Cheap Dodge Ram Van 3500 Car Insurance in 2026 (Top 10 Companies Ranked)

Discover cheap Dodge Ram Van 3500 car insurance with Progressive, Mercury, and State Farm as the top choices, offering monthly rates as low as $70. These companies are known for its competitive rates and user-friendly tools. Compare quotes now to find the best coverage for your Dodge Ram Van 3500.

Read more Secured with SHA-256 Encryption

Table of Contents

Table of Contents

Managing Editor

Laura Kuhl holds a Master’s Degree in Professional Writing from the University of North Carolina at Wilmington. Her career began in healthcare and wellness, creating lifestyle content for doctors, dentists, and other healthcare and holistic professionals. She curated news articles and insider interviews with investors and small business owners, leading to conversations with key players in the le...

Laura Kuhl

Sr. Director of Content

Sara Routhier, Senior Director of Content, has professional experience as an educator, SEO specialist, and content marketer. She has over 10 years of experience in the insurance industry. As a researcher, data nerd, writer, and editor, she strives to curate educational, enlightening articles that provide you with the must-know facts and best-kept secrets within the overwhelming world of insurance....

Sara Routhier

Insurance Operations Specialist

Michael earned a degree in Business Management degree with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Au...

Michael Leotta

Updated October 2024

Company Facts

Min. Coverage for Dodge Ram Van 3500

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Dodge Ram Van 3500

A.M. Best Rating

Complaint Level

Pros & Cons

Company Facts

Min. Coverage for Dodge Ram Van 3500

A.M. Best

Complaint Level

Pros & Cons

Discover cheap Dodge Ram Van 3500 car insurance with top providers like Progressive, Mercury, and State Farm offering rates as low as $70 per month.

Progressive is noted for affordability and excellent service. Compare quotes now for the best coverage.

Our Top 10 Company Picks: Cheap Dodge Ram Van 3500 Car Insurance

| Company | Rank | Monthly Rates | A.M. Best | Best For | Jump to Pros/Cons |

|---|---|---|---|---|---|

| #1 | $70 | A+ | Competitive Rates | Progressive | |

| #2 | $72 | A | Low-Cost Coverage | Mercury | |

| #3 | $75 | B | Excellent Discounts | State Farm | |

| #4 | $78 | A | Bundle Savings | American Family | |

| #5 | $80 | A+ | Flexible Policies | Nationwide |

| #6 | $82 | A+ | Various Discounts | Allstate | |

| #7 | $84 | A | Good Service | Safeco | |

| #8 | $85 | A | Reasonable Premiums | Farmers | |

| #9 | $88 | A | Flexible Options | Liberty Mutual |

| #10 | $90 | A | Budget Friendly | The General |

If you are in the market for car insurance for your Dodge Ram Van 3500, you might be wondering how much it will cost you.

While the cost of car insurance can vary greatly depending on a number of factors, we’ll explore factors influencing Dodge Ram Van 3500 car insurance costs and provide tips for finding affordable coverage. By entering your ZIP code above, you can get instant car insurance quotes from top providers.

