninsured/underinsured motorist coverage and roadside assistance.

How do safety features and ratings impact insurance costs for the Buick Regal?

Safety features and high safety ratings can lower insurance costs for the Buick Regal, as insurers view these features as reducing accident risks and injury severity.

Our free online comparison tool below allows you to compare cheap car insurance quotes instantly — just enter your ZIP code to get started.

What role does driving history and location play in determining insurance rates for a Buick Regal?

Driving history and location significantly influence insurance rates for a Buick Regal. Factors such as the number of years licensed, previous accidents or violations, and the location where the car is primarily driven and parked are considered by insurers.

What mistakes should I avoid when purchasing car insurance for a Buick Regal?

Common mistakes to avoid when purchasing car insurance for a Buick Regal include underestimating coverage needs, not comparing quotes from multiple providers, and failing to inquire about available discounts.

Read on our “Best car insurance discounts to ask for” to learn more.

Are there specialized insurance options available for luxury vehicles like the Buick Regal?

Yes, specialized insurance options may be available for luxury vehicles like the Buick Regal, offering additional protection such as high-value vehicle coverage, enhanced liability limits, and coverage for customizations or modifications.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.