- Find Dodge Ram Van 3500 car insurance from $70 per month

- Tailored coverage options for Dodge Ram Van 3500 drivers

- Progressive is the top pick for rates and service

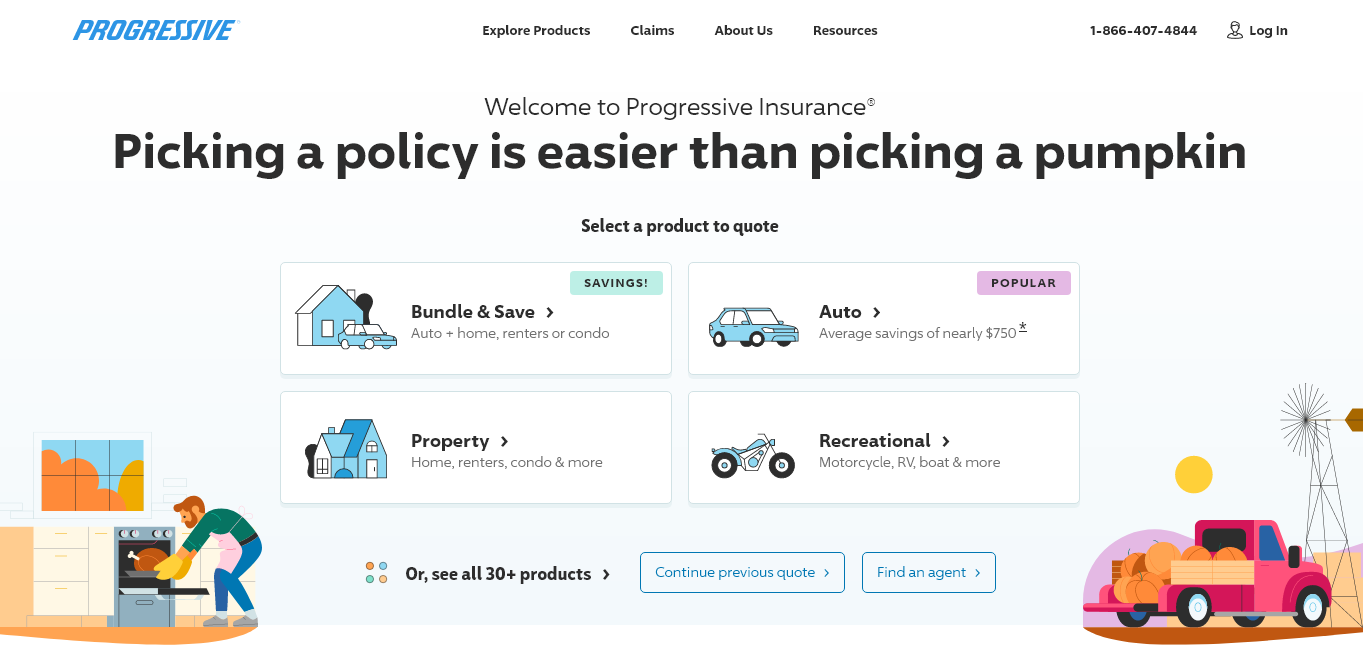

#1 – Progressive: Top Overall Pick

Pros

- Wide Range of Coverage Options: Progressive offers a variety of coverage options, including unique ones like rideshare coverage.

- Strong Online Tools: They have robust online tools and a user-friendly website for managing policies and claims.

- Competitive Rates: Progressive is known for offering competitive rates and discounts. Explore our Progressive car insurance review & ratings for more details.

Cons

- Average Customer Service: Some customers report mixed reviews regarding customer service.

- Complex Claims Process: The claims process can be complex, particularly for larger claims.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#2 – Mercury: Best for Low-cost Coverage

Pros

- Affordable Premiums: Mercury is known for offering low-cost coverage options.

- Good Customer Service: They have a reputation for good customer service and quick claims processing.

- Various Discounts: Offers a variety of discounts that can help reduce premiums.

Cons

- Limited Availability: Mercury insurance is not available in all states.

- Mixed Customer Reviews: While customer service is generally good, there are occasional mixed reviews.

#3 – State Farm: Best for Excellent Discounts

Pros

- Extensive Discount Options: State Farm offers a wide range of discounts, such as for safe driving and multiple policies.

- Large Agent Network: According to our State Farm insurance review & ratings, they have a large network of agents, making it easy to get personalized service.

- Strong Financial Stability: State Farm has excellent financial strength ratings.

Cons

- Higher Premiums for Some: Premiums can be higher compared to some competitors, particularly for certain demographics.

- Limited Online Tools: Online tools and digital experience may not be as advanced as some competitors.

#4 – American Family: Best for Bundle Savings

Pros

- Bundle Discounts: American Family offers significant savings for bundling multiple insurance policies.

- Good Customer Service: As mentioned in our American Family insurance review & ratings, they have a strong reputation for customer service.

- Flexible Coverage Options: Provides a variety of coverage options to tailor policies.

Cons

- Limited Availability: American Family is not available in all states.

- Slightly Higher Premiums: Premiums may be slightly higher compared to some budget-focused competitors.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#5 – Nationwide: Best for Flexible Policies

Pros

- Flexible Coverage Options: Nationwide offers a range of coverage options and add-ons to customize policies.

- Good Customer Service: Known for reliable customer service and claims processing.

- Strong Financial Stability: Nationwide has strong financial ratings.

Cons

- Higher Premiums: Premiums may be higher compared to budget-focused competitors.

- Availability Issues: As outlined in our Nationwide insurance review & ratings, not all coverage options are available in every state.

#6 – Allstate: Best for Various Discounts

Pros

- Extensive Discount Offerings: Allstate provides numerous discounts, including for new cars and auto-pay.

- User-Friendly Technology: Offers an easy-to-use app and online tools.

- Strong Financial Standing: Allstate has excellent financial strength ratings. For more information, read our Allstate insurance review & ratings.

Cons

- Higher Premiums: Premiums can be higher compared to some other insurers.

- Mixed Customer Service: Some customers report challenges with customer service.

#7 – Safeco: Best for Good Service

Pros

- Strong Customer Service: Safeco is known for providing excellent customer service.

- Competitive Rates: Offers competitive rates, particularly for safe drivers. (Read more: How do I add or remove drivers from my Safeco car insurance policy?)

- User-Friendly Online Experience: Their website and digital tools are easy to navigate.

Cons

- Limited Availability: Coverage may not be available in all states.

- Less Comprehensive Coverage Options: May not offer as many coverage options as some larger insurers.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

#8 – Farmers: Best for Reasonable Premiums

Pros

- Reasonable Premiums: Farmers offers competitive premiums, especially with discounts.

- Multiple Coverage Options: As outlined in our Farmers insurance review & ratings, they provides a variety of coverage options to choose from.

- Strong Financial Stability: Farmers has strong financial ratings.

Cons

- Mixed Customer Service Reviews: Some customers report less satisfactory experiences.

- Higher Deductibles: Policies may have higher deductibles compared to some competitors.

#9 – Liberty Mutual: Best for Flexible Options

Pros

- Flexible Coverage Options: Liberty Mutual offers a wide range of coverage options and add-ons.

- Customizable Policies: Allows for tailoring policies to individual needs. Learn more in our Liberty Mutual review and rating.

- User-Friendly Website: Offers a good digital experience with easy policy management.

Cons

- Higher Premiums: Premiums may be higher compared to some competitors.

- Mixed Customer Reviews: Customer service reviews are mixed, with some complaints about claims processing.

#10 – The General: Best for Budget Friendly

Pros

- Affordable Policies: The General is known for offering budget-friendly insurance options.

- Quick Claims Process: Claims are processed quickly and efficiently. (Read more: How do I appeal an car insurance claim with The General Insurance?)

- Accepts High-Risk Drivers: Specializes in providing coverage to drivers who may have trouble obtaining insurance elsewhere.

Cons

- Limited Coverage Options: Policies may have limited coverage options compared to other insurers.

- Customer Service Concerns: Some customers report issues with customer service and communication.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Average Cost of Car Insurance for a Dodge Ram Van 3500

The average cost of car insurance for a Dodge Ram Van 3500 can vary depending on the region in which you live. Insurance rates are influenced by a variety of factors, including the level of traffic, the crime rate, and the cost of healthcare in the area.

The table below compares monthly rates for minimum and full coverage car insurance for a Dodge Ram Van 3500 from various providers.

Dodge Ram Van 3500 Car Insurance Monthly Rates by Coverage Level & Provider

Insurance Company Minimum Coverage Full Coverage

Allstate $82 $155

American Family $78 $155

Farmers $85 $165

Liberty Mutual $88 $165

Mercury $72 $145

Nationwide $80 $160

Progressive $70 $145

Safeco $84 $160

State Farm $75 $155

The General $90 $175

Insurance rates can also vary between different states. Factors such as the cost of healthcare and the minimum insurance requirements set by the state can impact insurance rates. For example, states with no-fault insurance laws tend to have higher insurance premiums compared to states with traditional tort laws.

Read more: Car Accidents: What to do in Worst Case Scenarios

When comparing quotes for your Dodge Ram Van 3500, it is important to keep in mind that the average cost of insurance in your region may not necessarily reflect the cost you will pay. Insurance rates are personalized based on a variety of individual factors, including your driving history and credit score.

Obtaining quotes from different insurance companies will give you a better idea of the specific rates available to you in your region.

Factors That Influence the Cost of Car Insurance for a Dodge Ram Van 3500

When it comes to determining the cost of car insurance for your Dodge Ram Van 3500, there are several factors that insurance companies take into consideration. These factors include:

- The Age and Driving History of the Insured: Younger drivers and those with a history of accidents or traffic violations will typically pay higher insurance premiums.

- The Type of Coverage: The level of coverage you choose for your Dodge Ram Van 3500 will also affect the cost of your car insurance. Comprehensive and collision coverage typically have higher premiums, while liability coverage is generally less expensive.

- The Deductible Amount: The deductible is the amount you must pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your insurance premium, but it also means you will have to pay more in the event of a claim.

- The Location of the Insured: Where you live can also impact the cost of your car insurance. Areas with higher crime rates or higher traffic congestion may result in higher premiums.

- The Insured’s Credit History: Insurance companies often consider an individual’s credit history when determining their insurance premium. Those with a lower credit score may end up paying higher premiums.

- Modifications and Accessories: If you have made any modifications or added accessories to your Dodge Ram Van 3500, this could also affect the cost of your car insurance. Insurance companies may view modifications as an increased risk and charge higher premiums as a result.

By understanding these factors, you can make informed decisions to find the most suitable and cost-effective car insurance coverage for your needs.

Understanding the Different Types of Car Insurance Coverage for a Dodge Ram Van 3500

When insuring your Dodge Ram Van 3500, you can choose from several types of coverage. Liability coverage is the most basic type and is required by law in most states, covering damage to other people’s property and injuries they sustain in an accident where you are at fault.

Collision coverage pays for repairs to your Dodge Ram Van 3500 if it is damaged in a collision with another vehicle or object. Comprehensive coverage protects against damage not caused by a collision, including theft, vandalism, fire, or severe weather damage.

Medical payments coverage pays for medical expenses for you and your passengers after an accident, regardless of fault. Uninsured/underinsured motorist coverage protects you if you are in an accident with a driver who lacks insurance or sufficient coverage for the damages.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

The Importance of Choosing the Right Deductible for Your Dodge Ram Van 3500 Car Insurance

One important decision to make when purchasing car insurance for your Dodge Ram Van 3500 is choosing the right deductible. The deductible is the amount you must pay out of pocket before your insurance coverage kicks in. It is important to choose a deductible that you can comfortably afford in the event of a claim, but also one that will help to keep your insurance premiums affordable.

A higher deductible will typically result in a lower premium. However, it is important to weigh the potential savings against the amount you would need to pay out of pocket in the event of a claim. For example, if you choose a $1,000 deductible and have an accident that results in $2,000 in damages, you would need to pay $1,000 before your insurance coverage would apply.

Read more: What is the difference between a deductible and a premium in car insurance?

On the other hand, if you choose a lower deductible, such as $500, you would only need to pay $500 out of pocket before your insurance coverage kicks in. However, this will typically result in a higher premium. It is important to take your own financial situation into consideration when choosing a deductible and to find a balance that works for you.

Comparing Car Insurance Quotes for a Dodge Ram Van 3500: Tips and Tricks

When shopping for car insurance for your Dodge Ram Van 3500, it is important to compare quotes from multiple insurance companies to ensure you are getting the best coverage at the most affordable price. Here are some tips and tricks to help you with the process:

- Start by Gathering Multiple Quotes: Reach out to different insurance companies and request quotes specifically for your Dodge Ram Van 3500. This will give you a good starting point for comparison.

- Consider Using an Insurance Comparison Website: There are many online platforms that can help you compare car insurance quotes from multiple companies. These websites often provide a side-by-side comparison, making it easy to see the differences in coverage and cost.

- Take Advantage of Discounts: Insurance companies often offer discounts for things like safe driving records, multiple policies, and good student grades. Be sure to ask about any available discounts when obtaining quotes.

- Review the Coverage Details: When comparing quotes, be sure to review the coverage details and limits for each policy. The cheapest option may not always provide the level of coverage you need.

- Consider the Reputation and Customer Service of the Insurance Company: Price is important, but it is also important to consider the reputation and customer service of the insurance company you choose. You want to ensure that you are working with a company that will provide reliable coverage and be there for you when you need them.

By following these tips, you can make an informed decision and find the most suitable car insurance for your Dodge Ram Van 3500.

How the age and Driving History of the Insured can Affect Dodge Ram Van 3500 Car Insurance Rates

When it comes to car insurance rates for your Dodge Ram Van 3500, your age and driving history can have a significant impact. Younger drivers, particularly those under the age of 25, are often considered higher risk and therefore may face higher insurance premiums.

Read more: Cheapest Car Insurance for 25-Year-Old Drivers

Insurance companies also take into consideration your driving history. If you have a history of accidents, traffic violations, or other driving infractions, you may be viewed as a higher risk and could face higher insurance premiums as a result. On the other hand, if you have a clean driving record and have shown responsible driving behavior, you may be eligible for lower insurance rates.

It is important to note that insurance rates can vary between different insurance companies. Some companies may place more emphasis on certain factors, such as age or driving history, while others may consider a wider range of factors. It is always a good idea to obtain quotes from multiple companies to ensure you are getting the best rate based on your specific circumstances.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Exploring Discounts and Savings Options for Dodge Ram Van 3500 Car Insurance

When it comes to saving on car insurance for your Dodge Ram Van 3500, there are a number of discounts and savings options that you may be eligible for. These can vary between insurance companies, but some common discounts to look out for include:

- Safe Driving Discounts: Many insurance companies offer discounts for drivers with a clean driving record. This can include a certain number of years without any accidents or traffic violations.

- Multi-Policy Discounts: If you have multiple insurance policies, such as home insurance or renters insurance, you may be eligible for a discount by bundling your policies with the same insurance company.

- Good Student Discounts: If you are a student with good grades, you may be eligible for a discount on your car insurance. This can vary between insurance companies, but generally applies to full-time students with a certain GPA or higher.

- Anti-Theft Device Discounts: If your Dodge Ram Van 3500 is equipped with anti-theft devices or features, such as an alarm system or tracking device, you may be eligible for a discount on your car insurance.

- Defensive Driving Discounts: Some insurance companies offer discounts for completing a defensive driving course. This can be a great way to improve your driving skills and save on your car insurance premiums.

It is important to check with your insurance company to see what discounts may be available to you. Every company may have different requirements and eligibility criteria for each discount. Taking advantage of these savings options can help make your car insurance more affordable.

The Impact of Location on the Cost Of Insuring a Dodge Ram Van 3500

The location where you live can have a significant impact on the cost of insuring your Dodge Ram Van 3500. Insurance companies consider a variety of factors when determining insurance rates, including the level of crime in the area and the amount of traffic congestion.

If you live in an area with a high crime rate or a high number of car thefts, you may face higher insurance premiums. This is because insurance companies view these areas as higher risk, and therefore charge higher rates to offset that risk.

Traffic congestion can also impact insurance rates. Areas with high levels of traffic tend to have a higher number of accidents, which can result in higher insurance premiums. If you live in an area with heavy traffic, you may want to consider adding additional coverage, such as comprehensive or collision, to ensure you are fully protected in the event of an accident.

It is important to note that insurance rates can vary between different regions and even different neighborhoods within the same city. When obtaining quotes for your Dodge Ram Van 3500, be sure to provide your specific address so that the insurance company can accurately assess the risk associated with insuring your vehicle in that location.

The Role of Credit History in Determining Car Insurance Rates for a Dodge Ram Van 3500

Many insurance companies take an individual’s credit history into consideration when determining car insurance rates. Studies have shown that individuals with a lower credit score are more likely to file insurance claims, and insurance companies factor this into their pricing models.

In most states, insurance companies are allowed to use credit information as a factor in determining insurance rates. They look at things like your payment history, the length of your credit history, and the amount of debt you have compared to your available credit.

If you have a good credit history, you may be eligible for lower car insurance rates. On the other hand, if you have a poor credit history, you may face higher insurance premiums. It is important to review your credit report regularly and take steps to improve your credit score if necessary.

Read more:

- Best Car Insurance for Drivers with Bad Credit in New York

- Best Car Insurance for Drivers with Bad Credit in New Jersey

- Best Car Insurance for Drivers with Bad Credit in Nevada

If you are concerned about the impact of your credit history on your car insurance rates, there are some insurance companies that do not use credit information as a factor in determining rates. Be sure to inquire with different companies to see if this is an option for you.

Free Auto Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tips for Reducing the Cost of Insuring Your Dodge Ram van 3500 Without Sacrificing Coverage

If you are looking to reduce the cost of insuring your Dodge Ram Van 3500 without sacrificing coverage, there are several tips you can follow. Start by shopping around for quotes from multiple insurance companies to ensure you are getting the best rate, as insurance rates can vary greatly between companies.

Increasing your deductible can also lower your insurance premium, but make sure to choose a deductible you can comfortably afford in the event of a claim. Take advantage of available discounts, as insurance companies often offer reductions for safe driving records, multiple policies, and good student grades.

Kristine Lee LICENSED INSURANCE AGENT

If you have an older Dodge Ram Van 3500, consider reducing coverage to liability-only to help lower your insurance premium, though it’s important to carefully weigh the potential risks. Bundling your policies, such as home or renters insurance, with the same company can also provide discounts.

Additionally, review your policy to avoid paying for unnecessary coverage; for example, if you already have roadside assistance through a separate membership, you might not need to include it in your car insurance policy.

Enter your ZIP code below into our free comparison tool to see how much car insurance costs in your area.

Frequently Asked Questions

What factors affect the cost of insurance for a Dodge Ram Van 3500?

The cost of insurance for a Dodge Ram Van 3500 can vary based on several factors. These include the driver’s age, driving history, location, coverage options, deductible amount, and the insurance company’s policies.

Are there any discounts available for insuring a Dodge Ram Van 3500?

Yes, insurance companies often offer various discounts that can help lower the cost of insuring a Dodge Ram Van 3500. These may include multi-policy discounts, safe driver discounts, anti-theft device discounts, and more. It’s recommended to check with different insurance providers to see which discounts may be applicable.

Read more: Best Car Insurance Discounts to Ask for

Is it more expensive to insure a Dodge Ram Van 3500 compared to other vehicles?

The cost of insurance for a Dodge Ram Van 3500 may vary compared to other vehicles. Generally, larger vehicles like vans or trucks tend to have higher insurance premiums due to their size and potential for causing more damage in an accident.

Ready to find affordable car insurance? Use our free comparison tool below to get started.

What types of coverage options are available for a Dodge Ram Van 3500?

Various coverage options are available for insuring a Dodge Ram Van 3500. These may include liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, medical payments coverage, and more. It’s important to understand the different coverage types and choose the ones that best suit your needs.

How can I lower my insurance premium for a Dodge Ram Van 3500?

To lower your insurance premium, consider increasing your deductible, taking advantage of discounts, bundling your policies, and maintaining a clean driving record. Shopping around for quotes can also help you find the best rate.

Read more: How does the insurance company determine my premium?

Does the mileage I drive affect my insurance rate?

Yes, the number of miles you drive annually can impact your insurance rate. Higher mileage increases the risk of accidents, potentially leading to higher premiums. Conversely, low mileage can sometimes qualify you for a discount.

What should I do if I need to file a claim?

If you need to file a claim, contact your insurance company as soon as possible. Provide all necessary details about the incident, including photos and witness information if available. Your insurer will guide you through the process.

Can I get coverage if my Dodge Ram Van 3500 is used for business purposes?

Yes, but you may need a commercial auto insurance policy rather than a personal one. Commercial policies are designed to cover vehicles used for business activities and may offer different coverage options and limits.

How does the make and model of my vehicle affect my insurance premium?

The make and model of your vehicle can significantly affect your insurance premium. Vehicles with higher safety ratings and lower theft rates typically cost less to insure. Conversely, high-performance or luxury vehicles may come with higher premiums due to increased repair costs and risk factors.

Protect your vehicle from whatever the road throws at it by entering your ZIP code into our free comparison tool below to see affordable car insurance quotes.

Get a FREE Quote in Minutes

Insurance rates change constantly — we help you stay ahead by making it easy to compare top options and save.